MRM Research Roundup: End-of-March 2020-COVID-19 Edition

12 Min Read By MRM Staff

This edition of Modern Restaurant Management (MRM) magazine's Research Roundup features foot traffic analysis due to the COVID-19 outbreak, food trends evolving due to Coronavirus and changing shopping behavior.

COVID-19 Foot Traffic Analysis

Although the restaurant market is seeing a decline in foot traffic overall, the share of visits across categories is beginning to stabilize, according to the latest briefing from Sense360. The company is conducting daily analysis to keep up to date on foot traffic patterns.

Casual dining's share of restaurant visits was in free-fall from the 15th to the 22nd, and now has reached a more stable trend. Conversely, Pizza's share of restaurant foot traffic had been increasing, and now has leveled off. This may be due to restaurants increasingly promoting take-out and drive-through, or consumers getting sick of eating food from grocery stores.

Placer.ai dove into Washington state data to see if the local impacts could reveal trends on how retail is impacted by more heightened tensions. They examined the Seattle-Tacoma International Airport, the state’s top malls, Starbucks, McDonald’s, and Costco’s foot traffic data. A link to the full report can be found here.

Among the highlights:

The Seattle-Tacoma International Airport

Visits to the airport dropped 7.1 percent year-over-year for the last week in February before seeing that number drop to 20.4 percent in the first week of March.

Malls

Visits to the Westfield Southcenter were down by 23.8 percent year-over-year, while the Kitsap Mall saw a drop of 5.1 percent.

Starbucks

In the last week of February and the first week of March, as opposed to national year-over-year increases of 1.1 percent and 2.2 percent respectively for those weeks, Washington Starbucks’ drops were 3.7 percent and 20.2 percent respectively.

McDonald’s

McDonald’s also saw declines of 0.1 percent and 2.0 percent, going against nationwide increases and showing a hastening pace of slowdown.

Costco

While Costco, one of the clear retail success stories of this period, did see year-over-year growth for the last week of February and the first week of March, it was less than the number nationally.

In Washington, those weeks drove year-over-year increases of 11.6 percent and 7.2 percent, which was far less than the nationwide increases of 13.2 percent and 18.3 percent.

As the virus spreads, there are strong indications that the local impact will be far more severe, but the same will likely be true in revers. As areas are able to flatten the curve and mitigate the impact, the return could be far more rapid.

Zenreach monitors Walk-Through™ data in thousands of businesses across the North America. In a newly released deck, it shows the steep decline of foot traffic to America’s businesses in March 2020 due to the spread of Covid19 and associated governmental “shelter in place” orders.

Among the findings:

- San Francisco was among the first cities to see a decline in foot traffic, dipping during the first two weeks of the month and 58 percent YOY.

- New York businesses saw a decline beginning as early as March 9, 2020 and now show a 61 percent YOY decline.

- Phoenix and Chicago are among the cities that experienced no dropoff until the weekend of March 14-16, 2020. Zenreach experts expect more material declines are yet to come for these markets.

- In New Orleans, revelers held on through Mardi Gras, dropping off much later and more rapidly. Traffic is now down 71 percent but was otherwise increasing until mid-March.

- Despite reports otherwise, Boston showed a decline YOY during St. Patrick’s Day weekend.

- While food and beverage had been declining steadily, retail is generally trending up. This data accounts for supermarkets and some shopping centers.

Coronavirus-Driven Food and Consumer Trends

Food consumption patterns in the U.S. have changed more quickly in the past few weeks than they have comprehensively in the past decade. What we don’t yet know is if these patterns are simply temporary adjustments or the new normal. We’ve all seen the images of empty grocery shelves. Will the hoarding mentality and fear of scarcity rewire consumer thinking to stockpile shelf-stable foods and household products for good, or is this just a blip on the radar? We don’t know yet. Some trends, however, are already starting to materialize. Here’s Apron's look at the next 90 days.

Food consumption patterns in the U.S. have changed more quickly in the past few weeks than they have comprehensively in the past decade.

