MRM Research Roundup: End-of-April 2021 Edition

20 Min Read

In this edition of MRM Research Roundup, we have news on understanding customer loyalty, beverage insights, restaurant supply loyalty, the influence of discounts, the state of payments and the evolution of gift cards.

The Value of Trust

Customer trust may in fact be more important than customer satisfaction when it comes to understanding customer loyalty and their future intention to spend with a brand.

More than 9,500 consumers were polled for the study, which ranks the brands on three factors –consumers’ satisfaction levels with their most recent visit, their likelihood to return to the brand soon, and their trust in the brand. The study also uncovers consumers’ QSR competitive positioning, brand preferences, delivery trends, and use of new technology.

The impact of COVID-19 on customer behavior was experienced swiftly f by all industries. But for the QSR industry specifically, consumer expectations increased as priorities moved to health and safety first, which have, in turn, shaped decision making, long term brand engagement and buying behavior.

Customer satisfaction has traditionally been the main driver of loyalty. Satisfaction is immediate and can be established once consumers are conducting business with you. As previous QSR study results have shown, a majority of consumers chose to frequent brands that were conveniently located and provided a great experience.

Since COVID, the dynamics of consumer decision making have changed. Trust has become a more significant factor in decision making, as opposed to experience and location. Trust, is an outcome of consistent performance that meets a variety of consumer expectations. As QSR consumers return to a sense of normalcy it will be the QSR brands that can retain this trust that are well positioned to benefit from longer term consumer loyalty.

Positive Signs for On-Premise

CGA’s latest sales data reveal significant increases compared to performance in 2020, during one of the worst periods of decline when full lockdown restrictions were in place. Reassuringly, On Premise velocity is showing positive signs of nearly reaching levels seen in 2019. 100 percent of states have Restaurants open indoors and 98 percent of states have Bars open indoors, with some capacity measures in place.

Total U.S.

The average $ sales velocity for units across America were down -6 percent compared to the week before (April 17 v April 10)

Average $ velocity across all channels is +203 percent higher compared with the same week last year ending April 17th

$ velocity in Neighborhood Bars has grown by 447 percent vs the equivalent week in 2020

Casual Dining velocity has grown by 158 percent over the same period, suggesting many of the Casual Dining business models were able to maintain sales to some degree through pandemic restrictions

Florida

Against the US average of +203 percent, Florida has seen outlet average uplift in sales of 439 percent this week compared to the same week in 2020

Sales velocity is now +277 percent year-over-year (comparing the same week one year prior)

Sales velocity is now -5 percent vs April 10, 2021

Illinois

Sales velocity is now +174 percent year-over-year (comparing the same week one year prior)

Sales velocity is now -3 percent vs April 10, 2021

California

California also experiences velocity gains with the average outlet increasing sales by 400 percent this week compared to the same week in 2020

Sales velocity is now +264 percent year-over-year (comparing the same week one year prior)

Sales velocity is now -7 percent vs April 10, 2021

New York

Sales velocity is now +180 percent year-over-year (comparing the same week one year prior)

Sales velocity is now -7 percent vs April 10, 2021

Texas

All markets within Texas experience negative trends in the week to April 17, following a week of positive trends to April 10

Sales velocity is now +177 percent year-over-year (comparing the same week one year prior)

Sales velocity is now -4 percent vs April 10, 2021

Matthew Crompton, CGA’s Client Solutions Director, Americas said: “Recovery is well and truly here, and for many states sales may be close to returning to normal levels. Most channels are now showing only single digit velocity decline against booming 2019 levels, suggesting we may be nearing a new On Premise norm."

Beverage Insights

CGA's very latest sales data and consumer insights revealed how casual dining chains have a huge untapped beverage opportunity as the On Premise channel re-emerges from severe restrictions over the last 12 months. In fact, 30 percent of recent casual dining visitors think there is an opportunity to improve the quality of the beverage offer.

CGA’s latest large scale consumer study of On Premise users (OPUS) has found that approximately 30 percent of customers who frequent the top chains don’t agree that the range of drink brands is of ‘good quality’.

Set against a backdrop of a rapidly returning customer base as COVID-19 restrictions are lifting, evidence suggests that many of the most visited casual dining chains could improve their guest experience, and sales performance by reassessing their beverage offerings.

