According to a Recent Study/Survey … Midyear 2017 Edition

37 Min Read By MRM Staff

Isn’t 2017 just flying by? This midyear edition of Modern Restaurant Management (MRM) magazine’s research round-up features news on restaurant lines, food waste, berry lovers, hot dog topping topics and the rise of gastromic tourism.

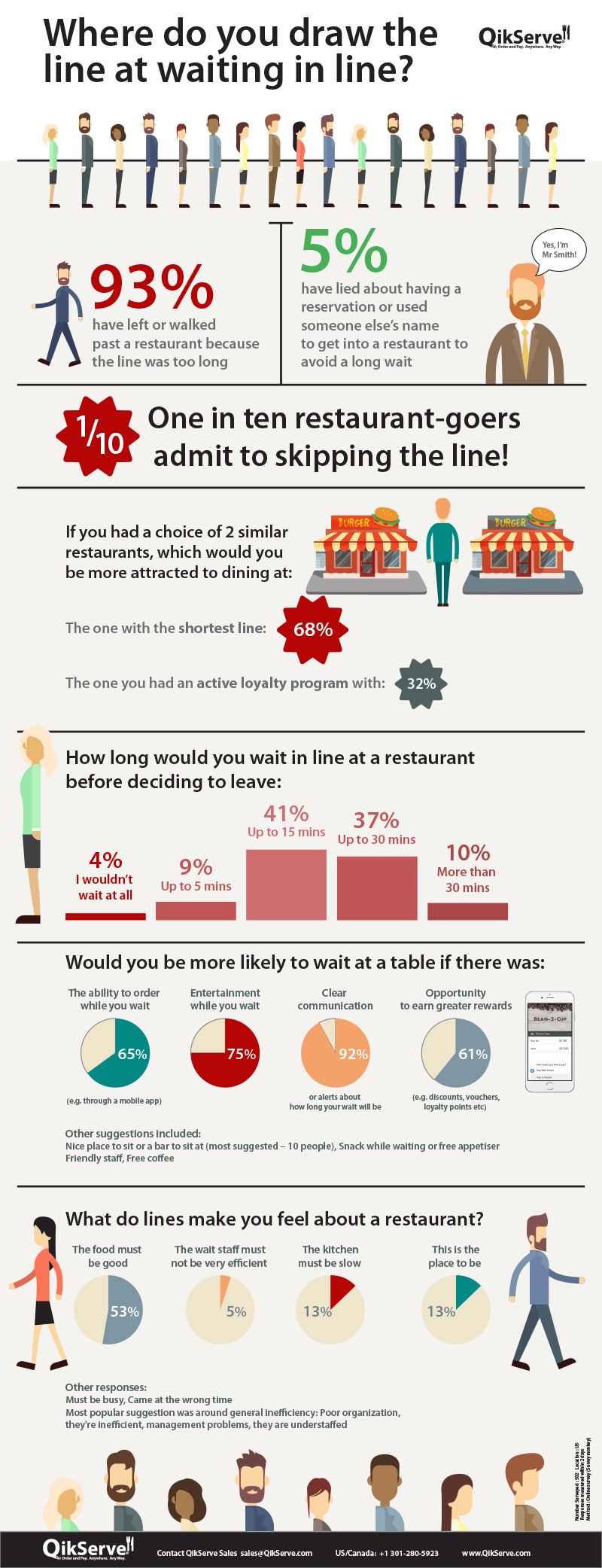

Line in Wait

A survey of U.S. consumers has found that one in ten people have “knowingly jumped ahead in a line for a restaurant or café to avoid a long wait”. The survey was conducted by QikServe.

The survey found, perhaps unsurprisingly, that 93 percent of consumers have left or simply walked past a restaurant due to long lines. But one in twenty respondents to the survey also admitted that they had “lied about having a reservation or used someone else’s name to get into a restaurant to avoid a long wait.”

Two-thirds of respondents felt that they would be more inclined to wait if restaurants provided the ability to order via an app while they waited. A majority also felt that would wait if restaurants provided entertainment while they wait, clear communication or alerts about how long their wait will be, or an opportunity to earn greater loyalty rewards.

“We expected to find that most people would avoid a restaurant due to long lines, but we didn’t think that so many people would adopt tactics such as cutting in line or even more deceptive tactics to beat the line up,” said Daniel Rodgers, CEO, QikServe. “This really drives home the fact that society is becoming less and less tolerant of waiting for their food and drinks, and that hospitality operators need to seriously consider how to reduce waiting times by offering more convenient and varied options for ordering and payment.”

Another interesting question revealed that, although a majority of respondents would usually pick restaurants with shorter lines, a third of people would potentially choose a restaurant with a longer wait if they had an active loyalty program there.

“This tells us that hospitality businesses should explore options for improving loyalty and ordering convenience to ensure they cater to the full range of consumer expectations,” added Rodgers.

To see the full survey results, click here.

Food Waste on the Brain

Waste not, want not. Or so the cliché goes.

But whether it’s parents admonishing children to clean their plates or commercial food enterprises extracting maximum output from the plants and animals that comprise the food supply, there’s a renewed sensitivity to issues of food waste and sustainability. That’s the clear conclusion of a new nationwide survey from Coast Packing Company and Ipsos Research, conducted in mid-June among more than 1,000 consumers.

Each year, U.S. consumers, businesses and farms spend nearly $220 billion on food that goes uneaten, according to Food Business News. Of the 63 million tons of food wasted annually, 16 percent occurs at farms, 2 percent at manufacturers, 40 percent at consumer-facing businesses and 43 percent in consumer homes. Food waste accounts for 21 percent of all fresh water used in the U.S. and occupies 21 percent of landfill volume. Coast Packing, the largest supplier of animal fat shortenings in the Western U.S., queried consumers on whether attitudes around food waste, sustainability and the importance of minimally processed food have changed over the last five years.

When compared with the population as a whole, younger respondents and women tended to be more concerned about sustainability, food waste and minimally processed food than they were five years ago. The overall percentages of being “more involved” in these issues were significantly higher than the incidence of being “less involved.” Some 42 percent of the sample said they were more interested in minimally processed food today than they were five years ago. Interest in minimally processed food was highest among four demographic segments: women (46 percent), millennials (43 percent), Midwesterners (47 percent) and those with a college education (46 percent). On the issue of food waste, women, millennials and Midwesterners expressed the highest levels of concern (36 to 37 percent) vs. five years ago. In the area of sustainability, women and millennials likewise showed a similar high level of concern (37 to 38 percent).

With nose-to-tail dining growing in popularity – in part in response to concerns about food waste and sustainability – the Coast/Ipsos survey also asked consumers which parts of a cow they were open to eating: bone marrow, fat (in the form of suet or tallow), heart, kidneys, liver, sweetbreads (pancreas/thymus), testicles, tongue and tripe (stomach). Liver (27 percent) and tongue (23 percent) topped the list; sweetbreads (11 percent) and testicles (7 percent) were least popular.

According to the survey, men and college educated respondents are consistently more adventurous eaters. Perhaps not surprisingly, older folks (those 55 and above) are more open to liver than younger consumers. While a greater number of respondents indicated that they are less likely to engage in nose-to-tail consumption than those who expressed a likelihood of doing so, the various parts of the cow do have their fans, especially heart (18 percent) bone marrow (17 percent) and kidney (14 percent). Millennials and those 55+ indicated a relatively greater openness to consuming beef tallow and suet.

“As a supporter of sustainable agriculture and nose-to-tail cooking, Coast Packing ensures that no part of the animal is wasted,” said Eric R. Gustafson, CEO, Coast Packing. “Why burn more rainforest to grow palms for palm oil when we can use already available, minimally processed animal fat instead? We’re heartened by the survey’s finding that concerns about food waste and sustainability are growing, and we’re especially pleased that a substantial number of consumers are more interested in minimally processed food than was the case five years ago.”

Restaurant Projections

The National Restaurant Association projects that the restaurant-industry sales will reach $798.7 billion in 2017, or gain a 4.3 percent over the industry’s estimated sales of $766 billion in 2016. A gradually improving economy will help the restaurant market sales to grow further in 2017, even as restaurant operators face continued margin pressures, a tightening labor market and some lingering consumer uncertainty.

The Association also projects that the restaurant industry’s workforce will grow slightly to 14.7 million in 2017. Restaurants will remain the nation’s second-largest private-sector employer, providing jobs and careers for about one in 10 working Americans.

Table service remains the largest segment in the industry, but quick service sales growth rate will be higher. Food and beverage sales in the table service-restaurant segment are projected to reach $263.0 billion in 2017, or up 3.5 percent from 2016. Quick service and fast-casual sales are expected to total$233.7 billion in 2017, or a 5.3 percent gain over 2016’s sales volume.

