Lessons from the Pandemic: What Restaurants Need to Know Now

4 Min Read By Jana Zschieschang

Five years have passed since the pandemic upended the restaurant industry, and its effects continue to shape consumer behavior. Are people dining out more or less? What’s driving their choices? How can restaurants stay ahead?

Revenue Management Solutions (RMS) explored these questions in its latest consumer report, Adapting to Change: How Restaurant Trends Have Evolved. The findings tell a story of shifting behaviors, digital transformation, and a new definition of value in dining.

Post-Pandemic Dining: A Mixed Recovery

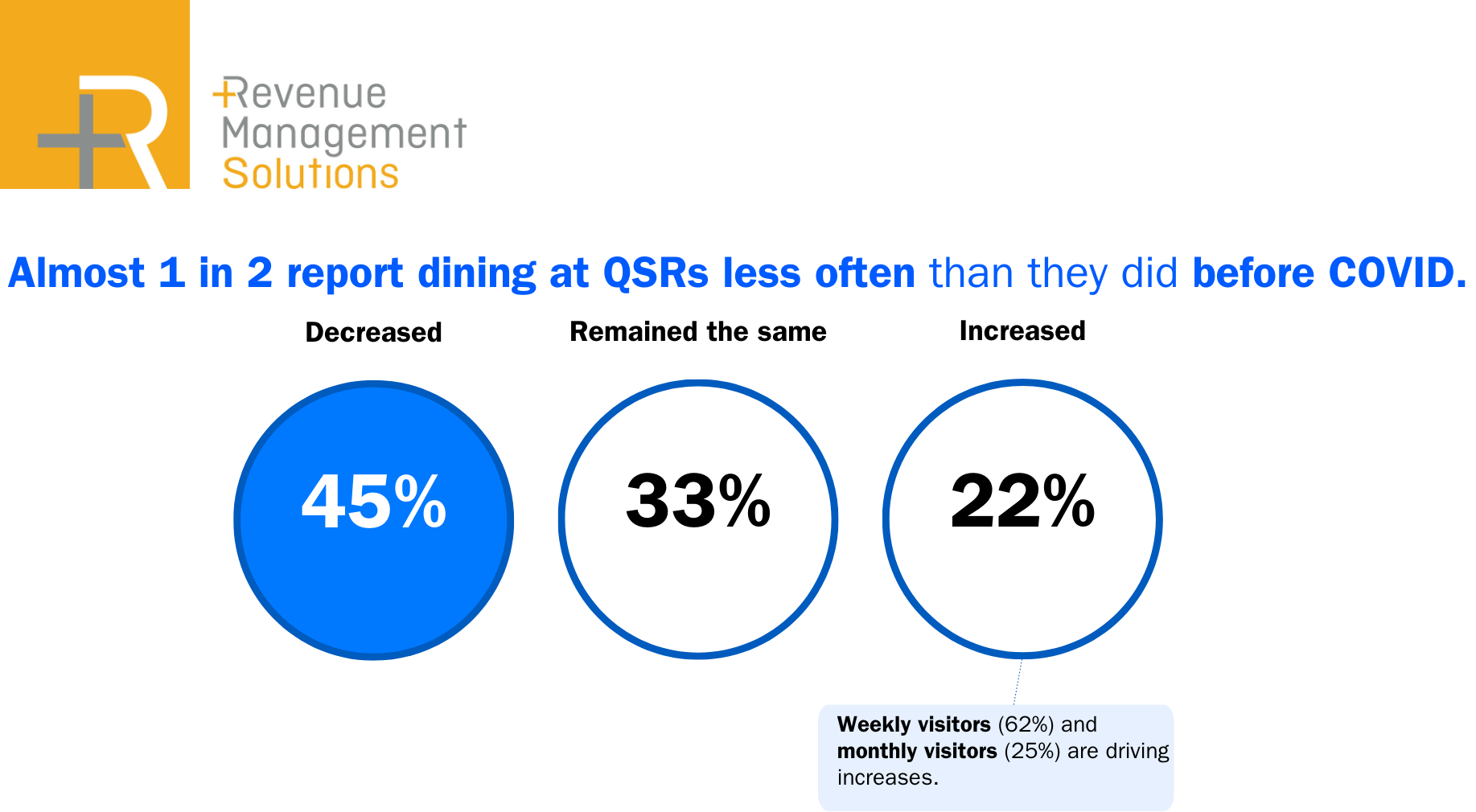

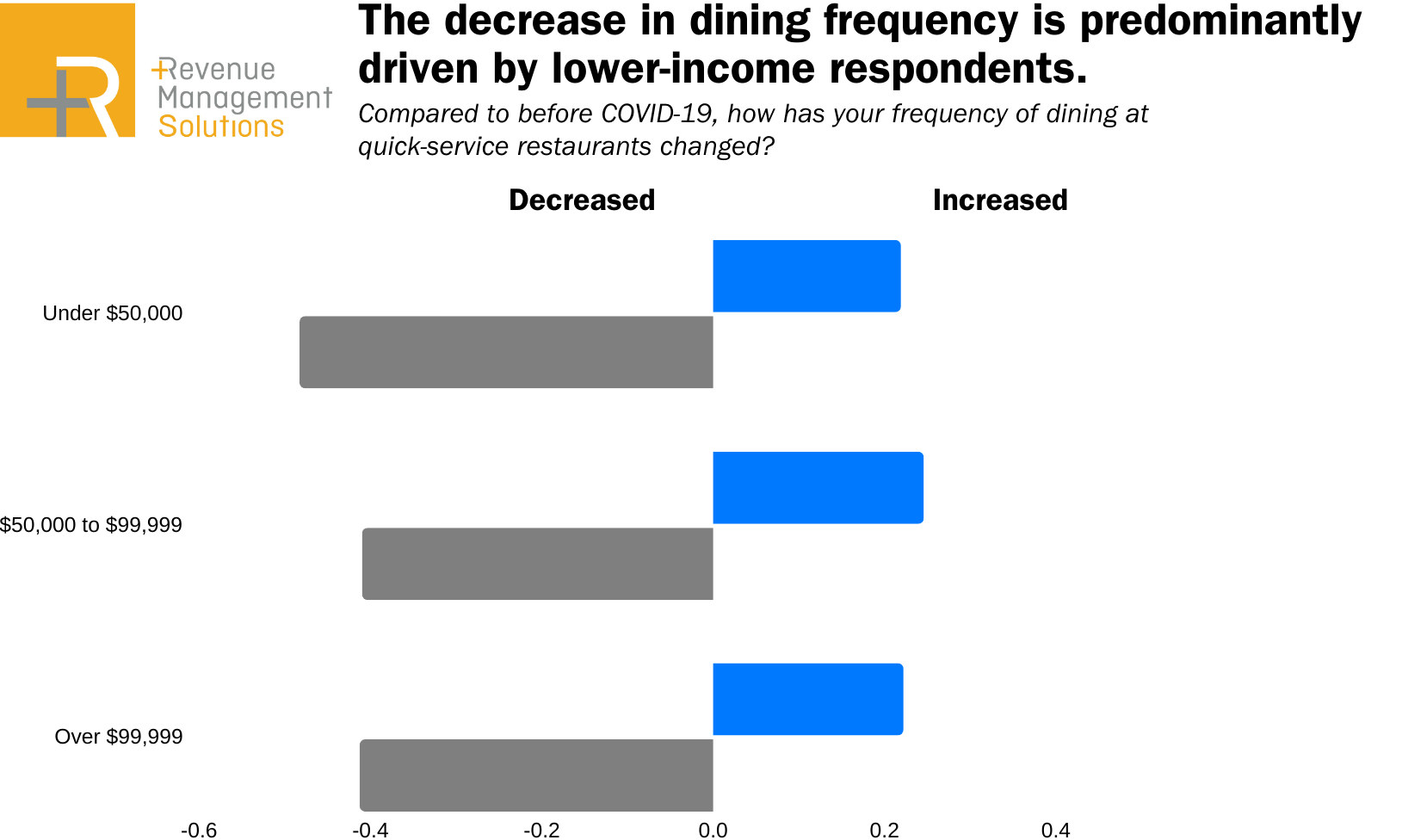

One thing is clear: Diners haven’t returned to pre-pandemic dining levels. Almost half (45 percent) say they visit quick-service restaurants (QSRs) less often than before, and 51 percent have cut back on table-service restaurants (TSRs). Lower-income consumers drive the decline in table-service visits —48 percent of those earning under $50K dine out less—but even 41 percent of high earners (over $100K) are pulling back.

