MRM Research Roundup: Price Wars, Influencer Impact and No-Show Fees

12 Min Read By MRM Staff

This edition of Modern Restaurant Management (MRM) magazine's Research Roundup features news of LTO impact, influencer impact and no-show fees.

Adjusting Priorities

Restaurant365 released findings from its midyear industry survey. Restaurant leaders representing nearly 3,700 QSR, fast casual, casual dining, and fine dining locations shared 2024’s top challenges and opportunities alongside plans for investment in back-of-house technology, increased sales, and team training, benefits, and support.

2024 By the Numbers

Participants reported continued food and labor cost increases with slight shifts compared to the end of 2023. So far this year, 80 percent said labor costs increased, with 64 percent noting it at 1 percent to 5 percent. Those totals are down from the end of 2023 when 89 percent said labor costs increased, with 54 percent reporting 1 percent to 5 percent. Meanwhile, 80 percent of operators said food costs are up, with 51 percent saying 1 percent to 5 percent and 40 percent putting the increase at 6 percent to 14 percent.

Looking at potential top challenges for the rest of the year, 38 percent identified sales as the top concern, 24 percent said recruiting and retaining staff, 18 percent said labor costs, and 16 percent said food costs.

While sales were a concern, 49 percent of restaurant leaders reported increased sales in 2024, and 34 percent reported a drop.

The Rest of 2024

With restaurant leaders expecting challenges, many are adjusting priorities to preserve profitability and grow revenue.

As the landscape changes, 39 percent of leaders said they’re prioritizing investments in sales, marketing, and related technologies for the rest of 2024. Another 37 percent are focused on staff enhancements, including additional training, recruitment, salaries, and other benefits.

With a heightened focus on team training, operators are also looking to revamp how they skill up teams. More than 55 percent of respondents said employees spend one to two hours a week training. The largest percentage, 40 percent, rely on shoulder-to-shoulder training. Only 18 percent of survey respondents said they used any form of digital or mobile training.

At the same time, restaurant leaders continue to explore ways to generate additional revenue while cutting Prime Cost. Thirty-seven percent said they’re expanding catering operations. Another 25 percent said they were investing in special events and one-off promotions, and 24 percent said they were prioritizing takeout and delivery operations.

Finally, restaurant leaders are doubling down on sustainability as an investment in their business and the future. More than 68 percent reported implementing sustainability practices. More than 39 percent said they focused on food waste tracking, 21 percent are investing in improved forecasting to optimize ordering, and 16 percent are enhancing training to prevent employee-level waste.

Operator Challengers

The Food Group identified the latest insights into operator behaviors to help manufacturers expand their reach and increase profitability in the year ahead.

In the new tfgTOUCHPOINTS™ 2024 Report, operators provide an in-depth look at the many challenges they are facing, including rising labor costs, staffing shortages and rising utility bills. As a result, they are making hard decisions to adjust prices and make menu changes. The report delivers a big-picture view of operator attitudes and behaviors, including how they’re responding to customer demands, what types of information and resources they’re seeking, as well as how they’re navigating the purchase process.

The report reveals key insights for how manufacturers can reach operators and strengthen their partnerships:

Feed their need: Serve up information that zeroes in on the top three motivators that prompt both commercial and noncommercial operators to change the brand or product they purchase: improved quality (77 percent), price consideration (61 percent) and labor savings (60 percent). For noncommercial operators (51 percent) and those in full-service restaurants (55 percent), menu enhancement is also a must as a motivator.

Diversify media mix: An omnichannel presence provides optimal reach and the widest range of information sources. Rather than dig into one, operators engage with multiple marketing channels, including trade shows, distributor/broker reps, manufacturer websites, foodservice trade media and social media (a key source of menu inspiration for commercial operators with a million or more in annual sales).

Talk culinary trends and menu ideas: Manufacturers should nourish relationships with operators by serving a diversified diet of topics of interest. Foodservice trends top the list as informational tools to help manage business for commercial operators (57 percent), while menu ideas and recipes rank highest for noncommercial operators (76 percent). Culinary trends are the content that interests both segments most (46 percent and 58 percent, respectively).

Refresh your event strategy: As a preferred source of information for operators, trade shows are a must for manufacturers, and knowing which to attend is key. While operators find the National Restaurant Association Show the most useful, local market-specific events (New England Foodservice Show) and smaller national market-specific trade shows (Restaurant Leadership Conference, MenuDirections) should not be overlooked.

