MRM Research Roundup: Holiday Spending, Franchise Optimism, and Pickle Energy

15 Min Read By MRM Staff

This final edition of Modern Restaurant Management (MRM) magazine's Research Roundup for 2024 features news of operator challenges and priorities, delivery trends, wages and hourly worker considerations.

2024 By the Numbers and Looking to 2025

Restaurant leaders representing more than 6,200 locations shared 2024’s top challenges and opportunities and their 2025 priorities in Restaurant365's annual industry survey. Those priorities include increased marketing and sales efforts alongside new benefits and programs to attract and retain staff.

Participants reported continued food and labor cost increases, with 88 percent experiencing rising staff expenses, compared to 89 percent in last year’s annual survey, and 86 percent reporting an increase in food costs. For those with rising labor, 51 percent reported a 1 percent to 5 percent increase, 41 percent experienced a six percent to 14 percent increase, and 8 percent saw labor costs rise more than 15 percent. The most significant impact was on restaurants’ ability to achieve their maximum potential, with 59 percent of respondents saying labor challenges led to operating below full capacity.

For food, 53 percent reported a 1 percent to 5 percent jump, 37 percent saw a 6 percent to 14 percent increase, and 10 percent saw a more than 15 percent rise. The primary response was menu price increases, with nearly 61 percent of respondents adjusting prices to cope with the new reality.

Restaurant leaders expect waves in the year ahead, with 32 percent pinning recruitment and retention as their top challenge, 27 percent most concerned about rising food costs, and 21 percent flagging sales volume as the main hurdle.

Despite potential challenges, the industry is both optimistic, as total restaurant sales crested $1 trillion for the first time on record, and ready to pivot to continue growing.

More than half of those surveyed, 55 percent, said increasing sales is 2025’s top priority, followed by reducing costs and enhancing guest experiences. Costs, however, will remain a challenge, with 82 percent of respondents expecting food costs to increase and 77 percent predicting rising labor expenses.

To combat revenue challenges, 36 percent of leaders said their top investments would be in enhanced sales and marketing technology, promotions, and loyalty programs, alongside 27 percent who are planning staff investments, including enhanced training, salaries, recruitment, and benefits.

As operators look to bolster these two key areas, they’re also closely watching employee training and guest preferences. At present, 58 percent of respondents said they provide one to two hours of training per week, with most of it, 45 percent, happening shoulder-to-shoulder and another 21 percent on digital platforms. Deploying training to enhance operators and guest experience is key, especially as restaurant operators expect continued shifts in consumer preferences and employee turnover challenges, with 39 percent of those surveyed seeing turnover in the 11 percent to 25 percent range. For shifting consumer preferences, 34 percent expect more takeout and delivery in 2025, 28 percent expect greater demand for healthier options, and 24 percent expect less frequent dine-in visits. How leaders meet these needs will become increasingly important, as nearly half of respondents said third-party delivery services account for between 11 percent and 30 percent of revenue.

Renewed Optmism Ahead for Franchise Landscape

The last five years have provided significant challenges to the restaurant franchise industry. However, the industry has renewed optimism, driven by the adoption of digital and mobile ordering, menu creativity and heightened expectations around AI. This is according to a survey conducted by TD Bank at the 2024 Restaurant Finance and Development Conference in Las Vegas, Nevada. The poll collected insights from 175 restaurant operators and financial professionals to uncover their expectations for 2025.

Continued technological advancements, better value meal strategies, as well as a better interest rate outlook are driving optimism. In fact, respondents believe lowering interest rates will have the greatest impact on the restaurant industry in the next 12 months (46 percent), followed closely by artificial intelligence and automation (42 percent). The industry's addiction to value menus appears to be moderately paying off, with a slight majority of operators indicating that the associated increase in foot traffic (60 percent) offsets the margin compression from these programs (40 percent). Furthermore, more than half (52 percent) of respondents say they've seen improved underlying foot traffic trends as compared to just three months ago.

