Reshaping the Guest Experience

4 Min Read By MRM Staff

Successful operators need to take a hybrid approach that balances modernization and human connection, according to Inside the Fast Lane: Consumer Insights for Quick-Service Restaurants, a report from MX8 Labs that asked consumers how they feel about quality, service and new technology.

Among the key highlights:

-

McDonald's captures both the highest brand awareness overall (85 percent) and largest share of recent visitors (67 percent). This dominance is even more pronounced among specific demographic segments, highlighting the brand's multi-generational appeal. 77 percent of Gen Z respondents noted recent McD’s visits while 73 percent of Boomer respondents noted they had recent visits.

-

Some brands shine in certain regions: Hits in the South include Smoothie King (57 percent regional awareness), Tropical Smoothie Cafe (52 percent), Whataburger (52 percent) and Zaxby's (53 percent). Meanwhile, In-N-Out (72 percent) and El Pollo Loco (53 percent) rule in the West. Brands like CAVA, Sweetgreen and MOD Pizza still have relatively low awareness (<30 percent overall), showing potential for expansion or awareness campaigns, especially in underpenetrated regions.

-

Comfort with using AI voice assistants to order food at a drive-thru or over the phone varies dramatically across demographic segments, with education level and income emerging as stronger predictors than age for openness to technological innovation. Overall, 61 percent of total respondents said they would be "somewhat" or "very" comfortable placing an order with an AI voice assistant.

For a deeper dive, Modern Restaurant Management (MRM) magazine reached out to Tyler Wade, CRO & Head of Partnerships at MX8 Labs, an AI-based market research platform.

What results, if any, surprised you?

One of the surprising results came from when we looked at the consumers by age demographic. Our survey found that older adults (65+), had higher awareness of a few QSR and fast casual chains compared to the general population.

In one case, for Arby’s, awareness of their brand was 18 percentage points higher than the general population, which suggests Arby’s might do well if they consider marketing strategies devoted to this group in parallel with developing strategies to drive up their general brand awareness Among U.S. consumers overall.

What should QSR operators take away from this report?

The U.S. consumer is fast-moving and their appetite, no pun intended, for immediate results and gratification is at an all time high and growing. In all aspects of a consumer’s life – from the content they watch to the people they interact with, results are immediate and driven by technological changes. It’s no different in the QSR space.

QSR operators have a business imperative to understand an evolving consumer in a manner that keeps pace with this hyperspeed world we all live in.

MX8 Labs research found consumers are willing to embrace tech, have high expectations for fast food brands and place a premium on quality and service. QSR operators have a business imperative to understand an evolving consumer in a manner that keeps pace with this hyperspeed world we all live in.

In what ways have guest expectations evolved? What are key generational differences?

We found that consumers still like having a human connection at the counter. Like other sectors, emerging technologies – in this case AI – has a generational divide when it comes to comfortability, according to our report. While it’s typical for younger generations to be ‘early adopters’ of tech and culture and older generations to be holdouts, we now know tech like streaming platforms has become ubiquitous among ALL consumers. It’s no different in the QSR sector with regard to AI. QSR operators should understand and implement AI voice assistance with that in mind and keep connected to who their customers are and how they feel – less they risk alienating some.

What are the best ways for operators to balance modernization and the desire for human connectedness and take a hybrid approach?