Product Recall Anger

A product recall can cost a company millions of dollars, not including lost sales and damage to brand reputation. A new survey commissioned by Marketpoint Recall, and conducted online by Harris Poll among 2,081 U.S. adults aged 18 and older, examines Americans’ views on company crises and product recalls. The study found that 85 percent of Americans would get angry when a company has a crisis or issues a product recall.

How a company handles a crisis or recall can also impact public opinion extensively. The study revealed that in the event of a crisis or recall, over 3 in 5 Americans say a slow response time from a company to correct the recall or a refusal to acknowledge that there is a crisis would make them angry (63 percent for both). Additionally, 60 percent of Americans said a lack of communication from the company to consumers would make them angry.

“When a company isn’t prepared for a recall or crisis scenario, it escalates the problem tenfold, not only harming the brand’s image, but negatively impacting customer loyalty,” said Peter Gillett, managing director, Marketpoint Recall. “Our survey revealed that if a company takes too long to address an issue, or doesn’t have the proper tools to communicate with customers around the globe, it risks damage beyond repair. In order to calm and reassure customers, quick and clear communication is essential.”

Americans also cited the following issues involving a crisis or product recall that would make them angry:

- Language barrier between the company and consumers (i.e. company correspondents/call centers don’t speak English) (32 percent)

- Infrequent status updates on the recall (30 percent)

- Company’s lack of activity on social media (11 percent)

Having a plan in place, along with access to global communication channels is vital for a business to survive and thrive after a crisis or recall. Marketpoint Recall offers the tools, expertise and a centrally managed team to guide businesses through emergency situations. Marketpoint Recall’s START Program establishes a central team and processes, and briefs executives to ensure they are ready for a potential crisis. This survey was conducted online within the United States by Harris Poll on behalf of Marketpoint Recall from June 16-20, 2017 among 2,081 adults ages 18 and older.

Very Berry in Love

Life is sweeter when sharing the berry joy! Driscoll’s, the leading brand of fresh, delicious berries, has unveiled the top 10 berry-loving metropolitan areas in the U.S.

Boston, Hartford-New Haven and Minneapolis-St. Paul claimed the top three most berry-adoring markets in the country, according to syndicated category data reported by The Nielsen Company* and based upon the highest weekly store sales of fresh strawberries, raspberries, blueberries and blackberries. The Twin Cities also emerged as the raspberry consumption capital of the U.S., with families enjoying 132 percent more fresh raspberries per household than the national average annually.

Consumers within these top 10 berry-loving markets, including Cincinnati, Philadelphia, Buffalo/Rochester, Denver, and New York City among others, consume nearly 400 million pounds of fresh berries, or more than 25 percent of America’s total berry consumption.

With national retail sales for all fresh berries continuing to grow at 7.6 percent and leading all produce category sales over the past five years, Americans continue to discover the berry joy.

Very Dairy in Love

Dairy foods are a core and cherished part of the American diet. Even as non-dairy alternatives expand into new territories, so do the animal milk-based originals, according to market research firm Packaged Facts in the report 2017 Forecast: Culinary Trend Tracking Series.

Packaged Facts forecasts that in the months and years ahead, consumers will gravitate to products that display the wholesome characteristics of dairy, such as cultures and connections to animal welfare and farming traditions—elements that point to safety, nutrition, and sustainable food production.

Consumers will also continue snacking on dairy foods that provide protein, calcium, and probiotics to promote good health. To that end, more savory options will beckon from the dairy case, calling out to be eaten at any time of day and to be paired with salads, sandwiches, meat snacks, and savory munchies. Packaging promoting portability and portion control will make our busy lives easier, and allow for more convenient access to these healthful dairy foods.

With increased consumption also comes a broader array of flavors and styles of dairy foods, meeting today’s mandatory call for flavor adventure in every daypart, from breakfast to snacking, treating to entertaining.

On that note, here are five of Packaged Facts’ key insights for inspiring consumers when purchasing and cooking with dairy:

- Leverage dairy foods’ heritage to connect with consumers seeking traditional, old-fashioned and authentic-feeling experiences with full-fat cultured dairy.

- Explore more savory flavors for dairy products that are positioned and packaged for snacking or mini-meals.

- Support consumers’ seeking to experiment in the kitchen with flavored butter or cheese with recipe resources, video clip series. Culinary experts as educators, like celebrity chefs or popular cooking authorities, will inspire consumers.

- More foods are going portable to be eaten away from home; what products can be packaged for easy access, grab and go, or airline travel? Three-ounce package sizes of cheese, cottage cheese or skyr are great for planes.

- Dairy foods add a wholesome and nutritious angle when baked or cooked into other foods. For instance, call out the notable dairy additions loud and clear in sweet baked goods, cookies, snack cakes and bread. Name farms or regions of sources, and indicate nutrients from dairy ingredients.

‘Will Fly for Food’

OpenTable announced the findings of its “Will Fly for Food” survey, pointing to growing interest among Americans in culinary travel. According to the survey, two-thirds (66 percent) of Americans would select a travel destination based solely on its culinary offerings, while more than half (52 percent) have already traveled to the country of origin of their favorite cuisine.

“Americans are redefining their travel bucket lists not by where they want to go, but by what they want to eat,” said Caroline Potter, Chief Dining Officer, OpenTable. “While traveling, they’re also not afraid to experiment with local cuisine, and make more adventurous dining decisions.”

“When in Rome” – An Appetite for Authentic and Local

Travelers are experiencing leisure destinations via their palate, with a majority (58 percent) “significantly” associating a destination’s culture with its culinary scene and dining customs. When deciding on where to dine, nearly 8 in 10 (78 percent) Americans prioritize restaurants that offer “authentic, local flavors.” Further underscoring a strong desire to dine like the locals do, fifty-two percent of Americans say they’ve flown to the country of origin of their favorite cuisine, and nearly 9 in 10 (87 percent) admit they feel more inclined to make adventurous ordering decisions while traveling for leisure.

Dream Dining Destinations – A Top 10 Look

Vacation planning is not something Americans take lightly, especially when it comes to food. An impressive three-fourths (75 percent) of Americans have booked a reservation in advance of a leisure trip. As far as where they’d like to book their next dream foodie trip, the beloved “City of Lights” – Paris, France – takes top prize, followed closely by Florence, Italy. Rounding out the top five dream dining destinations are Barcelona, Spain; New Orleans, Louisiana; and New York, New York.

The top 10 dream dining destinations cited by American diners in rank order are:

Paris

Florence

Barcelona

New Orleans

New York City

Tokyo

Bangkok

San Francisco

Madrid

Chicago

Culinary Passport – 25 Fly to Try Dishes

Just in time for summer travel, OpenTable has curated a list of must-try dishes from dining destinations from around the globe. Those hoping to stamp their culinary passport with new and exciting “dish-tinations” this season might find the below well worth the flight:

Bangkok – Coconut and turmeric curry of blue swimmer crab at Nahm

Chicago – Spinach margherita deep dish pizza at Gino’s East

Chicago – Spinach margherita deep dish pizza at Gino’s East

Dublin – Whole split lobster at Lobstar

Florence – Tagliatelle al sugo at Trattoria Sabatino

Guanacaste – Trilingual ceviche at HiR Fine Dining

Hong Kong – Sunday brunch dim sum at Duddell’s

London – Sunday roast at Roast

London – Meat fruit at Dinner by Heston Blumenthal

London – Afternoon tea at Fortnum & Mason Diamond Jubilee Tea Salon

Los Angeles – Zucchini lasagna at Plant Food + Wine

Madrid – Jamón joselito at TATEL Madrid

Melbourne – Sticky pork belly at Red Spice Road

Mexico City – Mole madre at Pujol

Munich – White sausage and pretzel at Wirtshaus zum Straubinger

Montreal – Disco poutine at Deville Dinebar

New Orleans – Oyster po’boy at Emeril’s New Orleans

New York City – Porterhouse steak at Keens Steakhouse

Oranjestad – Scallops tempura at The Kitchen Table by White

Paris – Steak frites at Le Relais de l’Entrecote

San Francisco – Roast chicken with bread salad at Zuni Cafe

Shanghai – Double boiled fish maw soup, crab claw, sea whelk in coconut at Jin Xuan

Singapore – Beef buah keluak at Candlenut

Sydney – Wood-roasted moran family lamb at CHISWICK

Tokyo – Kobo rainbow sushi at Itamae Sushi Edo

Vancouver – Chilled seafood platter at COAST

The survey was conducted online by more than 3,400 OpenTable diners aged 18 and older across the US from April 14 through May 16, 2017.

