MRM Research Roundup: End-of-September 2019 Edition

19 Min Read By MRM Staff

This edition of Modern Restaurant Management (MRM) magazine's Research Roundup features news about consumers view of restaurant technology, restaurant thievery , hidden gem restaurants and where football fans go to dine.

The Guest and Restaurant Tech

Technology plays a prominent role in nearly every aspect of US consumers’ lives and the dining out experience is no exception. But it seems that for some Americans, the spread of mobile, digital and artificial intelligence (AI) technology is unwanted as new research from Mintel reveals that 28 percent of US consumers agree that technology is ruining hospitality.

Mintel reveals that 28 percent of US consumers agree that technology is ruining hospitality.

However, it may be the fear of the unknown that’s influencing these perceptions as a large minority of Americans have not only never used certain types of technology when dining out, but they are not interested in trying them. For example, two in five consumers have not used and are not interested in trying a restaurant mobile app (44 percent) or kiosk (40 percent) to pay. Nearly half (48 percent) of diners have not used and are not interested in trying mobile wallet payment options (ie Apple Pay, Samsung Pay).

Given that less than one in five (17 percent) Americans express interest in fully-automated restaurant concepts, technology won’t be replacing human hospitality anytime soon. However, as discussed in Mintel’s 2019 US Foodservice Trend ‘Tech in Balance’, as technology drives the changing face of the foodservice industry, operators are finding the right mix of operational efficiency, the desire for human interaction and excellent service.

Striking this balance, many consumers see the value of technology in foodservice when using loyalty programs: 36 percent have used a loyalty program through a restaurant app and would use it again. What’s more, one quarter (23 percent) of consumers who have not participated in a loyalty program through a restaurant app are interested in trying it. For the most part, consumers are drawn to loyalty programs for the rewards, including ongoing discounts (50 percent), earning dollars towards future purchases (42 percent), and access to special deals (eg birthday treat) (35 percent).

“The majority of Americans are not interested in fully-automated restaurant concepts mainly because they prefer human interaction,” said Jill Failla, Foodservice Analyst at Mintel. “However, on-premise restaurant technology offers operators multifaceted solutions to growing labor challenges and consumer demand for speedy service. As such, striking the perfect balance between consumer-friendly technology and human hospitality is key to the success of the industry moving forward.

"Our research shows that mobile-app-based loyalty programs are one of the top forms of digital engagement on-premise at restaurants and are integral to the future of personalization within the industry. They offer a compelling way for consumers to opt into targeted messaging, geo-locating and other operator benefits, and all of their loyalty data is immensely valuable to the operator.”

Kiosks: Fast, Convenient and Judgment-Free

Speed and convenience are key consumer benefits and motivators for using on-premise technology due to increasingly time-pressed lifestyles. Nearly three in five consumers who use kiosks and would like to use them again do so to bypass the line (57 percent) or for a faster ordering process (55 percent). Over two-fifths of kiosk consumers say they do so because of the ability to customize their order (43 percent) and it offers better accuracy than ordering with a person (38 percent). Hoping to avoid any critical eyes, nearly one-fifth (17 percent) say they can order more food at a kiosk without feeling judged.

And while most consumers aren’t specifically looking to avoid human interaction when they use a kiosk, three in 10 (29 percent) say they are, including 34 percent of 18-34-year-olds.

Among the kiosk-averse, a notable two in five (40 percent) consumers who are not interested in using kiosks or would not use them again say they avoid using kiosks because they prefer human interaction. Despite the current buzz around cashless payments, one quarter (26 percent) of these consumers say they avoid kiosks because they prefer paying with cash. And a mere 15 percent cite sanitation concerns as the reason they avoid kiosks at restaurants.

“A notable two in five consumers who avoid using kiosks do so because they prefer human interaction. This means that while kiosks offer a clear benefit to operators and consumers alike, most operators will not simply be able to evade traditional human-centric hospitality. This is especially true of the consumers who avoid kiosks because of unfamiliarity. A human-based education component is necessary for successful kiosk adoption rates. Aside from kiosk tech, we see huge growth opportunities for operators leveraging pre-ordering options and table-side payments for sit-down meals, given how attractive these options are to younger consumers,” continued Failla.