Customer events are also increasingly important to commercial operators, particularly LTOs (65 percent) and value promotions (51 percent), with limited-service restaurants leading the way.

LTO Impact

A new Placer.ai report titled Limited Time Offers: Price Wars Boost Visits, analyzes visits at Buffalo Wild Wings, Starbucks, Chili’s Grill & Bar, and McDonald’s, and finds that the limited-time specials these and other restaurants are using to drive foot traffic are proving successful.

Here are some key takeaways from the report:

Buffalo Wild Wings: The chain launched an offer of unlimited boneless wings every Monday and Wednesday for just $19.99. In the seven weeks following the offer’s introduction, overall foot traffic grew 8.1 percent. Monday visits increased 45.6 percent and Wednesday visits increased 49.3 percent.

Starbucks: Starbucks rolled out a limited-time 50 percent Friday discount exclusively for app users during May. Subsequently, Friday visits on May 10, when the promotion launched, increased 20 percent compared to the year-to-date Friday visit average.

Chili's: In late April, Chili’s retooled its "3 for Me" menu, and as the report notes, “since the kickoff, YoY visits have remained consistently higher – and have yet to taper off.”

McDonald's: In late June, McDonald’s announced a $5 Meal Deal. From the report: “The Tuesday of the launch – June 25th – was McDonald’s busiest Tuesday of the year thus far (outpaced since by July 2nd), drawing 8.0 percent more visits than the year-to-date Tuesday average.”

Influencer Content = Recipe for Success

Matter Communications revealed findings from its 2024 Food & Beverage Trends survey. The survey of more than 1,000 U.S. consumers uncovered insights into popular food and beverage trends on social media, grocery shopping habits, and preferences for healthier and more sustainable choices.

The survey revealed the following:

- 85 percent of consumers have either researched, purchased or considered purchasing a product or service after seeing friends, family or influencers post about it. This marks a 4 percent increase since the 2023 Matter influencer survey

- Also, for back-to-back years, consumers are most interested in seeing and acting on influencer content about food and beverages (29 percent) followed by health and wellness (23 percent)

- 75 percent of respondents are either somewhat or very likely to try a viral food or beverage trend after seeing it on social media

- So, what’s the secret sauce for generating the perfect food and beverage content to reach the right audiences?

- Consumers stated their favorite content to engage with is recipes and how-tos (40 percent)

- 19 percent preferring snack hacks and healthy swaps

- Mid-sized influencers with 10,000 -1,000,000 followers are most likely (42 percent) to make consumers consider purchasing food and beverage products after seeing them promoted on their social media feeds

Healthier and Sustainable Choices in High Demand

Ninety-four percent of consumers said it is either extremely important (51 percent) or somewhat important (43 percent) to be able to find healthier choices when purchasing food and beverage products.

One trend having a moment is healthier beverage alternatives:

- 44 percent of consumers say they’re likely to incorporate healthier sodas/sparkling beverages that provide gut health support or enhanced water with electrolytes into their daily routine.

When asked to choose the three most important nutritional attributes when shopping for food and beverage products, the top choices were:

- Low sugar (64 percent)

- Protein-packed (58 percent)

- Low carbs (52 percent)

When it comes to sustainable food and beverages, consumers indicated that:

- sustainable packaging is most important (41 percent)

- followed by regenerative agriculture (20 percent)

Home Cooked Meals Are In, With a Dash of Dining Out

Most consumers (56 percent) indicated they’re more likely to buy food and beverage products in-store compared to online:

- 19 percent are more likely to buy food and beverage products online

- 25 percent are more likely to shop an equal combination of in-store and online

When asked about their two most common weekly dining habits, consumers' top answers were:

- Buying food and beverages in-store to cook at home (74 percent)

- Dining out at a local restaurant (38 percent)

But that doesn’t mean convenience is out of the question, with over 35 percent of respondents most common choice being fast food from a drive-thru

Consumers are also seeking options that will fill them up but won’t break the bank as we continue to grapple with inflation:

- 45 percent said affordable price point is the most important attribute when purchasing food and beverage products.

“People want to get behind food and beverages that not only offer value, but that they can feel good about putting in their bodies,” said Mandy Mladenoff, President of Matter. “Whether they’re stocking up at their local market to prepare a home cooked meal, indulging on-the-go, or even embracing home delivery, each consumer’s journey is likely to include a combination of online and offline interactions. Brands should recognize that need to not only be nimble and adapt to evolving shopping behaviors, but to also embrace an omnichannel communications and marketing approach.”

