GLP-1 Users Turn to QSRs

2 Min Read By MRM Staff

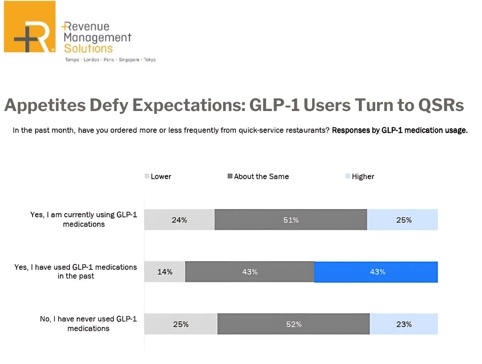

While nearly one in ten respondents to a survey of more than 2,000 US diners conducted by Revenue Management Solutions (RMS) have used or are using GLP-1, it hasn't slowed their restaurant-going behavior. One quarter of those currently taking a GLP-1 medication increased their QSR visits in the past month with 43 percent of past users reporting more visits. For context, just 23 percent of non-users reported an increase in QSR visits.

"Our survey shows that GLP-1 users are not pulling back from restaurant dining—in fact, they’re increasing their visits across all segments, particularly quick-service restaurants (QSRs)," Jana Zschieschang, Chief Brand Officer for Revene Management Solutions, told Modern Restaurant Management (MRM) magazine. "However, they are also more price-sensitive and selective about their menu choices. This indicates a strong preference for quality over quantity: GLP-1 users tend to eat less but are willing to spend more for better food. Operators should highlight nutrient-dense, high-quality, and portion-appropriate items that feel premium. Lean proteins, clean-label ingredients, and menu transparency (e.g., calorie counts) will resonate. Menus that include smaller portions or customizable options will appeal to GLP-1 users."

Zschieschang noted that QSRs are well positioned to benefit from the GLP-1 trend and should consider it in their future messaging points.

"GLP-1 users—particularly men—spend more of their disposable income at restaurants, but they’re also price-sensitive. QSRs should consider offering premium add-ons or smaller, higher-quality combos marketed with messaging that emphasizes balance, healthy ingredients, and responsible indulgence as opposed to bulk discounts or 'deal' messaging."

She added that restaruant operators should take note that GLP-1 users appear to be redefining value. They report higher sensitivity to restaurant prices, likely because they eat less and choose more premium ingredients or menu items that align with health goals.

"Restaurant menus should clearly showcase quality—from menu descriptions to food presentation—so that premium prices are warranted by visible quality or health benefits."

With some many selections, why are QSRs menus proving to be popular? Based on RMS' menu engineering expertise and survey feedback, Zschieschang pinpointed a few reasons:

- Convenience and control: QSR menus offer the ability to eat on the go and know what you’re getting, as brands’ menus are consistent across locations.

- Generational considerations: Many GLP-1 users are Gen Xers with high incomes and busy households, suggesting a preference for quick but satisfying meals.

- Behavioral shifts: Weight loss or health-related goals may result in more deliberate, mindful choices—rather than avoiding dining out. In fact, 28 percent of previous users and 15 percent of current GLP-1 users plan to dine out more in the future.

"While the survey didn’t name specific brands, the implication is that QSRs offering perceived health, customization, or premium ingredients would benefit most," she said.

As adoption of GLP-1 medications grows, especially among younger demographics and broader income segments, RMS expects the dining patterns will likely expand. Restaurants should anticipate a rising demand for:

- Personalized portions and premium light meals

- Nutritional transparency

- Less focus on bulk discounts and more focus on premium offers for smaller portion sizes (think quality over quantity)

- High-protein and low-sugar options

"In the long term, this could shift the definition of value in the restaurant space, pressuring brands to reimagine pricing strategies and menu engineering around perceived health and quality," Zschieschang said.