MRM Research Roundup: Thanksgiving Trends, Diner Optimism, and Holiday Spending

10 Min Read By MRM Staff

This edition of Modern Restaurant Management (MRM) magazine's Research Roundup features news of Drinksgiving and Thanksgiving trends, FSR challenges, and "out-of-the-box" dining habits.

An 'Out of the Ordinary' Year for Independents

2024 was an “out of the ordinary” year for independent restaurants, according to TouchBistro's 2025 State of Restaurants Report. The annual report surveys 600 independent full-service restaurant (FSR) owners and operators from across the U.S., outlining the top challenges facing the industry, alongside the emerging trends shaping it.

While many operators struggled to keep expenses – particularly food and labor costs – under control, they also observed an increase in guest traffic and in profit margins, in part due to strong takeout and delivery sales. Key findings include:

- Operators report spending 34 percent more on food costs compared to last year, on average

- 36 percent observed customers tipping less in response to higher prices

- 82 percent have seen an increase in takeout/delivery sales compared to last year

- 48 percent now use TikTok to promote their restaurant (up from just 26 percent in 2023)

- 49 percent plan to add catering services in the coming year

- Almost 9-in-10 (89 percent) feel positive about the use of AI in restaurants

Cash Flow Problems

Currently, 78 percent of independent FSRs report carrying some debt, which is an increase from 68 percent who said the same last year. While operators reported an uptick in visits this year, food and labor costs continue to eat into profits, which led many to turn to financing and loans.

Pain points include:

- Food Cost Inflation: More than a quarter (26 percent) said that food costs have been their biggest source of financial strain this year. Eighteen percent reported that higher food costs were the number one obstacle to growing their business right now.

- Labor Costs and Higher Wages: 99 percent of operators also reported spending more on labor this year compared to last year, partially fueled by rising minimum wage rates and the overall expectation of higher salaries. Despite the financial strain, reducing headcount was the least common strategy used to reduce labor costs.

One strategy for reducing costs has been the increased use of technology. Among full service operators, about half reported automating everyday business operations, with online ordering (57 percent) being the most common automation, followed by invoicing (54 percent) and email marketing (53 percent). Since implementing the technology, operators report seeing numerous benefits, including more efficient teams, more productive staff, and even an increase in sales.

AI usage has also skyrocketed, primarily in the back-of-house. Ninety-five percent of those surveyed reported using some form of AI in their restaurant, with the most common being AI-assisted inventory management (35 percent), AI menu optimization (35 percent) and AI reservations/bookings (32 percent).

Digital-First Dining

Independent FSRs are also recognizing the importance of a strong online presence – from digital ordering platforms to social media. For Gen Z in particular, easy online ordering and the use of social media as a restaurant discovery tool have become the norm.

How operators are catering to their customers online

- Off-Premise Sales on the Rise: Ninety-nine percent of operators use at least one online ordering platform, with 39 percent offering a direct online ordering option. 25 percent of operators also observed a significant increase in takeout/delivery in the past year, while 57 percent said their off-premise sales had increased slightly.

- Social Media Experiences a Shake-Up: Almost all (99 percent) of operators reported having at least one social media profile for their business. While Facebook is the most commonly used platform for restaurant marketing, TikTok has seen a massive spike in usage, with nearly half of operators (48 percent) now using the platform, compared to just 26 percent who said the same in 2023.

- Bringing Back Brand Loyalty: To keep customers coming back, operators are reframing the idea of value in their loyalty programs. 70 percent now report sending personalized offers to customers, with the most common being offers based on selected preferences.

Looking Ahead

Among independent FSR operators surveyed, 90 percent said they are optimistic about the future of their business. Based on the report’s findings, TouchBistro predicts the following trends and opportunities for 2025 and beyond:

- Accelerating Back-of-House Automation: In 2025, operators should hone in on their back-of-house, where cost-saving automations can make a major difference, without taking away from the customer experience. Operators who invest in back-of-house efficiencies like digital inventory tracking and labor forecasting are more likely to win the battle against higher food and labor costs.