Exponential Shift to Grocery Curbside Pickup & Food Delivery

With shelter-in-place orders rolling across the country and other “curve-flattening” measures becoming the norm, more consumers are choosing to stay away from the store and opt for curbside pickup or delivery from grocers and restaurants. Restaurants who didn’t offer delivery service just weeks ago have scrambled to initiate programs, some even selling booze or household essentials as part of their delivery offerings. Expect to see some grocery chains take this conversion to the next step by permanently converting designated stores into warehouses where only curbside or delivery are offered.

#2 – Food Safety Concerns Hurt Restaurants Most

How long do viruses or bacteria live on package surfaces? Consumers don’t want to have to guess. While the buzzword around packaging last year was minimization, we’re seeing a sudden shift to consumer concern about food safety and a related perception that more packaging is better. [Mintel – COVID-19 in the US: what’s happening now? – March 2020]. Going forward, consumers will expect take-out/delivery services to replace bags and boxes with technologically advanced materials that are both germ resistant and environmentally friendly.

Also, distrust of food safety practices at restaurants may make consumers wary of returning. Surface sanitization will become a selling point for those restaurants trying to attract people back, but it could be an uphill climb. In the UK, the fast food industry has ground to a halt as even drive-thrus are deemed unsafe. At home, the 83 percent of Americans who call themselves basic or intermediary cooks [Mintel], will focus on food safety in their own kitchens.

#3 – Consumers Learn to Cook All Over Again

For years, grocery store pre-packaged meals have slowly but surely taken over coveted in-store real estate. In a post-Corona era, a new generation is likely to be more motivated than ever to learn to cook for themselves. Convenience will give way to staple-based meal prep at home, accelerated by a) food safety concerns and b) realization of how much money can be saved / how much was being spent at restaurants.

Sales of shelf-stable and frozen products have already spiked – Spam is having a major moment, for example – but it doesn’t mean consumers know how to cook with those foods. Meal kit brands, whose history has been full of highs and lows, will do well with consumers who want to cook but need extra help. Blue Apron, for example, was in serious financial trouble just weeks ago but has surged as one of the best-performing stocks last week.

Because consumers will feel they’re saving much more on food, they’ll reward themselves by spending on better beer, wine and booze – and weed.

2020 Hospitality and The New Normal

Sterling-Rice Group brought together its internal cross-functional team of experts to create innovative solutions and strategies to help navigate what’s next. The report, 2020 Hospitality and The New Normal, outlines actions to take right away, as well as ways to plan for the future as the world evolves to a new reality:

Reassure and Reframe Experiences

The SRG report suggests that brands should have clear communications about new standards of service to reassure the public that ordering takeout and delivery from their favorite restaurants is safe. It’s also an important way that they can contribute to the health of the local businesses and connect with their communities.

“Communication has never been more important,” explains Amy Shipley, Managing Director and Partner. “Remind your customers that they can still order delivery and enjoy the experience. Reassure them that restaurants have always had food-safety procedures in place. Create ‘no-contact delivery’ protocols and details about what you are doing to ensure health and safety.”

Maintaining a Sense of Place

Also of great importance is the brand experience, which relies on the destination itself and the joy of dining out. In this age of social and physical distancing, brands need to find ways to show the brand experience in new ways. Enhanced mobile apps can reinforce messaging around delivery and pickup, and packaging can create those brand moments that make the dining experience so special.

The report suggests that elevating the drive through and developing new options for curbside pick-up can be inventive ways to solve for today’s environment. Jennifer Jones, Head of Brand Design and Managing Partner at SRG notes that “Brands must re-imagine their key touchpoints to inspire ways to connect with guests to bring the dine-in experience to them. Redefining the physical space can also be a way to adhere to new standards while using space and equipment effectively in a welcoming way.”’

Jeremy Kay, Director of Brand Environments for SRG, states “There’s the obvious need to get through this period of crisis using the means available to you. But we also need the foresight to think through ‘how will my business survive in the longer term?’ Restaurants need to cater to the changing customer needs, still create a sense of place, and reaffirm the brand promise, like a commitment to good food, new grab and go options, and customer safety."

Dial Up In-Home Excitement

Making virtual connections and replicating what guests crave most by curating menu items and offering meal kits for family-style dining is key to keeping consumers coming back. The report provides inspiration for restaurants to offer do-it-yourself meal kits, reassuring comfort classics, and adapting takeout menus to feature fewer, better items that meet these needs.