More on Culinary Destinations

According to new research commissioned by Booking.com, the global leader in connecting travellers with the widest choice of incredible places to stay, nearly three quarters (69 percent) of Canadians would travel somewhere known for its food and drink. With the joy of trying local delicacies often becoming one of the highlights of any trip, it’s clear Canadians have developed this taste for travel.

So, which destinations should be top of mind for those looking to sip, savour and sample their way through their next vacation? According to over 118 million real reviews from global travellers on Booking.com, the top Canadian cities for a salivating gastronomic experience are Vancouver, with its west coast charm and healthy treats, followed by the flavourful Quebecois cuisine ofMontreal and thirdly the Nova Scotia Capital of Halifax, known for its fresh seafood and award-winning wines.

Top five cities in Canada endorsed for food

- Vancouver

- Montreal

- Halifax

- Winnipeg

- Toronto

Globally, Asian and South American flavours were favourites in the top ten foodie destinations, with Greece, Australia and Spain not far behind[iii]. Hong Kong, with its famous dim sum, Sao Paulo with Brazilian barbeque and Tokyo, whose restaurants have accrued more Michelin stars than New York and Pariscombined[iv], top the list.

Top 25 cities globally endorsed for food by Booking.com travellers

- Hong Kong, Hong Kong

- Sao Paulo, Brazil

- Tokyo, Japan

- Athens, Greece

- Kuala Lumpur, Malaysia

- Melbourne, Australia

- Bangkok, Thailand

- Granada, Spain

- Las Vegas, USA

- Buenos Aires, Argentina

- Singapore, Singapore

- Warsaw, Poland

- Porto, Portugal

- Valencia, Spain

- Florence, Italy

- Milan, Italy

- Sydney, Australia

- Krakow, Poland

- Istanbul, Turkey

- Lisbon, Portugal

- Munich, Germany

- Copenhagen, Denmark

- Seville, Spain

- Brussels, Belgium

- Rome, Italy

Gastronomic tourism

In the last year, almost one in ten (eight percent) people have travelled to fulfil their hobby of fine dining and seven percent for their passion for wine. However, with 79 percent of travellers between the ages of 18 and 34 considering travelling somewhere that’s specifically known for its gastronomic delights[v], it seems globally millennials are leading the way for gastronomic tourism. In fact, one in ten have combined their love of street food with travelling, compared to only four percent of those travellers aged over 55[vi].

Pepijn Rijvers, Chief Marketing Officer at Booking.com commented,”Culinary travel is an ever-growing trend, with travellers planning trips centred on taste-inspired exploration and seeking to fully immerse themselves in the local culture, of which food plays a huge part. Not only are people looking for luxury gastronomic experiences, but also sampling local and street food.

Consumer Food Trends Drive Need for Better, Healthier Food Solutions

D In a recent Harris Poll study, 64 percent of American consumers reported that they try to eat healthier on any given day,1 showing they are increasingly aware of their eating habits, according to Dow Food Solutions.

As consumers become more conscious of their diet, they have begun looking for alternative food options including vegetarian and gluten-free options. The study found that more than 70 percent of American consumers consider plant-based proteins healthy,2 echoing the growing trend of vegetarian and vegan diets. In addition, one in five Americans now actively try to include gluten-free foods in their diet.3

“Major companies are continuing their efforts to reinvent themselves by providing healthier food options,” said Chris Spontelli, North America marketing manager, Dow Food, Pharma & Medical. “Our WELLENCETM portfolio meets these food industry trends to help manufacturers and brand owners create the products for which consumers are asking.”

Americans are also reducing fat in their diets, with 47 percent of respondents reporting that they try to avoid consuming fat.4 Over 60 percent of Americans have been cutting back on foods higher in saturated fats for more than a year,5 and 33 percent of consumers would be more likely to buy a product if it includes a “low-fat” claim.6

Wine Love Grows

US demand for wine is forecast to reach 1.2 billion gallons in 2021, according to Wine: United States , a report recently released by Freedonia Focus Reports. Sparkling wine is expected to outpace other demand segments due to the popularity of bubbly beverages with millennials being introduced to the wine market.

Growth will be restrained by baby boomers dropping out of the wine market, as they are among the most valuable consumers of wine. Additionally, beer and distilled spirits represent major competition to wine, as they have lower price points and are more accessible to the average buyer.

The Importance of Loyalty

U.S. consumers hold 3.8 billion memberships in customer loyalty programs, according to the 2017 COLLOQUY Loyalty Census, featuring for the first time COLLOQUY’s traditional audit coupled with consumer survey research. The 3.8 billion tabulation shows that membership growth continues, but has slowed to 15 percent compared to the 26 percent growth rate achieved in the 2015 Census when total memberships were 3.3 billion.

“The membership growth slowdown signals the U.S. loyalty market is maturing and retailers need to up their game on how to attract and retain members within their loyalty programs,” said Melissa Fruend, LoyaltyOne Global Solutions partner and COLLOQUY Census author. “In order to improve loyalty marketing, brands must optimize the overall experience by creating more personalized and relevant experiences for their best customers.”

The new consumer survey research from the 2017 Census shows that 53 percent of U.S. consumers identified “easy to use” as the main reason for participating in a loyalty program, topping “gives me great discounts” (39 percent) and “easy to understand” (37 percent), among other reasons.

Conversely, the top reason given for abandoning a program was “it took too long to earn points or miles;” a concern cited by 57 percent of respondents.

Additionally, the COLLOQUY Census shows that 51 percent of Americans still trust loyalty programs with their personal information.

The latest COLLOQUY Census scratched beyond the surface and analyzed motivators that drive consumer loyalty behavior. The survey research shows that across all sectors the top motivator is, I love the brand, company, retailer or service – purely emotional.

In other key Census results, the retail sector accounts for 1.6 billion reward program memberships, making it the largest slice of the loyalty pie. The biggest driver for active participation within retail is that the program is “easy to understand.”

Notably, grocery program memberships dropped to 142 million, compared to 188 million in 2015, continuing a downward trend in three consecutive Census reports. The 24 percent decrease is due in part to mergers and acquisitions within the industry.

Memberships in the financial services sector continued an upward trend, rising to 664 million versus 578 million in 2015. Cash back incentives led the pack when respondents were asked why they participate in financial loyalty programs.

The travel and hospitality sector, covering airline and hotel programs, plus restaurant, car-rental, cruise line and gaming programs, accounts for 1.1 billion memberships, the 2017 Census shows.

One of the most dynamic loyalty sectors, identified as other/emerging, covers online-only offerings, entertainment, daily deals, point aggregators and card-linked offers. Census research shows U.S. consumers hold a total of 462 million memberships in these evolving programs, and this sector accounts for 12 percent of the U.S. loyalty market.

Understanding Consumer Behavior

In today’s highly competitive, omni-channel market, companies are realizing the path to success hinges on their ability to understand consumer behavior. Retailers and manufacturers can unlock significant competitive advantage by leveraging consumer insights to make category decisions and create localized merchandising assortments. The JDA Voice of the Category Manager survey, conducted by JDA Software Group, Inc., reveals findings from nearly 100 professionals responsible for category management and merchandising activity in North America. The report revealed that most companies lack the ability to mine and leverage important customer data, and are therefore failing to meet evolving shopping demands. As such, respondents indicated that their No. 1 investment priority in the next five years is big data and predictive analytics (41 percent), followed by investment in customer-driven data science (37 percent.)

“The fact that manufacturers and retailers plan to prioritize investment in big data and predictive analytics over the next five years is a true testament to the transformational impact that the modern shopper is having on these sectors,” said Todd McCourtie, senior director, solution strategy at JDA. “Companies are realizing that the path to success in today’s omni-channel market is to analyze and react to consumers’ preferences and behaviors, ultimately truly understanding how, why, and in which manner they wish to shop. Data-driven technologies can help companies make more informed localized merchandising decisions that, in turn, enhance the shopping experience for the customer and improve the brand’s bottom line.”

Driving consumer insights with data and analytics

Currently, companies have access to volumes of essential data about their customers’ shopping preferences and behaviors. Where companies fall short is in their ability to derive actionable insights from this mountain of consumer data. While respondents on average stated that they are somewhat successful in mining consumer data to generate usable insights (82 percent), less than one-fifth (17 percent) feel they are highly successful in their ability to leverage the data to derive actionable insights

In fact, when asked to identify which processes respondents felt they lacked the most proficiency in, nearly 70 percent indicated that they are most behind on leveraging predictive analytics for improved pricing and merchandising—two capabilities that are of paramount importance for sustained success in today’s customer-centric world. Additionally, nearly 60 percent of respondents claimed that they are also behind in leveraging geographic and socio-economic data for targeted promotions and offers.

