Game Changing News for Brands’ Media Mix

5 Min Read By MRM Staff

Restaurant brands need to pay attention to evolving media consumptions in order to better engage with potential customers, according to results of a year-long study conducted by Digital Turbine in collaboration with Qrious Insight.

While 91 percent of people use social media, the report finds that, among QSR brand consumers, nearly four in ten social users actually spend more time playing mobile games than they do on social media. The report concludes that if QSR brands had reached the Mobile Gaming-First segment as effectively as social audiences, they would have boosted reach across the entire QSR audience by 18 percent

“Media measurement for advertising must go beyond simply understanding how many people use different platforms and dig deeper into what they are doing and why," said Andrew Moffatt, CEO of Qrious Insight. "This report dissects how different types of media engagement can deeply impact the effective reach of your advertising. While you might think you are reaching a large audience, you are only effectively reaching a fraction of that. This true and impactful insight cannot be gained by survey recall but must be uncovered using passively tracked behavioral data.”

Among the highlights:

- While QSR brands can be confident that they are reaching the majority of the consumers who spend more of their time on Social Media/YouTube (77 percent), they are missing more than 50 percent of the consumers who spend more of their time on mobile games.

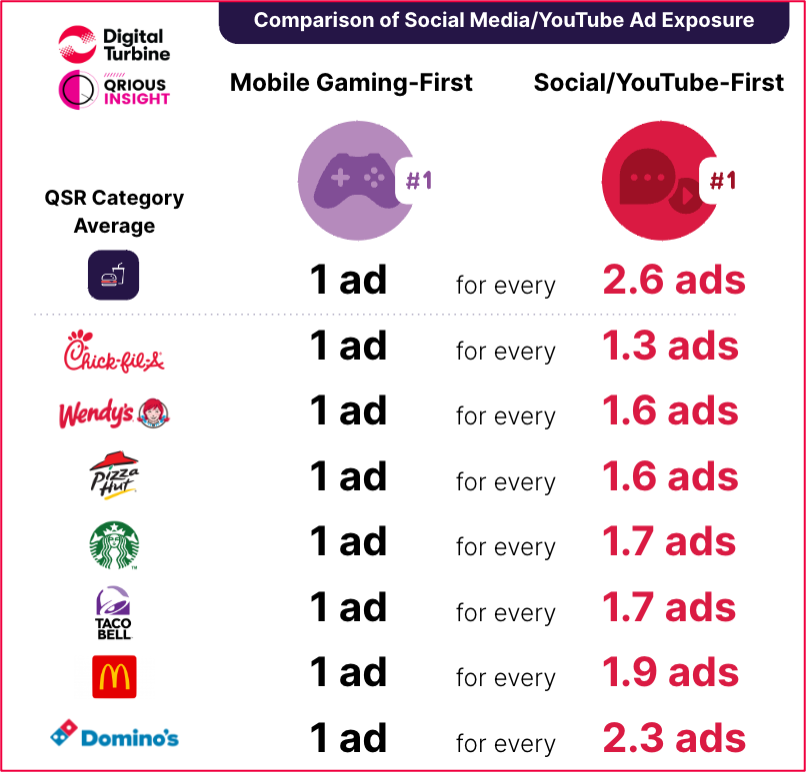

- Mobile gaming-first audiences were shown 61 percent fewer ads than social media-first audiences.

- The “Mobile Gaming-First” segment spent 2.5x times more time playing games than on social media.

- All leading QSR brands underdelivered. Chick-Fil-A did the best at exposing social ads to the Mobile Gaming-first audience, but still showed 23 percent fewer ads to that audience. Wendy’s managed to show 38 percent fewer, Pizza Hut 39 percent, Starbucks 41 percent, Taco Bell 42 percetn, and McDonald’s 46 percent.

To learn more about the study, Modern Restaurant Management (MRM) magazine quizzed Greg Wester, Sr. Vice President, Digital Turbine

Why should the mobile-gaming first audience be more important to QSR brands? And why weren’t they part of the conversation previously?

