MRM Research Roundup: Experimentation, Valentine’s Vibe Shift, and Wine Cork Market

26 Min Read By MRM Staff

This edition of Modern Restaurant Management (MRM) magazine's Research Roundup features news of dramatic Valentine's Day shift, best food scenes, and the evolution of c-store foodservice.

Year of Experimentation

Square released insights from its annual Future of Commerce report, providing a unique look at the restaurant, retail and beauty industries across the US, Canada, UK, and Australia.

The research found that businesses worldwide – particularly restaurants – intend to experiment more in 2025, especially with customer retention programs like loyalty, as they face the triple challenge of sustained high inflation, shrinking consumer wallets and the need to raise prices across the board. These experiments, largely rooted in technology solutions, will be focused on increasing their efficiency while also deepening their customer relationships.

Connecting with the consumer through loyalty programs and better customer data is a key focus for operators – more than seven in ten restaurant leaders (71 percent) are planning to increase investment in their loyalty or reward programs to keep customers close over the next 12 months. This reflects the positive impact loyalty programs have on driving revenue, with 83 percent of restaurant leaders saying their loyalty program successfully drives up order or basket size, as well as repeat visits (82 percent) and return on investment (78 percent). Consumers are happy to be part of the in-crowd at their favorite restaurants – 69 percent find loyalty programs to be valuable, and they’re reaping the benefits with 43 percent of businesses having implemented exclusive discounts for their members.

These developments are more important than ever as businesses are fighting for a share of consumers’ wallets – most consumers (63 percent) said they’re cutting back on restaurant spending. As they grapple with rising costs across their supply chain, 71 percent of restaurants plan to increase prices this year. Yet despite these challenges, businesses are feeling positive, with 78 percent of restaurant leaders saying they’re more optimistic about their business than a year ago. Nearly two-thirds (65 percent) say they plan to increase their number of locations in 2025, and 74 percent plan to expand their menu offerings, leaning into new experiences and experimentation to power their growth.

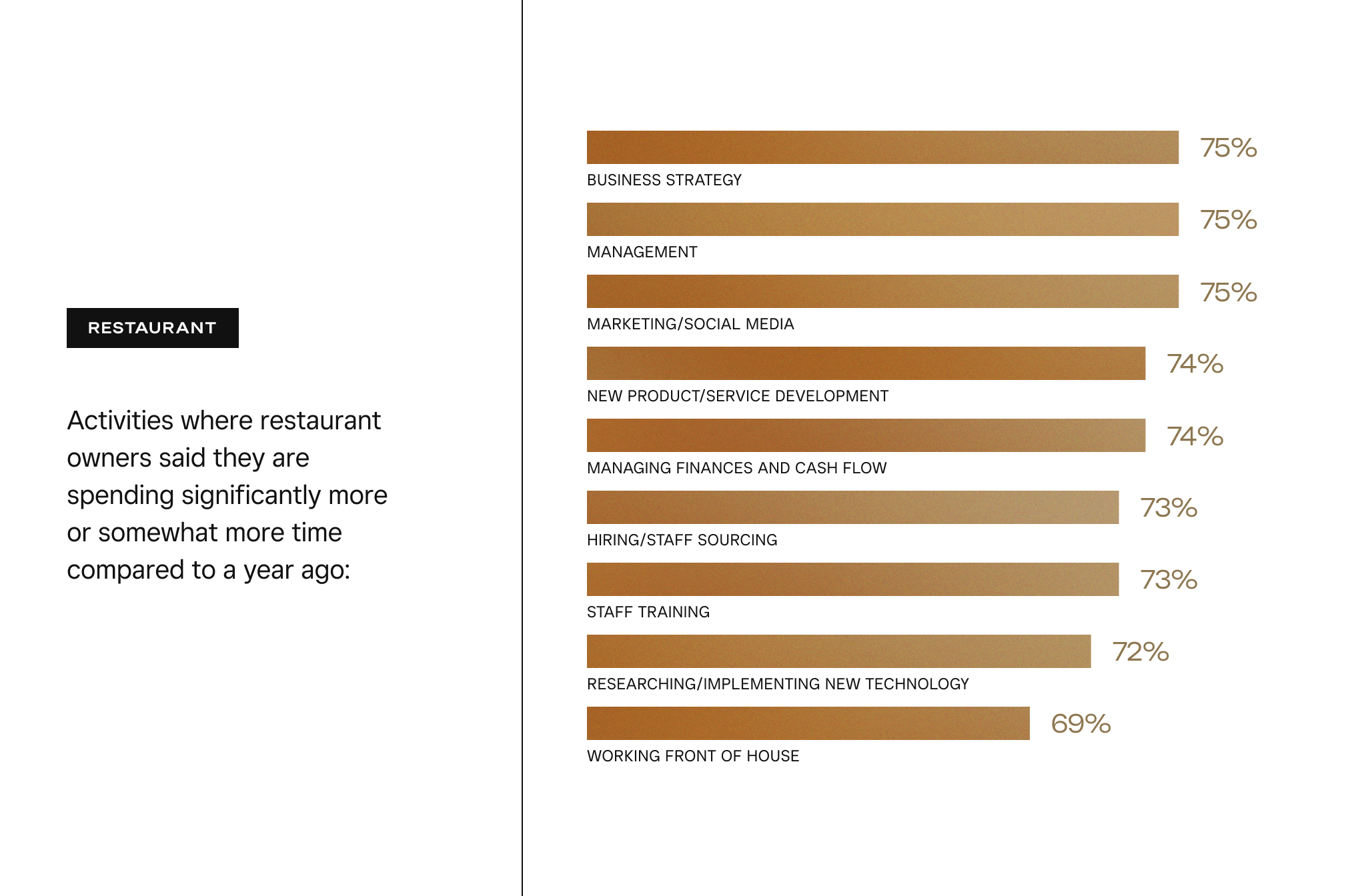

As businesses seek routes to greater efficiency while still maintaining hospitality, Square’s research shows that 85 percent of restaurant leaders plan to invest in technology, such as new AI and automation tools, to help improve their companies this year. Three-quarters of them (75 percent) are spending more time on business operations compared to a year ago as costs rise and industry challenges continue. Two-thirds of restaurant leaders believe AI or automation will improve their business in each of the 15 areas we asked about, the most popular of which are marketing and promotions (77 percent), inventory management (77 percent), payments (76 percent), menu optimization (76 percent), and staff management (75 percent).