AI Breaks Out

Finally, while AI has been present in the restaurant industry for several years, most recognizably via kiosks, it is now growing rapidly across the US with fast-food chains seeing the greatest potential. This growth is driven by younger consumers in particular: Nearly one third (32 percent) of GenZ consumers say they’d like digital ordering screens to suggest food add-ons/pairings, and three in 10 (30 percent) 18-24-year-olds want to see more personalized order suggestions based on their order history.

“There is ample room for the use of AI in restaurants to grow in the coming years. While operators are only just beginning to experiment with personalization via license plate and facial recognition technology, they will likely have the best response with geo-fencing enabled by mobile app loyalty program usage. Restaurants have begun using this technology to target specific customers and personalize the dining experience, presenting a huge opportunity for the future of personalization in the industry,” concluded Failla.

Server Challenges

Restaurant servers face any number of challenges on a daily basis, In a research report from the team at Software Advice, servers were quizzed about what they need to do to ensure their restaurant runs smoothly on any given day: their main challenges, key responsibilities and what skills are most valuable for their efficiency as servers.

Among the key findings:

Biggest challenge: Restaurant servers rank table management as their #1 challenge.

Most valuable feature: Servers say the ability to modify order requests and take customized orders is most valuable for their efficiency.

What diners get most annoyed by: Servers getting their orders wrong is the best way to leave a bad impression on your customers.

Restaurant Thievery Is Contagious

Plenty of workplace research shows that people with helpful, mentoring colleagues tend to be helpful and perform better themselves. Few researchers have looked at whether bad behavior spreads among workplace colleagues.

But now, three researchers from Olin Business School at Washington University in St. Louis have completed a study of workplace theft among restaurant workers that details, for the first time, how such stealing is contagious — and new restaurant workers are particularly susceptible.

“It is definitely worse than our data shows,” said Tat Chan, professor of marketing at Olin. Chan and his colleagues studied an extraordinary database looking at millions of restaurant transactions, but the algorithm it used took a conservative approach to flagging theft.

56 percent of servers in the database committed identifiable theft at least once.

While thieves tend to influence other workers to steal, the research team also found that peers are strategic about when to use their sticky fingers: If Bob is stealing a lot today, they’ll say, we’d better not steal — or everyone will get caught.

To reach their conclusions, researchers studied seven years’ worth of data from a restaurant point-of-sale equipment distributor, covering 1,049 locations from 34 different casual dining restaurant chains in 46 states. The database included more than 5.7 million transactions involving more than 83,000 servers.

The researchers used the data to gauge whether misconduct among workers spreads to coworkers. Their paper, “The Influence of Peers in Worker Misconduct: Evidence from Restaurant Theft,” is forthcoming in the journal Manufacturing & Service Operations Management.

“Bad apples with high levels of misconduct are even more costly than their individual behavior,” the authors wrote, because those bad apples negatively influence their peers to commit similar bad acts.

Chan collaborated with Olin’s Lamar Pierce, professor of organization and strategy, and Yijun Chen, a PhD student, along with Daniel Snow from Saïd Business School at Oxford University.

Among the findings: If new restaurant workers are exposed to stealing peers within the first five months of starting their job, they also are likely to become habitual thieves.

“One important thing we show is that people learn from peers,” Chan said. “To make sure employees do not learn stealing from their peers, it’s important to influence them in the first few months. If they don’t know what the typical conduct is, but they see their peers steal, they will follow.”

The data they reviewed relied on sophisticated algorithms to flag when a transaction likely sparked misconduct. Several schemes in the industry are notorious, including “the wagon wheel scam,” in which servers transfer an item from one customer’s bill to another who ordered the same thing. Once the first customer pays the original bill, the server reprints it without the item and pockets the difference.

Other schemes involve “comping” or refunding a meal — or voiding a transaction entirely — after the customer has paid, but before the ticket is closed.