“Brands can reframe moments that matter and move them online or in-home to keep diners engaged,” notes Liz Seelye, Managing Director and Partner at SRG. “Restaurants can align offerings with hit shows or family activities, such as cookie kits, pizza kits and even cocktail kits or wine pairings.”

In addition to giving guests a sense of community, Brands are rallying together in an unprecedented fashion and moving from being competitors to collaborators. Movements like “saverestaurants” are encouraging brands to unite while giving consumers a way to participate in that support.

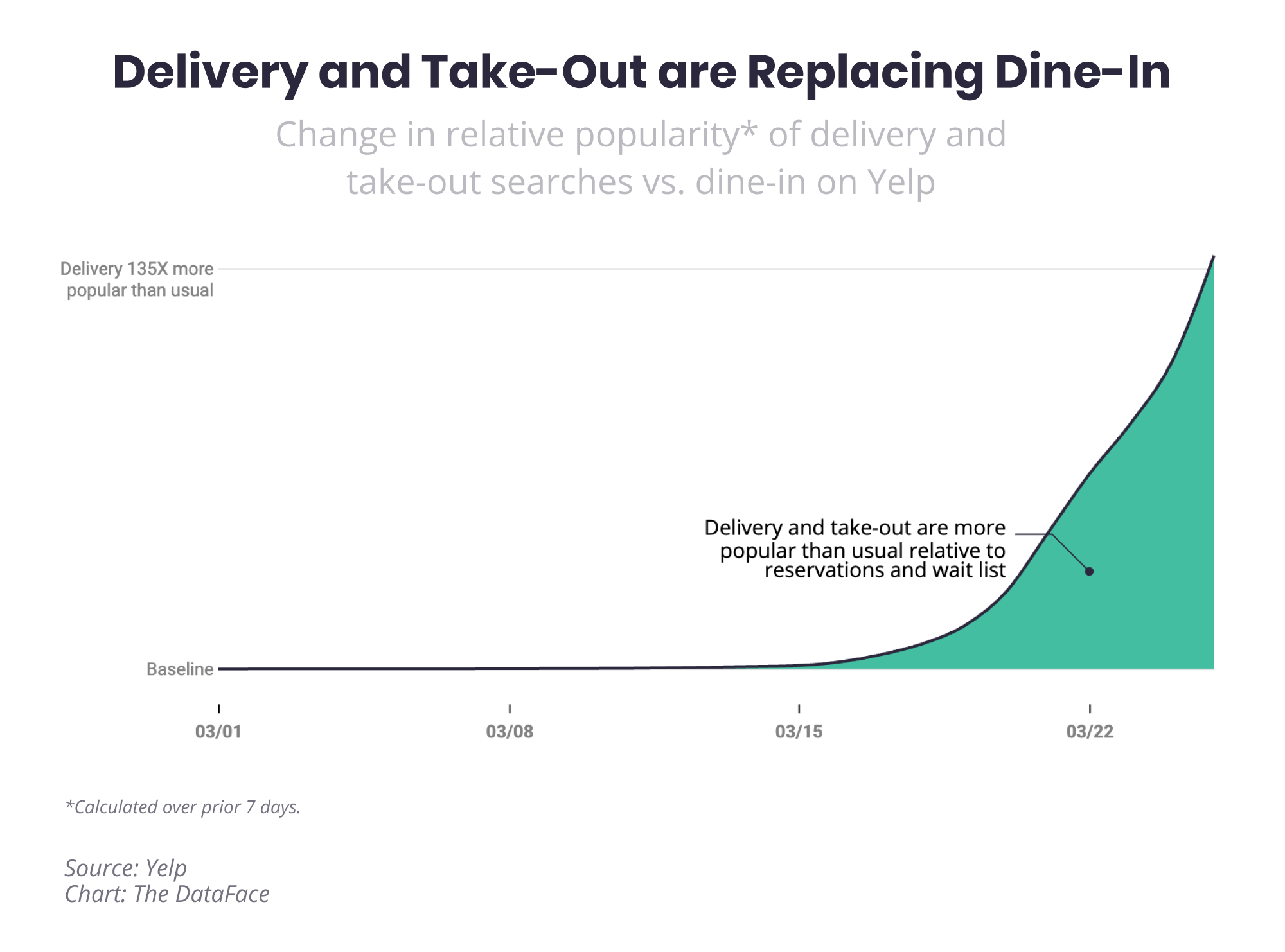

Yelp: Coronavirus Economic Impact Report

According to Yelp's Coronavirus Economic Impact Report, the desire for food with less handling has lifted community-supported agriculture, farms, water stores, meat shops, and fruits and veggies stores (up 430 percent, 149 percent, 147 percent, 139 percent, and 123 percent).