“In 2025, restaurants are walking the fine line between automation and hospitality,” said Ming-Tai Huh, Head of Food & Beverage at Square. “As businesses continue to face economic pressures, we’re seeing them invest in growth and experimentation as they find new, streamlined ways to work and deliver exceptional customer service – particularly through using time-saving and experience-enhancing technology.”

A Year of Challenges

U.S. restaurants and retailers are facing a challenging 2025, according to a recent presentation by Fitch Ratings at the 2025 ICR Conference. While consumer health remains strong, discretionary goods will suffer from inflation, decreased consumer savings, and a shift toward spending on services.

Food-away-from-home spending is likely to see modest growth as softer consumer spending patterns prevail. Restaurant traffic could remain flat or modestly decline due to inflation, a cooling labor market, and moderate real wage growth, all of which are making consumers more cautious and selective with their spending choices.

Quick service restaurants may benefit from the reduced discretionary spending, while full-service restaurants could struggle with decreased traffic. Restaurants that excel in customer service, offer a strong value proposition, and provide a high-quality experience are likely to successfully navigate these headwinds and gain market share.

Profit margins for the sector may remain flat or grow slightly as commodities inflation eases and operators streamline operations. However, increased investments in marketing and promotions to drive traffic could offset operational efficiency gains.

Fitch expects retail sales to be stable to slightly positive, with growth in consumer staples but weaker results in discretionary categories. Success will depend on inventory management and expense agility with consumers prioritizing value and experiences like travel after years of volatility triggered by the pandemic. Retailers with strong customer connections ad robust investments in omnichannel models, including technology, will be best positioned. New revenue opportunities will include marketplace offerings, retail media networks, and B2B services using internally developed assets and tools.

Dramatic Valentine's Shift

According to a survey commissioned by OpenTable, Valentine's Day dining is undergoing a dramatic shift, as singles and group celebrations redefine the traditionally couple-focused holiday. The data shows a remarkable 61 percent of singles are willing to dine out for a first date on February 14th, while 51 percent of all diners are considering double dates. The survey also indicates a surge in group dining for “Galentine's Day” celebrations and a strong appetite for new dining experiences.

Highlights include:

Singles Say "Yes" to Valentine's First Dates: Singles are boldly claiming Valentine's Day as their own, with most Americans willing to have a first date at a restaurant on the holiday. Men lead this shift at 65 percent compared to women at 57 percent, while Gen Z is the most adventurous with 70 percent willing to take the romantic leap on February 14th.1

Doubling Down: Restaurants may be seeing double this Valentine’s Day as 51 percent of diners consider double dates for the holiday. Gen Z is driving this trend with 62 percent open to sharing their Valentine's Day celebration with another couple.1

Squad Goals: OpenTable data revealed a 34 percent increase in parties of more than six on Galentine’s Day (February 13) in 2024, compared to the previous year.2 This suggests a growing preference for celebrating love and friendship and will be continued this year: 25 percent of survey respondents will celebrate Galentine’s Day this year.1

Love at First Bite: Diners are trading familiar favorites for new experiences this Valentine's Day, with 81 percent of Americans planning to try a new restaurant. More than a third (36 percent) are specifically seeking "special occasion" venues, signaling a desire to make this year's celebration more memorable than ever.1

Last Minute Planners, We Got You: Last year, 28 percent of Valentine’s Day reservations were made within 48 hours of dining.3 For those who leave things to the last minute, searching by date and time on OpenTable will save dining heartache.

“Valentine’s Day dining has gone through a major vibe shift over the years, and this year sees a continuation of that, with couples, double dates and groups of friends planning to dine out for the occasion,” said Robin Chiang, Chief Growth Officer of OpenTable. “Between OpenTable’s breadth of restaurants and resources, there’s something for everyone – from fine dining to the cozy neighborhood Italian spot – and our annual Top 100 Romantic Restaurants list and curated guides are great places to start.”

Whether seeking an intimate spot for a first date or a lively atmosphere for a double date, OpenTable's Top 100 Romantic Restaurants list offers diverse options from coast to coast. The list is compiled by analyzing more than 10 million diner reviews, along with diner ratings, reservation demand, percentage of five-star reviews among other factors, and features a diverse list of restaurants perfect for any occasion.

Hungry for Value

Americans are hungry for value dining, according to a new report from Placer.ai titled Chili’s and Texas Roadhouse: Full-Service Success in 2024. The report finds that last year, both Chili’s and Texas Roadhouse saw significant increases in foot traffic, outperforming other full-service restaurants. Additionally, another fresh Placer.ai report, McDonald’s and Chipotle: Recapping 2024 Visit Trends, shows recent visits slowing at McDonald’s but continuing to impress at Chipotle.

Chili’s saw visits grow 11.3 percent year-over-year during 2024. During Q4 2024, visits were up 23 percent, while visits to other full-service restaurants were down 2.9 percent.

Texas Roadhouse’s visits grew 7.2 percent during 2024 and were up 4.2 percent during Q4.

Both chains are using relative value compared to other restaurants to attract diners, and it’s even helped both attract relatively affluent customers.