- Optimizing for Off-Premise: With takeout and delivery sales continuously climbing, it’s clear that, even during a time of high inflation, consumers largely see takeout and delivery as a necessity, rather than a luxury. Improving speed of service, order accuracy, and operational efficiency of the online ordering process can translate into a better experience for customers and higher profits for operators.

- Reframing Restaurant Loyalty: With profit margins still slim, discount-based loyalty programs are no longer a sustainable option for operators. In 2025, operators need to use the data they collect about their customers’ behaviors and preferences to develop programs that will shift the guest perception of loyalty from a channel for discounts to one of value.

- Enhancing the Online Guest Experience: Attracting new customers was cited as one of the most common obstacles to business growth. There is ample opportunity for operators to take a digital-first approach to the guest experience, such as cultivating a presence on TikTok, in order to expand their reach. This will help operators not only reach new audiences, but also stay top of mind to drive repeat business.

- Choosing Future-Proof Technology: Restaurant operations are becoming increasingly complex, especially with many operators saying they plan to expand into catering, events, and even new locations. Operators will need to keep these objectives in mind when evaluating new technology – whether it is a cloud-based POS or cutting-edge AI software – to ensure the capabilities offered align with their future business goals.

Restaurant Workforce Report

The restaurant industry grew overall by 1.72 percent, adding 210,300 jobs over the year, according to T7shifts' annual Restaurant Workforce Report for 2025. Based on a survey of more than 900 restaurant managers, the research uncovers important findings about industry growth, hiring challenges, employee engagement, pressing financial considerations, and technology adoption and usage. A highlight from the report shows that the industry grew this year, with quick-serve restaurant (QSR) dining up by 4 percent, offsetting losses in the full-service sector. Recruiting and retention remain top concerns for employers, with 65 percent of respondents describing the current labor market as “tight” or “very tight."

In addition to the findings already cited, this year’s report revealed the following:

Employee Centricity

Benefits like PTO and positive work environments are priorities, but 69 percent of restaurants don’t offer important services like childcare or mental health support. The research also found that giving feedback is vital for staff engagement, as employees want to know how they’re performing and how they can improve.

Tipping Models

Despite ongoing wage discussions, 63 percent of restaurants reported no changes to their tipping practices in 2024.

Rising Wages

Base wages increased by 4 percent to $14.20/hour, with restaurants offering benefits like 401(k) plans to meet employee expectations and retain staff.

Regional Wage Disparities

While wages are up nationwide, the Pacific Northwest and Northern California lead with rates above $20/hour, while the Southeast and Midwest lag at $15/hour.

Tech Adoption

65 percent of restaurants adopted new technology to manage labor, though 27 percent still use manual scheduling. Technology is critical for efficiency and workforce management.

'Out-of-the-Box' Dining Habits

OpenTable reveals the trends and consumer behavior that reshaped the culinary landscape, with out-of-the-box dining habits gaining momentum through 2025. Another standout trend among OpenTable’s new consumer research is optimism for dining out next year, with 54 percent of respondents planning to dine out more next year than they did this year. Younger generations are leading this movement, with 71 percent of Gen Zers and 68 percent of Millennials planning to increase their dining frequency in 2025.

Three trends permeated the dining scene in 2024 (January 1–September 30) and are expected to continue through 2025:

● Is Wednesday the new Friday? – Mid-week dining emerged as a new trend, with Wednesdays seeing an 11 percent increase in dining YoY – the largest increase of any other day.2 Looking ahead, eyes on mid-week dining remain: 43 percent of Americans in OpenTable’s research plan to dine out on Wednesdays if they dine out during the week. Why? 41 percent say to break up the week.1

● Come one, come all – While solo dining is up 10 percent YoY, group dining is also having a moment: parties of 6+ are up 8 percent YoY.2 Consumer research backs the trend’s staying power, 55 percent plan to group dine over the holidays and a further 43 percent plan to do it more frequently in 2025.