“With almost 40 million alcoholic drinks sold weekly in America’s casual dining chains, small $ gains per beverage order can very quickly add up to some serious revenue gains. Which is not to be sniffed at considering the beverage program is one of the most profitable aspects of any restaurant’s operation”, said Alexandra Martin, Operator & Analytics Director for North America.

The research indicates that there is a clear, consumer-driven, opportunity to re-assess and to further optimize the drinks range on offer for many casual dining operators. So, what could a better designed and delivered beverage program mean for the channel?

“Let us assume that operators were able to better meet the needs of those 30 percent of guests who are under-whelmed by the beverage program. Assuming only a $1 increase, for just a single drink per week, then the casual dining channel would generate an additional $16.3 million of sales per week…or $845 million per year. Again, this pessimistic projection is only accounting for a small uplift for the 30 percent of unsatisfied guests and assumes no additional uplifts from other guests”, Martin continues.

In CGA’s latest COVID-19 Impact study, it was found that 62 percent of American consumers had been out to Bars/Restaurants since their local market re-opened. With 59 percent of consumers also saying that they were planning to visit the trade in the next two weeks, demand is certainly coming back strongly.

Casual dining chains are among the most visited of all On Premise venues and CGA’s recent Channel Strategy study revealed that 66 percent of all On Premise consumers visit casual dining chains, with 40 percent of those visiting the channel weekly. This makes the casual dining channel indispensable to a healthy On Premise recovery, both financially and in the eyes of consumers.

This consumer demand is unlikely to wane in the foreseeable future as 80 percent of consumers say they plan to revisit the casual dining channel with the same or increased frequency compared to pre-COVID-19. Last week’s analysis of sales data from many thousands of casual dining outlets throughout America also shows the most rapid rebound of any channel – with the average casual dining chain posting total $ sales numbers which were within 5 percent of the equivalent week in 2019.

As any casual dining operator will confirm, beverage alcohol is extremely important to maximising visit spend. CGA’s latest transaction-level data for example shows that the average check which includes an alcoholic beverage is 60 percent to 180 percent higher than one without.

So, what do casual dining visitors want from their post-COVID-19 visits?

Fifty-five percent of those surveyed say that they plan to buy premium drinks/brands in their next visit to the trade. 40 percent of casual dining customers also say that they desire an extensive range of beverage brands to be available, with multiple offerings in the premium and craft/artisan categories. A further 20 percent say that this availability of choice and quality is ‘essential’ to their satisfaction with the concept’s beverage program.

CGA’s Alexandra Martin, Operator & Analytics Director for North America, said: “This latest batch of research highlights that the On Premise is back and consumers are really excited about returning to their favorite bar and restaurants again! While goodwill, interest and excitement is high, the challenge for operators is to deliver a phenomenal experience in an operating environment which is still very difficult.”

“The evidence is overwhelming for the positive guest impact that the right beverage program can deliver and now is the time for the much-loved casual dining brands to look at what their guests really want in their glass after a year of trail and experimentation at home. CGA’s new consumer and analytics solutions can support operators to unlock this potential to ensure a robust product rationalization and overall optimization of the beverage offering.”

Restaurant Owners Are Comparison Shopping

In a recent survey of restaurant owners and managers, 85 percent of respondents reported an increase in comparison shopping and just 15 percent of respondents said they remain loyal to one restaurant supply store. The survey was conducted by Credit Key, a provider of B2B e-commerce payments solutions.

Owners and managers are optimistic things will return to normal as vaccinations increase, and two thirds of respondents anticipate they'll receive funds from the government's restaurant revitalization plan. Notably, 70 percent of these restaurants plan to dedicate their relief funds to purchasing equipment, furniture and supplies in 2021. At the same time, a majority of respondents still harbor concerns about Covid-19 and its ability to disrupt their business.

"There's optimism on the buyers' side, but they're willing to leave vendor relationships behind in favor of better pricing and payment plans that put less stress on their cash flow," added Tomich. "A safeguard for sellers is to provide buyers with varied payment options at checkout including the increasingly popular buy-now-pay-later solution."

Among the findings from the survey:

- 90 percent of restaurant buyers said it's important or highly important to be provided a variety of payment options at checkout

- 92 percent of respondents said they intend to purchase equipment online more frequently going forward

- 80 percent of restaurant owners and managers forecast a meaningful increase in business, but this same 80 percent says they're concerned that Covid-19 might present disruptions in the future

- 63 percent of buyers are interested in buy-now-pay-later plans

- Of those interested in BNPL, 28 percent of respondents prefer 90 day terms, 46 percent of respondents prefer 6 months terms, and 26 percent of respondents prefer 12 month terms

The survey cited above was conducted by Credit Key from April 12 to April 15, 2021. The findings were compiled from responses of 150 individuals who either own or hold a senior management role at a restaurant, bar, coffee shop, or catering company in the United States.