The practices are well-known among industry insiders. Media reports have cited National Restaurant Association estimates saying theft accounts for four percent of restaurant costs. The U.S. restaurant market is projected to earn about $863 billion this year.

Digging through the data, the team’s research found that fully 56 percent of servers in the database committed identifiable theft at least once. Through computer simulations with the data, they found that doubling a single worker’s average theft amount would yield a 76 percent increase in a restaurant’s average loss to theft.

Not all restaurants rely on point-of-sale systems that flag potential incidents of theft. Additionally, those systems tend to err on the side of giving servers the autonomy to correct a customer’s bill or provide a free drink as compensation for a service issue. But the team’s research indicated that managerial oversight does reduce theft.

“It’s not just to catch stealing,” Chan said. “People will restrain their stealing behavior themselves if they know they are being monitored.”

Best Cities for Vegans and Vegetarians

With Oct. 1 being World Vegetarian Day and Nov. 1 being World Vegan Day and research showing that skipping meat can save the average person at least $750 per year, the personal-finance website WalletHub released its report on 2019’s Best Cities for Vegans & Vegetarians.

To determine the best and cheapest places for following a plant-based diet, WalletHub compared the 100 largest cities across 17 key indicators of vegan- and vegetarian-friendliness. The data set ranges from the share of restaurants serving meatless options to the cost of groceries for vegetarians to salad shops per capita.

|

Top 20 Cities for Vegans & Vegetarians |

||||

|

1 |

Portland, OR |

11 |

Scottsdale, AZ |

|

|

2 |

Los Angeles, CA |

12 |

Anaheim, CA |

|

|

3 |

Orlando, FL |

13 |

Chicago, IL |

|

|

4 |

Seattle, WA |

14 |

Madison, WI |

|

|

5 |

Austin, TX |

15 |

Milwaukee, WI |

|

|

6 |

Atlanta, GA |

16 |

Washington, DC |

|

|

7 |

New York, NY |

17 |

Las Vegas, NV |

|

|

8 |

San Francisco, CA |

18 |

Pittsburgh, PA |

|

|

9 |

San Diego, CA |

19 |

Houston, TX |

|

|

10 |

Tampa, FL |

20 |

Charlotte, NC |

|

Best vs. Worst

Scottsdale, Arizona, has the highest share of restaurants serving vegetarian options, 20.14 percent, which is 12.5 times higher than in Laredo, Texas, the city with the lowest at 1.61 percent.

Scottsdale, Arizona, has the highest share of restaurants serving vegan options, 11.16 percent, which is 26.6 times higher than in Newark, New Jersey, the city with the lowest at 0.42 percent.

San Francisco has the most community-supported agriculture programs (per square root of population), 0.0161, which is 20.1 times more than in San Antonio, the city with the fewest at 0.0008.

New York has the most salad shops (per square root of population), 0.2724, which is 27.5 times more than in Laredo, Texas, the city with the fewest at 0.0099.

To view the full report, click here.

WalletHub also released its report on 2019's Best Coffee Cities in America.

To determine the best local coffee scenes in America, WalletHub compared the 100 largest cities across 14 key indicators of a strong coffee culture. The data set ranges from coffee shops, coffee houses and cafés per capita to average price per pack of coffee.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Best vs. Worst

Houston has the lowest average price for a pack of coffee, $3.51, which is 2.3 times lower than in Honolulu, the city with the highest at $8.20.

Fremont, California, has the highest average annual spending on coffee per household, $221.21, which is 3.4 times higher than in Cleveland, the city with the lowest at $64.53.

Gilbert, Arizona, has the highest share of households that own a single-cup/pod-brewing coffee maker, 26.08 percent, which is 2.9 times higher than in Detroit, the city with the lowest at 9.11 percent.

New York has the most coffee shops, coffee houses and cafés (per square root of population), 1.2212, which is 19.3 times more than in Laredo, Texas, the city with the fewest at 0.0633.

Portland, Oregon, has the most coffee and tea manufacturers (per square root of population), 0.0207, which is 41.4 times more than in Riverside and San Bernardino, California, the cities with the fewest at 0.0005.

To view the full report, click here.

