What’s Next with Paycheck Protection Program (PPP) for Restaurants?

4 Min Read By Sonia Desai

The Small Business Administration (SBA) and US Treasury department’s PPP loan forgiveness application was released on May 15, 2020 (Forgiveness Application). The much-awaited guidance does little to address the unique challenges afflicting the restaurant industry. Under the current guidelines, restaurants may find it impossible to take advantage of one of the cornerstones of the PPP program: loan forgiveness.

The restaurant industry has been hit particularly hard by COVID-19. Some staggering statistics on the restaurant industry during this pandemic include:

- Restaurants, on average, laid off 91 percent of their hourly workforce and 70 percent of salaried employees due to COVID-19 related closures (James Beard Foundation)

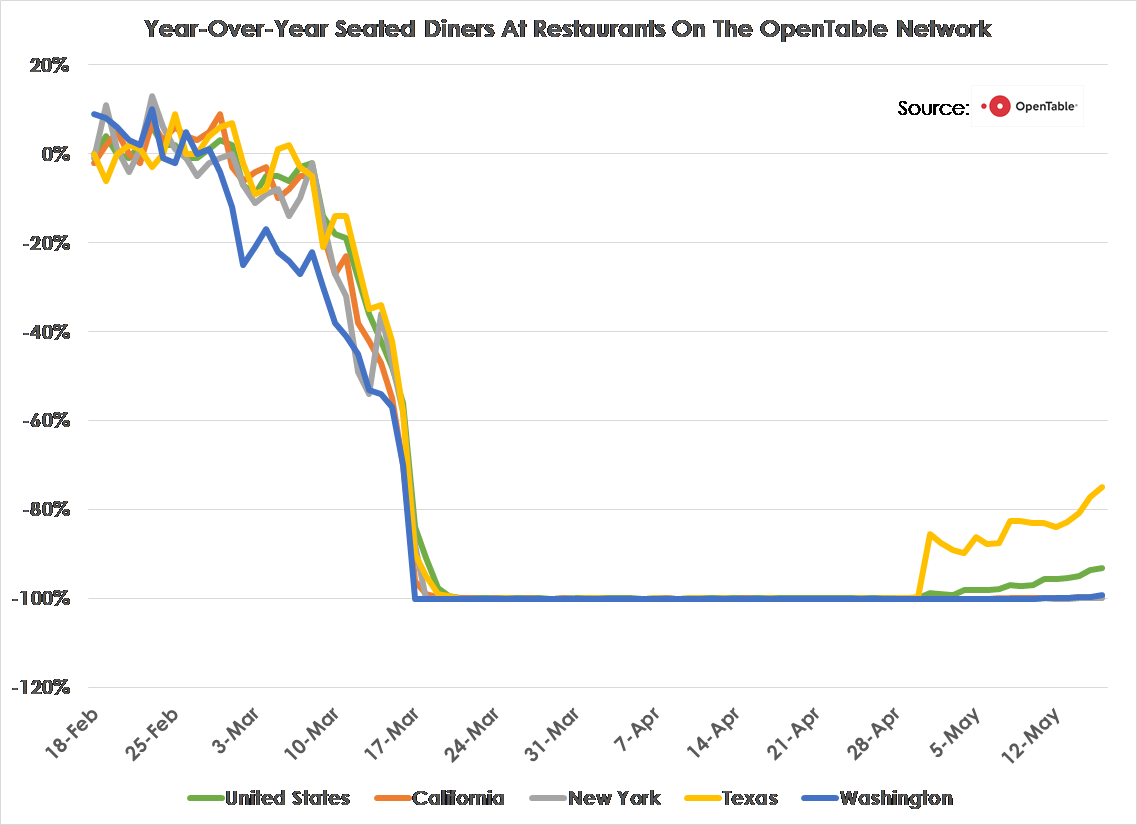

-

The biggest challenges restaurant owners believe they are facing in reopening are: Slow return of customers (41 percent), Cash to pay vendors (35 percent), Rehiring staff (16 percent), Retraining staff (three percent), and Health Inspections (two percent) (James Beard Foundation)

-

Restaurant owners said their biggest immediate cash challenges are: Rent (39 percent), Payroll (34 percent), and Taxes (nine percent) (James Beard Foundation)

Unfortunately, the Forgiveness Application poorly addresses the top challenges faced by the restaurant industry:

-

Closure or limited capacity opening of restaurants making it difficult to spend the PPP loan proceeds during the required timeframes;

-

Rehiring employees when they are incentivized to stay on unemployment insurance; and

-

Inability to utilize PPP loan funds to pay overhead costs in excess of certain thresholds.

