According to a Recent Study/Survey … End-of-November 2017 Edition

19 Min Read By MRM Staff

This edition of Modern Restaurant Management (MRM) magazine’s “According to …” research roundup includes exclusive research courtesy of the experts at Sense360 on the impact football season has on visits to Buffalo Wild Wings in addition to news about food tourism, POS trends and European food trends.

The Football Effect at Buffalo Wild Wings

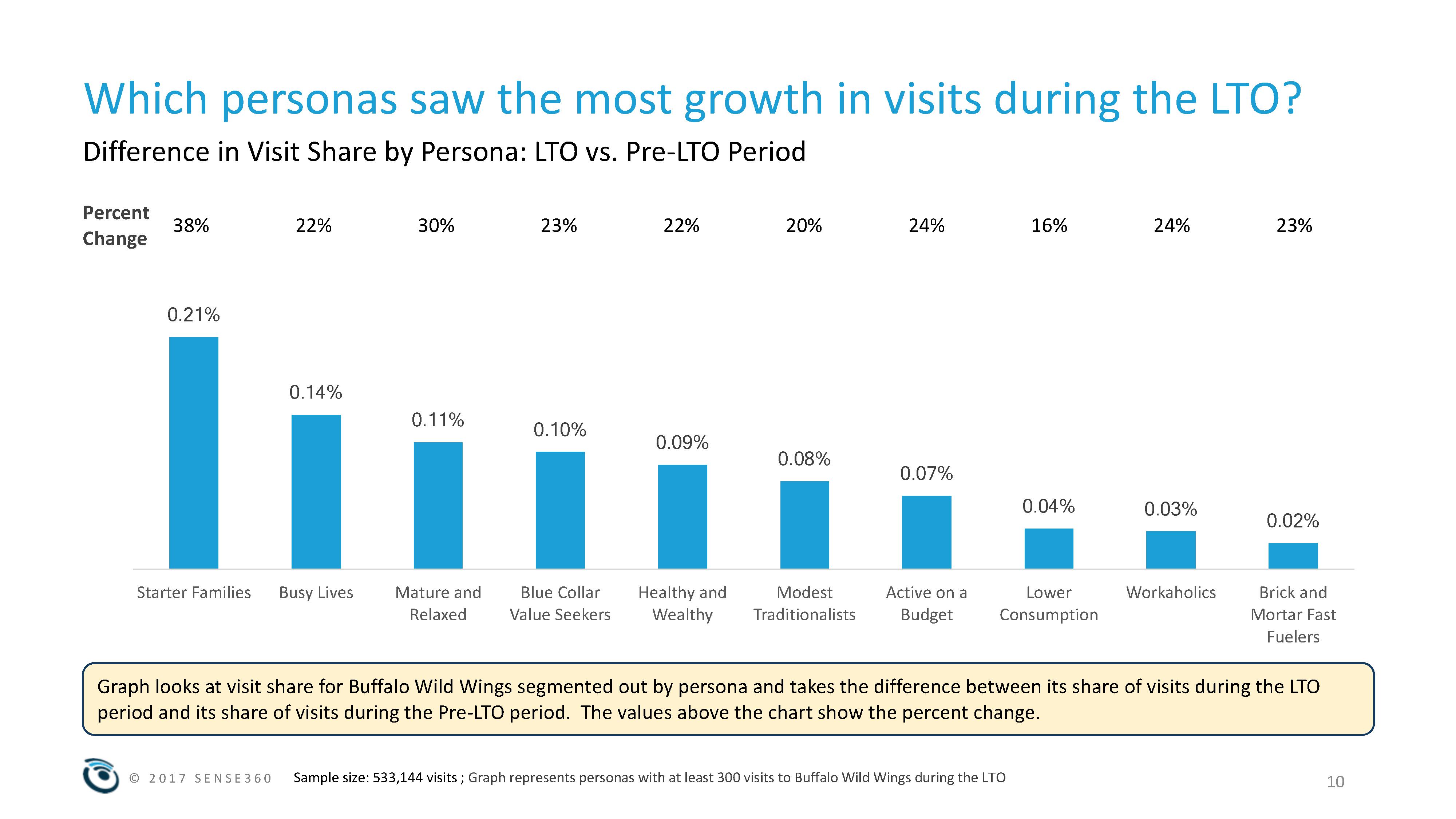

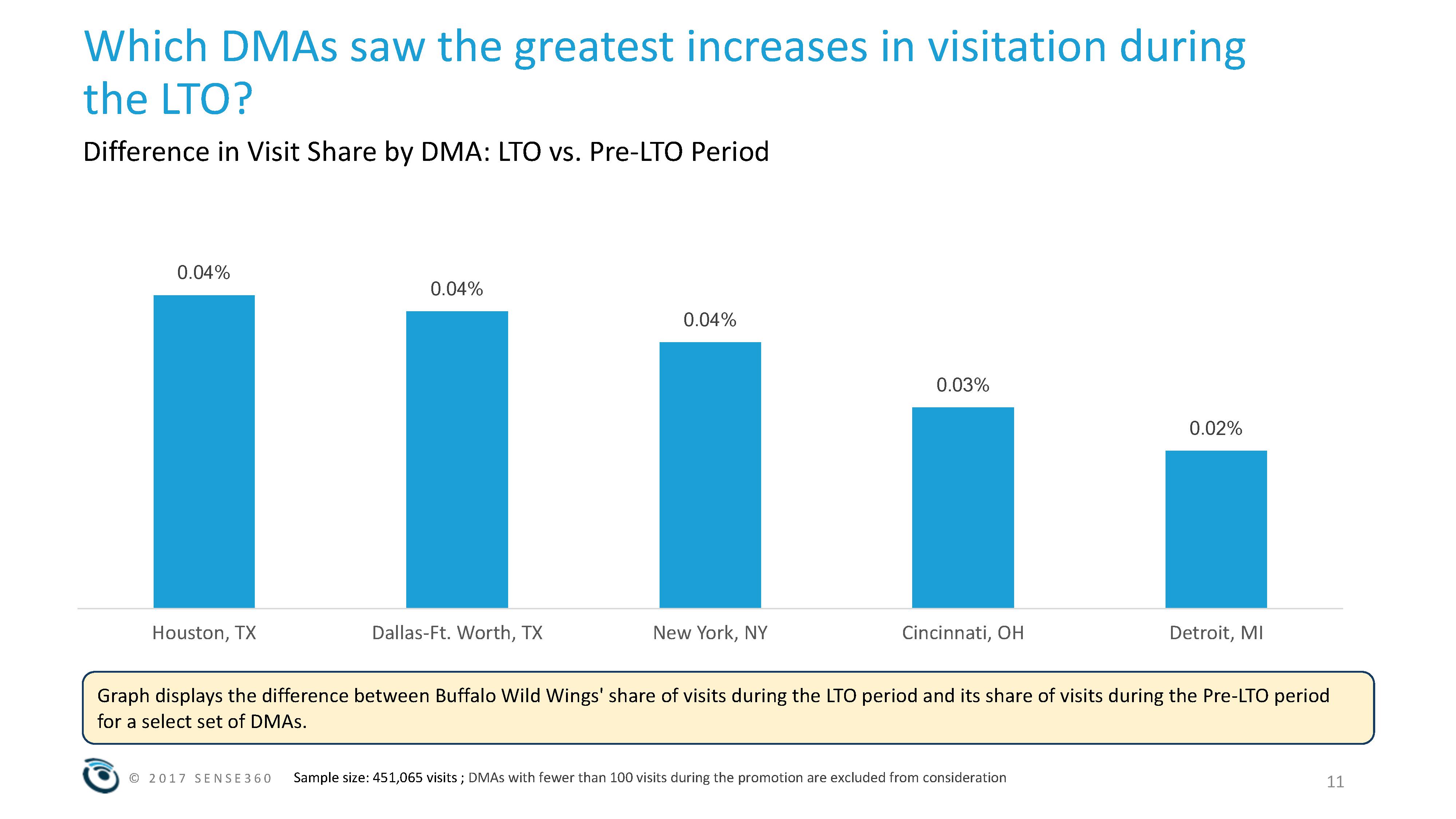

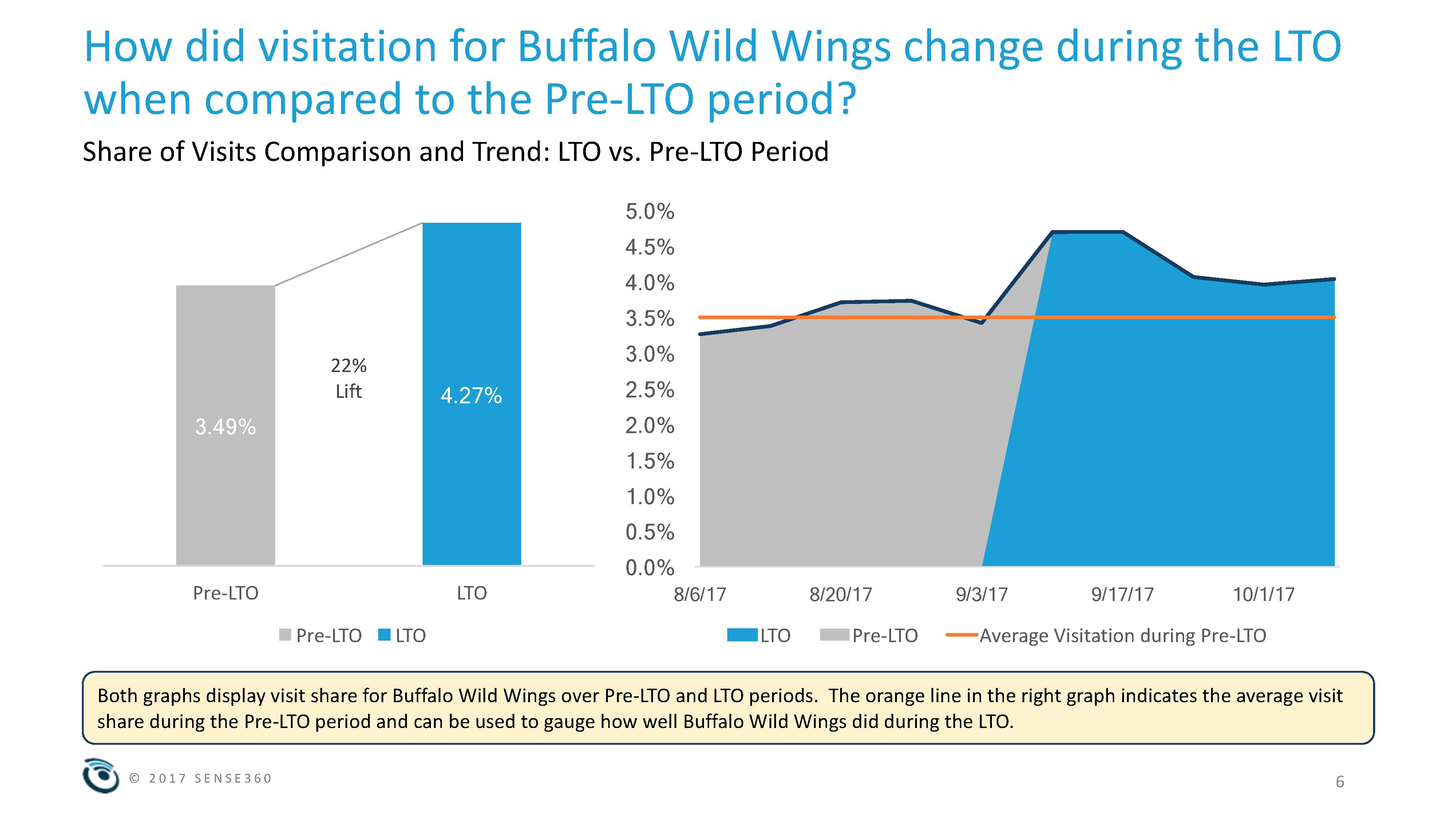

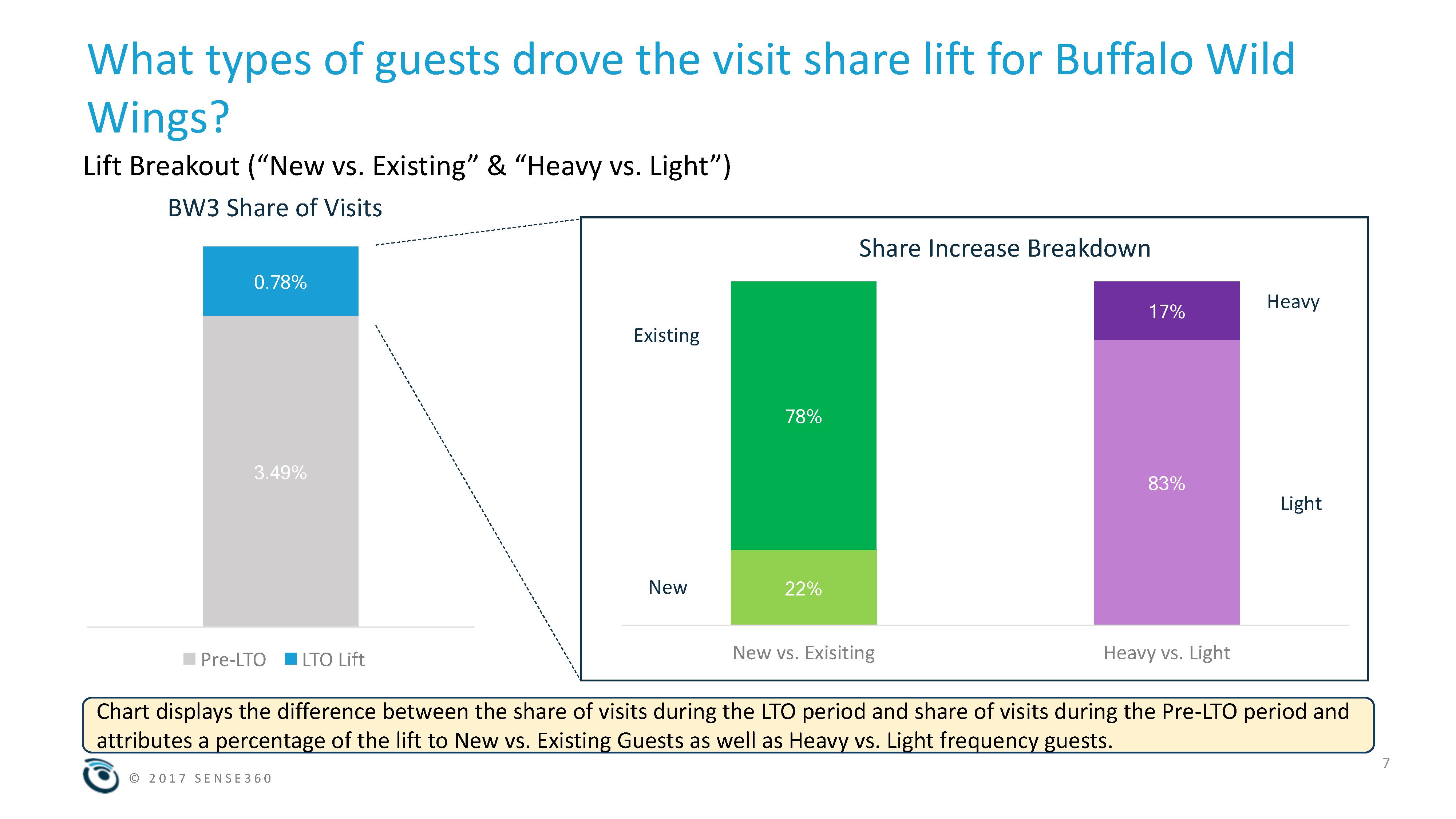

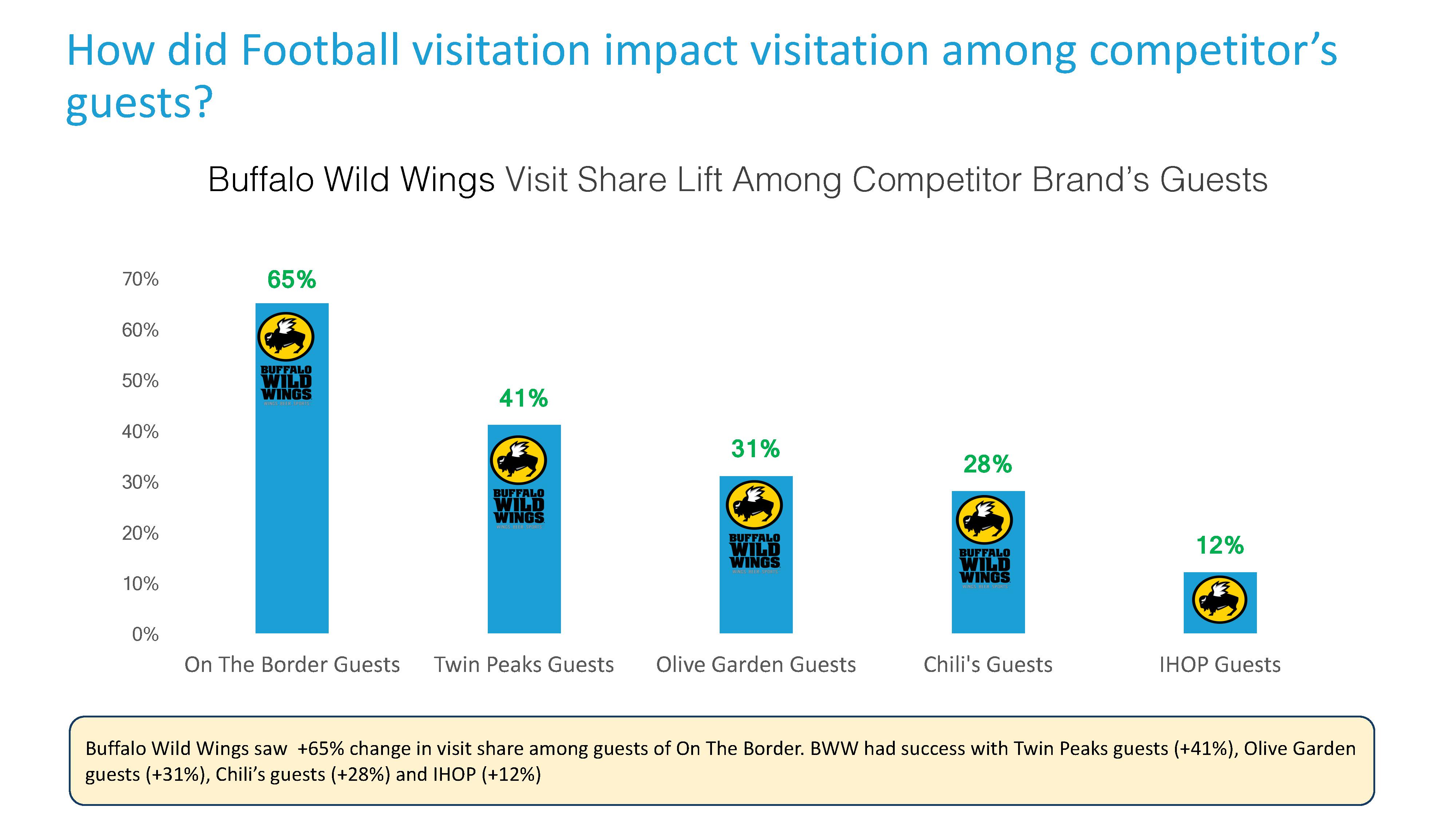

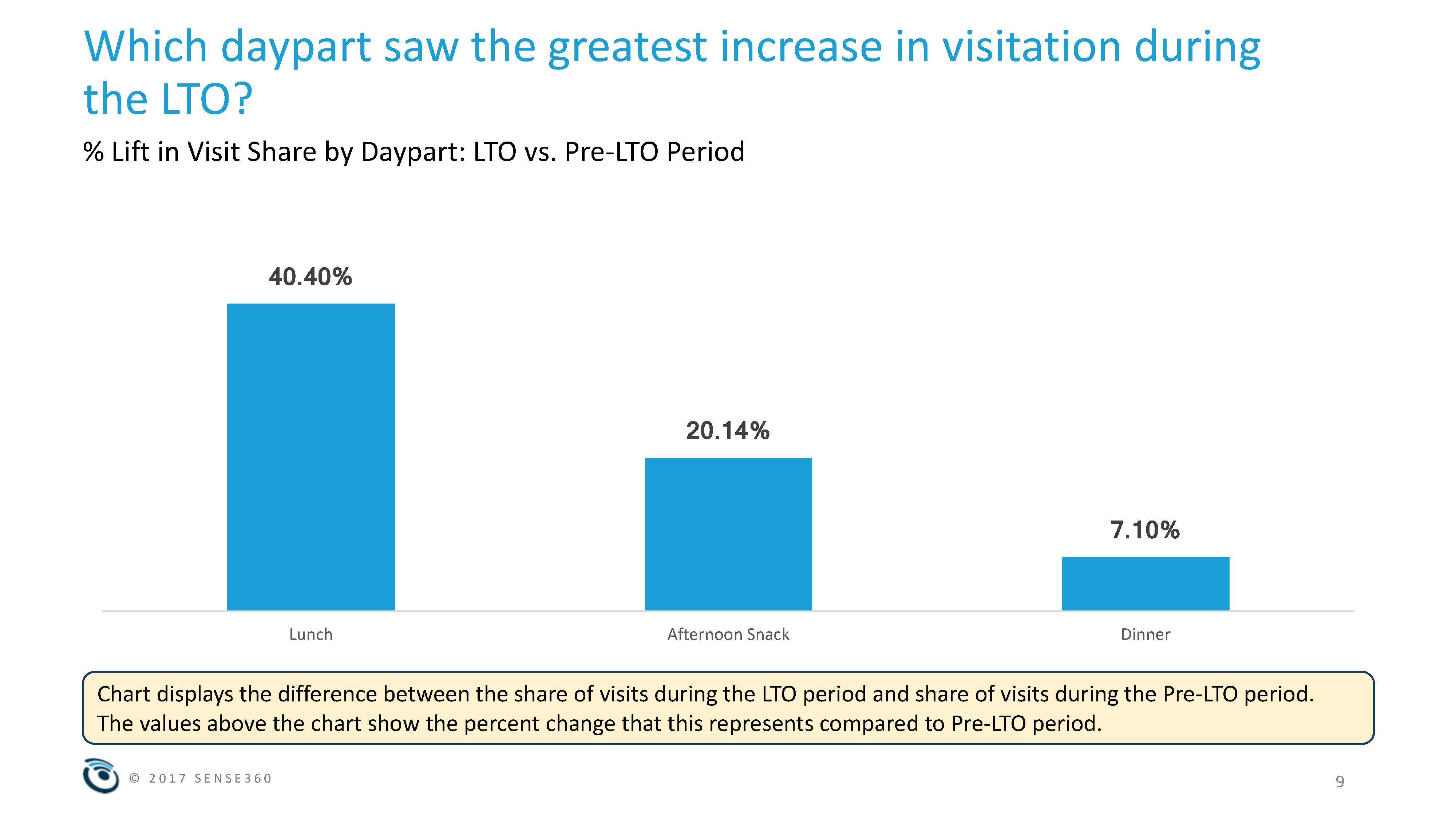

A report from Sense360 investigates the effects of an LTO on visitation by observing visit patterns both before and during the campaign and highlighting the differences between the two periods. This report specifically looks at the impact of football season on Buffalo Wild Wings.

Campaign Description: Football season began on September 7. This analysis looks at five weeks of visit trends on Sundays from the start of the season and compares to visit trends Sundays before the season started.

The study sought to:

- Understand the difference in Buffalo Wild Wings’ market share between LTO and Pre-LTO periods

- Identify which occasions and dayparts saw the greatest lift during the LTO

- Learn which guests the campaign resonated with most:

- Heavy vs. Light

- New vs. Existing

- Personas

- See if there was any variation between DMAs during the LTO

Changing Eating Patterns

Shifting consumer attitudes, behaviors, and demographics; an evolving marketplace with ongoing channel and digital disruptions; and increasing competition for consumer mindshare and dollars are changing the playing field for food companies and foodservice operators, reports The NPD Group, a leading global information company. The key shifts are how consumers shop, define convenience, use restaurants and foodservice outlets, and personalize health and wellness, according to NPD’s recently released Eating Patterns in America report.

“Consumer eating attitudes and behaviors are evolving in ways that transform long-standing consumption patterns. Shifting demographics, changing meal composition, more fresh foods, and new attitudes on beverages all create challenges for growth,” says David Portalatin, NPD vice president, industry analyst and author of Eating Patterns in America. “Today’s macro environment isn’t generating organic growth for the food and foodservice sectors so we’re dealing with a one percent world.”

In addition to changing consumption patterns, consumers are also making fewer visits to restaurants opting to stay at home or spend their money on experiences or something else. As a result, restaurant visits declined for the last several quarters; but evidence of the country’s stay-at-home culture is that foodservice delivery is growing.

One of the top factors contributing to the shifts in consumption is the attitudes and behaviors of two largest generational groups, Boomers and Millennials. Millennials have now surpassed Boomers in numbers but Boomers remain a large population and their behaviors still have a significant influence on the marketplace. For example, as Boomers age they use restaurants less and their cutback has resulted in 292 million fewer restaurant visits per year. Like the Boomers did before them, Millennials, a generation strapped by sizeable student debt and other committed expenses, are agents of marketplace change as they move through their life stages. They continue to influence Big Food and the restaurant industries with their want of authenticity, fresh, and social consciousness.

“Although the food and foodservice industries are in a stalled growth mode, there are still pockets of growth,” says Portalatin. “To grow in these challenged markets will require renovation by some, reinvention by others, and by many a deeper understanding of what consumers really need and want.”

Food Tourism Hot Spots

Food and travel go together like peanut butter and jelly, and it seems our appetite for a foodie adventure will be even bigger in 2018 with four in 10 travelers 41 percent) planning to incorporate new food and drink destinations into their travel plans next year (compared to 29 percent in 2017).

Booking.com analyzed the views of 19,000 travelers from 26 countries around the world and combined this with their own expert insights to reveal the foodie trends that will tickle our taste buds in 2018.

The research reveals that local food will be the biggest draw in 2018 with two thirds (64 percent) of travelers wanting to eat more local food. Food will even be a deciding factor when it comes to travel, with one in five (22 percent) planning to travel to a destination for the food alone and a quarter (25 percent) actively avoiding destinations that don’t have a strong ‘foodie’ scene.

