According to a Recent Study/Survey … Mid-June 2018 Edition

27 Min Read By MRM Staff

This edition of Modern Restaurant Management (MRM) magazine’s “According to …” research roundup features exclusive news on an LTO from Chick-fil-A’s from the experts at Sense360 and summer dining trends from Gather as well as news on disruptive brands, IHOb response, the future of dinner and the need for mead.

Summer Dining Trends to Note

For those hoping to take advantage of dining trends for the summer, Gather, a leading event software provider for restaurants and venues, polled over 500 US-based consumers to see how they’re planning to celebrate this summer. Here are some tips for restaurants to take advantage:

- Consumers prefer small, causal groups: consumers overwhelmingly want to get together with a few friends (fewer than 10 is ideal, according to 84 percent of respondents) and as they are (81 percent prefer casual clothing to fancy dress) – making restaurants ideal venues to get together.

- Summer is party season and restaurants should take advantage with drink and food specials, to make their location, the ideal spot to hang!

- Good food trumps a good location: 31 percent of people believe that great food and drink options trump the convenience of an event location – meaning people are willing to travel out of their way to get the offerings that are unique to these venues.

- Restaurant’s should highlight what makes you unique – a great tasting menu, a new cocktail. People will come.

- Know what they’re celebrating: Birthday parties (60 percent) and corporate events (24 percent) are the most-frequented events.

- Restaurateurs should focus on offering specials like birthday dinners and drinks or corporate event packages

