According to a Recent Study/Survey Mid-August 2017 Edition

27 Min Read By MRM Staff

Fellow research junkies, this Mid-August edition of Modern Restaurant Management (MRM) magazine’s “According to a recent study/survey …” research round-up includes dining trends, shifts in food preferences, views on “sin” taxes, the importance of the Millennial market and marketing to Millennials as well as list of the best new restaurants.

Attitudes About Food

Despite the convenience of fast food, Americans are eating more home-cooked meals than restaurant meals in a bid to take control over their health, according to the 2017 Food Attitudes and Behaviors Study by Benenson Strategy Group (BSG). The trend study also found growing concerns around sugar and pesticides, as well as changing preferences that are putting the pinch on quick-service restaurants (QSRs).

The study report can be accessed here.

Twice as Many Eating Home-Cooked Than QSR Meals

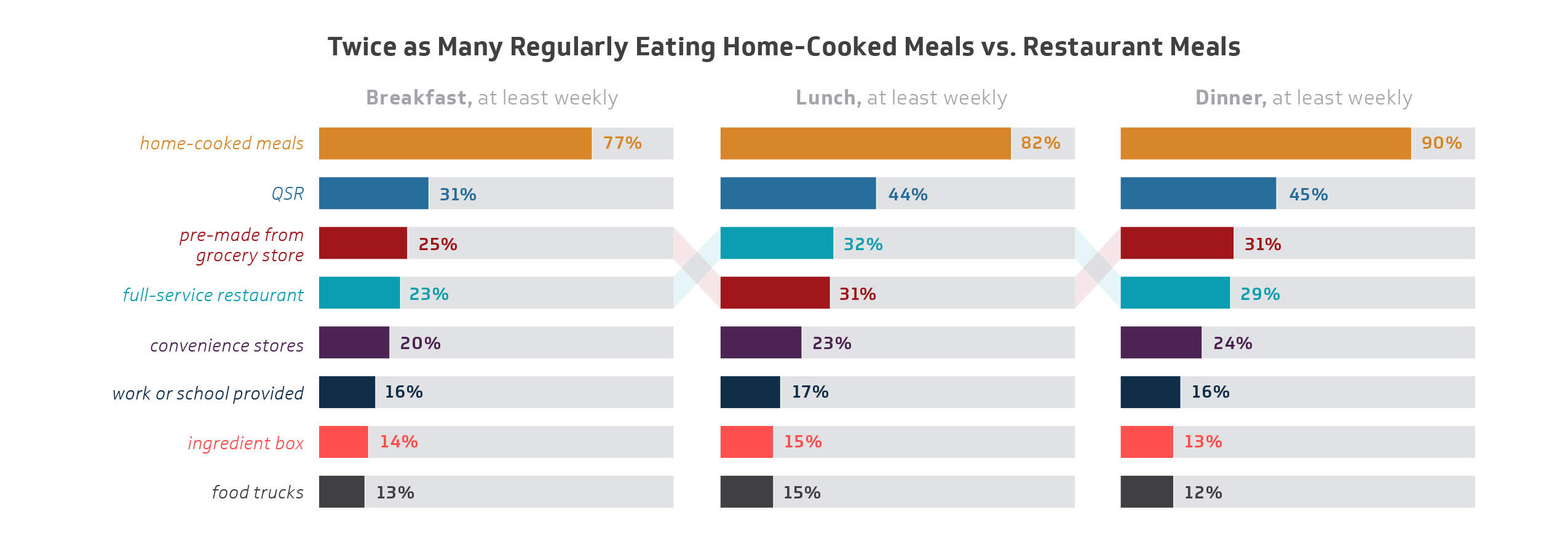

Consumers overwhelmingly favor the foods they prepare to the ones they buy, with 77 percent indicating they always prefer a home-cooked meal to a restaurant meal. What’s more, about twice as many eat home-cooked than QSR meals on a weekly basis. This even holds true for lunch, a meal when workers tend to eat on the go – 82 percent eat a home-cooked lunch at least weekly, while just 44 percent eat at a QSR, 32 percent at a full-service restaurant and 31 percent grab pre-made food from a grocery store.

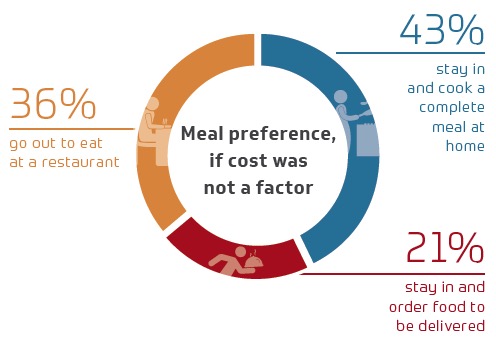

While most would prefer to eat at home rather than go out, surprisingly cost isn’t the main deciding factor. BSG found, price aside, 43 percent would stay in and cook, 36 percent would order delivery and just 21 percent would go to a restaurant.

“Americans are changing the way they eat and their appetite for increased control and wellness is impacting the fast food industry,” said Danny Franklin, BSG managing partner. “By eating home-cooked meals, people can control their wallet, but more importantly their wellbeing, and staying in also offers shared personal time with family and friends.”

Kids: Future Proponents of Cooking and Eating at Home

Kids are embracing the role of chef, frequently cooking with and for their families and perpetuating the trend of at-home cooking. In any given week, 72 percent of parents said they cooked with their kids and 31 percent ate something their kids cooked for them.. Additionally, nearly half – 43 percent – ate dinner at home with their families at least five times.

Pesticides and Sugar Out, Mediterranean Diet In

A desire for unmodified and “free-from” foods is also leading many to cook for themselves. The study reveals that pesticide-free, antibiotic-free, hormone-free and sugar-free ranked high on the list of important food attributes. These preferences are reflected in the types of diets that people want to try – Mediterranean was first, high-protein was second, and low-sugar and Paleo tied for third.

