Restaurants Can Fight the Bite of Chargebacks (Infographic)

5 Min Read By Monica Eaton-Cardone

Like any business, you may occasionally have to deal with an unhappy customer. Traditionally, this has meant that the manager comes out and apologizes to the guest, then offers a discount or a comped meal.

This system has worked well enough in the past. However, a lot has changed in the last four or five years. Widespread adoption of branded apps, online ordering and delivery, accelerated by the Covid crisis, has forced restaurants to deal with an issue that they’ve mostly avoided until now: chargebacks.

Historically, restaurant chargebacks typically happened when a guest found something wrong on their credit card statement, such as being double charged or having an unauthorized tip added to the bill. Instead of calling the restaurant, the customer called the bank and had the payment reversed. The merchant then loses the dollar value of the meal, and has to pay fees and other costs resulting from the chargeback.

Until recently, chargebacks in the restaurant business were comparatively rare. So, what changed?

The Impact of Online Ordering

The digital era has had a huge impact on the food and beverage space.

Being able to order online and have dinner delivered opened new doors of opportunity for eating establishments. Larger chains created their own mobile apps. Local eateries often got in on the game by working with third-parties to facilitate delivery services.

Many consumers still wanted the experience of going “out” to eat, so digital channels didn’t upend the industry. Rather they just let merchants augment their business with a new revenue stream.

Then came Covid.

With mandatory quarantines in place, gathering to eat wasn’t even an option. Consumers adjusted; between 2019 and 2020, online ordering for food/beverage rose by a record 93 percent.

Customers placed orders from their phones or computers, paying by credit card and having food dropped off without so much as talking to the delivery person. Online ordering probably saved the restaurant industry, but salvation came at a price. The rise of digital channels was accompanied by a comparable jump in chargebacks.

Obviously, guests had been using credit cards at restaurants for years. Those payments were made in a card-present situation, though. The server or host was able to physically see and handle the guest’s payment card. Also, as of 2019, up to 35 percent of in-person restaurant purchases were paid for in cash. Neither of these methods are particularly susceptible to chargebacks.

During Covid, however, in-person purchases dropped dramatically. No one was even eating in restaurants, let alone handing cash or a credit card to a server. The majority of payments were now card-not-present transactions, making them much more susceptible to chargebacks.

For starters, online orders don’t have the fraud protection provided by EMV chips. In fact, since no physical card scan is required, a fraudster might not have a physical card at all. Rather, they may have hijacked the account of a legitimate cardholder, or cobbled together a fake persona from bits of data purchased on the dark web.

Friendly Fraud and System Abuse

Criminal fraud exists in the food and beverage space. It’s a comparatively tiny number of cases, though; the bulk of chargebacks result from first-person sources like friendly fraud.

Naturally, not every customer complaint results in a chargeback. For example, miscommunication is much more likely with online or phone orders than orders placed in person. An order taker may write down the wrong item, or might misunderstand instructions. In these instances, the customer will often call the restaurant and try to resolve the problem.

What about online orders, though? In a growing number of these cases, the buyer calls the bank that issued the credit card and asks that the charges be reversed, rather than contact the merchant.

Why is this? Well, the fact that you’re dealing with an online form, rather than a person over the phone, makes it feel less personal, so there’s less inhibition to filing a chargeback. Or in situations where the ordering was done through a third-party, the buyer may not actually be able to reach the restaurant in question.

Also, sadly, there are people who play the system just to get a free meal.

The anonymity of online ordering has made it much easier to place an order with the intent of abusing the chargeback process. Because the buyer interacts with an online form, rather than a real person, it’s easier to rationalize this behavior as a “victimless crime.”

Whatever the reason, by the time the merchant learns of the dispute, the whole thing is over and done. Even worse, the guest has the right to file a chargeback for months after the date in question.

Things Are Bad All Over

Restaurants may be new to the friendly fraud threat, but they’re certainly not the only victims.

