QSR Halftime Report: Value and Channel Strategies to Finish Strong in 2025

4 Min Read By Jana Zschieschang

Declining consumer confidence, diminished traffic and pricing struggles have defined 2025 so far. Here’s how restaurant operators can prepare for the rest of the year.

Halfway through 2025, the quick-service restaurant (QSR) sector is at a crossroads. Consumer confidence is slipping, traffic is soft, and price and promotion alone can’t drive growth. Revenue Management Solutions data shows diners are rethinking where, when, and how they spend — from trading down or buying grocery meals to shifting toward late-night and off-premises channels. In response, brands are testing sharper promotions, loyalty programs, and extended hours. The challenge now: how to finish the year strong in a market where value, dayparts and channels are all in flux.

The First Half: What We Know

In the first half of 2025, consumer behavior showed marked shifts, creating challenges for QSRs.

Price fatigue. Traffic declines beginning in 2022-23 suggested guests were becoming more price-sensitive. In early 2025, customers got increasingly “exhausted” by inflation. In RMS’ Q2 2025 survey, nearly two in five consumers said they spent less at restaurants, leading to fewer visits, ordering fewer items and trading down to more affordable restaurants.

Shifting from tables to aisles. Despite budget tightening, casual-dining concepts such as Chili’s reported positive performance as consumers perceived value in upgraded service and atmosphere.

Yet, grocery and convenience stores also grabbed a share of food spend. In RMS’ survey, Check, Please or Checkout?, 24 percent of diners said they buy meals from grocery stores more frequently than they did a year ago. This outpaces the increase in visits to QSR (15 percent), fast-casual (eight percent) or full-service (10 percent) restaurants in Q2 2025 (RMS Q2 Dining Report). Most concerning were high-frequency restaurant goers. Those who visit restaurants five or more times a week were the most likely to shift their spend, which means restaurants are losing visits from their core customers.