Chick-fil-A’s All-Day Breakfast

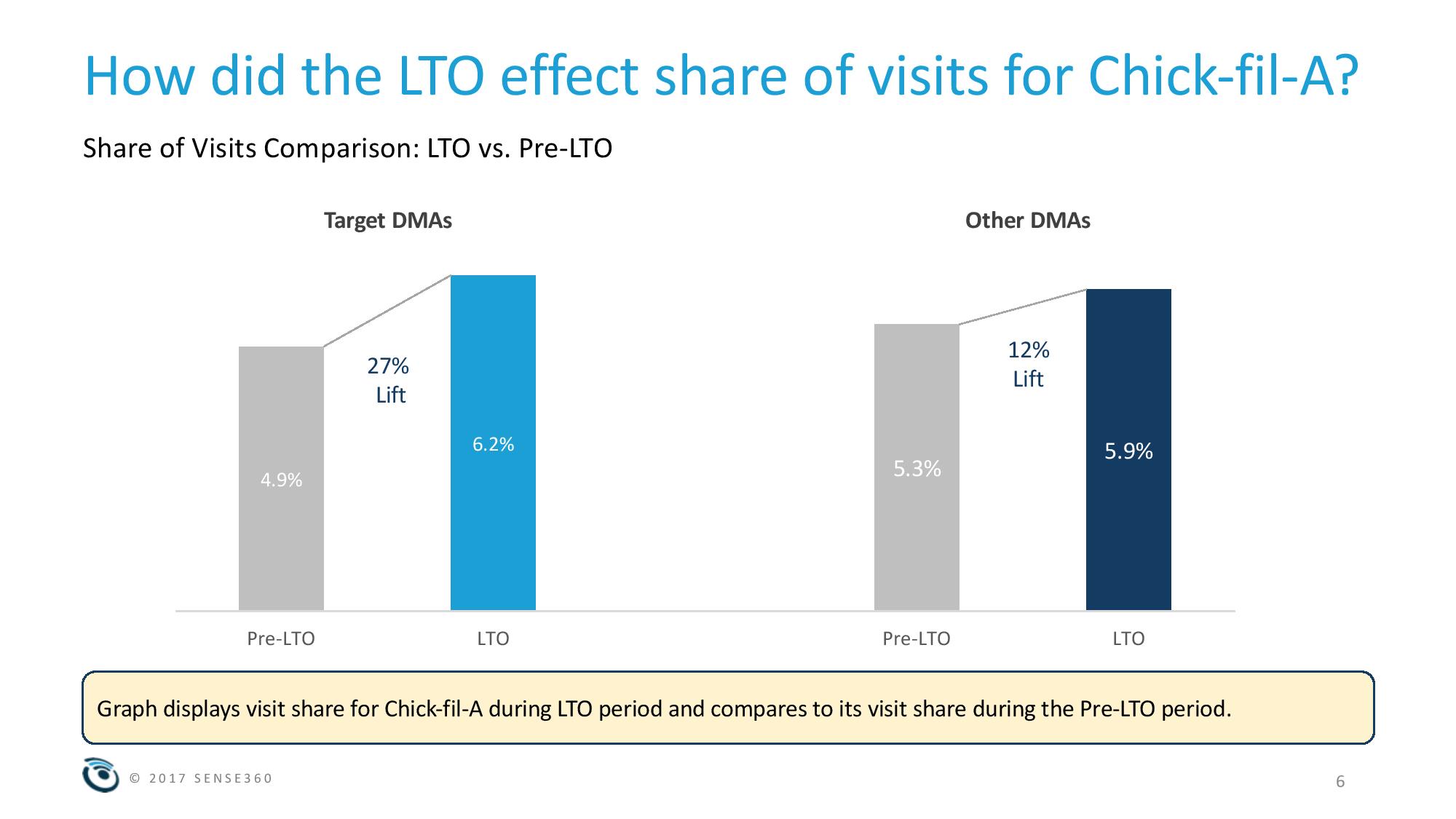

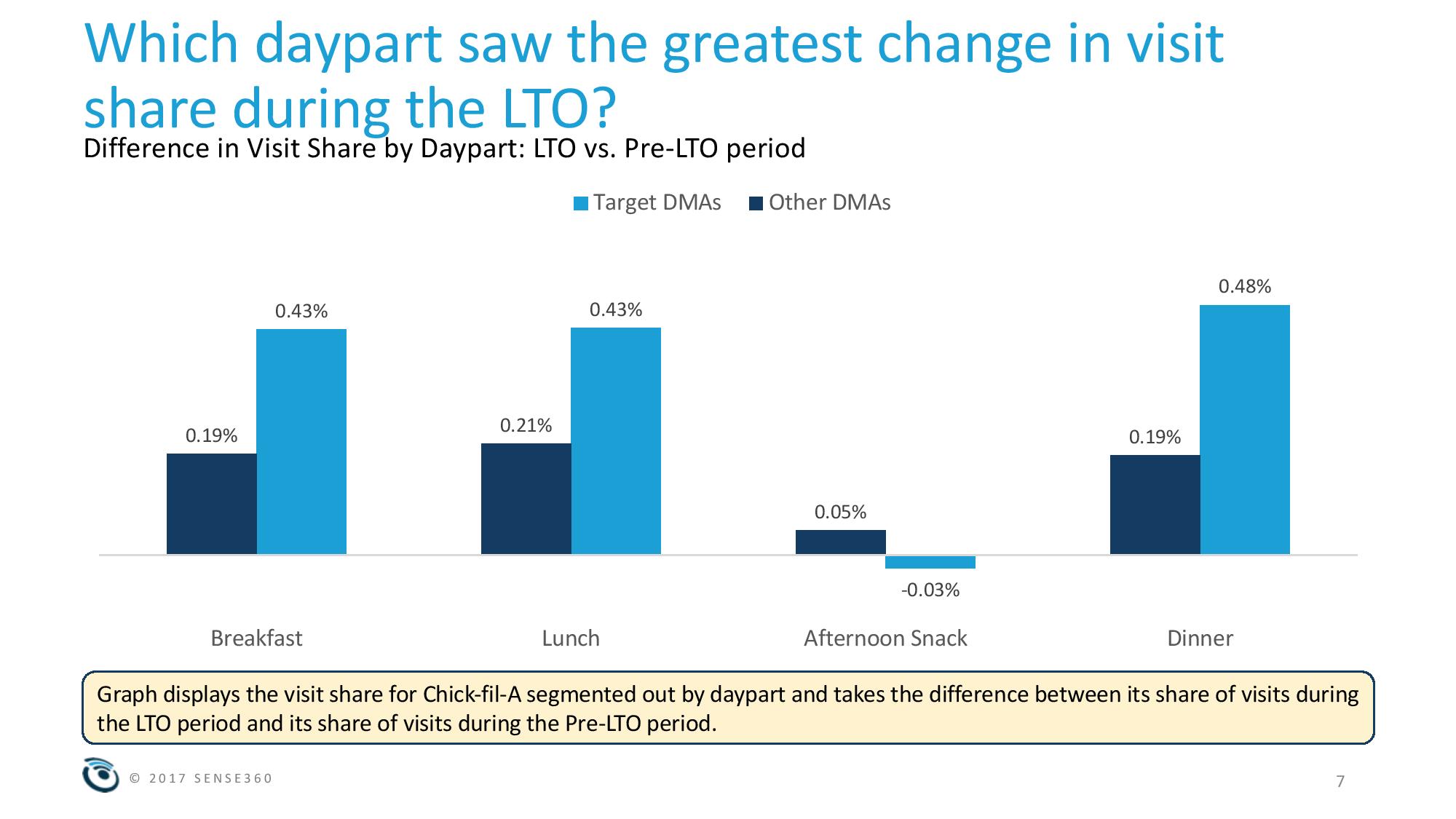

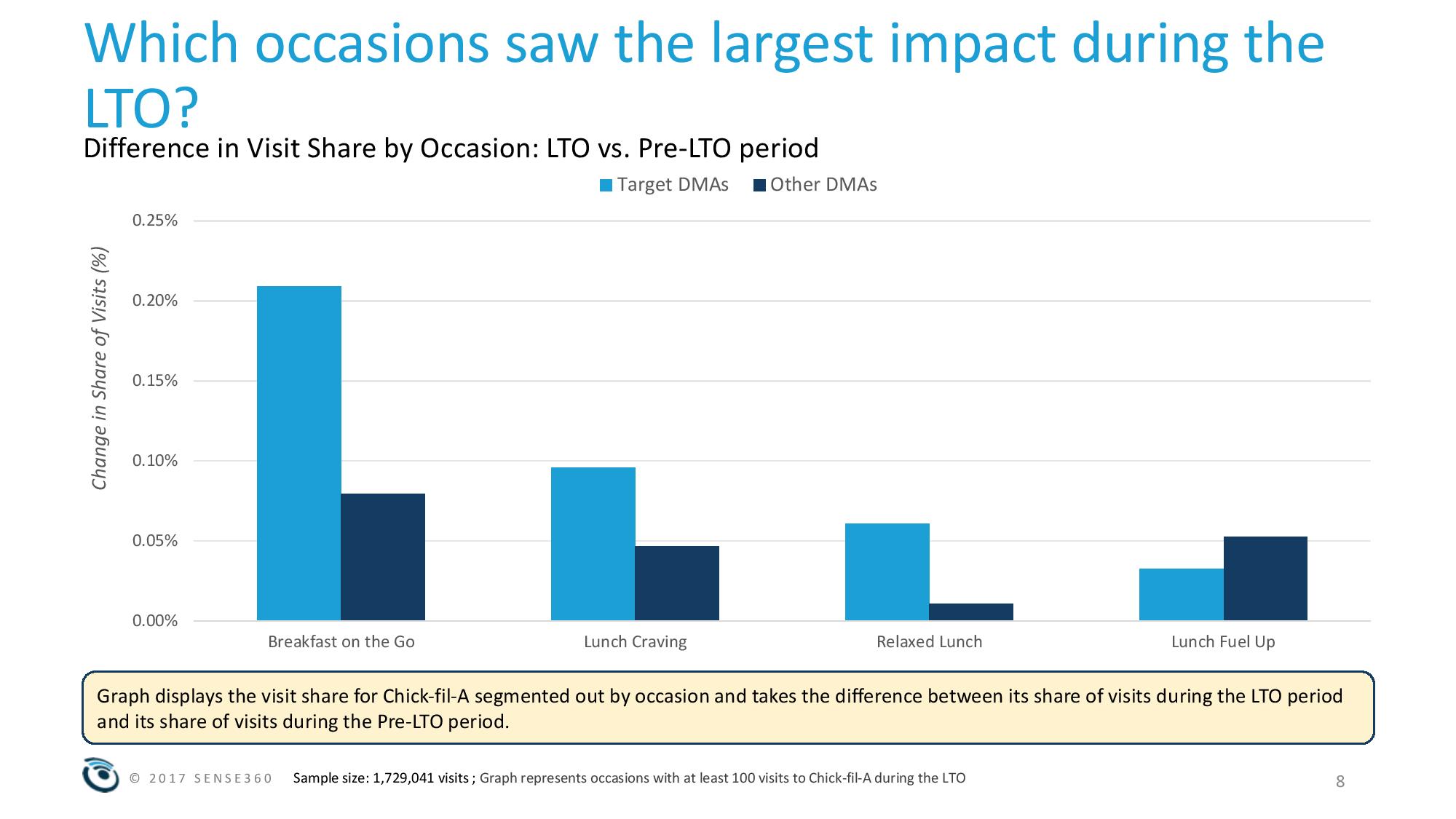

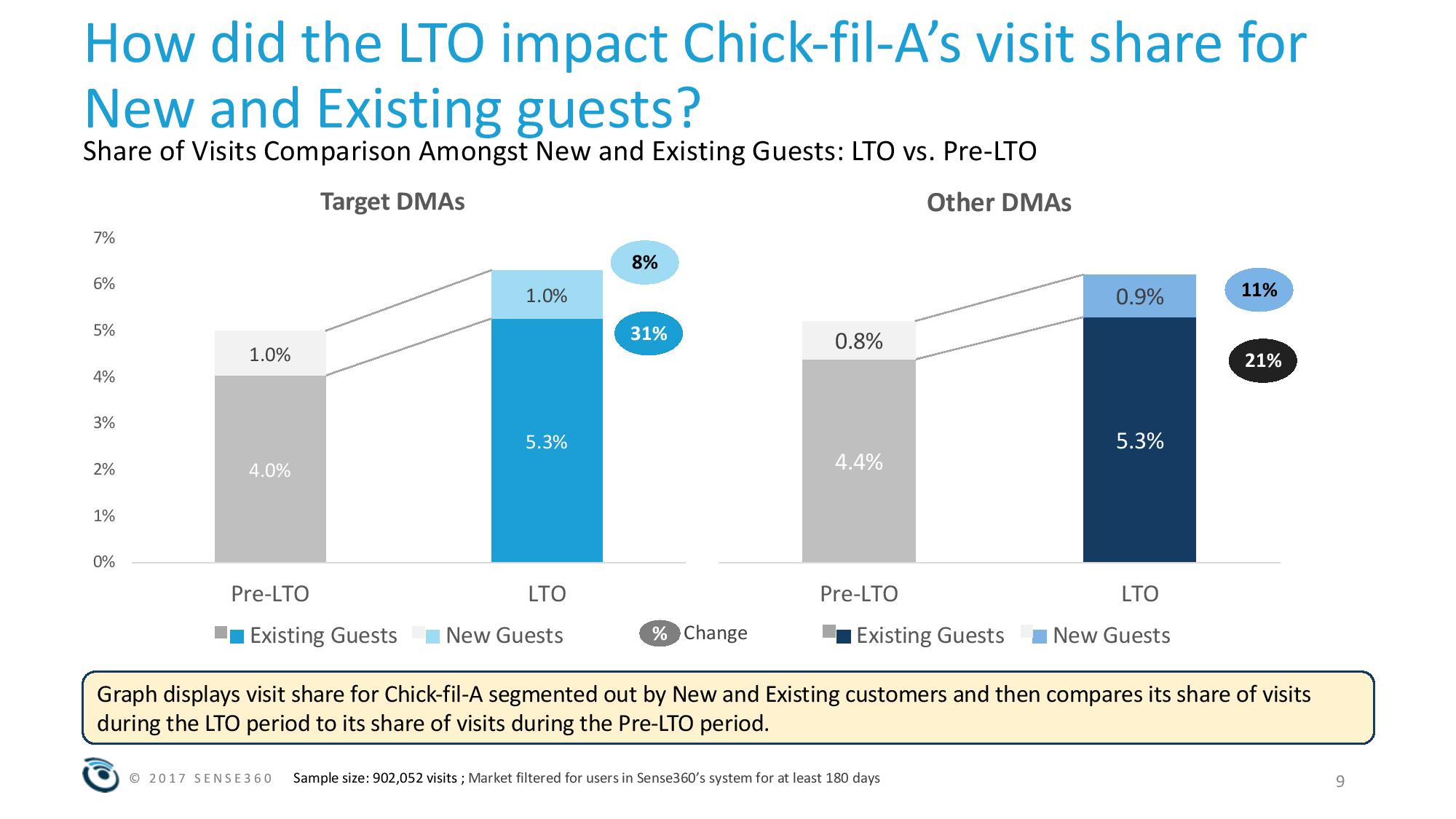

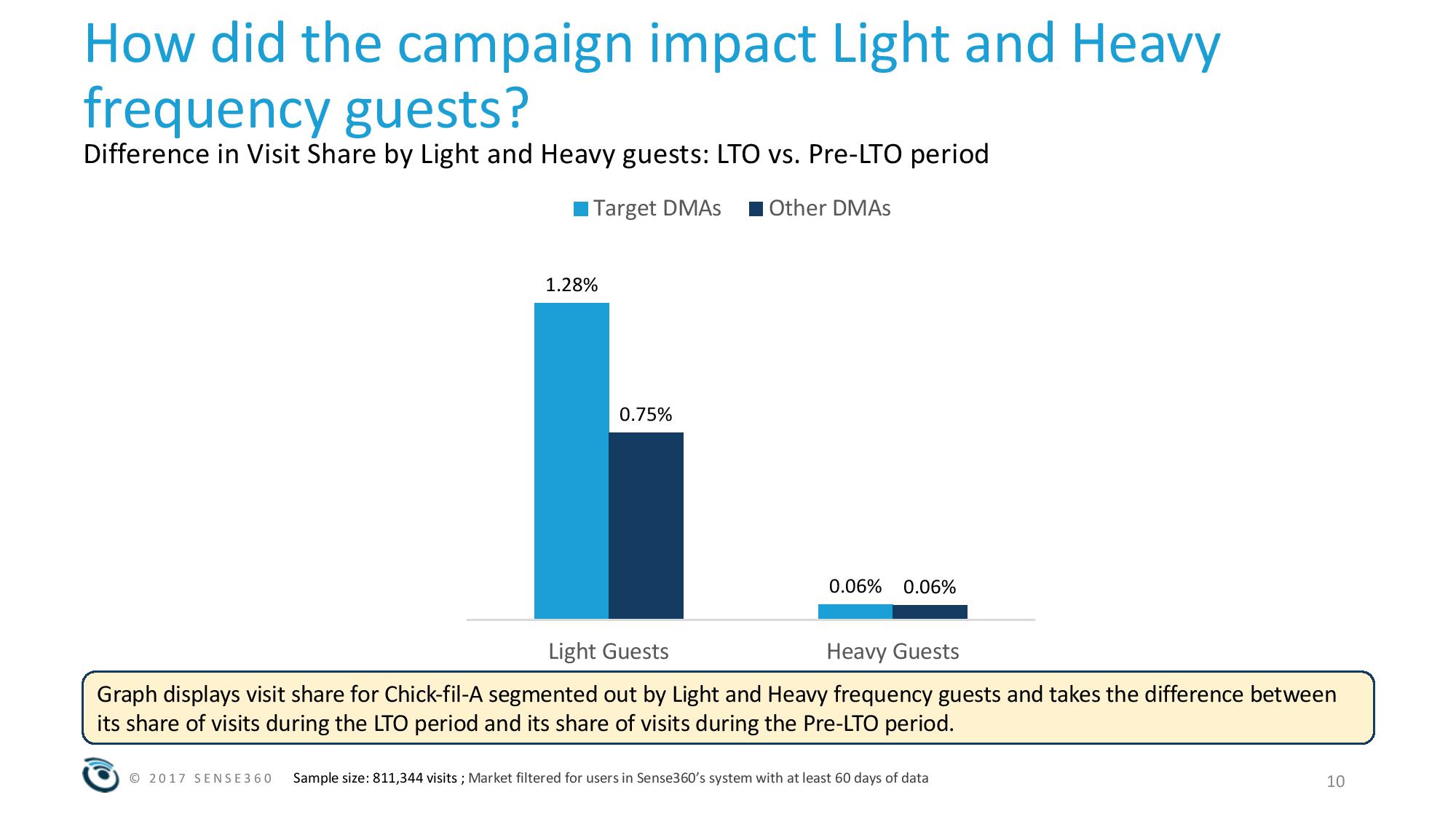

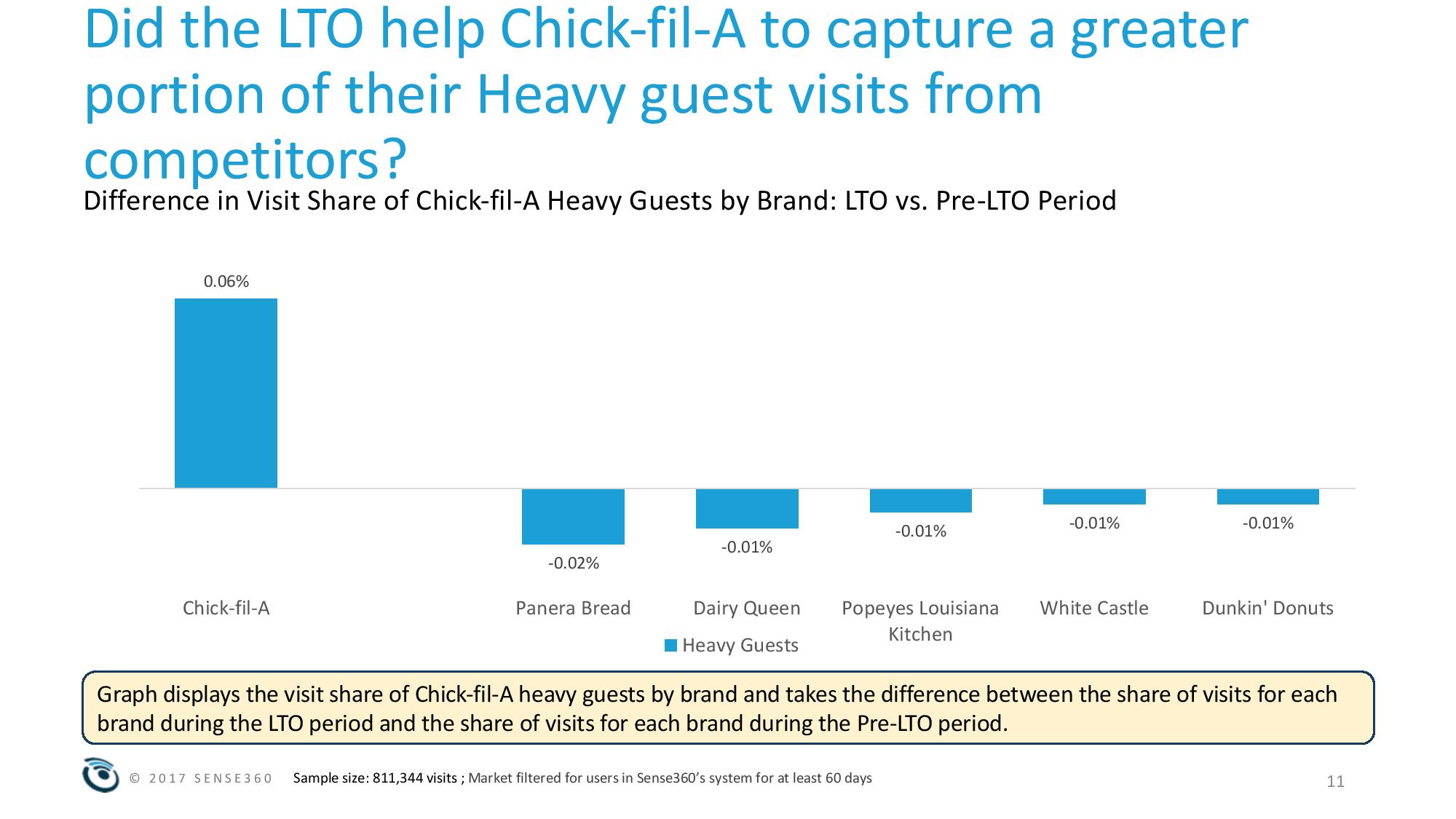

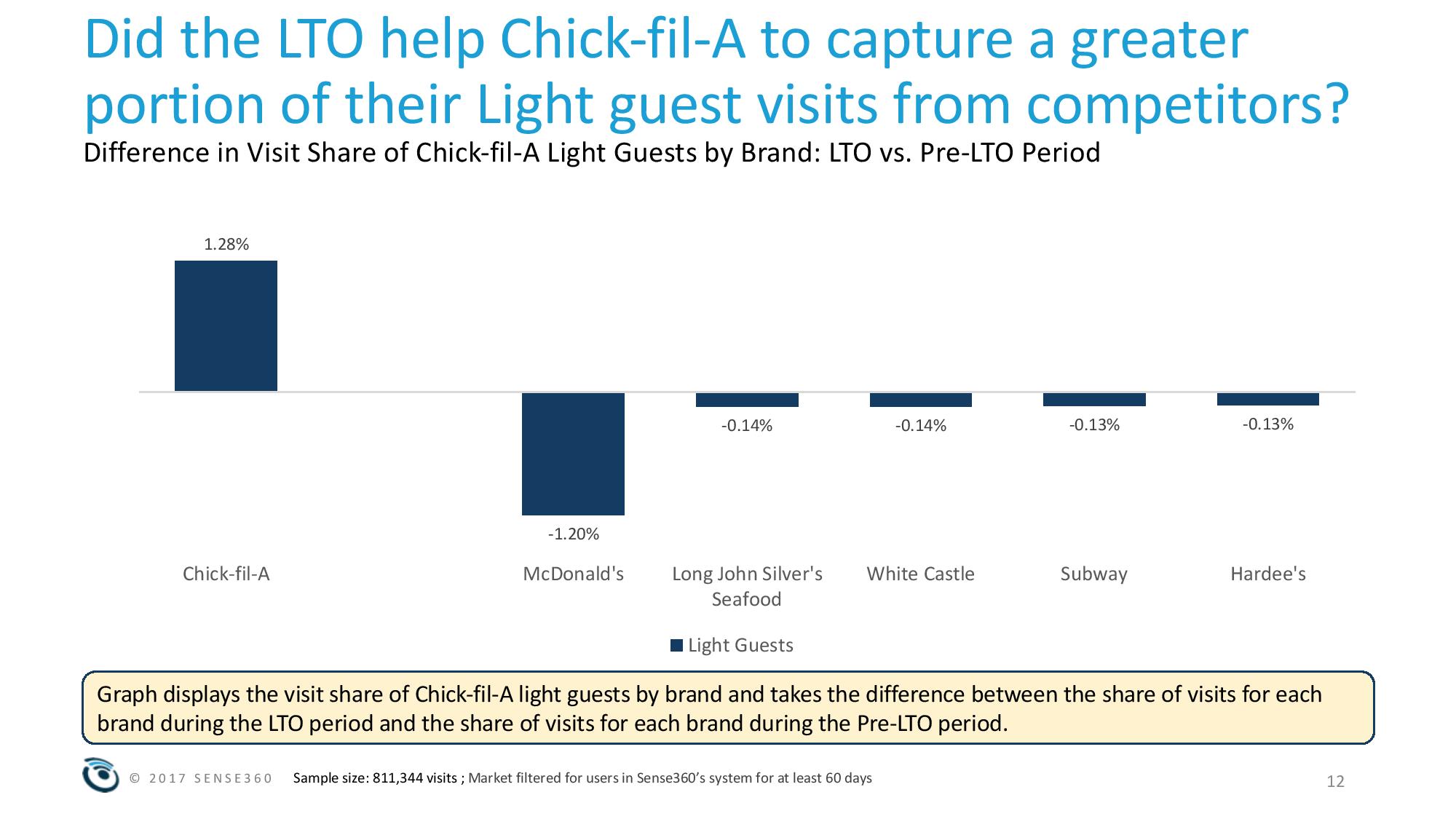

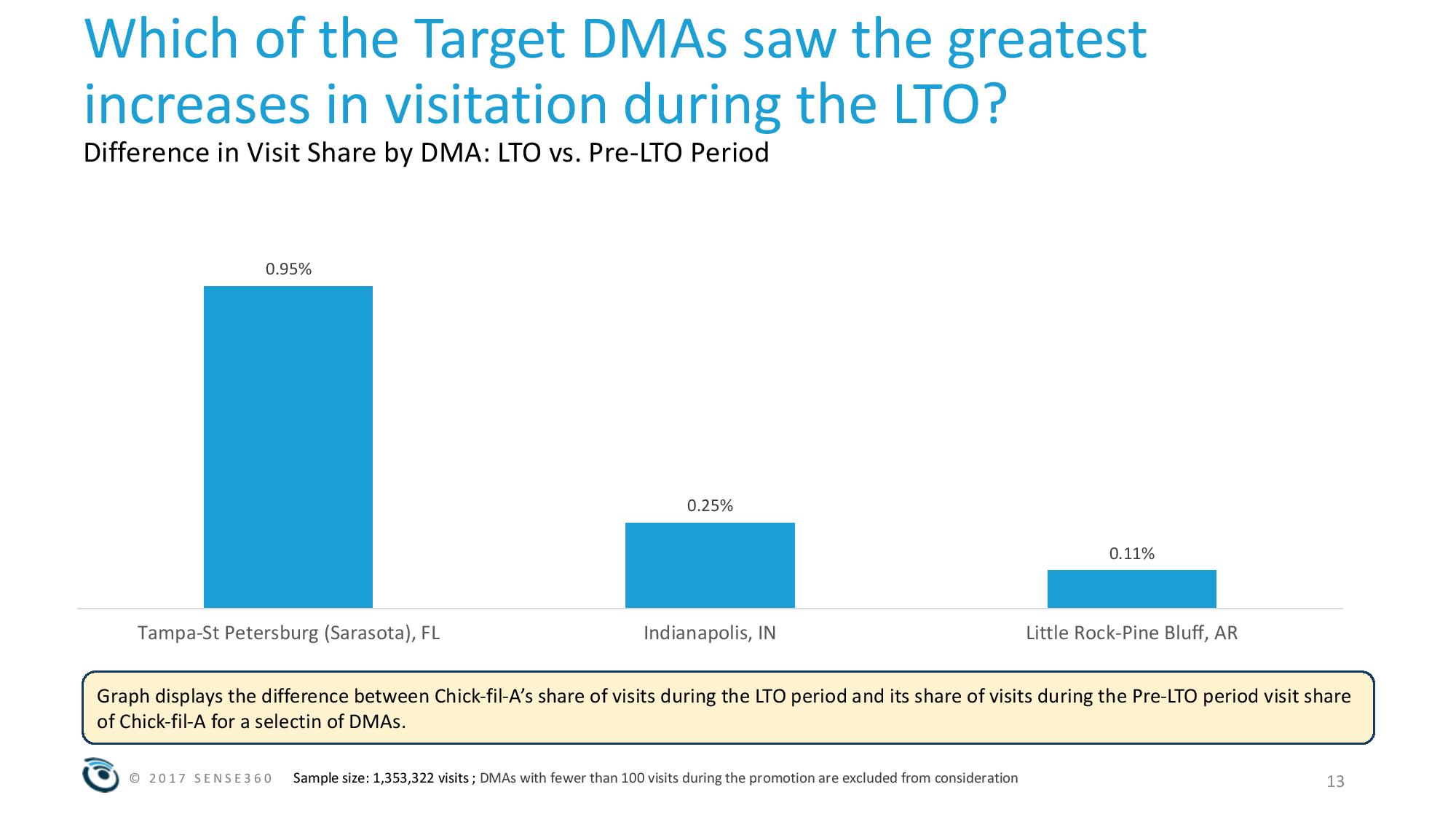

A new report from Sense360 explores the effects of Chick-fil-A’s All-Day Breakfast limited time offer on visitation by observing visit patterns both before and during the campaign and highlighting the differences between the two periods. Starting June 4, customers at participating restaurants in Tampa, Florida, Little Rock, Arkansas, and Indianapolis will be able to order breakfast favorite Chick-n-Minis throughout the day for a limited time this summer. Chick-n-Minis will be available in four-count, 10-count and catering tray options. Sense360 looked at visit trends for that week and compared to the same week last year.

IHOb as Marketing Ploy

When IHOP, the International House of Pancakes, recently announced a temporary name change to IHOb, the jeers came quickly on social media. Yes, it was a gimmick. But was it a success? Marketing professors at the University of Maryland’sRobert H. Smith School of Business weigh in:

B is for Bemusing

“People were surprised to find out what ‘B’ stands for. The fact that IHOP sells burgers seems rather bemusing. In some sense, the publicity stunt is certainly working in spreading the buzz. Nonetheless, the word-of-mouth so far appears to be fairly negative. It is an open question whether people would go to IHOP for burgers after they have learned about the offering.” — Jie Zhang, Professor of Marketing, Harvey Sanders Fellow of Retail Management

B is for Backlash

“As far as a publicity stunt, it seems to have worked as they have been able to dominate Twitter since they teased the public with their announcement to change their name on June 11. By capitalizing on social influencers they have been able to reach more individuals and stretch their promotional dollars. But in orchestrating this PR event for their new menu items, they have also raised expectations for their upscale burgers in the minds of potential customers.

“The gourmet hamburger field is quickly becoming crowded, and if the quality is not there, this new menu promotion could be detrimental to IHOP. With the interest in healthy eating and, consequently, pancake sales flattening, it’s understandable why they are diversifying into the red-hot gourmet hamburger menu offering. It will allow them to capture family and group sales when not everyone wants pancakes for lunch. However, often when companies venture into new product offerings, they are not always successful, especially when the initial product offering has been so engrained into the hearts and minds of consumers as IHOP’s has been.