However, 30 percent of high-income consumers are dining at TSRs more frequently than before, signaling room for premium offerings at the right price.

A New Demographic Emerges

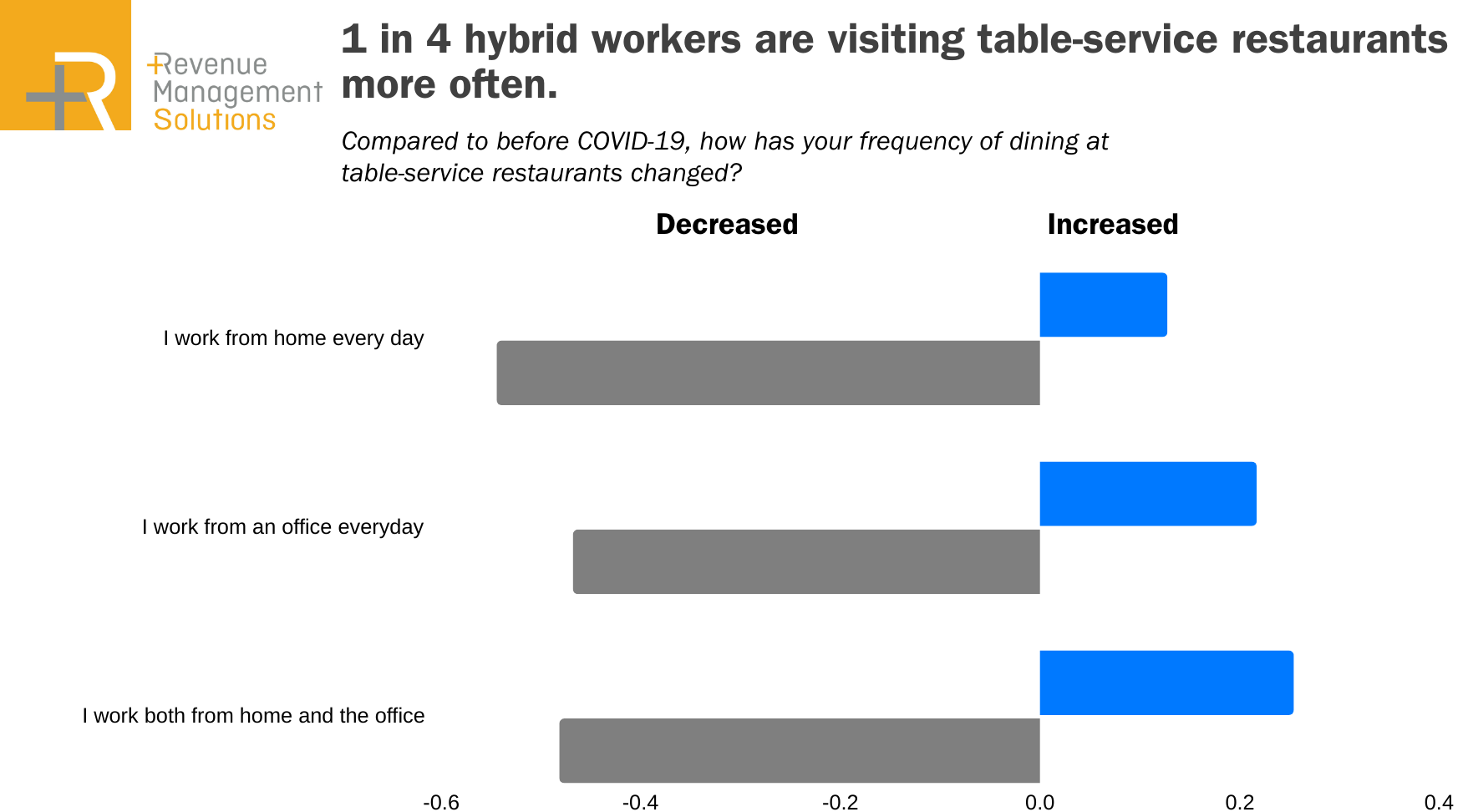

Another bright spot is purely post-pandemic — hybrid workers. This group leads the way in increased dining, with 25 percent visiting table-service restaurants more often than before and 30 percent upping their QSR visits, outpacing remote and fully in-office workers. The reason? Hybrid workers likely believe they save on meals while working from home and treating themselves on office days.

