F&Co Study: The Rise of the Food Connected Consumer

3 Min Read

There is a new and increasingly influential category of Americans: the Food Connected Consumer, according to a new study from strategy and branding firm Fogelson & Co.

A decade ago “foodies” were a specialized minority, today that deeper interest in food has gone mainstream. This segment of more food-aware, food-involved consumers now represents 62 percent of Americans across all demographics and geographies, and accounts for an estimated $835 billion* in US food expenditures.

“Our research underscores an emerging, passionate majority of mainstream Americans – FCCs – who care about the food they eat, value transparency and are loyal to brands that speak to them,” said Susie Fogelson, Founder and CEO of Fogelson & Co., and former head of branding and strategy at Food Network. “The findings suggest ways for food, beverage, hospitality and dining brands to rethink their storytelling strategy.”

The study reveals a number of compelling data points of importance to marketers:

“These confident cooks may be swapping certain ingredients based on health concerns, flavor preferences, or even product availability. Brands can improve their chances of being the consumer choice through education, and demonstrating the product’s range of use,” said Fogelson. “And marketers shouldn’t be afraid to present new products and flavors – 67 percent of FCC consider themselves food explorers, which is fueling the global flavors trend.”

While the vast majority (91 percent) of FCCs look online for recipes and inspiration, they still shop at supermarkets, club and specialty shops, and farmers’ markets. And they regularly watch food shows (56 percent), read food magazines (30 percent) and follow bloggers or food experts online (20 percent).

According to Fogelson, digital platforms are critical for food brands, but crafting stories that play across channels is the best way to capture their attention – and that includes engaging them at retail. “Digital is a clear priority, it’s where they’re finding inspiration and information, but developing the right mix across channels—and playing to each channel’s strength—is ideal.”

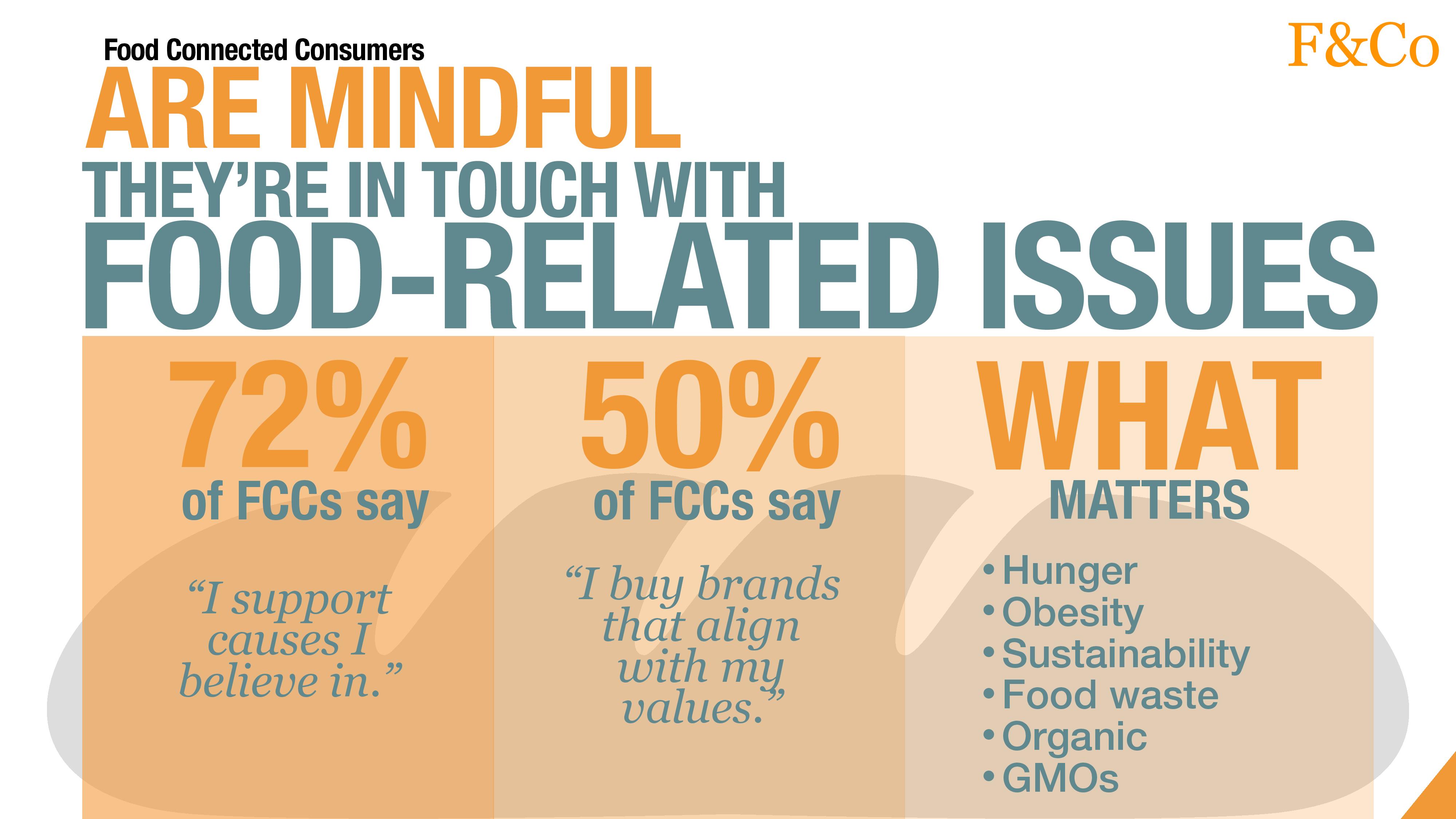

The majority of FCCs (72 percent) support causes they believe in and 50 percent say they try to buy brands that align with their values. They are also 26 percent more likely than the general population to look for foods with simple, recognizable ingredients.

The Power of Gen Z

In a follow up study, Generation Z’s passion for food is also evident, though in some different ways. Fogelson states, “Gen Z is really having a lot of fun with food. It’s a relief and a release from the perceived instability and uncertainty of their world.”

Over a third (37 percent) saying that snacking is their favorite meal and nearly half (47 percent) say they often eat breakfast foods at non-breakfast times. They also say they like to cook together with their family (40 percent) and, importantly, over half (54 percent) say they influence food purchases at home.

Fogelson notes that experimenting in these spaces could yield an excellent payoff for brands. “Quick service restaurants that are serving breakfast all day are certainly on target. And considering Gen Z’s influence on food purchases, brands must find ways to appeal to them to capitalize on their indirect purchase power.”

It’s Still All About Storytelling

FCCs, from Gen Z to Boomers, all care about where their food is from and its impact—on individual health and our world—just to varying degrees. “Tell your food’s story,” said Fogelson. “What is its origin? How was it made? Why is it the better choice—not just for consumers, but the world we live in? If the story seems elusive, embrace the truth of your product and tell that. Every brand – even many non-food brands – can have a food story that resonates with this powerful audience.”

For more findings and insights, click here.

The F&Co/Jump Rope Innovation study evaluated attitudes and behaviors around cooking, shopping, eating, media consumption, social issues and more. It was conducted online among 1,123 consumers age 18-54 in August, 2018. A follow-up study was conducted October 23, 2018 among 283 consumers age 15-22.

*Based on Bureau of Labor Statistics food expenditures data and FCC survey data estimates of income and food-related behaviors.