MRM Research Roundup: End-of-August 2020 Edition

15 Min Read By MRM Staff

This edition of Modern Restaurant Management (MRM) magazine's Research Roundup features a Restaurant Reckoning, what customers expect from delivery and a wine awakening.

Restaurant Reckoning: Dynamic Diner

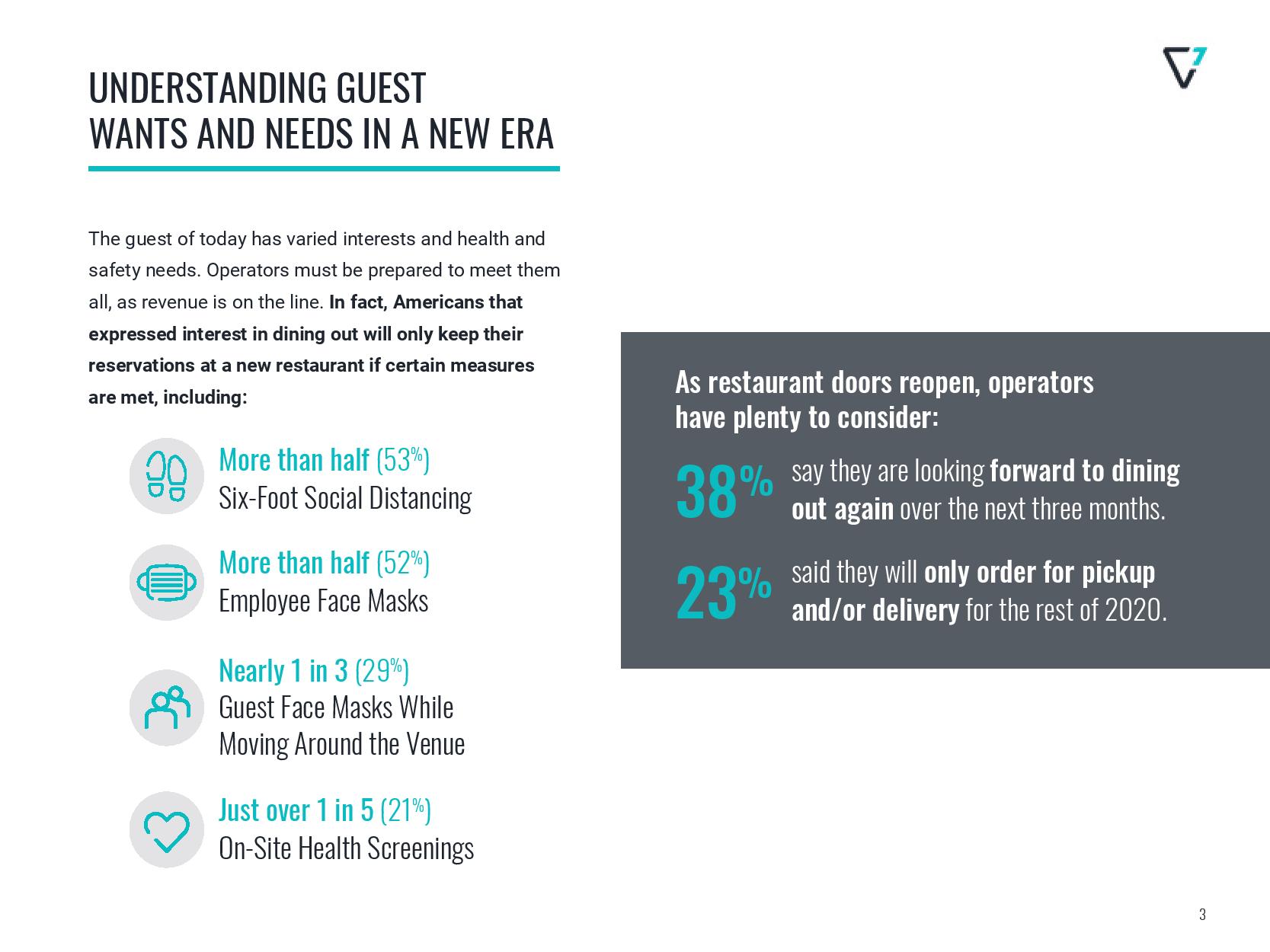

SevenRooms released its “Restaurant Reckoning: Dynamic Diner” report, which uncovered new diner personas to help operators understand what motivates guests to dine out in this new era of hospitality. According to the data, more than one in three Americans (38 percent) said they are looking forward to dining out again over the next three months. However, among those interested in dining out, needs for health, safety and extraordinary personalized experiences vary greatly, which SevenRooms has categorized into four diner personas.

