MRM Research Roundup: Mid-November 2019 Edition

17 Min Read By MRM Staff

This edition of Modern Restaurant Management (MRM) magazine's Research Roundup features if cooking is becoming a thing of the past, Drinksgiving, the state of snacking and the impact of sensory marketing.

Positive Traffic Growth

It is undeniable that the restaurant industry is experiencing a significant slowdown in same-store sales growth since the second quarter of the year, however in October, the industry was able to post its second consecutive month of small positive same-store sales growth at 0.1 percent. In addition, reversing the trend of negative year-over-year sales growth reported for July and August is welcomed news for the industry and consumer spending. This report comes from Black Box Intelligence™ data from TDn2K™, based on weekly sales from over 31,000 and $72 billion in annual sales.

“What is even more encouraging for the industry,'' said Victor Fernandez, vice president of insights and knowledge for TDn2K, “is that this small positive growth during the last two months has been achieved despite the industry lapping over two months with relatively strong performance in 2018. The industry’s two-year same-store sales growth continues to be positive and stable. The industry grew its same-store sales by 1.0 percent compared with October of 2017, while the average two-year growth for the previous six months is also 1.0 percent. Given the relentless erosion of guest counts, the industry is holding its ground surprisingly well when it comes to sales in the most recent months. The reason has been the acceleration in guest checks year over year. Consumers have signaled they are willing and able to spend increasingly more every time they eat out.”

Traffic Growth Remains Top Concern

Same-store traffic growth was -3.1 percent during October, which represented a 0.2 percentage point drop from September’s result. October’s weak traffic has become the norm in the industry. Same-store traffic growth has averaged -3.2 percent for the seven months since the beginning of the second quarter.

Although the net growth in the number of chain restaurant locations has slowed in recent years, growth continues to be positive and is compounded year over year. The result is a highly saturated industry in which restaurant visits continue to get diluted among many possible options for diners. In this environment, same-store traffic growth continues to be a real challenge for operators.

Off-Premise Sales Continue Fueling Growth, Third Party Delivery An Important Factor

Even if overall sales in comparable stores achieved some positive growth during October, it was entirely due to off-premise sales growth. This has been one of the most persistent and important shifts that we are tracking. The norm for the industry is now declining dine-in sales growth offset by very strong to-go and other forms of off-premise sales.

Third party delivery is undoubtedly playing a part in this shift, driven by the rapid adoption rates by the industry of this new sales channel. According to a recently published survey by Black Box Intelligence*, 86 percent of restaurant companies currently use some form of third party delivery, up from 82 percent at the end of 2018. And perhaps more telling, 86 percent of those restaurant companies that currently don’t use it are planning to implement third party delivery within the next twelve months.

Family and Upscale Dining are Best Performing Segments, Casual Dining Hurting

The fine dining and family dining segments continued to achieve positive same-store sales growth during October. Upscale casual rounded up the list of best performing segments based on same-store sales growth during October. The latter had been struggling through declining sales growth for most of the year, but experienced a strong rebound helped in part by a weaker comparison in October of 2018.

After a strong 2018, casual dining is experiencing a downturn this year. This segment was the worst-performing based on sales growth during October. Casual dining has now endured four consecutive months of negative same-store sales growth.

Pay Increases Necessary for Restaurant Managers

Restaurants continue adding jobs at an unyielding pace. The latest numbers from the Bureau of Labor Statistics show the number of employees in the industry growing by 2.6 percent in October. This rapid growth continues to ratchet up the pressure for those tasked with keeping restaurants staffed, especially considering the historically high turnover rates that the industry has been experiencing.

There was some relief for restaurants in the form of rolling 12-month turnover for hourly, non-management employees declining slightly during September. This small reduction notwithstanding, turnover for hourly crew remains at unsustainable levels for most restaurant companies. Furthermore, turnover is not expected to decrease significantly in the near term as long as unemployment continues to be this low.

After a slowdown in its upward trend in August, restaurant manager turnover increased again during September. Management turnover is crucial given its relationship to hourly employee engagement and retention, as well as its direct effect on the overall restaurant sales and traffic performance as revealed through ongoing TDn2K studies. Some of the reasons management turnover has been skyrocketing in recent years has been the tight labor market coupled with stagnant pay.

