MRM Research Roundup: End-of-May 2020 Edition

16 Min Read By MRM Staff

This edition of Modern Restaurant Management (MRM) magazine's Research Roundup features foot traffic trends, the rise of the cautious consumer and the takeout shakeout.

Restaurant Sales Velocity

Nielsen CGA released sales data with a particular focus on the states of Texas, Florida and Georgia that have eased shelter in place restrictions. Some key insights from the Nielsen CGA RestauranTrak dataset, powered by Check-Level Insights Pool (CLIP), for the weeks ending May 9 and May 16:

- Total sales velocity (average dollar sales per the average outlet in our measurement) in Nielsen CGA U.S. measured on-premise outlets increased by +25 percent from May 9 to May 16.

- Overall velocity now stands at -54 percent vs pre-COVID norm; that number is up from -80 percent when the COVID-forced lockdown began (and is now +204 percent vs. March 28).

- The average number of transactions/purchases our measured outlets are handling has doubled since the end of March, and is now only -14 percent below the norm for outlets still operating.

- As some states see restrictions ease, we see vast improvements in velocity trends.

- In Texas this is clearly the case as velocity is now only -32 percent below the pre-COVID norm

- Velocity has grown week-over-week by +29 percent (May 9) and +21 percent (May 16) over the last two weeks.

- Florida has delivered substantial week-over-week growth over the last two weeks – velocity is up +30 percent from May 9 to May 16.

- Differing trends are occurring across the region. Tampa trends outperform state level, yet in Miami where the on-premise is still heavily restricted, velocity grew but to a much lesser extent.

- In Georgia, week-over-week growth of +22 percent and +28 percent over the last two weeks mean that velocity is now -46 percent vs the pre-COVID norm, a substantial improvement on trends at the start of lockdown.

- In New York, California and Illinois, even as the on-premise space remains closed (for in-outlet dining/drinking), sales velocity continues to improve week-over-week, as both the market and consumers continue to adapt to the new trading style.

- New York: sales velocity is +13 percent from May 9 to May 16

- California: sales velocity is +13 percent from May 9 to May 16

- Illinois: sales velocity is +24 percent from May 9 to May 16

The most updated On Premise Impact Report by Nielsen CGA, along with other special reports issued over the past several weeks, can be found here.

Black Box Key Insights

According to Financial Trends Insights from Black Box Financial Intelligence™, based on data from the week ending May 17:

- Restaurant sales change YOY continued improving during the week ending May 17.

- Average check continues increasing rapidly for limited-service brands. However, growth in average spending per guest remains negative for full-service restaurants.

- Fine dining and family dining continue to be the industry segments with the biggest declines in sales YOY. While all other segments are seeing faster improvement in their sales, fine dining has seen little improvement in their sales in the last month.

- Consumer demand is strong in states that have started reopening to dine-in. Comp sales in those states that have had their dining rooms open since the beginning of the month are doing much better than at the national level for full-service restaurants. State results will be published in next week’s snapshot.

- Comp sales in Texas, Florida and Georgia during the week for full-service industry segments were on average between 10 to 20 percentage points better than at the national level.

- As dining rooms reopen, YOY growth in off-premise sales has begun slowing down slightly for full-service brands. However, for limited-service off-premise sales continue accelerating.

- Best performing states based on industry comp sales during the week were Alabama, Mississippi, Arkansas, Oklahoma, Tennessee, Georgia and Utah.

- Worst performing states during the week were New Jersey, Washington, Massachusetts, Vermont, Hawaii, New Hampshire, West Virginia, New Mexico, Maine (and Washington DC).

According to Guest Trends Insights:

- Guest sentiment for “off-premise” restaurant offerings improved in March as restaurants began shifting their efforts toward improving to-go and delivery operations.

- However, off-premise sentiment scores fell in early May as states started to reopen dining rooms. Many guests complained of long wait times for curbside pickup orders.

- Guest sentiment trends have started to recover as of the week ending May 24, with off-premise sentiment returning to similar levels as were seen in April.

Among the Consumer Trends Insights:

- Third-party delivery (3PD) adoption continues to increase for consumers of all ages since the pandemic began. Gen-Z has had the most significant adoption rates, with over 14 percent of Gen-Z consumers using 3PD to order from a restaurant since March 15th of this year.