● Diners are challenging the status quo – Diners are being drawn to dining experiences from multi-course tasting menus to cooking classes to Omakase and everything in between: OpenTable Experiences bookings are up 27 percent YoY2 and 42 percent of Americans are more interested in experiential dining next year vs. this year. Diners are also looking to up the ante in other ways: 61 percent plan to try new restaurants in 2025 rather than stick to the same.

Diner-Obsessed: OpenTable’s Top 100 Restaurants for 2024

To help diners put these trends to the test, OpenTable unveils its Top 100 Restaurants in America for 2024, highlighting the most sought-aer dining destinations from the past year from coast to coast. The list is compiled by analyzing more than 14 million diner reviews, along with diner ratings, reservation demand, percentage of five-star reviews among other factors, and features a diverse list of restaurants perfect for any occasion.

Trends across this year’s list include:

● Chicago sees the largest share of restaurants: 53 cities are represented in this year’s list, with Chicago home to 10 percent of this year’s list including Rose Mary and Boka. Up next is Austin, featuring seven spots including Uchi Austin and Red Ash Italia.

● Diners loved OpenTable Icons: OpenTable Icons, a new 2024 destination and designation for the best of the best restaurants, are featured prominently on the list, with 20+ restaurants earning spots, including Bestia in Los Angeles and Four Kings in San Francisco.

