MRM Research Roundup: Mid-November 2020 Edition

18 Min Read By MRM Staff

This edition of MRM Research Roundup features holiday plans and expectations and the move to contactless and digital.

State of the Industry

Online ordering is obviously huge in 2020, and customers are craving comfort food when they’re ordering in, according to Upserve’s new 2020 State of the Restaurant Industry data collected from the company's 10,000+ restaurant customers. Among the highlights:

- Online Ordering sales of pizza (+9 percent), burgers (+10 percent), and fried chicken (+5 percent) were up from last year, but the largest trend in online ordering was sandwiches and wraps as guests give up on slapping bread together at home and restaurants pivot to menu items that travel well.

- When it comes to dine-in, guests are going big with seafood (+17 percent) and steak (+8 percent) topping the list. With guests are dining out less, it makes sense that they are ordering bigger ticket items when they do.

In the report, Upserve shares national sales trends, and the tactics from 10 restaurants who were able to grow sales up to 188 percent year-over-year in 2020 despite COVID and average restaurant sales being down 40-90 percent year-over-year.

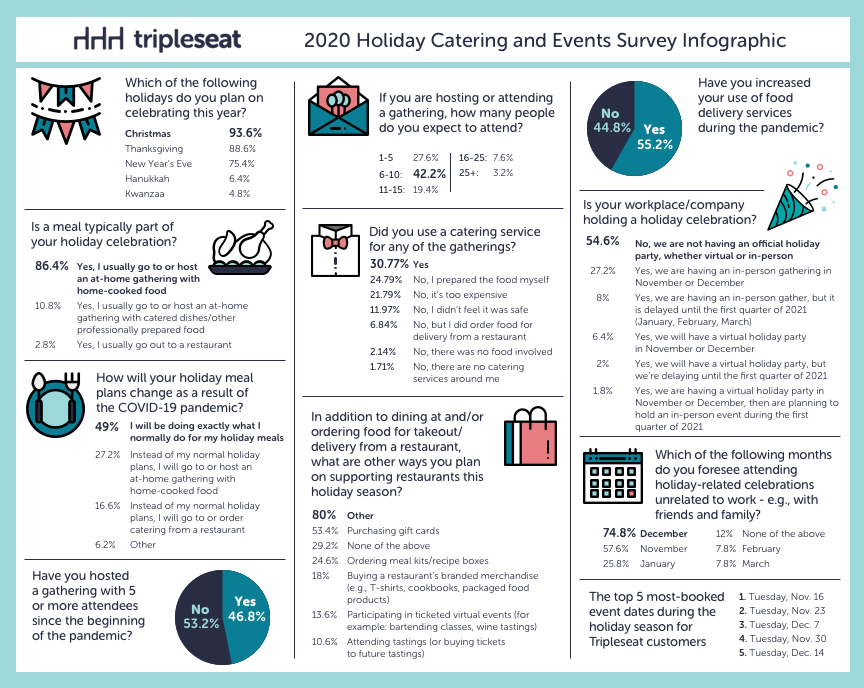

Holiday Plans Impacted by COVID

Tripleseat announced the results of a recently conducted survey of 500 Americans to see how their holiday plans have been impacted by COVID. The survey also gathered insights on consumer habits and spending preferences over the course of the pandemic.

The survey insights show how the hospitality and event industry can pivot their offerings to cater to consumer preferences. Key findings include:

- People generally stay home for their holiday meals and they are not changing that this year, except they may be having smaller gatherings or opting for a virtual celebration. For those who are hosting in-person gatherings this holiday season, a majority of them will be having 6-10 guests. For restaurants, this means that they can pivot to smaller portion sizes for to-go holiday meals, or offer a-la-carte choices.

- They asked respondents if they had hosted a gathering with 5 or more attendees. A little under half of the respondents said yes, and of those 30 percent of them used catering for these events. If they did not use catering, their biggest reasons were that it was too expensive, they cooked the food themselves or they felt catering was unsafe. In order to push catering for this holiday season, restaurants can provide pricing incentives in order to attract more customers, offer a-la-carte options for holiday meals, and push out more marketing material showing their sanitary precautions when preparing food to ease consumer's worries.

- More than half of respondents are purchasing gift cards to restaurants this holiday season. If possible, restaurants and event spaces should set up an online gift card system to make the transaction simple and easy for consumers.