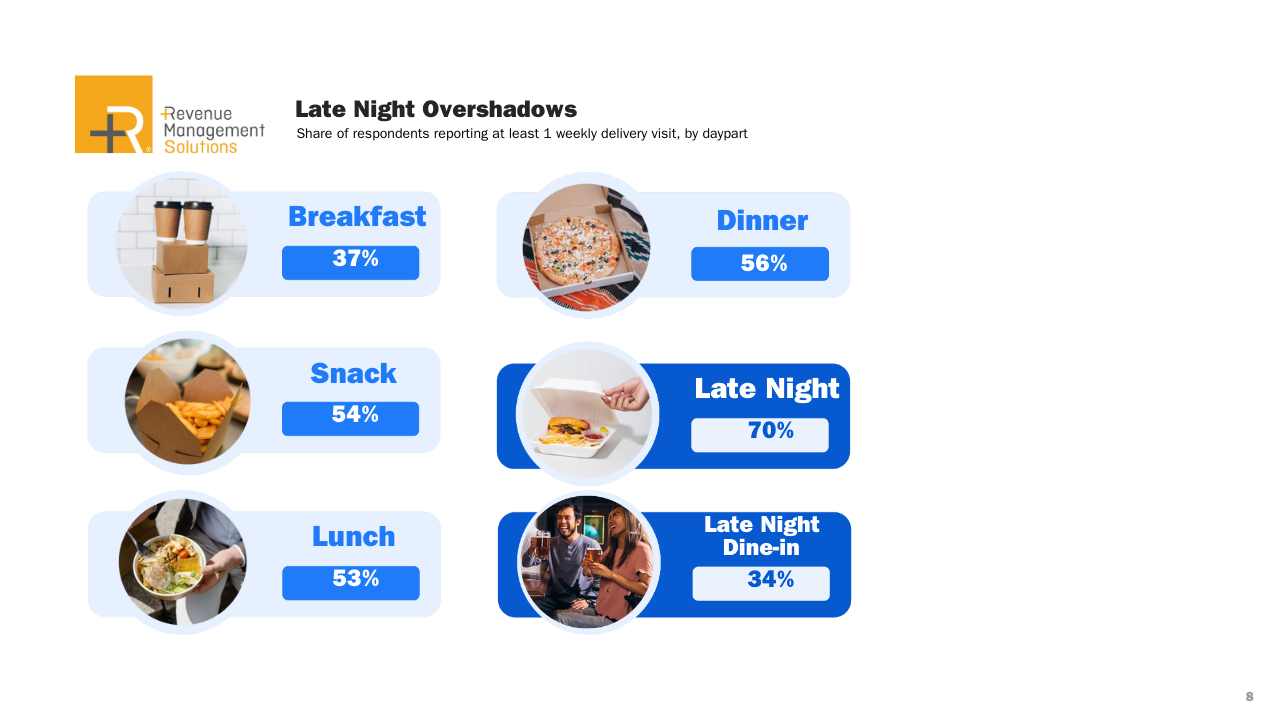

Dayparts are changing. QSR breakfast traffic trends have been negative throughout 2025, down an average of -8.0 percent YOY. But other occasions are on the rise. In RMS’ Q1 consumer study, 34 percent of respondents reported dining out more late at night, and 70 percent said they are ordering delivery during off-peak hours. In response, savvy brands are exploring late-night dinner, extending hours and offering meals that are both easy to assemble and highly profitable.

Channels are in flux. While RMS’ latest figures show QSR delivery up +10.8 percent YOY, nearly two in five consumers plan to reduce delivery due to fees and extra charges, signaling price sensitivity. Drive-thru visits are down five to eight percent OY throughout 2025, slipping to ~65 percent of fast-food sales, down from 83 percent at the 2020 peak. Brands that invest in speed, personalization and digital integration are best positioned to recapture drive-thru demand.

The Second Half: Playing the Odds

In the second half of this year, consumer confidence — which has dropped 14 index points since 2023 — will be a critical factor in QSR performance. A further decline could be consequential. For example, a 10-point decline in confidence could result in a 0.5 to two-percent decline in traffic within just two months.

In this tenuous environment, we predict the following:

Traffic: Overall visits will likely remain below pre-pandemic norms for casual and fine dining, while QSR will hold steady thanks to convenience and value-driven offers. We expect loyalty programs and promotional strategies to attract repeat customers, especially personalized offers tied to core cravings.

Value: The“value war” will shift from absolute low prices to offers featuring core items at affordable prices.

Dayparts: Expect breakfast to remain soft as commuters save with coffee at home. Dinner is likely to remain the strongest daypart for QSR in H2, with late-night becoming an opportunity.

Channels: Gen Z, millennials and families will eat at home, while Boomers will still crave the dine-in experience. Our latest consumer report reveals a majority of Gen Z, millennials and households with kids prefer off-premises dining, while Boomers remain dine-in advocates (59%). We expect mobile/takeout to continue growing, delivery to normalize (tempered by high fees) and dine-in to remain steady or tick up modestly.

Power Plays: What Operators Can Do Now

Play Offense: Win Demand and Check

To capture growth in a shifting market, fast-food operators should proactively steer demand with innovative menus and promotions that attract customers where and when they want to dine. Consider these power moves:

- Promote daypart-specific offers. Drive breakfast traffic with simple, low-cost offers like a free coffee with purchase, and give customers reason to linger over a more leisurely breakfast on weekend mornings. For afternoons, highlight snackable items, specialty beverages and small bites designed for convenience on the go. During dinner, spotlight core items through bundles or LTOs, and use loyalty rewards and targeted digital promotions to increase visits and check size. Finally, consider extending your hours of operation to meet the growing segment of late-night diners.

- Strategize menu innovation. Elevate high-margin items through seasonal LTOs, items or bundles to draw attention away from competitors. Experiment with menu engineering to increase the average check size. Use design and placement to direct attention and encourage trade-ups — without sticker shock.

Play Defense: Protect Pricing and Unit Economics

Protecting profitability requires disciplined control over costs, pricing, and shifting operations to maintain margins even in challenging conditions. These defensive plays can make the difference in the second half:

- Implement precision pricing at the store level. Rather than blanket price hikes, RMS recommends store-level pricing. Our clients are finding success by analyzing each location individually to align a location’s price points to suit local demand, competition and market dynamics in real time.

- View financials across the system. Multi-unit operators need consistent P&L visibility to see patterns early. Use financial tools, to get a standardized view across locations. Track key financial metrics like cash-on-cash returns, liquidity ratios, payback periods and more to identify cost-saving opportunities, target underperformance and strengthen franchises’ financial health.

Positioned to Win the Second Half

The first six months of 2025 were about adapting to shifting consumer patterns. The second half will be about anticipating them. Brands that use sharper insights to develop nimble strategies will be best positioned to keep pace with shifting consumer expectations.