For manufacturing and retail survey respondents looking to improve merchandising, pricing and promotional efforts, the top two behaviors they’d like to gain additional insight into were the modern shopper’s path to purchase (67 percent) and price sensitivity (53 percent.)

Localizing assortments to reach the modern shopper

The modern shopper has transformed the ways retailers and manufacturers operate and maintain profitability, as shoppers expect merchandise assortments to meet their needs from the first attempt. Survey respondents cited personalization and localization (68 percent) and increased development of digital technologies (62 percent) as the top two priorities they plan to implement within the next year to reach modern shoppers. Omni-channel retailing also remains a high priority, with nearly 60 percent of respondents citing it as one of their top two priorities.

Effective assortment localization is dependent on a company’s ability to identify the key product attributes that drive local preferences and demand in each category. The survey found that companies are best able to evaluate the success of their localization efforts by measuring an increase in sales (37 percent), increased visibility into stores (21 percent) and improved inventory levels (21 percent.)

Key investment priorities

With increased focus on localized assortments, technology investments are top of mind for both manufacturers and retailers. Unsurprisingly, the top two priorities driving the need for new technology solutions are automation as a means to do more with less, and consumer insights as a tool to support increased localization, dynamic pricing and improved merchandising.

Interestingly, from an investment perspective, respondents had varied opinions on which mobile technologies would be most beneficial to their business:

- 26 percent indicated augmented reality technology that provides shoppers with personalized information while shopping;

- 25 percent deemed the ability for customers to leverage beacon technology (Internet of Things) via mobile device for increased self-education on products;

- 21 percent identified in-store mapping for easy self-navigation around stores; and

- 19 percent believe location-based mobile coupons would be most beneficial.

Manufacturer vs. retailer point of view

Less than half of manufacturers and retailers feel they are successful in their ability to mine data to generate usable insights, though respondents from both sectors agree that there is more to be done when it comes to better understanding and addressing the needs of the modern shopper, and both groups have identified areas for improvement. For example, the majority of manufacturers surveyed (83 percent) see themselves lagging when it comes to leveraging predictive analytics for improved pricing and merchandising, whereas retailers report feeling behind on analyzing big data to recognize consumer preferences and demand trends (59 percent.) Both sectors agree that their ability to leverage geographic and socio-economic data for targeted promotions/offers could be improved, with 60 percent of manufacturers and 59 percent of retailers citing this as a weak spot. Further, both retailers and manufacturers cited path to purchase and price sensitivity as the top two behaviors they would like more insight into surrounding the modern shopper.

Additional interest in beacon technology and augmented reality was reported by respondents, though neither sector is planning to prioritize investment in these technologies in the next five years.

“Retailers and manufacturers that want to stay on top will need to be able to implement personalized localization at scale and with speed. While this will require some organizationwide changes to policies and procedures, as well as the adoption of technology solutions to help automate processes, it is a necessary evolution for those responsible for merchandising decisions. The success of a company’s merchandising strategy, both today and in the future, hinges on how companies leverage these data-driven insights to better serve the modern shopper’s ever-changing needs,” concluded McCourtie.

U.S. Pork Industry Expanding

Strong profitability and rising global demand create a strong incentive for U.S. pork processors to expand capacity. The impending increase in demand for hog supplies will create favorable terms for producers, while intensified competition among processors could lead to a short-term compression in packer margins, according to a new report from CoBank.

“U.S. pork packing capacity will increase eight to ten percent by mid-2019, when five processing facility construction projects are complete and fully operational,” said Trevor Amen, an economist with CoBank who specializes in animal protein. “Hog production is expected to increase two to four percent in both 2017 and 2018 to meet the demand for more supplies, with the bulk of the increased production coming from small to mid-size pork producers in the Midwest.”

Three new state-of-the-art pork processing facilities with the capacity to process more than 10,000 hogs per day are currently under construction. Two of the facilities are being built in Iowa and one in Michigan. Two smaller plants with daily capacities of less than 5,000 head are being renovated in Missouriand Minnesota.

“As each of the new projects comes online, hog supplies will adjust upward,” said Amen. “Transitional market conditions such as these typically come with increased price volatility over the short term, and bargaining leverage will shift in favor of producers as the expansion of hog supplies catches up with processing capacity.”

However, lean hog prices may soften until a new market equilibrium is established and an increase in exports fills the demand gap, added Amen.

Exports Will Play a Critical Role

The success of this substantial increase in processing capacity and hog production hinges largely on continued global demand for U.S. pork. While exports in 2017 are up 15 percent through April, total annual exports for the year are expected to increase five to eight percent, with an additional increase of three to six percent in 2018. Exports have been a boon to the industry, but the potential risk of export disruption carries severe consequences.

“Continued global demand for U.S. pork will be a critical factor as the market adjusts over the next two years,” said Amen. “Domestic consumer demand has been very strong and we expect that to continue. However, prospects for a further boost in domestic demand are limited. Therefore, export markets will have to absorb the production increases.” U.S. producer access to foreign markets will be critical to preventing a domestic supply glut as well as deterioration in margins for both producers and processors.

Processing Facility Upgrades to Continue

To remain competitive, processors must continuously upgrade or replace existing facilities to implement new technology, including automation and mechanisms that ensure compliance with stricter food safety standards.

“Historically, initial losses in new or expanded plants are inevitable and packer margins are typically narrower than pre-expansion,” said Amen. “But margins improve and normalize following the transition period and processors are better positioned with efficiency gains and an improved ability to customize production.”

Longer term pressure could persist for older plants as aging technology inhibits efficiency gains. Eventually, the cycle of replacing older infrastructure will reach its next phase and new investments take the place of retired capacity.

Dairy Alternatives Market

The report “Dairy Alternatives Market by Type (Soy, Almond, Coconut, Rice, Oat, Hemp), Formulation (Plain & Sweetened, Plain & Unsweetened, Flavored & Sweetened, Flavored & Unsweetened), Application (Food, Beverages), and Region – Global Forecast to 2022″, published by MarketsandMarkets™, the Dairy Alternatives Market was valued at USD 7.37 Billion in 2016. It is projected to grow at a CAGR of 11.7 percent from 2017, to reachUSD 14.36 Billion by 2022. The base year considered for this study is 2016, while the forecast period is from 2017 to 2022. The global Dairy Alternatives Market is expanding with considerable growth potential over the next five years. The growth of this market can be attributed to the growing inclination toward vegan, especially plant-based food, growing lactose intolerance among a large section of the population, and rising demand for various innovative dairy-free applications.

Soy milk estimated to be the largest segment, by type, in 2017

In terms of type, the soy segment is estimated to account for the largest share of the Dairy Alternatives Market in 2017. Soy milk and its products are experiencing steady demand in industrialized countries and occupy a significant share of the Dairy Alternatives Market, especially in Asia-Pacificregion. The popularity of soy milk can be attributed to the plethora of varieties, in terms of flavors, blends, fat content, and formulations offered by leading dairy alternative manufacturers. The rising awareness about the nutritional benefits of soy-based products, along with their easy availability, is driving the soy milk market growth. In addition to being lactose- & cholesterol-free, soy milk is also a good source of essential amino acids (high-quality protein), potassium, fiber, and B vitamins which are required for growth. Overall, the market for plant-based dairy alternatives has witnessed significant growth in the last couple of years, due to a steady decline in the consumption of cow milk.

Flavored & sweetened is estimated to be the largest segment in 2017

The flavored & sweetened segment is estimated to account for the largest share of the Dairy Alternatives Market, in terms of value, in 2017. Flavored & sweetened dairy alternatives such as dairy-free yogurt, milk, and frozen dessert alternatives are available in the market to cater to the changing consumer demands and for manufacturers to increase their product offering. Incorporation of flavor enhances the palatability of dairy alternatives such as soy, rice, and oat milk. The widely available flavored plant-based products in the market are vanilla and chocolate, followed by other flavors, such as peach, strawberry, blueberry, and mango. Companies have launched new products with fruit flavors to gain consumer base and increase their market share. The increasing diabetic population has also led to changing dietary preferences, which has further facilitated the rise in the number of different formulations to suit their needs.

Asia-Pacific is estimated to be the most lucrative market for dairy alternatives

In 2017, the Asia-Pacific region is estimated to hold a significant share of the global Dairy Alternatives Market. The major drivers for this significant share are the increasing consumer expectations for innovations and availability of healthy dairy-free food products. The Asia-Pacific market is driven by countries such as China, Japan, South Korea, Taiwan, Singapore, Malaysia, and Indonesia. The primary driver for this region is the increasing consumer demand for lactose-free food products coupled with abundance of soy-based dairy-free products. The Dairy Alternatives Market in this region is currently undergoing a dramatic transformation in response to rapid urbanization, diet diversification, and liberalization of foreign direct investment in the food sector. Also, the rising income, purchasing power, rapid growth of the middle-class population, and the increasing consumer awareness about health & fitness are driving the Asia-Pacific market growth.