The potential of technology will continue to seep into our food-filled adventures. Nearly three in ten (29 percent) travelers will choose a destination based on local restaurant reviews whilst nearly a third (31 percent) of travelers are planning to take even more pictures of food while travelling in 2018 so they can post these on social media to give their friends mouth-watering food envy!

The findings also show:

- Half (51 percent) of travelers will be more likely to seek out local street food markets – with that in mind the top destinations endorsed for ‘street food’ according to Booking.com travelers are Bangkok, Thailand; Taipei, Taiwan; Hanoi, Vietnam; Istanbul, Turkey and George Town, Malaysia[i].

- Others are after a more award-winning meal, with one in five (23 percent) seeking out more Michelin starred restaurants for 2018. If this takes your fancy why not take a trip to one of the top destinations endorsed for ‘fine dining’ by Booking.com travelers – Rome, Italy; Dubai, United Arab Emirates; Paris, France; Sao Paulo, Brazil and London, Great Britain[ii].

- It’s not just about the taste, it’s the experience that will count – travelers will be wanting to embrace all food has to offer with nearly half (49 percent) saying they will be more adventurous with the type of cuisine they eat while travelling and 54 percent wanting to experience more unique dining experiences when on holiday

- Whether you prefer high end gourmet cuisine, local street food, exotic dishes or something truly bizarre, sampling the local delicacies are a great way to discover a new destination.

Research commissioned by Booking.com and independently conducted among a sample of adults who have taken a trip in the last 12 months/plan to take a trip in the next 12 months. In total 18,509 respondents were surveyed.

European Food Trends for 2018

Mintel reveals a hunger for new ingredients across Europe.

Indeed, according to new research from Mintel, as many as 41 percent of Italian, 38 percent of Polish, 35 percent of German, 32 percent of French and 21 percent of Spanish consumers say they enjoy experimenting with ingredients.Consumer appetite is strong and according to Mintel there are four key ingredients that are expected to excel in 2018: chaga mushroom, green banana flour, hemp and blue algae.

Chaga Mushroom

According to Mintel research, consumer interest in ingredients with natural functionality is high and as a result, the chaga mushroom is receiving renewed interest. As many as 73 percent of German consumers agree that the health promoting benefits of natural foods such as fruit and vegetables are preferable to the added benefits of functional foods. Meanwhile, 48 percent of Spanish consumers have used a functional food or drink product containing anti-oxidants.

Emma Schofield, Global Food Science Analyst at Mintel, said, “Traditionally known as a medicinal mushroom, chaga mushrooms are touted as being rich sources of beta-glucans, antioxidants and certain B vitamins. Chaga is conventionally grated into a fine powder and used to brew a beverage resembling tea of coffee, more recently however, chaga has been used in cold drinks, food supplements and healthcare products. Brands looking to turn to chaga mushroom to enhance their products can emphasise the ingredients properties as an adaptogen. The term adaptogen is not legally or scientifically recognised, but, is touted as being a substance that can help the body cope better with mental or physical stress.”

Green Banana Flour

Gluten has been thrust into the spotlight in recent years, with the number of products featuring gluten-free claims booming. According to data from Mintel’s Global New Products Database (GNPD), 12 percent of bakery products launched in Europe in the year to September 2017 carried a gluten-free claim, up from just 6 percent of those launched in the year to September 2013. Taking advantage of this trend is green banana flour, whose use in food and drink products is starting to take-off according to Mintel GNPD.

“Green bananas are simply un-ripened yellow bananas, however, from a nutritional perspective, they are very different. Green banana flour is gluten-free and rich in resistant starch, as a result it is emerging as a fibre-rich, clean label, grain-free flour.” Schofield commented.

Hemp

Aspirations for healthier and ‘cleaner’ lifestyles are motivating consumers to include more vegetables, nuts, seeds, and grains into their diets. More than one in four (28 percent) consumers in Germany say they are incorporating more protein into their diet compared to a year ago, while 23 percent say they are incorporating more vegetarian foods, such as soya burgers and vegetarian sausages, into their diet compared to a year ago.

“Hemp seeds have been ignored for a long time, but the ingredient is said to contain a complete set of amino acids and a similar total protein content to soybean, it also contains micronutrients such as vitamin E and omega acids. As a result, hemp is emerging as a clean label plant protein ingredient that could thrive in plant-based, free-from and high protein innovations.” Schofield added.

Blue Algae

While once the taste of food was the first priority when it came to innovation, the rise of social media has spurred a rise in innovations that look striking too. As a result, colours, particularly natural colours, are receiving greater attention.

“With the exception of a few examples such as blue cheese and blueberries, blue colours aren’t associated that positively with food and drink, however, more blue coloured foods are beginning to emerge. The superfood spirulina provides colour with health and can be used to provide a blue colour in food and drink. Blue spirulina is making its way into cold-pressed juices, protein powders and even lattes.” she concluded.

The Changing Grocery Store

Today’s grocery stores are different from those of the past and it seems home meal replacement (HMR) is at the heart of this evolution. New research from Mintel reveals that 85 percent of Canadians have purchased prepared/made-to-order foods from a retailer that sells groceries in the last three months with younger Canadians aged 18-34 most likely (92 percent) to do so.

For many, HMR products are a viable alternative to dining in at or takeout from restaurants as one third (36 percent) of Canadian HMR consumers agree that prepared/made-to-order foods from retailers are as good as those from restaurants. Furthermore, HMR programs meet the needs of cash-strapped consumers with over one quarter (27 percent) of HMR consumers saying that HMR is a cheaper option compared to restaurants.

While stopping by the store to pick up a prepared meal is most common (87 percent), half (51 percent) of HMR consumers say they purchase prepared and made-to-order foods to eat in, rising to nearly seven in 10 (67 percent) HMR consumers aged 18-24. Grocery stores are the most popular (72 percent) HMR eat-in destination, followed by mass merchants (32 percent) and club stores (31 percent).

“It is no longer enough for home meal replacement to be just an extension of the deli counter. There is opportunity for grocery retailers to engage consumers as the foodservice industry does, with coffee shops serving as an example of a segment that has revolutionized itself and changed its value proposition to become a ‘third-space’ for people to meet, work or just decompress. Home meal replacement is undergoing a similar revolution as it becomes more important for grocery stores to provide eat-in experiences that rival those of the foodservice industry. ‘Grocerants,’ the marriage of home meal replacement and restaurant, have become a point of differentiation for Canada’s grocers, providing a means to support more frequent traffic and greater margins in an industry where profits are notoriously tight,” said Joel Gregoire, Senior Food and Drink Analyst at Mintel.

Consumers are on the hunt for convenient mealtime solutions as two in five (42 percent) HMR consumers say they purchase these foods because they’re already shopping at the store, while one third (34 percent) say that they use HMR because they are hungry while out. What’s more, as consumers are most likely to say they purchase prepared and made-to-order foods because they don’t want to cook (44 percent), and 36 percent purchase them because they have no time to cook, it seems HMR is becoming a go-to option to take the stress out of preparing dinner. In fact, prepared and made-to-order dinners (82 percent) are the most common meal purchased by HMR consumers at retail, while 68 percent eat these items for lunch.