“It reminds me of the time several years ago when Burger King decided to be known as BK to downplay its burger offerings and move more into sales of chicken sandwiches. It was at a time when the general public was concerned about their consumption of red meat and sales of hamburgers was on the decline. This does show the importance of being on top of consumer sentiment when planning your company’s marketing strategy.” — Mary B. Harms, Clinical Associate Professor in Marketing

B is for Brand Dilution

“It’s folly to make an abrupt change to the brand name (even on a temporary basis). It takes years for the public to amass the desired associations in memory that a firm projects toward the marketplace (e.g., IHOP means scrumptious pancakes served with strawberries, blueberries or chocolate chips).

“In my view, by taking on this radical approach, IHOP risks diluting its brand essence. Case in point, when I told my wife about the new logo, IHOb, she thought it stood for International House of Breakfast. It makes sense given her prior associations. Yet the intended inference behind this campaign is often easily missed. The newly minted IHOb now offers burgers on the menu. That’s wonderful. But is it really necessary to tinker with the logo to get this message across? Interestingly, in the wake of this campaign, IHOb has left itself wide open for ridicule and corporate mockery. Just check out some of the latest jeers in the Twittersphere.” — Henry C. Boyd III, Clinical Professor of Marketing

Restaurant Sales Growth Slows

Restaurant sales growth slowed in May, losing some of the momentum that carried the industry into positive same-store sales growth territory the last two months. However, for an industry that has struggled the last two years with declining same-store sales, May’s flat results (0 percent growth year over year) can still be considered encouraging news that continues to point to a restaurant recovery in relative terms. These insights come from TDn2K’s Black Box Intelligence™ data through The Restaurant Industry Snapshot™, based on weekly sales from over 30,000 restaurant units, 170+ brands and represent over $69 billion dollars in annual revenue.