The Appeal of Coupons and Discounts

Vericast offered for proprietary survey findings related to consumer sentiment around the use of coupons and discounts.

Based on responses from 1,000 U.S. adults, coupons and discounts are accelerating consumers’ return to pre-pandemic activities, with 64 percent of consumers noting that coupons or discounts would encourage them to take part in gatherings or group activities this summer including dining out, hosting a barbecue, seeing a movie at a theater, or playing mini golf. Additionally, 9 in 10 plan to use a coupon or discount in the next six months for grocery (70 percent), restaurants/dining (64 percent) and beauty/grooming (37 percent).

Coupons and discounts are also driving consumers to discover new businesses. In fact, 62 percent of adults reported having shopped at a brand, retailer or restaurant for the first time in the past year due to a coupon or discount. This aligns with consumer spending overall, with 83 percent of individuals saying they made at least one purchase over the last six months because of a coupon or discount.

“Now more than ever, consumers are placing an increased value on discounts and savings as they look to return to normalcy,” said Sarah O’Grady, Senior Director of Brand Marketing, Vericast. “Brands that take advantage of this sentiment will connect more deeply with consumers and maximize their brand visibility. Heading into the summer months, there is a significant opportunity for businesses to acquire new customers and strengthen relationships with current ones by delivering relevant offers for the products and experiences consumers want right now.”

Additional findings from the survey include:

- Using coupons and discounts lead to an emotional reward

- Almost half of consumers (43 percent) report feeling “excited” when they save money using a coupon or discount; more than half (51 percent) report feeling “satisfied.”

- Younger generations feel the emotional payoff even more, with 59 percent of consumers aged 25-34 saying they feel “excited” by savings.

- Coupons and discounts inspire people to stay in touch

- 67 percent of consumers have used a coupon or discount to purchase or send gifts to family, friends or colleagues in the past year.

- This is especially true for younger generations, with 85 percent of consumers aged 18-24 saying they used a coupon to purchase a gift at least once in the past year.

- 43 percent of consumers are more inclined to purchase a gift online and have it delivered to the recipient when a coupon or discount is offered.

- Deals are central to summer events

- Consumers are planning to use coupons or discounts to celebrate summer holidays, with 58 percent likely to capitalize on Memorial Day (40 percent), Independence Day (40 percent) and Labor Day (33 percent) deals.

- Coupons or discounts are used by consumers who have an active dating life

- 78 percent of consumers and 84 percent of Gen Z (age 18-24) currently dating say they would use a coupon or discount on a date at a restaurant.

- Over one-third (36 percent) of dating consumers aged 35-44 say they are likely to use a coupon or discount on a first date.

Restaurant Rewards

Paytronix Systems, Inc., published the latest report in its ongoing series “Delivering on Restaurant Rewards,” which finds that 92 percent of vaccinated restaurant customers who have shifted to ordering online plan to keep doing so after the pandemic has subsided with only the remaining 8 percent planning to return to dining on-site as they did before. This signals that the mobile order-ahead, curbside pickup and delivery capabilities that gained traction during the pandemic are here to stay.

Download the full report: Delivering on Restaurant Rewards here.

When Paytronix examined sales through February and March, as vaccinated people started returning to on-premises dining, it found that online sales increased along with in-store sales. Between The first week of February and the last week in March, in-store sales grew by 13 percent and online sales grew about 3 percent.

“Digital ordering is now a key part of the customer experience and that means restaurants need to make it a priority within their own operations. Customers will continue to expect a complete digital experience in addition to an on-premises experience, not as a replacement. The challenge for restaurant brands going forward will be how to offer a consistent and personalized experience, no matter how the customer chooses to interact,” said Andrew Robbins, CEO of Paytronix Systems, Inc.

Key findings from the research include:

- Convenience matters – 32 percent of vaccinated restaurant customers say they would spend more on their orders if they could pay online; 40 percent of vaccinated restaurant customers would spend more if they could earn loyalty and rewards for their orders.

- Vaccinations and loyalty – There is a surprising and inexplicable link between vaccination and loyalty program usage. Vaccinated consumers’ inclination to engage with loyalty and rewards programs is highest among younger demographics, including bridge millennials, millennials and Generation Z consumers.

