According to a Recent Study/Survey … End of September 2016 Edition

1 Min Watch By MRM Staff

As part of our mission to be the go-to resource for on-the-go restaurant industry professionals, Modern Restaurant Management magazine (MRM) offers highlights of recent research. This end-of-September edition features news about the sales potential of big-box office attractions for restaurants, millennials and organics and the evolving world of cocktails.

Dinner and a Movie

Our friends at CAKE were curious and wanted to know if the old-standby dinner and a movie was still a weekend staple. Do restaurants actually see an increase in diners and revenue when big name titles are released in the cinema?

““There is truly no more satisfying way to connect with someone than sharing a meal together,” CAKE CEO Mani Kulasooriya told Modern Restaurant Management magazine. “Movies are a relatively cheap and entertaining activity to accompany a meal and also provide a nice conversation starter. At CAKE, we help restaurants make data-based decisions to improve their business and we often like to explore how cultural trends and events might impact restaurants. ‘Dinner and a movie’ has been America’s quintessential date night for decades, and with so many people grabbing a meal before showtime, we at CAKE were curious: when box office ticket sales fluctuate between big blockbusters and less popular films, is there any impact on restaurant businesses? Our data team thought it would be fun to pull the box office revenues for highly anticipated movie releases and restaurant sales during big release weekends to see if there was any correlation between the two.”

Here’s what they found:

- Movies that smashed box office averages in revenue correlate by a full 70 percent to major upswings in restaurant revenue during release weekend

- Valentine’s Day weekend (Feb. 12 – 14) saw one of the most notable upticks, with new release revenues up an average of 150 percent and restaurant revenues up an average of 27 percent.

- The biggest restaurant swing of the year (59 percent) was tied to box office releases on June 17 – 19, including The Rock’s “Central Intelligence” and Disney’s “Finding Dory”

- The traditional summer blockbuster fell flat this year, with just a one percent increase in box office revenues over fourth of July weekend and three percent increase in restaurant revenues; by contrast, Memorial Day weekend saw a 19 percent uptick at the cinema tied to a percent percent increase in restaurant revenues.

This is just one example of the ways in which data can help restaurant owners make more informed decisions.

So – is dinner and a movie still the hot date it once was? The answer is usually yes, if the movie is a big hit. Restaurant owners looking to attract diners should tie promotions and advertising to the year’s most anticipated releases, especially around Valentine’s Day and Memorial Day Weekend.

“We were very shocked to see that “Finding Dory’s” opening weekend correlated to more restaurant business than “Star Wars” or “Deadpool,” Kulasooriya noted.

What can restaurant owners and managers take away from this survey?

“Interestingly, our data found the most notable upticks in restaurant sales during Valentine’s Day and Memorial Day Weekend,” Kulasooriya said. “From these findings, it seems that restaurant owners could consider focusing promotions on these key moments in time and tie their advertising to highly anticipated movie releases. One way this could be brought to life would be through a partnership with a local movie theater, creating a cross-promotional program that can either offer discounted tickets for eating dinner at your restaurant before a movie, or time reservations with the movie showtimes so guests can be sure they will not be late. Restaurants could also create special menu items that tie into a movie being released, or seasonal specials in honor of the holidays that correspond to these increases in sales. This is just one example of the ways in which data can help restaurant owners make more informed decisions.”