- Over half of respondents answered no when asked if their workplace/company is holding a holiday celebration; however that doesn't mean they won't happen eventually. Restaurants and event spaces can offer consumers incentives to book post-holiday parties in the spring months of 2021.

Jonathan Morse, CEO of Tripleseat said, "The 2020 holiday season will be a bit different than years past. Food brings many families together and is an important part of a lot of holiday traditions. We are excited to see how many people still plan to find ways to celebrate and we are hopeful that restaurants will be able to support that in safe and effective ways."

Demand for Contactless

More than 27 percent of Americans have not used cash to pay for food, beverages, merchandise, or services since Covid-19, and 77 percent will prefer contactless payments even after the pandemic ends. This is according to a recent Appetize Contactless Technology Survey that explored consumer trends in dining, sports, and shopping during Covid-19.

In the new report conducted October 19-20, 2020, Appetize polled 2,081 people ranging from 18 to 70 in the United States with 30 questions on the impact Covid-19, contactless technology, and mobile ordering has on their decisions and experiences at restaurants, stadiums and holiday shopping during the current landscape—as well as their preferences post Covid-19. From restaurants to retail, contactless payments, mobile ordering and digital technology are becoming “the new normal” for businesses now and into the future.

Mobile ordering trends

- Americans use their phones every day, but many go beyond the typical phone calls, texts and web browsing.

- According to the survey, over 74 percent of Americans use their phone to order and pay for food and merchandise at least once a week, with nearly 48 percent using their phones for purchases several times a week or more.

- The No. 1 reason Americans use mobile ordering? The sheer convenience. In fact, 44 percent Americans said convenience was the most important factor for ordering and paying for food and merchandise with their phone. Ease of use (18.6 percent) and avoiding going into stores (18.3 percent) were also top reasons.

- In the survey, more than half of Americans (54.8 percent) use their phone for online retail (ie: Amazon). Food app/restaurant delivery was the second most popular (25 percent) and In-store purchase, such as “tap to pay” at checkout came in No. 3 at 9.3 percent.

- While mobile ordering has been on the rise in America, mobile payments have not become the preferred method of payment during Covid-19. Americans still prefer using credit cards (55 percent), with payment using a mobile phone coming in No. 2 at 16.37 percent.

Holiday shopping trends

- Americans would shop in-store for the holidays if contactless payments were offered, and cash is becoming less commonly used for payment with shoppers, according to the survey.

- Almost half of Americans (49 percent) would do in-store holiday shopping if contactless payments, like mobile ordering, self-service kiosks, and tap-to-pay credit cards, were offered. The contactless technology they would most like to see their favorite store, restaurant and venue offer is mobile ordering (44 percent). Tap-to-pay credit card machines came in No. 2 at 20.3 percent with self-service kiosks coming in at 18.5 percent.

- 58.5 percent of Americans said they are more likely to support a business if it offers contactless payment, with 36 percent of Americans saying they were neither more likely nor unlikely.

- During Covid-19, credit cards (55 percent) was the preferred method of payment versus mobile phone (16 percent), tap-to-pay cards (13 percent) and cash (12.5 percent). While nearly three quarter Americans (73 percent) have paid for some merchandise, food, beverages or services with cash since Covid-19, 41 percent Americans paid less frequently with cash during Covid-19.

- 77 percent of Americans said they will prefer to pay for merchandise, food, beverages and services with contactless payments once Covid-19 is over, showing the decline in cash payments will continue after Covid.

- 55 percent Americans currently use their phone to purchase online retail versus food app/restaurant (25 percent) and in-store purchases (9.3 percent).

Stadiums / Sports trends

- In the survey, it’s apparent Americans care about social distancing at stadiums, and mobile ordering is important for them, too.

- When it comes to contactless technology, more than half (51 percent) Americans want to use mobile ordering directly from their seats, versus 18 percent self-service kiosk at concessions, 3.8 percent hawkers with handhelds, and 26 percent all of the above. 55 percent expect to use mobile ordering in stadiums post Covid-19, and it may become integrated more as the trend for mobile ordering at stadiums continues to rise.