An Escalating Fast-Food Stigma

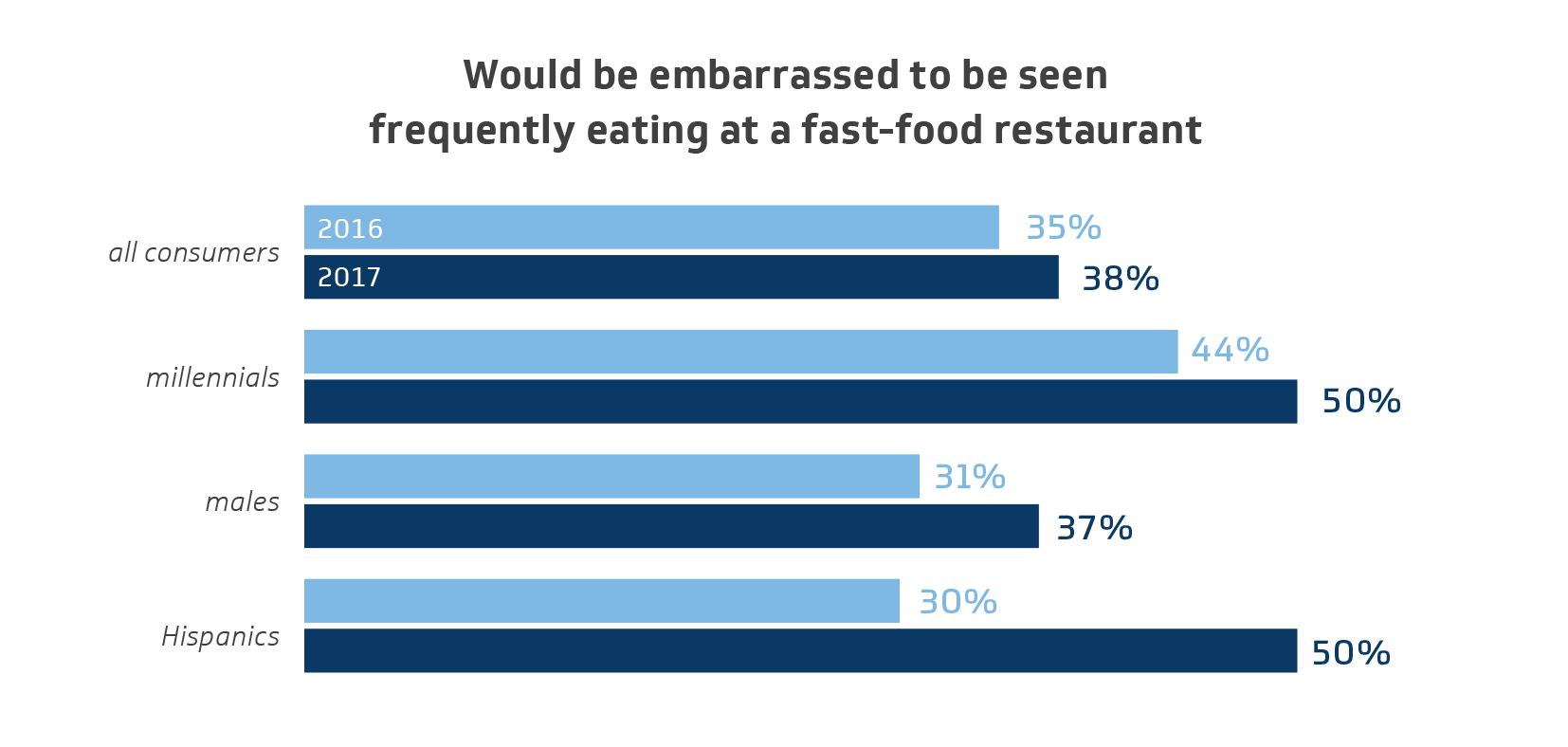

QSRs are taking a hit as a result of this health-centric movement, with flat growth and, perhaps worse, a mounting stigma. BSG found 38 percent of all consumers would be embarrassed to be seen eating too much at a fast-food chain. The numbers were highest among millennials – 50 percent said they’d be embarrassed, up from 44 percent over last year.

Millennials Will Pay Premium for Healthy Fast Food

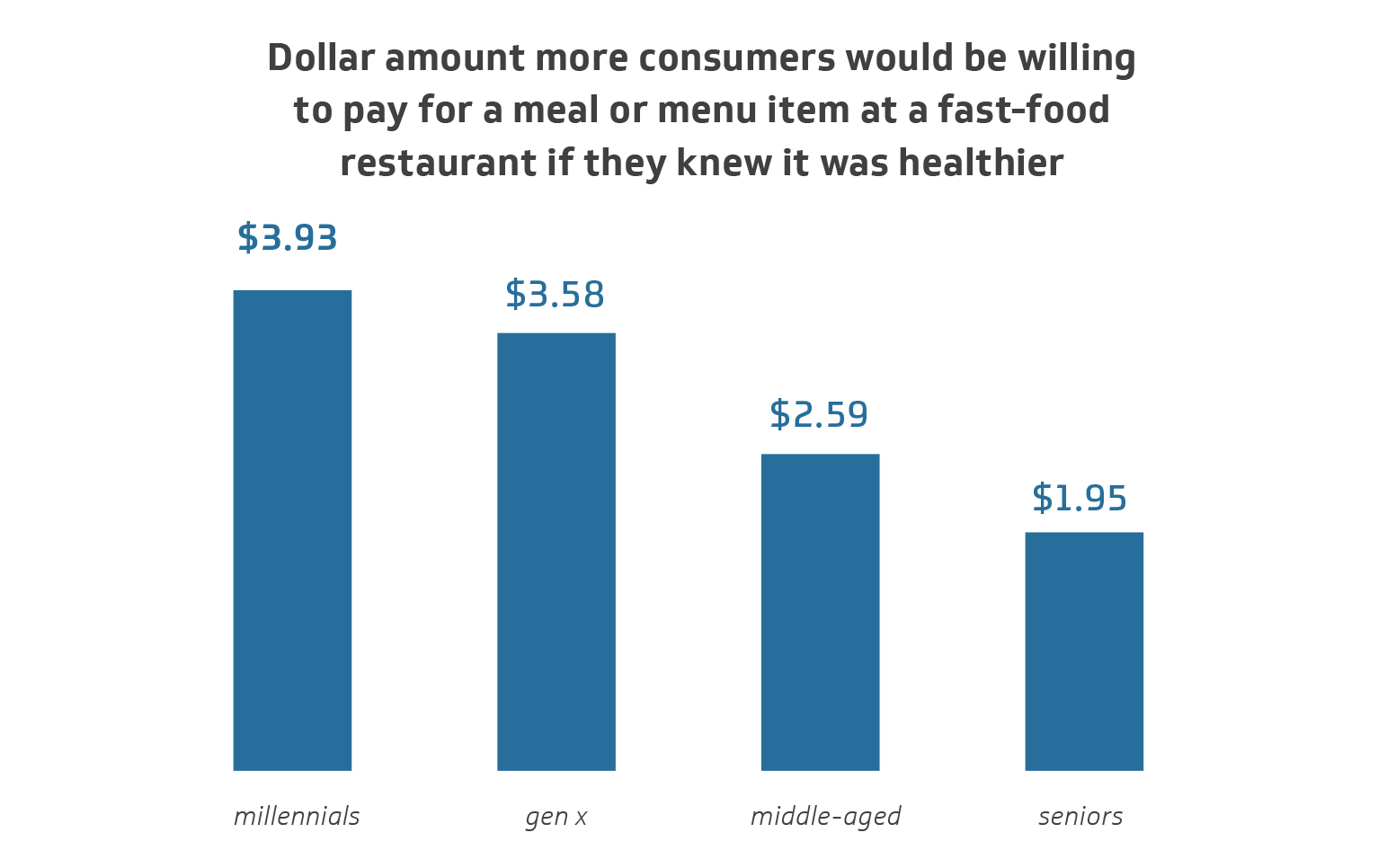

Americans want healthful fast food and are willing to pay for it. On average, consumers said they’d spend an extra $3 for fast-food items that are healthier than the originals. Millennials are willing to spend close to $4 extra, while seniors are only willing to spend around $2.

“QSRs will get more customers to their counters by not only offering healthier foods, but also being transparent about the ingredients, enabling people to make controlled choices,” said Franklin. “Beyond food, there’s also much to gain – and also to lose – if they fail to take steps to align with their customers on important measures such as trust and values.”