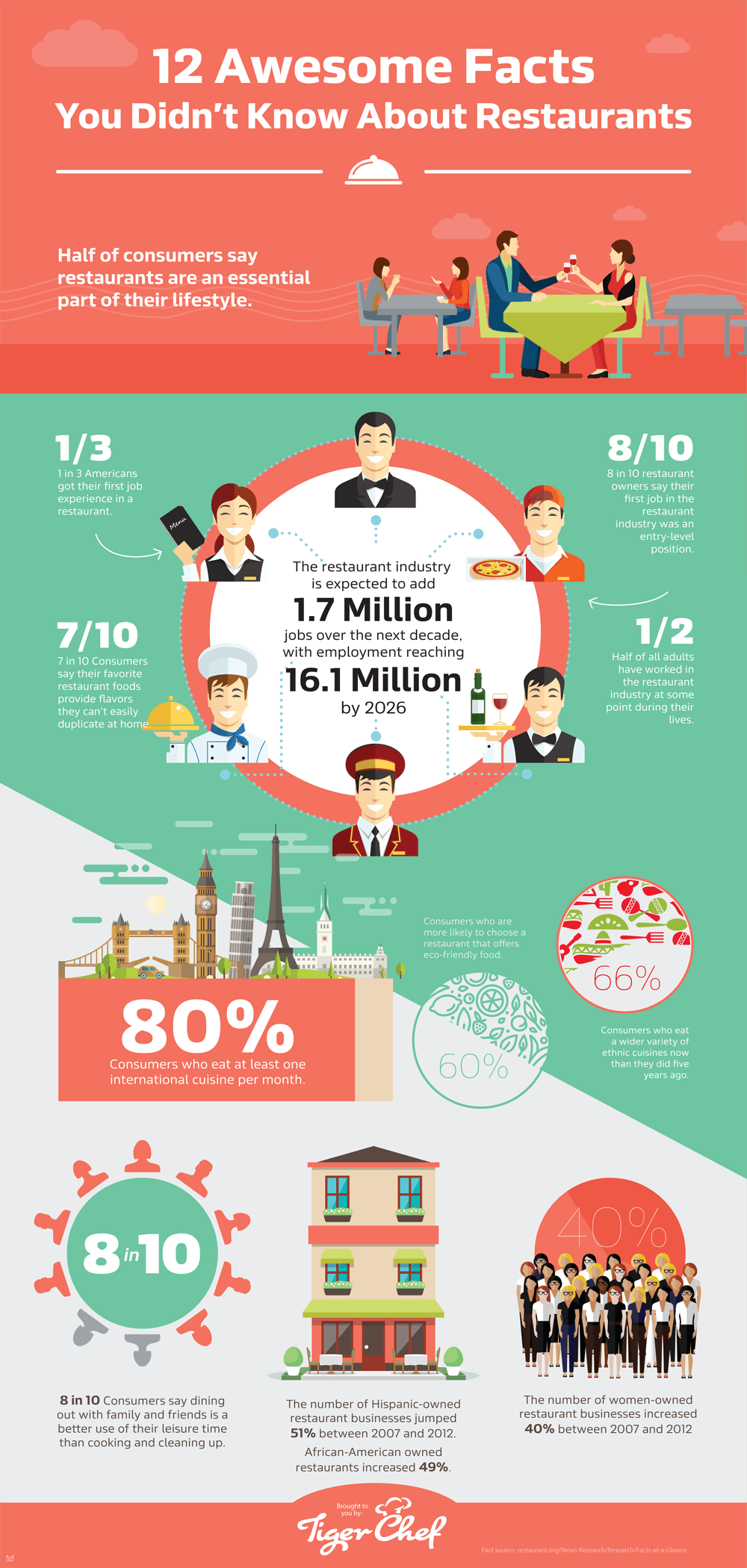

Restaurants are Awesome

Our friends at TigerChef create this great infographic that hits home how important restaurants are.

Top Food and Beverage Destinations

Mastercard released its 2016 Global Destination Cities Index, which examined spending breakdowns for each destination city for the first time. The Index found that visitors to Istanbul spend more on food and beverage (30.8 percent of expenditures) than any other city on the global top 20 list.

Now in its seventh year, the Index annually provides a ranking of the 132 cities based on projections of visitor volume and spend for the 2015 calendar year. The results help us draw conclusions about how international visitors travel and what they do once they’ve reached their destinations. Below are a few additional insights you might find valuable:

After Istanbul, other top 20 destination cities where visitors spend more on dining experiences are primarily European cities – Barcelona (29 percent), Prague (27.4 percent), Amsterdam (25 percent) and Osaka (22.4 percent).

Dubai is ranked the number one spending destination based on an international spend of US$31.3 billion. Visitor spending jumped 11 percent year-over-year. Overall, the destination city where spending on food and beverage ranks highest on the expenditure breakdown is Cairo (41.2 percent). Among the top 20 destination cities, more people travel internationally for leisure than for business, and experiences continue to be an important part of international travel.