Covered Period

The requirement for restaurants to spend PPP loan proceeds in order for it to be forgiven, during a time when they are closed or operating at limited capacity is at odds with reality.

The SBA’s guidance provides for four broad categories of costs that are eligible for forgiveness: (1) payroll costs; (2) business mortgage interest payments; (3) business rent or lease payments; and (4) business utility payments. Subject to some exceptions, forgiveness is generally available for eligible costs incurred or paid during the eight-week period that begins on the PPP loan disbursement date (“Covered Period),” or during the eight-week period that begins on the first day of the first pay period following the PPP loan disbursement date (“Alternative Payroll Covered Period”).

Reductions in Average Full-Time Equivalency

Further complicating matters, many hourly employees may not want to return to work until exposure to the coronavirus is mitigated, especially given the emergency increase in unemployment benefits of $600 per week made available under the CARES Act.

The CARES Act stated that a borrower’s forgiveness amount is limited where there is a reduction in the average number of full-time equivalent employees (FTEE) during the Covered Period as compared to a lookback period.

The Forgiveness Application provides an exception to the FTEE Reduction under the following circumstances:

(1) reductions related to any positions for which the borrower made a good-faith, written offer to rehire an employee during the Covered Period (or the Alternative Payroll Covered Period) that was rejected by the employee; and

(2) reductions related to any employees who during the Covered Period or the Alternative Payroll Covered Period (a) were fired for cause, (b) voluntarily resigned, or (c) voluntarily requested and received a reduction of their hours.

The Forgiveness Application provides that a borrower is exempt from the FTEE Reduction provided the safe harbor is satisfied. Under this safe harbor, a borrower is exempt from the reduction in loan forgiveness based on FTEE if both of the following conditions are met: (1) the borrower reduced its FTEE levels in the period beginning February 15, 2020, and ending April 26, 2020; and (2) as of June 30, 2020, the borrower restored its FTEE level to the FTEE level that existed during the borrower’s pay period that included February 15, 2020.

The FTEE Reduction Exceptions partially address the restaurant industry’s challenge with rehiring employees when they are making more money staying home. However, assuming a restaurant experiences a reduction in FTEE during the Covered Period as compared to the look-back period, in spite of available exceptions as noted above, it is very possible that restaurants will not be able to restore full service by June 30, 2020, either due to continued shut-down orders or due to customers’ efforts to socially distance, and therefore will not be able to take advantage of the FTEE Reduction Safe Harbor.

75 Percent Payroll Threshold

Many restaurants incur high occupancy costs such as rent. Further, during times when restaurants are either closed, operating their dining rooms at limited capacity, or offering only takeout and delivery, meeting the 75 percent payroll threshold would only be possible if restaurants paid their employees even if they weren’t actually working.

The SBA requires that at least 75 percent of the forgiven amount be attributable to payroll costs. In addition, the CARES Act and SBA guidance indicated that amounts eligible for forgiveness must be both incurred AND paid during the Covered Period.

While the Forgiveness Application did not modify the 75 percent payroll requirement, it has modified its definition to include non-payroll costs paid during the Covered Period OR incurred during the Covered Period and paid on or before the next regular billing date, even if the billing date is after the Covered Period. As a result of this modification, borrowers can now include amounts accrued prior to the Covered Period and paid during the Covered Period. The Forgiveness Application does not allow borrowers to prepay any mortgage interest but is silent as to prepayments on payroll and other non-payroll costs. Therefore, it appears that you can prepay rent and utilities during the Covered Period, or pay interest, rent and utilities in arrears, as long as the total of non-payroll costs remain at or below 25 percent of the requested forgiveness amount.

What Can Restaurants Expect?

Lawmakers are expected to make changes to the PPP forgiveness rules. Restaurant industry leaders and associations are lobbying for those changes to include an extension of the eight-week Covered Period[1], flexibility in starting the Covered Period so that restaurants can use the loans to re-staff when social distancing has eased and restaurants can fully reopen, and lowering of the requirement to spend 75 percent on payroll-related costs. The SBA has indicated that it “will also soon issue regulations and guidance to further assist borrowers as they complete their applications, and to provide lenders with guidance on their responsibilities.”

[1] The House of Representatives has passed an amendment to expand the Covered Period to 24 weeks, but the amendment is not expected to pass the Senate.