No-Show Fees

An increasing number of restaurants are set to enforce cancellation fees for diners who don’t arrive for their booking or those who cancel their booking.

Recent research data confirms a substantial increase in patrons not arriving for their bookings. The study by Zonal and CGA by NIQrevealed that in 2023, approximately 12 percent of customers did not honour their bookings at the UK’s pubs, bars, and restaurants, up 6 percent from the previous year.

Restaurants were the worst affected, with 27 percent of patrons not following through with their reservations.

A recent study by Mandoe Media revealed that 95 percent of the world's top restaurants now levy a no-show fee.

The financial implications are massive. The increasing number of ‘no-shows’ is estimated to cost the hospitality industry £17.59bn per year, not accounting for staff costs and wasted food.

Although this problem appears to be getting worse, it is not new. For this reason, over 90 percent of three Michelin-star restaurants already charge a cancellation fee for no-shows. As this continues to become an increasing problem worldwide, many smaller and lesser-known restaurants look set to follow suit.

Restaurants' no-show cancellation policies differ, with some, like Kaiseki Yu-zen Hashimoto Restaurant in Toronto, charging a hefty $300 per person for no-shows or late cancellations.

However, some restaurant-goers have criticised these policies, stating that last-minute cancellations are often out of their hands and stem from unexpected emergencies that cannot be accounted for.

For example, The Ultraviolet by Paul Pairet, in Shanghai, China, even penalises diners who cancel 30 days from their booking, keeping 25 percent of the deposit. Others, like the Mirazur in Menton, France, are more lenient, allowing cancellations with no charge up to 15 days out.

The issue many restaurant owners face is the struggle to fill tables left vacant by late notice cancellations. Paul Foster, owner of Salt in Stratford-upon-Avon, describes the whole left vacant by these cancellations as ‘dead money.’

“If someone cancels midweek within 48 hours, we struggle to resell the table. It is dead money. With that table being open, food has been ordered, prep has begun, and staff have been scheduled.”

Some restaurants offer to refund the cancellation fee or part of it if they can fill the cancelled booking. However, this is time-consuming and very admin-intensive.

This rising ‘no-show’ trend affects not only restaurant owners but also staff, many of whom are dependent on tips to make ends meet.

However, cancellation fees have faced severe backlash. Many disgruntled customers take to the internet when presented with a cancellation fee or if they only receive a partial refund and leave negative reviews, affecting the restaurants’ brand in the process.

However, for many restaurants, especially the smaller ones, enforcing a cancellation fee could be the difference between staying in business or not.

Independence Day Performance

CGA by NIQ’s latest US On Premise Sales Impact Report, powered by market-leading BeverageTrak data, uncovers key insights into On Premise performance across the nation.

Nationally, the average US outlet saw a +7 percent velocity uplift compared to the average Thursday of the year so far. This increase was primarily driven by a +10 percent rise in ticket counts, making the Fourth of July the third most valuable Thursday of 2024 to date. Additionally, the Wednesday preceding Independence Day performed well, with an +8 percent uplift compared to the average.

Eating outlets saw a slightly positive trend over both days, with a +10 percent velocity increase on the Fourth of July, as opposed to drinking outlets which displayed variability with a +34 percent uplift on Wednesday July 3rd followed by a -16 percent dip on Independence Day itself.

Year-on-year (YOY) comparisons show a striking upward trajectory compared to last year’s Independence Day, which fell on a Tuesday. While the different midweek days clearly contribute to this year’s velocity outperformance versus 2023, trends were nevertheless strong. Velocity increased by +16 percent versus 2023, driven by a +13 percent rise in traffic and a +2 percent increase in average check values. Eating outlets experienced an +18 percent uplift, while drinking outlets saw a +7 percent increase.