Best Coffee Cities

Personal-finance website WalletHub took a close look at 2016’s Best Cities for Coffee Lovers. To determine the best cities for partaking in America’s coffee culture, WalletHub’s number crunchers compared the 100 largest cities across 12 key metrics, ranging from “number of coffee shops, coffee houses and cafés per capita” to “average price of a coffee pack.”

|

Top 20 Cities for Coffee Lovers |

|||||

|

1 |

Portland, OR |

11 |

Oakland, CA |

||

|

2 |

Seattle, WA |

12 |

St. Louis, MO |

||

|

3 |

Minneapolis, MN |

13 |

Tampa, FL |

||

|

4 |

Pittsburgh, PA |

14 |

Atlanta, GA |

||

|

5 |

Orlando, FL |

15 |

Boise, ID |

||

|

6 |

San Francisco, CA |

16 |

Anchorage, AK |

||

|

7 |

New Orleans, LA |

17 |

Denver, CO |

||

|

8 |

Madison, WI |

18 |

Reno, NV |

||

|

9 |

Cincinnati, OH |

19 |

Honolulu, HI |

||

|

10 |

Scottsdale, AZ |

20 |

Miami, FL |

||

Best vs. Worst

- Louisville, KY., average price for a cappuccino, $2.83, which is 1.7 times lower than in Honolulu, the city with the highest, $4.69.

- Hialeah, FL., has the lowest average price per pack of coffee, $3.47, which is 2.2 times lower than in Honolulu, the city with the highest, $7.56.

- Portland, OR., has the most coffee shops, coffeehouses and cafés per 100,000 residents, 101.71, which is 32.5 times higher than in Laredo, Texas, the city with the fewest, 3.13.

- Portland, OR., has the most coffee and tea manufacturers per 100,000 residents, which is 38 times higher than in Riverside and San Bernardino, Calif., the cities with the fewest.

- Orlando, FL., has the most donut shops per 100,000 residents, 18.46, which is 18 times higher than in Anchorage, Alaska, the city with the fewest, 1.00.

More Coffee Stats

Redfin, the next-generation real estate brokerage, also chimed in on ultimate cities for coffee lovers. To identify these coffee capitals, Redfin data scientists looked at Walk Score data in 100 cities across the U.S. and found the top 10 with the most coffee shops per capita. For each city, Redfin also highlighted the ZIP code with the most coffee shops per person.

Here are the top 10 most caffeinated cities:

- San Francisco, CA

- Seattle, WA

- Portland, OR

- Oakland, CA

- Pittsburgh, PA

- Paradise, NV

- Salt Lake City, UT

- New Orleans, LA

- Minneapolis, MN

- Tacoma, WA

Millennials Like Organics

Among U.S. parents, more than five in 10 (52 percent) organic buyers are Millennials. And this influential and progressive generation is stocking their shopping carts with organic on a regular basis.

“The Millennial consumer and head of household is changing the landscape of our food industry,” said Laura Batcha, CEO and Executive Director of the Organic Trade Association. “Our survey shows that Millennial parents seek out organic because they are more aware of the benefits of organic, that they place a greater value on knowing how their food was grown and produced, and that they are deeply committed to supporting a food system that sustains and nurtures the environment.” OTA has partnered with KIWI Magazine to conduct surveys of the organic buying patterns of households since 2009. This year’s survey marks the first time that generational buying habits have been studied.

Compared to Millennials who account for 52 percent of organic buyers, Generation X parents made up 35 percent of parents choosing organic, and Baby Boomers just 14 percent. OTA’s U.S. Families’ Organic Attitudes and Beliefs 2016 Tracking Study, a survey of more than 1,800 households throughout the country with at least one child under 18, found that more than eight in ten (82 percent) U.S. families say they buy organic sometimes, one of the highest levels in the survey’s seven-year lifetime. The number of families never buying organic has steadily decreased, going from almost 30 percent in 2009 to just 18 percent today.

Organic and living green

While 35 percent of all families surveyed said that choosing organic products is a key part of their effort to live in an environmentally friendly way, a greater percentage of Millennials said buying organic is a key eco-conscious habit than any other generational group. For forty percent of Millennials, choosing organic is an integral part of living green, versus 32 percent of Generation Xers and 28 percent of Baby Boomers.

Organic buying continues to be on the rise across the generations. Forty-nine percent of all households surveyed said they are buying more organic foods today than a year ago.