Holiday Spending Shift

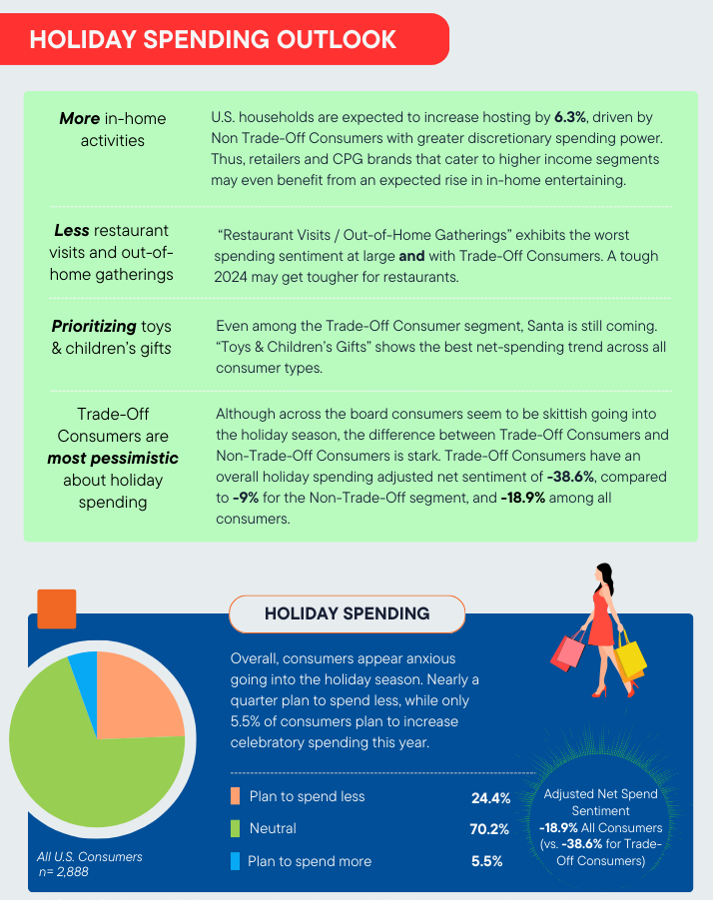

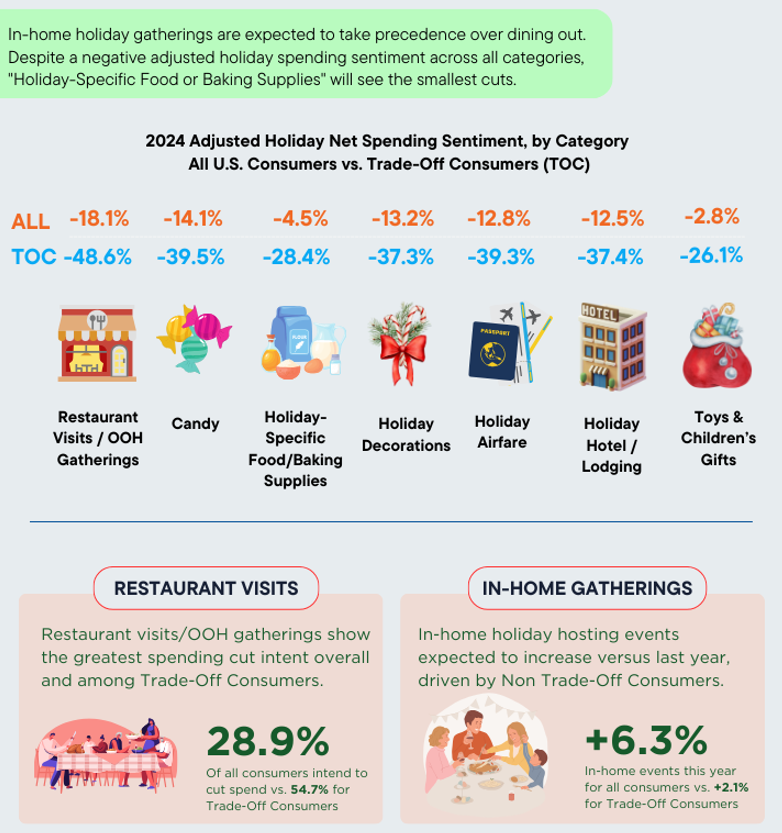

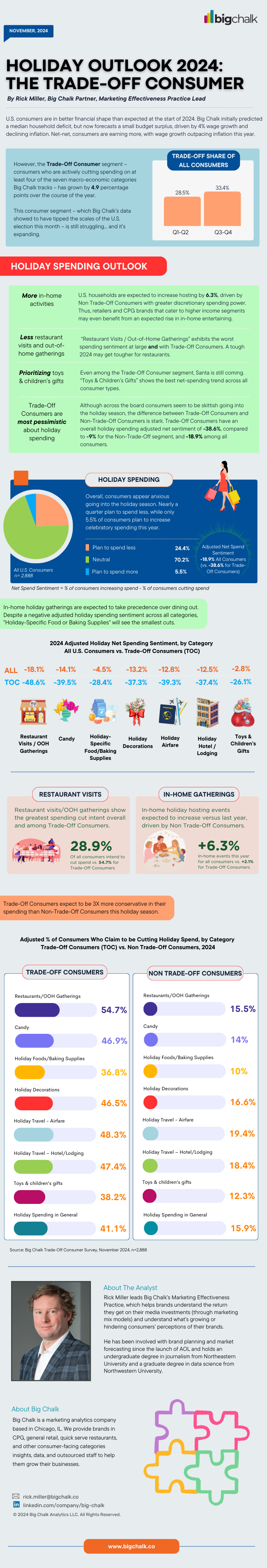

Fresh data from Big Chalk reveals a significant shift in holiday spending plans. Nearly 29 percent of U.S. households plan to cut back on dining out this season—a figure that soars to 54 percent among Trade-Off Consumers, a growing segment now making up one-third of the U.S. population.

As America budgets for the holidays, in-home hosting activity is set to rise by 6.3 percent, creating challenges for an already struggling restaurant industry. The one silver lining? Brands targeting higher-income consumers may see stability, as spending cutbacks are largely driven by the Trade-Off Consumer, who typically frequents lower-cost establishments.

Thanksgiving Eve by the Numbers

Thanksgiving Eve or “Drinksgiving”—is a game-changer for restaurants and bars. Restaurant tech platform Toast analyzed last year's sales data on this day to provide a glimpse into how restaurants and bars can maximize one of the year’s most social nights.

Thanksgiving Eve is driving massive spikes in food and alcohol sales, making it one of the most profitable Wednesdays of the year.

- There were 11 percent more transactions on Thanksgiving Eve than on the average Wednesday in 2023.

- The average ticket size on Thanksgiving Eve was about 10 percent larger

Drinksgiving?