Hidden Gems

KAYAK and OpenTable reveal the top 25 hidden gem restaurants worth traveling for around the world. Spanning the globe, from Australia to Canada, Japan, Mexico, the United Arab Emirates and across Europe and the United States, these restaurants from KAYAK’s most popular cities will fulfill diners’ appetite for an authentic dining experience.

Featuring under the radar establishments and off the beaten path hotspots, the list compiles local favorites, as well as details on flight cost and when to book both your flight and your dining reservation. Additionally, KAYAK and OpenTable share how to tip and what to order, including many of the restaurants’ most well-known dishes, so food-focused travelers can confidently plan their next vacation to the cities that ranked among KAYAK’s most popular destinations over the last six months.

44 percent of Americans said they would book a flight or train or even take a road trip or bus ride just to dine at a specific restaurant.

“As travelers look for more authentic dining experiences, we teamed up with KAYAK to create a guide that helps food focused travelers find all of the best tips and recommendations in one place”, said Caroline Potter, OpenTable's Chief Dining Officer. “From where to eat and what to order to when to book and how to get there, our goal is to make dining decisions in some of the world’s most popular cities even easier.”

To help uncover how travelers and diners are approaching their foodie escapes, KAYAK and OpenTable commissioned a survey which revealed 1 in 5 Americans will plan a trip based solely on how good they expect the food to be. A separate survey, conducted on KAYAK’s behalf by YouGov, found that nearly three quarters (73 percent) of Americans would pick a local restaurant over a high end restaurant when traveling. Additional key takeaways from the survey include:

Americans will travel for a good meal. 44 percent of Americans said they would book a flight or train or even take a road trip or bus ride just to dine at a specific restaurant. Many also noted that they’d take a long detour (30 percent) or a day trip (42 percent) just to dine at a restaurant they wanted to try.

Good food is worth buckling in for. 61 percent of Americans would travel an hour or more to eat at a restaurant on their wish list.

Travelers seek local vs. familiar. Over 6 in 10 Americans (62 percent) agree they prefer to eat the local cuisine over more familiar food when on vacation.

To help the traveling foodie uncover the best hidden gem restaurants in some of KAYAK’s most popular travel destinations, OpenTable looked to diners for their top recommendations. Here’s what we found:

12th Avenue Grill – Honolulu, Hawaii

Alux Restaurante – Cancun, Mexico

Battista’s Hole in the Wall – Las Vegas, Nevada

Bistro Campagne- Chicago, Illinois

Cafe Luxembourg- New York, New York

Frances- San Francisco, California

Gilda by Belgious- Barcelona, Spain

Mamma Maria – Boston, Massachusetts

Musso & Frank Grill- Los Angeles, California

Nusr-Et Dubai- Dubai, United Arab Emirates

Omonia Taverna & Bar- Frankfurt, Germany

Osteria Savio Volpe- Vancouver, British Columbia

Paddock & Vine- Sydney, Australia

Schnitzelei Charlottenburg- Berlin, Germany

Serafina by the Water- Fort Lauderdale, Florida

Stella Cocktail Club- Dublin, Ireland

Terroni Queen – Toronto, Ontario

The Tap Room at Dubsdread- Orlando, Florida

Van Speyk- Amsterdam, The Netherlands

Westerns Laundry- London, England

Wirtshaus in der Au- Munich, Germany

開花屋 (Kaikaya by the Sea )- Tokyo, Japan

You can learn more here.

A Profitable Pie

San Francisco chain La Boulangerie launched an innovative and admirable new pizza concept, charging customers only $2.75 for an entire pizza!

While providing delicious, organic food at an affordable price is certainly commendable, the team at Plate IQ wondered, is La Boulangerie eating its own margin?

To find out, Plate IQ analyzed the market cost of making such a pizza to see if the restaurant is making any dough off the concept. They evaluated the average cost of a classic nine-inch margherita pizza with organic dough (made with flour, yeast, salt and sugar), organic tomato sauce, olive oil, mozzarella and basil.

Click here for results that might surprise you!

Football Fans Go Local

When it comes to deciding where to watch their team, Buckeyes and Cornhuskers strongly prefer to gather in locally owned bars and restaurants.