Knowledge about organic is also growing across the generational spectrum of parents, but Millennials in particular are likely to view themselves as very knowledgable about organic products, with nearly 8 in 10 (77 percent) reporting that they are “well informed” (34 percent) or “know quite a bit” (44 percent). With that knowledge comes a great deal of trust for the organic label. Parents’ trust in organic labeling is the strongest and highest among Millennials, with 54 percent saying they have confidence in the integrity of the organic label. Almost 60 percent of Millennial parents say thay have a “strong connection” with the label and feel the organic label is an important part of how they shop for food.

New York is Top Salmon City

Hold the New York-style pastrami and pizza. An analysis by one of the world’s largest seafood providers suggests that New York locals may actually prefer salmon.

The internal analysis, conducted by Chicken of the Sea, ranked New York among the Top 10 Salmon Cities in the United States. This means that local New York residents eat more fresh and shelf-stable salmon per person than their counterparts in other U.S. cities, have the potential to eat more salmon or are more likely to try new salmon products, prepare salmon recipes or order salmon as a meal.

“Despite its reputation for pizza and corned-beef, New York is among the most sophisticated seafood markets in the country and home to an increasing number of seafood and salmon lovers,” said Maureen McDonnell, Chicken of the Sea’s director of brand marketing and category management. “We’d like to think that traditional protein lovers in New York are more likely to occasionally trade their pastrami for a hearty salmon recipe. From a seafood and salmon standpoint, New York is a trendsetter.”

Beyond New York, the other Top 10 Salmon Cities include Anchorage, Alaska; Baltimore; Chicago; Cincinnati, Columbus, Ohio; Nashville, Tenn.; San Diego; Seattle; and Washington, D.C.

Lower Food Prices

Lower retail prices for several foods, including eggs, whole milk, cheddar cheese, chicken breast, sirloin tip roast and ground chuck resulted in a decrease in the American Farm Bureau Federation’s Fall Harvest Marketbasket Survey. The informal survey shows the total cost of 16 food items that can be used to prepare one or more meals was $49.70, down $4.40 or eight percent compared to a survey conducted a year ago. Of the 16 items surveyed, 13 decreased and three increased in average price. Egg prices dropped significantly due to production recovering well from the 2014 avian influenza, according to John Newton, AFBF director, market intelligence. Milk prices are down substantially, particularly compared to record-highs in 2014, due to the current global dairy surplus.

“For all commodities in agriculture there is a lot of product on hand and prices are depressed,” Newton explained. “Dry conditions in the Northeast and Northwest the last few years likely contributed to smaller supplies and higher retail prices for apples,” Newton said. In addition, he said salad prices are up due to lower output particularly in California and Arizona.

The year-to-year direction of the marketbasket survey tracks with the federal government’s Consumer Price Index report for food at home. As retail grocery prices have increased gradually over time, the share of the average food dollar that America’s farm and ranch families receive has dropped.

“Through the mid-1970s, farmers received about one-third of consumer retail food expenditures for food eaten at home and away from home, on average. Since then, that figure has decreased steadily and is now about 17 percent, according to the Agriculture Department’s revised Food Dollar Series,” Newton said.

Tracking Culinary Trends

According to USDA, Americans spend just under 10 percent of their disposable annual income on food, the lowest average of any country in the world. A total of 59 shoppers in 26 states participated in the latest survey, conducted in September.

More than non-GMO, more than local, organic, or natural, more even than low price, consumers value freshness in food—and nothing says freshness like garden-fresh vegetables or fruit, according to market research publisher Packaged Facts in the brand new report, Garden and Grove: Culinary Trend Tracking Series (CuTTS). Packaged Facts consumer survey data from April 2016 show that freshness is the most important food characteristic to consumers across the board. This fandom for freshness extends to influential consumer segments such as Millennials, further securing the status of freshness at the center of culinary trends.

Packaged Facts’ Culinary Trend Tracking Series (CuTTS) is the essential source for tracking culinary trends and opportunities in the restaurant, foodservice, retail prepared foods, and packaged food and beverage sectors. This latest edition Garden and Grove: CuTTS profiles six essential “garden and grove” food trends that are driving innovation in restaurants and retail: celery and fennel; fresh mint; radishes; specialty salad greens; shishito, Peppadew, and ghost peppers as emerging hot peppers; and cocktail bar fruit.

Celery and Fennel – Celery and fennel each offer multiple opportunities in both restaurants and retail because of their versatility and the ability to use all parts of the plants in various ways. Use of fennel, in particular, is spreading rapidly in casual dining and fast casual restaurants. And both celery and fennel offer options for those looking for a brighter flavor and color during the winter months. Treating both vegetables as value-added products in grocery stores by displaying all the various parts together — bulb, root, stem, leaves, even seeds and pollen—draws and educates shoppers eager for new kitchen adventures.

