According to a Recent Study/Survey … Mid-August 2018 Edition

36 Min Read By MRM Staff

This edition of Modern Restaurant Management (MRM) magazine’s “According to …” research roundup features research in how guests use voice search, the economic vitality of the foodservice industry and noise levels in Manhattan restaurants.

Importance of Voice Search for Restaurants

Yext, Inc. released new survey data on how restaurant-goers use voice search to find and engage with restaurants. The results reveal that voice search has become an important part of how consumers interact with restaurants, and that voice search is an increasingly important part of restaurant marketing.

The Yext-commissioned survey polled 1,000 adults in the U.S. who have asked a restaurant-related question using voice-enabled services like Siri, Alexa or Google Assistant, to source information or ask questions within the last year. The research revealed the following key findings among this group of respondents:

1 in 4 consumers who get a restaurant result in voice search visit that restaurant.

- 53 percent of respondents would like to use voice to search for restaurants based on menu information

- 49 percent would use voice search to find information about a specific restaurant

- 44 percent would use a voice query to find restaurants based on cravings or cuisine type

- Upon hearing about a restaurant in voice search, 31 percent of respondents indicated they would likely go online to conduct further research about the restaurant, whereas 24 percent would visit the restaurant, and 20 percent would ask the voice device for more information.

Consumers frequently search for restaurant details and attribute information:

- 80 percent of respondents reported already using their voice device to search for a restaurant by particular attributes

- 38 percent of respondents use voice devices to search for cuisine by type or food items

- 28 percent use voice search to find hours of operation

- 14 percent used a voice query to determine specifics like WiFi availability.

Consumers want to use voice search to interact with restaurants:

- 39 percent of respondents would prefer to use voice devices over smartphones when searching for restaurant information

- 35 percent prefer to use voice devices over smartphones to order food from restaurants

- 61 percent of consumers indicated interest to use voice search to get directions to a restaurant

- 55 percent would use voice to initiate a phone call to a restaurant

- 47 percent would use voice to gather ratings or reviews about a restaurant

- 45 percent of respondents would make a reservation via voice search.

“The rise of smart devices, voice search, and AI is quickly changing the game for restaurants everywhere. In this new environment, more customers than ever are asking AI-powered services like Google Assistant, Siri or Alexa detailed questions about restaurant brands, locations and menu items,” said Lee Zucker, Head of Industry, Food Services at Yext. “Restaurant brands must take control of their digital knowledge everywhere to reach consumers with the right information, at the right moment, and ultimately gain an advantage over their competitors.”

Voice enabled digital assistant use is forecasted to grow by nearly 120 percent in the next year. With adoption climbing rapidly, voice search will continue to transform the way consumers find and engage with restaurants, and ultimately where they decide to dine.

To learn more, click here.

The Vitality of Foodservice Distribution

The foodservice distribution industry’s vast economic footprint contributes significantly to local, state and federal economies and delivers the goods to sustain America’s appetite for dining out, according to a report by the International Foodservice Distributors Association (IFDA). With annual foodservice distribution industry sales at $280 billion in 2017—about the size of Louisiana’s total state GDP—the foodservice distribution industry operates 153,000 total vehicles and employs 131,000 drivers. In fact, the industry’s total employment impact is more than 1 million jobs nationwide, more than the number of people who live in the state of Delaware.

“Americans love to dine out, and the foodservice distribution industry makes trips to our favorite restaurants possible, while also contributing to local and state economies and providing high-quality jobs,” said Mark S. Allen, President and CEO of the International Foodservice Distributors Association.

Key study findings show that annually, U.S. foodservice distributors:

- Employ a workforce of 350,000 people and support an additional 700,000 jobs in the nation’s economy, for a total employment impact of more than 1 million jobs.

- Generate industry sales of $280 billion and supports an additional $51 billion in economic output throughout the economy, for a total economic impact of more than $331 billion.

- Donate 2.9 million cases of food and beverage products to charity and volunteer 368,000 hours, adding up to an estimated value of charitable contributions at more than $550 million.

- Operate 15,000 distribution center locations and deliver 8.7 billion cases annually – nearly 24 million cases per day.

- Operate a vehicular fleet of 153,000 power units, trailers and trucks that are driven 3.2 billion miles by 131,000 drivers.

IFDA engaged FTI Consulting to produce the study by conducting primary research, include multiple public sources, and apply industry-leading economic modeling.

To view the full report, click here.

July Restaurant Sales Report

The chain restaurant industry posted another month of positive same-store sales growth in July, but concern about the industry’s strength resurfaced. Same-store sales were up 0.5 percent for the month, which is a drop of about 0.5 percentage points vs. June. More discouraging was the fact that July’s modest results were comparing to weak comparable sales from 2017. These insights come from TDn2K’s Black Box Intelligence™ data, based on weekly sales from over 30,000 locations representing 170+ brands and nearly $70 billion in annual sales.

“Restaurants had a terrible month in July of last year,” commented Victor Fernandez, vice president of insights and knowledge for TDn2K. “With same-store sales down -3.0 percent, July of 2017 was the third worst month in the last three years. Only two winter months hit by extreme weather posted weaker results. So the small uptick in sales in July is far from being cause for celebration given the extremely easy comparison. If anything, it was a great missed opportunity for the industry to post its best results in years.”

Underlying the industry’s weak sales is the persistent decline in guest counts. Same-store traffic dropped -1.8 percent in July, which also highlights the relative weakness of the month considering last year’s -4.8 percent decline. Restaurants may be getting a bigger piece of the overall food spending than grocery stores, but price increases are driving the increased spending. When it comes to traffic, chains have been losing guest counts to their many competitors every year since the recession.

Slow Wage Gains Raise Concern Despite Economy’s Positive Momentum

“Significant economic momentum was carried into the summer that should allow solid growth to continue for the overall economy,” predicted Joel Naroff, president of Naroff Economic Advisors and TDn2K economist. “Despite a less than stellar July job gain, the three-month average was still extremely robust.”

“But wage gains remain limited and continue to expand at a lethargic pace. While that has yet to affect consumer spending, which is being hyped by the tax cuts, it raises questions about the ability to sustain the solid consumption over the next year. In addition, there are few indications the issues being created by the trade skirmishes will dissipate soon. Thus, while expectations are for restaurant spending to continue to expand slowly, the risks appear to be on the side of a moderation in demand as we go into 2019.”

Fast Casual and Casual Dining Show Most Improvement

The best performing industry segment based on sales in July was fast casual. Only two other segments, family dining and casual dining, reported positive sales for the month.

Furthermore, the strong results for fast casual and casual dining extend beyond just the latest month. After reporting the weakest sales performance in each of the last two years, fast casual and casual dining have seen the biggest improvement in same-store sales growth in 2018 vs. 2017. Fast casual is the only segment with six consecutive months of positive sales growth.

Turnover Stabilizing for Hourly Employees, Management Turnover Still Rising

The labor markets continue to be extremely tight, with the unemployment rate at 4.0 percent or lower in the last four months. To further complicate things, job growth in the industry accelerated according to TDn2K’s People Report™. The number of chain restaurant jobs increased by 1.7 percent year-over-year in June.

As a result, restaurant turnover for both hourly employees and managers continues at record high levels. New and replacement positions constantly become available and employers are always on the outlook for new ways to fill the vacancies. To no surprise, most operators still consider staffing to be one of their biggest pain points.

Amid all the difficulties that surround recruiting and retention in recent years, there is some small relief with respect to restaurant hourly employees. Though still extremely high, turnover rates for hourly employees have begun decreasing slightly. This potentially indicates that turnover may have reached a peak and could be beginning to plateau at slightly lower levels.