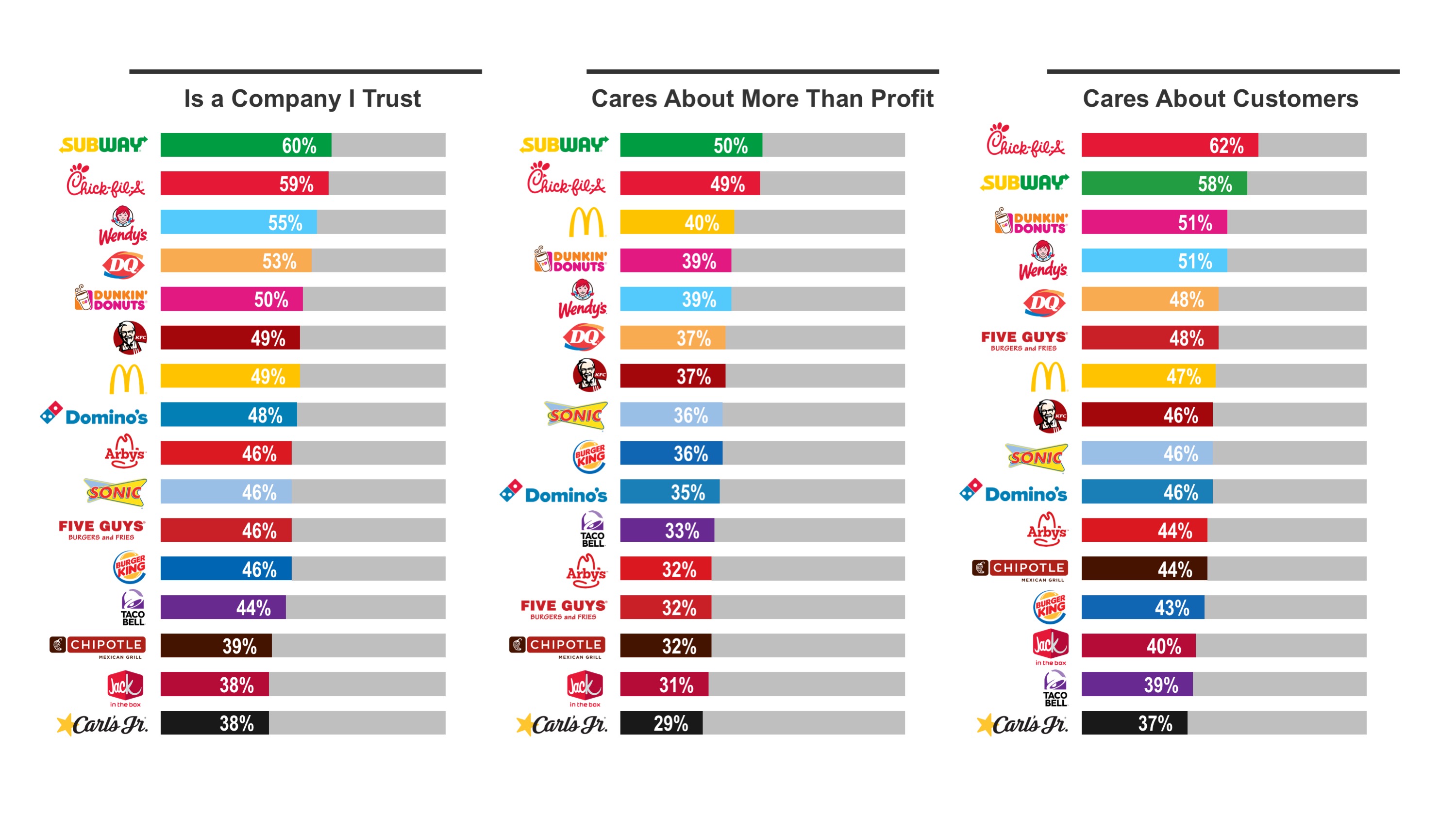

Subway and Chick-fil-A Earn High Marks

BSG looked at how major QSR chains ranked in areas of growing importance to diners, such as trust and caring about issues other than profits. Subway ranked as the most trusted of the QSRs studied, with 60 percent of consumers indicating they trust the brand, while Chick-fil-A ranked second with 59 percent, and Wendy’s was third with 55 percent. Subway, Chick-fil-A and McDonald’s were the top-three ranked in terms of “caring about more than profit,” and Chick-fil-A, Subway and Dunkin Donuts ranked highest for “caring about customers.”

A brand’s values can also considerably sway consumers, and even lead them to boycott. In fact, 20 percent report boycotting a restaurant chain (Chick-fil-A was the most boycotted), and in nearly half of those instances, it was because they felt a brand’s values were not aligned with their own.

The 2017 Food Attitudes and Behaviors Study was conducted in May 2017. BSG surveyed 1,500 consumers ages 18 and older nationwide to understand their attitudes, habits and values surrounding food. The random sample of 1,500 has a worst-case 95 percent confidence interval of ±2.5 percent about any one reported percentage.

Restaurant Sales Drop in July

Restaurant sales dropped again in July, dealing a blow to an industry that had shown modest signs of improvement in recent months. Same-store sales were down -2.8 percent, a sharp 1.8 percentage point decline from June. The drop was disappointing in light of the -1.3 percent average comp sales for the first six months of the year and -1.6 percent recorded in the last half of 2016. These insights come from TDn2K™ data through The Restaurant Industry Snapshot™, based on weekly sales from 28,500+ restaurant units, 155+ brands and representing $68+ billion dollars in annual revenue.

Same-store traffic declined -4.7 percent in July, a 1.7 percentage point drop from June.

“July proved to be a tough month for chain restaurants,” commented Victor Fernandez, Executive Director of Insights and Knowledge for TDn2K. “Based on recent trends, we were cautiously optimistic that the tide was turning a bit, especially since brands were comparing against weaker comps in 2016.” Calculated on a two-year basis, sales in July 2017 were down -4.2 percent compared with July of 2015. Same-store traffic was -8.7 percent for that same period. These are the weakest two-year growth rates in over three years, additional evidence that the industry has not reversed the downward trend that began in early 2015.

Consumers Spending on “Vacation”

“While the economy keeps growing at a moderate pace and job gains remain strong, the consumer seems to be on vacation – literally and figuratively,” said Joel Naroff, President of Naroff Economic Advisors and TDn2K economist. “One of the clearest indicators that households are spending cautiously is the softening of big-ticket purchases. In July, for the eleventh month out of the last twelve, vehicle sales were below the rate posted the year before. Home sales, while still trending up, are now expanding at a decelerating pace.”

“It is likely that consumption will improve, as confidence seems to have stabilized and income growth is improving. But households are currently maintaining their lifestyles by reducing their savings rate and that is likely restraining spending on discretionary goods. We may have to wait until the fall or early winter, assuming wage gains accelerate by then, to see any pick up in restaurant sales.”

Average Guest Check Increases Slowing

The growth in check averages has slowed in recent months as brands fight the tide of continuing traffic declines. Check increases in 2015 and 2016 were largely an effort to maintain margins in the face of higher labor costs. The slowdown in check growth may be a combination of value platforms and increased deal activity aimed at increasing visitation frequency. It may also be recognition that top-line increases are under more scrutiny despite the potential impact to operating margins. Given that grocery prices have been dropping year over year, it is no surprise that restaurants have been compelled to review their value proposition.

Fine Dining Continued Outperforming, Quick Service Struggled During July

Fine dining and upscale casual continue to outperform other industry segments. Fine dining was the only segment up in July (0.4 percent) and upscale casual was down fractionally. The slowdown in fast casual sales noted in the past continued in July, as did softness for quick service. While much of fast casual’s headwinds are a result of rapid segment growth, the steady performance decline in lower PPA segments will be important to follow. Both segments outperformed the industry in 2015 and 2016, but trail through July of this year.

