Is Market Volatility Ending? Or Just Beginning?

2 Min Read By Jana Zschieschang

Less than 24 hours before Silicon Valley Bank failed, restaurant analysts at Revenue Management Solutions released our monthly impact report.

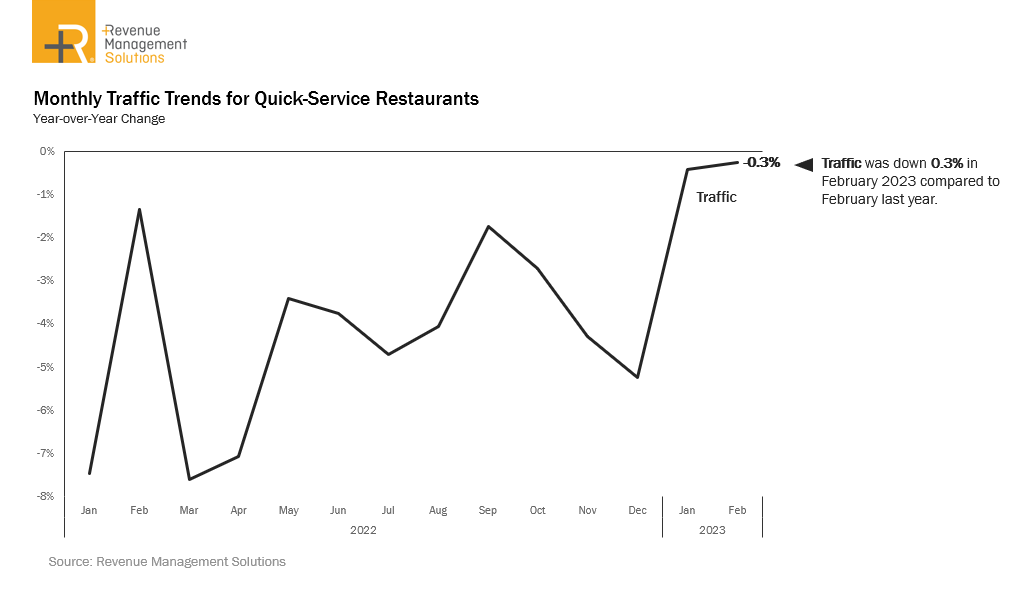

At the time, we lauded stability. Our graphs of early 2022 quick-service restaurant traffic trends looked like a mountain range — a significant dip in performance followed by a steep climb, thanks to the appearance and ultimate retreat of the omicron variant. But in 2023, month-over-month trend lines have evened out.

A week ago, we lauded a flat line (on a graph, that is). Now that Silicon Valley Bank has “flatlined,” will QSRs suffer?

According to our Senior Vice President of Consulting Services, Richard Delvallée, the short answer is no.

“Fallout from the Silicon Bank failure is unlikely to affect QSR performance trends,” he said in a conversation. “Consumers are reacting to a softening economy by buying fewer items per visit, but traffic has remained stable.”

Delvallée said that QSRs might even see moderate…

Sorry, You've Reached Your Article Limit.

Register for free with our site to get unlimited articles.

Already registered? Sign in!