Not one national chain registers among the top 10 dining options for Ohio State and Nebraska fans in the latest study of foot traffic by Buxton, the leading provider of customer analytics.

In fact, among the 27 identified restaurant brands with at least five locations where Nebraska fans are more likely to visit than the average college football fan, 18 (66 percent) are chains with fewer than 50 outlets. Among the 51 brands they are less likely to visit, 78 percent are chains with more than 50 locations.

The allegiance to local independents is even more pronounced for Ohio State followers. Of the 22 brands they are more likely to visit than the average fan, fully 99 percent have fewer than 50 locations, while of the 78 brands they are less likely to visit, 60 percent have more than 50 locations.

This overwhelming preference for local brands is unique so far in Buxton’s analysis of ESPN’s Game of the Week matchups this season. Using its Live Mobile Insights platform, Buxton compiled the results from anonymous location data generated by mobile devices over the past two college football seasons to determine the dining, apparel shopping and hotel preferences of fans of the Big Ten universities.

Traffic at Breakfast

Despite the adage that breakfast is the most important meal of the day, it has been the toughest sell for fast food chains as most Americansmake breakfast at home. Nevertheless, the big players haven’t given up, with Wendy’s nationwide breakfast relaunch being the most recent. Placer.ai, the world’s most advanced foot traffic analytics platform, analyzed Wendy’s latest visitor data, compared it to the other big players in the field and found the following:

- Over the past year, Wendy’s has had similar traffic to Panera, but Panera has almost three times more visitors between 6 am and noon: 27.6 percent vs. 10.7 percent

- Although McDonald’s sees most of their visits in the afternoon, breakfast still makes up 25.9 percent of overall daily traffic.

Placer.ai concludes, when it comes to breakfast menus, innovation is key. With the mouthwatering temptations offered by Panera, Dunkin Donuts, and McDonald’s, Wendy’s is going to need an equally innovative breakfast menu and continue to cook up fresh new choices to keep customers coming for more.

To learn more, click here.

An Early PSL

People usually complain that Christmas comes sooner and sooner every year but now it seems Starbucks just shortened summer. Starbucks rang in the Fall season with its earliest ever launch of their beloved Pumpkin Spice Latte ever – August 27th. Although the company received significant backlash for cutting summer short, Placer.ai, the world’s most advanced foot traffic analytics platform, discovered their calendar altering efforts paid off. The weekend of the launch was August’s strongest with visits rising 19.1 percent above the baseline.

Placer.ai explored further back and found that after a consistent dip in summer traffic, the early September period after the launch marked the beginning of an upward trend in visits. Placer.ai concludes it is no coincidence that Starbucks continuously promotes Pumpkin Spice Latte weekends to make their stores a popular coffee destination.

To learn more, click here.

Top Food and Beer Pairings

After a long week at the office, there’s no better way to toast the weekend than with happy hour. And with kegs, taps and beer fridges popping up in offices everywhere, businesspeople don’t even have to leave their desks to commiserate over a beer.

ezCater knows that no happy hour is complete without food. So after your office places the beer order from sites like Drizly, don’t forget to order grub on ezCater’s platform of more than 60,000 restaurants nationwide.

To help plan the perfect office happy hour, ezCater is sharing their top food and beer pairings:

- Donuts and Coffee Beers – Step up the standard donut and coffee combo with the roasty tones of a coffee porter or stout that cut through the sweet richness of a frosted donut, wrapping up the bite in a smooth, balanced package.

- Thai Food and Saisons – Punch up the citrus notes in pad thai or papaya salad with wheat-based beers that are bright and lemony, with high levels of carbonation that feel especially refreshing after a spicy spoonful.

- Taco Bar and Mexican Lagers – Imported beers like Tecate, Modelo and Coronas have exploded in popularity, and the easy-drinking taste makes them a fit for almost every palate.

- Pulled Chicken and Porters – As temperatures cool, malty but easy-drinking, roasted-grain porters are a classic autumnal pairing with sweet barbecue sauce.