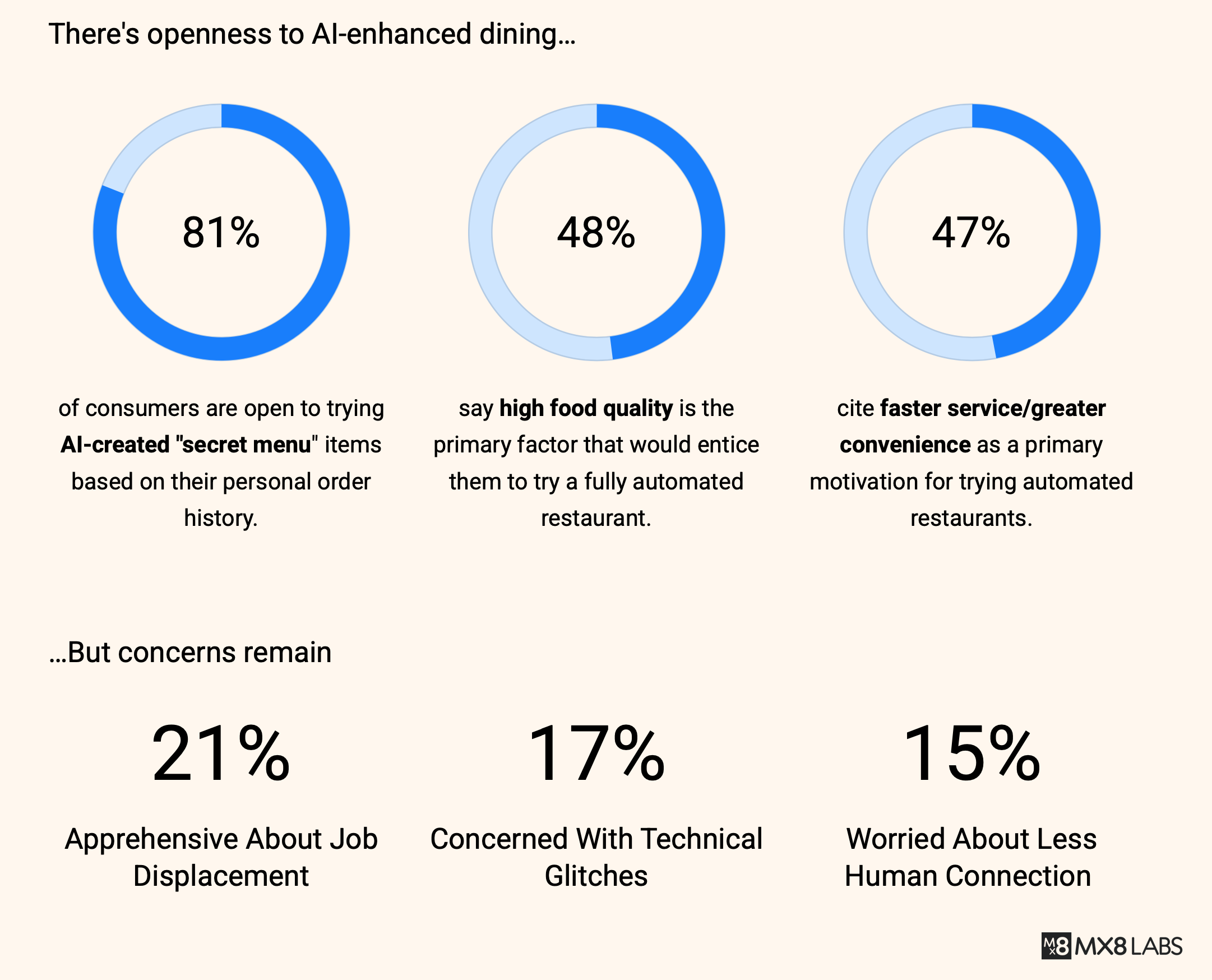

Balance is truly the key for QSR operators. Our report found that 66 percent of U.S. consumers still preferred human interactions, but a whopping 81 percent of consumers are totally on board with QSR operators leveraging AI to help create a "secret" personalized menu for patrons based on their personal past order history. This bespoke experience could actually create overall better brand experiences for consumers and help capture market share.

What lessons can emerging brands learn from legacy operators and vice versa?

Emerging brands challenging the bigger operators in the QSR space need to have a continued pulse on who their best customer is and what they desire. Doing that could help them quickly achieve brand awareness on par with the bigger operators in a much shorter arc of time.

Conversely, established QSR operators should take note: According to our survey, word of mouth is STILL the best way to drive patronage and social is not far behind, so the viral factor is clearly at play here.

What are key challenges for restaurant marketing campaigns?

I wouldn’t call it a challenge per se, but marketing campaigns in the QSR space are better suited alongside a cohesive social media strategy. Our report found that almost half (45 percent) of consumers said they've tried a new restaurant or ordered a menu item because it went viral on social media with 35 percent reporting that it did indeed live up to the hype. Think Grimmace Shake.

What does the report suggest about pockets of opportunity where operators should consider making tech investments?

AI investments are table stakes for QSR operators right now. Be it driving better ordering experiences to creating personalized menu items, AI is a tech investment too prominent to be ignored by QSR operators of all sizes – from challenger brands using AI to reduce cost and scale to leading QSR operators deploying AI to help with workforce efficiencies. AI is changing other industries, it’s certainly going to have an impact on this one.

Insights were collected from a comprehensive, nationally-representative survey of more than 500 U.S. adults conducted in July of 2025.