Snacking also represents a key eating occasion for the HMR category as Mintel research shows more than half (51 percent) of HMR consumers purchase prepared meals to eat as a snack.

“As consumers continue to look for ways to save time, foodservice satisfies an evolving need for convenience and grocers have taken notice. With convenience being the cost of entry for HMR, grocers need to take the importance of ‘quick and easy’ to heart. Grocers will need to increasingly invest in ways to make getting the foods they offer onto the plates of Canadians with the least amount of hassle,” continued Gregoire.

The increasingly popular meal kit trend could present unique opportunities for prepared and made-to-order foods as one quarter (24 percent) of HMR consumers say they are interested in a meal delivery service from HMR retailers. Canadian parents in particular are a prime target for delivered HMR as 31 percent of parents with children aged 6-11 say they are interested in HMR delivery service.

Finally, ordering prepared foods online from the local grocery store may soon become the norm for many Canadians as one quarter (24 percent) of HMR consumers are interested in online ordering options, increasing to one third (33 percent) of consumers aged 18-34.

“Our research indicates that there are two big areas of opportunity for the HMR category, the first being meal kits. HMR kits can spotlight an assortment of ingredients offered in the rest of the store and potentially encourage shoppers to explore beyond their usual aisles. The second major opportunity is delivery. While historically delivery has proven to be a challenge for Canadian grocers from an operational perspective, the landscape is changing and more and more consumers, especially younger generations, have come to expect delivery options. This indicates the importance of integrating online ordering and delivery capabilities with grocers’ home meal replacement programs, thereby providing ‘store-to-door’ solutions for shoppers,” concluded Gregoire.

*Canadian consumers who purchased prepared/made-to-order foods at a store where groceries can be purchased in the three months ending August 2017.

Craft Soda Market Forecast

The global craft soda market is projected to reach USD 732.4 million by 2025, according to a new report by Grand View Research, Inc. Mounting social awareness of the health problems caused by sugary as well as alcoholic drinks is one of the major drivers for this industry. The market is reforming itself by shifting its alignment from carbonated soft drinks containing artificial sweeteners to natural, sweet-laden, low-calorie beverages.

While traditional soft drinks are under review by nutritionists, craft soda, also known as specialty, small-batch, or artisanal soda, is gaining share owing to its finest and natural ingredients, unique packaging, creative flavors, and its strong local presence. Rising trend of gourmet food as well as wellness food is expected to be the vital factor for increasing consumption of craft sodas.

Strict government guidelines for artificial ingredients and labeling & packaging along with initiatives to build interest among major players by increasing trade promotion and foreign investments are anticipated to propel the product demand. Rising awareness of consumers about unhealthy ingredients used in soft drinks is encouraging craft soda manufacturers to produce beverages containing organic & natural ingredients.

Introduction of new product lines by craft soda producers is likely to enable consumers to choose products from extensive product line according to their specific choices. The broadening of distribution channels has led to easy availability for the users, which is acting as a driver for this industry. Marketing plays a vital role in sustainability and organizational sales. Supermarkets & hypermarkets emerged as the largest distribution channel for companies on account of their global footprint, brand value, and huge customer base.

Further Key Findings:

- The global craft soda market accounted for USD 537.9 million in 2016 and is anticipated to progress at a healthy CAGR of 3.5 percent over the forecast period

- Natural craft soda occupied the largest market share in 2016 owing to the rising health concerns and high market penetration

- North America was the largest regional market in 2016 owing to high standard of living of the population and developed economy

- Supermarkets & hypermarkets was the most dominant distribution channel for this market owing to the increasing distribution by mainstream retailers

Major players include Jones Soda Co., Reed’s, Inc., Appalachian Brewing Co., Boylan Bottling Co., and SIPP eco beverage co. Inc.

Mergers and acquisitions, R&D activities, product launches, and technological collaborations are among the major strategies adopted by market players for gaining competitive advantage.

Is FSMA Working?

Nearly half of all foodborne illnesses in the United States are tied to fresh produce. In 2010, the Food Safety Modernization Act (FSMA) was passed with the intent on regulating fresh produce marketed in the United States. The Food and Drug Administration (FDA), the agency in charge of FSMA, describes it as a way to “ensure U.S. food supply is safe by shifting the focus from responding to contamination to preventing it.”

So is it working?

“I would assess this more as a band aid than a cure-all,” said John Bovay of the University of Connecticut.

Bovay is part of a team of researchers who looked at the impact of FSMA from several points of view in the paper “Economic Effects of the U.S. Food Safety Modernization Act,” which was selected to appear in the journal Applied Economic Perspectives and Policy.

Bovay used the fresh tomatoes industry as a case study into FSMA. The paper looks at the impact on farmers, both large and small, and why some benefit from FSMA more than others. The paper also looks at the potential benefits and disadvantages to domestic growers due to new regulations.

As for the cost to the consumer, and the foodborne illness concerns FSMA was created to prevent? Bovay says the jury is still very much out on that.

“FSMA will reduce the number of food-borne illness cases by some unknown amount. Even if FSMA is effective, because it is similar to many private and state rules and regulations already in place, I don’t have a lot of confidence that this is going to drastically diminish the number of illnesses.”

POS Sea Change

Key players in the POS restaurant management systems market are shifting their focus toward providing customized solutions to restaurant operators and owners, depending on their business operations. In addition, some players in the market are offering innovative POS systems for staying at the market’s forefront. For example – Intuit and Revel systems entered into a partnership for developing QuickBooks, a point of sales restaurant system that enables a restaurant in spontaneously syncing its payroll, inventory, sales payment, and CRM information.

Clover, PAX Technology, AccuPOS, TouchBistro, EPOS now, Ravel Systems POS, POSist Technologies Pvt. Ltd., Lavu, Verifone System, and Ingenico Group are key companies profiled by Transparency Market Research in its recent report on the global POS restaurant management systems market.

Global POS Restaurant Management Systems Market to Reach nearly US$ 30,000 Mn by 2026-end. According to the report, the global market for POS restaurant management systems will exhibit a spectacular expansion throughout the forecast period, 2017 to 2026. Global sales of POS restaurant management systems are estimated to account for roughly US$ 30,000 Mn revenues by 2026-end.

POS systems have been significantly enhancing the performance of restaurants since the recent past. These systems have transformed into being an essential part of restaurants for registrations of payment receptions, discounts on cash register, and sales operations. POS systems help restaurant owners in improving efficiency by reducing the time order generation, cutting down errors particularly during peak hours of service, and lowering time per transaction.