People Report™ data shows the median base salary for general managers in limited service restaurant brands has increased by only 1.2 percent over the last four years once adjusted for inflation. As small as this increase is in real pay, it is much better than the -3.5 percent general managers in full service brands have experienced during the period. Their employers are likely asking them to do more than they did four years ago in an increasingly complex environment, yet their pay is not reflecting that.

When it comes to sales, the industry’s run to the finish line at the end of 2019 will be much more of a crawl than a sprint. Macroeconomic conditions are not very encouraging for anything but maintaining present consumer spending trends. Restaurant traffic continues to slowly vanish. Sales were relatively strong for the last two months of 2018 which means tougher hurdles when calculating sales growth in November and December this year.

The best-case scenario for the industry remains small positive same-store sales growth for the rest of the year, but dipping into negative territory again continues to be a distinct possibility.

What definitely will not change is restaurants struggling to find employees and keep them engaged. “As the word ‘recession’ starts appearing more often in the media and restaurant operators wonder what lies ahead with the economy we know those that are better prepared for a downturn are those brands that have been succeeding on the people side of the equation,” said Fernandez. “Those that have provided a compelling employee value proposition and are effectively delivering on it are likely to remain the winners in the current environment and fare better should economic conditions deteriorate.”

Ditching the Kitchen?

OpenTable released new survey findings highlighting delivery habits and revealing a growing appetite for convenience.

According to a recent survey commissioned by OpenTable, Americans are starting to break up with their kitchens with 41 percent dining out at least once a week and nearly one third considering delivery to be a top alternative. Six out of 10 (62 percent) respondents choose to order delivery because they like eating in the comfort of their own home, with 59 percent sharing that it’s often due to feeling burned out after a long day. Still, 42 percent say they actually plate their delivery meals with real silverware and plates to closely replicate the restaurant dining experience. For additional survey data on what Americans are getting delivered, where and how they are eating it and more, click here.

This survey was conducted using the online survey platform Pollfish, and compiled by DKC Analytics. The sample of 2,000 adults (18 years or older) in the United States was surveyed on September 8, 2019.