Franchise 2.0: Prioritizing Investments in Mobile Apps and Artificial Intelligence

Looking ahead, restaurant operators and financial professionals are focusing on investments that drive revenue and simplify operations – especially mobile apps. When asked about their predictions for the top three revenue drivers for restaurants over the next 12 months, more than three-fourths (77 percent) of respondents ranked mobile ordering number one. Similarly, 59 percent of respondents believe mobile apps that offer easy online ordering will have the greatest impact on operations over that same time period.

Meeting these consumer expectations and employee needs is pushing restaurant franchises towards artificial intelligence and automation. The survey found 43 percent of respondents believe that using AI to analyze customer data and predict market shifts will have the greatest impact on operations, followed by the automation of admin tasks to let restaurant managers spend more time helping employees (34 percent).

Ultimately, mobile apps and automation are key growth areas over the next 12 months, with 36 percent of respondents predicting restaurants/franchises will invest in digital platforms, mobile apps and online ordering to enhance customer experience, as well as technology to automate and streamline operations.

2025: The Year of M&A Growth

As lowering interest rates and technological innovation boost optimism, restaurant franchise leaders are turning their attention to mergers and acquisitions. Over the next 12 months, 84 percent of respondents believe mergers and acquisitions (M&A) activity will increase.

2024 Delivered Report

Grubhub released its annual 2024 Delivered Report, offering a deep dive into consumer ordering trends and behaviors. The report analyzes orders placed throughout the year—from restaurants, grocery stores, convenience stores, and more—delivered to customers at home, work, college campuses, hotel rooms, and beyond. Grubhub's trends reveal that even when it felt a bit “extra,ˮ no one hesitated to “add to bag.ˮ Americans fully embraced the art of going all in, making 2024 the year of ‘Doing the Most.ʼ

This year, Americans weren't just eating protein – they were going ALL in. Whether it was meal prepping like pros, or loading up on protein-heavy delivery favorites, they made sure every bite packed a punch. Pro tip: up the protein !

- Chicken ruled this year being included in nearly 40 percent of all Grubhub restaurant orders and crowding grocery carts like a superstar. Chicken was also part of Grubhub grocery store orders almost three times as often as beef. If there was a protein popularity contest, chicken would take home the crown!

- Extra protein was extra desirable with 15 percent of Grubhub Chipotle orders including double protein.

- Cottage cheese had a social media-fueled renaissance. Customers embraced the protein-packed dairy, transforming trending dishes like cottage cheese toast and flatbreads. But this trend wasn't just seen on social media. This year, Grubhub delivered over one ton of cottage cheese orders to customers. That's more than two thousand pounds of cottage cheese!

- These five cities were leading the charge, using curds and whey in the most creative ways:

- New York City

- Los Angeles

- Chicago

- San Francisco

- Boston

Americans were buzzing with their love for espresso – whether sipping it in their drinks or blasting it on repeat in their music playlists. So much so that even Grubhub espresso orders spiked the week of June 22nd, right as the hit song topped the charts. Coincidence? We think not! To top it off (literally), customers added more espresso shots to their orders than last year! But it wasnʼt just basic espresso that people needed in their lives. They were thirsty for variety and Grubhub delivered, offering nearly 15,000 unique variations of lattes alone this year.

The top five cities ordering the most espresso:

- Miami

- Los Angeles

- Denver

- Boston

- New York City

Pickle Energy

The briny cucumber continued to rise in popularity with a 14 percent increase in overall orders. This came as no surprise as people made the most of their pickle passions – whether as a bread substitute for cold-cut sandwiches or using its distinctive juices to sour their sodas. Whatever floats your boat!

Craving Convenience

Customers turned to their neighborhood convenience spots for 24/7 sustenance, making the most of their diverse offerings on Grubhub. Made-to-order hotdogs, bananas and sodas topped the list as the most popular items ordered from convenience stores this year.

Dr Pepper took the lead as the most-ordered soda from convenience stores. While people still found joy in their Diet Coke breaks, 2024 saw the soda claim victory in the battle of the bubbles! Whether poured from the fountain or straight from the can into the tumbler, customers embraced its unexpected viral twist—added pickles! Who could resist that bold flavor combination?

