Consumers Are Trading Down. Here’s How to Prevent Trade-Out

3 Min Read By Jana Zschieschang

What’s the saying? You can’t get blood from a turnip? Today’s restaurant guests are certainly an example. There’s only so much wiggle room in their discretionary incomes and it’s showing up in decreasing basket size and check. Based on our most recent QSR sales and traffic data, we can tell from decreases in traffic and basket size that we’re at an inflationary tipping point. In our April 2022 monthly industry impact report, QSR sales in the US are flat at 0.2 percent in Q1 2022 compared to the same quarter last year.

For more on this, click here.

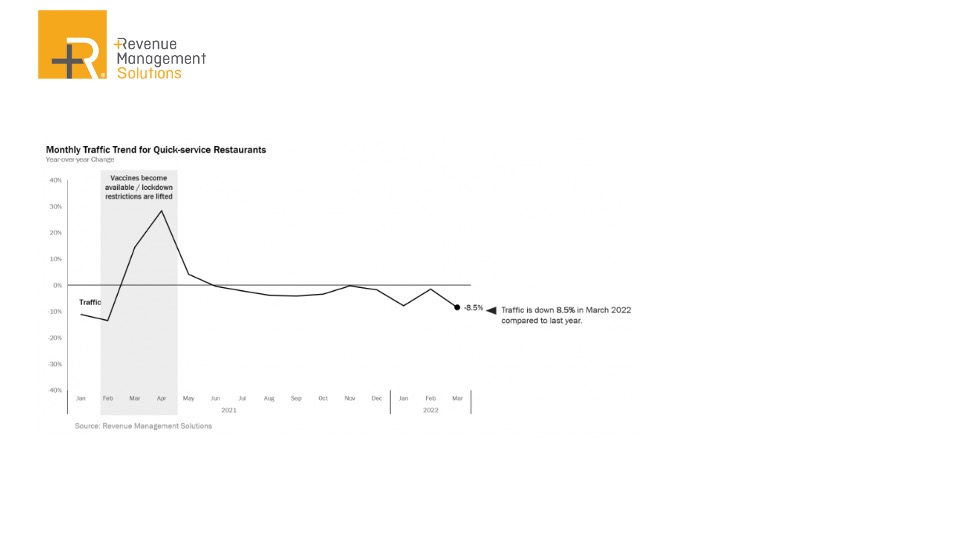

Our data shows QSRs have struggled to regain traffic since the second half of 2021. And as we examine Q1 2022, we see that QSR performance continues to lag. In March 2022, traffic was down -8.5 percent compared to March 2021. For the quarter, traffic was down -6.3 percent.

When we look at traffic by daypart, lunch and dinner were down by about -3 percent. Even breakfast, which was trending upward throughout 2021, has…

Sorry, You've Reached Your Article Limit.

Register for free with our site to get unlimited articles.

Already registered? Sign in!