Several advancements have been witnessed in POS restaurant management systems. The increasingly popular electronic point of sale (ePOS) systems are enabling restaurant operators to make huge savings in cost and time. Moreover, all-in-one POS systems are gaining prevalence in restaurants that offer pre-order or takeaway food services. The all-in-one POS systems are placed usually at the restaurant’s entry, allowing customers in making orders and payments independently.

Full-Service Restaurants to Remain Dominant End-Users of POS

On the basis of end-user, quick service restaurants are expected to register the highest CAGR through 2026, although estimated to account for a relatively lower revenue share of the market than full-service restaurants. Increasing demand for relatively low-cost high volume products in shorter duration in quick service restaurants will sustain its presence in the market. Full-service restaurants, however, will remain the dominant end-users of POS restaurant management systems.

Based on types, mobile POS systems are expected to remain the fast-selling POS restaurant management system Fixed POS terminal will also witness an impressive expansion through 2026. Demand for self-service kiosk systems has increased in quick service restaurants, in order to weed out long checkout lines, and serve more customers.

Software platform will become the most lucrative component of POS restaurant management system by 2026-end. Growth of software platform can be highly attributed to rising requirement for updating POS software in restaurants, in a bid to cater soaring consumer expectation concerning mobility security, customer engagement, and payment. Between all the components included in TMR’s report, support services will register a relatively higher CAGR than hardware, and a lower CAGR than software platform through 2026.

Delivery management and billing will remain the largest applications of POS restaurant management systems, with the former expanding at a comparatively higher CAGR through 2026. In addition, stock & inventory management will register the fastest expansion in the market throughout the forecast period.

Region-wise, Asia-Pacific excluding Japan (APEJ) will continue to be the fastest expanding market for POS restaurant management systems, followed by Middle East & Africa (MEA). Various restaurants in APEJ countries, such asIndia and China, are using systems such as tablets and digital kiosk for displaying menu and placing orders, which in turn helps in improving customer experience and increasing operational efficiency.

As per a report by Transparency Market Research (TMR), the global quick service restaurants (QSR) IT market showcases the presence of several players thereby making the vendor landscape highly fragmented and competitive. Key players within the QSR IT market include Abcom Pty Ltd, CAKE Corporation, Cognizant, Delphi Display Systems Inc., GoFrugal Technologies Pvt. Ltd., HM Electronics Inc., Imagine Print Solutions, LG Display Co. Ltd., Microsoft Corporation, NCR Corporation, NEC Display Solutions of America Inc., Oracle Corporation, Panasonic Corporation, PAR Technology Corporation, Restaurant Service Solutions, Revel Systems Inc., and Verifone Systems Inc. among others.

Leading players within the market are focusing on providing cost competitive and customized product offerings to customers. As part of the growth strategy, players are taking the inorganic growth route which will help bolster their position. This includes engaging in various strategic partnerships, acquisitions along with efforts for new service additions and geographical expansion.

As per the estimates of a TMR report, the global quick service restaurants IT market will clock a CAGR of 7.6 percent during the forecast period from 2017 to 2025, for the market to become worth US$18,664.0 mn by the end of 2025.

Based on component, the software segment held a significant 24.5 percent of the overall QSR IT market in 2016. Going forward, the software segment is likely to clock a 10.5 percent CAGR during the forecast period due to newer trend of automation which is primarily served through QSR software.

Geographically, North America is currently the leading market for QSR IT as the region has a large number of quick service restaurants, of which several are spending substantially on in-house IT to better serve their customers. Asia Pacific is also anticipated to emerge as a lucrative market for QSR IT in the upcoming years.

Majorly fuelling the growth of global QSR IT market is the increasing demand for user-friendly, easy to comprehend, and efficient solutions that customers expect from fast food joints. Today, QSR are innovating and adopting solutions such as digital signage, digital menu cards, point of sales solutions, handheld devices, and kiosks. Of all QSR IT solutions, signage systems and digital point of sales systems are the most adopted as they help serve customers in an efficient manner and also help in brand building.

At present, rising number of quick service restaurants that are giving tough competition to each other has necessitated them to devise new ways to make their business effective and efficient. QSRs are exploring various areas such as customer relationship management, supply chain management, and are increasing their reliance on technology to increase revenue generation as well as to optimize resources.

Additionally, the rising adoption of mobile payment solutions requires quick service restaurants to be equipped with an up to date and effective IT infrastructure. At present QSR IT is undergoing transformation due to incessant adoption of mobile devices, and rapidly changing consumer behavior. To cater to this, digital solutions are increasingly becoming common in a QSR ecosystem owing to their advantages of enhanced productivity, greater table turnaround, efficient customer check out, and improved accuracy.

Small Business Saturday Boost

As Small Business Saturday closed out its eighth year on Saturday, November 25th, shoppers provided an encouraging boost to small businesses at the start to the holiday shopping season.

According to data from the 2017 Small Business Saturday Consumer Insights Survey, released today by the National Federation of Independent Business(NFIB) and American Express (NYSE:AXP), an estimated 108 million consumers reported shopping or dining at local independently-owned businesses.

“Year after year, Small Business Saturday receives remarkable support from shoppers and communities nationwide,” said Elizabeth Rutledge, executive vice president of Global Advertising and Media at American Express. “In year eight, it’s encouraging to see Small Business Saturday continue to gain momentum as more people recognize the benefits that independently-owned businesses bring to their neighborhoods—and our country as a whole.”

The Small Business Saturday Consumer Insights Survey also found that 70 percent of U.S consumers are aware of Small Business Saturday. In addition to support on Main Streets, shoppers turned out for online small businesses – with 35 percent reporting that they Shopped Small® online on November 25th alone.

The 2017 Small Business Saturday 50-State Survey, also released today by the NFIB and American Express, showed 73 percent of consumers who reportedly Shopped Small at independently-owned retailers and restaurants on Small Business Saturday did so with friends or family. The most reported reason for consumers aware of the day to shop and dine at small, independently-owned businesses was to support their community (64 percent).

Further insights from the 2017 Small Business Saturday 50-State Survey include the following:

- Shoppers made Small Business Saturday an all-day affair, as 58 percent of those who participated in the day reported shopping or dining at more than one small, independently-owned retailer or restaurant on Small Business Saturday this year.

- On a national level, nearly half (48 percent) of consumers who participated in Small Business Saturday reported visiting a small business that they had not previously been to on Small Business Saturday.

- Relative to the national average, shoppers in Colorado, Hawaii, and Vermont reported pet stores as the type of small business frequented the most; while shoppers in Illinois, Massachusetts, and New York reported visiting a bakery the most; and shoppers in Georgia, Idaho, Texas reported visiting spas, nail salons or hair salons the most.