- Soft-Pretzel Bar and German Lagers – Classic German lagers like Oktoberfests, pilsners, and Kölsches are all foolproof companions for salty, bready pretzels and a selection of dipping sauces like tangy mustard and creamy beer cheese.

- Burgers and Brown Ales – Balanced and smooth, brown ales are the most versatile of food pairing beers, and their smooth caramel-and-bread malt notes complement the slight char and savory toppings of a grilled burger.

- Flatbread Pizzas and IPAs – Flatbread pies topped with seasonal vegetables and tangy tomato sauces highlights the range of earthy, spicy flavors and abundant hops of the IPA.

Gift Card Impact

Paytronix Annual Gift Card Sales Reportfinds a consistent 10 percent year-over-year growth in gift card sales for the 220 brands surveyed in this year’s report vs. the 190 brands surveyed for its 2018 reports.

The Paytronix Annual Gift Card Sales Report: 2019 includes an in-depth look into holiday gift card sales, sales by channel and service type, and anticipated redemption. The report also reveals new insights on eGift cards, such as average load to a virtual stored value card and how restaurants can anticipate their eGift card sales to look during the busy holiday season. With the online ordering industry expanding, the Report also examines the impact of gift cards redeemed online.

Significant findings include:

- Higher Online Sales – Not only are quick-service gift cards redeemed more frequently, they also contribute to higher sales in the online order channel, with a 6 percent increase in check size on orders placed and paid for online with a gift card.

- Third-Party Retail Sales — While in-store gift card sales continue to contribute to more than half of annual gift card sales, this percentage decreases slightly in favor of Third-Party sales. Discounted gift card sales, through retailers like Costco, BJ’s, and Sam’s Club amount to over a third of all third-party sales. Restaurants seeking to increase gift card sales should investigate third-party channels, given that adding just one third-party retail partner could contribute to increases of more than 25 percent.

- Holiday Gift Card Sales — Gift card sales drove a large portion of the increase in card sales from 2017 to 2018 as the popularity of gifting stored-value cards continue to grow. The average increase in card sales throughout the year was around 6.3 percent, but in the holiday months, gift card sales increased over 15 percent from 2017. Gift card sales between November 1st and December 24th pick up for the holiday season around mid-November, with the first noticeable spike of sales in 2016 – 2018 on Black Friday.

“The Paytronix Annual Gift Card Sales Report: 2019 highlights the significance of a gift card program to a brand’s overall sales,” said Michelle Tempesta, head of marketing, Paytronix Systems, Inc. “The report demonstrates that gift cards are effective sales tools across all restaurant types and that developing a multi-channel program that includes both traditional and eGift cards will result in a boost to overall restaurant sales, especially during the holiday season.”

Download the Paytronix Annual Gift Card Sales Report: 2019.

Workers of Tomorrow Want Flexibility

The Workforce Institute at Kronos Incorporated released additional findings from its global study of Generation Z1, which suggest today’s youngest employees and the workers of tomorrow are interested in the flexibility and independence of gig work, yet hesitant to join the gig economy due to lack of stability and unpredictable pay.

“Gen Z and the Gig Economy: It’s Time to Gig in or Get Out” is the second in a series of reports from The Workforce Institute and Future Workplace surveying 3,400 members of the newest generation across Australia, Belgium, Canada, China, France, Germany, India, Mexico, the Netherlands, New Zealand, the U.K., and the U.S. Part two expands on surprising contradictions uncovered in part one, “Meet Gen Z: Hopeful, Anxious, Hardworking, and Searching for Inspiration,” by examining this generation’s perceptions of the gig economy – the good and the bad – to reveal how traditional employers can best compete for Gen Z talent.

Fact or fiction? Gen Z will endanger the gig economy’s future

At first, this seems to be fiction: When asked if they would pass up a traditional job for full-time gig work, 53 percent said yes, identifying flexible work schedules (55 percent) and greater independence (i.e. being their own boss; 53 percent) as the most appealing aspects of the gig economy.