Unfortunately, rolling twelve-month turnover for restaurant managers continued to increase in June. This is a critical performance metric the industry should be focusing on, given its relationship with hourly turnover, guest service sentiment and its linkage to same-store sales growth.

Looking Ahead

One factor supporting the continued trend of positive sales for the rest of the third quarter is the soft comparisons vs. last year. Two major hurricanes disrupted major population areas in 2017 during the second half of the quarter.

“However, as July demonstrated, chains continue to face fundamental challenges and growth is highly dependent on being able to maintain check increases that offset declining guest counts,” said Fernandez. “As the industry laps over tougher comparable months in the fourth quarter, if consumers don’t start seeing some robust increase in their real disposable income, which the economy has been unable to deliver in the last two years, we may start seeing a reversal in the upward sales trend we have been experiencing this year.”

America’s Best New Restaurants

Bon Appétit unveiled the Hot 10: America’s Best New Restaurants 2018. The annual list is now available in the September issue and on bonappetit.com.

Taking the top spot is Oklahoma City’s Nonesuch, a 22-seat tasting-menu spot from three 20-something chefs inspired by their home state. It joins past winners like New Orleans’ Turkey and the Wolf (2017), Atlanta’s Staplehouse (2016), and San Francisco’s Al’s Place (2015).

“Nonesuch was the best dining experience of the year. Flying under the radar–even among OKC residents–I was ecstatic and grateful to have stumbled upon it,” says editor at large Andrew Knowlton. “Its chefs have mastered how to incorporate hyper-local and foraged ingredients in a landlocked state, how to minimally yet artfully plate each dish, and how to express an undying love of all things fermented, pickled, and cured. This is the place that will put OKC on the national dining map.”

Other noteworthy spots on the list include Washington, D.C.’s live-fire cooking Middle Eastern joint Maydan (No. 2), Los Angeles’ next-gen Jewish delicatessen Freedman’s (No. 4), and Yume Ga Arukara (No. 8), a small noodle shop hidden in a Cambridge, Mass., college food court that only serves one dish.Bon Appétit also crowned Portland, Maine, the Restaurant City of the Year, and its editors picked up a few new obsessions, from ultra-refreshing shaved ice to katsu sandwiches to skin-contact wines. Read more in the September issue on newsstands and on bonappetit.com now.

“The ten restaurants on this list encapsulate what makes going out to eat right now so exciting,” says Julia Kramer, Bon Appétit‘s deputy editor. “There’s no one formula that lands a place on the Hot 10. From an off-the-beaten-path tasting menu in Oklahoma City to a refugee-run Cambodian noodle shop in Oakland, these are deeply personal restaurants that couldn’t exist anywhere but where they are.”

Best New Canadian Restaurants

Air Canada presented the 30 nominees for Canada’sBest New Restaurants presented by American Express. The highly anticipated longlist, drawn from a coast-to-coast culinary exploration, is out today on CanadasBestNewRestaurants.com.

From an Italian-inflected seafood menu in a beachy Halifax room to the wildly creative charcuterie cabinet of a French bistro in Victoria, this year’s finalists celebrate the delectable diversity of Canadian cuisine. Based on the recommendations from a panel of food experts, Air Canada sends one writer on an anonymous, month-long, cross-country dining marathon to determine the most notable new openings that become contenders for the coveted annual Top 10 list.

“For over 15 years, Air Canada has been committed to discovering the latest Canadian culinary innovations and dining destinations, and celebrating the central role they play in our customers’ travel experience,” says Andy Shibata, Managing Director, Brand, Air Canada. “This year, we want to celebrate diversity in Canada’s culinary culture and highlight chefs and restaurateurs with global backgrounds. Their achievements will be honoured and featured online and in Air Canada’s enRoute onboard magazine.”

“Our Cardmembers are passionate about food and look to us to point them towards the country’s best restaurants and chefs,” says David Barnes, VP of Advertising and Communications, American Express Canada. “That’s why it’s a natural fit for us to pair with Air Canada and sponsor Canada’s Best New Restaurants for the fourth year running. We’re so excited about the contenders on this list this year.”

The 2018 nominees for Canada’s Best New Restaurants are:

1909 Kitchen, Tofino, BC; Aloette, Toronto; Atlas, Toronto; Avenue Restaurant, Regina; Bar Kismet, Halifax; Biera, Edmonton; Bistro Rosie, Montréal; Bread and Circus, Calgary; Bündok, Edmonton; La Cabane d’à Côté, Mirabel, QC; The Courtney Room, Victoria; Cruz Tacos, Calgary; Donna Mac, Calgary; Elena, Montréal; Giulietta, Toronto; Hopkins, Montréal; Il Covo, Toronto; Kanto 98th St., Edmonton; Kiin, Toronto; Kūkŭm Kitchen, Toronto; Vin Mon Lapin, Montréal; Omai, Toronto; Oxbow, Winnipeg; Passero, Winnipeg; The Restaurant at Pearl Morissette, Jordan Station, ON; Sand and Pearl, Picton, ON; Seedlings, Bloomfield, ON; Skippa, Toronto; St. Lawrence, Vancouver; Tanto, Toronto.

Canada’s Best New Restaurants 2018 highlights the top restaurants that have launched across the country over the last 12 months and deliver memorable experiences through the quality of their food, level of service and original contribution to the Canadian dining landscape.

The annual Top 10 ranking will be unveiled at a celebration in Toronto on October 25, 2018. Tickets for this event go on sale August 24, 2018, giving diners an opportunity to sample Canada’s Best New Restaurants all in one place. The winners will also be showcased on CanadasBestNewRestaurants.com and in the November issue of Air Canada enRoute magazine.