Canadians Love Protein

Results from the newest Canadian Community Health Survey (CCHS) report Canadians are consuming more of their calories from protein than they did over a decade ago. Fat consumption amongst adults increased slightly and there was a small decline in carbohydrates consumption.

According to Dr. David Ma, PhD, Department of Human Health and Nutritional Sciences at the University of Guelph: “While there are some differences in consumption since the last survey in 2004, the data shows Canadians are generally consuming carbohydrates, fats and protein within recommended ranges. We need to eat these in the right proportions of total energy to reduce risk of chronic disease and to provide enough essential nutrients.”

The report notes that for children and teenagers, the percentage of daily energy intake from protein increased one per cent (from 14.6 per cent in 2004 to 15.6 per cent in 2015). For adults, it edged up from 16.5 per cent to 17.0 per cent. This still lingers at the lower end of the acceptable range of 10 to 35 per cent of calories set by the Institute of Medicine.

“The data is encouraging as the previous national survey showed Canadians were consuming protein at the lower end of the acceptable distribution range,” said Dr. Stuart Phillips, PhD, Director of the Physical Activity Centre of Excellence (PACE) and McMaster Centre for Nutrition, Exercise, and Health Research. “Protein is essential for all tissues in the body, providing amino acids that are important for growth and development. Protein is particularly important for older people to help slow muscle loss.”

“Based on my research, consuming even more than the recommended amount of high quality protein, from nutrient-rich sources such as pork, beef, lamb, dairy products and eggs throughout the day, combined with regular exercise, helps prevent the loss of muscle tissue as we age,” he adds.

Many Canadians consume an abundance of foods, but many do not obtain the nutrients they require for good health. Meat, for example, is a compact source of many nutrients that are essential for good health and life. These include: protein, phosphorus, zinc, iron, selenium, magnesium, potassium, vitamin B12, thiamin, vitamin D, niacin, and riboflavin.

“Research shows that diets with increased protein and reduced carbohydrates may help prevent type 2 diabetes by facilitating weight loss through increased satiety, increased thermogenesis, and muscle retention,” said Mary Ann Binnieof the International Meat Secretariat Nutrition Committee and a Canadian Meat Council spokesperson. “This is especially important given the number of Canadians diagnosed with diabetes has tripled in the past 20 years.”

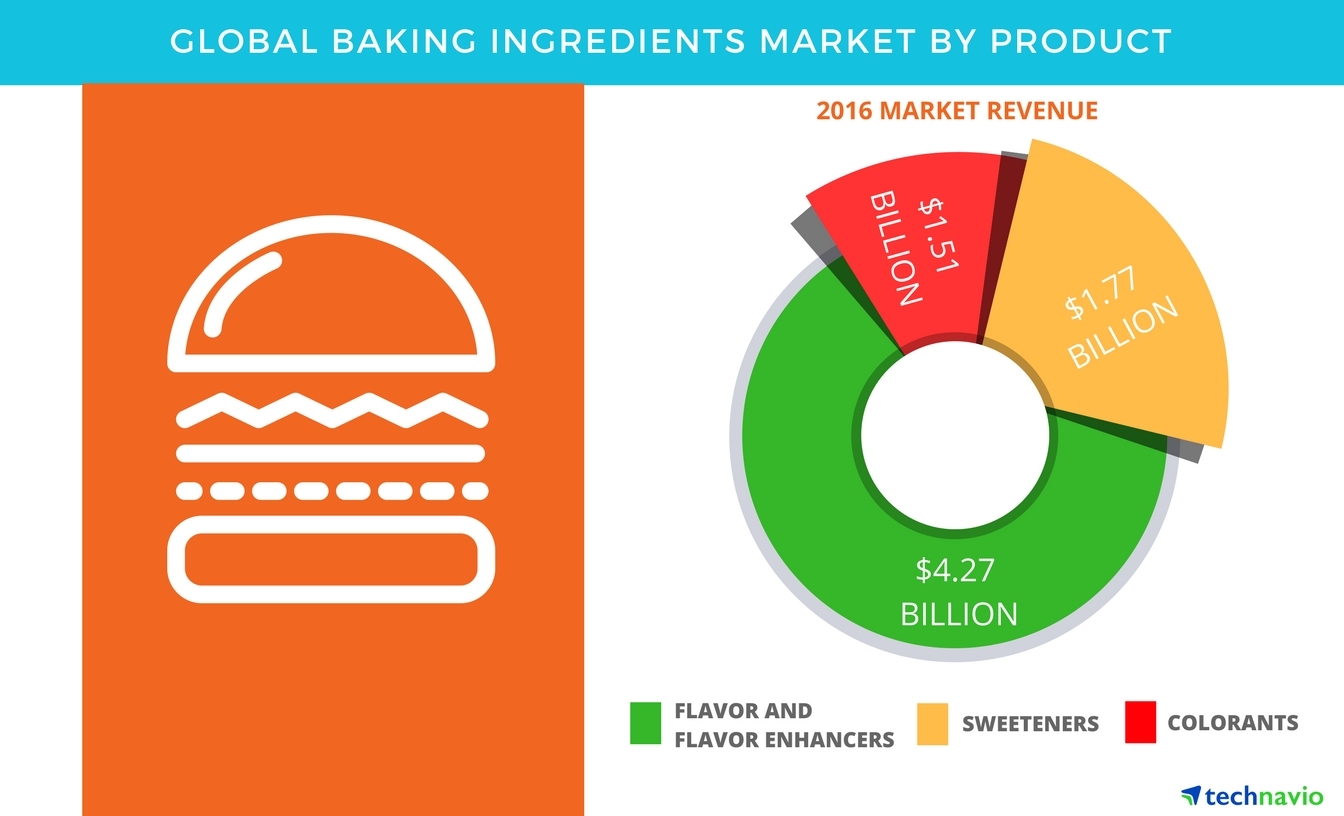

Baking Ingredient Market Growth

According to the latest market study released by Technavio, the global baking ingredients market is expected to grow at a CAGR of almost 6 percent during the forecast period.

This research report titled ‘Global Baking Ingredients Market 2017-2021’ provides an in-depth analysis of the market in terms of revenue and emerging market trends. This market research report also includes up to date analysis and forecasts for various market segments and all geographical regions.

This research report titled ‘Global Baking Ingredients Market 2017-2021’ provides an in-depth analysis of the market in terms of revenue and emerging market trends. This market research report also includes up to date analysis and forecasts for various market segments and all geographical regions.

Baking ingredients are used to improve the quality of foods while baking by enhancing the texture, taste, color, and moisture content of the foods. The growing disposable income and the increasing demand for convenience foods and healthy foods are some of the key parameters that are expected to drive the market during the forecast period. Product recalls, the negative effects of baking ingredients, and stiff government rules and regulations are some of the major challenges that are hindering the market growth.

Technavio’s analysts categorize the global baking ingredients market into eight major segments by product. They are:

- Flavor and flavor enhancers

- Sweeteners

- Colorants

- Emulsifiers

- Enzymes

- Yeast

- Baking powder

- Fat replacers

- The top three segments based on products for the global baking ingredients market are discussed below:

Global flavor and flavor enhancers market

Flavors are additives that are added to food products to give them a specific smell and taste. They can be derived naturally or artificially. Natural flavors are made from various natural sources like herbs, spices, fruits, vegetables, and others. Flavors only add taste and have no nutritional value.

According to Manjunath Reddy, a lead food research analyst from Technavio, “Flavor enhancers are used in different kinds of food products like savory snacks, condiments, and prepared foods. They can be derived from either natural sources or artificial sources. Monosodium glutamate is a common example of a flavor enhancer. Salt is a natural flavor enhancer. Its usage is recommended in moderate and controlled amounts.”

Global sweeteners market

Sweeteners provide a sweet taste to the food products. They can be either natural or artificial. Sugar is the most common natural sweetener. It is rich in calories and is also known as a nutritive sweetener. High-fructose corn syrup is another example of a natural and nutritive sweetener.

“Most artificial sweeteners are low in calories or non-nutritive. They are synthetic sugar substitutes but are made from natural sources like herbs and sugar. Mostly they are sweeter than regular sugar. Thus, small quantities of artificial sweeteners can provide extreme sweetness,” says Manjunath.

Global colorants market

Food colorants are the pigments, dyes, and substances that provide color to the food items. They are added to food and bakery items to impart the desired color to these items and improve their appearance. Colorants can be natural colorants or artificial colorants. Some of the commonly used natural colorants are caramel carotenoids, betacyanins, anthocyanins, and phenolics.