- While only 2.3 percent of baby boomers used 3PD in the past two months, this reflects a growth of 50 percent compared to the same months in 2019.Sense360's research on COVID-19, in case you'd like to share this with your readers.

Foot Traffic Improving

Sense360 examined total restaurant and bar foot traffic trends by channel, daypart, weekday, ethnicity, urbanicity, and state vs. national.

In terms of total traffic, trends are improving, though at a very slow pace from the low experienced on Easter Sunday.

Throughout COVID-19, breakfast and late night dayparts have suffered the most. Foot traffic is improving more during the later occasions in recent COVID-19 period.

In terms of day of week visitation, people are visiting restaurants more Thursday – Saturday, likely due to "pantry fatigue" during the week. The weekends have also been hardest hit during the COVID-19 period but are improving the most during recent weeks.

Rural-skewing DMAs have better foot traffic trends than the more densely-populated DMAs, though there is improvement across all types of DMAs. In general, rural-skewing areas have performed about 30 percent better in terms of foot traffic throughout the COVID-19 era.

Consistent with previous findings, there isn't much of a correlation between loosening restrictions and foot traffic improvement, as those states that reopened sooner were performing at better than national averages to begin with

The New Normal for Restaurants

The New Normal for Restaurants: Consumer behaviors after COVID-19 lockdown* study conducted by Simon–Kucher & Partners and Lucid surveyed more than 640 US consumers and revealed that many dining habits adopted during the COVID-19 lockdown will continue once lockdown orders are lifted, highlighting the need for agile design† within the industry. The study, which focuses on fast food and fast casual restaurants, compares pre- and post-crisis trends and topics such as delivery preferences (including 3rd party platforms) based on consumer segments, deep dives into consumer segments that value different order and pick up channels, and willingness-to-pay both in-store and for delivery.

The Rise of the Cautious Consumer

While 37 percent of consumers said they will continue to rely on home cooked meals even after the lockdown is over and restaurants begin to open back up (as opposed to 31 percent prior to COVID-19), this will be down from 55 percent during the lockdown.

Going forward, there will be a shift in how consumers evaluate where they choose to order from. Taste of food and food quality remain top drivers of which fast food and fast casual restaurants consumers visit, while in-store experiential drivers such as speed of service and atmosphere become less important. Healthy and high-quality options will become more important to consumers.

Philip Daus, Partner and head of the North American Restaurant Practice at Simon-Kucher, adds: “One key value driver that has emerged from this crisis and is now the third most influential is, unsurprisingly, a restaurant’s sanitation standards. What’s important to keep in mind is that complying with CDC standards and implementing more rigorous sanitation procedures is not enough. It is all about perceived safety in the eye of the customer, so making sanitation standards transparent and talking about them to make customers feel safe becomes imperative.”

Spending will Return, Thanks to Pent-Up Demand

Post-lockdown, willingness-to-pay will return to similar or higher levels across channels. Lockdown behaviors will even influence consumers to be increasingly willing-to-pay for delivery convenience, and even more so, for delivery directly from the restaurant itself.

“Particularly for dinner occasions, our research suggests higher willingness-to-pay, an indication that consumers are seeking moments of connection with family and friends”, explains Dave Clement, Senior Director and industry expert out of Simon-Kucher’s New York office. “While price is important, overall, consumers seem to be more deliberate as to where and how they spend their money and are willing to spend extra money for quality products and heath options.”

Convenience Is Here to Stay

Consumers plan to order more frequently from apps/websites post-lockdown – in fact, they intend to order 25 percent of meals via apps and online, as compared to 21 percent prior to the outbreak of COVID-19. The consumer segments most likely to use alternative channels for order are:

Younger consumers (<34 years old) – 34 percent app / website order intention

Urban consumers – 32 percent app / website order intention

High Household Income (>$100K) – 32 percent app / website order intention

Delivery and curbside pick-up consumption channels are the most likely to grow after stay-at-home orders are lifted. Consumers intend to receive14 percent of meals through delivery and eight percent of meals through curbside pick-up post-lockdown, as compared to 12 percent and five percent respectively, pre-COVID-19.