The Nightcap Before Thanksgiving

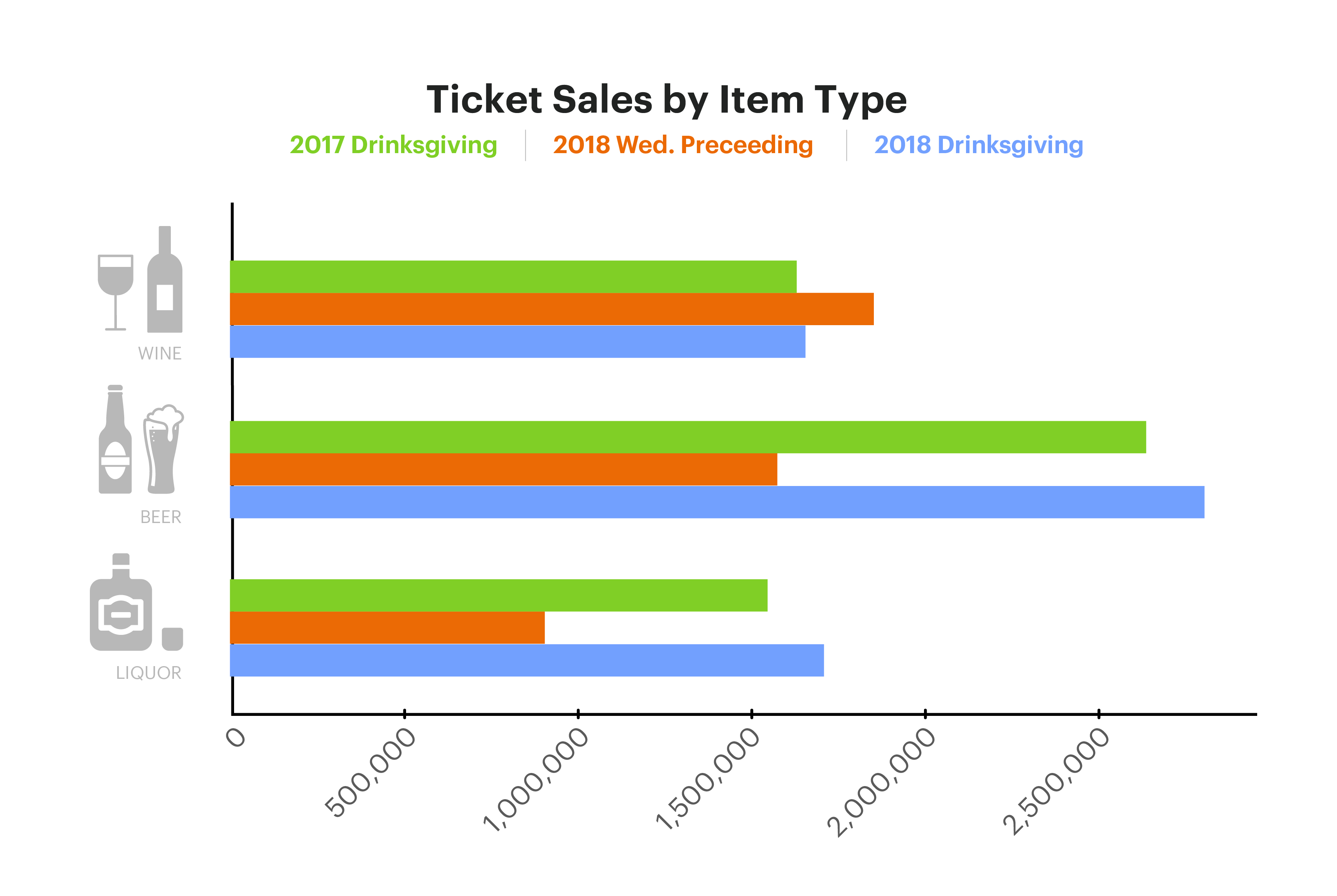

The team at Upserve tapped into data from over 10,000 bars and restaurants to see just how much customers are drinking the night before Thanksgiving. Among the highlights:

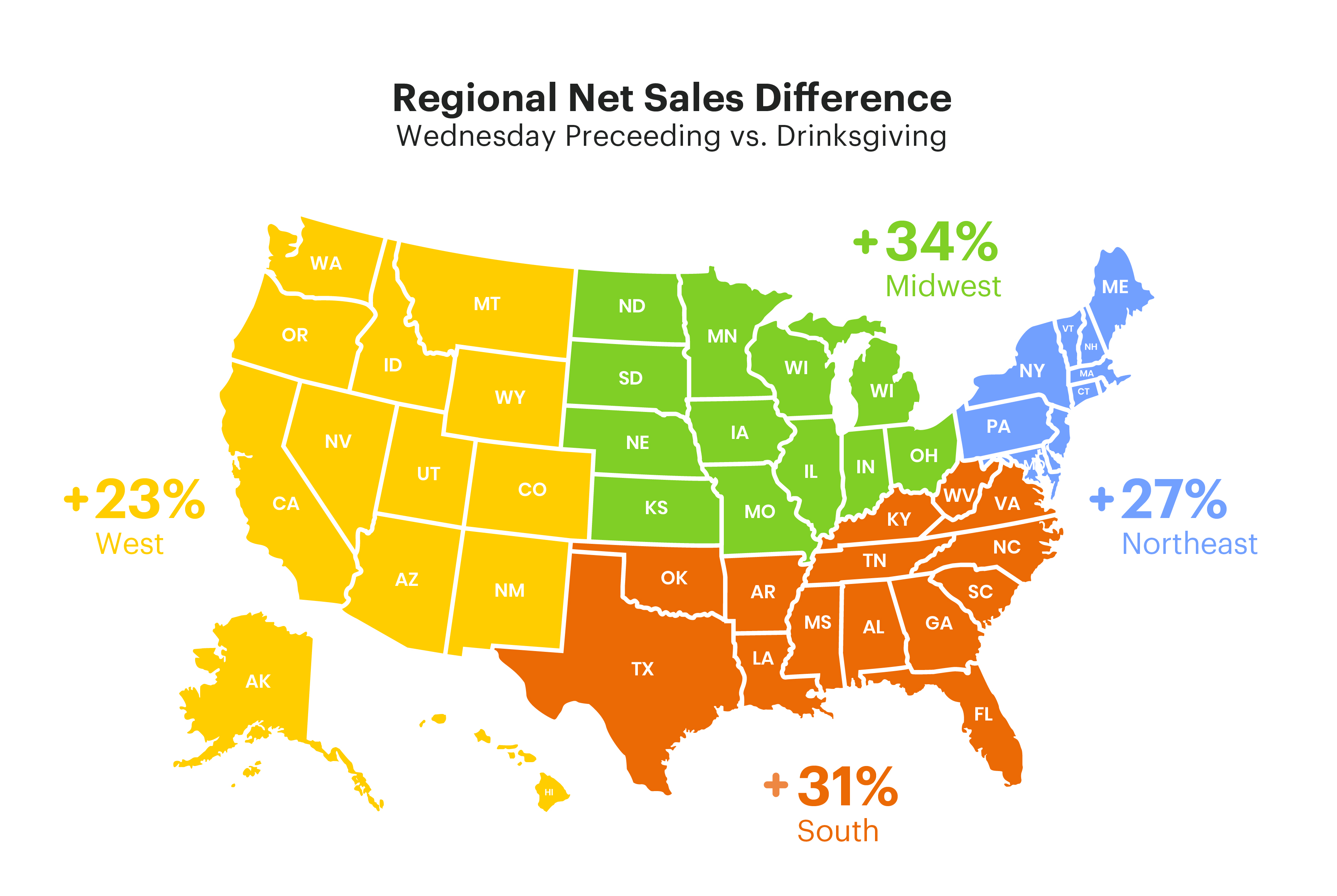

- Across the country, Thanksgiving Eve means more to some regions compared to others: The Midwest and South love their Thanksgiving Eve reunions with 34 percent and 31 percent increases compared to the previous Wednesday in 2018, with the Northeast and West trailing behind at 26 percent and 22 percent increases.

- Restaurants should expect an increase in foot traffic: Guest counts in over 10,000 restaurants across the country increased 25 percent on Thanksgiving Eve in 2018 vs. the previous Wednesday.

- Tired home cooks opt for takeout on Drinksgiving: When compared to the previous Wednesday in 2018, restaurants saw a 20 percent increase in to-go orders.

For the full report, click here.

Clueless About Cocktails

Cocktails have grown in popularity ever since their creation in the 1800s, however, despite the plethora of newly invented creations available to us each year, it seems that Brits prefer a classic tipple, according to a recent survey.

The study, conducted by catering equipment supplier Nisbets, surveyed 1,000 UK adults to discover the nations favourite cocktail and found that their drink of choice was resoundingly the fresh and minty Mojito.

UK’s Top Five Cocktails

- Mojito

- Pina Colada

- Gin Fizz

- Aperol Spritz

- Margarita

Despite none of the top five cocktails containing vodka, Brits listed the spirit as their number one cocktail base. This raises concerns about the UK publics’ ignorance around alcohol content, which could be particularly harmful when it comes to the festive party season.

Lack of knowledge around what we are actually consuming could pose a potential danger to those who drink cocktails, particularly regarding both the percentage of alcohol and the number of units per drink – which can quickly add up.

The Top Five Christmas Cocktails

- Snowball

- Eggnog

- Buck’s fizz

- Mulled Wine Cocktail

- White Russian

While often good value when considering the amount of alcohol per serving, it seems that cost is a deterrent for many Brits when it comes to cocktails, with many deeming them to be a treat rather than their first choice. However, the data showed that if money was no object, a cocktail would be the most popular drink on a night out for women (39 percent) followed by wine (15 percent). The most popular choice amongst men was still beer, with a quarter opting for this as their drink of choice.