McDonald’s saw visits fall 0.6 percent year-over-year during December and down 4.2 percent in November. In December, QSR restaurants overall saw visits decline 2.9 percent.

Chipotle’s year-over-year foot traffic grew 8.8 percent in December and 11.3 percent in November. Fast-casual visits overall were down 3.8 percent in December.

Best U.S. Food Scenes

A new study reveals the top ten states with the best culinary scene, and Hawaii has, by far, the best statewide restaurant scene, ranking at or near the top of five out of the seven categories we explored.

Perhaps unexpectedly, Rhode Island ranked in the top ten overall, powered by high restaurant spending, a large percentage of independent restaurants, and strong employment numbers.

Population size is clearly not everything; while several of the biggest states did crack the top ten, smaller states like Hawaii, Nevada, and Rhode Island also ranked highly, indicating that population size alone does not determine the vibrancy of a state’s restaurant scene.

Escoffier, analyzed all 50 U.S. states to determine the top ten with the best food scenes. The analysis explored economic factors like restaurant spending (Restaurant Expenditures = RE) and employment, restaurant density, and the presence of independent and Michelin-starred restaurants. Each state received a composite score to reveal the top food hotspots.Hawaii tops the rankings with a score of 100, standing out for its exceptional capacity to serve visitors, with 376 tourists per restaurant—the highest among all states analyzed. Additionally, 77.17 percent of its restaurants are independently owned. The state also ranks high in restaurant spending and employment, with 14 percent of jobs tied to the industry.

New York is second with a score of 83.23, offering a dense restaurant scene and 68 Michelin-starred establishments. It also has one of the highest percentages ofindependent restaurants at 71.87 percent, reflecting the diversity of its dining options.

Nevada takes third place with a score of 82.57, standing out for its restaurant spending, which accounts for 43.81 percent of the average food budget, and the highest percentage of restaurant jobs, making up 15 percent of the state’s workforce.

California ranks fourth with a score of 75.01. It leads the nation with 85 Michelin-starred restaurants and has the most restaurants per capita, making it a key destination for diverse dining experiences.

Florida is fifth with a score of 72.14. The state has 164 visitors for every restaurant, highlighting its popularity with tourists. It also has 26 Michelin-starred establishments, with 11 percent of its workforce employed in the restaurant industry.

Massachusetts takes sixth place with a score of 51.29, with steady restaurant spending and a strong restaurant workforce. The state also has a restaurant-to-tourist ratio of 73:1 and is home to 15 Michelin-starred restaurants, offering a variety of dining options.

Illinois ranks seventh with a score of 48.33. Residents allocate 41.20 percent of their food budgets to dining out, and the state features 20 Michelin-starred restaurants.These factors make dining out a popular choice across Illinois.

Texas comes in eighth with a score of 46.25. The state ranks high in restaurant density, with 16.98 restaurants per 100K people, and employs 11 percent of its workforce in the restaurant industry. It also has one of the highest numbers of culinary schools, further supporting its food industry.

Rhode Island ranks ninth with a score of 43.31. Nearly two-thirds (64.21 percent) of its restaurants are independently owned, and 12 percent of its workforce is in the restaurant industry. With one restaurant for every 30 visitors, the state offers a wide range of dining options for both locals and tourists.

New Jersey rounds out the top ten with a score of 42.04. Residents spend 36.76 percent of their food budgets dining out, and the state has one restaurant for every 24 residents. Although smaller in scale, 10 percent of New Jersey’s workforce is tied to the culinary industry, reflecting its importance to the local economy.

Convenience Stores as Food Destinations

Convenience stores are intensifying their focus on foodservice offerings to drive foot traffic, in-store sales growth and frequency of repeat visits. Strong consumer interest in prepared foods, commissary and beverage options has led convenience stores, often referred to as c-stores, to compete much more aggressively with quick service restaurants and fast-food chains.

The focus on offering a wider variety of prepared and ready-to-eat food items is clearly paying off, as c-stores registered record sales in 2023. Those gains are largely attributable to in-store sales, which grew 8 percent year-over-year in both 2022 and 2023 according to Circana, well ahead of overall inflation numbers for both food at and away from home. While sales appeared to soften in 2024, a Convenience Store News survey found two-thirds of c-store retailers predict total sales per store will grow in 2025.

According to a new report from CoBank’s Knowledge Exchange, the line between grocery stores, quick-service restaurants and c-stores will continue to blur, intensifying competition across the foodservice and retail grocery spectrum. C-store chains are increasingly viewing QSR and traditional fast-food chains as their chief competition and tailoring their food offerings to match if not exceed competitors’ menu options.

“Convenience stores have evolved from their gas-fueled beginnings to become true food and beverage destinations,” said Billy Roberts, food & beverage economist with CoBank. “Food service is the future for c-stores, and we expect they’ll continue to emulate their competitors with a greater variety of freshly prepared items, along with more attention to signature menu items and private label products.”

The emergence of c-stores as formidable destinations for prepared foods hasn’t gone unnoticed by major food manufacturers. Several leading food brands have taken the merger and acquisition route to enter the c-store channel. J.M. Smucker cites c-store distribution as an important reason behind its early 2024 acquisition of Hostess Brands.

Similarly, Hormel Foods dramatically expanded its c-store penetration with its 2021 purchase of Planters and Corn Nuts brands. Hormel has subsequently leveraged those newfound distribution relationships to bring more of its products to c-stores, including pizza toppings and bacon.

C-store kitchens are seeking quick and easily prepared products. Hormel is among the suppliers that has found c-stores to be something of a testing ground for new flavors and product concepts. For example, the key distinction of Hormel’s Bacon 1 isn’t necessarily flavor but ease for the operator. The fully cooked product heats quickly, enabling c-store operators to easily add bacon to a host of their menu options.