The Restaurant Workforce

Restaurants are not getting much relief from a labor perspective. According to TDn2K’s People Report™ Workforce Index, 63 percent of companies reported an increase in difficulty recruiting qualified employees to staff their restaurants during the second quarter of 2016. Additionally, the expectations component of the index predicts continued job growth for the industry, with 47 percent of restaurant companies anticipating an increase in their number of hourly jobs. 42 percent reported an expected increase in their net number of restaurant management jobs.

Retention continues to be a major challenge for the industry. Both restaurant management and hourly employee turnover increased again during June. However, the latest indicators may be hinting that increasing turnover rates are beginning to taper off. Even if turnover rates reach a plateau at their current levels, which is likely to be the best case scenario, they will remain at record high levels and continue to be a source of headaches for restaurant operators

Menu Labeling Costs

The National Association of Convenience Stores (NACS) released an economic study confirming that compliance with the currently delayed Food and Drug Administration (FDA) menu labeling rule is effectively impossible and that total costs under the rule will be more than triple the FDA estimate, costing industry more than $300 million per year – and seven times the cost for convenience stores. The study by Mangum Economics, an independent firm specializing in the economic analysis of public policy, found that based on past research, no matter how much businesses spend to comply with FDA’s rule, calorie count variations in prepared foods would result in 93 percent being more than 10 calories away from the posted amounts – and thus in violation.

In contrast to FDA calorie disclosure rules on packaged foods, which recognize that actual calorie counts unavoidably vary from one package to another, the menu labeling rule makes “no allowance for normal variation from one serving of food to the next in the number of calories and nutrition content.” For that reason, enforcement costs alone of the Final Rule – including fines, legal fees, and negative publicity – are likely to vastly exceed the $84.5 million total cost that FDA estimated for all covered industries.

The study also finds that the rule will hit the convenience store industry particularly hard. Due to the high level of expected non-compliance, additional costs associated with their decentralized format, and the fact that the FDA cost estimates are out of date, total annual enforcement and compliance costs for the convenience store industry alone will be $84.2 million on an annualized basis. That total is seven times the $12.1 million estimated by the agency – and almost equal to FDA’s estimated cost for all covered industries.

Economist David Zorn of Mangum Economics, who developed the analysis for NACS, said, “The way the FDA rule is written makes it virtually impossible for businesses to comply with the regulations even though they will spend billions over the next several years trying to do so.”

Lyle Beckwith, NACS senior vice president for government relations, stated, “This comprehensive study confirms what NACS and our members have asserted all along: the final FDA menu labeling rule will hit the industry, including small businesses, with huge costs, and in the end they will still have to pay fines because they just won’t be able to comply.”

Continued Mr. Beckwith, “We appreciate the action taken by the FDA to delay and re-evaluate the rule. We hope that these new findings will prove useful to the FDA in guiding the agency re-write the rule to recognize the practical problems that businesses face.”

To see the study, click here.

The Meaning of Being a ‘Foodie’

You might describe yourself as a “foodie” if you post photos of your avocado toast on social media or gift homemade jam with fruit from your garden. But being a “foodie” means much more than this.

According to the International Food Information Council (IFIC) Foundation’s 2017 Food and Health Survey, foodies are more confident in their nutrition know-how, will sacrifice cost and convenience to get foods that align with their values, and even define “healthy” differently than other types of consumers.

An analysis of purchase drivers from 2017 Food & Health Survey findings reveals six distinct groups of consumers, including foodies. These profiles help us understand how different consumers think about and shop for food beyond traditional demographics, like age, income or gender. Other groups identified include pleasure shoppers, diligent searchers, product selectors, unbiased buyers and indifferent consumers.

You Might Be a Foodie If…

According to the Food and Health Survey, a foodie is someone who sacrifices convenience and cost in search of a quality product, particularly one that is tasty, healthy, and made in a way that aligns with their personal beliefs.

Foodies also have a different definition of healthy food compared to other Americans. While the other five profile groupings consider a healthy food to be “part of an important food group,” foodies are the only group to include “minimally processed” in their top three attributes of a healthy food. Foodies also chose “free from artificial ingredients, additives” and “high in healthy components or nutrients,” rounding out their definition of healthy.

Foodies are also more confident in their nutrition know-how. While only 44 percent of the general population could name a food or nutrient associated with their most desired health benefit, 60 percent of foodies were able to do so. In addition, when confronted with conflicting nutrition information, this group was among the least likely to doubt their food decisions.

Other groups prioritize the cost and convenience of food while foodies are more likely to sacrifice these purchase drivers for quality. They are also not as concerned with sustainability or packaging. However, for foodies, taste still reigns supreme when deciding to purchase a food or beverage.

According to the survey, foodies are predominately female (63 percent female vs. 37 percent male), have higher incomes (52 percent make more than $75,000 a year) and a median age of 58. They are also less likely to have kids under 18. This might partially explain why foodies aren’t as concerned about convenience or the cost of food.

“As in previous years, the Food and Health Survey has shown us what drives consumers in their food purchasing decisions, but this is the first year we took a look at how foodies distinguish themselves from consumers generally,” said Alexandra Lewin-Zwerdling, Ph.D., vice president of research and partnerships at the IFIC Foundation. “Our hope is that by better understanding the attitudes, perceptions, and habits behind consumer behavior, we can work with partners to enhance and develop effective nutrition education strategies.”

The results are derived from an online survey of 1,002 Americans ages 18 – 80, conducted March 10 to March 29, 2017. Results were weighted to ensure that they are reflective of the American population, as seen in the 2016 Current Population Survey. Specifically, they were weighted by age, education, gender, race/ethnicity, and region. The survey was conducted by Greenwald & Associates, using Research Now’s consumer panel.

The mission of International Food Information Council Foundation, a 501(c)(3) nonprofit, is to effectively communicate science-based information on health, food safety and nutrition for the public good. The IFIC Foundation is supported primarily by the broad-based food, beverage and agricultural industries.

Millennials as Consumers

Millennials are growing up and having kids and while some of their generational attitudes remain intact, their lifestyle as parents often change the how, what, and why behind their consumption choices. Breakfast is a meal occasion where being a Millennial parent necessitates convenience over satiation, which is the primary motivation for breakfast choices of Millennials without kids, according to a recently released report by The NPD Group, a leading global information company. Like most parents, Millennial parents express a higher demand for convenience and look for breakfast foods that can be eaten quickly, are portable, and don’t require cooking. Whereas Millennials without kids look for breakfast foods that give them energy, are high in protein, tide them over, and keep them feeling full longer, according to the NPD study, Consumption Drivers: How Need Shapes Choices. This means the foods Millennials choose differ slightly based on the presence of kids. Millennials without kids take the time to make eggs or more complex items in the morning, but their counterparts with kids seek time-savers such as bars or yogurt.

Millennial parents still share with their generational counterparts without children the want for healthy breakfast options. With or without children, Millennials have a commitment to eating fresh, less processed foods, and organics. NPD’s ongoing food and beverage research forecasts that Millennials and Gen Zs will maintain their attitudes regarding fresh and organic food consumption throughout their life stages, and as a result, consumption of fresh food will increase by 9 percent and of organic food by 16 percent over the next several years. In addition to fresh and organic food consumption, Millennials also share the motivation to start the day with a healthy/nutritious meal and want to eat foods that tide them over the next meal.

“Millennials are forming their families and undergoing tremendous life stage and lifestyle changes, their motivations and needs are changing,” says Darren Seifer, NPD food and beverage analyst. “It’s important for marketers not to treat this generation as a monolithic group. Simply examining them by the presence of children alone reveals great differences in the ways they behave. Your product attributes and communications need to ensure they match the right needs with the right consumers.”