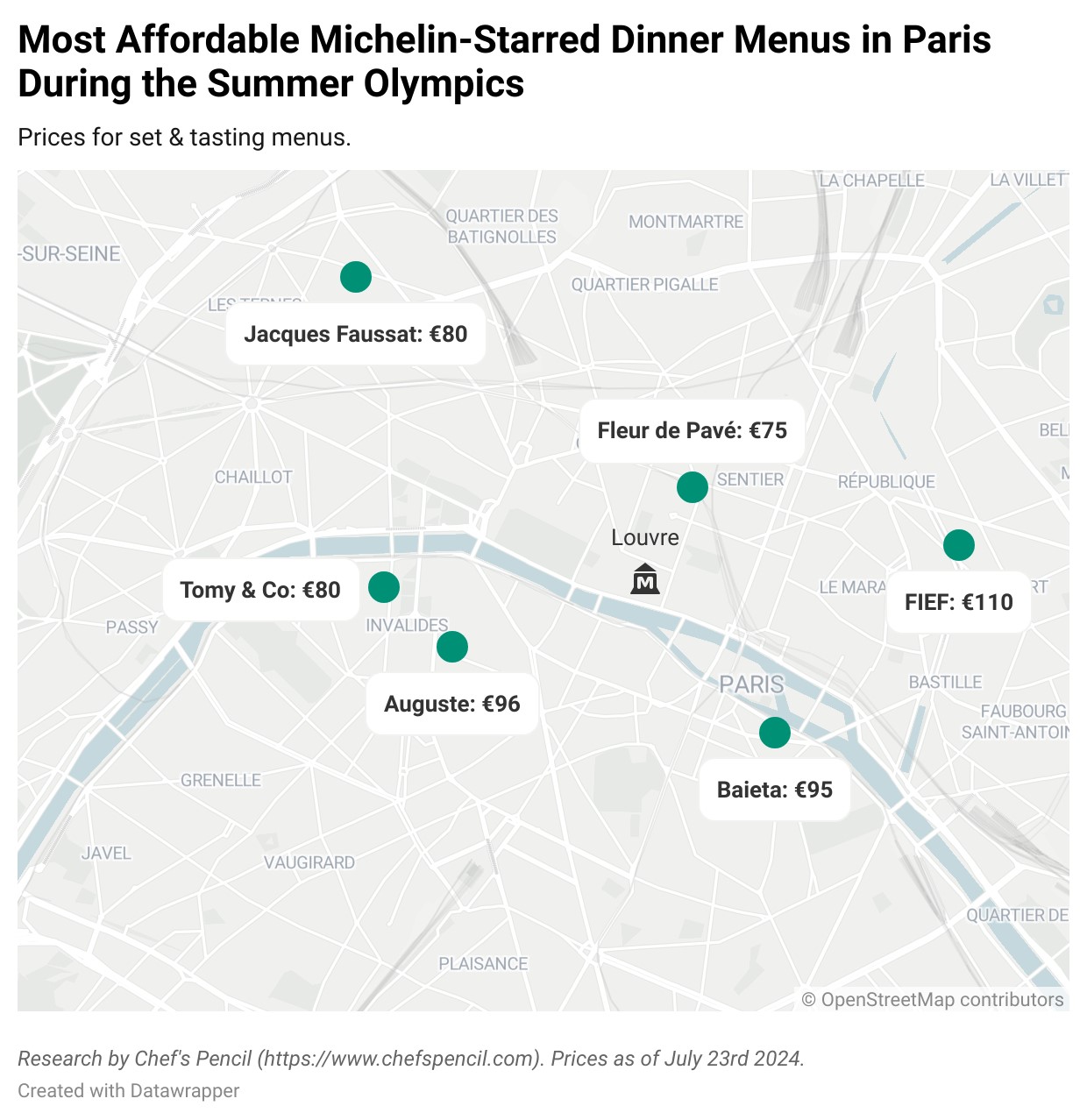

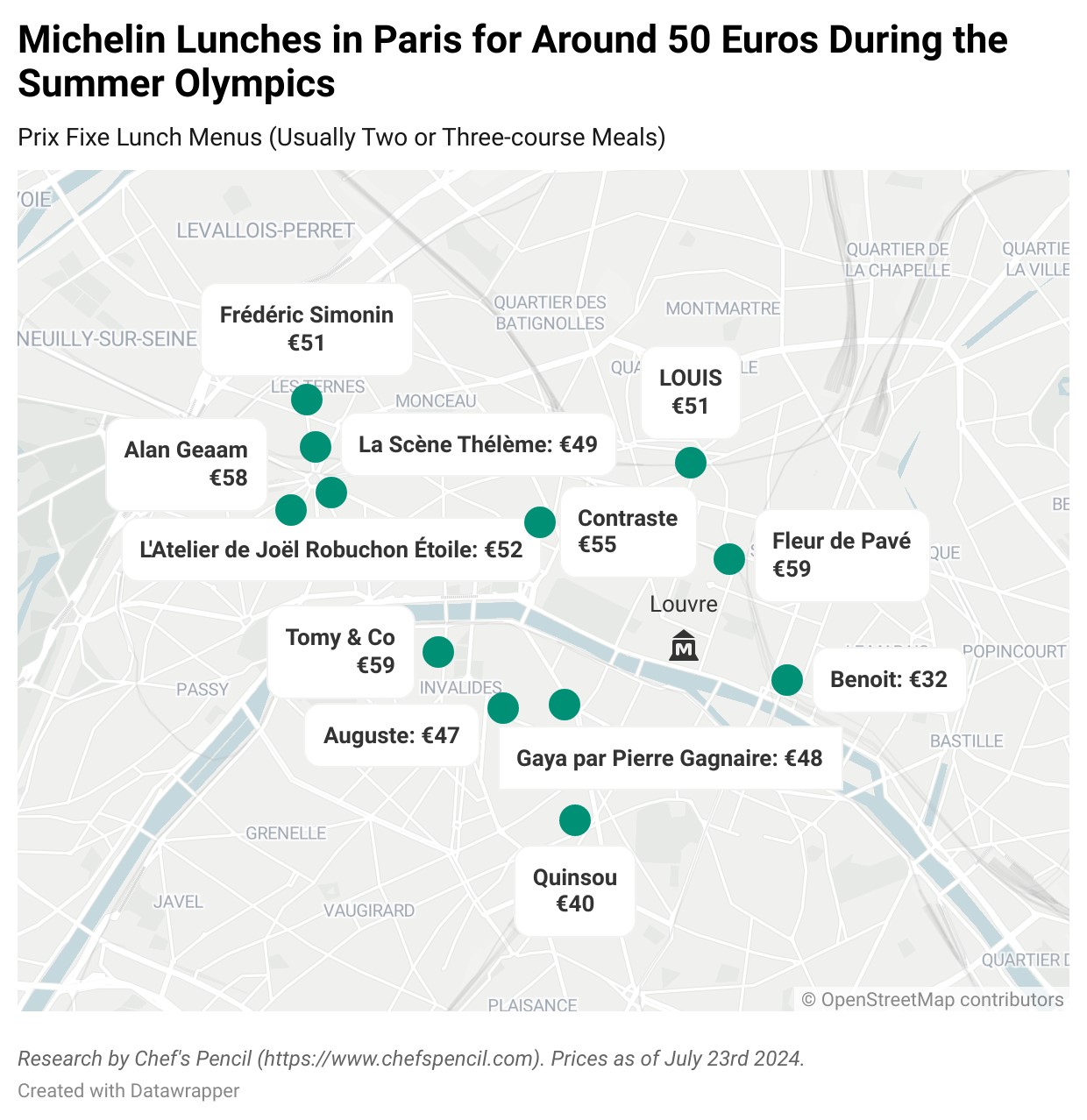

Budget-Friendly Olympic Dining

With the Summer Olympics in full force,Paris is welcoming over 15 million visitors. While the world focuses on the athletes, don't miss the chance to indulge in Paris's renowned culture and cuisine.

Paris is home to the second highest number of Michelin-starred restaurants globally, but dining at these establishments can be costly, averaging €210 per meal. However, affordable Michelin dining options still exist.

The team at Chefs Pencil has identified the most budget-friendly Michelin restaurants in Paris with reservations available in the coming weeks, perfect for experiencing the city's culinary excellence during the Games.

You can enjoy a Michelin-starred lunch for as low as 32 euros, while the most affordable Michelin-starred dinner starts at 75 euros.

Hot Sauce Preferences

For many, a necessary condiment to have is hot sauce, as a new study on American spice preferences finds: 51 percent of Americans use hot sauce more than once a week.

- We are a nation of heat lovers, as 34 percent self-identify as ‘hot sauce connoisseurs’:

- 40 percent of Americans rate spice tolerance as “hot” or “hot as it gets”

- 62 percent prefer products marketed as “hot” or “spicy”

- 1 in 10 make DIY hot sauce

Top hot sauces include Tabasco, Frank’s Red Hot, and Cholula. Take a look at the full report for the full ranking as well as just how many Americans are willing to try the world’s hottest pepper.

Hot Sauce Market Trends: How Gen Z is Redefining Hot Sauce Culture

Hot sauce can be a polarizing topic: some can’t eat it while others can’t go without it – to the point where they even bring it to restaurants. Among hot sauce enthusiasts, this topping is more than a condiment, it’s a culture.