However, it ultimately appears to be fact: Less than half (46 percent) of Gen Z respondents are active contributors to the gig economy today. Only 10 percent are exclusively gig workers and 18 percent do part-time gig work, while the remaining supplement their traditional full-time job with gig work (18 percent).

Gig in or get out: When asked what they want in a career, Gen Z desires align with the benefits that only traditional work guarantees. Gen Zers would hesitate to go all-in with the gig economy because of unwillingness to give up the stability (47 percent), predictable pay (46 percent), workplace structure (26 percent), health benefits (26 percent), predictable schedules (22 percent), mentorship opportunities (17 percent), and manager support (16 percent) that a traditional job may offer.

· Gen Z’s desire for stability and how they measure success may threaten gig’s future

o Job stability is “very important” for nearly half of Gen Zers (46 percent), with nearly all (91 percent) saying it’s at least moderately important. That said, 27 percent expect to move on from their first full-time job within two years.

Gen Zers primarily measure career success by how much money they make (44 percent) and how quickly they advance (35 percent), with 1 in 3 (35 percent) expecting a promotion in six months or less.

o Nearly 2 in 5 (39 percent) want managers to give them opportunities to work independently – but 1 in 5 (20 percent) crave guidance and they expect employers to provide a clear and defined path to promotion beginning on day-one.

o The grass is always greener: Nearly half (47 percent) of those who do gig work today want a traditional job, posing an opportunity for employers – especially those challenged to fill the skills gap – to poach or share gig talent. Success will be determined by managers and their ability to meet this generation’s expectations for full-time work with demands for gig-like independence (39 percent) and schedule flexibility (28 percent).

· Adopt flexibility to motivate: 1 in 3 (33 percent) Gen Zers would never tolerate an employer that gave them zero say over their work schedule.

o Gen Z respondents in Canada (33 percent), the U.K., and the U.S. (both 31 percent) say flexibility to work when, where, and how they want is motivation to deliver their “best work.” Similarly, 1 in 4 (26 percent) Gen Zers worldwide would work harder and stay longer at a company that supports flexible schedules.

o Gen Zers feel deeply that their time is valuable: 1 in 3 would never tolerate being forced to work when they do not want to (35 percent), being told they could not use vacation days when they want to (34 percent), or being made to work back-to-back shifts (30 percent). Gen Zers in China are most adamant, with 50 percent saying they would never tolerate being forced to work when they don’t want to.

o Gen Zers count on employers to help them achieve work-life balance: Flexible hours (37 percent), paid vacation time (34 percent), paid sick time (32 percent), and paid mental-health days (31 percent) are top benefits they say would do the trick.

A New Generation of Commerce

KPMG launched a new research report that explores how tokenization is transforming the way consumers interact with each other and businesses. The findings indicate that tokenization is ushering in a new generation of commerce, and brings to light the strategic value of deploying blockchain infrastructure for the many business opportunities it offers – from creating new customer engagement opportunities to driving new revenue streams.

However, the potential is vast in those industries where consumers already express high levels of loyalty. For instance, when asked about loyalty to products/services across industries, consumers reported high levels of allegiance to restaurants/fast food/coffee shops (86 percent).

The survey offers insight into consumer awareness and attitudes towards tokenization that are useful to businesses looking to leverage the technology. Some of the key findings include:

- Gen Z is the most accepting when it comes to adopting tokenization.

- Just one-third of respondents are highly familiar with the modern-day, blockchain-based definition of tokens, however, the majority of that group (63 percent) appreciate the advantages of tokens as an easy form of payment.

- Approximately 55 percent of those familiar with blockchain-based tokens believe tokenization will enable them to make better use of loyalty reward points.