Changes in food regulations and growing consumer demand for clean-label products in Europe and the US are creating a significantly high demand for natural colorants. This has increased the need for different natural colorants like tomato-based colorants. Favorable food laws for natural colorants in Europe will increase the demand for natural colorants in the continent.

Food Sustainability Report

DMCC (Dubai Multi Commodities Centre), the authority on trade, enterprise and commodities in Dubai, today issued a report on food security as part of its Connected Thinking thought leadership programme, titled “Sustainable Food Supply: the Key to Feeding the World”.

Food security has emerged as a growing concern in many parts of the world, with a rapidly growing population, development challenges and climate change. DMCC’s report seeks to underline the need for stakeholders across the supply chain to adapt and address these concerns, as well identify benefits and opportunities.

Sanjeev Dutta, Executive Director of Commodities, DMCC commented: “As the world’s population continues to increase, and emerging markets continue to improve economically, hundreds of millions of new consumers every year need ever-greater supplies of food.”

The report summarises the five key factors that companies operating in the food trade supply chain need to consider when looking expanding internationally, whilst ensuring optimum trading capabilities. The top consideration is location whereby the report highlights the importance of finding a city with world-class seaports, airports and road infrastructure. Additional considerations include expertise, partners, resources and regulations.

Recognising these key factors, the report goes on to highlight the importance of Dubai and DMCC given its strategic location and the major role they play in shaping the future of the global food supply-chain.

Sudhakar Tomar, Managing Director at Hakan Agro, a specialist food business based in the DMCC Free Zone goes on to explain these points in the report: “Propositions such as a stable government, freely convertible currency, a strategic location with convenient time zone, great infrastructure, no taxation on profits or personal or company income, no foreign exchange controls, no restrictions on capital movement and freehold ownership of property, all put Dubai and DMCC at a distinct advantage in the evolving global food supply chain.”

“Dubai and the UAE are perfectly positioned at the centre of the world, acting as a bridge between North and South, East and West. Around 90 per cent of the country’s food is imported, so the foundations of a global food supply chain hub have already been in place for decades. The Emirate’s recent advances and innovation and technology further cements its strong position in shaping the future of the global food supply-chain,” Sanjeev Dutta, Executive Director of Commodities, DMCC, concluded.

Furthermore, the report highlights other key challenges within the industry such as the ever-changing consumer demands, climate change, and reduction in water supplies. It explains how addressing these factors through technology, innovation and sustainability initiatives may help tackle the expected population growth in the next ten years and its implications on the supply and demand of food. The GCC is expected to see food imports grow to over $50 billion by 2020 from $25 billion in 2004.

The DMCC is at the epicentre of global trade and has been increasing and improving its platform and services to the food industry over the last few years. It most recently launched the DMCC Food Trade Group, which currently has over 50 member companies, which focuses on building trust and confidence amongst traders through uniting food companies from around the world.

To access a full copy of the report, click here.

Cookout Costs

A cookout of Americans’ favorite foods for the Fourth of July, including hot dogs, cheeseburgers, pork spare ribs, potato salad, baked beans, lemonade and chocolate milk, will cost slightly less this year, coming in at less than $6 per person, says the American Farm Bureau Federation.

Farm Bureau’s informal survey reveals the average cost of a summer cookout for 10 people is $55.70, or $5.57 per person. The cost for the cookout is down slightly (less than 1 percent) from last year.

“As expected, higher production has pushed retail meat prices down,” said AFBF Director of Market Intelligence Dr. John Newton.

Competition in the meat case is making grilling for July 4th even more affordable for consumers this year, Newton noted.

“Retail pork prices also declined in 2017, largely due to more pork on the market and ample supplies of other animal proteins available for domestic consumption. Lower beef prices are most likely putting downward pressure on pork prices,” he said.

AFBF’s summer cookout menu for 10 people consists of hot dogs and buns, cheeseburgers and buns, pork spare ribs, deli potato salad, baked beans, corn chips, lemonade, chocolate milk, ketchup, mustard and watermelon for dessert.

With regard to drivers behind the moderate decrease in dairy prices, Newton said, “We continue to see stability in dairy prices because of the improving export market. Chocolate milk will be a little more affordable this July 4th, in part because some retailers are promoting it as a sports recovery drink superior to other sports drinks and water.

He also noted the retail price of American cheese has declined due to very large inventories and a lot of competition in the cheese case.

Newton said retail dairy and meat prices included in the survey are consistent with recent trends and are expected to continue to be stable. The year-to-year direction of the marketbasket survey tracks closely with the federal government’s Consumer Price Index report for food at home. A total of 97 Farm Bureau members in 25 states served as volunteer shoppers to check retail prices.

Hot Hot Dog Research

The National Hot Dog and Sausage Council (NHDSC) estimates that Americans will eat 150 million hot dogs on July 4th alone and while they enjoy many different kinds of hot dogs, research commissioned by the NHDSC and conducted online by Harris Poll provides new insight into what kinds of hot dogs are preferred.

A majority of Americans say beef hot dogs are their favorite, with 61 percent choosing beef as their preferred meat in hot dogs– pork ranked second (12 percent) and turkey third (7 percent). Americans seem to like their hot dogs with some snap as 38 percent who eat hot dogs said they prefer a natural casing on a hot dog while 25 percent enjoy their hot dogs skinless and 25 percent have no preference.

A hot dog is best enjoyed among friends and the research found that Betty White (31 percent) is the famous person (past or present) with whom Americans who eat hot dogs would most like to share a hot dog. The 95-year-old White has said she regularly enjoys hot dogs for lunch on the set of her TV shows. Hot dog magnate Oscar Mayer and baseball legend Babe Ruth tied as the next most popular choices at 14 percent each.

“At a time when so many issues divide us, hot dogs stand as a food that unites,” said NHDSC President Eric Mittenthal. “Whether people enjoy them with beef or pork, natural casing or skinless, hot dogs are a food that is truly beloved.”

Hot Toppings

JJ’s, the Charlotte-based, upscale Hot Dog and Sausage brand, which was featured earlier this year on Diners, Drive-Ins and Dives released its fourth annual study of the Top Ten Hot Dog Toppings, based on five years of the brand’s sales data.

According to JJ’s, which celebrates its fifth anniversary on July 4th and has featured more than 300 toppings on its Hot Dogs since 2012, America loves their Hot Dogs with the following toppings, in order of preference in the past year:

- Mustard

- Chili

- Cheese

- Onions

- Relish

- Kraut

- Slaw

- Ketchup

- Bacon

- Pickles

The normal suspects, chili, cheese, onions and relish rounded out the top five for the fourth consecutive year. Ketchup, JJ’s founder and proprietor Jonathan Luther’s least favorite topping, refuses to go away, fading but still listed at #8.

“Old habits die hard,” said Luther. “While we are always pushing the envelope to include the hottest new toppings like pulled pork and brisket, and introducing our guests to things they’ve never tried before, we always make the classic ingredients available and more often than not, guests opt for traditional favorites.”