Customer loyalty programs are also playing a significant role in the success c-stores have had with food sales and repeat visits. Several c-stores have developed loyal followings on a near-nationwide scale. The 2024 Loyalty Trend Report from Paytronix finds at least 80 percent of c-stores’ loyalty program members in the top half of loyalty transaction visits per store every month.

“This enthusiasm for loyalty programs will be a tool that c-stores look to sharpen as they attempt to claim more traffic from restaurants, which have seen weak results of late,” said Roberts.

Customer Loyalty Engagement Index

Results of the 28th annual Brand Keys Customer Loyalty Engagement Index (CLEI) identified the brands which will dominate their categories in 2025 and revealed dramatic differences in how loyalty operates as the most accurate predictor of consumer purchasing behavior, sales, brand market share, and profits.

The index surveyed more than 81,000 consumers aged 16 to 65, examining their attitudes toward and their relationships with 1,100 brands in 104 categories. The yearly study is designed to determine the drivers of brand loyalty, including how the consumer views the category, compares offerings and ultimately buys the product. Rankings are based on a brand’s ability to successfully deliver on drivers the consumer desire most, which are predictive of the highest levels of engagement and loyalty over the next 12 to 18 months.

“The impact of loyalty on brand profitability has increased so significantly since we released those very first calculations in 1997,” said Robert Passikoff, founder and president of Brand Keys (brandkeys.com), the New York-based brand loyalty and engagement research firm that conducts the annual research, “We introduced gold, silver, and bronze levels to this year’s CLEI to specify brand loyalty hierarchies in the companies consumers evaluated.”

This year’s Brand Loyalty Award winners in the Restaurant Sector included:

Fast Casual Food

Gold: Chipotle

Silver:Panera

Bronze: Shake Shack

Fast Food

Gold: McDonald’s

Silver: Taco Bell

Bronze: Wendy’s

Out-of-Home Coffee

Gold: Dunkin’

Silver: McDonald’s

Bronze: Peets

Pizza

Gold: Domino’s

Silver: Papa John’s

Bronze: Pizza Hut

Food & Beverage Industry Economic Trends Report

Food Liability Insurance Program (FLIP), a national insurance program designed for small to mid-sized operators in the food industry, released its second annual “Food & Beverage Industry Economic Trends Report,” which includes proprietary insurance statistics from the previous year, insights from both consumers and SMBs operating in the food industry, and general economic and consumer trends. The report includes a market-wide analysis of out-of-home food businesses, excluding restaurants and grocers, and segment-specific insights into bakers, mobile bartenders, caterers, event-based businesses such as food truck and farmers market vendors, personal chefs, and home (cottage) food businesses.

● An analysis of insurance claims processed in 2024 compared to 2023 shows a 4.4 percent decrease in claims. The most prevalent claim type in 2024 was Accidents Causing Damage, which represented 31 percent of all claims, an increase of 73 percent over 2023. The following three claim types were claims involving an Auto or Trailer (24 percent), Theft (12 percent), and Food Spoilage (11 percent).

● The average payout for all claims filed was $3,385

● California, Texas, and Florida represented the highest concentrations of claims throughout the United States

● 61 percent of all claims filed resulted in a payout

Food Business Owners Insights and Predictions

Growth:

- 52 percent of food businesses indicated that their businesses grew in 2024 over the previous year and 79 percent of business owners believe that growth will happen again in 2025

- In terms of footprint, operators were divided on whether they plan to physically expand in 2025, with 35 percent noting that it would depend on economic success

Costs & Inflation:

- 60 percent of food businesses reported that higher food costs affected their business’ profitability while 27 percent noted they were able to adjust prices to compensate for the costs. Looking to the future, about half of businesses predict that ticket prices will continue to go up while the other half predict that they will remain level in 2025.

- When predicting challenges in 2025, 42 percent of food business owners believe rising costs will continue to be their top challenge in 2025; however, 54 percent believe that labor costs will remain the same as they were in 2024.

- 41 percent of food businesses are targeting more than 10 percent average profit margins in 2025 with 36 percent targeting 4 percent-10 percent

Marketing and Consumer Trends:

- Business owners indicated that they are planning to stick with their menus heading into 2025, with 54 percent indicating they had no intention of changing theirs

- Food businesses seem torn on adding more dietary-specific menu options (e.g., vegan, gluten-free) with 54 percent reporting they continue to see an increase in requests for this and 45 percent reporting they are not

- Marketing is still a major focus for operators, as 31 percent reported that attracting and retaining customers will be their largest challenge in 2025 and 97 percent are still considering changing their advertising spend in the new year

- Food business owners are not sold on artificial intelligence use in their operations, with 43 percent indicating they will not be adopting any AI tools into their business and 36 percent being unsure, while only 13 percent are already leveraging the tool

Diner Insights:

● 60 percent of diners indicated that they eat out on a weekly basis and an additional 22 percent reported dining out 2-3 times per month

● 70 percent of diners said they are willing to spend between $11 and $30 when dining out with 25 percent willing to pay over $31

● Customers noted that Quality of Food and Price are the most important factors when choosing where to eat

● Diners continue to choose electronic payments over cash with 80 percent favoring cashless payment options such as credit cards and mobile payments

● Surprisingly, 36 percent of diners are willing to travel 10-20 miles for an out-of-home dining experience with an additional 29 percent willing to travel 20+ miles for a unique dining experience

● Customization of menu items was revealed to be important in the eyes of diners, with 90 percent indicating that being able to customize their order was very or somewhat important

The Nation's Pizza Stagnation

One in seven Americans has been eating pizza the exact same way without changing their order for over five years. That’s according to a new survey that polled 5,000 people across every state on their pizza ordering and found that the last time the average person strayed from their usual order was two years (2.1) ago.