The study, conducted with third-party research firm YouGov, examined Americans’ preferences around dining experiences and revealed four diner personas based on varying characteristics, including the Pick-up Patron, Safety-Savvy Consumer, Tech-Conscious Contactless Diner, and Carefree Guest.

New guest expectations are incredibly crucial for operators to consider, as Americans interested in dining out will only keep their reservations at a new restaurant if certain measures are met, including:

- More than half want six-foot social distancing and employees wearing face masks enforced (53 percent and 52 percent, respectively)

- Nearly one in three (29 percent) want restaurants to enforce all guests wear face masks when moving around the venue or between courses

- Just over one in five (21 percent) want restaurants to perform on-site health screenings

Diner Dynamics

As restaurants continue to tackle challenges sparked by the Coronavirus pandemic, operators must not only ensure their venue(s) are following health and safety guidelines to keep guests comfortable, but also deliver exceptional experiences that result in long-term guest loyalty. The four diner personas identified by SevenRooms data include:

The Pick-Up Patron: Not all Americans are ready to venture back out to restaurant dining rooms. More than one in four (27 percent) stated they will not feel comfortable dining out until there is a vaccine, with nearly one in four (23 percent) saying they will only order for pickup and/or delivery for the rest of 2020. More specifically, up to half of Americans are interested in take-out dining, with 51 percent saying they are comfortable ordering for pick-up and over four in 10 (43 percent) saying they are comfortable ordering for delivery.

The Safety-Savvy Consumer: Now, more than ever before, guests have expressed concerns around their physical health when choosing where to dine out, meaning that restaurant layouts and safety features are crucial. In fact, more than one in five (22 percent) say a restaurant providing a detailed outline of health and safety protocols would make them more likely to visit or return. The most important safety measures include:

- More than one-third of Americans (37 percent) want physical barriers between tables

- One in three Americans (33 percent) want personal table hand sanitizer

- Nearly one in four (24 percent) want their food covered as it is served to them