“There are two takeaways from May’s flat performance,” said Victor Fernandez, vice president of insights and knowledge for TDn2K™. “First, the stronger economy is lifting restaurant spending and 2018 should be better than the last two years. Same-store sales growth year-to-date is at 0.3 percent at the end of May, compared with -1.0 percent for both 2016 and 2017. Secondly, the fact that same-store sales growth dropped by 1.5 percentage points compared with April’s rate highlights the fact that the underlying challenges remain. It will be very hard for chain restaurant sales to rise beyond very modest positive gains. Those challenges include the oversupply of restaurants and the fierce competition from other sectors like grocery store prepared foods, convenience stores and even independent restaurants.”

One metric that has highlighted restaurant challenges since the recession is the continued erosion in traffic. Same-store traffic dipped -2.9 percent in May, which also represented a 1.5 percent fall from April’s growth rate. Even with this negative result, there is some room for guarded optimism. Traffic growth year-to-date currently stands at -2.5 percent, which is a modest step up from the -3.2 percent recorded for each of the previous two years.

“The economy appears to have accelerated in the second quarter from its mediocre performance in the first part of the year,” stated Joel Naroff, president of Naroff Economic Advisors and TDn2K economist. “Consumer spending, which grew decently in the first quarter, has picked up further as the tax cuts added to household spending power. Business investment activity has also increased, though we are still not seeing as much of the tax benefits going to new spending on buildings, machinery or software as hoped for. That is just one of the two concerns facing the economy. The second is wage gains, which may be accelerating, but so is inflation and that means spending power continues to expand sluggishly. The expected stronger economy is coming and we could see growth in the next two quarters at or above 3.0 percent. But there is still little reason to believe that the improvement will be powered by sharp gains in consumer spending. Thus, look for restaurant sales to rise a bit further,” said Naroff.

Spending More Per Visit

Another sign of the economy’s strength and improved consumer optimism is the fact that average spending has accelerated in recent quarters. For 2018, average guest checks are up 2.8 percent. By comparison, checks grew 2.1 percent in 2017. “To put all this into perspective,” continued Fernandez, “guests are spending more per visit but dining out less frequently. If it wasn’t for the growth in check average, we wouldn’t have seen any positive sales growth since the recession.”