The research also looked into the favorite cocktail of cities up and down the country, and found that the traditional Old Fashioned reigned supreme in Belfast, whilst Glasgow preferred something a little more exotic, voting for the Daiquiri.

In contrast, Birmingham, Cardiff, Leeds, and Liverpool all chose the Mojito as their drink of choice, with the rest of the top five all making it to number one in at least one major UK city.

Dean Starling, Head Development Chef at Nisbets, commented on the findings, “It’s interesting to see people’s choices when it comes to the UK’s favourite cocktails. We’ve seen a boom in bartenders creating new and exciting drinks in the last decade, so it’s surprising to see such traditional drinks in the top five, as opposed to more contemporary tipples with prosecco bases or flavoured spirits. Sometimes you can’t beat a classic!

“Christmas is a popular time for experimenting with your drinks, and cocktails are one of the best ways to enjoy different flavours and tastes.

The State of Snacking

Mondelēz International released its first-ever State of Snacking™ report, a global consumer trends study examining the role snacking plays across the world in meeting consumers’ evolving needs: busy modern lifestyles, the growing desire for community connection and a more holistic sense of wellbeing. The study reveals the rise of global snacking, underscored by regional parallels demonstrating how snacks are helping lead the future of food by delivering on the spectrum of needs that exists in our day-to-day lives.

The State of Snacking report, developed in partnership with consumer polling specialist, The Harris Poll, complements Mondelēz International’s global snacking knowledge estate with new research conducted among thousands of consumers across twelve countries. The report sheds light on snacking as a growing behavior worldwide. Notably six in 10 adults worldwide (59 percent) say they prefer to eat many small meals throughout the day, as opposed to a few larger ones, with younger consumers especially leaning into snacks over meals as that number rises to 7 in 10 among Millennials (70 percent).

Key findings from the 2019 State of Snacking report, which is available for download at www.stateofsnacking.com, include:

- Our relationship with food is fundamentally changing. For consumers around the world, the role food plays in health and wellbeing is increasingly top of mind; people are more commonly considering how smaller bites – snacks – effect their emotional wellbeing, as well as their physical health.

- For more than 8 in 10 people, convenience (87 percent) and quality (85 percent) are among the top factors impacting snack choice.

- 80 percent of consumers are looking for healthy, balanced bites.

- 71 percent of adults say snacking helps them control their hunger and manage their calories throughout the day.

- However, moments of indulgence continue to have an important place in daily routines.

- 80 percent of adults worldwide acknowledge the need for balance by appreciating the option of both healthy and indulgent snacks depending on the moment of need.

- 77 percent of consumers agree there is a time and a place for a healthy snack, and a time and a place for an indulgent one.

- The majority of people say snacks are just as important to their mental (71 percent) and emotional (70 percent) wellbeing as their physical wellbeing.

- Snacking is about so much more than what we eat. Snacking is a key way for people around the world to connect to their culture and share their sense of identity with their communities and families.

- 71 percent say snacking is a way to remind themselves of home.

- 7 in 10 adults make an effort to share their favorite childhood snacks with others (70 percent).

- Around the world, more than 8 in 10 parents use snack time as a small way to connect with their children (82 percent).

- 76 percent of parents use snacks to pass cultural snacking rituals on to their children.

- More than three out of four parents (78 percent) say the snacks they choose for their children reflect who they are as a parent.

“As the snacking market continues to grow globally, we’re living our purpose to empower people to snack right by constantly learning about the many different ways consumers around the world are snacking and evolving their relationship with food,” said Dirk Van de Put, Chairman and CEO of Mondelēz International. “We see that the average global adult now eats more snacks than meals on a given day, driven by a number of evolving demands largely associated with how we live today, including a growing need for convenience, yearning to share nostalgic and cultural experiences, expanded wellbeing

The Impact of Sensory Marketing

Mood Media released a new quantitative behavioral marketing study, “Quantifying the Impact of Sensory Marketing,”which proves that sensory marketing has positive emotional, cognitive and behavioral impacts on shoppers in-store. In this study, Mood Media partnered with its international sports retailer client, INTERSPORT, to conduct a controlled experiment that found when sensory marketing was applied, sales increased by 10 percent. Also highly noteworthy, shoppers spent almost six minutes longer in-store when the senses were activated.

