The Value Shift Is Underway

2 Min Read By MRM Staff

QSRs face headwinds as consumers prioritize affordability, a trend that is deepening the two-tier economy and causing a shift toward lower-cost food options, according to a report from Placer.ai. During August, visits to fine dining restaurants were up 2.9 percent year-over-year, and were up 2.4 percent at coffee chains, 1.4 percent at casual dining chains, and 0.5 percent at fast casual chains, but they were down 3.4 percent at QSRs.

The year-over-year decline in visits to QSR chains this August is likely due to two key factors, according to R.J. Hottovy, Head of Analytical Research at Placer.ai.

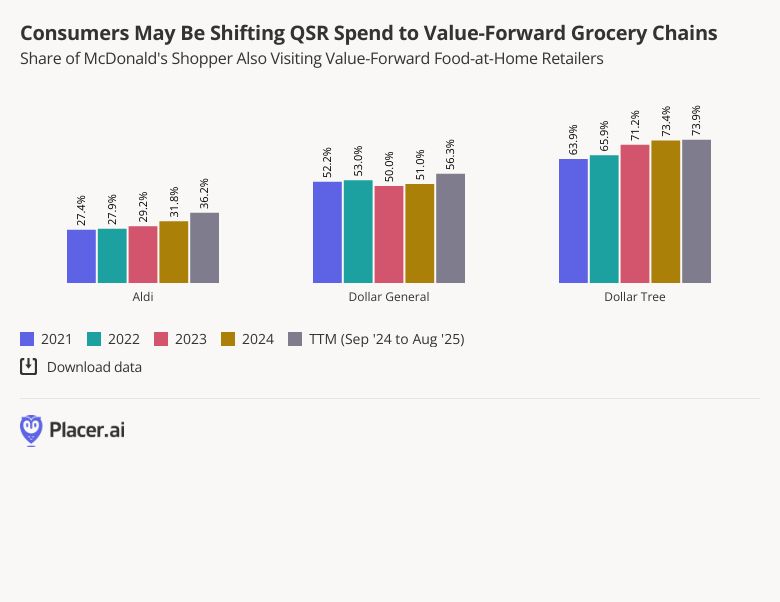

“First, many chains are lapping last year's successful $5 bundled meal promotions, which drove a temporary lift in traffic and created difficult comparisons. Second, we've seen lower- and middle-income consumers increasingly opt for value-oriented food channels, like discount grocers and dollar stores, as they look to stretch their household budgets.”

Additionally, Placer.ai found retail and dining traffic declined for the third month in a row in August., while value promotions at casual brands including Chilis and Applebees continued to resonate with guests.

Hottovy notes that if the two-tier economy and trade-down effect continue, the industry could see a lasting market share shift, squeezing restaurants that fail to offer a clear value proposition.

“Brands that cater to either affluent consumers or the budget-conscious should continue to thrive, while those stuck in the middle will lose visits to both value-driven competitors and other food retail channels like grocery and dollar stores.”

Craig Miller, former Sonic Drive-In CIO, said the distinction between convenience, fast food, and grocery is fading. 7-Eleven is actively introducing new store layouts and formats that strongly support its goal of integrating fresh-prepared food and foodservice as a core growth driver.

“As traditional drivers (e.g. tobacco, fuel) face pressure or declining margins, convenience chains see fresh prepared food as a growth and differentiation lever," he said. "Many already stop at 7-Eleven for speed; adding fresh-prepared food means they can solve 'real meal' occasions without going elsewhere."

Budget-conscious fast-casual customers are trading down to less expensive options or reducing visit frequency, while others are assembling their own meals specialty grocers for a lower-cost. Placer.ai data also suggests economic pressures aren’t the only factor driving slower traffic to fast-casual chains, as a growing number of consumers are experiencing the “slop bowl fatigue” phenomenon.

“‘Slop bowl fatigue’ refers to a growing consumer perception that the fast-casual bowl format, once seen as innovative, has become commoditized and lacks meaningful differentiation between brands like Chipotle, CAVA, and Sweetgreen,” Hottovy explained. “Brands should be concerned about the related store traffic because this fatigue, combined with economic pressures and increased competition from grocery stores, is causing a slowdown in visits as consumers begin to seek out more unique dining experiences.”

With added competition for the share of stomach, what can brands do to attract and retain guests?

“To attract and retain guests in a highly competitive market, we've seen brands succeed by combining menu innovation with competitive pricing,” said Hottovy. As seen with casual dining leaders in Q2 2025, this approach successfully captures the budget-conscious consumer by pairing appealing new items or fan-favorites with affordable meals that create a compelling reason to dine out.”

Top chart courtesy of Placer.ai.