Couch to Table: Adapting to New Consumer Habits

4 Min Read By Rosie Atkins

It’s the weekend. Time to head out to a restaurant for date night, or a meal with family and friends, right? You’d think so.

Weekend dinner reservations are hard to come by, and that hot new place in town has a line snaking down the block.

This must mean that business is booming, right? The answer is complicated. Data shows that traffic and revenue in many segments in the restaurant industry is flat or even down.

So where have the diners gone?

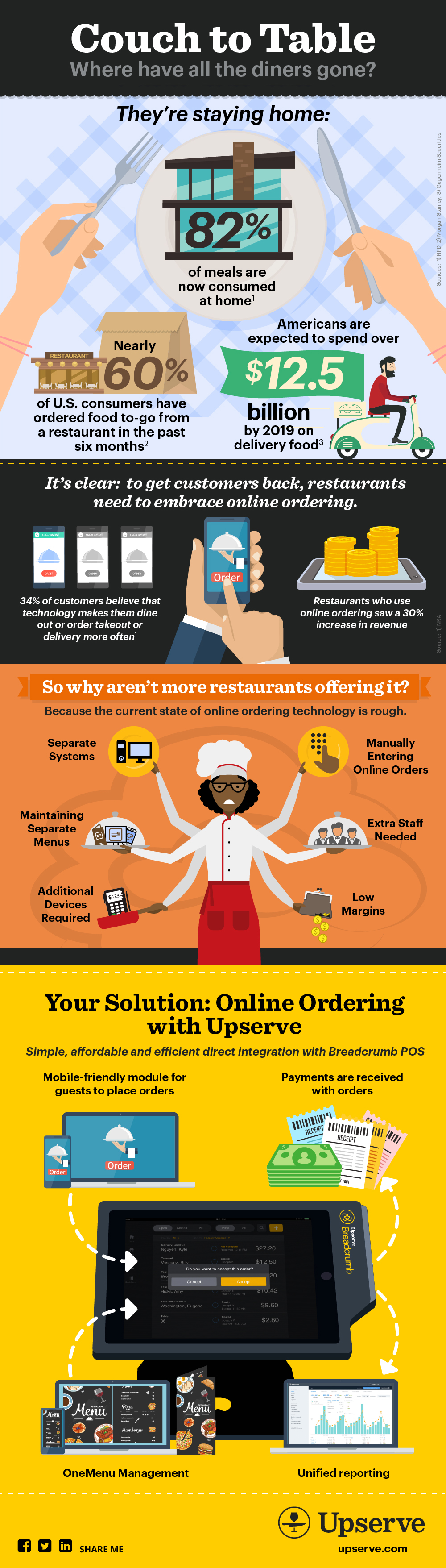

- They’re staying home: 82 percent of meals are now consumed at home (NPD Group). This represents an upward trend that is validated by the fact that restaurant foot traffic has been basically flat since 2009.

- They’re trying to save money: 75 percent of respondents to an NPD group survey said they are eating out less, with many citing prices as a reason.

- They’re learning how to cook: Meal Kit services (Hello Fresh, Blue Apron, etc) are currently a $400M market and are expected to increase tenfold in the next five years (Technomic). Despite market consolidation, funding is still flowing to these companies, including a $32M Series A to Habit, among others (CB Insights).

A reasonable restaurant owner might look at this data and be discouraged, but there is also data that presents the opportunity that lies in the stay at home habit.

- 61 percent of casual and fast casual restaurant transactions are take out.

- By 2019, Americans are expected to spend over $12.5 billion on delivery food.

- And finally, online ordering is expected by more than double to 58 percent over the next three years.

But the opportunity may not be that simple. There are some strong arguments against this strategy. The most well-founded is the difficulty of online ordering fulfillment process. For diners, delivery is simpler than ever: find the menu, click, pay and wait for your meal to turn up at your door.

The same is not true from the restaurant side of things. It’s an expensive, time consuming and distracting endeavor to receive and fulfill orders. We’ve all seen the busy host at the front of the house frantically entering orders into the point of sale (POS) while real-life diners wait. It’s no wonder that many in our industry view takeout and delivery as an opportunity cost rather than an a pure opportunity. Let’s break it down.

- Menu Management. WIth fragmented sources of orders – from aggregators like GrubHub and Caviar to branded online ordering platforms – restaurants are required to maintain many versions of their menu. This means multiple logins, time consuming updates, and even incoming orders for items that are 86ed, mis-priced or even off the menu.

- Transcription. When an order comes in, the restaurant must transcribe the order into the POS: this can take up to 90 seconds per order. This can require additional labor to meet demand, eroding margins even further. It also increases the likelihood of introducing mistakes into the order.

- Tech Clutter. Many online ordering services come with a dedicated tablet to receive orders. Restaurants that skip the tablet, must grapple with fax or emailed orders.

- Expense. Each platform comes with a cost. If you want to skip the fees and stand up your own e-commerce, the ROI on such an investment can be elusive.

It’s no wonder some restaurants see more cost than opportunity.

But ignoring the diner desire can be perilous. Data shows that restaurants using online ordering have seen a 30 percent increase in their revenue. And new solutions are starting to come onto the market that streamline the operational overhead associated with takeout and delivery. For instance, we just completed an integration between Breadcrumb POS by Upserve and Grubhub (and Seamless).

Data shows that restaurants using online ordering have seen a 30 percent increase in their revenue.

Our customers immediately embraced the concept. With one place to manage the menu, orders that flow directly into the POS, and integrated kitchen printer logic — overhead is reduced, mistakes are eliminated and throughput increases. Within days of going live, one of our customers opened up online ordering during his lunch rush. He’d previously only taken orders during shoulder times because he considered them a distraction.

The best technologies are those that truly understand the restaurant’s needs, opportunities and true work flows. This usually means integration directly into a restaurant’s POS, which is the operational heartbeat of the business. With the POS as the central technology, orders, customer information, and operational analytics become more efficient, more accurate and more useful.

This is why we see restaurants sprinting to new mobile and cloud-based software to manage their businesses. These solutions are less expensive, more agile and more attractive than the outdated, Windows-driven technology that has traditionally been the go-to for restaurants. These solutions also offer a future that promises to integrate best-in-class solutions, including inventory, labor, online ordering and accounting.

Most restaurants are independent operations with fewer than 50 employees. One could argue that our industry represents one of the last true guilds in America. A guild centered on hospitality, not technology. The most successful operations understand this, but they also understand that technology that supports hospitality is critical. They don’t want to be IT experts, but they do want technology that can quickly adapt to market indicators and changing diner behavior.

For those of us in the technical corner of the guild, it means solving the problem while staying out of the way so that our customers can focus on delivering great experiences to their guests whether they’re at the table or on the couch.

The diner’s definition of what it means to dine at – or from – a restaurant may be changing, but that doesn’t have to mean disaster for restaurants. Smart owners will evolve along with their diners, and embrace the “couch to table” trend as a way to grow revenue, win new loyalties and maintain their place in their guests hearts and stomachs.