“Knowing that 78 percent of shoppers say an enjoyable atmosphere plays a key factor in purchasing a product in-store versus online, we partnered with Walnut Unlimited to develop unique behavioral and neuromarketing quantitative research that demonstrates how shoppers react first-hand to specific sensory experiences,” said Scott Moore, Global CMO of Mood Media. “The results speak for themselves. A strategic top-level approach to incorporating in-store sensorial elements creates a measurable emotional response with consumers that delivers bottom-line results.”

Additional key findings showcasing the positive impact of in-store sensorial stimuli include:

- Shoppers purchased more items (increase of 4 percent) – and higher priced items (increase of 6 percent in value) – when sensorial marketing elements were in place.

- The use of scent is even more impactful when being used to highlight a specific department or zone. In the scented football zone, customers’ emotional levels were elevated by 28 percent compared to the baseline.

- From the installation of scent in the football area to-date, INTERSPORT has noticed a 26 percent increase in sales in the category in the test store compared to the same category performance in all the other stores throughout the country.

- Based on Eye Tracking (ET) metrics, awareness of digital screens in-store increased by 5 percent when moving visualizations were activated on-screen (vs. static images).

- Based on Galvanic Skin Response (GSR) metrics, a lack of sensorial elements in-store caused many consumers to become awkwardly self-aware while shopping, with 17 percent becoming more emotionally sensitive and uncomfortable in an unusually quiet and stimulant-free environment.

- Consumers like seeing themselves, which the study describes as “the science of narcissism.” Galvanic Skin Response (GSR) and Eye Tracking (ET) metrics showed a significant increase in nervous system activity and engagement when consumers saw themselves in mirrors and interacted with products in front of mirrors.

- Shoppers showed a 50 percent emotional increase when touching and engaging with a product. This supports first-hand the important and unique role that in-store shopping continues to serve.

“As we build our omnichannel strategy, we continue to focus on enhancing our brick & mortar stores with memorable and engaging experiences that connect with our customer base,” said Chris Kleine, Director Design and Development from IIC-INTERSPORT Intl Corp. “The involvement of our national licensee in this research has further highlighted how important sensory experiences are in creating a positive in-store environment that brings shoppers back time and time again.”

To download the booklet to view more comprehensive study results, click here.

StarChefs Trends

Some of the best chefs, mixologists, and pastry chefs from around the world gathered, showcased their skills, and shared their culinary knowledge at the Brooklyn Expo Center for the 2019 StarChefs International Chefs Congress (ICC).

These are some of the trends that dominated not only the Brooklyn Expo Center floor, but are making their way into restaurants and dining experiences all over the world:

1. Fermentation 2.0 Meets Fruit

Pickled raisin sofrito, cantaloupe vinegar, calvados soaked cherries, and different yeasts were used to add some flavorful funk, acidity and brightness to the dishes and drinks at the 14th Annual StarChefs ICC. Fermentation isn’t exactly a new and innovative method, but it is one that continues to be a staple on the rise, with more chefs assigning fermentation stations in their kitchens. This year we saw an array fermentation methods take a focus on fruits. Chef Curtis Gamble from Pittsburgh’s Station took fermentation to the next level with his dish of miso-braised Japanese eggplant, black garlic royale, cantaloupe vinegar and sungold tomato. We found that fermented fruit added a level of sweeteness to the otherwise souring processes used by chefs and mixologists alike.

Beyond flavor, fermentation has its clear benefits and that wasn’t left out from ICC conversations. Chef Brad Deboy of Ellé also points out that fermented food isn’t just delicious, but has health benefits as well. “I got my start when I had a catastrophic illness when I was 22. I was paralyzed, and I used fermentation as a way to heal myself, and it became a hobby, then I started using it in the kitchen,” he told Symrise. “I was already using it in the kitchen before that, and now I promote it to use it in everything I do.”

2. Chefs Make Health a Priority

Aside from veg-forward dishes and the use of mushrooms, more chefs are looking into catering to their customers’ allergies and sensitivities. Chef Diego Guerrero of dStageshared his efforts of utilizing fresh produce and prime ingredients to create more dishes that are naturally gluten-free and dairy-free.