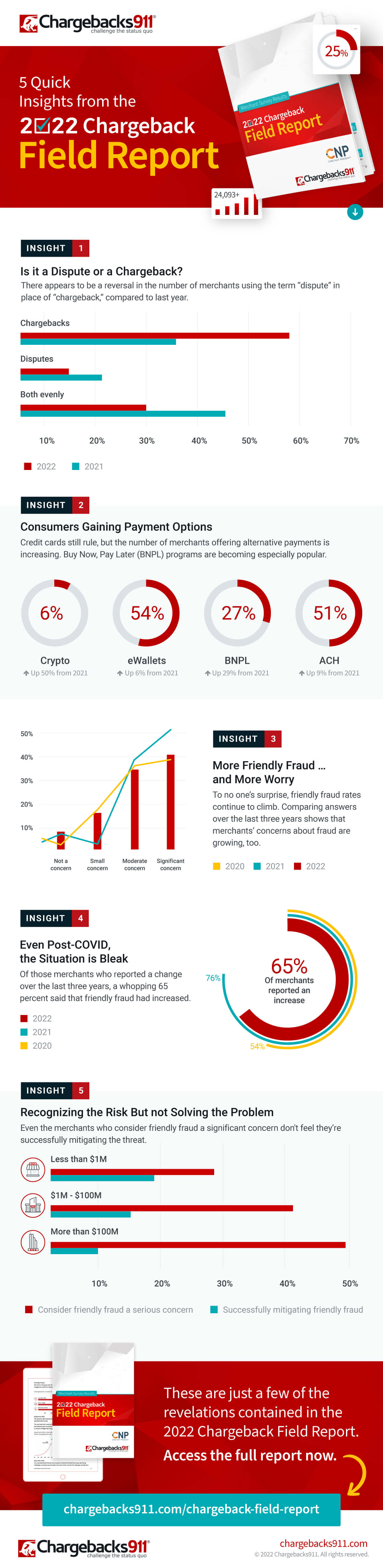

Like we mentioned before, chargebacks and friendly fraud surged during the Covid outbreak. The numbers continue to climb, according to findings from the recently-published 2022 Chargeback Field Report.

The study, a joint endeavor between Chargebacks911 and Card Not Present, reflects survey results drawn from more than 300 retail merchants across all verticals. Of the respondents, nearly two-thirds said that chargeback abuse—commonly known as friendly fraud—had increased.

How Merchants Can Fight Back

The report also shows that more and more businesses are accepting payment methods other than cash or credit cards. For eating establishments, in particular, this may be something to consider. Most friendly fraud comes from credit card orders, so offering alternative payment options may help lower the risk of chargebacks from online orders.

That said, there are plenty of other steps which merchants in the food and beverage space can take to minimize fraudsters’ opportunities.

Some solutions are common sense approaches. For instance, merchants should double-check phone orders with customers. They should ask for the CVV number on the backs of credit cards for all orders, and compare the order to the ticket before the delivery goes out the door.

Another good chargeback prevention technique is an increased focus on customer service outside the restaurant. Every establishment should have someone regularly monitoring review sites and social media. All comments should be acknowledged, whether they’re good or bad. If a customer has a complaint, for example, an apologetic message directly from the proprietor, with a solution to help make the situation right, can make a big impact.

Some fraud prevention techniques are the same, no matter what the vertical. All merchants should carefully adhere to each card networks’ requirements and best practices. Having clear, easy-to-understand billing descriptors is also important: many chargebacks can be avoided if the cardholder can recognize the name of the restaurant where the purchase was made.

Some restaurants are also seeing problems with “digital dine-and-dash” situations. This refers to customers who order and consume food, then call the bank and claim the order was wrong, or that the service was bad, or that the food never arrived. The bank then files a chargeback on the fraudster’s behalf.

Fighting this type of fraud requires merchants to have evidence that the claims are invalid. Including a receipt with each order is a must, with the merchant keeping a copy. Photographs of orders and tickets before they’re picked up and after delivery can be helpful. Requiring buyers to show ID at delivery provides evidence.

The Bottom Line

Even under the best conditions, it’s hard being in the restaurant business. Now, circumstances have forced even sit-down restaurants into the delivery game, as well. That brings with it an increased risk for fraud and chargebacks.

The threat will likely continue to grow, but that doesn’t mean managers and proprietors have to be victims. Like other businesses, restaurants must adapt to these new circumstances, acknowledge the threat, and take steps now to effectively manage chargebacks wherever they can.