- The No. 1 reason why fans like to use mobile ordering in stadiums? Avoiding waiting in concession lines (39 percent). 30 percent Americans responded “convenience of ordering food/beverage directly from their seat”, and 17 percent said mobile ordering “helps avoid contact with staff.”

- While Americans found mobile ordering ideal at stadiums, social distancing during Covid-19 was still a priority for fans. Since teams are playing to empty stadiums, with only a few welcoming back fans, Covid-19 still has influence over fans returning to the games—and while mobile ordering helps social distancing, it’s only part of the equation. 34 percent Americans responded “I’m not sure” when asked if they would be willing to attend a game sooner if mobile ordering was offered (33.5 percent said no, 32 percent said yes). Almost half Americans (46 percent) said social distancing was important for them when attending a live event (versus 24.6 percent very important, 19 percent somewhat important, 5.5 percent not so important, and 3.8 percent not at all important).

- When will fans likely attend their next live sporting event? 34.9 percent said “I’m not sure” while 17.8 percent responded “some time in 2021.” 15.9 percent will return when there is a Covid-19 vaccine, and 14 percent will return “as soon as my local stadium opens for fans.”

- The survey also found that nearly three quarter of Americans (74 percent) would like to see better ordering technology enhancements (like self-service kiosks and mobile ordering) at stadiums.

Restaurant trends

- As more restaurants pivot to contactless technology to accommodate the demand from guests, they can rest well knowing they’re meeting those demands.

- In the survey, three quarter (75 percent) of Americans think restaurants are doing enough to offer contactless payment technology. Only 13 percent Americans believe restaurants are not doing enough.

- When it comes to the technology offered at restaurants, almost half (45 percent) Americans prefer to view the menu, order, and pay with their phone rather than interact with waitstaff during Covid-19. 40 percent of those Americans would want to continue doing this once Covid-19 is over.

- Diners may be seeing more self-service kiosks at their favorite restaurant soon. More than half Americans (57 percent) want to see self-service kiosks at their favorite restaurants. The main reason why? Convenience. In fact, 39 percent Americans respond that “convenience” is the most important factor, followed by “no interaction with staff” (19 percent), and “more time to browse the menu” (14 percent). Do Americans want to use self-service kiosks the next time they visit their favorite restaurant? Yes, 44 percent Americans would like to, versus 23 percent who said no.

- As for quick-serve restaurants, 71 percent prefer self-service kiosks over interacting with a person at least some of the time. Only 19 percent responded that they prefer a person.

- The other technologies that Americans would like to see on their next visit to a restaurant are: Tap-to-pay at checkout at the counter (43 percent); mobile ordering directly from their car in the parking lot (40 percent); curbside pick-up (38 percent) and waiters with handheld devices (34 percent).

- Nearly half of Americans (48 percent) would dine at a restaurant more often if it offered a brand loyalty program (versus 14 percent no and 32 percent maybe).

- The most important factor for Americans to join a brand loyalty program? Discounts and special offers for future visits (54 percent); free food (27.5 percent); reaching a certain tier in a program (10 percent) and getting news and updates (5 percent).

Americans Like Self-Service

- Almost 72 percent of Americans said they prefer self-service kiosks at quick service restaurants over interacting with a person.

- 57 percent said they would like to see more self-service kiosks at their favorite restaurants.

- 45 percent said that they would prefer to use their phone when dining at a restaurant rather than interact with waitstaff during Covid, and 40 percent said that they would still prefer to use their phone rather than interact with waitstaff after Covid.

Shift to Digital

According to new research from Incisiv, the limited service restaurant industry—restaurants where diners order and pay before eating—is undergoing a dramatic shift to digital sales. Although digital sales are expected to decrease in 2021, over half of the industry’s business will come through digital channels by 2025. As well, digital sales through September 2020 are 70 percent higher than pre-COVID estimates. These findings are from Incisiv’s annual Limited Service Restaurant Digital Maturity Benchmark report, sponsored by Cybera and Rakuten Ready.

Additional key highlights from the report include:

- Delivery services have enabled restaurant survival: The share of sales through delivery is expected to grow to 23 percent in 2025 vs pre-COVID forecasts of 15 percent. What’s more, more than 90 percent of the top 50 LSR/QSR chains now have partnerships with third-party delivery services.