Fast Casual v. Upscale Dining

The top performing segments based on same-store sales growth during May were fast casual, upscale casual and fine dining. The latter segments led the industry in sales during 2017 and continue to experience positive results in 2018. Fast casual, however, takes the prize for most improved. After two years of declining sales, which followed years of dominating the marketplace as the top performing segment, fast casual is experiencing a resurgence in 2018. The segment’s growth results have improved by 2 percentage points from their 2017 rate. By comparison, the other segments have only improved their sales results by an average 0.5 percentage points compared with the previous year.

Growth Opportunities

The weakest daypart year-to-date is dinner, with only 0.1 percent growth. For many brands, particularly those in full service, dinner is the biggest and, in some cases, only daypart. Lunch sales are also struggling and traffic in that daypart continues to decline. So where are restaurants finding success in driving incremental sales? The good news is that it is happening in all other dayparts. Sales in the mid-afternoon (after lunch and before the dinner rush), late night (after dinner) and at breakfast have each grown over 1.0 percent or more in 2018. At the same time, off-premise sales are also rising, reinforcing the trend of consumers spending relatively less for traditional in-unit dining experiences.

The Workforce

There is no doubt that one of the biggest challenges restaurants are facing is finding enough qualified employees to run their restaurants. The latest results published by TDn2K’s People Report™ indicate things are not getting any easier. Restaurant turnover is currently the highest it has been in decades. Compounding the problem, turnover for both restaurant hourly employees as well as restaurant management inched up again in April on a rolling 12-month basis. “This is to be expected,” said Fernandez, “considering that the national unemployment rate is now as low as it has been in the last 50 years. Furthermore, in 1969, restaurants were not up against companies like Uber or GrubHub when competing for employees. People Report data shows currently over 75 percent of restaurant companies are constantly understaffed.” So what can companies do to improve their retention? The recent People Report Recruiting & Turnover survey revealed that the most successful strategies to reduce turnover at the hourly and management level focus on three specific areas: compensation adjustments, improving engagement in restaurant managers and providing more training to all levels of employees.

Mobile Foodservice Forecast

The global mobile foodservice market is expected to register a CAGR of close to 10 percentduring the period 2018-2022, according to the latest market research report by Technavio.

A key factor driving the market’s growth is the increasing popularity of food trucks. There is an increase in demand for fast food in emerging economies. To cater to this demand, mobile foodservice operators have started focusing on strengthening their domestic and international presence. Another contributing factor for the rising number of food trucks is the relatively low initial capital investment and yearly overhead.

This market research report on the global mobile foodservice market 2018-2022 provides an analysis of the most important trends expected to impact the market outlook during the forecast period. Technavio predicts an emerging trend as a major factor that has the potential to significantly impact the market and contribute to its growth or decline.

In this report, Technavio highlights the use of improved equipment as one of the key emerging trends in the global mobile foodservice market:

Global Mobile Foodservice Market: Use of Improved Equipment

Foodservice operators use advanced equipment to reduce cost and increase efficiency. The use of improved equipment ensures energy efficiency, reduction in cooking time which leads to production efficiency. Also, the use of improved equipment leads to consistency in cooking which leads to better quality and taste thereby assuring repeat customers.

“The incorporation of new designs to offer visually appealing, multi-functional equipment, compliance with refrigeration regulations will lead to the growth of the market. In the fast-food industry, it is essential to invest in the correct equipment to ensure consistency in terms of taste and efficiency. In addition, the mobile foodservice market relies on multi-functional equipment that optimizes the limited space available in such a set-up to enable quick and systematic production,” says a senior analyst at Technavio for research on food service.

Global Mobile Foodservice Market: Segmentation Analysis

This market research report segments the global mobile foodservice market by product (food, and beverages) and key regions (the Americas, APAC, and EMEA).

The food segment held the largest market share in 2017, accounting for over 81 percent of the market. This product segment is expected to increase further over the forecast period, while the beverages segment will witness a corresponding decline in its market share.

The Americas held the highest share of the global mobile foodservice market in 2017, accounting for a market share of approximately 56 percent. However, the market share occupied by this region is anticipated to decrease by around two percent during 2018-2022. Although APAC held the smallest share of the market it is expected to register the maximum growth in its market share over the forecast period.

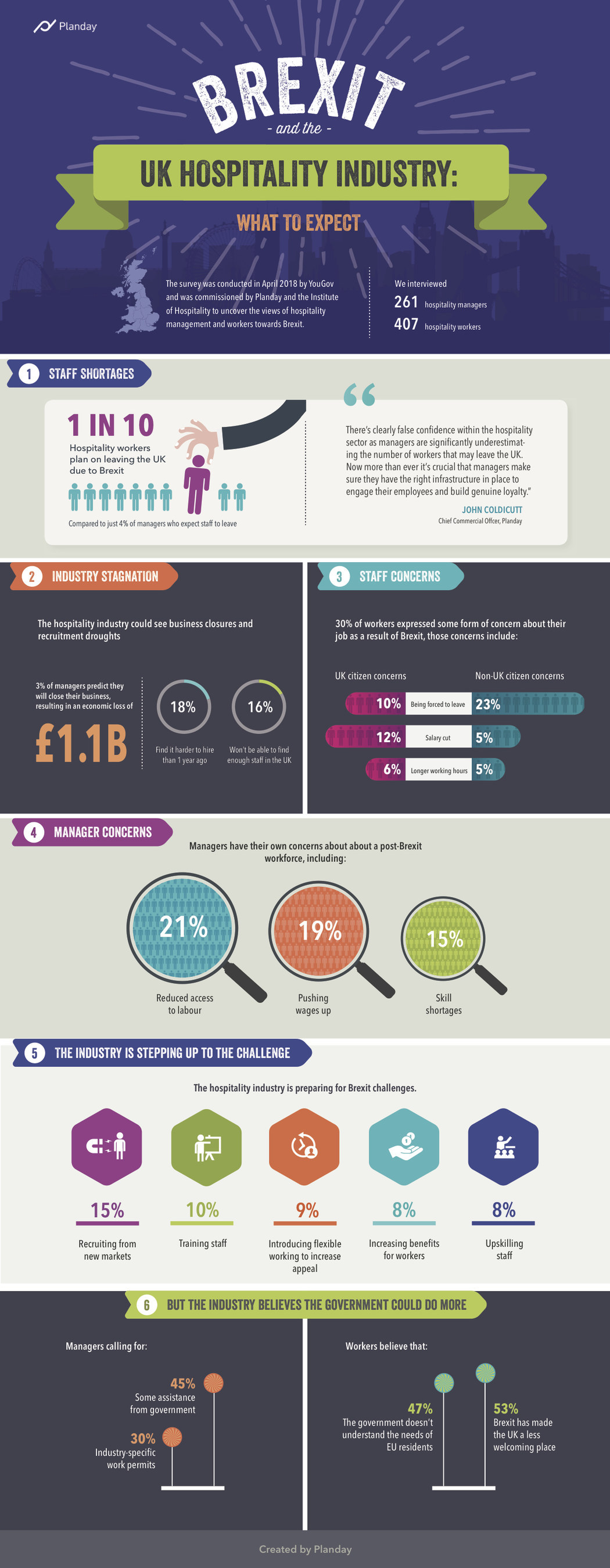

Brexit and the UK Hospitality Industry

- One in five hospitality businesses are finding recruitment harder than last year with serious concerns raised about fulfilling staff requirements over the next five years

- Three percent of businesses predicted to close as a result of Brexit, which would mean a loss to the UK economy of around £1.1bn

- 53 percent of workers think that Brexit has made the UK a less welcoming place to live and work

The UK hospitality industry could face significant staff shortages if results from a new survey launched by workforce collaboration software company Planday come to pass. The survey, conducted by YouGov, reveals that just over one in ten workers (11 percent, which is equivalent to around 330,000* staff nationally) working in UK restaurants, catering, bars and hotels are thinking about leaving the UK as a result of Brexit. This is in stark contrast to hospitality managers’ expectations that only around 4 percent of their workers are considering leaving the UK due to Brexit.

Industry Stagnation

Three percent of hospitality managers predict they will be forced to close their businesses as a result of Brexit, which nationally could equate to around a £1.1 billion loss for the economy**. Almost one in five (18 percent) of hospitality managers find recruitment harder now than in April 2017. 16 percent of hospitality managers do not think they will be able to fulfil staffing requirements over the next five years with domestic workers.

John Coldicutt, Chief Commercial Officer for Planday commented: “These findings show to us the depth of the potential impact of Brexit on the UK economy, with the hospitality industry being hit especially hard. There’s clearly false confidence within the hospitality sector with almost three times as many workers considering leaving as managers expect. Now more than ever it’s crucial managers make sure they have the right infrastructure in place to engage their employees and build genuine loyalty.”

Specific job concerns for hospitality workers

30 percent of workers expressed some form of concern about their job as a result of Brexit. Topping the list were immigration worries, with 23 percent (equivalent to around 86,500* people nationally) of staff polled who are born outside the UK concerned that they would be forced to leave. Other key staff worries amongst all staff focus on expectations of pay decrease (11 percent) or being made to work longer hours (six percent). About a third of managers (32 percent) who haven’t done so already think they will have to pay higher salaries and will experience labour (21 percent) and skills shortages (15 percent) as a result of Brexit.

Hospitality managers want more support from the government, calling for the following:

- Almost half (45 percent) of hospitality managers want the government to offer some form of assistance to the sector due to Brexit

- 30 percent want specific work permits or visas for hospitality workers post Brexit.