Night two of the Congress featured a friendly competition among chefs under the name of the Chef Ann Foundation’s Real School Food Challenge. With a budget of $1.25 per plate, Chefs were challenged to design a balanced dish under the suit of educating children about heathly-eating. Chef Mihoko Obunai from Midtown International School in Atlanta took home the prize with her simple yet nutritious dish of Japanese chicken curry with rice.

Mixologist Pamela Wizniter said that more and more people are moving away from sugary cocktails, but instead are choosing more low-proof cocktails with ingredients like turmeric, acai, and matcha. Chef Eric Plescha of Charcoal BYOB was particularly excited about a new sugar approved by the FDA called allulose, which isn’t as sweet as normal sugar and supposedly lowers blood sugar. “So people who are diabetic can actually indulge in sweets without having to worry about sugar levels,” Plescha shared.

3. Seasonal, Sustainable and Spectacular!

Along with health-consciousness is also consciousness about environmental impact. Many of the chefs at the convention made sure to source their ingredients seasonally, ethically, and sustainably from companies, local farmers, and butchers they trusted and partnered with. A ripe example for season and sustainably sourced ingredients comes from 7A Food’s Chef Daniel Sauer whose Umami Tsunami sandwhich featured an ingredient list fresh from Martha’s Vineyard. The sandwhich was a delicious combo of roasted shiitakes, pimento, pickled jalepenos and greens – a tsunami of seasonal flavors!

With the ICC being held at the peak of fall, there were many pumpkin and squash dishes, potatoes, apples, as well as the use of warm spices such as cinnamon, nutmeg, cloves, and coriander. As an example, Kensington Quarter’s Matt Harper was a featured Chef at the Steelite’s demo booth who served a Winter Squash Salad with apple, buttermilk & herbs

4. Minimalism in the Kitchen

Previously, trendy restaurants would pack as much as they could into one dish — over-the-top fries, instagrammable waffles for brunch, resulting in a lot of elements on a single plate. Now, simplicity and minimalist dishes with a labor of love are taking over.

Chef Carlos Raba of Clavel likes to stick to his Mexican roots, by keeping all his dishes simple so as to showcase classic flavors. He served a barbacoa tostada, which was a quick but satisfying bite with an edge of spice.

“I love that everyone’s getting back to rustic. I love that everyone’s making pastas and doing everything from scratch,” said Chef Brother Luck of Four by Brother Luck. “I think simplicity is in right now, and we need to continue that.” Chef Luck served European veal shank, green chile, blue corn grits, pickled red onion, and avocado crema, an earthy and delicious dish.

5. Crossing Borders and Fusing International Flavors

Many chefs have also been challenging their chosen cuisine’s traditional limits. “I see a lot of restaurants go a lot more out of their natural ethnic boundaries, and being more experimental,” said Chef Fiore Tedesco of L’oca D’oro. This is especially applicable for chefs who have different worldwide restaurant locations. Chefs Jamie Bissonette and Ken Oringer of Torocook Spanish food, but with their location in Bangkok they were able to use Southeast Asian flavors and ingredients such as lemongrass and galangal to give their traditional dishes a twist. It isn’t exactly fusion, since the goal is to replicate similar flavor profiles, and a familiar feeling when eating the dish.

6. Age-old African Spices and Ingredients Today

At Symrise’s customary roundtable, Cafe Boulud Pastry Chef Shaun Velez said that one of the most interesting things they’re currently playing with in the kitchen is the African spice blend ras el hanout. “We’re making a ras el hanout ice cream – and everyone has their own secret blend of ras el hanout, some have cinnamon, some have cumin – but being able to start something like this where we’re using sweet things on the plate like a toasted almond cream or orange blossom,” Velez said. “There’s so many different flavors and so many different elements and textures that play off each other so that it still comes out very balanced and clean.”

