Check, Please… or Just Check Out? How Grocery and Convenience Stores Are Eating Into Restaurant Market Share

3 Min Read By Jana Zschieschang

The restaurant industry's competitive landscape for mealtime dollars is changing fast, and it's no longer brand against brand. Increasingly, grocery and convenience stores are stealing share by offering quick, affordable, and increasingly high-quality meal options.

In Revenue Management Solutions' (RMS) recent consumer report, Check, Please or Check Out, 24 percent of surveyed diners say they buy meals from grocery stores more frequently than a year ago. This represents a larger increase than those increasing visits to fast-casual (14 percent) or full-service (11 percent) restaurants and is on par with those visiting QSRs more frequently (24 percent) (RMS Q1 2025 Dining report). The 2,000 U.S. consumers surveyed also hit up convenience stores for meals 15 percent more often than in the past.

The findings reinforce a key truth: value and convenience drive decisions and restaurant operators must respond or risk losing ground.

The Rise of the Retail Meal

When asked about their primary motivation for increasing their purchases, respondents reported value for the money and ease.

Grocery and c-store competitors recognized the opportunity. Pre-packaged meals, made-to-order sandwiches, fresh salads, and even hot food bars are no longer afterthoughts—they're part of a growing meal strategy. Consider Buc-ee's, the Texas-based gas station chain whose food selection is so popular that it inspires resale markets and fan pages. Customers spend a remarkable 21 minutes on average in its stores, according to The Hustle, indicating that Buc-ee's offers an experience, not just a super-sized drink for the road.

What's at Stake for Restaurants?

While our Q1 survey found some diners were visiting QSRs more frequently, nearly 40 percent across generations said they were spending less at those restaurants. This suggests that while traffic may not have entirely dropped off, customers are reevaluating the value equation.

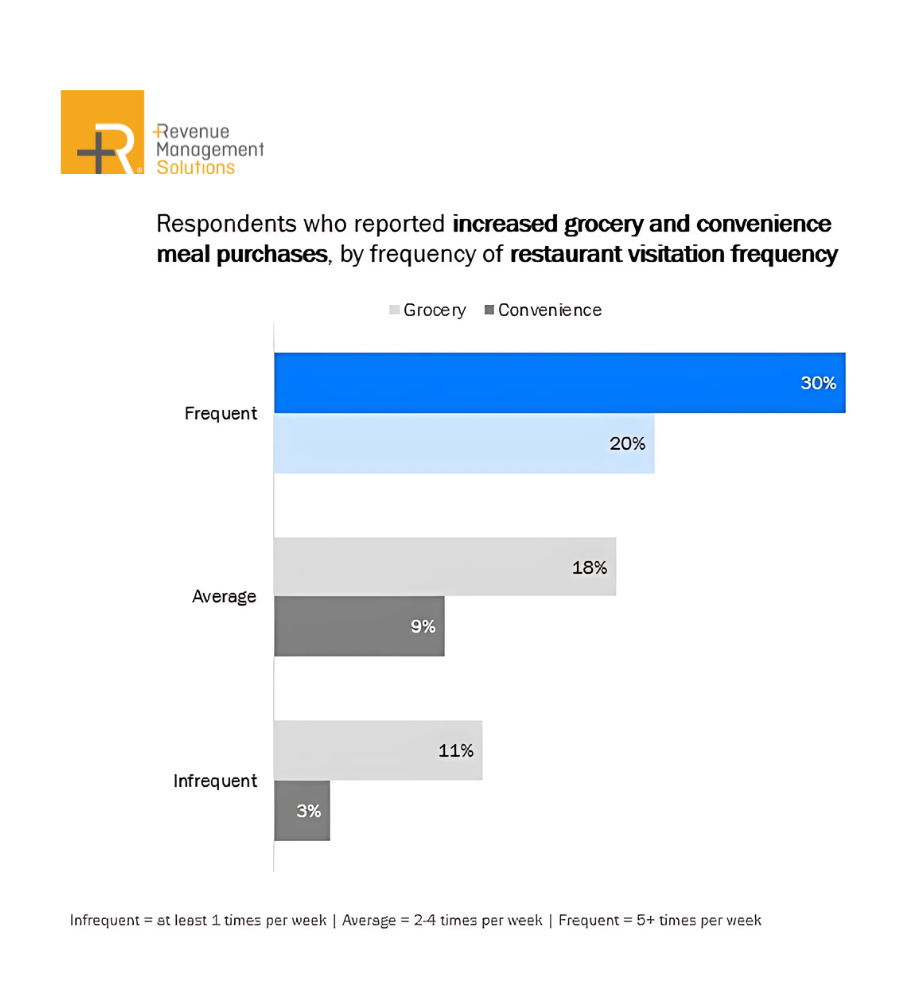

Even more concerning, high-frequency restaurant users, those eating out five or more times a week, were the most likely to increase their grocery and convenience store meal purchases. That means restaurants are losing more than just the occasional diner; they're losing their core customers.

Adding pressure, price perceptions remain high. Almost four out of five RMS respondents feel restaurant and grocery prices have increased compared to the previous month. Data from the U.S. Bureau of Labor Statistics shows restaurant price increases continue to outpace grocery inflation. In a time of economic tension, the perception of a better deal, even by a dollar or two, can easily tip the scales.

Lessons from the Aisles

Retailers aren't just offering convenience; they are enhancing the experience. Sheetz plans to open 60+ made-to-order food stores in Michigan, while 7-Eleven is expanding food-focused formats across North America. These brands are flipping a page from the restaurant playbook with faster service, less overhead, and, often, lower prices.

To compete, restaurants must rethink their approach. This includes:

- Reexamine the Value Equation:

With 40 percent of all respondents saying they're spending less on dining out, restaurants must clearly demonstrate the value behind every menu item. That doesn't always mean lower prices. Portion size, quality ingredients, bundled deals, or loyalty rewards can reinforce perceived value. - Streamline the Customer Journey:

Operators can learn a lot from the convenience of convenience stores. While full table service remains a differentiator, restaurants should also evaluate friction points in ordering, pickup, or drive-thru experiences. RMS' Price Studio and other AI-powered tools can help identify where efficiencies might increase margins and guest satisfaction. - Pay Attention to Meal Types and Formats:

RMS found that the top grocery meal purchases are frozen meals, beverages and ready-to-eat items. Restaurants can compete by offering flexible, portable or refrigerated take-home options that meet the same "grab-and-go" need while delivering restaurant-quality taste. - Know Your Most At-Risk Guests:

RMS data shows that frequent restaurant users are the most likely to increase their grocery and convenience store visits, and Gen Z and millennials are especially drawn to these stores. That's a red flag for operators. Your most loyal and likely customers may be quietly drifting toward competitors. Targeted promotions, personalized offers, or loyalty perks may help pull these customer types back.

What's Next?

As retail options enter the race, operators should remember this isn't just a price war. It's a call to redefine value. For restaurants, that means asking: What can we offer that retail can't? And how do we communicate that clearly to a cost-conscious, convenience-driven customer?