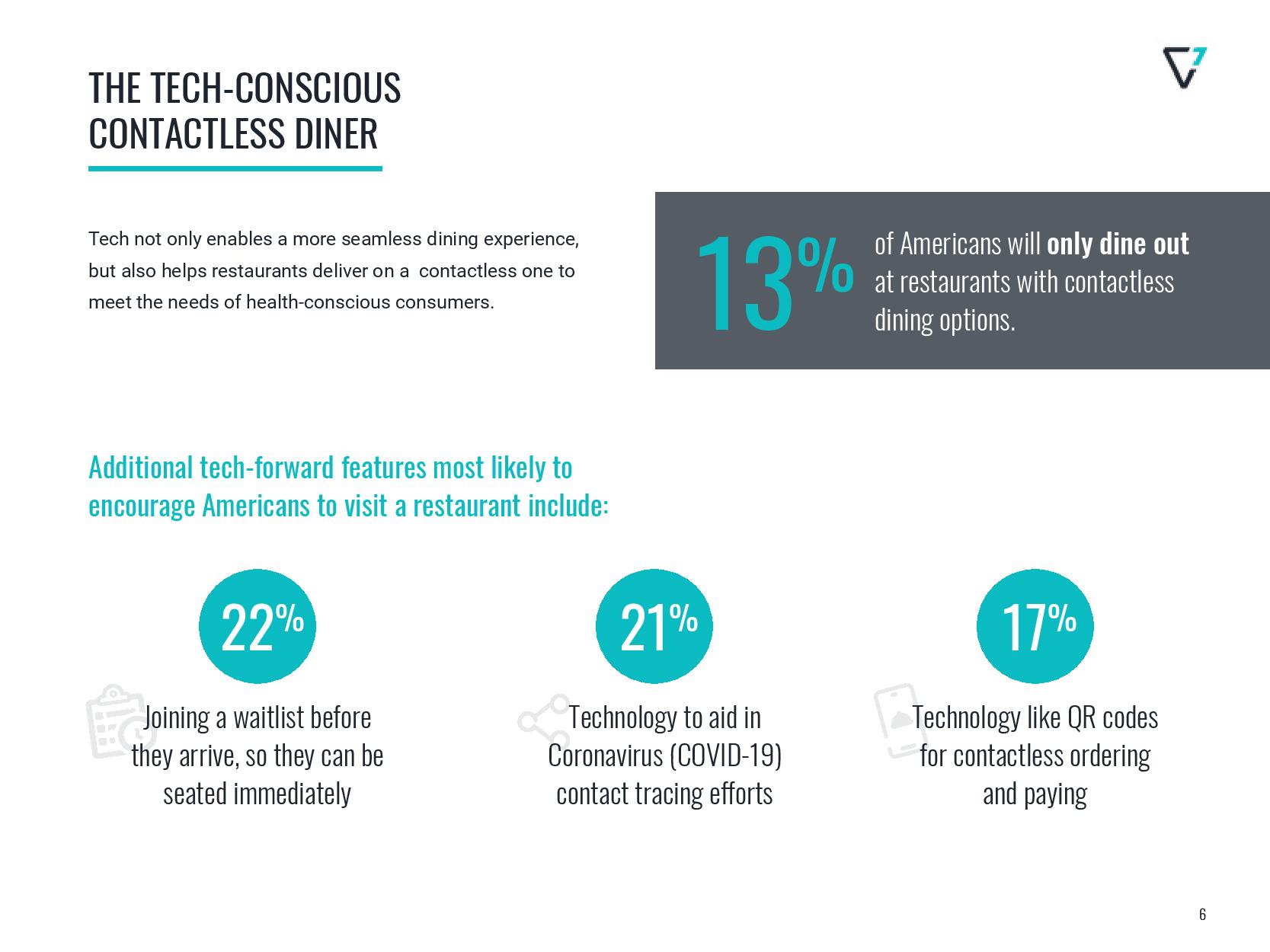

The Tech-Conscious Contactless Diner: In today’s new era of hospitality, technology can not only enable a more seamless experience but also help restaurants deliver contactless experiences. In fact, nearly 1 in 7 Americans (13 percent) will only dine out at restaurants with contactless dining solutions. Features most likely to encourage Americans to visit a restaurant include:

- More than one in five (22 percent) want virtual waitlists (e.g. join a waitlist before they arrive so they can be seated immediately)

- More than one in five (21 percent) want restaurant operators to employ contact tracing technology

- More than one in six Americans (17 percent) want QR codes for ordering and paying

The Carefree Guest: While many Americans have shifted their dining preferences, there are still many individuals that are eager to dine and drink out with less strict restrictions. For those interested in dining out:

- Nearly one in three (29 percent) are comfortable dining at venues that have indoor seating, compared to the 42 percent that are comfortable with outdoor seating

- One in four (25 percent) are comfortable dining at restaurants they have never been to before, compared to the 37 percent that are comfortable dining at restaurants they are familiar with and have been to before

- More than one in seven (15 percent) are comfortable visiting other venues, like bars

Leveraging Data to Build Loyalty

As operators look to deliver a dining experience that appeals to guests, taking care and attention to their tech preferences and health and safety requirements, one of the best ways to build strong guest relationships is by utilizing data to personalize dining experiences – whether for take-out or dine in. SevenRooms research found that diners who are comfortable sharing their data with restaurants are happy to do so for certain things, including:

Data for a Deal

- One in two (50 percent) of these diners would share data to receive discounted offers or promotions

- Nearly half of these diners (48 percent) would share data to receive delivery or pick-up promotions or offers

Data for Health

- Nearly one in two (45 percent) would share data for contact tracing efforts (e.g. being notified of potential COVID-19 exposure after a visit)

- Nearly one in three (29 percent) would share data for personalized communication and updates around COVID-19 precautions and processes at the restaurant

Data for Personalized Dining

- Nearly one in four (24 percent) would share data for a more personalized dining experience (i.e. menu tailored to dietary preferences)

“The hospitality industry has been one of the most severely affected industries throughout the pandemic, with operators having to implement a new playbook overnight for how they can stay in business for the long term,” said Joel Montaniel, CEO & Co-Founder at SevenRooms. “As local economies across the country continue to reopen, restaurant operators are navigating the right balance between safety and traditional models for hospitality. Our research has made one thing clear: operators need to be flexible. Whether it’s in regard to outdoor dining, virtual waitlists or contactless order and pay – every guest has different needs. While the four profiles we have identified in this research are not mutually exclusive to each other, they are outlined to provide operators with the knowledge they need to not only remain profitable but deliver experiences that are truly exceptional to all guests.”