Fresh Mint – Mint can work miracles on menus. Beyond mint jelly with lamb chops, beyond tea and juleps and mojitos, fresh mint is enlivening appetizers, sandwiches, salads, relishes and salsas, and other savory dishes. Further, channeling the spirit of international cuisines is one of the best things spices and herbs like mint can do for food. With mint part of the arsenal of so many different on-trend cuisines—from Vietnamese to Mediterranean to Mexican—it’s not surprising that chains are starting to pick up the trend, using mint as a kind of shorthand for authenticity.

Radishes – Highly adaptable in the supermarket environment, the radish is a traditional salad bar item that can be sold as a value-added vegetable in the produce aisle, a burger topping at the deli counter, and as a roast chicken accompaniment on the hot food bar. Fast casual restaurants can take a cue from food trucks and juice bars by adding a peppery punch of radish to everything from fish tacos to breakfast smoothies.

Specialty Greens – The world of specialty salad greens—including not only lettuces but also herbs such as sorrel and the many varieties of microgreens—is growing by leaps and bounds. Specialty salad greens add flavor, texture, color and value not only to salads, but also to small plates, as side-salad garnishes for appetizers and entrees, in sandwiches, and in other menu applications. Their availability is also growing at retail, particularly in the area of specialty mixes.

Emerging Specialty Peppers – More consumers are seeking new and bold flavors in the form of hit heat-’em-up products like specialty peppers. And as consumer interest in ethnic foods and hot, spicy flavors continues to grow, lesser-known peppers are moving into the mainstream. Three of these newly “hot” hot pepper varieties are shishito, Peppadew, and ghost pepper or bhut jolokia. It’s safe to assume that these peppers will continue to infiltrate mainstream menus and retailers, cropping up in more varied applications, such as soups, relishes and sauces, entrees, and side dishes.

Cocktail Bar Fruit – All kinds of fruit are popular in cocktails, but consumers are increasingly interested in fresh, local ingredients, as well as internationally-inspired beverages. Focusing beverage menus on farm-to-glass offerings appeals to food-savvy customers (i.e., Millennials and Hispanics) and boosts premium alcohol sales. In addition, as spirits continue to grow in market share against beer and wine, cocktail culture is becoming more influential, providing new opportunities for fruit of all types to get in on the party, and also for non-alcoholic fresh beverages to follow and learn some tips from cocktails.

Food Insecurity

Feeding America’s Map the Meal Gap 2016 study finds many low-income communities that are home to a significant number of food-insecure households have higher-than-average food costs.

The study, released earlier this year finds that, on average, food-secure individuals report spending $2.89 per person, per meal. This marks a slight increase from the national average of $2.79 as reported in 2015.

“Map the Meal Gap 2016 puts dollars on the data, uncovering everything from money spent on meals, to resources needed to close the food-budget shortfall of food insecure households,” said Crystal Barnes, vice president of corporate social responsibility, Nielsen. “Hunger and Nutrition is a key priority area for our Nielsen Cares program and Map the Meal Gap is a strong example of the difference data can make in advancing social challenges.”

Map the Meal Gap 2016 estimates the relative cost of an average meal for each county in the nation based on data provided by Nielsen (NYSE: NLSN), a global provider of information and insights.

Among the study’s findings:

- The lowest meal cost is $2.02, in Maverick and Willacy Counties, Texas.

- The highest meal cost is $5.61, in Crook County, Oregon.

- The meal-cost data demonstrates that 25.4 million food-insecure people, more than half of the total reported, live in areas where food costs are higher than the national average.

- Among the 77 counties with estimated food-insecure populations of 100,000 or more, meal costs are 5 percent higher on average. In New York County, where more than 243,000 individuals are estimated to be food insecure, the average meal cost is 58 percent higher.

“This research underscores the great challenges the people we serve face,” said Diana Aviv, CEO of Feeding America. “Not only do they have to make tough choices on what bills must get paid each month, but they also are forced to spend more of their limited budgets to put food on the table.”