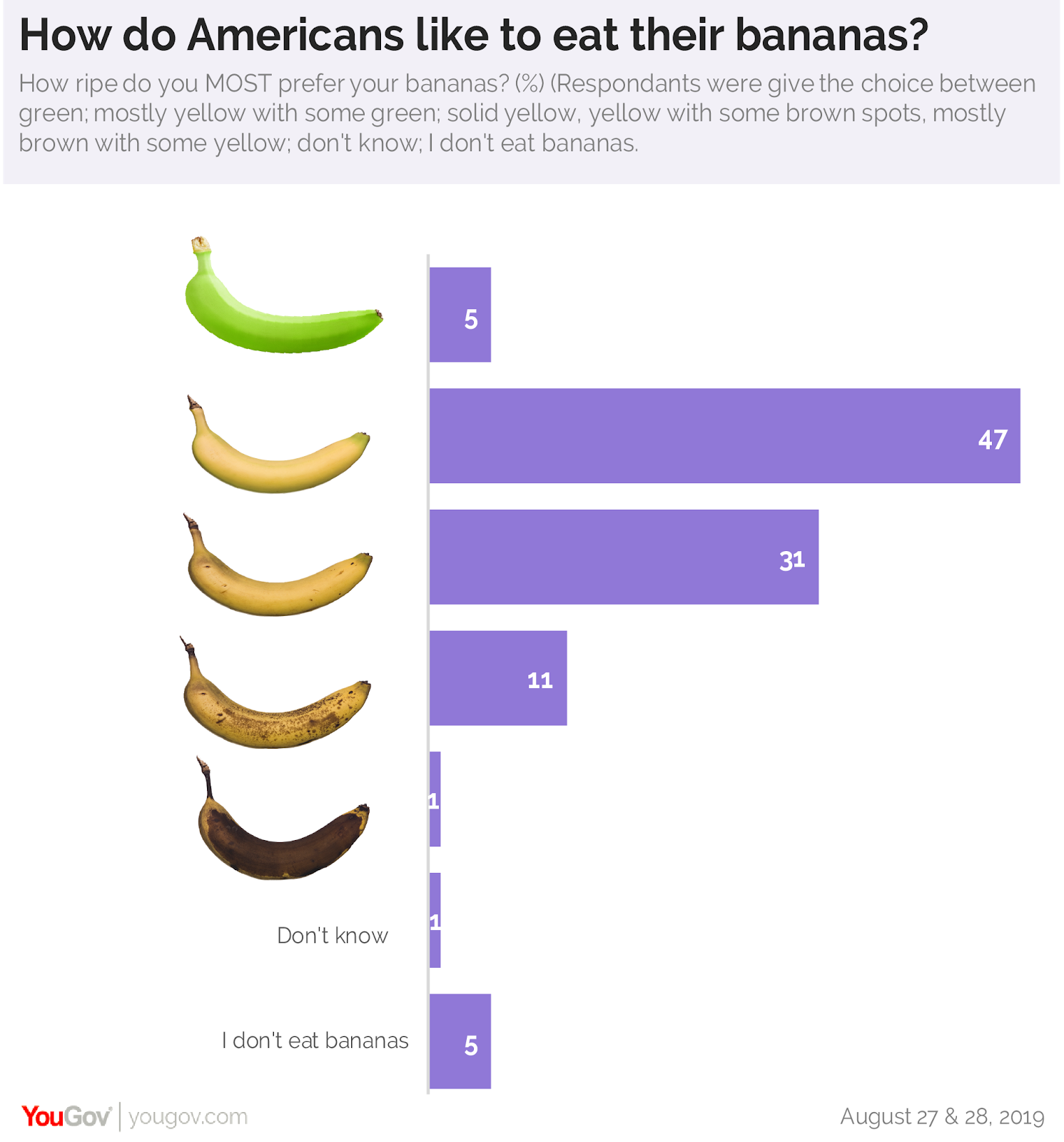

Banana Preferences

YouGov’s latest data results for a possible upcoming story? When it comes to bananas, Americans eat them as their daily fruit, in smoothies, baked goods, baby food and many others. However, how people eat their bananas meaning the ripeness is what varies.

When it comes to how they prefer to eat it:

- 47 percent prefer them yellow with a little bit of green

- 54 percent Baby boomers

- 42 percent Gen X

- 38 percent Millennials

- 31 percent like them a solid yellow

- The largest fan of this ripeness is Gen Xers (38 percent)

- 11 percent them with a dash of brown spots

- Five percent said they eat them green

- Seven percent of them were Millennials

- Five percent said they don’t eat bananas