The full report is available at sevenrooms.com.

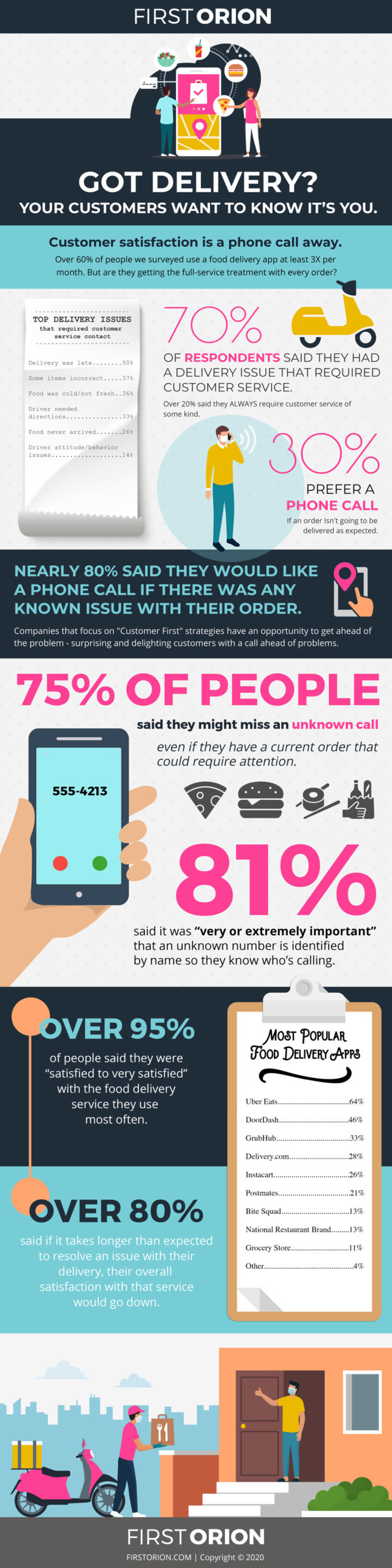

Customers Don't Like Late Delivery

On-demand food delivery services have a customer support problem, according to a new study released by First Orion. Half of the 2,000 survey respondents said the top reason for needing to connect with the delivery service’s customer support team was the late delivery of their food order. However, 62 percent had missed a call about issues with their delivery because they didn’t recognize the phone number calling, leading to dissatisfaction (more than 80 percent), not to mention hungry customers. An infographic illustrating the findings of the study of 2,000 U.S. consumers titled “Got Delivery? Your Customers Want to Know It’s You” can be found here.

There’s been a recent surge in the use of popular on-demand food delivery platforms like GrubHub, Uber Eats, and DoorDash (First Orion’s study found 92 percent usage of these services), yet despite the convenience of mobile app ordering and contactless delivery, problems still occur. When they do, more than 80 percent of survey respondents said they want to receive a phone call and 93 percent expect problems to be resolved in less than 10 minutes. When asked how important it is to be able to identify an unknown phone number by the business name, 81 percent said very or extremely – otherwise, they simply won’t answer.

“It’s clear from our research that food delivery has a ways to go before improving answer rates and customer satisfaction. Right now, too many customers are hangry when there is a potential issue with their order,” said Viki Zabala, chief marketing and product officer at First Orion. “Consumers are willing to answer the phone when they see a brand’s logo or name, driving greater engagement, loyalty and a positive experience overall. We have seen this firsthand with another on-demand service. In just nine months after adopting First Orion ENGAGE, they saw a 92 percent answer rate, which dramatically increased their customer satisfaction and experience. It meant that drivers were no longer waiting outside for 10-15 minutes and customers were not wondering where they were, but instead at the ring of their phone, it notified the customer they had arrived.”

While late delivery accounted for 50 percent of the top reasons people needed to connect with the food delivery service, these were the other most common problems:

- Incorrect order (37 percent)

- Food was cold / not fresh (36 percent)

- Driver needed directions (33 percent)

- Food never arrived (26 percent)

- Delivery driver attitude/behavior issue (14 percent)

Download the full research report here.