The Importance of Marketing to Millennials

As operators struggle to maintain positive bottom lines, it will become imperative to cater to influential users and consumer segments. Millennials and kids have emerged separately as major consumer targets over the past few years. Now millennials are coming of age and having kids of their own, and millennial parents are a new demographic that operators must pay attention to.

Technomic’s 2017 U.S. Millennial Parents Insights Report provides an overview of key themes that appeal to millennial parents. Also included is rationale for their consideration as an emerging consumer target.

Download report sample here.

A whopping 90 percent of millennial parents order food from a restaurant at least once per week, as opposed to 77 percent of millennials without kids (and 73 percent of the overall population). Further, 46 percent of millennial parents’ away-from-home dining occasions include children under age 18, while 43 percent of millennial parents allow their children to decide where to eat.

Millennial parent dining occasions are not wholly unpredictable, however, as this group tends to value the same elements that most consumers do. Understanding how to differentiate while emphasizing the specific visit drivers millennial parents are looking for is the key to winning over this cohort.

Restaurant Food Safety is a Concern

In a recent survey, conducted online by Harris Poll on behalf of Bureau Veritas among over 2,000 US adults ages 18+, regarding food safety and restaurants, 79 percent of Americans indicate that they avoid eating at restaurants that they know have had previous health and food safety violations.

“Consumers seem to be more educated about their choices,” said Jorge Hercules, vice president of certification at Bureau Veritas North America. “This survey reminds us that the consumer is clearly in control of choice, and food chains have very little room for error related to food safety in their operations.”

The poll also found that nearly two in five Americans (38 percent) consider a strong food safety track record to be among the most important factors in choosing a restaurant. Here is how consumers ranked factors related to restaurant choice:

- Quality of food (85 percent)

- Price of food (69 percent)

- Location (63 percent)

- Recommendations from family/friends (49 percent)

- Strong food safety track record (38 percent)

- Positive reviews on social media (26 percent)

- Child-friendly (15 percent)

- Sustainably sourced food (12 percent)

- Ability to meet dietary restrictions (10 percent)

To minimize potential negative impact on brand integrity and revenue, national and local food chains are placing greater emphasis on improving their food safety processes through the application of technology and employee training.

“We are excited to be partnering with Bureau Veritas to increase our monitoring of food safety through digital technology and processes,” said Tim Hughes, Regional Corporate Chef at Fig & Olive. “It gives me even greater confidence that we are properly managing food safety across our different locations while reducing the amount of time spent doing paperwork. Fig & Olive is committed to using fresh, simple, and classic ingredients prepared in a contemporary style to reinvent traditional Mediterranean cuisine — and the safety of our ingredients is imperative.”

From a generational perspective, those in the silent generation — born between 1925 and 1942 — a strong majority seem to be influenced in their eatery choices by food safety issues, with 85 percent claiming to avoid eating at restaurants that they know have had previous health and food safety violations. Not far behind, 77 percent of millennials (ages 22-40) and 78 percent of baby boomers (ages 53-71) make the same claim.

The Hot 10: America’s Best New Restaurants 2017

Bon Appétit unveiled The Hot 10: America’s Best New Restaurants 2017. The annual list is now available in the September issue and on bonappetit.com.

Taking the top spot is New Orleans’ Turkey and the Wolf, a quirky, nostalgic, counter service–only sandwich spot. It joins past winners like Atlanta’s Staplehouse (2016), San Francisco’s AL’s Place (2015), and Washington, D.C.’s Rose’s Luxury (2014).

“Turkey and the Wolf serves the best sandwich I’ve ever crammed into my mouth, with a mastery of flavors and textures way beyond what you might expect from this fun, unconventional, casual joint,” says deputy editor Andrew Knowlton. “Ultimately, what makes every sandwich—every dish—here so special is that it tells a very personal story. Turkey and the Wolf was the best restaurant we ate in all year.”

Other noteworthy spots on the list include Raleigh’s dim sum/flower shop mashup Brewery Bhavana, Philadelphia’s members only Italian-American eatery Palizzi Social Club, and new-school Chinese restaurant Mister Jiu’s inSan Francisco. Bon Appétit also crowns Chicago the Restaurant City of the Year, and reveals the best drink and dessert of 2017.

“This year’s list is the most eclectic and culturally diverse one we’ve ever compiled,” says special projects editor Julia Kramer. “After a combined 99 days on the road, their meals stuck with us the longest. These are the places you want to go back to multiple times.”

Views on ‘Sin’ Taxes

Consumer Reports (CR) examines the pros and cons of using so-called “behavior” or “sin” taxes as weapons in the complex war to end America’s obesity crisis in a new report, ”Can ‘Sin Taxes’ Solve America’s Obesity Problem?,” published on CR.org.