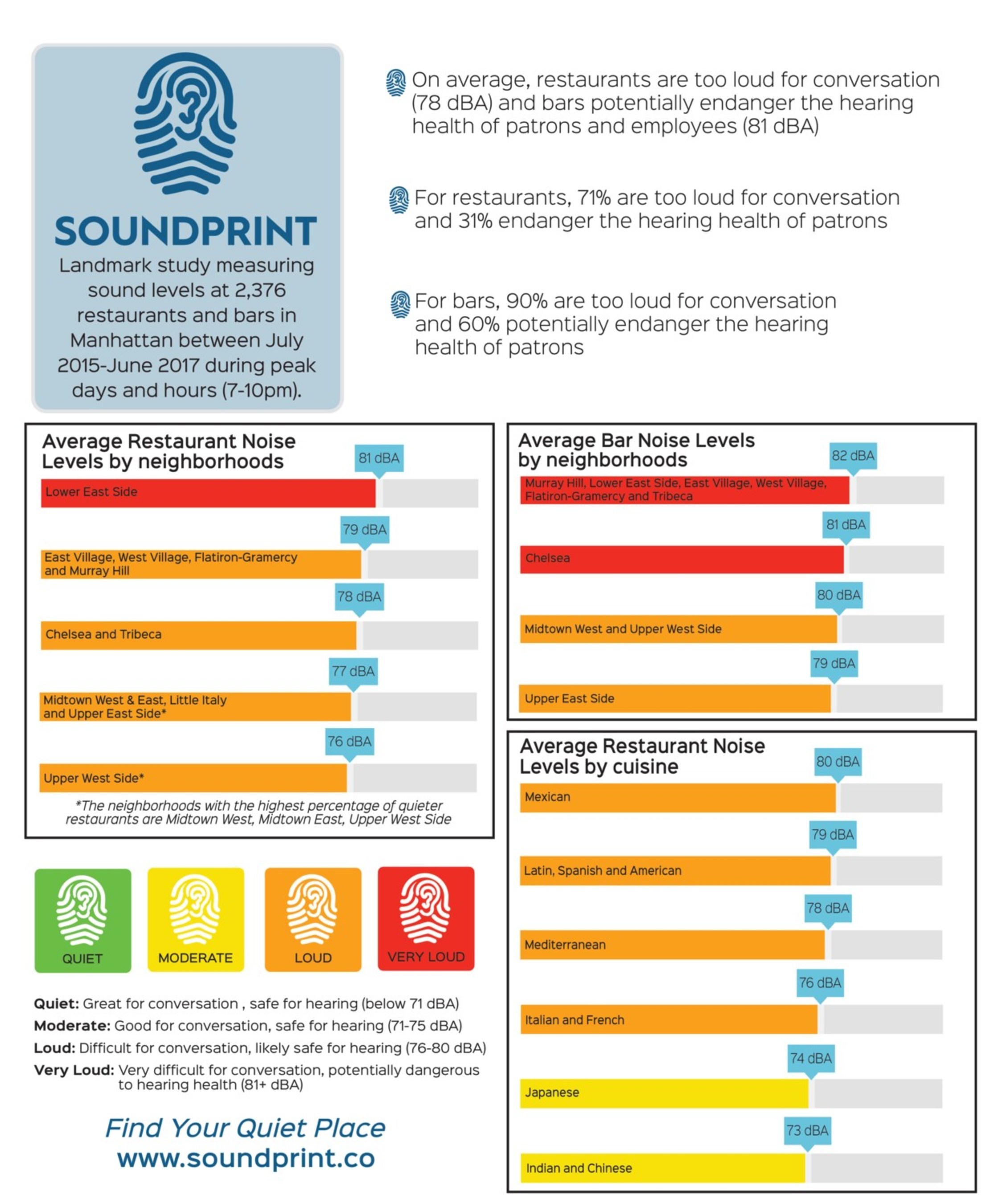

Manhattan Restaurants Are Too Loud

SoundPrint, a crowdsourcing app that allows people to search for and rate the noise levels of city venues, released a groundbreaking study published in the Open Journal of Social Sciences, that measures sound levels at restaurants and bars in Manhattan. It is the first ever large-scale study of its kind and also provides insight into sound level variance by neighborhood and type of cuisine.

The survey found that on average, New York City restaurants, measured in decibels (dBA), are too noisy for conversation (78 dBA) and that New York City bars potentially endanger the hearing health of venue employees and patrons (81 dBA). More than 70 percent of restaurants and 90 percent of bars are either Loud (dBA 76-80) or Very Loud (dBA +81), meaning 30 percent of restaurants and 10 percent of bars are conducive to conversation. Additionally, 30 percent of restaurants and 60 percent of bars are Very Loud, putting venue employees and patrons at risk for noise-induced hearing loss and other non-auditory health effects.

The survey, using the SoundPrint app, measured 2,376 Manhattan restaurants and bars between July 2015–June 2017 during primetime days and hours (Wednesday-Saturday, from 7pm-10pm) and were measured at least three times. Each venue’s dBA submissions were averaged to get one output dBA, and all submissions were at least 15 seconds. The sound level ratings system used was as follows: Quiet (below 71 dBA), Moderate (71-75 dBA), Loud (76-80 dBA – difficult for conversation and likely safe for hearing) and Very Loud (81+ dBA – prolonged exposure potentially endangers hearing health).

In comparing the sound levels in restaurants by neighborhood, SoundPrint found the Lower East Side to be the loudest, with an average dBA of 81. The East Village, West Village, Flatiron-Gramercy and Murray Hill were all at 79 dBA, Chelsea and Tribeca at 78 dBA, followed by Midtown West, Midtown East, Little Italy and the Upper East Side at 77 dBA, and the Upper West Side at 76 dBA. And the neighborhoods with the highest percentage of quieter restaurants are Midtown West, Midtown East, Upper West Side and Upper East Side.

Not surprisingly, bars revealed higher sound levels. Murray Hill, Lower East Side, East Village, West Village, Flatiron-Gramercy and Tribeca were all finalists for neighborhoods with the loudest bars, each with an average dBA of 82, which is Very Loud; while Chelsea had an average dBA of 81, Midtown West and Upper West Side had an average dBA of 80, and the Upper East Side with an average dBA of 79.

When looking at noise level by cuisine, Mexican restaurants were the loudest at an average dBA of 80, followed by Latin, Spanish and American at 79, Mediterranean at 78, and Italian and French at 76. In contrast, Asian restaurants such as Indian and Chinese, at 73 dBA, and Japanese at 74 dBA, were the quieter cuisines. These venues tended to have low background music, if any, and more sound absorbing materials such as carpeting and tablecloths.

This evidence-based study helps raise noise pollution awareness, a topic that SoundPrint founder Gregory Scott, a New Yorker with hearing loss, is passionate about. As sound levels increasingly eclipse 75 dBA, people with normal hearing have increasing difficulty following a conversation. Moreover, excessive noise is a health hazard for patrons and venue employees such as managers, waiters, and kitchen staff, and can lead to hearing loss and non-auditory health effects such as stress, hypertension and heart disease.

“There has been a considerable rise in noise complaints in restaurants as reported in surveys such as Zagat’s and evidenced by the rise in number of media articles on the subject. Yet the feedback until now has been primarily subjective,” said Scott. “SoundPrint was created to empower patrons and business owners to evaluate noise levels based on objective data (dBA), and share their findings with others so people can make informed decisions about which venues they would like to patronize, and how and when they might be able to optimize or mitigate the sound levels in the noisier venues.”

As a data collection tool for venue sound levels, SoundPrint aims to collaborate with researchers, notably in the field of acoustics and audiology, as well as with local agencies, public health organizations and other university departments to collect and analyze data.

For the entire study, click here.

Gen Z Habits

By 2020, Gen Z is projected to become the largest generation of consumers. That’s why Foursquare teamed up with Carat to use their combined consumer insights and understanding of how phones move through the world to uncover trends in GenZ consumer behavior.

Below are are a few of the top myths that their data busted:

- Gen Z is health obsessed: false

o GenZers are more likely to visits fast food joints (+19 percent) than the average consumer, such as In-N-Out (+111 percent), Shake Shack (+102 percent) and Chipotle (+93 percent).

o Millennials’ favorite chains tend to skew a little healthier, such as Juice Generation (+81 percent), Just Salad (+78 percent) and Chop’t (+58 percent).

- Gen Z prefers to shop online: false

o GenZers are 38 percent more likely to visit outlet malls, and 23 percent more likely to visit shopping malls than the average consumer.

o The top three stores they are more likely to visit than the average consumer are Urban Outfitters (+139 percent), Forever 21 (+134 percent) and Zara (+51 percent).

- Gen Z spends their free time on their phones: false

o Gen Z is intellectually and culturally curious, confirming the stereotype that they are more ambitious and entrepreneurial than Millennials.

o They’re more likely than the average U.S. consumer to enjoy a variety of leisure activities outside of the home, including theme parks (50 percent), water parks (41 percent) and planetariums (36 percent).

Gen Z College Student Food Trends

Today’s Gen Z college students, those born from the mid-1990s to the early 2000s, want it all when it comes to their food – quick, fresh, healthy, local and sustainable. Aramark, erving more than 3 million higher education students on more than 500 college and university campuses each year, is rising to the challenge and introducing new sustainability commitments, healthier menu items and innovative programs, to fit Gen Zers’ desires.