- Curbside takes centerstage: Curbside pick-up adoption has experienced a 5x increase, growing from 15 percent to 71 percent during the pandemic. This growth makes restaurant the most advanced segment among all other retail segments including grocery, apparel and others.

- Customers are less enamored with restaurant fulfillment: LSR/QSR culinary guests are largely satisfied with the initial stages of the buying journey (search and ordering) but are far less satisfied with the execution of available fulfillment methods and customer engagement techniques.

- New capabilities become the norm: The onset of new segments such as virtual and dark kitchens as well as third-party delivery offers more choice to guests but also blurs the lines between formats.

Based on performance analysis over four stages of the customer journey – research and discovery, digital ordering, order fulfillment, and customer engagement and service – the top 10 LSR and QSR brands on the 2020 Restaurant Digital Maturity Benchmark are:

- Starbucks

- Panera Bread

- McDonald’s

- 4. McAlister's Deli

- Pizza Hut

- Domino’s

- Chipotle

- Moe’s

- Panda Express

- QDOBA Mexican Eats

“While fulfillment is the area that has matured the most in the digital buying journey, only 25 percent of guests are satisfied with the delivery and fulfillment experience. This should be a huge wakeup call for LSR restaurants. From our standpoint, the chains that look closely at changing guest expectations in the digital realm will rise to the top as winners,” said Amar Mokha, chief operating officer, Incisiv. “This means adding capabilities around menu filtering with things like allergens or vegetarian, providing estimated times of arrival for deliveries, check-in prompts to ensure freshness of food and offering assistance through things like live chat.”

Click here to download the complete study.

Thanksgiving Insights

Thanksgiving is right around the corner and while celebrations may look different this year due to the pandemic, one thing remains constant and that is everyone’s favorite thanksgiving foods.

Viant used their Total Graph, inclusive of more than 250 million registered users and 115 million U.S. households, to look at approximately 500,000 viewers of the Thanksgiving Day Parade to better understand what food brands viewers are more or less likely to purchase as they prepare for their Thanksgiving feasts. Some interesting insights gleaned include:

- Parade watchers are 19 percent more likely to purchase Purdue brand turkey and 10 percent more likely to purchase Butterball brand

- Viewers who purchase stuffing are 27 percent more likely to purchase Progresso brand with Pepperidge Farm 14 percent more likely and Stove Top following at 13 percent

- When it comes to canned goods, viewers are 10 percent more likely to go for Libby’s brand followed by Dole brands at 6 percent and Del Monte brands at 5 percent

- Parade audiences are 14 percent more likely to purchase Ocean Spray brand cranberry sauce

- Finally, when it comes to dessert viewers are 16 percent more likely to purchase Pillsbury pie crust closely followed by Marie Callender’s at 14 percent, while viewers are 1 percent less likely to purchase Mrs. Smith’s pie crust

Shopper Anxiety

Hundreds of thousands of shoppers head to the grocery stores each year in preparation for their Thanksgiving feasts. But against the backdrop of the current pandemic, consumers are more concerned than ever about being in crowded stores and standing in long lines. As Americans everywhere plan to shop for the food-centric fall holiday while trying to protect their own safety and minimizing contact with others, online Order for Pickup across the grocery industry will spike.

Rakuten Ready recently found that:

- The volume of online Click and Collect orders since February 2020 has increased by over 200 percent, and will likely only continue to rise through the holiday shopping season.

- The number of grocery-specific Click and Collect orders has grown 57 percent since the start of the 2020.

- More than 82 percent of consumers said they have used Order for Pickup to purchase from restaurants, grocery stores and other retailers in the last six months.

- Customers who wait less than two minutes to pick up their order are 4x more likely to repeat purchase.

Business Cleanliness

Findings from a recent national survey unveils strong consumer confidence in business cleanliness, with two-thirds of Americans (65 percent) saying businesses are cleaning enough. The findings from the survey conducted for American Cleaning Institute (ACI) by Ipsos underscore shoppers’ confidence in not only the cleaning products and recommended protocols, but also their confidence in businesses to implement these protocols effectively within their workplace. The survey analyzed consumer perceptions of cleaning measures following an unprecedented decline in sales for many small businesses and retailers due to the coronavirus (COVID-19) pandemic.