As Americans make homemade hot sauce, test the limits of their taste buds, and try artisanal hot sauce, one generation seems to be fueling this trend: Gen Z. In a survey of over 1,000 Americans about consumer hot sauce habits and preferences, we found Gen Z really stands out. While 34 percent of Americans consider themselves “hot sauce connoisseurs,” over half (51 percent) of Gen Zers classify themselves as one.

Five Reasons People Eat Hot Sauce

Ninety-three percent of Americans eat hot sauce, but their tolerance varies. A bold 9 percent say they can eat anything as hot as possible, and 31 percent can handle hot flavors. Meanwhile, 33 percent say their limit is medium, while 20 percent can handle mild and nothing more.

One generation is leading the charge when it comes to hot sauce: Gen Z. While 21 percent of Americans have been willing to sign a waiver to eat something with hot sauce, 35 percent of Gen Z have done the same. Their presence on social media could be a key driver. Over one in three (34 percent) Zoomers have tried a social media-inspired hot sauce challenge.

“Swicy” Food and Drink Trend

While sweet and spicy food isn’t a new concept, the word “swicy” is a new trendy term being used in marketing. Searches for the word on Google have increased 1,700 percent from March 2023 to March 2024 (the latest data available from Google at the time of this report), and three in four Americans say they would be willing to try swicy food or drinks.

Although a bold 37 percent of Americans would try a taste of the hottest pepper in the world, younger generations have a greater desire to test their taste buds. Sixty percent of Gen Z and 47 percent of Millennials said they’d try a bite.

The consumer sentiment survey of 1,114 Americans was commissioned by NCSolutions in April and May 2024 and was made up of U.S. adults ages 18+, who were asked about their eating habits and preferences. Results were weighted to be representative of the U.S. population by age, gender, region, ethnicity, marital status, education level, and household income.

Hot Dog Topping Trends

A new study by US Foods finds the "ideal" American hot dog and settles the age-old debate over the most popular toppings.

- 67 percent say a hot dog is NOT a sandwich

- Americans are willing to spend $5.88 on a hot dog

- 84 percent say ketchup is an acceptable hot dog topping

- Americans are eating about two hot dogs a month

According to survey data, the perfect hot dog is grilled, served on a white bun, and is topped with mustard, ketchup, onions, relish and chili. The top side dishes to serve with a hot dog are french fries, potato salad, potato chips, baked beans, and macaroni and cheese. Nationwide, the top regional hot dog is Chicago-style, followed by a New York hot dog and a California hot dog.

What's your state's favorite hot dog topping? Check out the full study here.

Chicago hot dogs reign supreme when it comes to famous regional-style hot dogs. Other popular hot dog styles include the New York hot dog, the California hot dog, the Texan hot dog, and the Michigan Coney (hot dog with chili.)

Hot dogs aren’t just for the kids. When it comes to a restaurant’s menu, 71 percent voted for hot dogs to be listed as both an entrée and on kids menus.

The vast majority (91 percent) of consumers agree that hot dogs are undeniably an American staple food.

Each person has their preferences when it comes to hot dog toppings. But are there any regional trends when it comes to these condiments?

We know Chicagoans believe ketchup doesn’t belong on hot dogs, so it makes sense that mustard is the most popular topping in Illinois. Nearby Michigan prefers chili, which also makes sense, considering the popular Michigan Coney.

In the South, mustard reigns supreme, except for Florida, which prefers ketchup.

Although not as popular as ketchup or mustard, several states prefer onions or relish as their hot dog condiment of choice. Washington is the only state in the West that likes onions with their hot dogs, and is joined by some states like Minnesota and Indiana. Relish is also popular in the Midwest, as the preferred condiment in states like Iowa, Kansas and Nebraska.

On the East Coast, there’s a variety of popular toppings among all the states. New York, home of the famous New York-style hot dog, loves onions, while New Jersey prefers ketchup. Maine is all about the relish, while neighbors Vermont and New Hampshire like mustard and onions, respectively.

One of the popular hot dog controversies revolves around ketchup, and 84 percent of Americans believe ketchup is an acceptable hot dog topping (sorry, Chicago). But for the perfect dog, Americans believe the top condiments are mustard, ketchup, onions, relish and chili. The hot dog should be grilled and served on a white bun. The most popular sides are french fries, potato salad, potato chips, baked beans, and macaroni and cheese.