The study also found that 57 percent of respondents are open to trying new pizza combinations but don’t know where to start. For some, spice may be the solution, as half (49 percent) agree that spice makes pizza taste better.

New Mexico and Hawaii (both 58 percent) are the states that add the most spice to their pizza, followed by California (55 percent) and Texas (53 percent), according to the survey conducted by Talker Research on behalf of Tabasco Brand.

Michigan and South Carolina were jointly the least likely states to spice up their pizza with just 31 percent of people from either state saying they do this.

Not only was Michigan unlikely to spice up their pizza, but they were also the state with the most respondents who said they’d never tried a new pizza at all (11 percent).

Which shows that when it comes to being a pizza repeater, some states are more loyal to their order than others.

People in Indiana and Vermont both 95 percent) are the most likely to stick with the same pizza toppings they’ve had in the past.

The survey also pinpointed which states liked spicy food the most asking respondents to rate their spice love out of 10. New Mexico (6.1) and California (5.7), ranked highest in terms of preference for spicy food — Alaska interestingly came in third (5.6).

The survey also uncovered interesting ways people from different states prefer to eat their favorite pizzas.

- Forty percent of Georgia residents surveyed said they like to eat the crust first

- More than half (53 percent) of Illinois respondents said they prefer to use a fork and knife rather than using their hands.

- Sixty-six percent of Minnesotans were adamant about not folding their pizza slices.

- And when it comes to how often we indulge in a slice around the country, results vary with Iowa eating the most pizza per month (five times), Alaska (4.7 times) and North Dakota (4.9 times).

- However, the state that gathers families together for “pizza night” the most in a typical month is Louisiana (3.5 times), followed by Connecticut (3.4) and Iowa (3.3). Interestingly, New York — famous for its pizza — only reported having an average of 2.8 pizza nights in a month.

- Respondents from Louisiana average eating the most pizza in one sitting (3.3 slices). Friday night was unanimously voted the most popular night to order pizza in every state.

Canadian Foodservice Trends

The Canada foodservice market is likely to increase drastically as it grows to US$135.52 billion in 2033 from US$ 84.14 billion in 2024. It is expanding with a compound annual growth rate (CAGR) of 5.43 percent from 2025 2033 due to nationwide popularity of convenience, delivery services, and new emerging food products.

The increase in market size is mainly driven by increased consumers' spending on different foods, changed eating patterns of consumers, and high consumer demand for diverse foodservices.

Foodservice is the segment that deals with the preparation, service, and sale of food and beverages outside the household. This includes a variety of establishments, such as restaurants and cafes, catering services, quick-service outlets, and institutional food services (hospitals, schools, and corporate offices). The food service industry is one of the important sectors in the economy of Canada, creating employment opportunities and innovating culinary trends.

Foodservice in Canada is diversified, catering to a wide range of consumer preferences, including casual dining, fine dining, and fast food. It satisfies the increasing demand for convenience by providing ready-to-eat meals for busy individuals, families, and professionals. The rise of delivery services, online food ordering, and takeaway options has expanded the reach of the food service market.

Moreover, the Canadian food service industry increasingly focuses on healthier menu options, plant-based foods, and sustainable sourcing, responding to changing consumer demands for nutrition and environmental responsibility. The food service market also serves as an essential space for developing local food culture and innovation, driven by consumer trends and evolving dining experiences across the country.

Growth Driver in the Canada Foodservice Market

Rising Consumer Demand for Convenience

As Canadians continue to get busier, the demand for convenience in food options only continues to increase. More and more people are searching for fast, ready-to-eat meals. This has led to the growth of quick-service restaurants (QSRs), delivery services, and takeout options. This trend has further been facilitated by the rise of digital ordering platforms and food delivery apps, as it now becomes easier to access favorite meals with minimal effort. This trend toward convenience is driving the growth of Canada's foodservice market, especially in urban regions where lifestyles are busy.

Health and Wellness Trends

Health-consciousness among Canadian consumers is transforming the foodservice market. There is an increasing demand for healthier menu options, including plant-based dishes, organic foods, and sustainable sourcing. As consumers become more aware of the impact of food on their well-being, they are choosing restaurants and foodservice providers that prioritize nutritious, low-calorie, and allergy-friendly offerings. In response, many foodservice businesses are revising their menus to cater to these preferences, expanding market growth and appealing to a broader, health-conscious audience.

Expansion of Delivery and Online Ordering Services

The rise of online food delivery services is one of the key drivers of growth in the Canadian foodservice market. The widespread use of food delivery apps and platforms, such as Uber Eats, DoorDash, and SkipTheDishes, has made it easier for consumers to access meals from their favorite restaurants without leaving their homes. This change in consumer behavior, driven by the COVID-19 pandemic, has hugely added to the growth in the foodservice industry. Enterprises are responding to the demand for more convenience by offering delivery and pickup options, hence, growing their customer base while creating more revenue potential.

Barriers in the Canada Foodservice Market

Staff Shortages and Increased Expenses on Employment

There is a significant challenge in the foodservice industry in Canada associated with staff shortages and an increased expense on employment. Helping the industry source and retain more skilled workers–specifically chefs, servers, and kitchen staffs–the shortages will continue to raise wages, boost training costs, and pose a challenge for operations in serving customers to their full quality. Beyond these shortages, the recurring struggle of finding employees to sustain businesses continues to threaten foodservice, making it harder to service growing consumers while sustaining profitability.

Supply Chain Disruptions and Ingredient Cost Hikes

The Canadian foodservice sector is grappling with supply chain disruptions, as well as creeping ingredient price hikes. Worldwide, especially after outbreaks like COVID-19, and heightened geopolitics, delays occur in all food and drink, also packaging supplies, while the costs for their purchases get higher.