“Students’ demand for quality, health, convenience and personalization drives every stage of our menu innovation process,” said Jeff Gilliam, president of Aramark’s Higher Education business. “Our team layers consumer insights and proprietary data with trends from industry experts and market research partners to identify, create and introduce innovation to each menu we develop for college campuses.”

Enhancing Sustainability Efforts

Aramark’s mission of enriching and nourishing lives goes beyond the food being served. With more than 8 million tons of plastics leaked into the world’s oceans each year, and 80 percent of Aramark consumers trying to reduce personal consumption of plastic1, the company is significantly reducing single-use disposable plastics across its global food service operations by 2022, including a nearly 100 percent reduction of plastic straws and stirrers on its Higher Education campuses, starting September 2018. Smaller quantities of plastic straws will be available upon request, for those that need them, and for retail customers in some locations.

As a way to meet students’ growing demand for local and sustainable food, Aramark partnered with FarmLogix to launch Open Fields, a software platform that allows the company to easily source and report on sustainable ingredients and purchases. Aramark is using the tool to track sustainable attributes such as: Seafood Watch® Best Choice or Good Alternative, Fair Trade USATM certified, USDA Organic and more. Open Fields increases Aramark’s access to fresh, high quality, local produce and sustainably sourced products that also support the thousands of local communities the company serves.

Growing Plant-Forward Menu Options

Aramark’s proprietary plant-forward research suggests that consumers, primarily motived by health, are shifting their eating habits toward more plant-forward foods, with 60 percent wanting to reduce their meat intake2. Nearly three out of four (65 percent) Gen Zers, specifically, find plant-forward eating appealing and 79 percent would go meatless, 1-2 times a week now or in the future3.

As part of its Healthy for Life 20 By 20 commitment with the American Heart Association (AHA), Aramark’s chefs are finding creative ways to include more fruits and vegetables into menus; Thirty percent of the main dishes Aramark serves in Higher Education locations are vegan or vegetarian. This year, more than 150 Aramark chefs from college campuses across the United States and Canada participated in plant-based culinary trainings with the Humane Society of the United States (HSUS) to bring even more innovative recipes, that center on foods including vegetables, whole grains, legumes and nuts to their campus menus.

Some of the new plant-forward options debuting this fall Include:

Making Personalization More Popular

Aramark is introducing an enhanced Campus Dish web and mobile experience on the campuses it serves, to meet the demand for quick, easy and great tasting options. The new interactive design will let students, faculty and staff:

Aramark is also adding a new franchise partner to its robust list of national brands, with the introduction of New England-based Oath Pizza. The fast-casual pizza restaurant boasts a proprietary style of pizza crust that is hand-stretched, grilled, and seared in avocado oil, for a crispy crunch, that cooks in 90 seconds or less, and will appear on a dozen campuses this fall. Customers can choose from nearly 40 ethically sourced, seasonally inspired, and Certified Humane toppings, sauces and garnishes. As the only existing Certified Humane pizza restaurant in the country, all of Oath’s pizzas are made without hormones, artificial preservatives or antibiotics.

Yum! Brands Q2

Following the release of Yum! Brands Inc. Q2 2018 results, James Quinlan, Foodservice Analyst at GlobalData, a leading data and analytics company, offers his view on the challenges ahead for the quick service restaurant company:

‘‘Overall, Yum! Brands Q2 2018 results have exceeded analysts’ expectations; however a major ongoing challenge for the company is the rise in popularity of on-line food-ordering service companies combined with the rise of a more discerning consumer in its core markets. Both of these developments could pose a threat to future growth, especially for Pizza Hut where the brand’s consistency of menu offer and lack of innovation is becoming a major downside with millennial consumers.

‘‘Yum! Brands recent investment in on-line food-ordering service provider GrubHub may then prove a timely strategic move allowing them to put KFC, Taco Bell and Pizza Hut’s offer up-front on this on-line platform.

‘‘Marketing at KFC continues to attract younger consumers, a demographic that had drifted away from the brand to competitors and Taco Bell’s product mix continues to appeal to consumers hungry for Mexican food. This has resulted in both of these brands performing roughly in line with the wider quick service restaurant (QSR) channel. However, Pizza Hut continues to underperform dragging down overall growth for Yum! Brands in Q2.

Group Performance

‘‘Net income of $321 million is up 55 percent from $206 million the previous quarter. System-wide sales grew 4 percent compared to the same period in 2017. These results equated to earnings of 82 cents per share excluding special items, around 10 percent more than analyst expectations surveyed by Thomson Reuters of 74 cents. However, core operating Profit is down 6 percent on the same period in 2017. Also dampening Yum! Brands results, same-store sales, adjusting for new outlet growth, only grew by 1 percent in comparison with the same period in 2017. This indicates that the company may be reaching saturation point in it’s established markets and is struggling to establish itself in new areas.

KFC Performance

‘‘KFC accounted for 54 percent of Yum! Brands revenue in Q2 of 2018. Despite occasional hiccups in established markets, clever marketing and the chain’s well established product offering continue to resonate with QSR consumers. The chain saw same store sales growth of 2 percent in comparison to the same period in 2017, roughly matching most analysts’ predictions.

Taco Bell Performance

‘‘Despite its smaller size globally, in terms of profitability, Taco Bell is the standout in the Yum! Brands portfolio. Overall, despite only accounting for 21 percent of total system-wide sales for Yum!, the brand brought in 36 percent of total operating profits for the group. However, Taco Bell same store sales growth rose only by 2 percent in Q2 compared to the same period in 2017, indicating that the brands appeal may be waning. Further expansion of the Taco Bell brand both inside the US and into other developed foodservice markets will continue to drive profitability for Yum! Brands.

Pizza Hut Performance

‘‘Pizza Hut continues to be the weak performer in the Yum! Brands stable. The brand achieved static system-wide sales growth despite the opening of 27 locations in Q2. Pizza Hut is underperforming compared to KFC and Taco Bell, accounting for 24 percent of system-wide sales but only 19 percent of operating profits. This resulted in same store sales growth dipping into the negative for Pizza Hut compared to the same period in 2017.’’

American Love Affair with Coffee

It’s no secret Americans love their coffee, so McCafé set out to see just how deep the connection really is, uncovering the many feel-good moments of the day and how drinking coffee stacks up.

A McCafé’s Feelin’ Good Summer Survey* asked 1,000 U.S. adults about their love of coffee and other moments that contribute to their everyday happiness to coincide with the official launch of the brand’s latest beverage innovation: bottled McCafé Frappés, a line of ready to drink, coffee drinks.

When asked about their preferred ways to start their day in the McCafé survey, consumers said it’s a toss-up between coffee and cuddles with their beloved pets. While about a third (31 percent) of survey respondents said cuddling their pet would help turn around a bad morning, almost half (47 percent) turn to coffee to get a better start to their day.

Our obsession isn’t just about the caffeine fix—it’s also because coffee makes you feel good, and no season is as full of good vibes as summer. A majority of Americans (80 percent) agree that they have the most feel-good moments during the summertime, and coffee is an essential component. Summer just wouldn’t be summer without iced or cold coffee, and Americans believe summer would be incomplete without pool days (54 percent), ice cream trucks (44 percent) and iced or cold coffee (40 percent).

McCafé also found that when it comes to coffee, Americans would be willing to make all sorts of sacrifices. More than a third (34 percent) of respondents said they would prioritize drinking coffee over brushing their teeth if they only had 10 minutes to get ready in the morning, while nearly two out of five (38 percent) Americans would be more willing to spend a day without their smartphone than abstain from java for a whole 24 hours.