Delivery Spending Up

Despite more restaurants opening their doors to dine-in patrons, delivery spend was up +174.5 percent year-over-year (YOY) the week of 8/6 – the highest increase so far in 2020 that broke records for the third straight week. This is according to Cardlytics, which (as you know) sees half of U.S. card swipes.

Cardlytics’ Seventh State of Spend Report found that on-premise restaurant spend is unsurprisingly down compared to last year, but that the week of August 6 in-store fast food spend wasn’t meaningfully less than it was in 2019, down just -0.2 percent YOY for the first time since March. This milestone indicates that more consumers are becoming comfortable dining at restaurants as states reopen. Full service and quick service restaurants have struggled more to bounce back, down -30.4 percent and -8.6 percent YOY the week of August 6 respectively, but they’re seeing positive growth after facing setbacks in July.

Weekly Traffic and Sales

RMS has posted its weekly traffic and sales figures – with promising news.

For the week ending August 9, traffic improved to the best level since mid-March, trending at negative 10 to 15 percent YOY. In other changes: the chicken category may have finally laid an egg – perhaps the new spicy McNugget will get demand rising again. Also, restaurant traffic on the New England coast beat out other regions in the US for the first time, and dinner is now consistently outperforming all other day parts. More below.

For QSR:

Performance has remained at the same level for the past four weeks. Traffic is between negative 10 to 15 percent YOY, while sales are still flat to 5 percent YOY.

Drive-thru continues to out-perform other channels. Traffic is up 15 to 20 percent YOY and sales are up 35 to 40 percent YOY.

Dine-in YOY traffic and sales remain low, down 65 and 70 percent YOY.

Sense360 also reported that the number of consumers expecting to increase their use of drive-thru or pick-up at a fast food restaurant increased by 2 ppt this week.

For TSR:

TSR traffic and sales are trending at negative 30 to 35 percent YOY.

Delivery and ‘to go’ meals maintained steady growth. Traffic and sales are both up close to 100 percent YOY.

Dine in traffic and sales saw another slight improvement this week, trending at negative 50 and 55 percent YOY.

By Daypart:

Dinner began outperforming lunch in the middle of June and continues to do so in July and August. YOY traffic is slowly and consistently improving after a dip in late July — down just 5 percent YOY compared to declines of 10 percent back in June. Sales are up 10 percent YOY.

Lunch YOY traffic also improved slightly from negative 10 percent in June to negative 8 percent in August. Lunch sales are growing now at 5-8 percent YOY, in line with July trends,

Breakfast YOY traffic and sales trends improved slightly compared to July; traffic is down 18 percent YOY and sales are at negative 5 percent YOY.

Late night continues to lag other dayparts but is showing improvement. Traffic for the segment improved about 5ppt from a low in late July and is down 18 percent YOY. Sales are down 5-10 percent YOY.

By Food Category

Chicken may have laid an egg. While it still leads all other categories (breakfast, burger, ethnic and other), sales this week were positive 18 to 22 percent YOY, down significantly from the peak in mid-May of +35 percent YOY. Traffic for chicken concepts is flat to negative 5 percent YOY, about the same as it has been since the trough of mid-April.

Regional/Category

New England outperformed other regions this week. Traffic for the region is negative 5 to 10 percent YOY and sales are positive 5 to 10 percent YOY.

Pacific, South Atlantic, Middle Atlantic and West South Central were the worst performing divisions, with traffic down between 5 to 10 percent YOY and YOY sales trending between positive 5 percent and negative 5 percent.

Chicken Wars Reboot?

Although the 2019 version of the Chicken Wars was exciting, get ready for the battle royale! Foot traffic analytics firm, Placer.ai, believes the combination of new competitors and a rising giant in the sector could make for a Chicken Wars reboot where the sequel is better than the original!

A link to the full report can be found here.

Report highlights include:

Popeyes pops and then falls: Looking at the first seven months of 2020, Popeyes saw a 23.4 percent increase in visits compared to the first seven months of 2019, all this at the height of a global pandemic. Yet, Popeyes’ visits have been returning to more “normal” levels with July 2020 visits up only 7.8 percent compared to an increase of 23.1 percent year-over-year in May.