Maximized Perks

Thanks to return-to-office policies and trends like coffee badging, corporate ordering made a big comeback. This year, Grubhub saw a 53 percent increase in corporate coffee orders. If employees were heading back to the office, they were definitely getting their corporate dollarsʼ worth!

But coffee isnʼt the only workplace routine that made a statement this year. “Chipotle Boysˮ shook up the lunch scene, turning the burrito bowl into the ultimate workday staple – one forkful at a time, multiple times a week. As a result, burrito bowls spiked as THE office lunch choice with corporate Chipotle lunch orders increasing by 27 percent on Grubhub.

More than Taco Tuesday

It wasnʼt just taco night – Mexican cuisine stole the show as the most popular international cuisine for Grubhub customers across the country, and many took their taco game to the next level, ordering nearly 1.3 million birria orders this year alone.

Caffeine College

This year, energy drinks trended as a caffeine sidekick and coffee alternative. College students powered through midterm season with February seeing the highest energy drink orders across college campuses, up nearly a third compared to other months.

And while college years are punctuated by exams, getting the most out of the college experience requires energy for epic, early-morning weekend tailgates and late-night socializing. The East Coast did the most when it came to caffeine orders on Grubhub, and these were the top five colleges that ordered the most coffee:

- Pace University – NYC

- West Chester University of Pennsylvania

- Syracuse University

- University of Rochester

- Rowan University

Decaf

- Fordham University

- California State University Fullerton

- University of Massachusetts Lowell

- University of Illinois Chicago

- WashU

In 2024, America embraced the power of peaceful slumber with a surge in decaf orders, marking a 5 percent boost in caffeine-free choices nationwide. But the real trendsetter? A whopping 21 percent of those decaf orders were placed after lunch, making the 2 p.m. coffee break a mindful ritual rather than a caffeine-fueled habit. Itʼs clear: Americans are now sipping their way to better sleep, and that afternoon decaf moment has never been more intentional or more relaxing!

Swicy

Swicy took the nation by storm, mixing the best of both worlds—sweet and spicy—into everything from summer drinks to snacks and spirits. Why settle for one when you can have the best of both? This irresistible combo wasnʼt just a trend—it was a full-blown movement. In fact, hot honey purchases surged by 30 percent in Grubhub grocery stores orders, proving that Americans were all in on swicy, pairing it with everything from fried chicken to French fries. Talk about a flavor duo that hits all the right notes!

Wage Trends

ADP Research analyzed a sample of almost 100,000 hourly employees at full-service restaurants in 50 states, people who work for both wages and tips. They tracked individuals who held the same job for at least 12 months and measured any change in their pay.

Trends in full-service restaurant wages

Nationwide, as of September 2024, median pay for these full-service restaurant workers was $23.88 an hour including tips and base wages. That’s up from $18.61 an hour in January 2020, a 28 percent increase. Tips have long made up the bulk of restaurant servers’ pay. And for years, as minimum wages stood stagnant, the workers who depend on tips attached greater importance to them. Now the residual effects of the pandemic, rising minimum wages, and state tipping laws have combined to make tips a shrinking piece of the wage pie for these employees.

ADP Research looked at wage growth between January 2020 and September 2024 for full-service restaurant workers in 10 metropolitan areas.

Restaurant workers in New York and Boston had the highest tipped wages, at $22.03 and $21.44 an hour, respectively. Tips accounted for 76 percent of total wages in Boston and 67 percent in New York. Washington, D.C. had the highest tip share at 81 percent.

Workers in Los Angeles-Long Beach and San Jose-San Francisco earned the highest base wages at $17.12 and $18.67 an hour, respectively, as well as some of the lowest tip wages.

2025 Predictions for Independent Restaurants

As the restaurant industry continues to face mounting pressures from rising costs, shifting consumer behaviors and sentiment, and the growing complexity of technology, SpotOn,, revealed its 2025 predictions for independent restaurants. In the year ahead, operators will need to rethink their approach to technology, using it strategically to manage costs, improve efficiency, and stay ahead of industry challenges.