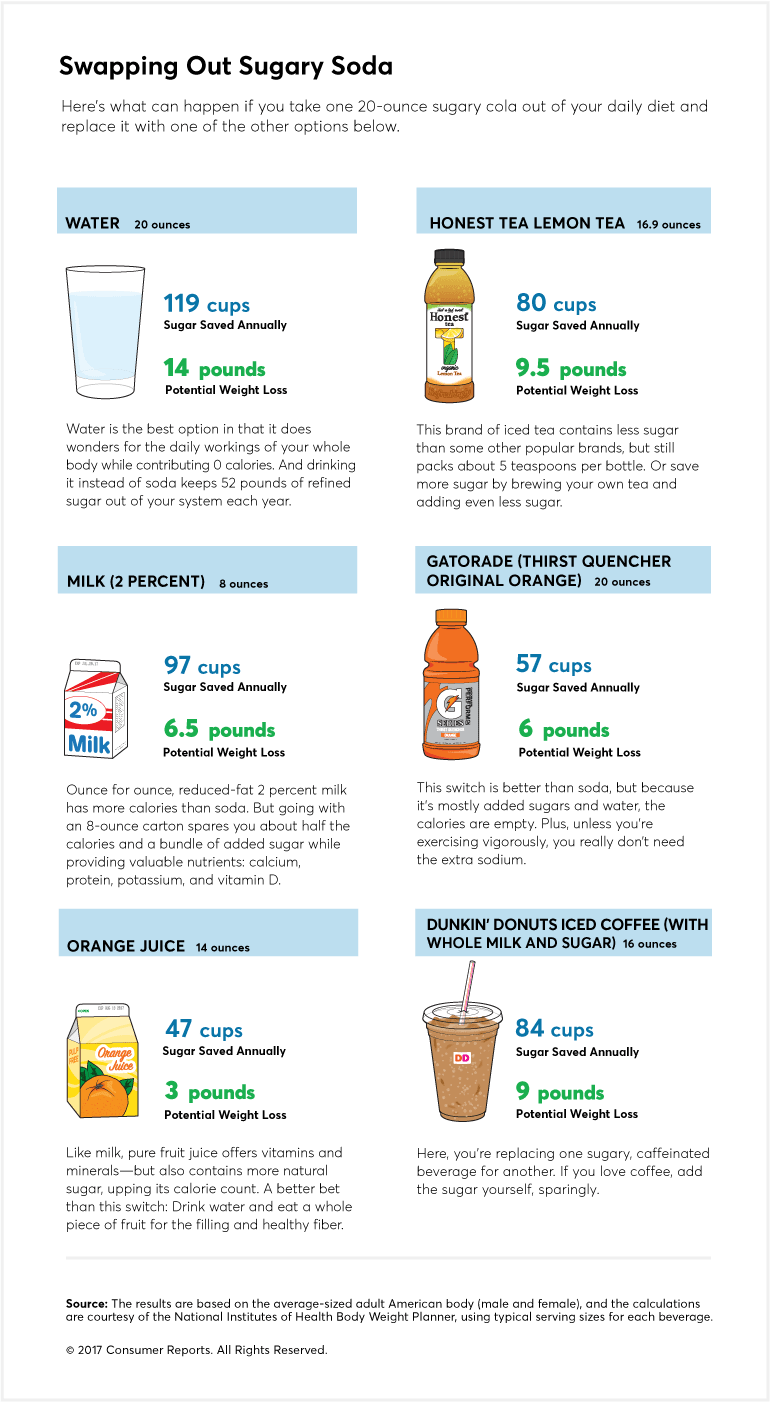

CR’s extensive report explores the growing effort across the nation and around the globe to hike taxes on sugar-sweetened drinks and sodas as a way to reduce sugar consumption and calories and help prevent obesity and related chronic diseases such as diabetes and hypertension. The report features graphics that look at the health benefits associated with drinking more water and another on how much sugar can be avoided by switching to a different beverage.

A new nationally representative CR survey of 1,010 adults shows that while consumers have mixed feelings about sin taxes, among the 42 percent who favor them, the majority approve of taxing sugar sweetened beverages. The survey also finds that half of Americans say they would not cut back on unhealthy food even if it cost more. But most people—73 percent—say they would eat more healthy food if it cost less.

“It doesn’t take a radical change in a person’s diet to make a difference in weight. An average 20-ounce soda contains about 16 teaspoons of added sugar,” said Trisha Calvo, CR’s Health and Food Deputy Content Editor. A simple switch in daily beverages can help an individual drop unwanted pounds and live healthier, she said.

Replacing one 20-ounce sugary cola with water out of a daily diet could save 119 cups of sugar annually and result in 14 pounds of potential weight loss, according to the National Institutes of Health Body Weight Planner.

The U.S. currently holds the unenviable title of most overweight nation on earth, with more than a third of its citizens now considered obese. Local governments around the country–including Philadelphia, San Francisco, Seattle, and Berkeley, California—have begun enacting laws that tax sodas and sugar sweetened drinks at a higher rate than other foods and beverages. Sugary drinks are a major contributor of daily American calorie intake, roughly seven percent of all calories consumed, while contributing little to no nutritional value.

Research suggests that taxing soda and sugary drinks can help alleviate the problem but they are most effective when paired with subsidies for healthy foods and education programs. Experts say such efforts should focus on two groups, the young and the heaviest soda consumers.

In addition, reducing sugary drinks won’t help prevent obesity unless consumers replace those beverages with healthier choices. Water is the best choice since it provides zero calories and is essential to good health.

In November 2016, Consumer Reports conducted a nationally representative telephone survey to assess American consumer opinion of government taxes and subsidies and their effects on behavior. Respondents were selected by means of random-digit dialing and were interviewed via phone. The data was statistically weighted so that respondents in the survey are demographically and geographically representative of the U.S. population. The margin of error is +/- 3.1 percentage points at the 95 percent confidence level.

Demand for Red and Yellow Natural Colors

Red and yellow natural colors were the largest classes in 2016, each accounting for just over 20 percent of total demand, at $45 million each. They will remain the leading segments, each growing 7.6 percent a year to $65 million. Gains will be supported by healthy demand from cheese and butter, as well as candy, breakfast cereals, and other products primarily marketed to children. Green natural colors will post the fastest growth, expanding at a near double-digit rate as spirulina products further penetrate the market and widen the possibilities for green- and purple-hued blends. These and other trends are presented in Food & Beverage Natural Colors Market in the US, a new study from The Freedonia Group, a Cleveland-based industry research firm.

According to analyst Christine O’Keefe, “Brown natural colors will post growth slightly below the overall average, as stronger gains are restrained by declining carbonated soft drink (CSD) production and concerns regarding the health impact of darker caramel food coloring classes.” Red, yellow, orange, and brown shades have historically accounted for the majority of the natural colors used in food and beverages. Their dominance arose from the established use of annatto, caramel, carotenoids, curcumin and cochineal.

The overall US demand for food and beverage natural colors is forecast to rise nearly eight percent yearly to $295 million in 2021. Growth will be supported by wider trends in the food and beverage markets, including “all natural” and “clean label” preferences; increasing availability of new natural color products with increased functional stabilities; and rising consumption of some foods, in particular cheese, butter, and functional beverages.

Cage-Free Egg Market to Grow

According to Persistence Market Research forecasts, the global cage free eggs market is estimated to record a market valuation of US$ 4,541.0 Mn by 2017 end and is likely to witness a CAGR of 4.7 percent during the forecast period, to be valued at US$ 6,559.1 Mn by the end of 2025.

Persistence Market Research presents analytical insights into the global cage free eggs market in a new report titled “Global Market Study on Cage Free Eggs: Europe to Dominate the Global Market in Terms of Value Share During 2017-2025” touching upon key aspects such as drivers, trends, opportunity areas, and a global market forecast on the basis of color, size, and region.

The Growing number of cage free commitments from various food manufacturers and food service providers is expected to fuel market growth. Further, an increasing consumer concern towards product origin as well as animal welfare is also anticipated to boost the growth of the global cage free eggs market.

Global Cage Free Eggs Market: Segmentation & Forecast

The global cage free eggs market is segmented on the basis of color into Brown and White. Brown cage free eggs are likely to dominate the global market in terms of consumption and the brown segment will hence show increased revenue growth. Persistence Market Research predicts that the brown segment will hold the maximum market share throughout the forecast period, reaching a huge value share in excess of 85 percent by the end of 2025. The brown segment is estimated to reach a market valuation of US$ 5,653.4 Mn by 2025 end, registering a growth rate of 5.1 percent. This segment is expected to represent absolute $ opportunity of US$ 159.8 Mn in 2017 over 2016 and an incremental $ opportunity of US$ 1842.5 Mn between 2017 and 2025.

The global cage free eggs market is segmented on the basis of size into Medium, Large, Extra Large, and Jumbo. Large size cage free eggs are the choice of consumers in key markets and this probably explains why the large segment is slated to dominate the global cage free eggs market. The large segment is estimated to be valued at US$ 2,899.8 Mn by the end of 2025 and register a CAGR of 5.4 percent during the forecast period.

The global cage free eggs market has been tracked across the key geographies of North America, Latin America, Europe, APAC, and MEA. Europe is anticipated to be the dominant regional market, holding an estimated value share in excess of 40 percent by the end of 2025. Europe is predicted to be the highest growing market followed by North America. The North America cage free eggs market is expected to represent absolute $ opportunity of US$ 49.1 Mn in 2017 over 2016 and an incremental $ opportunity of US$ 601.3 Mnbetween 2017 and 2025.

Organic Fruit and Veggies Top Grocery Lists

While Americans don’t often buy organic food and drink, when they do, organic fruits and vegetables are at the top of their grocery lists. New research from Mintel reveals that half (50 percent) of consumers say they are most likely to purchase organic fresh produce such as fruit and vegetables, compared to other food categories like meats/poultry/seafood (41 percent), juice (39 percent) and dairy/milk/yogurt (38 percent). While three in 10 (29 percent) Americans say they do not typically buy food and drink with an organic or natural claim, these products are finding their place in shopping carts across the country. One third (32 percent) of consumers say half or more of the groceries they buy are organic.