Canada Full Service Restaurant Market

Full-service restaurants continue to be a dominating component in the Canada Food Service Market. They do their business even if customer choices change and if delivery/casual and delivery companies seem to rise and grab many of the pie because, as mentioned, it delivers an all-inclusive meal. Famous for customized service, atmosphere, and multiple menu options, they attract a wide range of clients. The ongoing appeal of the relaxing dining experience and the changing nature of the industry mean that Full-Service Restaurants remain the staple in the Canadian foodservice, where they remain the market leaders.

Canadian Retail food service non-commercial restaurant industry

The Canadian retail food service non-commercial restaurant market is growing very fast. This increase may be due to shifting consumer preferences, increased demand for different types of food services, and innovation in non-traditional food service concepts. The non-commercial sector, which includes entities within retail, educational, and health care settings, is gaining more popularity.

The retail food service non-commercial restaurant industry is booming, and it focuses on comfort and providing quality food in non-traditional dining venues. The ability of such businesses to change and adapt to meet the fluid needs of the consumer accounts for much of their enhanced growth within the Canadian food service environment.

Reviews Influence Real-Time Consumer Decisions, Trust

To understand how consumers interact with and trust reviews, Chatmeter surveyed more than 1,000 people. The results revealed that:

- Nearly half (46 percent) of consumers would not dine at a restaurant without reading reviews–and around a third (30 percent) said they would read reviews or look at photos while at the table, deciding what to order.

- Gen Z (44 percent) was most likely to say they would do this compared to 35 percent of Millennials, 27 percent of Gen X and 20 percent of Baby Boomers.

- Google Reviews was ranked the most trustworthy review platform by consumers, followed by Yelp, Better Business Bureau, TripAdvisor and Facebook. Trusted platforms varied across generations, reinforcing the importance of a multi-platform presence.

- Gen Z (42 percent) was most likely to trust Google Reviews most compared to 20 percent of Baby Boomers.

- Conversely, Baby Boomers were most likely to say they trusted Better Business Bureau most compared to just 5 percent of Gen Z.

- While researching a local business, consumers said they look for signals like an average rating of at least 4/5 (52 percent), reviews including photos (51 percent), and a lot of reviews (46 percent) to decide on one business over another.

- More than a third (36 percent) also said a business could differentiate itself by responding publicly to reviews.

- Gen Z (61 percent) and Millennials (53 percent) ranked a business having a lot of reviews as the top differentiating factor, followed by reviews with photos (60 percent and 48 percent, respectively).

- Consumers said they would not trust reviews if they seemed like they were generated by AI (53 percent), reviews didn’t provide enough information or context (52 percent), they were poorly written (47 percent), they excessively praised the business (34 percent) and reviews that didn’t include images or photos (26 percent)—reinforcing the need for high quality reviews in addition to quantity.

Lunar New Year Menu Preferences

Chinese Menu Online analyzed over 7 million orders from 3,000+ Asian restaurants in 2024 to uncover valuable insights into shifting consumer preferences. Celebrated by Chinese and other East and Southeast Asian communities, Lunar New Year is the most important festival of the year, marked by family gatherings and festive meals that welcome prosperity and good fortune. For restaurant owners, this is a prime opportunity to cater to customers seeking traditional favorites and celebratory dishes. It is the Year of the Snake, which is associated with wisdom, strategy, and transformation, and also presents an opportunity for restaurants to adapt and evolve their offerings, ensuring they meet consumer demands while honoring the holiday's rich traditions.

Strong Growth in Popular Chicken Entrées

While General Tso's Chicken continues to dominate, accounting for 14.8 percent of orders with a 6.17 percent growth from 2023, other chicken dishes like Sesame Chicken (+7.32 percent YoY), Orange Chicken (+6.86 percent), and Chicken with Broccoli (+6.59 percent) also saw notable increases in popularity. All four dishes ranked among the top 20 most purchased items, highlighting their widespread popularity.

As the Chinese saying goes, "No feast is complete without chicken". Restaurant owners can capitalize on this by promoting these chicken dishes as part of the special Lunar New Year offering. Consider introducing family-sized portions or bundled meals that pair the dish with other favorites like fried rice and spring rolls. This not only meets demand for familiar flavors but also enhances the celebratory experience.

The Shift Towards Healthier Dishes

Consumer demand for lighter, healthier options rose in 2024, with plant-based proteins, vegetable-focused dishes, and steamed items gaining popularity. Dishes like General Tso's Tofu and Sesame Tofu are increasingly favored by health-conscious diners. Tofu holds cultural significance, as its name sounds like "fu" in Chinese, which means "wealth."

Additionally, vegetables, like lettuce, symbolize prosperity because the Chinese word for lettuce sounds like "sheng cai." Steamed dishes are particularly meaningful, as they are associated with the idea of "zheng zheng ri shang," a Chinese saying that conveys the wish for steady growth and continual improvement. By incorporating these healthier, symbolic options into Lunar New Year menus, restaurants can cater to modern tastes while celebrating cultural traditions.

Appetizers: A Key Category for Increased Sales

Appetizers like Egg Rolls (the most ordered item, appearing in 18.23 percent of all orders), Crab Rangoon, Spring Rolls and Fried Dumplings remained central to Chinese dining and drove strong sales in 2024. These shareable dishes are perfect for group dining, especially during Lunar New Year.

Dumplings, shaped like ancient gold ingots, symbolize wealth and prosperity, while Spring Rolls, closely tied to the Spring Festival (another name for Lunar New Year), represent renewal and the arrival of spring, with their golden color signifying good fortune. Restaurants can highlight these items in Lunar New Year promotions, offering seasonal variations or combo platters for group celebrations to boost sales and enhance the festive atmosphere.