- 70 percent increase in alcohol sales compared to an average Wednesday in 2023.

- Hard seltzer sales skyrocketed by 252 percent, making it the drink of choice for reunions.

- Whiskey orders were up +21 percent

- Beyond hard seltzers, tequila sales rose 145 percent, vodka 135 percent, and rum 131 percent.

Prepping for Turkey Day:

- When compared to the average Wednesday in 2023.

- Catering sales surged by 35 percent

- Take-out sales were up by 10 percent

What are people eating:

- All food sales were up except salads (-10 percent)

- Pie sales more than doubled (244 percent) when compared to the average Wednesday in 2023

Top Thanksgiving Dining Destinations

AI aggregation platform GMTech, synthesized insights from five leading AI models to create a definitive ranking of the top 10 Thanksgiving dining destinations in the United States for those who prefer not to spend the holiday in the kitchen.

The results showcase a mix of luxurious fine dining, regional culinary excellence, and traditional comfort food offerings.

The Top 10 Restaurants for Thanksgiving, Powered by GMTech

- The French Laundry (Yountville, CA) – Celebrated for its impeccable attention to detail and elevated holiday menu, this Michelin-starred restaurant redefines Thanksgiving.

- Commander's Palace (New Orleans, LA) – A Creole twist on classic holiday fare in a vibrant, historic setting.

- Eleven Madison Park (New York, NY) – A creative and elegant multi-course dining experience.

- The Plaza Hotel's Palm Court (New York, NY) – A quintessential Thanksgiving experience in an iconic luxury setting.

- The Inn at Little Washington (Washington, VA) – Known for its inventive, Michelin-starred Thanksgiving menu, offering an intimate holiday experience.

- Canlis (Seattle, WA) – Combining traditional Thanksgiving elements with a Pacific Northwest flair.

- Blue Duck Tavern (Washington, D.C.) – A farm-to-table dining experience emphasizing seasonal ingredients.

- Zuni Café (San Francisco, CA) – Renowned for its Mediterranean-inspired cuisine with a focus on fresh, local ingredients.

- Old Ebbitt Grill (Washington, D.C.) – A historic institution serving classic Thanksgiving dishes.

- The Borgata Hotel Casino & Spa (Atlantic City, NJ) – A lavish buffet offering gourmet takes on Thanksgiving classics.

AI models analyzed restaurant recommendations based on factors like ambiance, menu creativity, historical significance, and consumer reviews, resulting in a diverse and consensus-driven list.