Whether a cart full or just a few items, nearly three in five (57 percent) Americans agree that today they are buying the same amount of organic foods as they did in 2016. However, it appears preference for organic options is on the rise as one third (34 percent) say they are buying more organic foods in 2017 than a year ago.

Mintel research indicates that price and authenticity are purchase deterrents, even among organic shoppers. Just two in five (39 percent) consumers whose food purchases are at least half organic and one in five (21 percent) consumers overall agree that organic foods are worth the extra cost. In fact, Americans are most likely to say they would purchase more organic foods if they were less expensive (62 percent). Highly skeptical of organic claims, just one quarter (26 percent) of consumers say they trust organic food labels, while a mere 13 percent agree that organic foods are highly regulated. For many, brand name outweighs an organic label as just one in seven (14 percent) consumers agree that an organic claim is more important than a specific brand.

“The fact that consumers are more likely to seek organic fresh produce items not only speaks to the lack of organic options in certain segments, but also to the notion that organic claims simply resonate in some categories more so than in others. Our research shows that organic brands appeal to younger consumers, but there is significant effort required to persuade older generations of the value of organic or natural claims. This indicates that if organic brands can reassure consumers that organic foods are indeed living up to their claims, whether through on-pack messaging or marketing campaigns, it could be a boon to the category,” said Billy Roberts, Senior Food and Drink Analyst at Mintel.

In addition to organics being more affordable, Americans say they would be motivated to purchase more organic foods if they were proven to be healthier (33 percent) and stayed fresher longer (31 percent). And with organic consumers the most likely to say they purchase organic foods and beverages at a supermarket (55 percent) or mass merchandiser (36 percent), more than one quarter (27 percent) of Americans overall agree they would purchase more organic foods if there were more organic options from major brands. Meanwhile, one in seven (13 percent) of those who purchase organic foods shop through online channels, including both delivery and in-store pickup.

Overall, Mintel research shows that feeling good inside and out compels consumption for natural and organic food shoppers. More than one quarter (28 percent) of Americans agree that they feel better about themselves when buying organic foods, rising to nearly half (48 percent) of those who are buying more organic foods this year. What’s more, 28 percent of consumers overall report buying natural/organic products because they know these products are better for them, again, rising to half (49 percent) of those consumers who are buying more organic foods this year.

“While consumers overall may be unaware of organics’ traits or the precise benefits of eating organically, the products do enjoy a positive reputation and generally appear to make consumers feel good about their purchase, even if it comes at a higher cost. More affordable organic options would do well with consumers and more private-label options are emerging that could help push prices down. While consumers pay attention to brand names, in their eyes, there is little difference between national brand and store-brand organic options. As such, a considerable price difference could compel consumers to turn away from national brands in favor of a comparable option with an organic claim,” concluded Roberts.

The Sugar Shift

A new report from Rabobank, a global financial services leader, identifies consumers’ shift away from sugar consumption as an important driver behind dramatic changes in the food and beverage industry. These changes will have long-term ramifications, including a likely slowdown in the worldwide sugar market.

The report, “Sweetness and Lite,” by Rabobank Global Strategist Andy Duff and Rabobank Senior Analyst Nick Fereday indicates a combination of changing preferences, product reformulations and government pressure have caused structural changes in the way sugar is perceived and consumed worldwide.

“The consumer shift away from sugar has become a global trend,” Fereday said. “This is a big deal for the sugar industry and cannot be dismissed as a passing fad or wished away.”

While they do not intend to act as “judge and jury” on sugar and related sweeteners in the report, Duff and Fereday identified the primary reasons why consumers are moving away from sugar, including:

- More consumers adopting low-sugar diets instead of ones that focus just on fats because they see sugar and refined carbohydrates as the main culprits in obesity.

- The increase in legislation penalizing sugar-laden beverages, such as a tax on sugary soft drinks in countries such as Chile, Egypt, Mexico, South Africa and Thailand and in major metropolitan areas in the U.S.

In the report, the authors detailed how companies in the food industry are responding, including overhauling ingredients, decreasing portion sizes and diversifying their corporate portfolios.

Duff and Fereday estimate that, if initiatives by companies and governments were to achieve a significant (5 percent or above) reduction in global food and beverage sector sugar use over a two- to three-year implementation period, it would offset much of the expected global growth in consumption during this period.

They also said the outlook for industrial sugar use depends heavily on consumption trends in emerging markets.

“The rate of growth of global sugar consumption in the coming 15 years is likely to be lower than the growth rate seen in the last 15 years,” Duff said.

Food Brand Index

Digital benchmarking firm L2 Inc releases its 4th annual L2 Digital IQ Index Food: US 2017 Report

The L2 report benchmarks the digital performance of 146 Food brands operating in the US. The report focuses on key digital strategies and best practices for Food manufacturers to compete as the grocery market continues to proliferate online. The L2 Digital IQ Index methodology examines a brand’s strengths and weaknesses across the four digital dimensions of Site and E-Commerce, Digital Marketing, Social, and Mobile. Index brands are classified as either Genius, Gifted, Average, Challenged, or Feeble.

“More than 95 percent of Index Food brands are available online on Amazon, Target, and Walmart,” explained Bill Duffy, Associate Director of CPG at L2. “While these e-commerce platforms present a major sales opportunity for food brands, they also introduce stiff competition to capture the greatest digital share of shelf, and open the door to independent brands which, with access to cheap fulfillment and accessible merchandising opportunities, are able to really compete against established, legacy brands for the first time.”

Key findings from L2’s report include:

E-Tailer Handoff – Forty-seven percent of brands now incorporate e-commerce handoff on their brand sites, up from 35 percent in 2015. However, only 46 percent of brands feature reviews on product pages, 45 percent offer on-site video content, and just 4 percent include user generated content – all of which are necessary to push consumers down the path to purchase.

Competing for Video Views: Video is an area of heavy investment across social platforms for food brands online, earning 1.6 billion views across Facebook, YouTube, and Instagram; 93 percent of which are paid for. Index brands can improve their video strategies by taking inspiration from third-party media companies, such as Tasty, which published 191 videos betweenJanuary 2017 and May 2017 that earned more than 10 million views each.

Private Label Threat: Major retailers with established brick-and-mortar stores are pushing their private label brands at the expense of Index brands. For example, Kroger ClickList and Whole Foods Delivery heavily promote their private label products, owning a full 33 and 32 percent of total SKUs in category navigation, respectively. Brands should combat the private label threat by taking advantage of digital merchandising opportunities such as sponsored banners and featured products in both category navigation and search.

Brits and Meat Consumption

Move over ‘meat and two veg’, it seems that many Brits today are following the ‘meat alternative and two veg’ mantra. Indeed, new research from Mintel finds that over a quarter (28 percent) of meat eating Brits have reduced or limited their meat consumption in the last six months*. What is more, a further one in seven (14 percent) adults say they are interested in limiting or reducing their consumption of meat or poultry in the future, proving that the meat-free movement is no flash in the pan.

And while many may be picking up equipment to skin a pumpkin or braise a fennel, health is the number one motivation for those limiting or reducing meat consumption. Today, as many as half (49 percent) of Brits who are interested in or who are already limiting or reducing meat consumption agree that eating too much meat is bad for their health. Meanwhile, weight management (29 percent) is the second most popular reason for limiting or reducing meat consumption, while concern over animal welfare (24 percent) and the environment (24 percent) are equal motivators.