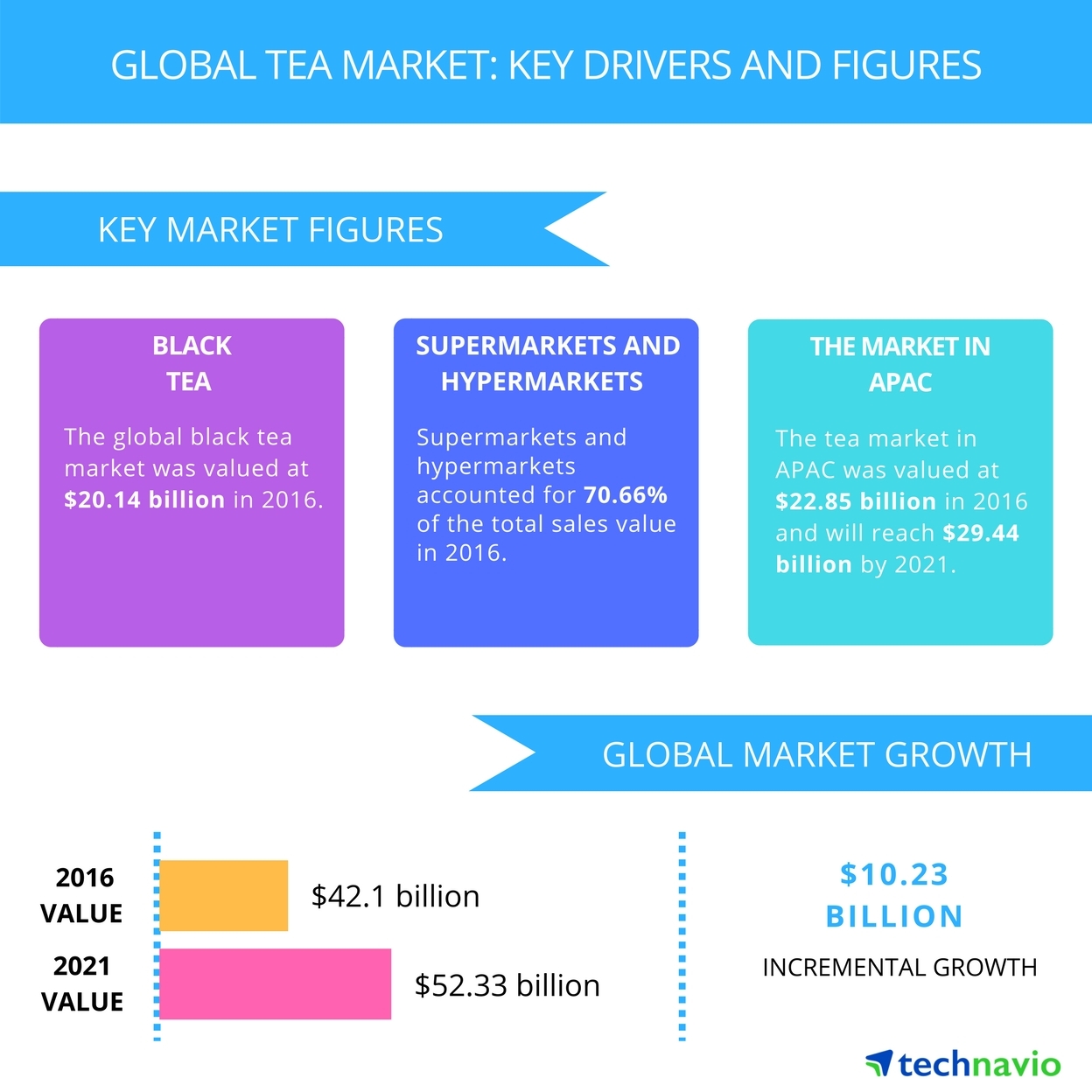

A Taste for Tea

Technavio analysts forecast the global tea market to grow at a CAGR of more than 4 percent during the forecast period, according to their latest report.

The research study covers the present scenario and growth prospects of the global tea market for 2017-2021. The market is segmented on the product (black tea, green tea, fruit/herbal tea, and instant tea), packaging (loose tea, tea bags, and bottled and canned tea), and distribution channel (supermarkets/hypermarkets, independent retailers, convenience stores, and specialist retailers). The market is further segmented based on geography, including the Americas, MEA, APAC, and Europe.

Many tea manufacturing companies have introduced several flavors in tea, ranging from fruity flavors with a tinge of fruity smell or flavor additive to chocolate, thus creating a large portfolio of choices for the customers. This diversification in flavors has helped in attracting the millennials, who visit cafés regularly and follow a café culture. In India, flavoring tea with different spices such as carom seeds and star anise has become a trend. These spices add their flavor and medicinal properties to the tea, adding value to the beverage.

Technavio food and beverage research analysts highlight the following three factors that are contributing to the growth of the global tea market:

- Increased demand from millennials in developing economies

- Numerous health benefits

- Growing usage of green tea in beauty and skin treatments

- Increased demand from millennials in developing economies

The developing economies of the world are flourishing because of improved economic indicators and foreign investments, leading to abundant employment opportunities. The improved economy and increased job opportunities have made premium brands and varieties of tea more affordable for young consumers aged between 18 to 34 years, who are also called millennials.

Atul Kumar, a lead non-alcoholic beverages research analyst at Technavio, said, “The millennial generation, being accustomed to technology and innovation, is eager to know everything about different tea variants, such as their source, processing techniques, serving methods, and other aspects. The millennials are also interested in experiencing tea from different perspectives such as heath and cultural, by experimenting with varied brewing techniques from different regions.”

Numerous health benefits

Tea has a high capacity to absorb oxygen radicals in the body, which helps to destroy free radicals that are harmful to the body. Tea can reduce the risk of Parkinson’s disease in both the genders as well as is effective in curing type 2 diabetes. The compounds in green tea are very effective for processing blood sugar.

“Weight loss is believed to be one of the main benefits of having tea. Generally, green tea is believed to aid in weight loss. Japanese medical researchers have found out that tea can decrease the loss of teeth by changing the pH balance inside the mouth. Tea also offers health benefits such as improvement in the immunity of one’s body by stimulating the immune cells,” adds Atul.

Growing usage of green tea in beauty and skin treatments

Green tea has catechins, which make it anti-bacterial. It is, thus, used in curing acne and regulating hormonal imbalances. The main benefit of green tea in this regard is that it protects one from skin cancer due to its anti-oxidant properties. It contains several antioxidants as well as enzymes, amino acids, and phytochemicals like polyphenols along with vitamin B, folate, manganese, potassium, magnesium, and caffeine.

Green tea is found helpful in flushing out toxins from our body, thus doing natural detoxification. It aids in healing blemishes and scars, reduces inflammation, and enhances the skin’s elasticity.

Lemon Pricing Up

Runzheimer, a relocation and business vehicle data provider, recently performed their annual study based on their goods and services pricing. Runzheimer’s data showed that the average price of lemons is up over 18 percent from this same time last year. This significant year over year increase could take a bite out of profit margins, which may translate to a higher price point next time you stop at your neighborhood lemonade stand.

Runzheimer collects goods and services costs across the U.S. and Canada for the purposes of calculating living cost comparisons across locations. Such comparisons are used by organizations that relocate employees to new work sites, calculating cost-of-living allowances. Other organizations use Runzheimer’s data to create geographic salary differentials when creating competitive compensation strategies across labor markets.

The study includes prices from almost 100 communities across 65 major metropolitan areas.

The data collected includes a regional breakdown which demonstrates the change in prices based on specific regions of the country:

|

REGION |

2016 |

2017 |

Percent Change |

|

NORTHEAST |

$1.83 |

$2.07 |

13.1 percent |

|

MIDWEST |

$1.71 |

$2.03 |

18.7 percent |

|

SOUTH |

$1.47 |

$1.76 |

20.2 percent |

|

WEST |

$1.57 |

$1.88 |

19.4 percent |

The northeast region of the U.S. experienced the smallest increase year over year (13.1 percent) while the south experienced the most significant increase (20.2 percent).

Food as Convenience

With 29 percent of consumers saying they will drive more in June as compared to the previous month (2017 NACS Consumer Fuels), and U.S. gas prices at the lowest level for the summertime since 2005, convenience stores are ready to welcome a wave of consumers traveling near and far. In support of the summer season, Tyson Convenience released results from a national consumer survey conducted with 1,000 U.S. adults aged 18+ to help retailers understand which prepared foods customers prefer for making their trip more enjoyable, regardless of the distance.

“Busy summers and convenience stores go hand-in-hand for meals and snacks on-the-go,” said Rob Ramsey, senior manager of convenience channel marketing for Tyson Foods. “Consumers use convenience stores as their summertime home to keep them refueled and not slow them down.”

Survey findings include:

- The number one reason (51 percent) American adults purchase food at a convenience store is to satisfy a craving.

- Americans love breakfast. Many (48 percent) would like to see a breakfast station serving waffles, biscuits, breakfast meats and baked goods at a convenience store.

- Breakfast sandwiches are so popular that more than half of Americans (51 percent) would purchase one at their local convenience store if they wanted to have breakfast for dinner. On the other hand, pizza rose to the top of later-in-the-day prepared foods to cross over to breakfast, with (45 percent) of Americans interested in eating pizza for breakfast.

- Americans prefer to eat their snacks with two fingers (47 percent) while shying away from using any utensils.

“Hearing directly from consumers on what they want and expect from a convenience store can be invaluable for retailers, especially during the busy summer season,” Ramsey said. “These survey insights, like having breakfast offerings served all-day in unique, creative ways, give retailers feedback from consumers on how to merchandize prepared food offerings to attract consumers in the summer.”

Ben & Jerry’s Top Flavors

National Ice Cream Month News: Ben & Jerry’s Top Ten Flavors Revealed

Currently, Ben & Jerry’s most popular fan favorites in the U.S., based on sales, are:

- Half Baked

- Cherry Garcia

- Chocolate Chip Cookie Dough

- Chocolate Fudge Brownie

- The Tonight Dough

- Americone Dream

- Phish Food

- Chunky Monkey

- Strawberry Cheesecake

- Salted Caramel Core

Meal Kit Popularity

Traditional grocery is in a current state of massive disruption with Amazon’s recent purchase of Whole Foods and the meal kit subscription market reaching $1.5 billion. In fact, one in four Americans has tried a meal kit – with Millennials and Generation X consumers 321 percent more likely to purchase them (Nielsen) and most likely to share and discuss their customer experience on social media.