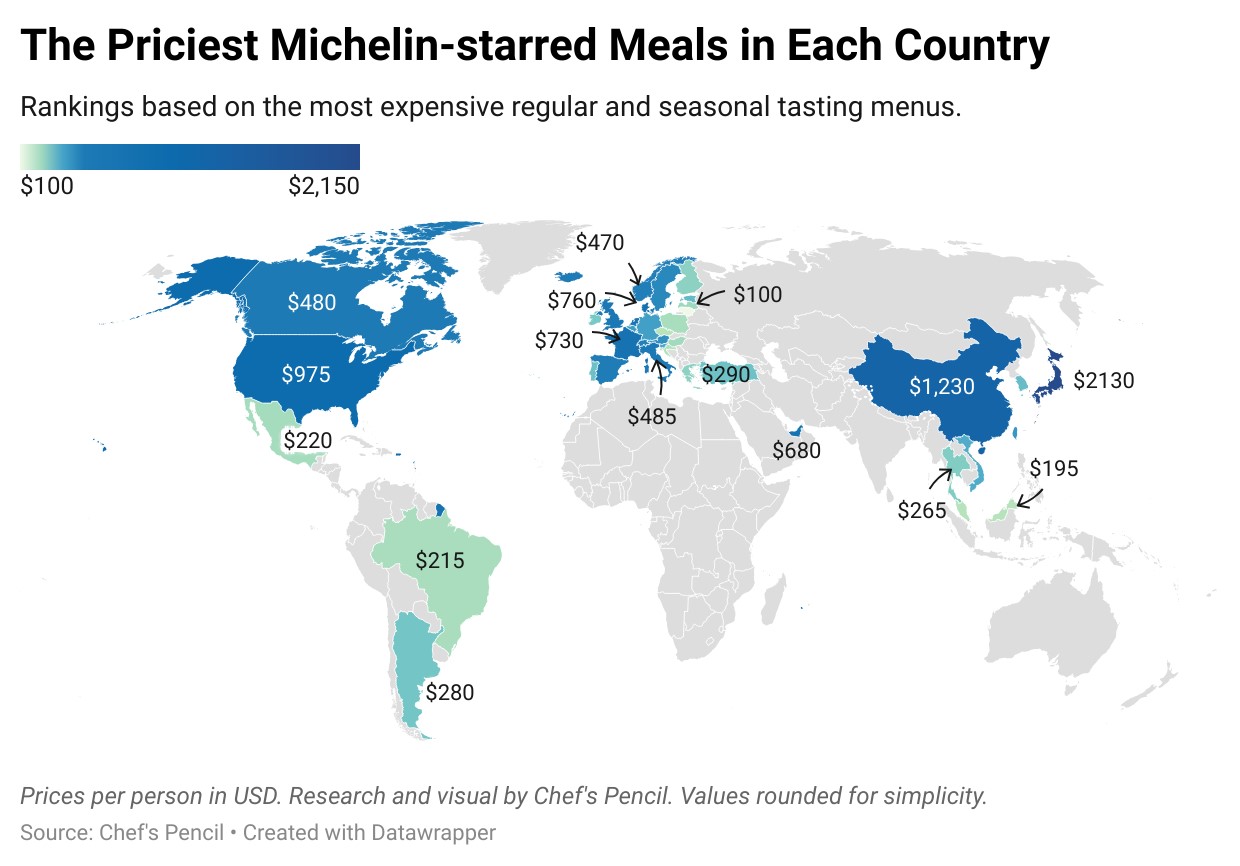

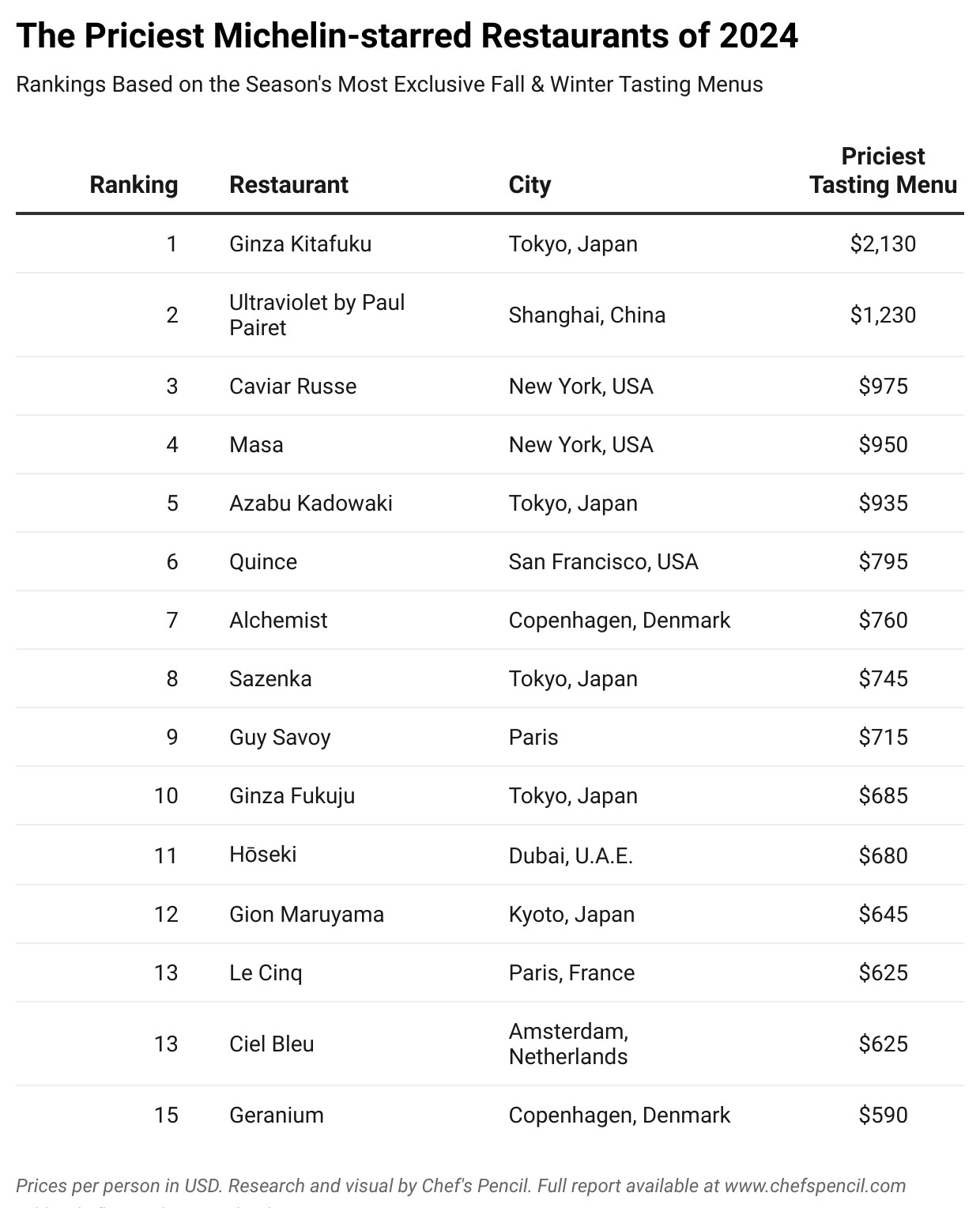

Priciest Michelin-Starred Restaurants of 2024

Chef's Pencil revealed the Priciest Michelin-Starred Restaurants of 2024, showcasing the world's most exclusive dining experiences by their most expensive tasting menus.

The report highlights the world's best Michelin-starred restaurants with menus showcasing luxurious seasonal ingredients, such as snow crab, white truffles, and premium caviar. Topping the list is Ginza Kitafuku in Tokyo, Japan, featuring a seasonal Echizen Crab Kiwami course priced at $2,130 USD.

Future of Morning

Circana released insights from its Future of Morning™ report, highlighting that convenience remains a top priority for consumers in the United States, with 90 percent of morning meals prepared in less than 15 minutes. While quick, heat-and-eat options will be a morning staple at home through 2027, each demographic shows distinct preferences. Younger consumers will opt for potatoes and breakfast sandwiches, while older consumers favor frozen pancakes, waffles, and French toast.

While most morning meals are prepared at home, on-the-go and away-from-home breakfast occasions are expected to experience some growth through 2027, driven primarily by Gen Z and millennial consumers. As inflation stabilizes at lower levels, consumers—while still dealing with higher prices—are finding it easier to budget and are gaining confidence to spend at restaurants. This shift is particularly significant for Gen Z consumers, who are turning to restaurants more frequently due to life transitions and limited cooking skills. The cohort’s reliance on restaurants for morning meals is projected to grow at a pace faster than its population.

Beverages continue to play a crucial role in morning routines. Beverage-only mornings sourced from home/retail have grown by 16 occasions per capita since 2020 and will remain a key area for growth through 2027. Water, tea, coffee, and energy drinks are popular across all generations for their sought-after benefits of hydration and energy. Health-conscious consumers, especially older Gen Z and younger millennial consumers, are also increasingly opting for nutrition-focused beverages like protein shakes and diet drinks as part of their wellness routines.

Consumers are still traveling, attending events, and seeking unique experiences despite higher costs. Foodservice operators and consumer-packaged goods (CPG) manufacturers can differentiate by offering something consumers can’t easily replicate at home—whether it’s a distinctive flavor, a creative presentation, or an enjoyable dining experience. Success will lie in identifying the target audience, understanding their evolving needs, and delivering solutions that meet them.