Don’t put all your eggs in one basket: Over the last few weeks, as Popeyes trends down, KFC, Checkers and Rally’s have been holding relatively steady. Chick-fil-A, the sector’s giant, saw nearly three times the number of overall visits as Popeyes, and dramatically more than either Checkers or Rally’s. So, as Popeyes’ luster has begun to fade, Chick-fil-A is rising again. Stay tuned!

Top Authentic Chinese Food

When it comes to what Chinese food enthusiasts' order the most, chowbus, the delivery app that specializes in Asian cuisine, might be one of the delivery platforms that have more comprehensive data. The company that just completed the $300 million series A funding analyzed the ordering data from over 3,000 participating restaurants in more than 20 cities since March 19, and below are some interesting findings.

1. Milk tea is almost every top city's favorite drink.

2. Users love getting hot pot delivered on chowbus, and spicy food is on almost every top city's favorite list.

3. The most popular dessert is crepe cake for Chinese food lovers.

4. Chicken wings are just as popular on chowbus as on other delivery apps.

5. As for comfort food, while tacos and pizzas are the most popular on other platforms, beef noodle soup and pork over rice are the top choices on chowbus.

Click here for the complete list.

Consumer Confidence

As consumers continue to adjust to the current landscape, how are their behaviors and attitudes shifting? To answer this and more, DISQO released a study that dives into how consumer behavior and confidence have changed since COVID-19 began in March.

One of the key findings include: From March 23rd to August 10th, reported dining activity increased by 150 percent — while plans to dine at a restaurant soon increased by 300 percent.

You can find the report here.

Pandemic Impact on Craft Distillers

A new study of fresh data on the crushing impact of the COVID-19 pandemic on craft distillers reveals that 41 percent of their sales evaporated—worth more than $700 million—and 31 percent of their employees have been furloughed. A significant portion of these losses was attributed to the shutdown of on-site sales from tasting rooms and other on-premise sales.

The study, conducted by the Distilled Spirits Council of the United States (DISCUS), was based on data from a June 2020 survey by the American Distilling Institute, a trade association for craft distillers.

“This study draws two important conclusions regarding the growth and future viability of the craft distilling industry,” said Chris Swonger, president and CEO of the Distilled Spirits Council of the United States. “The analysis underscores the importance of craft distilleries as economic drivers in their communities that create jobs and support local farmers and tradesmen. It also makes clear the extreme challenges these small businesses are facing and the need for Congress to immediately act to help these cherished distilleries recover.”

The study was conducted to analyze the size of the craft distilling market and determine what impact COVID-19 restrictions have had on craft distillers in the United States in terms of sales and jobs. The survey includes feedback from nearly 300 distilleries across all 50 states and the District of Columbia.

Key Findings on Impact of COVID-19 Restrictions on Craft Distillers:

- Due to lost tasting room sales and lost wholesale sales, craft distillers are projected to lose $700 million in annualized sales, representing a loss of 41 percent of total craft business.

- The craft distilling industry has been forced to furlough 4,600 employees – almost 31 percent of all employees.

- Craft distillers rely heavily on sales through on-site tasting rooms, which have been hit hard by the pandemic.

- In 2019 an estimated $919 million of craft distiller revenues came from on-site sales; more than 40 percent of craft distillers derive more than 50 percent of their business from tasting rooms sales.

- Approximately 40 percent of craft distillers reported that their on-site sales were down 25 percent or more; more than 15 percent said that their tasting rooms were completely shut down.

- More than 40 percent of craft distillers report that their wholesale business is down 25 percent or more; 11 percent said they have lost all of their wholesale business.

Key Findings on Size of the Craft Distilling Market:

- Craft distilling is a $1.8 billion industry, generating approximately $3.2 billion in retail sales in 2019.

- There are more than 2,000 craft distilleries operating in the U.S. that collectively generate more than 15,000 direct jobs.

- Craft distillers are small businesses within the hospitality industry.

- 45 percent of craft distillers operate in just one state; only 12 percent of craft distillers operate in more than 10 states.

- 70 percent employ 10 or fewer employees; 55 percent employ one to five workers.

- Approximately 60 percent sell less than 2,500 cases per year.