And employers could benefit from stocking the office fridge with coffee to boost morale, since more respondents said coffee perks them up (47 percent) than a compliment from their boss would (17 percent).

Key Findings

From AM to PM, any time is fine for a coffee:

- Americans are reaching for the good stuff throughout the day – 60 percent go back for more joe after noon.

- More than two in five (43 percent) Americans would grab an iced or cold coffee if they needed a “pick-me-up” during the day.

- A majority (65 percent) of iced or cold coffee drinkers regularly drink coffee throughout the day.

Our love affair with coffee extends from coast to coast:

- On average, New Yorkers would pay $33 for the last iced or cold coffee drink on a hot summer day.

- Chicagoans (57 percent) said coffee can turn around a bad morning better than a sweet goodbye from a partner or family member (51 percent).

- Los Angelinos know the pain of a jam-packed highway and yet to turn a bad morning around, many would choose their morning coffee (52 percent) ahead of experiencing little traffic or an easy commute (41 percent).

Iced or cold coffee has a special place in our hearts:

- More than a quarter (26 percent) of Americans drink iced or cold coffee year-round, regardless of the weather.

- Parents need that extra boost. Survey respondents with kids were more likely to grab an iced or cold coffee to brighten their day than non-parents (53 percent vs. 38 percent).

Our U.S. survey respondents agree: Coffee is a top choice when it comes to feeling good in the summertime – and always.

This survey was conducted by Wakefield Research for McCafé. The online survey included 1,000 nationally representative U.S. adults ages 18+, and 100 adults in each of the following DMAs: New York City, Chicago, and Los Angeles.

Food Recall Facts

With 2018 shaping up to be a serious year for foodborne illnesses,1 food recall activity by both the FDA and USDA saw significant increases in Q2 2018 due largely to bacterial contamination, undeclared allergens and foreign materials, according to the latest Recall Index released today by Stericycle Expert Solutions. The Recall Index covers recalls in the food, pharmaceutical, automotive, medical device, and consumer product industries.

Recalled FDA food units increased more than 20 times in the last quarter to nearly 213 million, mostly due to one large recall of salmonella-contaminated eggs that caused illnesses across the eastern seaboard and Colorado. The number of FDA food recalls increased seven percent over the previous quarter to 147, driven by undeclared allergens in foods (42.2 percent) and bacterial contamination (32 percent).

Similarly, USDA recalled pounds of food increased 74 percent to more than 1.75 million. The surprise was beef, which was the top category for recalled USDA pounds for the second consecutive quarter, coming in at 44.2 percent. Prior to Q1 2018, beef had not been a top recall category for two years. The discovery of foreign materials was the top cause of USDA recalls (31 percent).

“Outbreaks of foodborne illness caused by bacteria and other contaminants are perennial news makers, but if the first half of the year is any indication, 2018 will be one of the more noteworthy years for food and beverage recalls,” said Mike Good, vice president of Marketing & Sales Operations, Stericycle Expert Solutions. “There is no single cause we can point to. Whether it’s better testing methods, fewer inspectors, flawed farming and production practices, or other causes, this news suggests we need to redouble efforts in protecting the nation’s food supply chain.”

The full Q2 2018 Recall Index is available at https://www.stericycleexpertsolutions.com/recall-index/.

Retail Sales Uptick

July retail sales were up 0.4 percent seasonally adjusted from June and increased 4.9 percent unadjusted year-over-year, giving the industry a solid kickoff for the third quarter as consumers continued to spend despite concerns about the growing trade war, the National Retail Federation said today. The numbers exclude automobiles, gasoline stations and restaurants.

“Today’s numbers mirror the economy, which is in very good shape,” NRF Chief Economist Jack Kleinhenz said, citing consumer confidence, a strengthening labor market and more after-tax dollars in household wallets thanks to tax reform. “Consumer fundamentals remain healthy and continue to provide wherewithal for consumers to drive domestic economic growth.”

“Consumer spending is the backbone of the current economic expansion but the fly in the ointment is uncertainty regarding tariffs,” Kleinhenz said. “If they escalate, they will no doubt weigh on confidence and household spending.”

The three-month moving average was up 5 percent over the same period a year ago. The numbers come two days after NRF revised its annual forecast, saying 2018 retail sales are now expected to grow at least 4.5 percent over 2017 rather than the 3.8 percent to 4.4 percent predicted earlier this year.

The July results build on improvement seen in June, which was down 0.1 percent monthly from May but up 3.9 percent year-over-year.

NRF’s numbers are based on data from the U.S. Census Bureau, which said overall July sales – including automobiles, gasoline and restaurants – were up 0.5 percent seasonally adjusted from June and up 6.4 percent year-over-year.

Specifics from key retail sectors during July include:

- Online and other non-store sales were up 11.3 percent year-over-year and up 0.8 percent month-over-month seasonally adjusted.

- Health and personal care stores were up 6.2 percent year-over-year but down 0.4 percent month-over-month seasonally adjusted.

- Building materials and garden supply stores were up 5.8 percent year-over-year and unchanged month-over-month seasonally adjusted.

- Clothing and clothing accessory stores were up 5.4 percent year-over-year and up 1.3 percent month-over-month seasonally adjusted.

- Electronics and appliance stores were up 4.2 percent year-over-year and up 0.1 percent month-over-month seasonally adjusted.

- Furniture and home furnishings stores were up 3.9 percent year-over-year but down 0.5 percent month-over-month seasonally adjusted.

- Grocery and beverage stores were up 3.6 percent year-over-year and up 0.6 percent month-over-month seasonally adjusted.

- General merchandise stores were up 1.8 percent year-over-year and up 0.7 percent month-over-month seasonally adjusted.

- Sporting goods stores were down 5.7 percent year-over-year and down 1.7 percent month-over-month seasonally adjusted.

NRF increased its retail sales forecast for 2018, saying sales are expected to grow more than previously predicted thanks to tax reform and other positive economic inputs but warning that tariffs threaten to dampen consumer confidence. NRF now expects 2018 retail sales to increase at a minimum of 4.5 percent over 2017 rather than the 3.8 to 4.4 percent range forecast earlier this year. The numbers exclude automobiles, gasoline stations and restaurants.

“Higher wages, gains in disposable income, a strong job market and record-high household net worth have all set the stage for very robust growth in the nation’s consumer-driven economy,” NRF President and CEO Matthew Shay said. “Tax reform and economic stimulus have created jobs and put more money in consumers’ pockets, and retailers are seeing it in their bottom line. We knew this would be a good year, but the first half turned out to be even better than expected. However, a tremendous amount of uncertainty about the second half remains. It could be a banner year for the industry, or we could keep chugging along at the current rate.”

Retail sales in the first half of 2018 grew 4.8 percent year-over-year and have been up 4.4 percent year-over-year in the most recent three-month moving average. NRF now expects gross domestic product for the year to grow at the higher end of the 2.5 to 3 percent range it forecast earlier.

“We don’t want to see these economic gains derailed by protectionist trade policy,” Shay said. “With retailers ramping up imports and stocking their warehouses before most of the proposed tariffs will take effect, an immediate impact on prices on consumer goods is unlikely, but that won’t last for long. And just the mere talk of tariffs negatively impacts consumer and business confidence, leading to a decline in spending. It’s time to replace tariffs and talk of trade wars with diplomacy and policies that strengthen recent gains, not kill them.”