Bargain Hunters

According to Valassis’ 2016 Purse String Survey, consumers using savings apps have grown from 36 percent to 49 percent over the last two years among savings-minded shoppers. Additionally, more than half of these consumers say they have visited a store, restaurant or business after getting an offer on their smartphone when near the location – and 72 percent report checking their mobile devices for coupons and offers while they are in a store. With this in mind, as consumers look to save and use a variety of physical and digital channels on their journey, local brands need to cater to the evolving path to purchase.

“Millennials represent a key audience for our restaurant,” said Andy Zarka, owner of European Street Café, Jacksonville, Florida. “With Local Flavor, we have tapped into this elusive demographic through in-app ordering and custom loyalty rewards. By catering to mobile browsing habits, we have met millennials on their own turf and they’re now redeeming coupons and engaging with our brand.”

“Shoppers today want to be in the know on relevant deals in their neighborhood,” said Steve Hauber, president, Valassis Local Solutions. “Many of the deal sites and apps in the market today only provide consumers with discounts in large metro areas, which could be several miles away from them, not down the street. With the latest release of our Local Flavor mobile app, we’re helping brands meet shoppers at a hyper-local level, with new savings content posted daily.”

Cocktails are Evolving

Cocktail culture is booming and showing no signs of slowing, with forecasts showing that by 2020, there will be 400 million new consumers drinking luxury spirits. Historically cocktails were enjoyed by the Europeans and Americans but the industry is now growing on a global scale, stretching far beyond the confines of New York and London. In the past five years, consumption of spirits has risen by 26 percent in Africa and the Middle East, 15 percent across Asia and 22 percent in China[2].

In turn, cocktails are leading the way on a global scale with bartenders experimenting with ingredients and playing with technologies to satisfy the senses. But in a world where we are constantly looking for the next big thing, they need to be one step ahead of the game.

WORLD CLASS, the bartender competition – an initiative by spirits company Diageo to inspire the world to drink better – has partnered with renowned future consultancy, The Future Laboratory, to delve into the future of cocktails and reveal the trends set to revolutionise our drinking experiences.

The WORLD CLASS: Future of Cocktails report explores the cross-pollination of cultures as globe-trotting cocktail drinkers spark new experiences, court controversy and overturn boundaries. Launched at the WORLD CLASS Bartender of the Year Global Final competition in Miami, the report reveals the top trends and themes to look out for…

Controversy Cocktails

The Context: As we spend more time online, we are more opinionated than ever. In turn, people are looking to brands to do the same and stand for something – 40 percent of people say we want a purposeful brand.

Controversy Cocktails – The Trend: When it comes to cocktail making, forward thinking bar owners are ditching the traditional rules and reclaiming their creativity – making what they want to make, in the way they want to make it…

Doing it my Way

Once upon a time, the customer was always right. The next generation of bartenders are more willing to voice their opinions and giving up on trying to please all of the people, all of the time. You wouldn’t go to a Michelin starred restaurant and tell the chef how to dress a salad, so why tell an experienced bartender how to make a Mojito?

As Benjaḿin Padrón Novo, owner of Mexico’s Licoreria Limantour explains: “I always get customers asking me to sweeten the drinks we serve, even though by doing so it’ll dilute the taste of the spirit or the fruit. So, now, we just say no – and explain our reason to the guest. It’s all part of the education process.”

Performance (B)art and Provocative Theatre

To exhilarate and trigger a reaction from customers, bars are starting to add theatre to the experience, leaving a strong impression with patrons.

At Operation Dagger in Singapore, a dramatic cloud of lightbulbs on the ceiling greets drinkers, while owner Luke Whearty’s installation of fake CCTV cameras in the toilets adds a provocative dynamic. His cocktails are pure theatre too: vodka infused with pH-sensitive blue pea flower and bright lemongrass, which when mixed with champagne, the bubbles transform the cobalt liquor into fluorescent pink.

The Next Generation Menu

Cocktails have evolved significantly over the years but menus have stayed the same…until now. Innovative bartenders are now going against the traditions of the trade and thinking about new creative ways consumers can relate to drinks and navigate the menu. Rather than having traditional names of cocktails, new menus invite exploration and engage with the drinker. Trick Dog, in San Francisco, has replaced all cocktail names with astrological signs and Pantone colours, while Fragrances at The Ritz-Carlton in Berlin is the first bar where you can order drinks based on perfumes and aromas.