2025 will be the year restaurants redefine how they engage with technology. With AI and other advancements demanding more evaluation than ever, operators are now tasked with cutting through the noise to find the technology solutions and, more importantly, partners that will work for their specific needs. SpotOn expects operators to shift their focus to tech tools that prioritize operational efficiency, helping them manage costs while gaining a deeper understanding of their business and guests.

Data: The New Heartbeat of Restaurants

As the POS evolves into a full restaurant-operating system, it will become the central hub uniting data across every aspect of the business. Operators will increasingly rely on their point-of-sale reporting to make business decisions in real-time, better understand consumer trends, and drive profitability. SpotOn predicts that operators who become more sophisticated in their use of data to anticipate and respond to guest needs will be the ones to exceed profit expectations, even in a highly competitive market. SpotOn Restaurant will offer multiple interfaces to address the needs of a larger group of restaurants, from a local watering hole to a multi-unit, full-service restaurant group.

Changing Consumer Behaviors to Shape 2025

One of the biggest challenges for restaurants in 2025 will be adapting to the continued decline in alcohol consumption, driven by generational and health trends, including the rising use of GLP-1 drugs. With alcohol sales shrinking, restaurants must reevaluate their offerings, menus, and inventory management to maintain profitability.

AI: The Invisible Tool to Boost Profitability

As resources tighten, more restaurants will turn to AI to do more with less. While AI can help restaurants in several ways, operators should lean on their tech partners to identify the most effective uses.

Holiday Season Spending Pulse

According to preliminary insights from Mastercard SpendingPulse™, U.S. retail sales excluding automotive increased 3.8 percent year-over-year from November 1 through December 24. Mastercard SpendingPulse measures in-store and online retail sales, representing all payment types and is not adjusted for inflation.

“The holiday shopping season revealed a consumer who is willing and able to spend but driven by a search for value as can be seen by concentrated e-commerce spending during the biggest promotional periods,” said Michelle Meyer, chief economist, Mastercard Economics Institute. “Solid spending during this holiday season underscores the strength we observed from the consumer all year, supported by the healthy labor market and household wealth gains.”

Key retail trends for the full holiday season included:

The most ‘valuable’ time of the year – Empowered consumers sought value at every turn this year, responding to promotions during the November and Black Friday shopping period, and filling their baskets in the run-up to December 24. Overall retail sales saw a 3.8 percent increase compared to 2023, with the last five days of the holiday season accounting for 10 percent of all holiday spending.

A balanced basket – Consumer demand for experiences like dining out strengthened in the holiday season, with Restaurant spending growth up 6.3 percent compared to last year. Additionally, this season saw an increase in spending growth on goods compared to last year, with Apparel (3.6 percent), Jewelry (4.0 percent) and Electronics (3.7 percent) as notable sectors for gift-giving.

Clicking all the way – Consumers increasingly preferred digital-first shopping this year, with e-commerce, curbside pick-up and delivery being top-of-mind for the festive season. Online retail sales grew 6.7 percent year-over-year, whereas in-store sales increased 2.9 percent. Notably, the Apparel sector showed a strong lead in e-commerce sales, with 6.7 percent growth for online purchases compared to last year.

Digital-savvy shopping cities – While many Americans shop online for the holidays, there are some cities in particular that have embraced e-commerce. Cities like Tampa (10.6 percent) and Phoenix (10.0 percent) lead with double digital growth followed by Minneapolis (8.9 percent), Dallas (8.4 percent), Charlotte (7.9 percent), Orlando (7.8 percent), and Houston (7.6 percent) coming in well above the national total for e-commerce sales compared to 2023.

November QSR Trends

RMS released its November QSR trends with a little cheer. Traffic stayed in positive territory (+1.3 percent YOY) after breaking the negative barrier last month, likely due to promotions. Despite brands’ value focus, average price continued to increase, up +2.6 percent YOY. Net sales were up 4.9 percent as a result.

Q4 Survey

Consumers may be dining out in greater numbers, but they remain hesitant. In RMS’ Q4 consumer survey, respondents reported dining out less across all categories – with fast casual and full service being hit the hardest. Thirty percent of respondents dined at QSRs less – but 42 percent reported going less to fast casual, and 46 percent reported going less to full-service restaurants (see chart). It turns out they might be heading to their nearest 7-11. All generations reported increasing meal purchases at convenience stores, but more than one-third of Gen Z upped their stops.