Tariffs of 25 percent on $34 billion worth of Chinese goods took effect in July, and are scheduled to take effect this month on another $16 billion, but both lists include a relatively low number of consumer products. Another round of tariffs on $200 billion in goods from China that would include a broader array of consumer items is currently under consideration and is expected to be finalized in September. Imports, meanwhile, have been at record levels this summer as retailers bring merchandise into the country before the tariffs can take effect, according to NRF’s Global Port Tracker report.

“There are many factors that can impact our forecast, but our overall outlook is optimistic,” NRF Chief Economist Jack Kleinhenz said. “Spending was weaker than expected at the beginning of the first quarter but has grown more rapidly since then and we continue to anticipate strong sales during the second half of 2018.”

“Despite this upgrade in our forecast, uncertainty surrounding the trade war and higher-than-expected inflation due in part to increased oil prices could make consumers cautious during the fall season,” Kleinhenz said.

In addition to expectations for this year’s spending, Kleinhenz said the revised forecast takes into account government revisions to retail sales, personal income and consumption numbers from 2016 and 2017 that affect year-to-year comparisons.

NRF is continuing to watch economic developments closely and will evaluate any changes to its forecast as necessary. If needed, the next update to the forecast will come as part of NRF’s annual holiday forecast in October.

Kleinhenz said total retail sales have grown year-over-year every month since November 2009, and retail sales as calculated by NRF — which excludes automobiles, gasoline stations and restaurants — have increased year-over-year in all but three months since the beginning of 2010.

Top Cruise Suites

Elite Traveler announces its Top Cruise Suites for 2018 featuring the best, most opulent suites from nine different ships.

Catering to ultra-high-net-worth individuals flying on private jets, Elite Traveler’s panel of luxury travel writers hand-picked suites from nine distinct cruise ships provide a discerning, modern traveler with the best the world has to offer. Below are some editors’ picks from the list:

Seabourn Ovation’s Grand Wintergarden Suite – Debuting earlier this year, not only does the ship feature 1,600 different works of art throughout, but it also relies on the expertise of seven Michelin starred chef Thomas Keller and Golden Globe-winning lyricist Sir Tim Rice to provide a multi-sensory experience to die for. Keller’s personally designed menu will be served in a personal dining area for those staying in the Grand Wintergarden Suite, and Rice has worked extensively on providing a soundtrack fitting for one of the world’s most luxurious cruises.

Crystal Serenity’s Crystal Penthouse with Verandah – Offering a once in a lifetime opportunity, next year Crystal Serenity will be embarking on an around-the-world expedition taking guests from Los Angeles through to the Pacific Islands, Australia, Africa and Europe before settling in the glitzy Monte Carlo. Onboard guests can enjoy a butler service, lectures on each of the destinations and a restaurant menu designed by legendary chef Nobu Matsuhisa of Nobu fame.

Oceania Cruises’ Marina Owner’s Suite – Featuring four fine dining restaurants, Monte Carlo-style casino and a 24 hour butler service, Oceania Cruises’ Marina is one of the world’s most luxurious suites and offers guests the chance to take part in a 34 day Seashores to Skyline cruise through the French Polynesian islands and the geographically diverse Americas.

Checkout Woes

Digimarc Corporation announced findings from a commissioned survey conducted by Forrester Consulting on behalf of Digimarc, revealing that long lines and poor checkout experiences reduce shopper morale, and are significant reasons for why consumers would shop elsewhere or shift to buying groceries online.

The survey of 1,000 U.S. consumers found that both the length of checkout lines and overall checkout experience are among the areas with the lowest customer satisfaction. According to the survey, 84 percent of shoppers said the checkout experience was important or very important, falling closely behind only location and price as criteria for deciding where to shop. In addition, 39 percent of shoppers have left a store without making a purchase because of long lines, and 56 percent are likely to change stores if the primary difference was better checkout.

Among the key findings from the Forrester study:

- Line length and the checkout experience has become as important as price in determining customer satisfaction and where they choose to shop

- Despite the importance that shoppers place on line length and the checkout experience, retailers may not be delivering a satisfactory experience

- Slow checkout experiences clearly hurt, not only customer satisfaction, but also have a detrimental impact on retailers’ revenue as shoppers buy less or abandon trips

“The research shows that slow checkout frustrates today’s shoppers who value their time as much as they do their wallet,” said Heidi Dethloff, vice president of marketing, Digimarc. “Retailers put effort and expense into pricing promotions for consumers focused on value, but they may be underestimating the true cost of slow checkout in terms of lost business revenue and diminished loyalty.”

Forrester forecasts that over the next five years, online grocery shopping will nearly double, going from $185 million in 2018 to $334 million in 2022.* To compete with the speed and convenience of online shopping, retailers must make the in-store experience better, and consumers surveyed say that means faster checkout among other amenities.

Forrester also conducted interviews with retail professionals as part of the study, revealing that some grocers may be reluctant or unable to hire more cashiers or expand the total number of checkout lanes at the front end. This reluctance was due to the increased capital expenditure and labor shortages.

Digimarc Barcode offers retailers a solution to the challenges of long lines and slow checkout, along with additional benefits throughout the entire store and the supply chain. Digimarc Barcode is an advanced, imperceptible code added to product packaging, retail labels, point-of-purchase (POP) displays and print material. It is reliably and efficiently scanned by consumer phones, associate mobile devices and retail barcode scanners. Retailers and consumer packaged goods manufacturers benefit from easier checkout, improved consumer engagement and supply chain efficiencies.

Download the free study and also register for a live webinar on September 13, detailing the study results, and demonstrating how retailers can implement technology solutions to improve the customer experience.

Frozen Bakery Products Forecast

Global Frozen Bakery Products Market is estimated to grow at a substantial CAGR in the forecast period as the scope, product types, and its applications are increasing across the globe. Frozen bakery products comprise doughnuts, pancakes, cakes, etc. These Frozen bakery products have a restricted shelf-life, hence are not bought in a huge amount by consumers. Storage of frozen bakery products at an appropriate temperature is essential to confirm safety and decrease wastage.

The factors that propel the growth of the Frozen Bakery Products Market include surge in demand for suitable food products and drive for consistency, safety, and greater taste, surge in the number of bakery industries. On the other hand, there are factors that may hamper the growth of the market including partly baked frozen bread after re-baking have a denser structure, harder crumb, and lesser volume, than the directly baked bread.

Frozen Bakery Products Market may be explored by type, application, and geography. Frozen Bakery Products Market may be explored by type as Pizza Crusts, Breads, Cakes & Pastries, Others (waffles, cookies, pretzels, biscuits, donuts, and bagels). The “Cakes & Pastries” segment led the Frozen Bakery Products Market in 2016 and is anticipated to maintain its dominance by 2024 owing to surge in imports and exports of frozen cakes & pastries from leading regions, huge popularity.

The Frozen Bakery Products Market could be explored based on distribution channel as Retail, Catering & Industrial, and Artisan Bakers. The “Retail” segment led the Market in 2016 and is anticipated to maintain its dominance by 2025 due to inclination and capability of customers to spend and try new products and changing consumption patterns. Frozen Bakery Products Market may be analyzed by technology as Ready Baked & Frozen, Raw Products, and Ready-to-Bake.

Frozen Bakery Products Market is categorized based on geography into North America, Latin America, Japan, Middle East and Africa, Western Europe, Asia Pacific, and Eastern Europe. Asia-Pacificaccounted for the major share of the Frozen Bakery Products Market Size in 2016 and will continue to lead in the forecast period. The factors that could be attributed to the growth include developing countries have significant potential clients that are accepting the ready-to-cook and more suitable food choices. China is the major country to hold the maximum part in the market owing to the changing consumption pattern of consumers and rapid urbanization in this nation.