Emotional Cocktails

The Context: In a world where people now value experiences over possessions, we are seeing the rise of the emotional economy with people looking for deeper connections to brands.

Emotional Cocktails – The Trend: Bartenders have always been early adoptors when it comes to connecting with people – the social aspect of their job gives them a strong insight into how people think. Trendsetting bar owners and drinks brands are nowestablishing even more innovative ways to connect deeper with customers…

Cocktails with feelings

In the next decade, look out for bars who ditch the traditional menus and list their cocktails by mood instead. Drinks will be tailored to conjure a specific emotion – you may be given a red cocktail to stimulate confidence, a yellow one for friendship or a black drink for discipline.

Using sense of sight and smell to direct cocktail drinkers’ emotions, Seymour’s Parlour in London is using scent to plug into pleasurable and nostalgic memories, emitting the smell of freshly mown grass to summon images of spring and smoked pine to plunge guests into a cosy autumn evening.

Story in a glass

Cocktails are now being used to tell a story and transport drinkers to exotic places. Local spirits such as Baijiu (distilled from wheat or glutinous rice from a 5,000-year-old recipe) are being used to introduce people to Chinese traditions.

Forward thinking bar Artesian in London taps into the personal experiences of customers asking about recent holidays and creating a cocktail that captures that mood and essence in a glass.

Introducing the Micro-friend

People are looking for instant connections to savour the here and now and bartenders often fit the bill. A new trend, ‘the micro-friend’, sees bartenders focusing on building relationships with customers in the short time that they have with them. According to Australian Tim Philips, former WORLD CLASS Bartender of the Year, some ‘micro-friendships’ are built in as little as 30-45 minutes, equivalent to the time it takes to drink one cocktail.

“Making a micro-friend is all about getting that emotional connection with someone quickly and definitely has an effect on how much people like your bar,” he explains. So expect your bartender to ask you questions about your weekend, work and family life to turn you from a customer into a friend…

Fluid Identity Patrons

The Context: According to the UN, a record 232m people are living outside the country in which they were born. Considering ourselves ‘borderless’, we define ourselves more by our lifestyles or musical tastes than we do by our country of origin.

Fluid Identity Patrons – The Trend: Ahead-of-the-curve bar owners are catering for drinkers who have a healthy disregard for conformity…

Leave gender at the door

The days of drinks being considered ‘manly’ or ‘girly’ are over. Boundaries are blurring and as society evolves beyond traditional gender norms, people are feeling liberated with their choice of tipple. Bartenders are now using ‘gender neutral’ language to describe, name and serve cocktails.

Look out for ‘Brosé’ – men unapologetically enjoying Rosé wine and women confidently sipping an Old Fashioned.

A career, not a job

As consumers become more clued up and demand more at the bar, the role of the bartender is evolving too. Global competitions such as WORLD CLASS Bartender of the Year show how professional bartending relies on sharp skills, creative vision and an ability to wow; fluid identity in action.

Alex Kratena, founder of global drinks collective P(OUR) explains: “The best bartenders now have to keep up with the assertive, knowledgeable and worldly cocktail drinker – so they have to be at the top of their game and offer that extra something.”

This has led to exciting career prospects as bars invest in their staff more than ever, sending them around the world to develop local heroes that will further grow the cocktail scene. Licoreria Limantour supports its bartenders who save up to train abroad in order to hone their skills, while Outrage in South Africa equips staff with all the skills they need – from sourcing key ingredients and tools to running a full service bar.

Multi-skilled bartenders

Bartenders are a multi-talented bunch, increasingly with fluid identities of their own. Part chef, part barista, part patissier – this role now extends far beyond the bar.

Pushing the boundaries still further, these multi-skilled bartenders are challenging their customers over what constitutes a cocktail. “The most memorable course I had at The Clove Club, was this hundred-year-old Madeira,” says Mike Knowlden, co-director of Blanch & Shock. “They pour you a tiny bit, which you get to taste, and then they pour a duck consommé over the top, and it becomes a duck soup effectively. It left me with a fascinating thought: why can’t a consommé be a cocktail?”

“Cocktails have evolved far beyond their classic form of a mixed liquid in a glass. Creative bar staff equipped with the latest ingredients, technologies and ideas are changing the whole concept of the cocktail – and leaving us all thirsty for what comes next,” says Tom Savigar, Senior Partner, The Future Laboratory.