- More accessible loyalty programs – Restaurant loyalty programs need to be accessible both online and offline to meet their customers’ payment needs as more consumers migrate back to brick-and-mortar establishments.

Consumers' Digital Preferences

FullStory released a new survey that reveals consumers’ preferences, frustrations and opinions around digital interactions. The survey of more than 1,500 American consumers found 8 in 10 (81 percent) plan to maintain or increase their online usage, even as in-person shopping, services and activities resume. However, digital frustrations are common and costly. The survey finds that the majority of respondents (64 percent) have been frustrated or struggled in the last six months, and 77 percent will abandon a transaction when they experience an issue.

Yet brands are often unaware of these challenges because only 12 percent of consumers are very likely to share feedback when a digital error occurs, making it difficult to identify and address errors in a timely manner.

“Across every industry, consumers are holding companies accountable for subpar digital experiences,” said Kirsten Newbold-Knipp, chief marketing officer of FullStory. “The rise of digital-first business brings great opportunity but also risk, as this survey correlates a poor digital experience with customer and revenue loss. To be successful, businesses must understand not only what is happening in their customers’ experiences, but most importantly why, in order to stay one step ahead of digital users.”

Businesses pay a high price for digital errors

- Companies have invested heavily in digital experience innovation, but remain challenged by technical issues that prevent consumers from accomplishing their tasks, erode trust, and negatively impact sales.

● Nearly two out of three Americans (64 percent) have been frustrated or struggled to complete an online transaction in the last six months.

● After an error, 77 percent of consumers are likely to leave without completing a transaction, and 60 percent say they aren’t likely to return.

● 65 percent report that they trust a business less when they experience a problem using a website or mobile app.

Common frustrations often go unreported

- Customers are unlikely to share details around digital struggles, making it difficult for brands to quickly identify and fix problems.

● The most important factor in creating a good online experience is being able to “quickly accomplish what I came to do” (83 percent).

● The most frustrating issues for consumers online are page glitches (55 percent), forms that don’t correctly accept inputs (45 percent) and page-loading errors (42 percent).

● When a problem occurs, only 12 percent of consumers are very likely to provide feedback to the business.

● Even when consumers do provide feedback, it’s most likely through manual and time-consuming methods like surveys (49 percent) or by chatting or emailing the business (41 percent and 40 percent, respectively) and not typically to the team that can directly fix the issue.

Digital experience ratings vary widely by industry

- Four in 10 respondents (41 percent) transact online at least once a day, and a quarter (26 percent) head online multiple times a day to place an order, purchase an item, pay a bill or make a reservation. But, while digital is here to stay, the quality of experiences varies widely.

● 81 percent of consumers anticipate the frequency of their digital interactions will increase or stay the same, even as COVID-19 restrictions lift.

● Retail received the highest ratings for positive online experiences (34 percent excellent; 7 percent poor), followed closely by banking (26 percent excellent; 7 percent poor).

● Airlines scored last for online experiences (27 percent poor; 10 percent excellent). Hotel and quick service restaurants also received low rankings (13 percent poor; 7 percent excellent).

“To improve the digital experience, companies need insight into what works and what doesn’t in a way that is automated, scalable, and actionable,” continued Newbold-Knipp. “Unfortunately, many consumers don’t take the time to provide feedback when things go wrong, and even those who do so use methods that are expensive and difficult for businesses to scale. Companies need to take a new approach to digital experience intelligence to meet evolving expectations and stay in step with consumers.”

State of Payments

Podium released the 2021 State of Payments Report, highlighting the types of payment methods customers use, their preferences and the impacts local businesses may face if they don’t support their customers with frictionless payment methods.

According to the report, U.S. consumers are comfortable spending 43 percent more money swiping their credit card than paying with cash, and 53 percent more compared to reading their credit card numbers over the phone to a representative. A third (33 percent) of all (U.S. and Australia) respondents listed swiping or inserting their credit cards as their preferred method of payment, and nearly a quarter (23 percent) of consumers abandon transactions entirely when their preferred methods of payment aren’t available. Enabling more ways to pay, especially preferred ways, will help local businesses drive repeat customers.

“With the current digital transformation and pandemic-induced pressures, payments have evolved from ‘how you get paid’ to playing a critical role in your business’ customer experience,” said Eric Rea, co-founder and CEO at Podium. “Local businesses need to be acutely aware of preferences across the entire customer experience, and with so many ways to pay these days, it’s crucial for them to provide the options their customers want.”

