MRM Research Roundup: End-of-October 2020 Edition

27 Min Read By MRM Staff

This edition of MRM Research Roundup features the impact of cold weather on restaurant viability, why franchises need to be nimbler and the pandemic's effect on guest expectations.

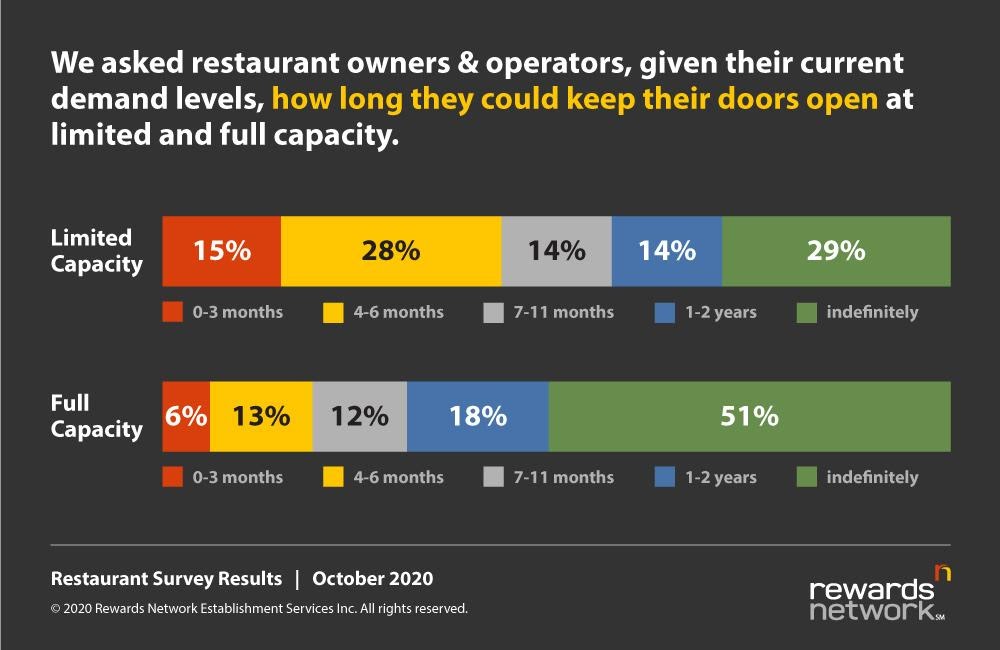

Restaurant AdaptationRewards Network released the results of a restaurant owner survey (400+ respondents) about how restaurants plan to adapt their upcoming business plans to the fall and winter months. survey found that of the restaurants who are operating at less than full capacity, only 29 percent said they could keep their doors open indefinitely. Nearly half of respondents said they would last less than a year, with 28 percent saying they would last between four and six months – enough to sustain through the winter.

Limitations and consumer demand

A vast majority of the U.S. restaurants are operating at less than 100 percent capacity in their dining rooms. For the restaurateurs who responded to our survey, only 15 percent said they were allowed to dine at full capacity, with…

Sorry, You've Reached Your Article Limit.

Register for free with our site to get unlimited articles.

Already registered? Sign in!