Consistent with last quarter’s stats on hybrid workers driving traffic, 40 percent of respondents reported dining out LESS on weekends.

Additional November Trends

Monthly QSR Traffic by Daypart

Breakfast traffic decreased by -4.7 percent YOY.

Lunch traffic is down -0.1 percent compared to November of 2023.

Dinner traffic stayed high, up +4.2 percent YOY.

Monthly QSR Traffic by Sales Channel

Delivery moved to the top-performing fast-food sales channel in November, with traffic up +25.0 percent YOY. This was the only fast-food sales channel that saw positive traffic compared to the previous month.

Takeout increased +13.7 percent YOY.

Dine-in traffic was up +13.3 percent YOY.

Drive-thru traffic declined by -6.2 percent YOY but jumped considerably from -11.4 percent in September of this year.

Gift Card Sales

Restaurant gift card sales peaked earlier in the 2024 Thanksgiving weekend with shoppers purchasing 13.2 percent more in dollars per card on Black Friday and 17.7 percent more spent over the weekend while Cyber Monday sales remained flat vs. those same days in 2023, according to data from Paytronix. Additionally, 2024 saw renewed confidence in in-person dining experiences with consumers spending $7.8 million buying in-store cards vs. $7.3 million on digital card sales, which reversed last year’s trend.

This appetite for in-person dining is amplified by the fact that, overall, $12.3 million was spent on gift cards for full-service restaurants and $5.2 million on cards for quick service restaurants. On average, consumers loaded $66 on FSR cards vs. $31 on QSR cards.

For the entire four-day weekend, shoppers spent 10 percent more while the total number of cards sold surged six percent vs. the same weekend in 2023. In addition, the average dollars loaded on all cards sold was higher ($57) on Black Friday than over the weekend ($49) or on Cyber Monday ($47).

According to data from Paytronix, the total dollar value of cards sold over the 2024 four-day weekend reached $17.5 million vs. $15.8 million in 2023 with the overall volume of cards sold jumping to 338.5 thousand from 316.7 thousand in 2023.

Following trends in closed-loop restaurant gift card sales, the Paytronix Thanksgiving Holiday Card Sales Research includes data from gift card sales November 29 – December 2, 2024, including both full-service and quick-service restaurants. The 2024 data includes 366 brands while the 2023 data included 351 brands.Hourly Worker Concerns

Hourly

Flexibility, in all its forms—from hours to pay options—has become the most sought-after benefit for hourly workers according to the sixth annual Branch Report. The survey, which polled over 3,400 hourly workers nationwide.

Workers now place greater value on scheduling flexibility than on traditional benefits like paid time off and health insurance, with 46 percent ranking it as the most important benefit, compared to 44 percent for paid time off and 34 percent for health insurance. In fact, 43 percent of respondents identified flexible hours as the top reason they choose hourly work. Additionally, 29 percent said they would consider switching jobs for roles that offer work-from-home options, while 57 percent pointed to work-life balance as a key factor in staying with their current employers. This need for flexibility is particularly pronounced among the one-third of hourly workers juggling other commitments, such as caregiving or pursuing higher education.

The report also underscores a growing demand for flexible payment options. Four in five respondents reported experiencing fluctuations in their weekly pay, while 59 percent admitted to postponing medical procedures due to financial strain. Alarmingly, only 1 in 5 have $500 or more in emergency savings. In light of these challenges, 88 percent of hourly workers stated that having early access to earned wages would be a valuable resource.