Delivery and takeout is more than 135 times popular as usual, relative to reservations and wait list, as we continue to see stay-at-home orders implemented throughout the country.

The drive to avoid as much handling of items as possible extends to retail, causing a slump in used, vintage and consignment stores and thrift stores (down 64 percent and 38 percent).

Several beauty services that can involve close contact with people or equipment that touches people have fallen, including day spas, tanning, waxing, and eyelash services (down 23 percent, 19 percent, 18 percent, and 16 percent).

People are shying away from home-improvement projects, setting back roofing services and decks & railing services (down 85 percent and 66 percent).

As we’ve seen in previous reports, exercising outdoors is gaining resulting in hunting and fishing supplies, hiking, and lakes all gaining interest (up 155 percent, 102 percent, and 93 percent). Fitness and exercise equipment have especially gained (up 409 percent).

Nationally, the states with the smallest economic shifts include the Dakotas, with only sparse case counts, and Mississippi, where the number of people who have tested positive for coronavirus is growing quickly.

Coronavirus Effect on Shopping Behaviors

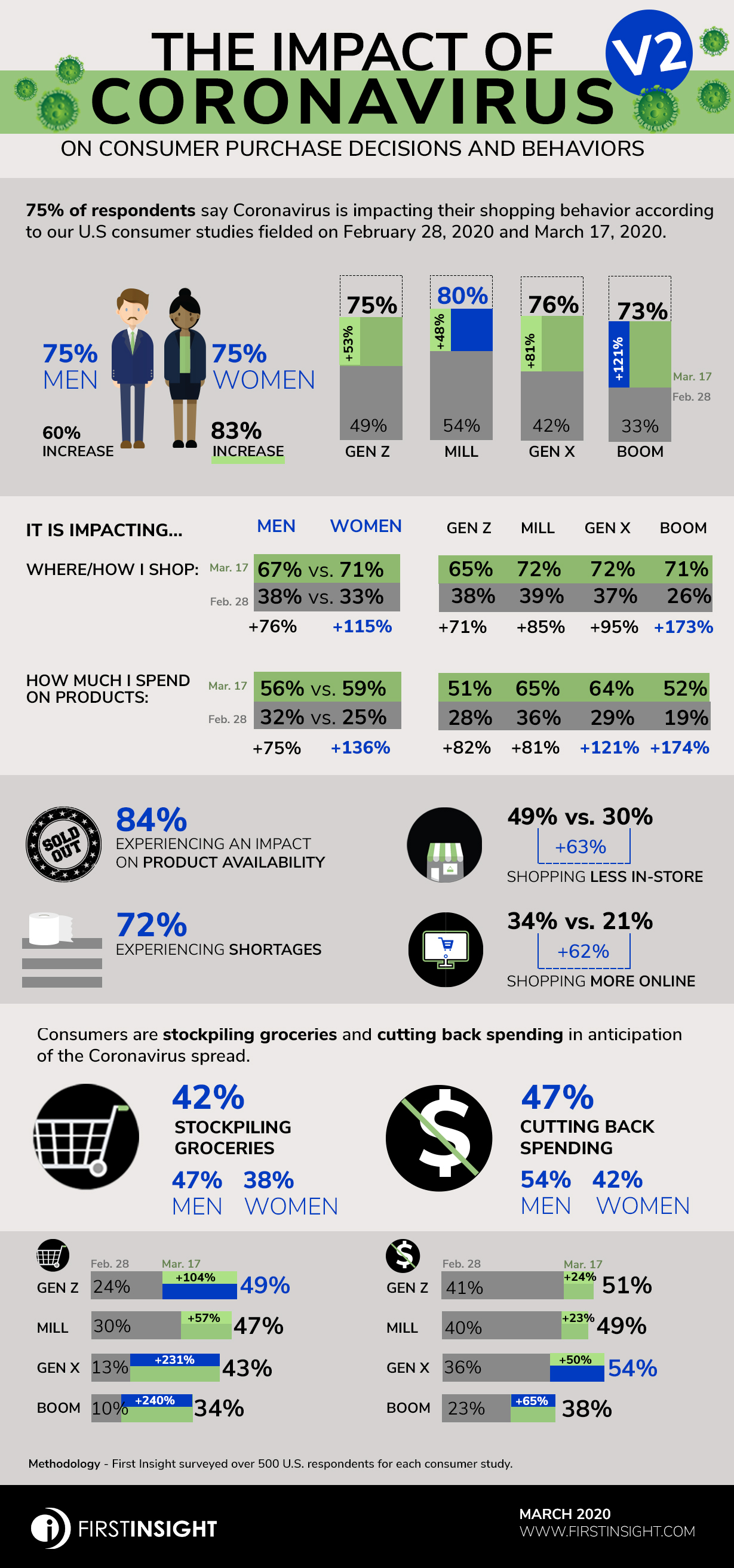

As Coronavirus spreads nationwide, a recent survey by First Insight found that news of the virus is impacting the shopping behavior of 75 percent of respondents, up from 45 percent (a 70 percent increase) when comparing to a survey fielded in late February. The survey by First Insight, Inc., also pointed to significant swings in behavior by women and Baby Boomers over the last three weeks. Both groups had been slower to change behavior based on Coronavirus fears than their gender and generational counterparts, but are now in greater alignment. For example, 71 percent of women now say that the virus is impacting where and how they shop, a 115 percent increase from late February, compared to 67 percent of men (a 76 percent increase). Similarly, while Millennials report the greatest impact on purchase decisions (80 percent, a 48 percent increase from the previous survey), Boomers have now aligned behavior more with their younger counterparts with 73 percent saying the same, a 121 percent increase from the prior survey.