When it comes to delivery, 70 percent of orders go through a 3rd party platform. Usage of 3rd party delivery platforms varies by segment — Uber Eats is the most prominent platform for most consumer segments except older, non-urban, and low income consumers, who opt for DoorDash.

“There are a lot of opportunities when it comes to how brands think about their delivery pricing structures,” says Daus. “Consumers will continue to be willing to pay for convenience, and striking the right balance between delivery fees and menu price inflation is key.”

Takeout Shakeout

According to Influence Central, needing to prepare food seven days a week, three times a day, for an extended period of time has many consumers turning to someone else to help out with the cooking. Take-out and delivery from restaurants offer a welcome reprieve during stay-at-home orders around Covid-19.

Influence Central surveyed 630 consumers in May as part of our effort to understand the consumer mindset during this time.

- 69 percent of consumers have ordered take out or delivery food from restaurants during the pandemic.

- 71 percent order from restaurants they used to dine-in at prior to the crisis.

- 87 percent order take-out from a specific local restaurant out of a desire to support the restaurant financially.

- When it comes to getting food delivered, consumers’ top choice is direct from the restaurant itself (60 percent). Favorite delivery services: Door Dash, followed by GrubHub and Uber Eats. More than half said they have not been concerned to leave the house to pick up food or collect it from a delivery driver.

Top choices for restaurant types for take-out:

- Pizza (79 percent)

- Fast Food (52 percent)

- American and Pub Food (ex. Burgers and wings) (45 percent)

- Mexican (39 percent)

- Asian (35 percent)

- Italian other than Pizza (23 percent)

As consumers weary of “What’s for dinner?!” endless days in a row, many take-out restaurants have started getting creative, marketing home meal kits, such as a dinner kit from Shake Shack (each kit has eight burger patties, eight buns, eight slices of American cheese and Shake Shack's signature sauce). Chick-fil-A made a similar move, with a chicken parmesan meal kit that can be served in 30 minutes, and includes chicken fillets, marinara sauce, cheese, and creamy lemon garlic pasta. These meal kits help the restaurants move unused food inventory, while blurring the lines between fast casual take-out and grocery ready-to-cook meals. Along these lines, Denny’s has opened Denny’s Market, offering grocery staples such as meats, cheese, eggs and toilet paper for free delivery. Local restaurants have followed this same trend – using their access to great food to sell these items to their customers.

When it comes to what people most miss about dining in restaurants, they miss most:

- Not having to cook and serve the meal: 64 percent

- The social aspect of meeting friends and family: 61 percent

- Trying new dishes and foods: 44 percent

- Being able to eat a variety of different dishes: 29 percent

- Access to specialty cocktails and drinks: 22 percent

These trends are promising for brands in the restaurant and food-service industry. Marketers can appeal to the sentimental side, as people recognize there’s an owner, or person, behind their favorite restaurant. Despite having to battle with lingering safety concerns and disconcerting recommendations around re-opening, the inherent craving for that social setting will allow restaurants to regain momentum despite the current increase in home-cooking.

Do People Want to Dine Out?