Peter Ducker, chief executive of the Institute of Hospitality commented: “Brexit will present some fundamental challenges to our sector if the changes proposed around immigration are approved, given the sheer number of staff and businesses that would be affected. These results clearly show the need across the sector for forward-planning and we are encouraged to see evidence of the industry stepping up to the challenges ahead through increased training and upskilling as well as the many innovative recruitment strategies we know our members are starting to put in place.”

The survey was conducted online in April 2018 by YouGov. The survey findings were based on 261 hospitality management interviews and 407 hospitality worker interviews across the UK. YouGov has conducted this research amongst a range of hospitality sectors including hotels, restaurants and bars.

Disruptive Brands Fuel Innovation

Disruptive brands provide Kraft Heinz with a springboard for new innovation, said GlobalData.

The future of Kraft Heinz new product development (NPD) is due to include avocado sauces, fermented foods and anti-oxidant lemonade according to GlobalData. Kraft recently launched its Springboard program to partner with companies who are disrupting food and drink markets in order to bring exciting new product innovation to supermarket shelves.

The Kraft Heinz Springboard program is designed to create partnerships with the most innovative product developments from up and coming smaller independent players. In return these players have the opportunity to work with a big FMCG business and gain increased exposure and capabilities.

Ronan Stafford, Lead Consumer Analyst for GlobalData commented, “Springboard offers a 16 week program, ensuring that Kraft can rapidly rotate brands and increase the chance of finding a big win.’’

Kraft Heinz has joined companies like PepsiCo, Coca Cola and General Mills in setting up incubators to foster the growth of disruptive products. Ayoba-Yo Meat Snacks stands out as Kraft Heinz’s strongest bet as consumers continue to snack frequently and are looking for healthier alternatives to chocolate and potato-based snacks.

Stafford explains, “Meat snacks match well with lots of different spices, appealing to adventurous consumers. However meat snacks remain a small market worldwide, rarely accounting for more than 10 percent of Savory Snack sales so this investment could make Kraft Heinz a big fish, but only in a small pond.”

The other four investments are closer to a game of hipster buzzword bingo. Cleveland Kraut fermented food, Kumana avocado-based sauces, Poppilu antioxidant lemonade and Quevos egg-white snacks are all on-trend. They target popular health needs and flavor trends, and are strongly differentiated from current offerings in these markets.

Stafford adds, ‘‘However, these four products target trends that are fleeting, many feel that we have reached “peak avocado”, fermented foods and egg-white snacks might be too unusual to resonate with a mass market audience, and selling health claims in lemonade is challenging, with drinks struggling to overcome perceptions of being either too high in sugar or full of artificial sweeteners.

New Respect for Eggs

Eggs have always been a restaurant and home kitchen workhorse, but lately they have garnered new levels of respect.

As noted in the Packaged Facts recent report Eggs: Culinary Trend Tracking Series, consumers are seeking higher levels of protein in their diets—a movement eggs-actly favorable to eggs, with their six grams of high-quality protein. A single egg does contain 62 percent of the currently recommended daily intake for cholesterol, but the new nutritional consensus is that the cholesterol level in foods should not be of special dietary concern. And though growing consumer attention to livestock animal welfare presents a business and ethical challenge, specialty brands and product offerings are at least addressing these issues, as are related trends in the meat, poultry, and dairy cases.

While fresh eggs as grocery products have held a high and steady 93-94 percent usage rate over in U.S. households, the percentage choosing to buy organic eggs notched up from 22 percent in 2010 to 26 percent in 2017. At the same time, data published in the report reveal that specialty egg offerings draw a significantly high share of health-conscious food shoppers, while store brands do the reverse. Dedicated vegetarians, for example, are nearly twice as likely to buy Land O’ Lakes, a brand line featuring organic eggs, cage-free eggs, and brown eggs with ALA Omega 3.

Creature Comfort Millennials

The Need for Mead

Mead, once the drink of the Gods, is resurgent once more in the premium alcoholic beverages category, said GlobalData.

Mead, otherwise known as honey wine, is one of the oldest alcoholic beverages known to man and has proved popular among all communities historically, including royalty, Vikings and even the Greek gods. According to GlobalData Mead is now making a comeback in the premium alcoholic beverages category and is fast becoming a drink of the future, rather than the past.

Charles Sissens, Associate Consumer analyst for GlobalData commented, ‘‘As consumers turn to more complex artisan attributes, including heritage, there is a clear sustained interest in craft brewing and premium alcoholic beverages. Consumers have become more experimental as they try more niche and unique products like Mead, leading to a rise in the number of meaderies around the world.’’

According to GlobalData’s Q4 2017 global survey, eight percent of global consumers state they ‘always’ purchase premium alcoholic beverages, whilst nearly half (47 percent) consume them ‘occasionally’. The American Mead Makers Association, confirm that there has been a steep rise in the number of producers, as mead has become one of the fastest growing alcoholic categories in the US. In 2003, the US only had 30 producers, now there are over 300.

Sissens added, ‘‘ ‘Forgotten’ drinks like mead are entering the mainstream once again and appealing to those consumers wishing to indulge in sweeter, less alcoholic beverages. We can expect more high-end bars to adopt drinks like Mead as a mixer giving them a modern twist, providing a natural next step for ‘craft’ drinks producers. With obscure product names and ancient flair, mead is expected to make an unprecedented comeback – delivering a tremendous opportunity for both small and big brewers.’’

Frozen Foods are Hot

The news for frozen food is good. The conversation is changing, consumer perceptions are on the rise…and now the numbers are showing growth in the category after a number of years of decline, as evidenced in this new Frozen Foods Have Never Been Hotter Infographic.

- Results from the National Frozen & Refrigerated Foods Association’s (NFRA) recent March Frozen Food Month promotion showed a 1.9 percent increase in unit sales and 2.2 percent in dollar sales, according to Nielsen – the best March performance for the frozen food category in five years*.

- A recent RBC Capital Markets report showed volume growth for the frozen category turned positive for the first time in five years, up 1 percent for the 12 weeks ending March 10. Frozen meals and appetizers, which make up 35 percent of the category, saw sales growth of 3 percent, the highest in five years.

- Nielsen reported that frozen food dollar sales in the U.S. rose 1.4 percent in the last year, with frozen vegetables particularly strong, jumping 4.5 percent.

- Acosta’s The Future of Frozen report showed 26 percent of total U.S. grocery shoppers shopping in the frozen foods department more frequently than last year with Millennials leading the way. Forty-three percent said they had bought more frozen items than the previous year, spending 9 percent more than average households per trip on frozen foods in 2017.

Many NFRA member companies, including Conagra, Pinnacle Foods, B&G Foods and Kellogg are all reporting positive frozen food growth for many of their frozen brands like Healthy Choice, Birds Eye, Green Giant, Eggo and MorningStar Farms.

Innovation in Frozen Foods

“The industry together is doing a great job in making this turn around happen,” said Skip Shaw, President & CEO of the National Frozen & Refrigerated Foods Association (NFRA). “The innovation we’re seeing from our brands in both product development and packaging demonstrates success in meeting the needs of a changing consumer base and aligning frozen food offerings to their new demands.”

Shaw noted that consumers are shopping differently and dining habits and traditions are changing. “There are many new frozen food brands and product lines that are now catering to a wider variety of cultures and dietary requirements,” he added. ” Whether someone is looking for vegan, ethnic, gluten-free, organic or antibiotic-free meat, the frozen food aisle has it all, and more.”

Changing Perceptions and Stigma

NFRA recognized a changing and challenging food environment, as well as a more food-aware and selective consumer, and launched a contemporary communications program in 2013. The Association enlisted Edelman PR to develop relevant industry messaging platforms, as well as new and engaging ways to reach consumers. A new PR Campaign Real Food. Frozen emerged with an overall goal to spark new conversations, to change the perceptions and stigma surrounding frozen foods, and to ultimately bring more shoppers into the frozen food aisles.

‘We go where the consumer is talking about food, and communicate about the benefits of frozen food,” continued Shaw. “We utilize extensive social media campaigns, influencer marketing, media outreach and strategic partnerships, and collaborative industry efforts to tell the frozen food story to large audiences. The messaging is resonating for sure, particularly with Millennials.”

Through its Easy Home Meals website, blog and social media platforms, NFRA’s messaging focuses on real ingredients, fresh flavors, chef-inspired recipes and wholesome meal ideas. “Additionally, the industry’s ‘perfect preservation’ flash-freeze technology is appealing to consumers today,” said Shaw. “They are looking for simpler, nutrient-rich, flavorful and less engineered foods. And they are concerned about food waste. Many products in the frozen aisles today meet their criteria, and this new consumer is realizing more and more that frozen food is real food…just frozen.”