Other key findings from the 2021 State of Payments Report include:

Consumers want convenient payment options

Being offered convenient payment options (41 percent) is the second most important factor customers consider when choosing a local business, next to customer service (60 percent). Preferred payment options were more important to customers than proximity to their home (36 percent), availability of sales or discounts (25 percent) or a personal relationship with the business (20 percent), among other elements.

If a local business only accepts cash and credit card swipes, they are missing the top payment choices of 31 percent of U.S. consumers.

Digital options—including website payments, mobile wallets such as Apple Pay and Google Pay, direct pay platforms like Venmo or Paypal, and text links—were the top payment choice for 20 percent of consumers. Those with higher incomes often have higher expectations 38 percent of high-income consumers (those with a household income greater than $100,000 per year) have delayed payment or abandoned a transaction because their preferred payment method was not offered, 74 percent higher than the typical consumer.

Fifty-eight percent of high-income consumers were more likely to avoid local businesses that failed to offer contactless payment methods. Nearly two-thirds (64 percent) of high-income consumers who have tried text payments either liked or strongly liked it.

The pandemic adjusted consumers’ payment preferences, and those changes are here to stay Neary three-in-four (72 percent) consumers reported the changes to their preferred payment methods due to COVID-19 are likely to last beyond the pandemic.

To access the full report, click here.

The Evolution of Gift Cards

The $160B gift card market represents a significant source of revenue for U.S. retailers and restaurant brands, and while growth in physical gift cards was 9 percent in 2019-2020, digital gift card adoption is projected to grow 23 percent by 2025—more than 2.5X faster than overall gift card sales. COVID-19 has accelerated the adoption of digital gift cards, as mobile and digital gifting increases and a younger demographic embraces eGift cards. However, as the gift card market shifts to a digital-first mindset, retailers and restaurant brands must improve their digital gift card capabilities or risk being left behind.

These findings are from Incisiv’s new benchmark research studies, “Evolution of Gift Cards in Retail: From Transactions to Engagement,” and “Evolution of Gift Cards in Fast Casual Restaurant: From Transactions to Engagement,” commissioned by GiftNow. While the analysis uncovered that the fast casual restaurant industry is trailing the retail industry across most major areas, each study pinpoints four areas of transformation that must be improved for retailers and restaurants to take realize the full value of their gift card programs.

- Reduce friction by allowing faster, seamless purchase and redemption of eGift cards. 60 percent of restaurant and 24 percent of retail digital gift cards evaluated take more than 24 hours to deliver. In addition, an average of 75 percent of retailers and restaurant brands evaluated do not enable gift cards to be added to the user’s mobile wallet. Physical gift cards don’t fare much better, as 60 percent take more than 10 days to deliver by mail. Retailers and restaurants are failing to meet shopper expectations for speed, convenience and simplicity.

- Improve omnichannel capabilities by enabling purchase, transfer, and redemption of gift cards across all channels. 94 percent (fast casual restaurant) and 88 percent (retail) of eGift cards can’t be sent via a text message—a clear miss in a mobile world—and 17 percent of retailers don’t allow omnichannel gift card redemption. These retailers and restaurants must do a better job of integrating mobile, digital and physical channels or risk losing shoppers that expect a seamless experience.

- Enable greater personalization so shoppers can customize gift cards and make them more personal. The vast majority of retailers and restaurants that offer eGift cards allow the cards to incorporate personal messages, photos and videos, but they can improve the range of templates, designs and occasions for gift cards.

- Provide recommendations that drive smarter sales with curated gift card options and relevant products. 76 percent of retailers don’t suggest gift cards in the search bar or suggest product options based on a gift card type—for example, suggesting diapers if shoppers are gifted with a “new baby” template. It is far worse with the restaurant industry as no major brands evaluated (0 percent) suggest gift cards in their search bar. Retailers and restaurant brands are clearly leaving money on the table by failing to make relevant product recommendations.

“Retailers can still derive tremendous value from gift cards, but in an increasingly digital world, it requires new thinking. They must understand how their gift card capabilities need to mature to support this 'new normal,” said Dan Farrell, general manager of gift cards at GiftNow, a Synchrony Solution. “Gift cards need to be positioned in e-commerce with deeper attributes which are integrated with the search, and recommendations engines that account for things like special occasions. Embracing this type of new thinking in this new normal will deliver significant enhancements to the gift card shopping experience.”