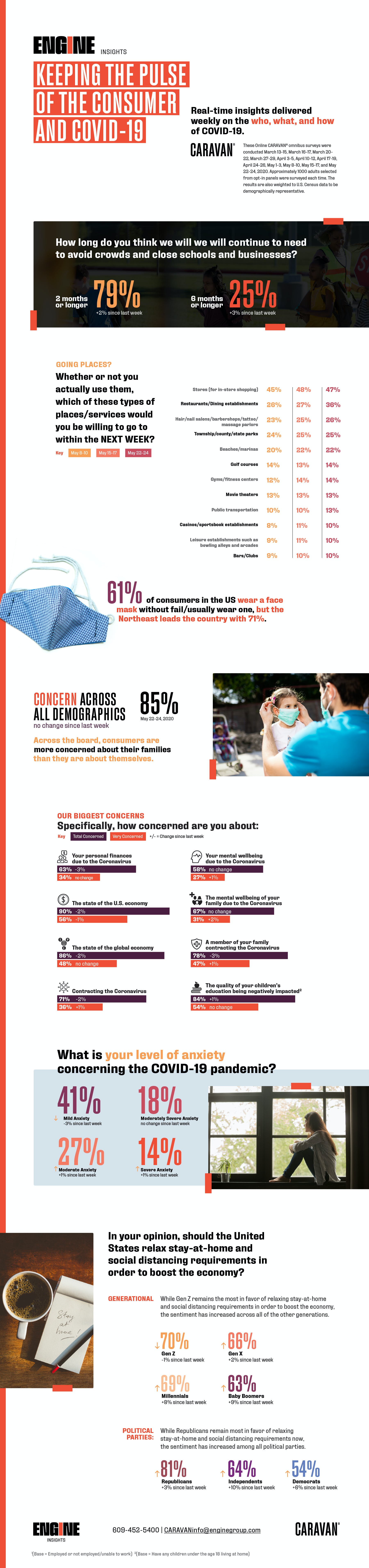

As restaurants begin to reopen and offer dine-in options, many are wondering if people are flocking to them? And more importantly, if they’re being safe about it? To answer these questions and more, Engine Insights released a study that uncovered the following:

- 42 percen of consumers would be willing to visit a restaurant within the next week, up by 16% since last week.

- They’re even more willing to shop in-store — over half (52 percent) would do so in the next week, up by 10 percent since May 22.

You can find the full study here and the infographic below with prior results.

State of Spend

Cardlytics’ first State of Spend report that highlights important shifts in US consumer spend during the pandemic across sectors, including restaurants. Cardlytics is seeing spend slowly recover in most restaurant categories, and – although Fast Food is leading the charge – even Full Service restaurants are capturing more spend as dining rooms reopen.

The report also found that delivery is keeping restaurants alive. Delivery spend increased 65 percent from mid-March to late April compared to the same time period in 2019, and this momentum isn’t slowing down. Restaurant delivery saw three straight weeks of year-over-year growth that topped 100 percent starting the week of April 16.

Social Distance and Outdoor Dining Is the Way Forward for Reopening Restaurants

As restaurants across America reopen following pandemic restrictions, a national survey conducted by 1Q on Tuesday, May 26 shows social distancing and outdoor dining are the most important features for bringing back anxious, safety-minded patrons.

The survey told a story of an America that’s deeply divided about the safety of visiting reopened restaurants. While 52 percent percent said they were “very” or “somewhat excited” about visiting reopened restaurants, 1 in 8 (13 percent) said they wouldn’t consider going at all. Additionally, another 18 percent said they were not excited about revisiting reopened restaurants and had serious concerns about safety.

This concern is reflected in a reordering of traditional dining priorities for restaurant goers. While 74 percent said delicious food was an important part of the dining experience, safety precautions (63 percent) ranked ahead of mainstays like excellent service (61 percent) and good value (53 percent).

Still, the survey showed a path forward for restaurant owners: social distancing and outdoor seating, combined with features like hand sanitizer and face masks for staff. When asked about the safety features that would help them feel safest, social distancing (60 percent) ranked first, followed by access to hand sanitizer (58 percent), outdoor seating (48 percent), and face mask and glove requirements for staff (47 percent). This endorsement of outdoor seating was supported by a separate question where 77 percent said they felt “very” or “somewhat safe” dining outdoors compared to only 44 percent who said they felt “very” or “somewhat safe” dining indoors.

Notably, these features like outdoor seating and access to hand sanitizer ranked among the lowest in safety features that would be a turn-off for those visiting reopened restaurants. Among features that would turn customers off, 8 percent said outdoor seating, 9 percent said access to hand sanitizer, 16 percent were turned off by social distancing, and 17 percent said staff wearing masks and gloves. The highest turn-offs were face mask requirements for diners (except when eating) at 30 percent and plexiglass/plastic barriers between tables at 22 percent. Still, 49 percent said they wanted as many safety features as possible.

And the one part of restaurants that created the most anxiety? Open bar areas. 51 percent said they believe they’re “very” or “somewhat unsafe.”