As the Year of the Snake uncoils, leveraging these insights and incorporating both traditional favorites and modern options will help restaurants attract more customers and create a memorable dining experience, ensuring success throughout the holiday season and beyond.

Top Ordered Items in 2024 ( percent of Total Orders)

- Egg Roll (18.23 percent)

- General Tso's Chicken (14.84 percent)

- Crab Rangoon (10.92 percent)

- Sweet and Sour Chicken (10.05 percent)

- Sesame Chicken (8.57 percent)

- Wonton Soup

- Chicken Lo Mein

- Orange Chicken

- Chicken with Broccoli

- Chicken Fried Rice

- Beef with Broccoli

- Spring Roll

- Egg Drop Soup

- Hot and Sour Soup

- Shrimp Fried Rice

- Fried Chicken Wings

- Fried Dumplings

- Vegetable Lo Mein

- Steamed Dumplings

- Beef Lo Mein

Alcohol Consumption Survey

After the U.S. Surgeon General's recent call for cancer warning labels impacts the beverage alcohol sector, an annual NCSolutions survey signals a seismic shift in consumer behavior that could reshape industry strategy.

The study shows 49 percent of Americans plan to reduce their alcohol consumption in 2025 – an 8 percent increase from 2024's numbers.

This accelerating moderation trend, coupled with the mainstreaming of movements like Dry January and Sober October, presents both challenges and opportunities for beverage manufacturers and retailers. The research highlights a pivotal moment for product innovation and market adaptation.

Key insights:

- Significant year-over-year increase in moderation intent (41 percent to 49 percent)

- Growing market potential for low/no-alcohol alternatives

- Gen Z and Millennial-driven shift in consumption patterns

- Implications for product development, marketing, and distribution strategies

A Year of Resilience and Innovation

BeerBoard released its 2024 Year in Review report. This comprehensive analysis highlights the key trends, shifts, and data-driven insights that defined the on-premise alcohol market in 2024 across over $1 billion in alcohol sales equating to 2 billion ounces poured.

The on-premise beverage alcohol sector demonstrated remarkable resilience and adaptability in 2024, overcoming challenges posed by shifting consumer preferences, economic fluctuations and a dynamic regulatory landscape. Even though BeerBoard’s data shows both draft and packaged down -6 percent in 2024 versus 2023, there were bright spots across key segments like Beyond Beer, which was up +69 percent led by canned cocktails. Beer styles continue to be led by Lager and Light Lager styles (imported and domestic) across both draft and packaged, while non-alcoholic beer volume share has grown tremendously within packaged in 2024.

Key Highlights from the Report

Draft & Packaged Beer

Volumes were down -6 percent in 2024 vs. 2023, in total ounces poured.

The biggest gainers in draft volume in 2024 (in order) were Modelo, Michelob Ultra, Busch Light, Coors Light, and Pacifico.

Packaged products decreased by -6 percent in total units served, with domestics a 48 percent share of volume, imports at 35 percent, craft at 9 percent, and Beyond Beer at 8 percent.

Beyond Beer (Canned Cocktails, Hard Seltzers)

Beyond Beer increased overall volume share of the packaged category by +13.5 percent led by RTD cocktails, which grew by +121.5 percent over 2023.

The rate of sale for the Beyond Beer category increased by +69 percent in 2024 vs. 2023.

Top brands contributing to volume gains in 2024 include (in order): Surfside, High Noon, Happy Dad, Nutrl, and White Claw.

Wine & Spirits

Whiskey was the top spirits category sold in 2024 with 24 percent volume share followed by tequila at 21.5 percent and vodka at 20 percent. However, whiskey declined by -6.7 percent while tequila was up +6.3 percent.

Top performing volume spirits brands of 2024 (in order): Tito’s, Jameson, Jack Daniel’s, Sauza and Bacardi.

Within wine, white wine held a 50 percent volume share while red wine was 32 percent volume share. Top varietals were Chardonnay, Pinot Grigio and Cabernet Sauvignon and top volume brands in 2024 were (in order): Josh Cellars, Ecco Domani, Chateau Ste. Michelle, La Marca and Chloe.

2024 Trends

Lager and Light Lager styles (imported and domestic) led sales across both draft and packaged. IPAs on draft are the third most popular style poured.

Non-alcoholic packaged beer has overtaken RTD cocktails by volume share and is catching up to hard seltzers.

While still a small share compared to beer, hard seltzers and RTD cocktails are growing in share of on-premise packaged.

Whiskey is still the most popular subcategory with tequila growing share driven by on-premise cocktail favorite the margarita. Rum grew in share in Q4.

Chardonnay, Pinot Grigio and Cabernet are the top volume wine style poured YTD. In the ‘Others’ segment, Sauvignon Blanc, white blends and Moscato lead sold ounces.

Looking Ahead to 2025

Draft beer is a big priority of both suppliers and on-premise operators in 2025 – fresh beer is a win-win for consumers and the overall industry. On-premise operators are facing pressure to optimize their tap lineups with high-margin, high-performing brands. They benefit most from a curated, focused assortment that maximizes velocity and revenue, offering a better beer experience for guests.

Focusing on Top Brands for Better Outcomes: Not all brands contribute equally to volume or revenue: the top four draft brands drive about 2.5 times more sales than the next eleven brands, and 15 times more than the long tail.

Prioritizing High-Performing Brands: Operators benefit from prioritizing these high-performing brands, which deliver both higher dollar revenue and faster turnover. Simplifying assortments around a select group of high-velocity brands means more consistent sales, fresher product, and an optimized guest experience.