Are You a Moody Eater?

The relationship between mood and eating played out big time during the pandemic, especially when it comes to snacking and treating ourselves, reports The NPD Group. With many people spending more time at home during the pandemic, snack foods and treats, both better-for-you and indulgent, help to fill voids created by sadness, boredom, stress, and other moods. For example, the average U.S. consumer ate +37 percent more snack foods and treats while feeling sad or depressed during the pandemic than they did in 2019, according to NPD’s recently released Future of Snacking report, which shows what snack food consumption in America looks like now and over the next two years.

Of all moods, being sad or depressed had the most impact on snack food and treat consumption, but boredom followed closely increasing snacking by +33 percent. In addition to being sad, depressed, or bored, consumers tended to eat more snack foods and treats when they were cranky, stressed, anxious, calm, and relaxed. Snack food consumption declined when consumers were feeling rushed, happy, good, tired, and just normal or neutral, finds NPD.

A combination of savory snack foods and treats helps to comfort consumers. Although sad or depressed consumers lean toward sweeter treats whereas bored consumers tend to reach for more savory snack foods. There is also a balance of better-for-you and indulgent snacking in most cases. At the beginning of the pandemic, consumers did reach for more treats and indulgent snack foods but as the pandemic continued, they realized long-term indulgent behaviors needed to be balanced.

“Looking forward, the snack food and sweets industries need to keep a keen eye on the mental state of consumers, as changing times impact emotional needs for snack foods and treats,” said Darren Seifer, NPD food and beverage industry analyst, a contributor to the Future of Snacking study. “Today it’s about fighting boredom and boosting mental well-being. Tomorrow, look for more sharing of snack foods and treats in social environments as shared experiences come back into focus and pent-up demand for these types of occasions is released.”

Hot Vax Summer

Half of U.S. adults (50 percent) are likely to take at least one vacation this summer (June – September 2021), according to a new study by The Points Guy and Healthline Media. The interest in taking a summer vacation rises with those who are likely to get a coronavirus (COVID-19) vaccine or are already vaccinated (54 percent) versus not likely to get a vaccine (40 percent). Of those who aren’t taking a summer vacation, more than 2-in-5 say they can’t afford it (41 percent), the most popular reason overall. Click here for more information:

“Even if you’re vaccinated, it’s still a good idea to wear a mask, stay six feet from others, avoid crowds, and wash your hands frequently. This is good advice for staying healthy even if we’re not in a pandemic.”

While 27 percent are very likely and 23 percent are somewhat likely to take a vacation this summer, those numbers rise for millennials (ages 25-40, 59 percent at least somewhat likely), parents with children under the age of 18 (65 percent), and those earning $80k+ per year (70 percent).

Of those who are at least somewhat likely to take a summer vacation, over four in ten (43 percent) anticipate spending more than $1,000, including 20 percent who think they’ll spend more than $2,000. Fifty percent say they will spend $1,000 or less and 7 percent don’t know. The likelihood to spend more than $1,000 increases with age: 53 percent of baby boomers (ages 57-75), 45 percent of Gen X (ages 41-56), 40 percent of millennials, and 20 percent of Gen Z (ages 18-24).

“Some Americans may not have had a summer vacation since 2019, and so there's clearly a lot of pent-up demand,” says Melanie Lieberman, senior travel editor at The Points Guy. “Nearly half of prospective travelers plan to spend more than $1,000 on their summer vacations, which indicates they're ready to make up for lost time by spending more for bigger trips.”

Of those who are likely to take a vacation this summer, nearly half (49 percent) say they are interested in taking a road trip. Other popular activities and destinations include interest in visiting a state or national park (39 percent); visiting a public beach (38 percent); going to an outdoor event such as a festival, sporting event, etc. (28 percent); camping (23 percent); visiting a big city (22 percent); attending an indoor event/venue such as theater, museum, comedy show, etc. (21 percent) and visiting a resort (20 percent), staycation (20 percent), visiting a theme park (18 percent), traveling abroad (15 percent) and taking a cruise (9 percent).

Potential travelers this summer travel season are overwhelmingly in favor of COVID-19 protocols at their destinations; just 15 percent say they prefer limited or no precautions. Opinions differ between those who are likely to get a vaccine/already vaccinated and those who have no plans to get a vaccine: 38 percent of potential travelers who are unlikely to get the vaccine would prefer limited or no precautions versus only 9 percent of those who are vaccinated/plan to get vaccinated.