Ahead of the holiday shopping season, these survey results come at an important time for businesses and retailers as many consumers are deciding on doing their shopping in-store or online.

To help business across the country navigate a successful re-opening, the American Cleaning Institute rolled out new resources through the Healthy Returns program. Adapted from public health recommendations, the free online toolkit provides guidance and checklists containing easy to understand reminders on hygiene and cleaning that are crucial to keeping the workplace healthy and safe.

“As the country continues to grapple with the long-lasting impacts of the ongoing COVID-19 pandemic, we know how important this holiday shopping season is for many businesses,” said Melissa Hockstad, ACI President & CEO. “At ACI, we are committed to serving our business community and providing them with the tools and resources needed to both ensure safe operations and also reinforce confidence among employees and customers through effective cleaning measures.”

Additional survey responses include:

- Confidence in cleaning products is particularly high among older adults (90 percent of those ages 55+ vs. 81 percent of those ages 18-34). Those over the age of 55 are also significantly more likely feel as though businesses are generally cleaning enough (72 percent vs. 59 percent of those ages 18-34).

- More than half of Americans (51 percent) believe businesses, schools and other public locations are maintaining an adequate level of cleanliness in preparation for cold and flu season.

- Respondents expect to see businesses take additional cleaning and disinfecting measures in order to maintain a safe environment, including:

- Providing hand sanitizer (73 percent)

- Frequent wipe-downs of surfaces (77 percent)

- Signage of cleaning measures and regulations (53 percent)

No Travel this Holiday Season

A new national survey commissioned by the American Hotel & Lodging Association (AHLA) shows that many Americans are not expected to travel this holiday seasons. Results show that 72 percent of Americans are unlikely to travel for Thanksgiving and 69 percent are unlikely to travel for Christmas, compounding the challenges for the hotel industry during this public health crisis.

Business travel has been even more impacted. Only 8 percent of Americans say they have taken an overnight business trip since March, and just 19 percent of respondents who are currently employed—or 8 percent of all adults—expect to travel for business within the next six months. Sixty-two percent (62 percent) of employed Americans have no plans to stay in a hotel for business.

The survey of 2,200 adults was conducted November 2-4, 2020 by Morning Consult on behalf of AHLA. Key findings of the survey include the following:

- Only 3 in 10 (32 percent) respondents have taken an overnight vacation or leisure trip since March

- 21 percent of Americans say they are likely to travel for Thanksgiving, 24 percent are likely to travel for Christmas

- Looking ahead to next year, 24 percent are likely to travel for spring break

- 44 percent say their next hotel stay for vacation or leisure travel will be a year or more from now or they have no plans to stay in a hotel

The hotel industry was the first impacted by the pandemic and will be one of the last to recover. Hotel occupancy rates partially rebounded from record lows in April, but they have continued to decline since Labor Day. According to STR, nationwide hotel occupancy was 44.4 percent for the week ending October 31, compared to 62.6 percent the same week last year. Occupancy in urban markets is just 35.6 percent, down from 71.8 percent one year ago.

As a result of the significant drop in travel, more than half of hotels report they have less than half of their typical, pre-crisis staff working full time currently. Without further governmental assistance, 74 percent of hotels said they would be forced into further layoffs. Business and group travel are not expected to reach 2019 peak demand levels again until 2023. As a result of the sharp drop in travel demand from COVID-19, state and local tax revenue from hotel operations is estimated to drop by $16.8 billion in 2020.

The Road to Recovery

According to Cardlytics’ Ninth State of Spend update, which analyzed half of all U.S. card swipes, spend at fast food restaurants and QSRs is creeping closer to pre-COVID levels with spend surpassing 2019 levels in Sept. (up +0.4 percent year-over-year). Restaurant delivery is the bright spot for the industry, up +120 percent YoY.

As restaurant spend continues to recover, grocery spend is leveling off (sliding from +34 percent YoY in March down to just +8 percent YoY in Sept.). With the busy holiday season approaching, this trend could continue, presenting restaurants with the opportunity to target consumers whose grocery spend dropped while their restaurant and delivery spend increased. This is important, given that the decline of in-store retail spend means less dine-in patrons in high-traffic shopping areas for QSRs and FSRs. During the 2019 holidays, in-store shoppers spent $562.39 per customer dining out.