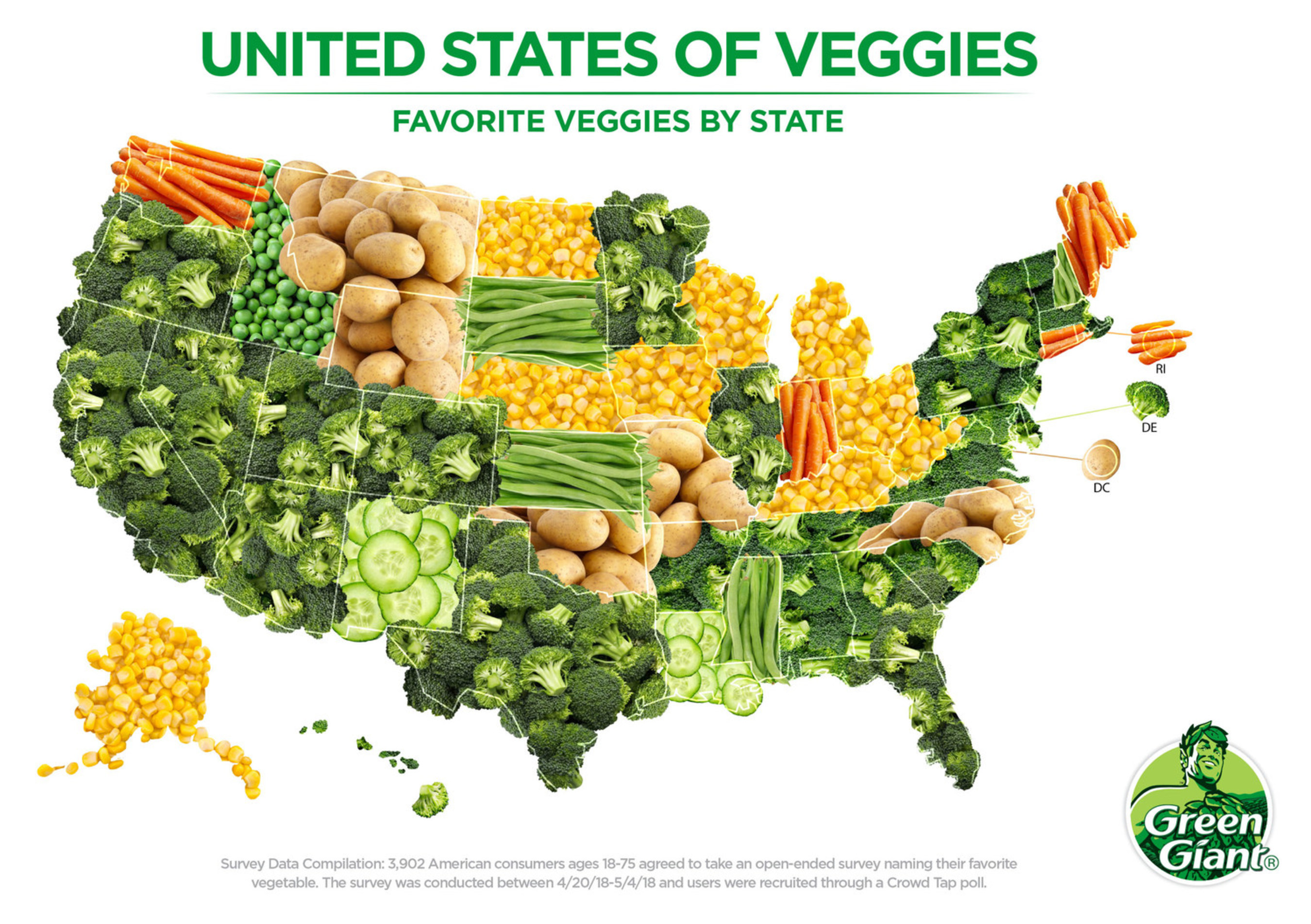

Broccoli Wins Most Popular

Green Giant® unveiled survey result findings naming broccoli as America’s favorite vegetable. In an open-ended survey timed to National Eat Your Vegetables Day (June 17), Green Giant polled nearly 4,000 Americans to determine the most popular vegetable in each state.

Key survey findings include:

- Broccoli is the most popular vegetable in 47 percent of U.S. states

- Corn is the second most popular vegetable, chosen as the favorite in nine U.S. states

- Idaho, known for its potatoes, was the only state to choose peas as the favorite veggie

- Onions, peppers, celery and spinach are noticeably absent from the list of favorites

Survey Data Compilation – 3,902 U.S. residents ages 18 and older agreed to take an open-ended survey outlining their favorite vegetable and the state they reside in. The survey was conducted by Green Giant from April 20, 2018 to May 4, 2018 using Crowd Tap.

Popular Plant-Based Proteins

Plant-based proteins aren’t just for vegans and vegetarians anymore as U.S. consumers seek more protein in their diets and plant-based foods become more available and tastier. Higher demand for plant-based proteins is evidenced by the 19 percent growth in cases shipped of these proteins from broadline foodservice distributors to independent (one to two units) and micro-chain (three to 19 units) restaurant operators in the year ending March 2018 compared to same period year ago, according to The NPD Group. In-home consumption trends are also showing an increase in consumer demand with a 24 percent increase since 2015.

With 60 percent of U.S. consumers telling NPD they want to get more protein in their diets, consumers are mixing both meat and plant-based proteins into their diets. In a recent NPD survey, 14 percent of U.S. consumers, which translates to over 43 million consumers, regularly use plant-based alternatives such as almond milk, tofu, and veggie burgers, and 86 percent of these consumers do not consider themselves vegan or vegetarian. The heaviest users of plant-based foods are those who are more likely to be on a diet or to have a medical condition, and consumers who tend to think of food as fuel, are more convenience-oriented than others, and less confident in their cooking skills. One of the fastest growing consumer segments who eat plant-based foods are those who are all about the taste of foods.

Beef alternatives make up 44 percent of the plant-based categories being shipped to independent and micro-chain restaurant operators and are the primary contributor to the total category’s growth. Burgers are the largest beef alternative category but ball products, like meatless meatballs, used as ingredients have outpaced burgers and all other plant-based protein formats in terms of growth. The Census Divisions that have realized the strongest growth in case shipments of plant-based proteins to foodservice operators are the Mountain/Pacific Census Division (Arizona, California, etc.) and the South Atlantic (Florida, North and South Carolina, etc.).

“It’s clear by the growth of plant-based proteins that this category has mainstreamed beyond those consumers who choose a meatless diet,” says David Portalatin, industry advisor for NPD’s Food Sector. “Food manufacturers and operators have improved the quality and taste of plant-based foods over the past several years and these foods are appealing to a variety of consumer segments for a variety of reasons.”

Going Local for Foodie Adventure

- More than six in ten travelers (61 percent) say they pick a destination for its great food or drink

- Over half of global travelers (51 percent) are likely to seek out local street food markets

- Malaysia, Taiwan, Japan and Brazil are among the top places to discover local food across the globe

If there’s one thing most people agree on when traveling, it’s that food is a major consideration when picking a destination. According to Booking.com data from over 50,000 global travelers, more than six in ten travelers (61 percent) say they pick a destination for its great food or drink. There’s no denying the significance of culinary travel, with more than a third (34 percent) of global travelers – rising to 40 percent of millennials – planning to take a dedicated food tourism trip sometime in 2018.

It’s also clear that our appetite is only increasing. Almost half (49 percent) of global travelers are still looking to be more adventurous with the type of cuisine they eat while traveling, rising to 60 percent of millennials. One way to achieve this is to sample the local delicacy whilst traveling. In fact, almost two thirds (64 percent) of global travelers will try to eat more local food in 2018.

Local Delights: Places to Try

Some of the best places to try the local cuisine are in Southeast Asia, with regional delicacies like dim sum, noodles and pho. Perhaps it’s no coincidence that exploratory eaters also come from this area, as 57 percent of Asians confirm they are looking for new cuisine to try this year.

|

Top Destinations for Tasting Local Food |

|

Ipoh, Malaysia |

|

Kaohsiung, Taiwan |

|

Nagoya, Japan |

|

Johor Bahru, Malaysia |

|

João Pessoa, Brazil |

|

Ho Chi Minh City, Vietnam |

|

Sarajevo, Bosnia and Herzegovina |

|

Colmar, France |

|

Lima, Peru |

|

Catania, Italy |

|

Belgrade, Serbia |

Street Food Markets

Over half (51 percent) of global travelers are likely to seek out local street food markets this year, which is a great way to try local food. More than half of travelers (54 percent) want to experience more unique dining experiences when traveling and food trucks are the perfect way to do this. Millions of Booking.com reviews by real travelers reveal the top destinations to enjoy these unique foodie experiences:

|

Top Destinations for Street Food |

Top Destinations for Food Trucks |

|

Jeonju, South Korea |

Portland, USA |

|

Hsinchu City, Taiwan |

Sao Paulo, Brazil |

|

Marrakech, Morocco |

Seoul, South Korea |

|

New York City, USA |

Bangkok, Thailand |

|

Mexico City, Mexico |

Istanbul, Turkey |

A Photo Good Enough to Eat

Social media is filled with photographs that show off traveling and foodie adventures. Beautiful, bright and unusual foods are the perfect way to fill your feed and offer an opportunity to show off local food finds. Nearly a third of travelers (31 percent) plan to take more food pictures this year. This is most popular amongst Asian travelers from China (65 percent), India (57 percent), Thailand (53 percent), Indonesia (50 percent) and Hong Kong (48 percent).

Pepijn Rijvers, Senior Vice President and Chief Marketing Officer at Booking.com comments: “Food plays a huge role in our travel choices and ultimately in our overall travel experiences. Trying the local and street food is a great way for travelers to really embrace the local culture, get immersed in local communities and explore the new and different. Using our endorseme

The Impact of SEO

Small businesses rely on SEO experts to track on-site engagement for their SEO efforts, according to a new survey from The Manifest, a B2B news and how-to website. More than 20 percent of small businesses that partner with an SEO agency or consultant measure on-site engagement to determine the success of their SEO strategy.

Measuring on-site engagement allows small businesses to determine how potential customers will engage with their website content and advance through the conversion funnel.

The other popular SEO metric small businesses track is the number and quality of backlinks (25 percent).