The key players contributing in the robust growth of the Frozen Bakery Products Market comprise Oleo-Fats Inc., Adani Group, Wilmar Group, Ruchi Soya, Cargill Inc, Gef India, United Plantations Berhad, Ssd Oil Mills, Wilmar International Limited, Astra Agro Lestari, Conagra Foods Limited, Pt Astra Agro Lestari Terbuka, International Foodstuff Company Holdings Limited (Iffco), Fuji Oil, Bakes Group, and Peerless Foods. The leading companies are taking up partnerships, mergers and acquisitions, and joint ventures in order to boost the inorganic growth of the industry.

In this report, the global Frozen Bakery Products market is valued at USD XX million in 2017 and is expected to reach USD XX million by the end of 2025, growing at a CAGR of XX percent between 2017 and 2025.

Greenpeace: Retailer Progress on Sustainable Seafood

The 10th edition of Greenpeace’s Carting Away the Oceans report found that grocery retailers across the United States have vastly improved on providing sustainable seafood, while failing to take significant action on the growing problem of single-use plastics. Overall, 90 percent of the retailers profiled received passing scores, ten years after every single retailer failed the first assessment. Whole Foods, Hy-Vee, ALDI, and Target ranked as the top four retailers this year, while Trader Joe’s dropped the furthest, seven spots since Greenpeace’s last report.

“Supermarkets across the country have made significant progress on seafood sustainability in recent years,” said Greenpeace Oceans Campaigner David Pinsky. “It is time for major retailers to put the same energy into tackling the other issues facing our oceans and seafood workers, such as plastic pollution and labor and human rights abuses in seafood supply chains. It’s not truly sustainable seafood if it is produced by forced labor and then wrapped in throwaway plastic packaging.”

Whole Foods remains the top ranked retailer this year, following the implementation of a strong shelf-stable tuna policy and marked sourcing improvements. Hy-Vee placed second, achieving high marks for its advocacy and transparency initiatives. ALDI moved into the top three for the first time ever, buoyed by new policies to address problem practices like transshipment at sea, which is linked to illegal fishing and human rights abuses. Target moved into the top four following improvements in policy and advocacy initiatives, though the company broke a 2010 commitment by re-introducing farmed salmon in its stores.

On the other end of the spectrum, Price Chopper, Save Mart, and Wakefern scored the lowest in this year’s report. Trader Joe’s dropped the furthest for its lack of initiatives or customer engagement on sustainable seafood. More than eight years after Trader Joe’s committed to improve on seafood sustainability, the retailer does not have a robust, public sustainable seafood procurement policy.

None of the retailers profiled have comprehensive policies to reduce and ultimately phase out their reliance on single-use plastics. The equivalent of a garbage truck of plastic enters our oceans every minute, and with plastic production set to double in the next 20 years—largely for packaging—the threats to ocean biodiversity and seafood supply chains are increasing. Greenpeace is urging retailers to take responsibility for their contribution to this pollution crisis, as cities nationwide and large foodservice companies are already making commitments to start phasing out single-use plastics.

Earlier this year, Greenpeace released Misery at Sea, which documented illegal fishing and human rights abuses linked to Taiwanese fleets and large seafood trader Fong Chun Formosa Fishery Company (FCF), which supplies many U.S. supermarkets. Greenpeace is urging retailers to demand sustainable, ethical seafood from traders like FCF and Tri Marine (which procure and then supply large amounts of seafood, especially tuna, to the U.S. market), and support the creation of legally binding labor agreements to protect workers’ rights in the larger seafood industry.

Carting Away the Oceans primarily scores retailers on their sustainable seafood efforts, though in this edition has also looked at labor and human rights issues and plastic pollution. While the majority of retailers passed this assessment, many have significant work to do on labor and human rights and the single-use plastic threat to our oceans.

To read the entire report, click here.

Fun Pizza Facts

Americans eat around 350 slices of pizza per second and pizza appetites are fed by approximately 62,000 pizzerias in the United States. “Pizza is the original fun food and it only makes sense that a food associated with having a good time would have some interesting and fun facts in its history,” said Randy Syracuse, owner of Marv’s Original Pizza in Paso Robles, CA.

1. The first recorded pizzeria, Port ‘Alba, opened in 1830 in Naples, Italy. Pizzas were cooked in an oven lined with lava from Mount Vesuvius.

2. Until the 1800s pizza was a meal for Italian peasants. That changed when Raffaele Esposito created a Margherita pizza for visiting royalty. The king and queen were impressed by the colors of the Italian flag represented by the pizza’s white mozzarella cheese, red tomato sauce, and green basil and Queen Margherita gave the pizza her name. After that, pizza became an Italian staple.

3. Pizza has its own special day. Well, actually at least three special days. September 5th is National Cheese Pizza Day. October 11th is National Sausage Pizza Day. November 12th is National Pizza with the Works Except Anchovies Day.

The first official pizzeria opened in the United States in New York City in 1905 by Gennaro Lombardi.

4. According to a Gallup Poll, kids up to 11 years old prefer pizza to other food for lunch and dinner. Regular pizza crust is still the most popular crust, preferred by 61-percent of the population. Thick crust and deep dish tied for second, at 14-percent. Only 11-percent of the population prefers extra thin.

5. Every pizza chef has a secret recipe for the best crust and so does Marv’s Paso Robles pizza where the dough is made fresh daily and topped with the finest sauce, whole-milk mozzarella and fresh ingredients.

6. According to Guinness World Records the largest circular pizza was baked in Norwood, South Africa in 1990. It weighed 26,883 pounds. There are rumors of another record breaker baked in 1987 in Havana, Florida that weighed 44,457 pounds.

7. The Hawaiian Pizza was invented in Canada.

8. The International Pizza Expo is an annual event held in Las Vegas Nevada. Pizza restaurant owners, distributors, food brokers, and other businesses that support the pizza industry attend. Sorry! The expo is not open to the general public!

9. Pizza museums? Oh yes. The U.S. Pizza Museum is opening in August 2018 in Chicago. New York’s Museum of Pizza claims to be the “world’s first and only immersive art experience celebration pizza.”

10. Can you eat pizza and still lose weight? A New York man named Brian Northrup claims that he did, and he documented the yearlong project on Instagram. In his recently released book, “The Pizza Diet: How I Lost 100 Pounds Eating My Favorite Food—and You can, Too! ” Chef Pasquale Cozzolino’s reveals how he included pizza in a healthier diet. It all seems to come down to what weight loss specialists have been saying for years: moderation, more vegetables, and less fat and refined carbohydrates.

Most Businesses Avoid Retargeting Advertising

“Sales and revenue are at the heart of the business,” said Aylin Cook, head of content marketing at digital marketing agency Single Grain. “Without it, the lights wouldn’t remain on, and no one would get paid. Revenue is key to keeping a business alive.”

Overall, the survey indicates that most businesses view online advertising as an important part of in their overall digital marketing strategy.

The Manifest’s 2018 Online Advertising Survey included 501 digital marketers from U.S. companies with more than 100 employees. Read the full report here.

Competing on Customer Experience: The Driving Force Behind Supply Chain Innovation

BluJay Solutions and Adelante SCM, a research firm and peer-to-peer community for supply chain and logistics professionals, released its research report, “Competing on Customer Experience: The Driving Force Behind Supply Chain Innovation.”

The research, produced by Adelante SCM and presented by BluJay Solutions, was conducted to explore the links between supply chain management innovation, customer experience, technology adoption, and company performance. The findings provide supply chain and logistics decision-makers with benchmarks and insights to develop informed strategies with regard to innovation and improving customer experience. The research highlights leading factors driving supply chain technology adoption and the next wave of innovation, as well as the barriers to innovation and influence of a customer-centric approach over others.