New Beverage Dynamics

At face value, on-premise figures are stark for both suppliers and retailers, with the average outlet’s beer sales down -33 percent and spirits sales down -19 percent against pre-COVID-19 velocities (as of the week ending Oct. 10). However, Nielsen CGA’s latest consumer research, backed up by check-level (i.e., at the level of each transaction) sales data in BeverageTrak, revealed critical context around changing consumer behavior and the promising trends that are emerging.

A key trend revealed in Nielsen CGA’s BeverageTrak data is the significant shift in check value. Prior to COVID-19, checks with at least one beer had an average value of $43; this has now risen +17 percent to $50. This dynamic is even more significant for spirits: checks containing at least one spirit used to average at $49. This has now risen to $61, equating to a staggering +24 percent increase. These jumps in check value data shed light on several new on-premise consumer trends: maximising the occasion, trading up / premiumization and the wider ‘treat’ mentality.

Above all else, Nielsen CGA’s BeverageTrak and consumer data highlights how COVID-19 has forced a change in consumer behavior and spend, requiring strategic action from on-premise businesses. With four in five (79 percent) on-premise visitors now staying in a single venue or reducing the number of places they visit, there is a rare opportunity to engage with guests for longer and tap into the ‘treat’ mentality that’s driving sales. This is emphasized by the 53 percent of consumers who agree that they are now more likely to treat themselves on bar or restaurant visits than they were before the pandemic

Unsurprisingly, alcohol–particularly beer and spirits–plays a key part in driving spend in on-premise outlets. For all checks–factoring in both those with and without drinks–Nielsen CGA’s BeverageTrak data revealed that they currently average at $38; -23 percent less than those with beer. For spirits, it’s a staggering -37 percent.

With fewer opportunities to go out, consumers are pushing for the best experience possible with each outing; ordering an extra drink is proving to be a good way to treat themselves. The emerging trend of premiumization will also play a big part in driving spend, with two in five (39 percent) on-premise visitors saying they are now more willing to trade up to a premium drink while out than they were before COVID-19. This number soars to 58 percent among 21 to 34 year-olds.

Nielsen CGA’s BeverageTrak data also revealed the subcategories driving the highest average check value. Across key U.S. states (NY, IL, CA, TX, FL, GA, CO, NJ and MI), the average value for checks containing vodka is up +36 percent vs. pre-COVID-19 norms (as of week ending Oct.), followed by tequila (+32 percent), whiskey (+29 percent) and rum (+28 percent). For beer, import leads in driving average check value at +23 percent, followed by craft (+22 percent) and domestic premium (+21 percent). In alternative categories, cider is also performing well, pushing the average value up +20 percent; however, this is dramatically overshadowed by hard seltzers, which are pushing the average check value up +81 percent vs. pre-COVID-19.

To tap into these trends and drive revenue, retailers and suppliers must have a strong understanding of the brands that are valuable and popular with consumers. Further, bartenders and wait staff need to be equipped with knowledge of brands that encourage trade-ups or give consumers the feeling of a treat. With well over half (62 percent) of visitors agreeing they are likely to add a higher tip than before COVID, this dynamic is a positive one for consumers and staff alike.

Surging Demand for Meatless Alternatives

The global meat sector at present is facing unprecedented level of disruption and competition, due to mounting growth of plant-based alternatives across many categories. Earlier, plant-based meat alternative products warranted limited shelf space and were meant for niche consumers. With increased awareness of “Veganuary” multiple manufacturers have expanded new product line for plant-based products owing to increased vegan or indeed flexitarian diet. These insights are based on a report on Plant-Based Beef Market by Future Market Insights.

The global food and beverage recent industry changes illustrate the growth in plant-based alternatives that has brought disruption. Companies across the spectrum are investing heavily in creating and acquiring new products and brands which will provide momentum to the surging consumer demand for plant-based beef products.