With 53 percent of U.S. workers now operating in a hybrid model, restaurants can focus on becoming the go-to destination for office-day meals through targeted promotions, convenient ordering options and other innovations.

Value Isn’t Just About Price—It’s About Experience

Price sensitivity may be at an all-time high, but focusing solely on discounts risks missing the bigger picture. Diners aren’t just looking for the cheapest meal; they’re looking for the best balance of quality, quantity, and experience.

While RMS’ deep dive into last fall’s value meals found that portion size was the biggest driver of perceived value, quality remains the #1 reason diners choose a restaurant, followed closely by affordability and atmosphere. In other words, diners are still willing to spend—especially when they perceive they’re getting something extra.

RMS research shows that premium menu items are met with lower price sensitivity and higher willingness to spend. Offering truffle fries in addition to regular fries or adding bacon to a cheeseburger are ways to elevate a dish, making customers feel they’re getting a more indulgent, satisfying experience that justifies a higher price.

The key to success for restaurants is delivering on core menu strengths while strategically introducing premium options. Limited-time offers (LTOs) and promotions that highlight quality ingredients can boost guest satisfaction and profitability without relying on deep discounts.

Diners Want Digital—And Restaurants Can Profit from It

Before the pandemic, digital ordering was growing slowly. Now, it’s table stakes. In our study, 35 percent of diners report increasing their takeout orders, and 28 percent use delivery more often. Younger consumers are leading this shift, with over half of Gen Z and 42 percent of millennials using delivery more often. While older generations have been slower to adopt digital, they, too, are shifting toward online ordering.

For restaurants, digital isn’t just convenient—it’s profitable.

For restaurants, digital isn’t just convenient—it’s profitable. Digital transactions now make up 18.6 percent of all QSR orders, and digital checks are 25-30 percent higher than in-person orders.

What drives app usage? Loyalty programs and app-exclusive deals. According to RMS’s 2024 survey, Dining in the Digital Age, millennials rank app-only promotions as the most valuable app feature, while Gen X and Boomers favor loyalty-based incentives. In other words, the better the deal, the more customers will use digital platforms—and the higher their spending will be.

However, a poor digital experience is a dealbreaker—38 percent of consumers would stop using a restaurant’s app if they encountered technical issues, and one in five would reconsider using the brand altogether.

'At-Home' Doesn’t Mean 'Home-Cooked'

Pre-pandemic, eating at home typically meant cooking at home. But today, diners are just as likely to order takeout or pick up a prepared meal from a grocery store.

Convenience store meals, in particular, are gaining traction. According to RMS' Q4 2024 Consumer Trends, more than one in three Gen Z consumers report purchasing more convenience store meals. This shift indicates that while consumers desire restaurant-quality meals, they also prioritize speed and convenience.

The Future of Restaurant Engagement

Today’s restaurant customers interact with brands across multiple touchpoints: apps, kiosks, delivery, and in-store experiences. The challenge for operators is to meet customers at every point in their journey while ensuring a seamless experience.

Leading QSR brands have cracked the code. The top players now generate up to 70 percent of transactions through digital channels, compared to the industry average of just 20 percent.

The key is to connect individually – offering value-driven promotions, personalized digital experiences, and unique touches that resonate with evolving preferences and – in the near term – a limited willingness to pay.

The Path Forward for Restaurants

The restaurant industry has changed for good. The brands that succeed will:

- Perfect your customer’s digital journey. Customers now associate their app experience with their overall brand perception—and a bad digital experience can drive them away.

- Customers want more than a "cheaper" meal—brands can add value by delivering quality and a seamless experience from start to finish.

- Fast, high-quality off-premise dining is key to competing with grocery and convenience store meals.

- Digital transactions drive higher spending—brands that invest in loyalty programs and app-exclusive deals will increase repeat visits.

Consumers want convenience, quality, and value—on their terms. Restaurants that listen and adapt will not only survive but thrive.

For a deeper dive into these trends, explore RMS’s full research reports:

📌 Dining in the Digital Age

📌 Deal or No Deal: How Value Meals Change the Game

📌 Post-Pandemic Dining Trends

📌 Q4 2024 Consumer Trends