Chef Jonathan Benno of Leonelli Taberna, played off Velez’s excitement for the African spice with his own experience, “Using the example of ras el hanout, to study a spice blend that has a thousand year history and is made differently in a relatively small part of the world, to me that’s one of the most exciting things about being a chef—if you challenge yourself there is always something new to learn.” During the roundtable, it became apparent that Chefs and Mixologists like Mea Leech are finding exciting ways to resurrect ancient spices in modern and innovative ways.

Chef Kwame Onwuachi also gave a talk on the main stage about West African, specifically Nigerian ingredients and dishes. Dishes like moi moi, puff puff, and chin chin all make use of nutmeg — an essential in Nigerian kitchens.

7. Israeli Inspired Flavor

Another cuisine that seems to be on the rise is the food from Israel. “I’m seeing more pomegranate syrup. Zahav has pretty much gotten national accreditation at this point,” Kocab said. “So anything along those Israeli flavor profiles I’ve seen a lot more across the board. And I think that’s because the general public is becoming more and more familiar with those flavor profiles.” Pastry Chef Tova du Plessis of Essen Bakery agreed with these sentiments. She said, “There’s definitely a big interest in Middle Eastern flavors. I’ve seen that a lot,” she said. “These flavors — the citrus, the nuts, the spices that you find in that part of the world, or part of that cuisine since thousands of years ago, are becoming popular.”

8. Hearty Bases for Wholesome Dishes

Following the theme of the entire ICC, “new foundations,” many of the presenters made sure to give hearty — but not too decadent — bases to all of their dishes. Brother Luck used blue corn grits as a base for his veal shank dish, Scott Drewno from Chiko used rise porridge in his Korean version of shrimp and grits, Olivia Chef Matt Kuhn’s bright chicken tagine sat on a helping of farro couscous, Drew Adams of Bourbon Steak had a rich scallop cream to round out his dish, and David Kocab had a foraged acorn ragu to complement his pig’s heart cavatelli. Even Pastry Chef Abby Swain from Temple Court used a frozen olive oil base, topped off with a concord grape sorbet, for her perfect parfait.

9. Mother Sauces – Nouveau Style

‘What’s your mother sauce?’ was the lunch theme for Day 1 of the Congress. Mother sauces were (and still are) very French and part of the basic techniques within the culinary world. Today we’re seeing new influences from Asia and other part of the globe evolving what the traditional style of ‘mother sauce’ means to Chefs.

As previously mentioned, Chef Curtis Gamble introduced an Asian influence to his mother sauce incorporating ingredients like miso-braised Japanese eggplant. Chef Opie Crooks from A Rake’s Progress, shared his mother sauce with a crafted dish of ember-grilled koginut squash, country ham dashi and BBQ peanuts.

How Food Purchases Have Changed

Leisure analysed UK government data to find out how our weekly food purchases have changed over the last 25 years. You can view the full findings here.

Here are some key findings :

- There has been more than a 50 percent drop in purchases of white bread and potatoes

- Wine and champagne consumption has increased by 77 percent as more Brits entertain at home

- Over 25 years meat and fish purchases have seen a nearly 20 percent drop

- With three-and-a-half times more purchases since 1993, liqueur, cocktails, soya and novel protein foods have had the biggest change than any other food group

- Dairy and fats/sugars are the two food groups with the biggest drop in purchases over the past 25 years

Chicken War Redux

Was the summer’s crazy Chicken War a flash in the pan or could the relaunch of Popeyes’ chicken sandwich catch strike gold twice so soon after the first (chicken) coup? Placer.ai, dug into the first day’s data of the long-awaited relaunch and found:

Popeyes’ November 3rd relaunch rose 299.3 percent above the baseline, blowing past the summer peaks of 255.6 percent and 243.0 percent on Friday, August 23rd and Saturday, August 24th.

KFC saw Friday visits ahead of the launch that were 36.4 percent above the baseline, yet, Saturday and Sunday rose dramatically over the same days the year before from 16.9 percent and 11.2 percent in 2018 to 24.5 percent and 28.6 percent in 2019.

Placer.ai concluded the Chicken Wars returned with their gloves on. The big question remains: Can these fast-food battles sustain interest or will they die like wounded chicken soldiers on the field?

For the full report, click here.