When it comes to fuelling the veggie vanguard, Mintel research shows that meat reduction campaigns are proving particularly influential; some 39 percent of meat limiters or reducers say that meat reduction campaigns (eg Meat-free Mondays, National Vegetarian Week, Veganuary) have made them more aware of the benefits of eating less meat. Online bloggers and vloggers are also having a significant impact. As many as 16 percent of Brits say that advice from healthy eating bloggers and vloggers, such as Deliciously Ella and the Hemsley sisters, is encouraging them to reduce the amount of meat they eat, rising to three in 10 (29 percent) of those who have already reduced or limited their consumption of meat.

“Despite the ingrained popularity of meat and poultry, a clear trend has emerged of people cutting back and limiting how much of these products they eat,” said Emma Clifford, Senior Food Analyst at Mintel. “That ‘flexitarianism’, a whole new dietary phrase, was coined to describe this movement also highlights its indisputably mainstream status. The flexitarian trend carves a very accessible and unrestricted middle ground between simply meat-eaters and non-meat eaters, while acknowledging a conscious effort to eat less meat. On top of the various other benefits linked to reducing meat consumption, following a meat-free diet is likely to be aspirational to many consumers and social media is playing an important role in the attraction of this endeavour.”

Indeed, it seems that many are adopting this flexitarian approach, with just nine percent of Brits saying they don’t eat red meat or poultry. However, the younger generations are the most likely to be following a meat-free lifestyle. One in five (19 percent) Brits under the age of 25 say they do not eat red meat or poultry, rising to one in four (25 percent) women in this age group.

And while animal welfare (54 percent) is the number one reason why non-meat eaters say they avoid meat, for those under 25, environmental benefits is the leading factor. Indeed, this group is the only group which is more likely to avoid meat for environmental reasons (29 percent) as opposed to concerns over animal welfare (22 percent).

“The ethical card in terms of helping to maintain a green planet is a powerful one for meat-free brands to play, particularly now that the issue is attracting a lot of attention. Flagging up that consumers are making a choice which is good for the environment and which can help to create a greener future in the long-term is likely to be a persuasive selling point,” added Clifford.

The trend towards meat reduction comes at a time when the meat-free foods market shows green shoots of recovery. Indeed, while volume and value sales dropped 14 percent and 10 percent respectively between 2012 and 2015, in 2016 volume sales grew 2 percent year on year, while rising average prices saw value sales jump 4 percent to £559 million. Furthermore, the future looks fruitful. In 2017, the market is set to reach £572 million, with rising prices forecast to increase value sales to £658 million in 2021, an increase of almost a fifth (18 percent) between 2016 and 2021. Overall, half (50 percent) of UK adults have eaten meat-free foods in the last six months*, with 38 percent having eaten vegetable-based products, such as a burger made from vegetables, 32 percent eating bean-based products and 26 percent nut-based products.

“A number of factors have been at play helping to reverse the fortunes of the meat-free category. Lifestyle trends are helping to broaden the appeal of these products, most notably many consumers are becoming more vigilant about the amount of meat in their diet. Increased innovation, with a big new product development push from brands in 2016, and growing mainstream availability of these products, has also underpinned this positive performance,” Clifford concluded.

Ice Cream Flavor Perception

Quick, name your favorite ice cream flavor. Chances are, it’s probably not one of the nation’s top sellers.

According to national sales figures from the International Dairy Foods Association (IDFA), Vanilla is number one in sales rankings and has been since as long as anyone can remember. But is the versatile, no-frills flavor truly the top choice among ice cream fans? To find the answer, Turkey Hill Dairy polled more than 4,000 of its fans on social media and its Turkey Hill Nation fan club.

After the votes had been counted, it was Choco Mint Chip (aka Mint Chocolate Chip) that emerged as the frosty favorite. The classic combination of mint ice cream and chocolate chips was followed by Chocolate Peanut Butter Cup, Butter Pecan, Chocolate Marshmallow, and Black Raspberry to round out the top five.

As for Vanilla? It was nowhere to be found on the list and eventually ranked number 12 in the Turkey Hill poll. Even Chocolate — the perennial number two in the IDFA sales rankings — failed to crack the top 10.

“The results of the poll don’t necessarily mean that Vanilla and Chocolate aren’t good flavors,” explained Turkey Hill President John Cox, whose own personal favorite is All Natural Vanilla (almost everything else is a close second). “They’re fantastic flavors and universally liked, which makes them good choices for birthday parties and ice cream socials. That’s exactly why they’re the top sellers.”

Rounding out the top 10 in Turkey Hill’s survey, starting at number six, are Black Cherry, Chocolate Chip Cookie Dough, Double Dunker (a Turkey Hill-exclusive flavor consisting of mocha-flavored ice cream swirled with cookie dough and chocolate cookie swirl), Peanut Butter Ripple, and Cookies ‘n Cream.

Food Waste Management Market

According to the latest report published by Future Market Insights (FMI), the global food waste management market is poised to increase at a CAGR of the 6.3 percent during the forecast period (2017-2027). Factors such as rapid rate of industrialisation, emergence of new markets for food waste management, and greater importance to innovation and R&D for developing efficient food waste management systems are expected to make a cumulative impact on the future prospect of the market. Moreover, in an effort to control food wastage, governments in many countries are now enforcing stringent laws on excessive food waste. In recent years, the participation of small and medium enterprises in the global food waste management market has escalated to a significant extent owing to increasing demand for streamlining food waste management procedures.

Some of the leading companies profiled in the FMI’s report include Waste Management, Inc, Advanced Disposal Services, Inc., Republic Services, Inc., Waste Connections Inc., Clean Harbors, Inc., Stericycle, Inc., FCC Environment Ltd., CT Environmental Group Ltd., Veolia Environnement SA, Recology Inc, OzHarvest Ltd., Boulder Food Rescue, Boston Area Gleaners, Inc. Amp Your Good LLC, The Sustainable Restaurant Association Ltd., 412 Food Rescue, Caritas Corporation, City Harvest Ltd., ExtraFood.org and Global Feedback Ltd. By emphasising on the development of innovative technologies, many of the companies are trying to expand their operations in several parts of the world. In addition, companies are increasingly targeting the rural areas as they still lack efficient food waste management systems or solutions. At the same time, automation and systemic segregation of food waste at source including industrial, commercial, and residential are likely to play an important part in streamlining food waste management.

North America at the Forefront of the Global Food Waste Management Market

Among all the regions, the food waste market in North America currently holds the top position. The federal government in the U.S. is promoting the construction of composting facility across the country. By the 2017-end, the region is projected to account for 36.1 percent value share of the global market. Meanwhile, both Western Europe and Asia Pacific excluding Japan (APEJ) are expected to remain the two other lucrative markets for food waste management over 2027.

Key excerpts from the report include

- Based on end use, the majority of the food waste produced in the world is used as animal feed. Towards the end of 2027, the animal feed end use segment is expected to account for more than 42 percent share of the global market in terms of revenue.

- By waste type, the amount of waste that is generated while food processing is significantly high. The food processing wastes segment is expected to remain dominant throughout the forecast period, accounting for a revenue share of 41 percent by 2027.

- By service, the prevention segment is expected to remain dominant in 2017 and beyond. By 2027-end, this segment is expected to command for more than 55.3 percent revenue share of the market.