Looking ahead to 2025, here’s the top financial priorities reported by hourly employees:

1. Improve credit score: 56 percent

2. Create an emergency fund: 52 percent

3. Pay off credit card debt: 30 percent

4. Purchase a car or pay off a car loan: 30 percent

5. Purchase a home or pay off a mortgage: 22 percent

6. Save for a vacation: 20 percent

7. Pay off personal loans or other types of debt: 20 percent

8. Save for retirement: 16 percent

9. Pay off student debt (for yourself or a family member): 11 percent

10. Start a business: 10 percent

Consumers and Ad Exposure

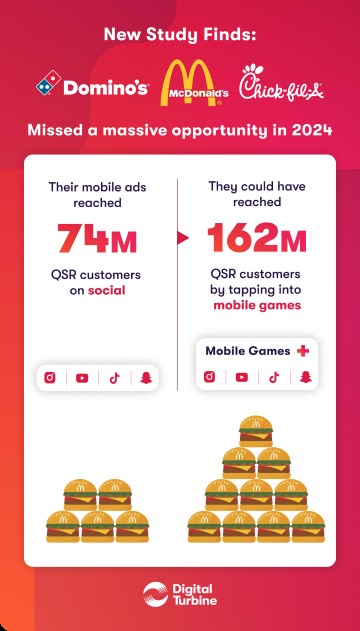

A new report from Digital Turbine shows that many major brands are missing millions of potential customers via social media ad campaigns.

The study analyzed consumer behavior and ad exposure from January to June 2024, and found that:

- Mobile gaming advertising reached 88 million incremental Quick Service Restaurant (QSR) customers that social media and YouTube advertising did not reach

- 34 million of these incremental customers were “social-lite” users, or users that while counted as social users, are served significantly less ads (50-80 percent less ads) via social media platforms

- Social-light consumers spend an average of 2.6 hours per day playing mobile games, compared to just 0.7 hours on social media and YouTube

“While brands are certainly beginning to understand the opportunities for programmatic media inside of mobile games, adoption has been slow," said Jarrod Dambro, Senior Sales Director at Digital Turbine. "Social media and YouTube campaigns are essential, but they’ll never reach everyone. Our groundbreaking six-month behavioral tracking study reveals that mobile games really should be a must buy for brands. Millions of consumers who slip through the cracks of traditional social platforms are being touched hundreds of times by in-app ads in mobile games. Brands need to stop playing games with your media budget and start buying into the platform where your audience is already engaged and ready to interact.”

Holiday Dining Options

To help understand where people are eating and how the holiday impacts the restaurant industry, Upside analyzed nearly 10,000 food and beverage outlets.

Here are the key takeaways:

- Dive Bars: Surprisingly, 80 percent of dive bars remain open on Christmas Day, but transactions are down by 41 percent.

- Chinese Restaurants: While many expect Chinese restaurants to be open, only 40 percent were last year. However, those that stayed open saw a 120 percent increase in transactions and an 81 percent jump in spending per visit.

- Diners: A popular third choice, with 65 percent open on Christmas Day. Diners saw an 80 percent increase in transactions and a 35 percent rise in spending per visit.

- Christmas Eve vs. Christmas Day: While 91 percent of restaurants were open on Christmas Eve, only 15 percent stayed open on Christmas Day. The ones that did saw a 30 percent increase in spending per transaction.

Full Insights on Christmas Day Dining Trends

A complete breakdown of restaurant categories, open rates, transaction trends, and spending per visit is included below.

|

Category |

Open on Christmas |

Transactions Change |

Spending Change |

|

Dive Bars |

80 percent |

-41.09 percent |

+7.23 percent |

|

Gastropubs |

72.41 percent |

+41.02 percent |

+17.85 percent |

|

Diners |

64.44 percent |

+80.20 percent |

+34.61 percent |

|

Buffets |

53.33 percent |

+70.57 percent |

+50.13 percent |

|

Lounges |

50 percent |

+2.75 percent |

+2.96 percent |

|

Indian |

44.44 percent |

+36.82 percent |

+1.53 percent |

|

Pubs |

43.75 percent |

+27.85 percent |

+19.68 percent |

|

Burgers |

42.89 percent |

-29.10 percent |

+19.21 percent |

|

Chinese |

40 percent |

+120.37 percent |

+81.00 percent |

|

Vietnamese |

37.50 percent |

+105.64 percent |

-9.06 percent |

Based on 2023 Christmas Day data from 9,752 restaurants open year-round (July 2023 – June 2024).