“Craft distillers are a special community of men and women who entered this industry with a passion for spirits and a dream to build a craft distillery in their local town,” said Erik Owens, president of the American Distilling Institute, which represents more than 600 independently owned craft distillers. “For many, these dreams have been shattered in the blink of an eye. These small businesses are going to need the continued support from federal and state legislators to weather this unpredictable storm.”

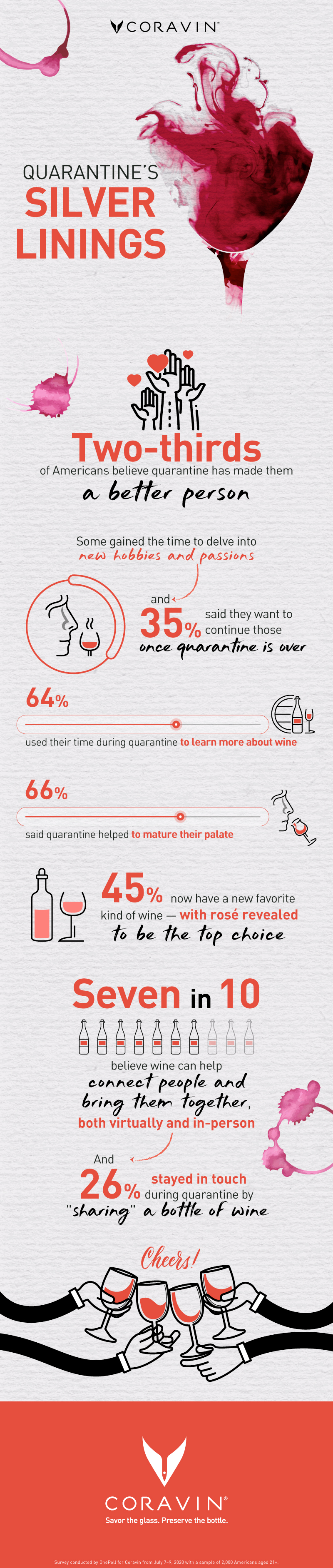

A Wine Awakening

Two-thirds of Americans said quarantine has made them a better person, according to new research.

The survey of 2,000 Americans (aged 21+) looked at the positives changes to come from this challenging time — and the ways in which respondents are re-prioritizing what they value.

Results revealed 55 percent of respondents were even a bit embarrassed by some of the things they valued or favored pre-quarantine, and this time spent inside gave 70 percent a chance to learn more about themselves.

Commissioned by Coravin and conducted by OnePoll, the survey found quarantine has, understandably, changed Americans’ outlook on life.

Some respondents gained the time and flexibility to delve into new hobbies and discover new passions, and 35 percent said they want to continue those hobbies once quarantine is over.

“What once brought people together spontaneously must now be more planned out and orchestrated. Shared passions, such as enjoying a bottle of wine, are perfect ways to come together and create shared experiences virtually,” said Greg Lambrecht, Coravin Founder.

Coravin CEO Chris Ladd adds, “Quarantine has given us unprecedented time to explore and try new things both personally and with our loved ones. It’s forced us to be creative in how we remain connected when we are physically distant. And it’s created an environment where virtual events like wine tastings have flourished, introducing a broader audience to experiences they might not have had in person. We expect these new approaches to last well after ‘normal’ returns.”

Sixty-four percent of respondents used their time during quarantine to learn more about wine, and 66 percent of respondents said quarantine helped to mature their palate.

Wine lovers, new and old, also used the time to experiment with using wine in their cooking (39 percent) and to learn more about different types of wine (37 percent).

And learning more about wine paid off, as 45 percent now have a new favorite kind of varietal. Results revealed respondents’ favorite wine pre-quarantine was pinot grigio — while post-quarantine, rosé edged it out as the top pick.

This opportunity to explore personal interests beyond work has led 27 percent of respondents to indicate they are hoping to achieve a better work/life balance coming out of quarantine.

Being close to the people we care about was a major theme for respondents, as 46 percent want to spend more quality time with friends and family, and 38 percent plan to create more meaningful relationships with those around them.

During quarantine, some respondents stayed in touch with loved ones through “sharing” a bottle of wine while connecting virtually (26 percent).

Seven in 10 respondents believe wine can help connect people and bring them together, both virtually and in-person, which might be one of the reasons people embraced this during COVID-19.