Meanwhile, those thinking of traveling this summer would find safety measures important like social distancing rules (50 percent); mandated masks (48 percent); strict cleaning protocols, such as wiping down and cleaning seats, rides, tables, etc. (48 percent); being able to make reservations ahead of time (40 percent); vaccine passports/proof of vaccinations (34 percent); temperature checks conducted upon arrival (31 percent) and negative COVID-19 tests (27 percent). Just 9 percent would see value in quarantine upon arrival.

“The most important aspect of traveling is to always stay safe and healthy. No one wants their vacation to be spoiled by being ill,” says Laurie Dewan, Healthline Media Vice President of Brand, Insights and Communications. “Even if you’re vaccinated, it’s still a good idea to wear a mask, stay six feet from others, avoid crowds, and wash your hands frequently. This is good advice for staying healthy even if we’re not in a pandemic.”

Of those who are likely to skip a summer vacation, the most common reason is affordability (41 percent), followed by 29 percent who are not interested in taking any vacations, and 28 percent who worry about their health while traveling due to COVID-19. Less popular reasons include no desire to wear a mask or deal with other mandates (10 percent), too many family obligations and inability to take time off from work (both 9 percent), no interest in receiving the COVID-19 vaccine (7 percent), already having travel plans for later in the year (6 percent) and children not being able to receive the COVID-19 vaccine yet (6 percent). Eight percent say “other,” and 4 percent say “don’t know.”

Overall, 41 percent of U.S. adults are likely to get the COVID-19 vaccine once it is available to them (28 percent very likely and 13 percent somewhat likely), versus 26 percent who are unlikely (9 percent not too likely and 17 percent not at all likely). One-third of U.S. adults say they already received the vaccine.

SMS at 29

Want to hear something shocking? SMS turns 29 this year. That’s right: the first SMS, which said “Merry Christmas,” was sent by Neil Papworth to his Vodafone colleague, Richard Jarvis, in December 1992.

What started as a friendly, festive message, sparked a texting phenomenon. Almost 30 years later, consumers and businesses rely on SMS, or short message service, as an essential communication tool.

On average, the open rate for text message marketing campaigns is 98 percent compared to 20 percent for email marketing campaigns*. This is good news for businesses investing in SMS marketing. But it’s important to note that an open rate doesn’t necessarily mean engagement, particularly if your SMS marketing efforts don’t align with what your customers want.

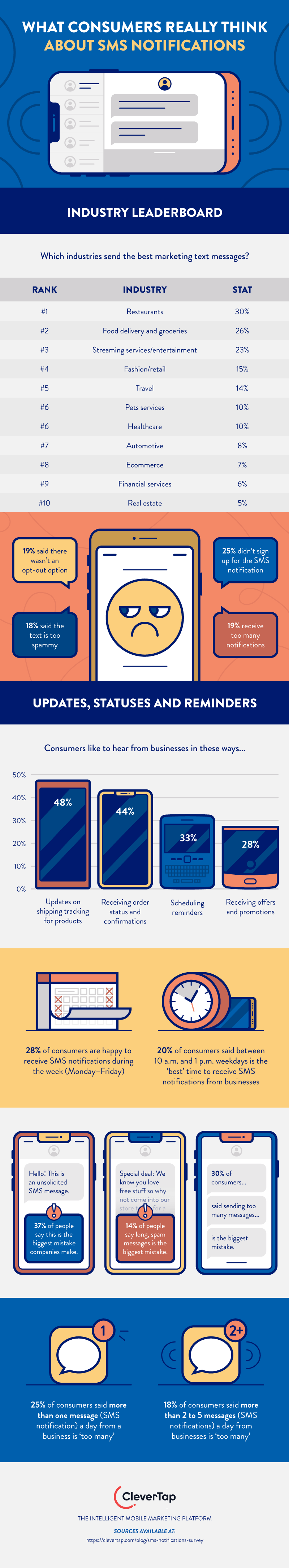

To help you increase both open rates and engagement levels, we surveyed 1,000 respondents to find out what consumers really think about SMS notifications from businesses. In this post, we share the inside scoop from consumers on which industries send the “’best” marketing messages, the ways that businesses annoy customers with notifications, and the ideal frequency.

Below is an infographic on the essential takeaways about how consumers really feel.