“As the number of Coronavirus cases increases, the governments have reacted appropriately, with more restrictions on movement and face-to-face interaction coming every day. This certainly has affected people and their perceptions of the world around them,” said Greg Petro, CEO of First Insight. “This survey shows a significant shift in behavior as consumers adapt to their new reality, whether it’s increasing purchases of staple items, moving more shopping online, or cutting spending in some areas. The world looks very different than it did three short weeks ago, and things are likely to look different three weeks from today. Retailers, brands and manufacturers need to continue to be vigilant in providing the products customers need and want, both now and in future seasons. But, just as importantly, they need to understand what consumers want and how they feel today and into the future. That requires understanding the shifts in supply, demand, and customer preference.”

The results of the survey were announced today.

Other significant generational and gender findings include

- Women Surpass Men on Impact of Virus on Shopping Behavior: Fifty-nine percent of women surveyed said that the virus was impacting how much they spent on products, compared to 56 percent of men.

- More Men Stockpiling Groceries and Cutting Back on Spending: With 46 percent of all respondents buying more products in anticipation of Coronavirus, 47 percent of men say they are stockpiling groceries in particular, compared to only 38 percent of women.

- Boomers Show Greatest Shift in Behavior Compared to Other Generations: Immobility has had a dramatic affect over the last three weeks, with 71 percent of Baby Boomers saying it has impacted where and how they shop, up 173 percent from the last survey.

- Baby Boomers Less Inclined to Cut Back on Spending than Other Generations: While 47 percent of respondents are cutting back on spending overall, only 38 percent of Boomers say they are reducing their spend in preparation for greater Coronavirus spread.

- Baby Boomers Show Greatest Increase in Those Stockpiling Groceries: Similar to men, Baby Boomers are the generation showing the greatest increase over the last three weeks, with 34 percent now saying they are stocking up versus only 10 percent last survey, a 240 percent increase.

Women Surpass Men on Impact of Virus on How Much they Spend

Fifty-nine percent of women surveyed (and 57 percent overall) said that the virus was impacting how much they spent on products, compared to 56 percent of men. This represents a significant shift in behavior since the last survey, when 32 percent of men and only 25 percent of women felt the same. Similarly, while an equal number of both men and women felt it was affecting the products they purchase, this was a 136 percent increase for women, compared to a 75 percent increase for men.

