Creative Dining Shifts: Understanding Guest Behavior Amid Rising Costs

4 Min Read By MRM Staff

Consumers are getting used to inflation-driven price increases and plan to dine out just as often or more, which is a shift from previous years, according to Epsilon's recent study asking about guest motivations for dining out.

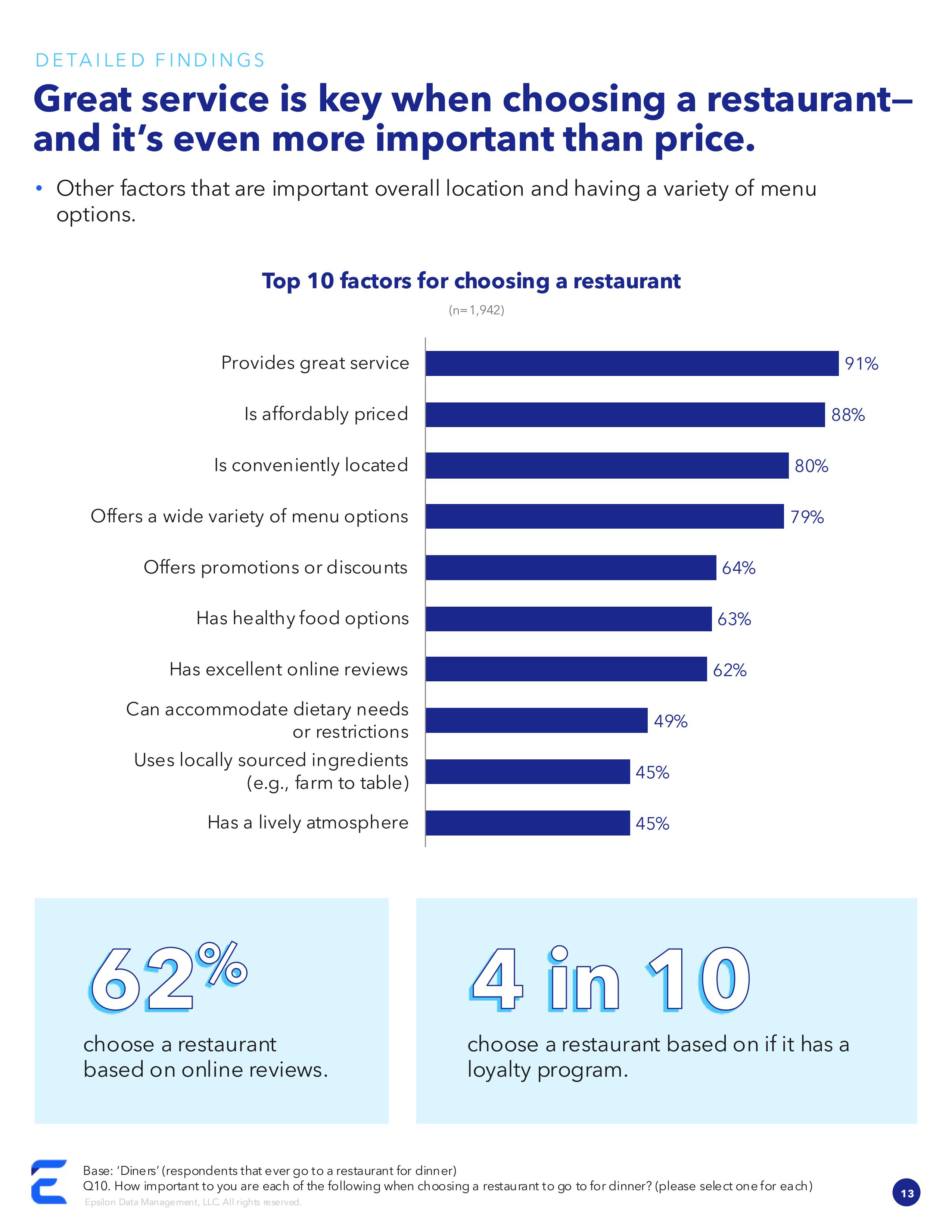

“However, price remains a concern, prompting diners to seek value through meal-sharing, opting for appetizers, or reducing alcohol consumption,” Gillian MacPherson | SVP, Products and Customer Insights at Epsilon, told Modern Restaurant Management (MRM) magazine. “Despite these changes, providing excellent service remains critical to attracting and retaining customers.