Brands are missing out on this significant audience if they are only trying to reach them on social media. Our mobile habits differ, and quite simply, some people spend more time in places other than social platforms. By not investing in in-game advertising, QSR brands have (most likely without knowing) way underreached and underserved this customer segment. And it’s not trivial. The Mobile Gaming-First audience –those that spend more time in mobile games than on social or YouTube– is large AND were found to be equally valuable customers. This underinvestment means brands are losing share of wallet, sales, and customer loyalty.

Why do you feel the brands underdelivered to this segment?

This is a case of what comes first, the chicken or the egg . . . or better said, the chicken nugget or the egg wrap. What I mean is that the industry lacks real media mix modeling that shows the effect of mobile game impressions on brand results. But without significant spending on mobile games, those models haven’t come to fruition. And as a result, brand spend continues to languish. We know the impact of adding mobile games, and our clients certainly know, but we need industry-wide awareness. And that’s my nugget in a wrap!

What do you think restaurant operators can learn from these results to improve their social media marketing efforts?

Not all advertising problems can be solved by spending on social media. The ideal way to solve it would be to reallocate some campaign dollars to mobile gaming and run the appropriate brand impact studies. If shifting dollars isn’t an option, shift to buying social feeds/content that skew to mobile gamers. The results for QSR brands are clear. We just recently shared some great results for a campaign we did with KFC – showing the power mobile gaming can have in reaching an awesome QSR audience segment. Brands need to see how reaching this untapped audience can mean more engagement – and more orders.

What can brands do to more effectively and efficiently reach the mobile game audience?

Start with making sure every brief and RFP goes out to providers that can help your brand directly engage mobile gamers. Many providers claim scale but don’t have direct access to their gaming inventory. Focus on those with scale and diversity of games, but seek out those that give you direct SDK access to optimize your supply path. Finally, look for providers that can source creative offerings to customize in-game engagement to drive players down the funnel. The natural ad break between game levels affords the ability to seamlessly supplement video with the ability to browse more info, visualize more, customize menu selections, and even gamify the brand as shown in the KFC example.

Wao Bao recently announced that it’s linking restaurant rewards to Roblox. Do you think this move aligns well with the study results and do you anticipate other brands to launch similar efforts in the near future?

The study was behavioral – looking at real customer behavior and ad exposure. This means it’s based on what people actually do and not what they say or think they do. That said, kudos to Wao Bao for understanding the value of directly engaging gaming enthusiasts. It’s a great start at engaging younger gaming fans. The data I’ve seen is that less than 20 percent of Roblox users are 25 or older, but mobile gaming audiences as a whole span all demographics. If Wao Bao wants to reach older audiences, for example, there are many additional methods they could look to.

Did any results surprise you?

Two things:

-

The magnitudes of the results were unexpected: The size of the Mobile Gaming-first segment and the size of the reach disparity and exposure diversity were extraordinarily large.

-

I was also surprised that every leading QSR brand underperformed. We had assumed that with larger budgets and access to more resources, some brands may have been able to find a magic bullet to reach the mobile gaming-first audience in social.

In what ways is social media consumption shifting, particularly among generations desired by QSRs and what can they do to better respond to these shifts?

From my empirical observations and other research over the years, social media continues to be a “killing time” media. However, so are mobile games – and it’s an activity that spans generations. The simple thought that “everyone uses social media” shouldn’t be the prevailing thought from advertisers anymore. We’ve seen shifts in media usage throughout time – from radio to movies to TV to computers to smartphones and beyond. Things will always evolve and advertisers should pay attention to how things do shift over time.

The first in the “Game”-Changing shift series focuses on QSR brands and uses insights drawn from consumer behavioral data passively collected from 23,000 consumers during 2023. Through their opted-in consumer panel, Qrious Insight tracked overall mobile use, social and YouTube app usage, website usage, restaurant visits, and detailed info on QSR advertising exposure within Social Media and YouTube. Detailed behavioral data of leading QSR brands, including McDonald’s, Starbucks, Chick-fil-A, Taco Bell, Dunkin Donuts, and Burger King, were also analyzed.