“These past few months have been a time for reset and to explore new passions like wine,” said Chris Ladd, CEO of Coravin. “Whether tasting new varietals or discovering fun ways to incorporate wine in your cooking or experimenting with at-home food pairings, Coravin gives you the freedom to explore without committing to an entire bottle, nor worrying about wasting the rest."

Among the highlights:

- Experimented with using wine in my cooking – 39 percent

- Drank more wine – 38 percent

- Learned more about different types of wine – 37 percent

- Tried new varieties of wine – 36 percent

- Watched videos/read articles about different varieties of wine – 29 percent

- “Shared” a bottle of wine with loved ones while connecting virtually – 26 percent

- Set up my own at-home wine tastings – 26 percent

- Attended virtual wine tastings – 22 percent

- Attended virtual happy hours – 21 percent

Employment Watch

The latest Paychex | IHS Markit Small Business Employment Watch shows that despite hiring remaining flat since its drop-off in April, employees of small business are seeing the benefits of solid wage growth. Hourly earnings growth was steady at 3.28 percent in August and weekly earnings continue to improve as the number of hours worked increases. The national jobs index stood at 94.39, moderating 0.21 percent from the previous

“The national index stalled this summer, with the month of August again, as it has since April, closing below 95,” said James Diffley, chief regional economist at IHS Markit.

“As the jobs index has remained near April levels, PPP loans appear to have provided stability and prevented further declines,” said Martin Mucci, Paychex president and CEO. “While employment levels remain challenging, wages continue to show positive momentum.”

The report also includes regional, state, metro, and industry level analysis, showing:

- Amid a regional COVID-19 surge, the West and South reported the largest declines in employment growth, -0.38 percent and -0.31 percent, respectively.

- Weekly earnings and hours worked growth is strongest in the Northeast.

- New York posts the best weekly hours worked growth among states.

- Despite a significant downturn in August (-0.69 percent), Florida continues to lead states in employment growth with an index of 96.50.

- At 4.23 percent, hourly earnings growth in the Construction sector has improved every month in 2020.

The complete results for August, including interactive charts detailing all data at a national, regional, state, metro, and industry level, are available here.

COVID-19 Impact on Hotel & Lodging Sector

The American Hotel & Lodging Association (AHLA) released an analysis on the economic and human struggle of the hotel industry six months into the COVID-19 pandemic, with millions of employees still furloughed or laid off and travel demand lagging far behind normal levels.

Key findings of the report include:

- Four out of 10 hotel employees are still not working.

- Almost two-thirds (65 percent) of hotels remain at or below 50 percent occupancy, which is below the threshold at which most hotels can break even and pay debt.

- Consumer travel remains at all-time low, with only 33 percent of Americans reporting they have traveled overnight for leisure or vacation since March and just 38 percent saying they are likely to travel by the end of the year.

- Urban hotels are suffering the most and facing collapse with cripplingly low occupancies of 38 percent, significantly below the national average.

- COVID-19 has left hotels in major cities across the country struggling to stay in business, resulting in massive job loss and dramatically reducing state and local tax revenue for 2020 and beyond.

Chip Rogers, president and CEO of AHLA, said the prolonged economic impact of the pandemic has taken an incredible toll on the hotel industry, with no sign of a recovery in sight.

“While hotels have seen an uptick in demand during the summer compared to where we were in April, occupancy rates are nowhere near where they were a year ago. Thousands of hotels can’t afford to pay their mortgages and are facing the possibility of foreclosure and closing their doors permanently,” said Rogers. “We are incredibly worried about the fall and what the drop in demand will mean for the industry and the millions of employees we have been unable to bring back. The job loss will be devasting to our industry, our communities, and the overall American economy. We need urgent, bipartisan action from Congress now.”

As a result of the sharp and sustained drop in travel demand, industry leaders say hotels are now facing the harsh reality of deciding whether to close their doors permanently. Hoteliers are urging Congress to move swiftly to help the industry through a targeted extension of the Paycheck Protection Program, establishing a commercial mortgage backed securities market relief fund, and making structural changes to the Main Street Lending Facility to ensure hotel companies can access the program.

“Our industry is in crisis. Thousands of hotels are in jeopardy of closing forever, and that will have a ripple effect throughout our communities for years to come,” said Rogers. “We need help urgently to keep hotels open so that our industry and our employees can survive and recover from this public health crisis.”