It seems like the cost increases over the past three years have finally been accepted as the new reality.

MacPherson noted it was surprising to see service rated higher than prices, as that's uncommon in previous studies.

“Additionally, it's encouraging to see a shift in consumer behavior, with more people eager to dine out rather than cut back. It seems like the cost increases over the past three years have finally been accepted as the new reality.”

Among the key findings:

-

51 percent of people say they plan to go out for dinner just as often as they do now.

-

Second to socializing, the top reason to go out to eat for Millennials is for a treat or indulgence, while for Gen Z and Gen X, it's when they don’t feel like cooking.

-

On average, Gen Z goes out for dinner the most at an average of 4.1 times per month.

-

Four in ten choose a restaurant based on if it has a loyalty program.

“From a consumer’s POV and looking at my own behaviors, the accessibility of options to dine out more often has and continues to evolve dramatically beyond just an occasional experience,” said Brian Giannone | SVP, Dining Vertical Lead at Epsilon. “This means that the share of wallet (or stomach) is more competitive than ever.”

Understanding guest preferences, expectations, and behaviors should be top of mind for all restaurant operators.

Utilizing more discrete data beyond demographics or the last purchase to better connect with what resonates with customers can help increase effectiveness and repeat trips.

“The future-forward brands are thinking about operations, marketing strategies, and customer engagement in conjunction with one another instead of in silos to deliver more personalized and impactful experiences that encourage repeat visits,” Giannone added. “Customers are expecting more personalization pre-and-post visits. Marketers must consider this as part of the diverse consumer journey rather than adopting a one-size-fits-all approach, recognizing that even within generations, preferences can differ significantly.”

There are numerous strategies restaurant operators can engage to better meet the needs of value-seeking guests including offering special deals, LTOs, and enhanced loyalty efforts.

“We’ve seen a broad response to declining in-store sales or low customer confidence in spending by discounting to drive up traffic,” Giannone said. “In some cases, this has helped short-term same store sales growth, but in others we’ve observed that guests are getting lost in what constitutes real value so it’s not changing their behavior. This causes new challenges for marketers to break through the noise. We are spending time focusing on the limited-time offer or discount strategy, but also the ways to communicate value more effectively and to who. Utilizing more discrete data beyond demographics or the last purchase to better connect with what resonates with customers can help increase effectiveness and repeat trips.”

MacPherson added that guests tend to focus on three main areas to find value.

“First, they look for value meals or special deals, so restaurants can offer seasonal menus or time-specific features to attract these diners. Second, appetizers are gaining popularity, especially among younger Gen Z customers, so expanding these offerings can keep customers coming in. Lastly, loyalty programs are influential in diners' choices and can encourage repeat visits. These programs can also offer special pricing on value deals to help the customers manage costs. These programs enable operators to better understand their customers, encourage visits and expand the product they are using. This profile can also help to efficiently identify new customers.”

Adopting thoughtful communication strategies and gaining deeper insights into customer preferences is a competitive edge for dining brands.

To appeal to the coveted Gen Z diner, restaurants should consider offering healthy options, as this is a driver for those hesitant to dine out. Additionally, introducing diverse cuisines and expanding the appetizer menu can attract Gen Z, who are eager to try new things and appreciate a variety of dining options, Macpherson noted.

Giannone said it's important not to overlook other demographics or customer groups that are also major fans of a brand.

“We know accessibility to data is easier now more than ever, so it’s the application of the data that allow savvy marketers to go beyond a one-size-fits-all marketing approach to all guests. Gen Z and Millennials may both love burgers, for example, but how they evaluate what burger restaurant to visit differs. It’s important to not just focus on brand awareness that conveys the dining experience more broadly, but also on messaging that is personalized to strengthen connections with your customers. Adopting thoughtful communication strategies and gaining deeper insights into customer preferences is a competitive edge for dining brands.”

MacPherson added that implementing an integrated marketing approach is critical.

“Make sure that the message and offer are consistent in communications across all channels including location, website, email, programmatic, and TV. Invest in identity resolutions to accurately identify your customers to ensure a seamless and consistent experience.”