Finally, restaurants should expect to continue to see a surge in takeout orders as seats are slow to refill. Even after reopening, 81 percent of respondents said they plan to take out as much as they do now or more. Meanwhile, 46 percent said they planned to dine-in less than they did before the pandemic. Another 46 percent said their dine-in habits would be similar to before the pandemic, and only 8 percent said they planned to dine-in restaurants more often.

“This survey shows that reopening restaurants isn’t simply a matter of swinging open the doors,” said 1Q Founder and CEO Keith Rinzler. “Restaurants need to pay close attention to the shifting and divided mindset of their customers who are excited to patronize them again, but deeply concerned about their safety.”

Consumer Behavior Response

As states start reopening, how are consumers behaving in response?

To answer this and more, DISQO released a study this morning that assesses consumer confidence amid COVID-19, and the following was uncovered:

- The amount of people likely to book a trip has increased by 73 percent since April

- 54 percent have planned trips to places like the bank or post office, up 18 percent since early April

- 13 percent plan to dine out in the next two weeks, up by 5 percent since mid-April

- They’ve seen a 113 percent increase in reported home & garden purchases since mid-March

For the full report, click here.

Latest Impact of COVID-19

New data from Dragontail Systems that reveals only 11 percent of consumers would start going to restaurants and stop ordering for delivery – showing that the coronavirus will have a lasting impact on the restaurant industry.

With so much industry upheaval, there is a massive opportunity for restaurant chains to capitalize, but in addition to delivering a great product, transparency and trust will be key in a post-COVID world, and big business isn’t exactly on great terms with consumers right now. This survey highlights consumer expectations, and what these organizations need to do moving forward, as businesses continue to open nationwide, including:

- Nearly 70 percent respondents said that if their food was delivered and the delivery person was not using protective gear, it has deterred or would deter them from ordering from the same restaurant again.

- 70 percent of respondents said that they would be more comfortable with delivery if they were able to monitor their order’s preparation from start to finish.

- Of consumers who said they were spending more on delivery/carry out, 73 percent said they would be more inclined to order for carry out over delivery if given the option for a contactless experience.

Retail Recovery

As part of an ongoing survey, a report, the Babbage Pulse, demonstrates retail recovery will depend on how different communities have responded to the seriousness of the virus and sheltering in place. Babbage Pulse was created by Alexander Babbage, a leading national research firm. Consumers have been tracked weekly since March 20 to determine changes in consumption, attitudes and trends during the pandemic.

“Now that states are starting to open up in this fragile economy, it is critical that businesses that reopen, do so at the right time,” said Alan McKeon president and CEO of Alexander Babbage. “Retailers operating in areas that are still reluctant to end their shelter-in-place should treat their businesses and customers differently than those areas where people have been more lax regarding socializing, safe distancing, wearing masks, etc.”

“The differences can be subtle,” McKeon explained. “If you open your store/restaurant/retail center in a market where 40 percent of consumers never leave their home, you will be less successful than in the store/restaurants/retail center where 30 percent never leave home. The two markets are probably in the same state, just exhibiting different consumer behavior. The difference between the two could mean success or failure in this economy.”

The report looked at consumers across the country. It found there are areas where residents’ attitudes are significantly different toward COVID-19 than their overall state. So, while their Governors might be opening-up or extending shelter-in-place, communities across the country were at odds with their state’s protocol.

While the report shows a majority of Americans still believe that it’s too early to open up, those who are most willing to get back to shopping, dining and work were divided by party, age and race. It makes sense that those who are more worried about the virus are those who have been most impacted—older Americans, African Americans and Latinxs, as the report indicates. When the respondents were assessed by political preferences, 51 percent of Republicans were confident that people like them, who contract COVID-19, will make a full recovery. Compared to less than 32 percent of Democrats.

The majority of Republicans and Democrats agreed that improved health practices need to remain after post shelter-in-place orders; however, there were measurable differences between the two groups with Republicans less likely to think places should be constantly cleaned, social distancing should remain and they did not think employees should still be required to wear masks.

Key findings in the report included:

- Destinations should plan their re-entry strategies around Millennials and Gen X consumers while assessing how to assure boomers of their personal safety.

- Shelter in place restrictions are decided at the state level, but consumer behavior is determined by their beliefs. These vary widely by generation and political affiliation.

- Destinations should look to the composition and behavior of their trade areas in making individual re-opening decisions.