More Men Stockpiling Groceries and Cutting Back on Spending

Forty-seven percent of men say they are stockpiling groceries compared to only 38 percent of women. This is a 114 percent and 111 percent increase over last time, respectively. Men also show greater shifts toward cutting spending, as reported by 54 percent of men versus only 42 percent of women who took the survey. This is a 54 percent versus 24 percent increase respectively compared to the last survey.

Boomers Show Greatest Shift in Behavior Compared to Other Generations

Seventy-four percent of Baby Boomers (and 71 percent of respondents overall) report the Coronavirus impacting how often they go out in public, a 164 percent increase from the last survey. This immobility has had a dramatic affect over the last three weeks, with 71 percent of Baby Boomers saying it has impacted where and how they shop, up 173% from the last survey. Other generations including Generation Z (65 percent), Millennials (72 percent) and Generation X (72 percent) show similar impact, but a much less dramatic increase from the last survey.

Baby Boomers have also shifted their shopping to online significantly over the last few weeks. While overall 34 percent of respondents are shopping more online, more Generation Z (37 percent), Millennials (42 percent), and Generation X (35 percent) have increased their shopping online compared to Baby Boomers (23 percent). Only 8 percent of Baby Boomers reported shifting to online in the first survey; the growth to 34 percent represents a 187 percent increase.

Similarly, while 49 percent of overall respondents are shopping less frequently in-store, Baby Boomers show the greatest percentage increase for shopping less frequently in-store (48 percent), bringing this generation on par with younger generations including Millennials (50 percent) and Gen Z (51 percent). The number of Baby Boomers shopping less in-store increased 118 percent over the last three weeks, a significantly larger jump than other generations.

So Far, Baby Boomers Less Inclined to Cut Back on Spending than Other Generations

Fewer Baby Boomers are cutting back on spending compared to other generations, even since the time of the last survey. Only 38 percent of Boomers say they are reducing their spend in preparation for greater Coronavirus spread, compared to 54 percent of Generation X, 49 percent of Millennials and 51 percent of Generation Z.

Baby Boomers Show Greatest Increase in Those Stockpiling Groceries

While 42 percent of respondents overall admit to stocking up on groceries, more Millennials (47 percent) and Gen Z (49 percent) are doing so than other generations. That said, Baby Boomers have shown the greatest increase over the last three weeks, with 34 percent now saying they are stocking up versus only 10 percent last survey (240 percent increase).

Similarly, Baby Boomers show the greatest percentage increase in the outbreak’s impact on spending on products as well as services. More than half of Baby Boomers (52 percent, compared to 66 percent overall) reported an impact on how much they are spending on products (a 174 percent increase over last time). While Generation Z (51 percent), Millennials (65 percent) and Generation X (64 percent) said the same, Baby Boomers showed the greatest shift overall. However, when considering impact on services such as restaurants, entertainment and travel (64 percent overall reported an impact), Baby Boomers showed the greatest percentage increase with 64 percent (a 112 percent increase) versus 62 percent of Generation Z (100 percent increase), 65 percent of Millennials (48 percent increase), and 70 percent of Generation X (53 percent increase).

Product Availability and Shortages Driving People to Shop Online

According to the survey, the vast majority of respondents reported an impact on not only product availability (84 percent) but shortages (72 percent) and a growing number of consumers are shopping more frequently online, with a 62 percent increase (34 percent versus 21 percent). Similarly, the number of consumers shopping less frequently in-store showed a 63 percent increase (49 percent versus 30 percent).

Nearly All Respondents Feel Coronavirus Will Impact Global Economy

Ninety-eight percent of respondents feel that the Coronavirus will impact the global economy, up slightly from 93 percent at the time of the previous survey. Responses were split near equally across gender and generation. Further, 71 percent of respondents said they were “worried about the Coronavirus,”up from 66 percent at the time of the previous survey. Worth noting, Baby Boomers are now the most worried generation at 81 percent, up from 72 percent last time, with 68 percent of Generation X, 72 percent of Millennials and 64 percent of Generation Z saying the same.