At the local level, Small Business Saturday is fueled each year by grassroots activities organized by Neighborhood Champions— small businesses, business associations, local Chambers of Commerce, and other community organizers that rally their communities to celebrate Small Business Saturday. This year, more than 7,200 Neighborhood Champions (a seven percent increase from 2016) across all 50 states, Washington, D.C. and some U.S. territories — engaging an estimated 2.2 million small businesses — celebrated Small Business Saturday on November 25th, showing their love and appreciation for small businesses through activities such as shopping passport programs, pop-up holiday markets, sleigh rides and a Shop Small sand sculpture.

Through the Small Business Saturday Coalition, more than 575 organizations helped spread the Shop Small message this year, an 18 percent increase over last year. The Coalition, led by Women Impacting Public Policy (WIPP), was created in 2011 to help amplify Small Business Saturday and is comprised of national, state and local associations that help coordinate activities for Small Business Saturday with consumers and small business owners.

“Small Business Saturday has become an incredibly important day for small businesses across the nation,” said NFIB CEO and president Juanita Duggan. “We are very proud to be a part of this program and to be able to show how valuable small businesses are to local communities, whether on Main Street or online. Partnering with American Express is a great honor and we look forward to Small Business Saturday each year.”

Global Black Friday

A survey conducted in November 2017 by One Hour Translation presents a global perspective on the preferences of online consumers concerning the end-of-year shopping events. The survey reveals that the event most consumers look forward to is Black Friday, which enjoys a double-digit popularity percentage in six countries outside the United States. Cyber Monday tops out at only four percent in the examined countries outside of North America.

The online survey was conducted with Google Consumer Surveys among 3,400 participants from the following eight developed countries: The United States, Canada, the UK, France, Germany, Spain, Australia and Japan. One Hour Translation asked the participants: “Which online shopping event have you been waiting for this year?” and allowed the respondents to pick more than one answer. The survey analyzed the answers of 1,000 participants from the US, 600 from the UK and 300 in each of the remaining participating countries.

In the United States, 14.5 percent of respondents said they were waiting for Black Friday, which took place on November 24 this year, while 16 percent were waiting for Cyber Monday (November 27). Black Friday is particularly popular in Canada (about 26 percent), Spain (about 22 percent), France (about 21 percent), the UK and Germany (about 19 percent each) and to a lesser extent in Australia and Japan (about 10 percent in each country). On average among the eight countries sampled in the survey, 17 percent of respondents were looking forward to Black Friday, compared to about eight percent who were looking forward to Cyber Monday and about three percent who were looking forward to the Singles Day event (the Chinese holiday celebrating single people) – making Black Friday a significant shopping event outside the U.S.

Cyber Monday, on the other hand, enjoyed a double-digit popularity percentage only in the North American countries. 16 percent of respondents in the United States said they were waiting for Cyber Monday, and 10 percent of respondents in Canada, figures that were much higher compared to the ones observed in the UK (about foir percent), Australia, Germany, Spain, France and Japan (about three percent).

The Chinese “Singles Day” shopping event, which takes place every year on November 11, was highly anticipated among 7.5 percent of respondents in Japan, as opposed to approximately six percent in Spain and France, four percent in Canada, three percent in Germany, two percent in Britain and Australia, and only 1.4 percent in the United States.

Despite the fact that the survey was conducted online and was naturally geared towards online consumers, about two thirds of respondents (68 percent) on average among the eight countries said that they were not looking forward to any online shopping events. About four percent of the 3,400 respondents said they were looking forward to shopping events other than those examined in the survey. The level of variability among the countries when it came to these two figures was low.

“We already knew that Black Friday has become the top brand among the end-of-year shopping events around the world, thanks to the survey we conducted last year. This year, Black Friday is once again the most popular shopping event among consumers. However, looking at the figures, we can see a major difference in the levels of anticipation for the Cyber Monday shopping event, which is popular in North America – the United States and Canada – as opposed to the anticipation it enjoys in the major economies outside of North America,” said Ofer Shoshan, co-founder and CEO of One Hour Translation.

“Based on our extensive work with thousands of e-commerce companies, we would encourage companies outside of North America in this particular field to invest in associating their activity and their brand with the Cyber Monday event.”

The Bacteria Around Us

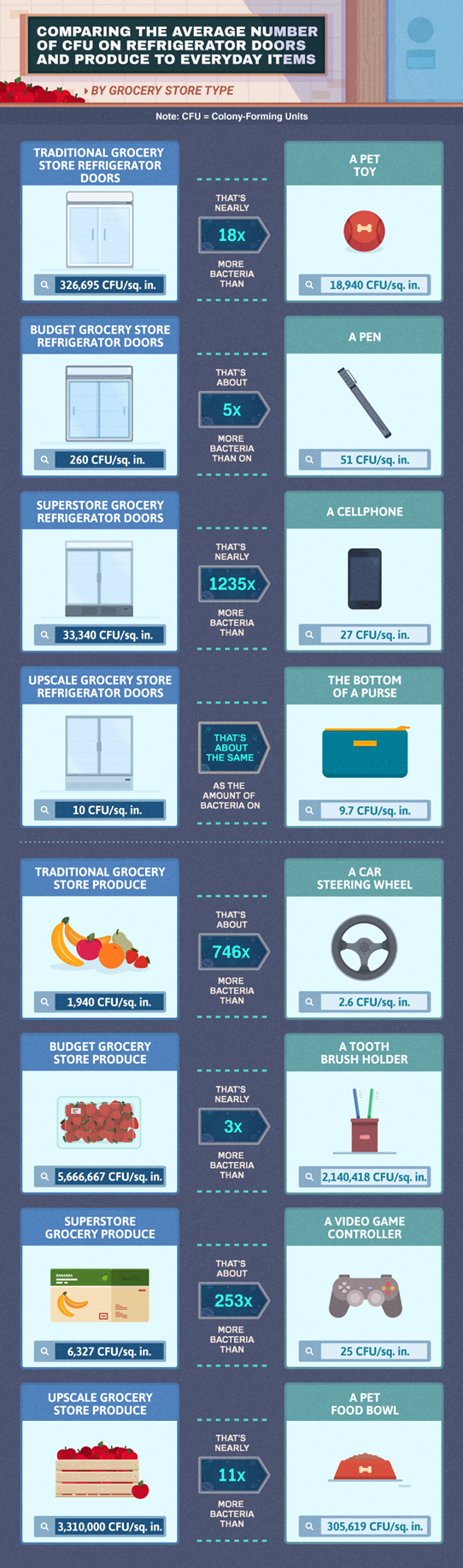

Did you know that a shopping cart has 271-times more bacteria than a toilet handle, 18-times more bacteria than your pet’s toy or that grocery store produce has 253-times more bacteria than a video game controller?

To celebrate their 10-year anniversary of making “green” grocery bags, the team at California-based ReuseThisBag.com surveyed more than 100 grocery stores in 10 states in September 2017.

The study visited 50 supermarkets in 10 states about this issue.