Three Consumer Segments Are Hungry for a Positive Dining Experience

3 Min Read By Sara Tucy

The restaurant industry continues to struggle with driving traffic, ending the first quarter of 2019 down -2.4 percent and marking the 12th consecutive quarter of negative visits. With this, it’s more important than ever for restaurants to understand the reasons behind consumer behavior. It’s also critical for brands to be able to predict, motivate and even incentivize consumers to take action in order to reverse declining guest counts.

A recent study from Valassis was conducted to better understand some of the fundamental questions that so many brands have, such as “what drives consumer behavior for restaurant decisions?” “What motivates them?” “How are value consumers different than coupon users?” “Will discounting hurt my bottom line?”

Three distinct segments of consumers emerged: value seekers, coupon savvy consumers and full priced purchasers. Surprisingly, these segments looked very much the same, demographically. The real distinctions appeared within the behaviors of each consumer segment. The data revealed differences in spending, frequency, switching behaviors, media preferences and what motivates each segment’s dining decisions.

Providing a Menu of Options for Value Seekers

Let’s begin by examining the segment that makes up the largest (70 percent) portion of restaurant visits — value seekers. Much like their name suggests, this group looks for the lowest price when visiting restaurants but is also driven by finding the best value possible for the lowest price. Top motivators are affordability, convenience, good value and deals. Restaurant brands have an opportunity to move value consumers who are looking for the best deals into the coupon consumers’ segment thereby increasing visit frequency, spend and overall ROI.

Motivating Coupon Savvy Consumers to Spend

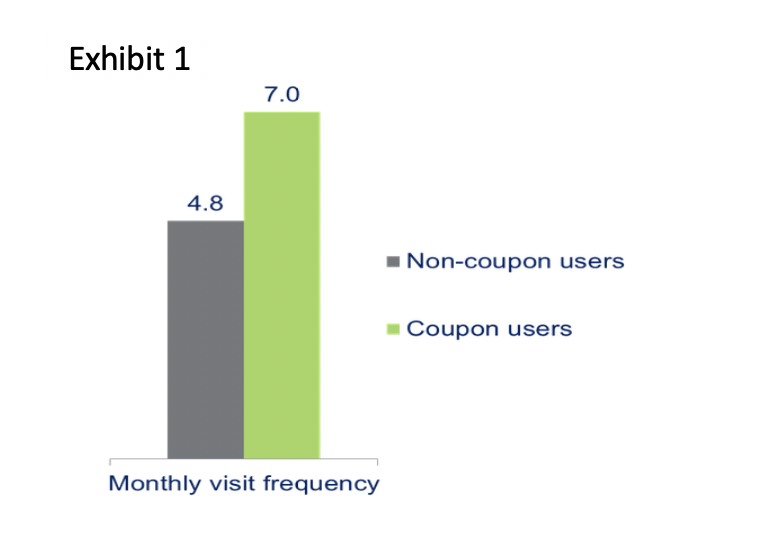

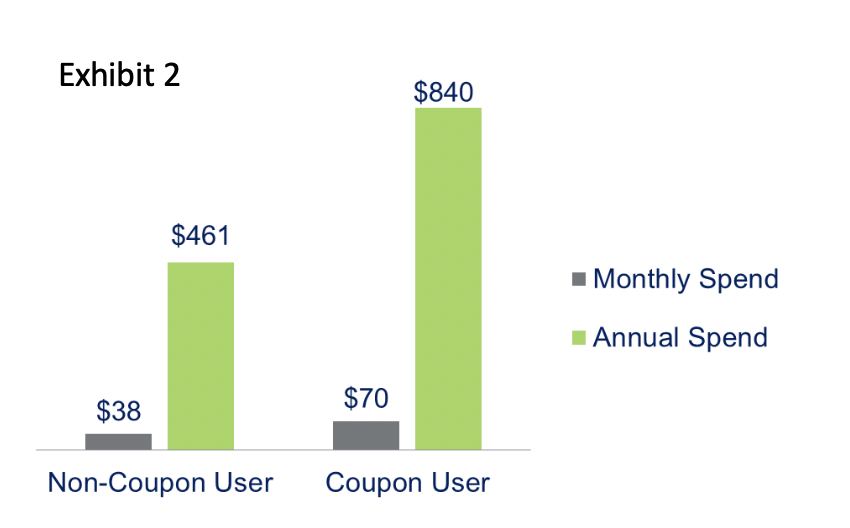

Coupon savvy consumers (13 percent of restaurant visits) are motivated by food quality, a wide variety of options, and of course, the coupons and deals offered by a particular restaurant. An important consideration with the average coupon savvy consumer is the likelihood of higher visiting rates and spending than their non-coupon savvy counterparts. For example, on average, a non-coupon quick service restaurant (QSR) guest spends $8, while a coupon QSR guest spends $10 per visit. Applying the monthly frequency averages (exhibit 1) along with this average visit spend, a single QSR coupon user is worth $379 more annually than a non-user (exhibit 2). Above all, receiving the highest quality within their budget, is a priority for this consumer group. By strategically providing both savings and more value per dollar, restaurants can expect to reserve a few tables for couponers.

“The role coupons play in consumers’ lives is multifaceted. There is a small percentage of consumers who are leveraging coupons exclusively to save money. However, the bulk of consumers are leveraging coupons in a way that gives them permission to not only spend more, but also permission to try something new and different. This means that when consumers dine at their favorite restaurants, coupons increase the chances that the market basket is larger than it would have been otherwise. That equals more money per transaction, but also it gives competitive restaurants a fighting shot at stealing traffic because of that permission to try something different.” – Rich Shank, Senior Director, Consumer Insights at Technomic Inc., which fielded the study on behalf of Valassis

Catering to Those Willing to Spend

The final segment is the full priced user (17 percent of restaurant visits). Similar to coupon users, food quality is a top driver along with customization and a restaurant that is suited for a variety of occasions. In addition, full-priced purchasers value speed of ordering. For brands looking to shift their focus to attract big spenders, they should consider the frequency of repeat customers and how they can offer a more personalized dining experience with customized deals, while also speeding up the ordering process.

Activating all Consumer Segments

All segments play an important role for restaurants, however, there is a real opportunity for brands in shifting value consumers to coupon users as they are visiting and spending more than non-users. In order to reverse the declining traffic trends, it is also important to have a mass acquisition strategy in place to generate incremental margin and also activate new and lapsed users. Brands that rely too heavily on their apps for driving traffic are missing valuable guests and should instead use apps to reinforce a loyalty strategy. Forty-five percent of guests use restaurant apps once a month or more often, with monthly app usage higher among coupon savvy consumers (55 percent). Furthermore, half of restaurant consumers use apps to find deals once they have already decided on where to dine, further reinforcing the need for acquisition strategies and media channels that drive incremental guests.

Understanding each type of restaurant user will provide deeper consumer insight into what it will take to get them in the door. After all, regardless of the segment, all consumers are hungry for a positive dining experience.

For more in-depth insights on all three consumer segments including demographic highlights, strategies and actionable tactics on activating switchers in a variety of restaurant sub-categories download the free eBook restaurant research.