Data-Driven Assortment Strategy: Suppliers have an opportunity to better leverage data to understand which brands drive optimal performance at each location. With the right data insights, suppliers can help operators identify the right assortment based on consumer demand and past performance, ensuring each tap works as a high-revenue generator.

Flavor Forecast

McCormick® announces the Flavor Forecast 25th Edition, their annual report on the latest culinary trends, shaping the way people prepare and enjoy food worldwide. With this year's report, McCormick unveils its 2025 Flavor of the Year: Aji Amarillo, a pepper native to South America featuring fruity, tropical notes with moderate heat. McCormick is offering a taste of this standout flavor with their new Aji Amarillo Seasoning, available for a limited time online beginning early February. In celebration of the milestone Flavor Forecast 25th Edition, McCormick will also host its first-ever Flavor Night Market in Miami, FL, and is inviting guests to step into an immersive flavor experience inspired by the Flavor of the Year.

The McCormick 2025 Flavor of the Year, Aji Amarillo, which translates to 'yellow chile pepper' in English, is a pepper grown in Peru and native to South America that is a staple ingredient in Peruvian cuisine. Despite its name, the yellow pepper turns orange when fully mature. The vibrant pepper has fruity, tropical notes, reminiscent of passion fruit and mango, with a moderate heat ranging from 30,000 to 50,000 Scoville Heat Units (SHU). Today, Aji Amarillo is trending beyond Peruvian cuisine, showing up as a key ingredient in appetizers, drinks, entrees and more, with an anticipated 59 percent menu growth over the next four years

McCormick has defined flavor for over 135 years. Established in 2000, the McCormick Flavor Forecast is the company's annual global trend report, which has predicted flavors like pumpkin pie spice, chipotle, ube, Korean BBQ, Ube, Swicy and more. The report explores what is shaping the future of flavor at home, restaurants, and grocery stores. It's crafted through a blend of primary and secondary qualitative and quantitative research, including on-the-ground research across the globe, as well as social listening insights, SEO trends, and more. It encompasses flavor, culinary trends and stories, cooking techniques and applications, exploring trends on the cusp of adoption around the world.

Flavor predictions and trends identified in the Flavor Forecast 25th Edition include:

Tropical Vibes: In this trend, taste buds travel through warm-weather flavors and cuisines to taste tropical fruits, seafood, and island and beach cuisines.

Charred & Smoked: These culinary techniques underline and emphasize the natural characteristics of a dish or ingredient. Smoky, charred, roasted and ultra-caramelized notes come through in unique ways and a variety of applications.

Deliciously Unexpected: This trend is all about reimagined familiar ingredients and deliciously unexpected combinations, evoking curiosity and cravings. Early evidence of this includes the chili cucumber salad trend that has amassed nearly 23 million views on TikTok.

Wine Cork Market Dynamics

In recent years, consumers have upgraded their level of interest shown by consumers in wine, resulting in higher wine sales. Their consumption patterns of alcoholic beverages, such as beer, wine, and champagne, are distinct from boomers' consumption patterns.

According to the data provided by the International Organization of Vine and Wine, the quantity of wine produced in Argentina and Chile increased by 23 percent and 36 percent, respectively. In addition, exports in Chile, Australia, and South Africa each climbed by 7.7 percent, 6.7 percent, and 4.7 percent. Winemakers in these countries are ramping up output to satisfy the ever-increasing demand in their markets and capitalize on opportunities to sell their wares elsewhere.

The significant replacement rate in Italy, Spain, and France are the leading wine-producing countries globally, accounting for roughly half of the entire production worldwide. According to Eurostat, approximately 35–40 percent of the wineries and vineyards in these countries have been in operation for more than 30 years, and about 50 percent of the wineries and vineyards in these countries have been in operation for between 10 and 30 years.

Enhancement of Technological Progress of Winemaking Creates Tremendous Opportunities

Cork manufacturers on the cutting edge of innovation are fusing traditional practices with cutting-edge technologies, resulting in new facilities that are both energy- and resource-efficient. Additionally, using fewer resources, gravity feed, underground construction, and natural light produce outstanding wines. Using solar and co-generated power can result in considerable cost and time savings.

Europe is the most significant contributor to the global wine corks market and is expected to grow with a CAGR of 4.9 percent during the forecast period. The prevalence of European countries, including France, Italy, Germany, Russia, and others, has increased their consumption and production of wine. In addition, the rise in wine consumption is predicted to encourage vineyard producers to expand their production facilities, hence fueling the expansion of the wine corks market.

North America is anticipated to gain significant traction in the global wine corks market during the forecast period. This is owing to the increase in winemaking plants in critical countries like the United States, Canada, and Mexico. The market in North America is evaluated by considering three powerful nations: The United States, Canada, and Mexico. Numerous developed and wealthy countries in North America, such as the U.S., Canada, Mexico, and others, are expected to stimulate the wine corks market expansion. Increases in industrial development and manufacturing demand are anticipated to allow wine cork makers to create or extend their businesses, fostering market expansion.

Key Highlights

The global wine corks market size was valued at USD 22.25 billion in 2024 and is projected to reach from USD 23.90 billion in 2025 to USD 42.30 billion by 2033, growing at a CAGR of 7.4 percent during the forecast period (2025-2033).

Based on type, the global wine corks market is divided into Natural and Synthetic Segments. The natural segment is the most dominant and is expected to grow at a CAGR of 6.6 percent during the forecast period.

Based on distribution channels, the global wine corks market is segmented into Online and Offline Distribution Channels. The offline segment owns the highest market share and is expected to grow at a CAGR of 6.6 percent during the forecast period.

The global wine corks market is primarily classified into three regions, namely North America, Europe, Asia-Pacific, and LAMEA. Europe is the most significant contributor to the global wine corks market and is expected to grow with a CAGR of 4.9 percent during the forecast period.