Key Takeaways from the Plant Based Beef Market Study

- A latest study by an ESOMAR certified market research and consultancy company, forecasts impressive growth of the Plant Based Beef market at over 22.7 percent CAGR between 2020 and 2030

- Based on the source, the soy-based protein segment holds the dominance in the market for plant based beef, while wheat-based protein segments are expected to grow prominently in the forecasted period of 2020-2030

- Based on the product type, burger patty segment holds the dominance in the market for plant based beef

- As alternate protein gains traction in the market owing to the increasing awareness about the environmental impact of food choices consumers make, the majority of the population is shifting towards plant based beef and is expected to gain traction in near future

- Companies across the spectrum are investing heavily in creating and acquiring new products and brands which will provide momentum to the surging consumer demand for plant-based beef products

- “Leading market players are focusing on launching novel tastes and textures to woo consumers. With COVID-19 tightening its noose worldwide, more companies are likely to focus on ensuring better nutrient profile, as consumers gradually move away from meat consumptions. This will bode well for the overall market,” said a lead analyst.

New Product Development Fuelling Plant-Based Products Demand

Increasing demand for innovative products has paved the way for product development across frozen, chilled and ambient segments. This innovation helps consumers with a wider choice of brands and products, and allows plant-based beef to advance improved shelf space and recognition.

UK is the global leader for vegan food launches. In 2019 approximately 18 percent of new food launches were vegan. Tesco has developed wicked kitchen range of meat-free products.

A few of the leading players operating in the Plant Based Beef market are Impossible Foods, Inc., Gardein by Conagra Brands, MorningStar Farms, Archer Daniels Midland Company, Symrise, Roquette Frères S.A., Kellogg's, Tyson Foods, Inc., Sotexpro SA, Crown Soya Protein Group, Puris Proteins, LLC, Ingredion Inc, Beneo GmbH, Glanbia plc, Fuji Oil Co., Ltd. and other players.

Several leading manufacturers of Plant Based Beef are focusing on partnering with prominent players in the market to increase its business footprints and to increase their production capacity. Leading players of Plant Based Beef are investing in research and development to produce organic, non-GMO ingredients for Plant Based Beef.

Foodservice Paper Bags Gains Momentum

A new market intelligence study by an ESOMAR certified market research and consulting firm, has forecasted that the global foodservice paper bags market will record healthy growth between 2020 and 2030, and will progress at a CAGR of 5.4 percent. Moreover, the study projects that the market will attain a global valuation of US$ 1.45 Bn by 2030. These insights are based on a report on Foodservice Paper Bags Market by Future Market Insights.

In the recent past, rising concerns regarding alarming levels of pollution caused by plastic have compelled several nations to impose a ban on plastic materials. This is promoting foodservice providers to opt for sustainable packaging solutions, thus driving the demand for paper bags.

Along similar lines, the proliferation of online food delivery and the growing trend of on-the-way meals are positively influencing the adoption of paper bags in foodservice applications. As end-users seek packaging solutions that are strong and leakage-proof, manufacturers are emphasizing on innovation in product design.

"Market players are focusing on developing products with high tensile strength and better quality to gain an edge over their counterparts, plastic bags, which are stronger than paper bags," remarks study analyst.

Key Takeaways

- Brown kraft-based paper bags are expected to account for more than 4/5th of market value, owing to their stiffness.

- Non-handle bags will remain the most sought type, capturing nearly 2/3rd of market value, backed by their convenience and low cost.

- On the basis of end-use, restaurants are poised to capture more than half of overall global value, ascribed to the rising trend of take-away.

- Europe is projected to spearhead the regional landscape of the market, capturing more than 1/3rd of market value.

- East Asia will prevail as the second most lucrative regions through the forecast period, holding a quarter of the market value.

- The outbreak of COVID-19 is exhibiting a dual impact on the packaging industry and it clearly reflects in the demand for paper bags in the foodservice sector. As people across the world remain confined in their homes, packaged food has emerged as a solution for their food cravings.

With efficient online food delivery services in place, consumers are resorting to online orders. This will aid the demand for paper bags to sustain during the forecast period to an extent. However, the closure of restaurants and other food outlets coupled with limitations on the production front will pose a challenge to the steady growth of the market during the pandemic.

Key players in the market are focusing on producing sustainable products to comply with the existing norms on packaging methodologies. Along similar lines, traditional growth strategies such as acquisitions, mergers, and expansions will continue to shape the competitive landscape. On these lines:

- In 2019, Amcor launched a new recyclable packaging format that is capable of reducing carbon impact by 64 percent.

- In the same year, Westrock company completed acquisition of KapStone Paper and Packaging Corporation with an intention to expand its product portfolio.