“The most important lesson learned from companies that have been disrupted is the danger of becoming too complacent with the status quo,” said Doug Surrett, Chief Product Strategist at BluJay Solutions. “Our hope is this research will provide insights to help companies determine actions they can take to implement market-leading supply chain solutions. As we move into the next evolution of supply chain logistics, it’s not just about getting goods from point A to point B at the lowest cost, it’s about innovating with a clear objective to optimize the overall customer experience. This requires an approach that considers the entire supply chain ecosystem.”

Supply chain executives from industries including manufacturing, retail, and logistic service providers (LSPs) were surveyed, with 140 qualified respondents answering a series of questions about innovation, customer experience, and technology. Participants self-identified their company’s effectiveness and maturity (Above Average Performers v. Average or Below Average Performers, Innovators/Early Adopters v. Laggards/Late Majority). Key findings from the survey include:

Market leaders place customer experience at the center of supply chain design

The report uncovers the close affinity between above-average performers and innovators, who both measure customer experience and rank it as the top factor in supply chain innovation. Conversely, average or below performers and laggards measure customer experience much less and identify cost reduction as the driving factor in supply chain innovation.

The data indicates that logistics service providers (LSPs) are champions of enhanced customer experience as they look for ways to differentiate themselves, focusing less on competing on cost, which often leads to commoditization. Cost is a top factor among shippers (manufacturer, retailers and distributors) where cost reduction or competitiveness is still a key indicator for success.

Innovators place greater emphasis on looking beyond internal systems to improving the entire supply chain

Innovators/Early Adopters seem to have matured to the point where they are less concerned about their existing systems and are now focused on outwardly focused needs (i.e. flexibility/innovation of supply chain, working with other functional groups). Additionally, they have adopted an integrated solution for managing their supply chain. In contrast, laggards are still focusing on updating their antiquated systems and are trailing on adopting integrated solutions. A majority of laggards are still relying on Excel spreadsheets to manage their supply chain. These findings suggest that in order to drive faster and more efficient supply chain innovation, leaders need to find flexible, future-proof solutions (i.e. cloud infrastructure, open architecture) to continue to innovate, while laggards must leapfrog ahead by replacing their outdated IT systems with modern ones that eliminate the silos that still exist between their systems and processes.

Transportation, visibility, mobility, and automation will occupy greatest mindshare as companies look to the future

In terms of the future, the five supply chain investment priorities that received the greatest percent of overall top rank votes were Transportation, Supply Chain Visibility, Warehousing, BI/Analytics, and Trading Partner Connectivity. The results are not too surprising considering that many of the respondents are involved with transportation, and that many of these investment areas, especially Supply Chain Visibility, will continue to be of key importance as more companies look to optimize their operations, decrease costs, and improve the overall customer experience. Despite all the hype surrounding blockchain, drones, and driverless trucks, those technologies ranked near the bottom of the list in terms of which technologies will deliver the most innovative benefits to the supply chain in the next five years. Instead, companies believe technologies such as Mobile Devices and Apps, Control Tower Visibility, and Warehouse Automation/Robots will lead the way. In general, the top three technologies are all further along the maturity curve and have more established records of delivering benefits than the technologies lower on the list. The findings suggest that perhaps there’s still a level of skepticism or a “wait and see” attitude among supply chain executives when it comes to some emerging technologies.

“Competing on Customer Experience” highlights keys to winning in the new age of supply chain logistics

“Competing on Customer Experience: The Driving Force Behind Supply Chain Innovation” takes a look inside the drivers of supply chain innovation. It offers key insights that to help readers identify how their organization stacks up against competitors in terms of innovation, and perspective to develop informed strategies to approach supply chain innovation and customer experience.

The report also provides historical views on recognizing disruptive technologies, the importance of customer experience as a key competitive differentiator, and pitfalls of outdated and rigid supply chain solutions.

“Competing on Customer Experience: The Driving Force Behind Supply Chain Innovation” is available for free download here.

Business Travel Trends

Clear generational differences exist when it comes to business traveler dining, payment and expensing options, according to new research released today by the Global Business Travel Association (GBTA), in partnership with Dinova, Inc. According to first-of-its-kind research that delves into the psyche of the business diner, Millennials are more likely to dine on-the-go, while Boomers are most likely to wine and dine clients and Gen Xers typically dine in a group with colleagues.

Contrary to popular views that Millennials are often entitled or difficult employees, they are much more likely to have reservations about ordering extras such as room service (66 percent) or coffee and snacks (70 percent) while traveling as opposed to their Gen X or Boomer colleagues – even when their travel policy permits it.

When asked what diners can expense in their travel policies, 71 percent of respondents said client meals, 56 percent said group meals and 46 percent said alcoholic beverages. Additionally, 72 percent said they pay for meals with a corporate credit card.

“A one-size-fits-all approach often isn’t the answer when it comes to crafting travel policy,” said Jessica Collison, GBTA research director. “The research reveals that clear generational differences exist when it comes to preferences around dining out while traveling for work. For travel buyers considering a preferred dining program, it’s important to make sure the program you choose meets the needs of all of your travelers.”

“The research findings really highlight the significance of understanding the spectrum of travelers within an organization,” said Alison Galik, president of Dinova. “Travel managers are serving multiple generational groups, each with their own preferences. The more they can dial in on what makes for a good travel experience, on the opportunities for reducing employee stress and increasing job satisfaction – and then cater to and engage their travelers in those areas – the more effective their overall program will be. We believe dining is an area that absolutely fills this bill. Cultivating a successful preferred dining program can both serve a broad range of needs and help create an unforgettable travel experience.”

Technology & Dining

In today’s world, technology has become an essential part of how employees of all ages travel, but as digital natives, Millennials especially embrace technology and not surprisingly, are more willing to use the tools and technology made available to them through their travel programs. The research found that 63 percent of business travelers research where to dine prior to leaving for their trip. When broken out generationally, Millennials are much more likely to use Uber Eats while Boomers prefer to search for the best-reviewed restaurants in the area and use Yelp. In fact, 63 percent of business travelers have dining related apps on their mobile phone. In the last year they used their device to search for local places to eat (54 percent), to make a reservation (47 percent) and to search social media for information about a restaurant (33 percent).

Healthy Eating

Eating healthy on the road has become front and center for business travelers, which is why the vast majority (77 percent) of business travelers consider it to be important when traveling. Additionally, 64 percent prefer healthier menu options and 43 percent want to see published nutritional facts. When ranking factors for choosing a restaurant on the road, three in 10 Millennials rank the nutritional value of the meal in their top two reasons.

Where Are Business Travelers Dining?

Dining is always on the mind of the road warrior, and the type of dining they do depends on the trip. The study found that in total, 64 percent of business travelers take their money to upscale casual restaurants, followed by fast casual (52 percent), fast food (34 percent) and finally, fine dining (29 percent).

Preferred Dining Programs

Similar to how companies have preferred airline, hotel or car rental vendors, a preferred dining program provides a list of policy approved restaurants for dining on official company business. Nearly 4 in 10 (38 percent) business travelers say their companies have a preferred dining program and a similar share (37 percent) are interested in having one.

Additionally, 74 percent say they would be more motivated to use a preferred program if they earned rewards. Interestingly, 75 percent of Millennials would be more likely to become a member if rewards points could be redeemed toward their favorite charity, compared to 61 percent of Gen Xers and 42 percent of Baby Boomers.