“As it is for many businesses built on the web, social media is integral to the success of meal kit businesses,” said Jenifer Kern, CMO of Tracx. “Social media shapes overall reputation, how they build their brand, expand their reach, and interact with consumers. Meal kit businesses are not just social media darlings, they rely heavily on social media marketing to drive customer acquisition and retention.”

In its inaugural Social Sentiment and Performance Report, Tracx, a robust social media management and analytics engine, conducted a social listening study on the two leading meal kit delivery competitors in the industry: Blue Apron and HelloFresh.

To measure their brand health and reputation, Tracx analyzed nearly 350,000 social conversations, posts, and interactions, sentiment and engagement across the top 14 social networks from May 14th through June 12th, 2017. (Note: To make it a direct comparison, Tracx excluded all posts containing “IPO” and “public” and sponsored ads.)

Key findings from the report include:

Female Millennials Dominate: 66 percent of Blue Apron’s and 79 percent of HelloFresh’s social activity comes from female consumers with Blue Apron attracting a wider age range (18-54) vs. HelloFresh’s 25-34 range.

Instagram is King: Both brands use Instagram as a major social media platform – 75 percent of HelloFresh and 61 percent of Blue Apron’s social activity occur on Instagram. Blue Apron has broader social coverage as it’s also active on Facebook, forums, blogs, Flickr, etc.

Share of Voice (Winner: Blue Apron): Blue Apron leads in terms of conversation volume with more than 6,000 conversations vs. HelloFresh’s 4,400. Blue Apron also leads in mention volume with more than 7,400 mentions vs. HelloFresh’s 3,000.

Interactions (Winner: HelloFresh): HelloFresh takes the reigns for number of interactions with over 170,000 interactions vs. Blue Apron’s 144,600.

Sentiment (Winner: Blue Apron): Blue Apron tops HelloFresh in positive sentiment, and pulls in less negative sentiment than HelloFresh.

Positive posts about Blue Apron are about the business and meal delivery services; those about HelloFresh consist of clean, healthy eating and fitness.

Negative posts about Blue Apron and HelloFresh driven by customer service and delivery issues. HelloFresh sees more disappointment after receiving the kit.

Engagement (Winner: HelloFresh): Across all social media, HelloFresh edged out Blue Apron with a 74 percent overall engagement rate vs. Blue Apron’s 65 percent. On Facebook, HelloFresh boasted a 99 percent engagement rate vs. Blue Apron’s 82 percent.

Mobile Insights

Verve™ announced a newly published study on the state of location-fueled strategies and campaigns among brands and advertisers active in the mobile marketing space.

Pursuing the Mobile Moment, a June 2017 commissioned study conducted by Forrester Consulting on behalf of Verve, explores how mobile advertisers in North America use location data in their mobile-marketing campaigns: examining how location data informs their advertising efforts, what challenges they face, and what benefits they have received.

Highlighting the ways location intelligence drives insights — helping organizations to better understand their customers and enabling them to deliver on the “mobile moments” needed to win, serve, and retain digitally-empowered customers — the key findings in the study include the following.

Location data both increases ad relevancy and drives consumers in-store. 74 percent of the advertisers surveyed recognize location’s value in increasing the relevancy of their messaging specifically to deliver on “mobile moments”— the moments when consumers receive information in context and in their moment of need. Additionally, nearly half the respondents value location data’s omnichannel usefulness in driving incremental in-store visits.

Many advertisers struggle to use insights to contextualize consumers. Among the respondents in the study, 38 percent have difficulty contextualizing historical insights about consumers and are unable to target them granularly (37 percent) — suggesting that they are not able to take advantage of the unique characteristics of mobile in the effort to maximize advertising value for the consumer.

Focusing on location-based marketing efforts has helped mature companies increase ad relevancy. Organizations that both matured their mobile marketing and focused on their use of location data are more likely to increase the relevancy of their ads served to consumers. In addition to increased relevancy, these more mature organizations experience increased targeting efficiency, ROI of their marketing technology investments, and overall brand awareness.

“It’s not enough to point to the successful outcomes that leading global brands are achieving with location-powered mobile marketing; we have to strive for even deeper insights into what advertisers across the spectrum of mobile-marketing maturity are experiencing,” said Julie Bernard, Chief Marketing Officer at Verve. “This new study provides a wealth of insights along these lines. The research provides a lens onto how a wide range of advertisers are building strategies that leverage location intelligence, the ways they are encountering and overcoming location-data challenges, and what we’re additionally understanding about how fostering maturity in all these efforts also helps drive improvements to the advertiser’s targeting efficiency, marketing technology ROI, and brand awareness.”

The new study is available for download here.

Clean Water Stats

Access to clean drinking water and the nation’s water infrastructure are major concerns for Americans across the country, according to “Perspectives on America’s Water,” a new study. A total of 6,699 American adults shared their views on water-related topics in this comprehensive online study conducted on behalf of Nestlé Waters North America by the global market research firm PSB in May 2017. The study, the first of its kind to gather both the opinions of the U.S. general population and those of experts in the field, found that water is viewed as themost important natural resource in Americans’ daily lives, more so even than clean air (87 percent compared to 81 percent). Yet, 61 percent of American consumers and 66 percent of experts characterized water problems as a crisis or major issue for the United States.

The study found that two in three Americans (66 percent) believe their own community’s clean drinking water is at risk, while 59 percent say a major overhaul of U.S. water infrastructure is needed to avoid that possibility. City-dwellers are especially likely to fear their community’s clean drinking water is at risk (70 percent versus 63 percent in rural areas). There is almost universal agreement (96 percent) that if the United States does not proactively invest in the country’s water infrastructure system now, it will end up costing more in the long run.

“The takeaways from this study are clear to us: Americans care deeply about the state of their drinking water, and they believe investments in infrastructure and innovation are needed now,” said Nelson Switzer, Chief Sustainability Officer at Nestlé Waters North America. “It’s our hope that these insights will accelerate the pace of conversation and jump-start concrete actions needed to address our shared water challenges. At Nestlè Waters we believe that access to safe and secure drinking water is a fundamental human right and we know we all have a role, responsibility and obligation to contribute to making this a reality.”

Concerns About Cleanliness and Safety

Many American consumers and experts question whether the tap water in their home (36 percent and 30 percent, respectively) and schools (40 percent for both) is clean and safe. Parents with school-aged children under the age of 18 are more likely to worry; 45 percent of this group question the safety of the tap water in their schools. Government officials polled worry the least, with only 16 percent who say they question the safety of water in their homes.

There is also a widespread concern among Americans that water supply issues will become more pressing within the next decade. Forty-two percent of Americans surveyed believe water will become less available in the next 10 years, and two-thirds (66 percent) believe water crises will have widespread consequences for individuals, businesses and the United States overall.

Most Believe Climate Change Will Increasingly Impact Access to Clean Water

Nearly three-quarters (71 percent) of respondents say climate change has had a great deal or somewhat of an impact on access to clean drinking water, by reducing the overall amount (41 percent) and quality (38 percent) of water available. About half (51 percent) say the impact of climate change on access to clean drinking water will increase over the next 10 years, but improving infrastructure (59 percent) or developing innovations for purifying water (58 percent) could help mitigate this impact. Experts are especially likely to say climate change is impacting clean drinking water (76 percent) and are more likely than American consumers overall to say this impact will increase over the next 10 years (58 percent).

Broad Support for Infrastructure Improvements and Funding

Americans surveyed support investment in infrastructure to address both the causes and effects of water-related issues. In terms of specific infrastructure improvements, Americans believe it is necessary to prioritize early detection systems that identify contamination in the water supply (64 percent), more efficient water collection and purification methods (52 percent) and infrastructure to increase water access, quality and capacity (48 percent).

To accomplish this, Americans expect cross-sector collaboration from government at all levels, as well as businesses and environmental organizations. American consumers expect local (71 percent), state (71 percent) and federal governments (65 percent) to play a role in ensuring people have access to clean drinking water, as well as consumers (39 percent) and businesses (35 percent). Experts are especially likely to see opportunity for consumers (45 percent) and businesses to be involved (40 percent).

“As the leading bottled water company in the United States, we have knowledge and experience in water management, water efficiency, source water protection and collaboration and problem solving,” said Switzer. “But we know we can accomplish far more together than we can alone. That is why we are committed to using these insights and skills to engage with our employees, suppliers, communities as well as non-profits, policymakers and other stakeholders who care deeply about the sustainability and the security of America’s water supply to drive innovation and collaboration to ensure a clean, safe and secure water future for generations to come.”