Equipped with engagement metrics tracked with help from an SEO agency or consultant, small businesses can adjust their SEO strategies to optimize how they convert search audiences to leads and ultimately to customers.

Company Size and Marketing Budget Determine SEO Investment

Number of employees and scope of marketing budget indicate how likely a small business is to invest in SEO and PPC advertising.

Over 80 percent of small businesses with more than 50 employees currently invest in SEO or plan to in 2018. Nearly three-quarters (74 percent) of this group also invest in PPC advertising.

The size of a small business’ marketing budget indicates whether a small business will invest in SEO.

Over 90 percent of small businesses surveyed with a marketing budget of $500,000 or more invest in SEO, compared to 34 percent with marketing budgets of $10,000 or less.

SEO Investment Is a Competitive Advantage for Small Businesses

Experts say investing in SEO provides a competitive advantage and a stamp of legitimacy for a small business.

Most small businesses with fewer employees and smaller marketing budgets don’t invest in SEO, providing an opportunity for other businesses to fill a market gap. Researching how competitors invest in SEO can help a small business stand out.

“Since your competition is most likely not investing in SEO, I’d urge small businesses to take the plunge. Because your competition isn’t there, there’s sure to be low-hanging fruit you can leverage and find success early on,” said Lisa Hirst Carnes, co-founder and marketing director of ArcStone, a design and marketing agency based in Minneapolis.

Failing to appear in search engines for relevant queries, particularly those that contain a company’s brand name, may raise skepticism among customers who expect all companies to have either a website or a social media presence.

Regardless of company size or marketing budget, social media marketing (56 percent) is the most common SEO service that small businesses carry out.

Read the full report here.

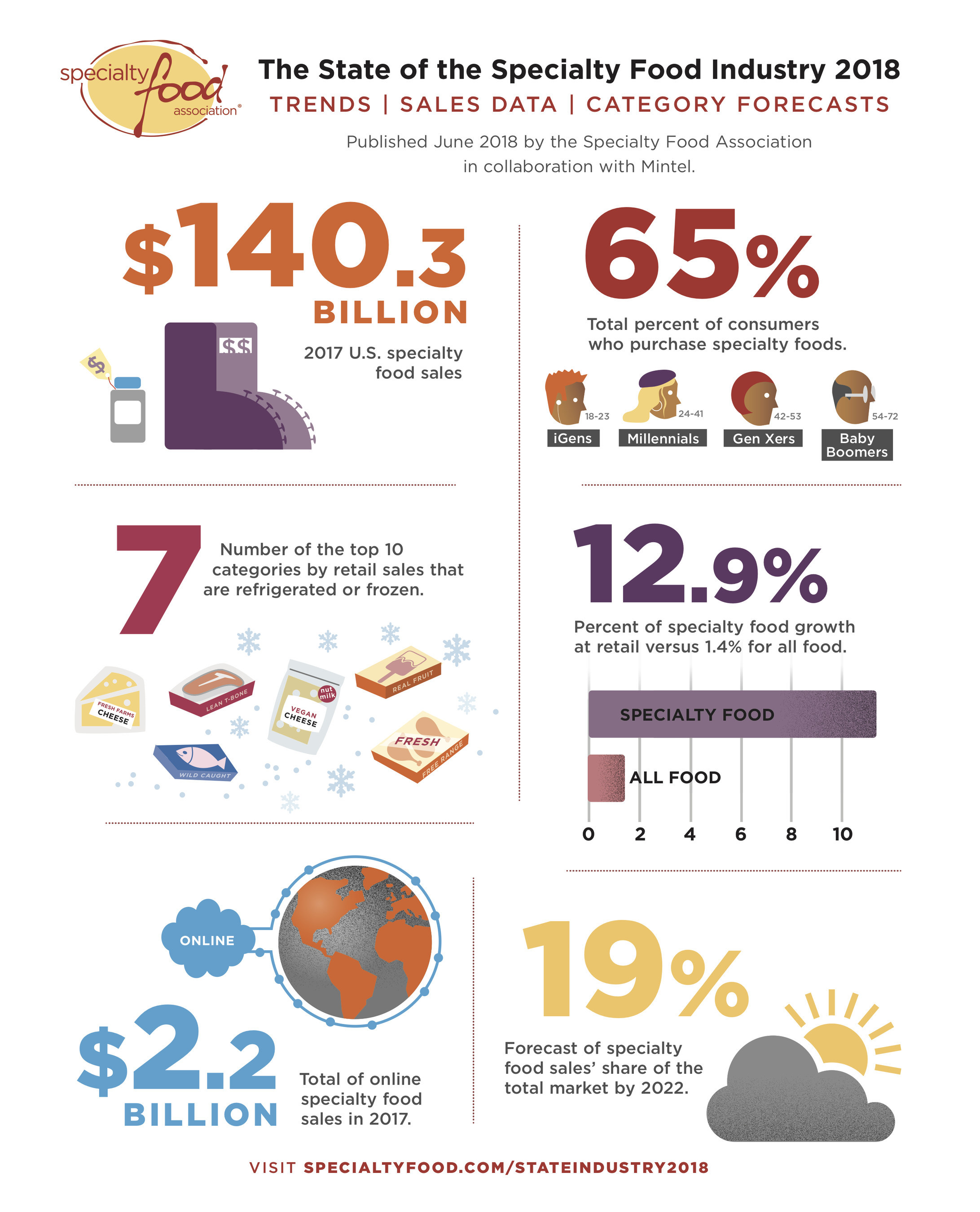

Specialty Food Growing Fast

The Specialty Food Association’s (SFA) annual State of the Specialty Food industry report reveals that specialty food remain one of the fastest-growing segments of the food business. Fueled by increasing interest from both consumers and retailers, total sales jumped 11 percent between 2015 and 2017, hitting $140.3 billion last year. Specialty food sales outpaced the growth of all food at retail – up 12.9 percent vs. 1.4 percent. Product innovation and the wider availability of specialty foods through mass-market outlets is also playing a part in the industry’s success. Sales through foodservice increased 12.8 percent and online by 21 percent as U.S. consumers make specialty food a regular part of their diets both at home and when dining out.

“The specialty food industry is a business that is constantly evolving,” said Phil Kafarakis, president of the Specialty Food Association. “Consumers of all ages are embracing specialty foods and making purchases everywhere they happen to be – from convenience stores to big box retailers to online, as well as in traditional gourmet shops and groceries. Foodservice and retailers are relying more and more upon our products. The industry’s growth has been building and will continue to maintain momentum for years to come. Our research provides a comprehensive picture of where we are today and can be used to help businesses prepare for future success.”

Beginning this year, the Specialty Food Association has refocused its annual research into a single, comprehensive State of the Specialty Food Industry report. Working with Mintel, the report explores where the current market stands, the opportunities and challenges it faces, where it is going based on sales forecasts in key categories, and how the specialty food consumer is evolving.

Key Facts and Figures:

Top Five Categories with Highest Dollar Growth ( percent Change from 2015-2017)

- Water +76.1 percent

- Rice Cakes +64.1 percent

- Refrigerated RTD Tea & Coffee +63.2 percent

- Jerky & Meat Snacks +62.1 percent

- Shelf-Stable Creams and Creamers +61.7 percent

Share of Consumers Buying Specialty Foods By Generation (2018)

- iGens (age 18-23) 79 percent

- Millennials (age 24-41) 67 percent

- Gen Xers (age 42-53) 65 percent

- Baby Boomers (age 54-72) 60 percent

Top U.S. Dollar Sales of Specialty Food by Market Segment ( percent change 2015 to 2017)

- Brick-and-Mortar retail Channels +10.7 percent

- Foodservice +12.8 percent

- Online +20.9 percent

The Future of Dinner

U.S. consumers ate nearly 100 billion dinner meals last year with the vast majority of those meals being shared with others in the home. The tradition of eating dinner at home together has stood the test of time and will continue into the near future but with a lot of modern twists, finds the recently released Future of Dinner study by The NPD Group.

Although consumers still have dinner at home together, the American dinner meal today looks different compared to 20 years ago. Consumers now have access to almost anything through grocery delivery, meal prep kits, grocerants (supermarkets that offer restaurant quality foods), online ordering, and mobile apps. Convenience is just as important as it was 20 years ago but a new level of it has been enabled with technology and new kitchen tools. In the past, dinner comprised of the “trinity meal” – a protein, a starch, and a vegetable. Today, dinner tends to be a “multi-component” meal, rather than three separate items, the protein, vegetable, and starch are combined in one item, like tacos, according to the NPD study, which provides a comprehensive view of how solving for dinner is, and will be, evolving based on generational shifts, consumer needs, and new solutions available to consumers.

In the future consumers will be less concerned about getting the parts and pieces for their dinner and more focused on getting the meal as a whole. Even with more focus on getting the entire or most of the meal at once, the types of dinners forecast to grow over the next five years show meal preparers’ willingness to invest a moderate amount of time into the meal. The average dinner meal takes about 30 minutes to prepare and cook and this level of involvement will continue in many U.S. households. As breakfast and lunch become more snack food driven, fragmented, and portable, dinner retains a structure of mostly hot main dishes paired with a side along the dinner continuum, reports NPD. Fresh, refrigerated, and blended meals (meals that include a restaurant or prepared food) are among the types of dinner items forecast to grow.

“While dinner as an institution is deeply rooted, the what, how, and why surrounding dinner reflects much of the disruptive change we see all around us,” said David Portalatin, NPD food industry advisor. “Consumers are solving for convenience at dinner time in new ways while still retaining dinner meal traditions. Food companies need to understand these shifts in order to meet the needs of their consumers and grow their business.”