Dynamic Pricing in Fast Food: Profit-Driver or Diner Turnoff?

3 Min Read By Jana Zschieschang

Faced with rising labor costs and increasingly price-sensitive customers, restaurant brands are exploring new ways to balance profitability with consumer expectations. One of the most debated strategies is dynamic pricing, which adjusts based on demand and other variables.

Although dynamic pricing is a staple in industries like travel and hospitality, its application in fast food is uncharted territory. Recent experiments with pricing strategies, such as summer value promotions, yielded lukewarm results, leaving operators questioning the best approach to menu pricing.

To illuminate the topic, Revenue Management Solutions leveraged its proprietary eye-tracking technology and decades of menu engineering expertise to understand consumer reactions. The findings reveal critical insights into how dynamic pricing impacts customer behavior and what strategies might retain loyalty in a competitive market.

The Psychology of Pricing

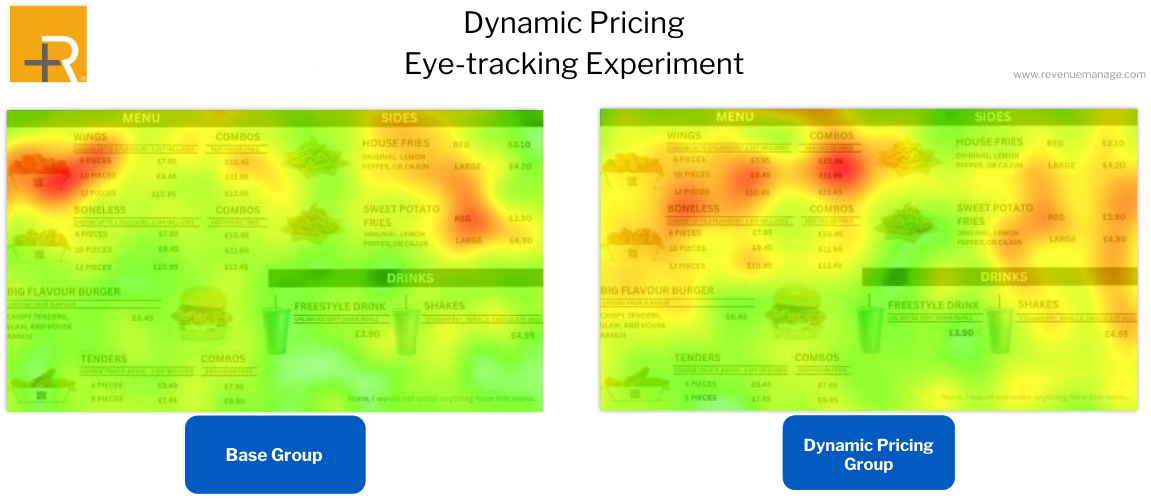

RMS conducted a behavioral study using eye-tracking technology with 260 UK and US participants to determine how customers make dining decisions if they suspect dynamic pricing.

Participants were split into two groups: one primed with questions about past airline ticket purchases (dynamic pricing context) and the other with general questions about a past vacation (control). They were asked to place an order from an online restaurant.

Key Study Insights

As participants placed orders from identical menus, RMS used eye-tracking technology to track where they focused. Results were assessed using heat maps and the participant’s order. RMS found:

● Price Focus: The dynamic pricing group spent more time evaluating prices.

● Lower Spend: The dynamic pricing group ordered less expensive items, chose smaller portions, and spent an average of 3% less.

● Perception: Anticipating price variability made consumers feel less fairly treated.

In a similar “perception-versus-reality” scenario, 74 percent of our latest consumer survey respondents believed they were paying more for restaurant food — despite a slowdown in price increases in 2024. As a result, they are overwhelmingly dining out less across all restaurant segments.

Strategies for Effective Price Differentiation

So, how can restaurants improve profit from price differentiation without triggering negative consumer emotions? Here are three key strategies:

1. Reframe the consumer perspective from loss to gain. Happy hours make customers happy. When brands promote low prices, they remove friction — aligning with the psychological principle that people are more motivated by avoiding losses than achieving wins.

Notes RMS Managing Director of Europe Philipp Laqué, “Avoiding perceived unfair pricing can transform customer hesitation into loyalty and profit.”

2. Reinterpret “value” as “valued.” Customers’ perception of value changes their willingness to pay for an item (price sensitivity). They are willing to “treat themselves” to an elevated experience that leaves them feeling valued.

● A guest is far less price sensitive when a product is considered “premium” versus non-premium. Adding premium components to standard items, such as truffle sauce to fries or avocado and bacon to a cheese sandwich, improves the value equation. Customers are more likely to justify a higher price that is also higher than the added cost of the extra ingredient.

● Different occasions (a quick office lunch vs. a sit-down family dinner) influence willingness to pay. If you visit a casual dining pizza chain near your office, you expect fast service and a good pizza at a consistent and affordable price. Visit the same brand at a location near home with family, and customers are willing to pay more for the same menu if they are treated to family-friendly service or extras for their children.

3. Implement location-based price differentiation. Regional-based pricing strategies have more significant gains than across-the-board menu price increases. Consider:

● Restaurant operators maintaining one price point across all locations recognize a mere 65 percent of the potential gross profit benefit from price increases.

● Grouping restaurants with similar characteristics and having multiple price points improves the flow-thru to 85 percent.

● Building restaurant-specific price strategies can boost efficiency to almost 100 percent.

Looking Ahead to 2025

Despite declining restaurant traffic, lackluster sales growth and softening demand, customers still want the restaurant experience – if it meets their expectations. In 2025, focusing on regional, daypart and sales channel data, while prioritizing customer trust, can turn the fear of loss into a golden opportunity for profits and lasting loyalty.