A summary of the report is available here.

Brick and Mortar Visiting by the Generations

MomentFeed released data from a new survey – “Impact of COVID-19 on National, Brick-And-Mortar Brands.” The latest round of results sheds light on how each generation is being impacted and provides clues for how brick-and-mortar brands should approach them as the economy reopens.

The survey found that 85 percent of baby boomers and 80 percent of Generation Zers plan to visit brick-and-mortar businesses the same or more than they did before COVID-19. While support from Gen Xers and millennials is slightly lower at 76 percent and 69 percent respectively, brick-and-mortar brands can still earn these buyers’ business with the right strategy. Gen Xers are likely to prefer online options for doing business, even after concern subsides, and millennials will likely be more apt to visit businesses that provide special offers and discounts.

While our survey identified several differences across generations, support for the local economy appears to transcend generations as we come out of COVID-19. All generations unanimously agreed they would put their support behind local businesses and local jobs, with only a few percentage points differentiating one generation from the next.

“There may be subtle differences in how multi-location brands market to the different generations they serve, but the premise of their campaigns should center around support for local communities,” said Nick Hedges, CEO of MomentFeed. “Proximity to nearby customers, and the convenience that brings, has always been the competitive advantage of brick-and-mortar businesses. Now is the time to put your proximity advantage to work for your brand, showcasing how local stores are connecting with the communities they serve.”

Gen Z — Engage with Fun, Entertaining Ads

Generation Z is likely to be missing out on once-in-a-lifetime events like graduations and first jobs. This generation is also likely to be feeling isolated and suffering cabin fever. Research shows fun, entertaining ads might help Gen Zers feel less isolated and create connections now that will help earn their loyalty when things open back up.

44 percent of Gen Zers are concerned about contracting COVID-19, less than all other generations.

66 percent of Gen Zers said they have greatly changed their daily routines due to COVID-19, second only after millennials.

68 percent of Gen Zers agree they are experiencing cabin fever and can’t wait to get back to their regular routines, higher than all other generations.

Millennials — Engage with Discounts and Offers

Hit by the 2008 stock market crash at the start of their careers, millennials are now experiencing their second major economic shock, many now with a mortgage and family to support. This generation was the most concerned about contracting the virus and also the most likely to say discounts and special offers will influence their decision as the economy reopens.

61 percent of millennials were highly concerned about contracting COVID-19, more than any generation.

74 percent of millennials said they have “greatly changed” their routines during COVID-19.

Millennials are also the least likely of all generations to return to brick-and-mortar businesses after concerns subside, with 69 percent saying they will visit the same or more as before COVID-19.

62 percent of millennials agree offers and discounts will influence buying decisions post-COVID-19, more than any other generation.

Gen- X – Engage by Offering Online Options

Generation X is most open to trying new ways of interacting with businesses online during COVID-19. Our survey also suggests online behavior may be lasting among this generation. To stay engaged with this generation, keep online options in place to give Gen Xers a choice of how they want to engage with you.

Gen Xers frequently ranked middle-of-the-pack for most COVID-19 concerns, behaviors, and preferences. Online behaviors being the one exception, with Gen Xers showing a clear preference for doing more online during and post-COVID-19.

Gen Xers were 19 percent more likely to say they are visiting online businesses more than they did before COVID-19 (compared to those that said they were visiting less).

Even when concern subsides, Gen Xers are 13 percent more likely to visit online businesses more than they did before COVID-19.

Baby Boomers — Engage by Showing Support for Local Economy

Baby boomers will likely lead the rebound in foot traffic back to brick-and-mortar businesses across all industries as concerns subsides. To stay engaged with this generation, it is important to know they are less interested in discounts, and more interested in supporting their local economy.

85 percent of baby boomers will visit brick-and-mortar businesses the same or more than before COVID-19, more than any other generation.

78 percent of baby boomers agree that they plan to support small businesses, followed closely by 77 percent that plan to support local jobs.

Baby boomers will put their support behind all industries, but grocery stores (90 percent*), banks (90 percent*), convenience stores (87 percent*), and retail establishments (87 percent*) will see the most support from this generation. (*percentage who say they will visit the same or more)