Value Meals: A 3M Strategy for Restaurant Success

3 Min Read By Jana Zschieschang

May was a challenging month for restaurant companies. Shares of major quick-service restaurant (QSR) brands experienced double-digit drops, consumer confidence declined, and traffic at fast-food restaurants was down by 2.1 percent, according to the Revenue Management Solutions (RMS) Monthly Trends report.

Will the summer sun heat up sales?

The Summer Outlook

Triple-digit temps might light up lagging traffic, but QSRs aren’t going to wait for the post-beach visits. Chains from major burger chains to Taco Bell and Starbucks have announced value meals designed to lure inflation-weary customers or keep loyalists from the grocery or C-store aisles.

But margins are at a historical low. Positive net sales in May (+1.9 percent YOY) and throughout 2024 were primarily due to price increases, which have surged nearly 50 percent in some segments since the pre-pandemic era and were still up 3.0 percent YOY in May. Extreme discounts, even in the short term, could impact margins.

RMS’ Senior VP of Consulting, Richard Delvallée, notes, “Now is the time to invest in menu optimization, as pricing activity is limited and consumer pushback is rising. The key is to maximize your brand’s value proposition across diverse consumer groups, including those who want to spend less, but also different generations, types of households, app users, and beyond.”

To optimize your menu using value or bundled meals, remember the 3M’s: Measure, Market and Monitor. Additional insights into QSR sales, traffic, and pricing trends are in the Revenue Management Solutions June Trend Report.

1M. Measure More Than Sales

Significant changes in consumer behavior started well before the pandemic and have only persisted post-2020. For example, breakfast traffic is down 5.6 percent compared to May 2023, potentially due to changing eating patterns and budget concerns, as well as the competition with winning promotions the previous year.

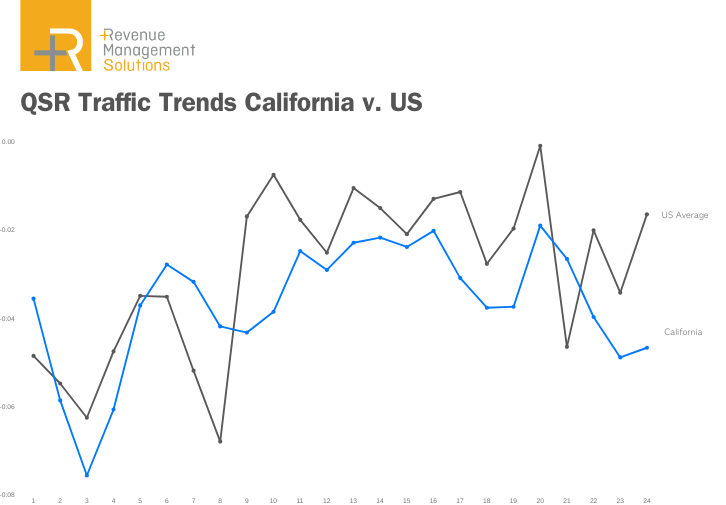

When we drill down regionally, California sales and traffic are significantly below the national average, likely due to price hikes in response to the California FAST Act. In April, QSR traffic was down 4.7 percent YOY in California compared to -1.6 percent YOY nationally.

Subtle differences can make or break a national strategy, while insights gleaned from comprehensive measurement can lead to a winning campaign.

When analyzing monthly check size and quantity per transaction, for example, data revealed that customers in California are replacing higher-priced items with value items and, in some instances, are buying two value items instead of one larger meal, as it is more pocket-friendly.

2M. Market Effectively

Price reductions can attract new customers and encourage existing ones to visit more often, but only when paired with effective marketing initiatives. Without “buzz,” infrequent or lapsed customers may not realize prices have decreased on their favorite items, removing the halo effect of your value meal and lessening the likelihood of a return visit.

Effective marketing can bridge this gap. Brands should communicate discounts and value meals loudly, clearly, and consistently through various channels, including digital marketing, social media campaigns and in-store promotions.

3M. Monitor Competition

Value customers tend to be fickle, following the most intriguing or cheapest offers. As Morningstar’s Sean Dunlop recently pointed out in Yahoo! Finance, "A value war is good for no one…Everyone's dominant strategy when traffic is down is to promote, discount, and lean into value, but all players lose if their peers also make that choice."

The summer of 2024 is shaping up to be pivotal for the fast-food industry with challenges and opportunities for QSR brands to refine their value strategies.

To optimize a value meal rollout, we recommend carefully monitoring the competitive landscape and strategically adjusting its price, offerings and marketing to gain and maintain a competitive advantage.

RMS' Competitor Price Intelligence Solution enables operators to track monthly pricing of commonly ordered menu items across nearly 250,000 restaurants worldwide, helping them understand how other brands or segments may be competing for your customers' wallets.

The summer of 2024 is shaping up to be pivotal for the fast-food industry, with challenges and opportunities for QSR brands to refine their value strategies. By measuring more than sales, marketing effectively, monitoring competition, and making a good impression, restaurant brands can navigate the complexities of the current market and emerge stronger.