According to a Recent Study/Survey … Mid-February 2018 Edition

38 Min Read By MRM Staff

This edition of Modern Restaurant Management (MRM) magazine’s “According to …” research roundup features restaurant stats, mobile technology, Valentine’s Day spending, advertising preferences, Fancy Food trends and gloal burritos market.

Snapshot: Same-Store Sales Growth

Restaurant same-store sales growth returned to negative territory in January after three straight months of flat or positive sales growth. Although this could spark some concerns regarding the recovery experienced during the fourth quarter of last year, January was plagued with some external factors that suggest it may be too soon to sound alarms. Same-store sales dipped -0.3 percent in the first month of the year, which represented a 0.6 percentage point drop from December. Again, the driving force behind the slowdown was the drop in same-store traffic, which at -3.0 percent year-over-year represented a 1.3 percentage point decline from the previous month. This restaurant industry update comes from TDn2K™ data through The Restaurant Industry Snapshot™, based on weekly sales from over 30,000 restaurant units, 170+ brands and represent over $68 billion dollars in annual revenue.

“Although January’s sales results are somewhat disappointing, we remain cautiously optimistic about the industry’s performance,” said Victor Fernandez, executive director of insights and knowledge for TDn2K. “Even if the month posted some small negative growth in sales, January results were better than any other month February through September last year. Furthermore, there were some extrinsic factors that added noise to the month’s results. The first week of the year was aided by a calendar shift regarding the New Year’s Day holiday, but more importantly, severe winter storms hit large regions, primarily in the east coast, causing significant losses in restaurant sales later in the month.”

January’s Restaurant Sales Hurt by Winter Storms

The three worst performing regions in January, all with same-store sales worse than -2.0 percent, were the Mid-Atlantic, Midwest and New England. These three regions also experienced drops in sales growth during January of at least 1.5 percentage points when compared with the average for the previous three months. Also suffering a decline in sales growth of 0.5 percentage points or worse compared with their previous 3-month average was Texas, the Southeast and Florida.

The biggest effects of the severe winter storms during the month were in many of those regions, particularly along the eastern coast and Midwest.

“If sales from those three weakest performing regions (Mid-Atlantic, Midwest and New England) are excluded from all calculations,” continued Fernandez, “restaurant sales growth only dropped by 0.1 percentage points in January compared with the previous month. In other words, sales growth would have remained essentially flat; and that doesn’t remove the small effect that weather had in other regions of the country.

Economic Conditions Suggest Increased Restaurant Spending Ahead

“The economy continues to grow solidly and tax cuts should be adding to the expansion soon,” stated Joel Naroff, president of Naroff Economic Advisors and TDn2K economist. “That is both the good news and the bad news.”

“Stronger growth in the 3.0 percent range looks likely this year and into 2019 as consumers spend the extra money in their paychecks and businesses increase their capital spending. But the added demand comes on top of an economy that was already good and labor markets were already tight. That has raised concerns wage and price inflation will accelerate and interest rates could rise higher and faster consequently.”

The growing uncertainty over inflation and interest rates explains, at least to some extent, the recent volatility in the equity markets, which had seen little worry for years. However, barring an unexpected market meltdown, the activity in the markets shouldn’t change the direction of growth significantly. It will be better the rest of this year and that should lead to more spending on all types of activity, including restaurants.

Guest Checks Growth Continued to Accelerate

Average guest checks grew by 3.0 percent year over year during January. The last time guest checks grew at a higher pace was almost three years ago. This jump in check average also represents a substantial increase from the 2.3 percent reported for the fourth quarter of 2017.

Leading the industry in guest check growth during the month was the casual dining segment. This seems to be a departure from the discounting strategy and low guest check growth experienced by this segment last year.

On the opposite end of the spectrum, the segment with the lowest guest check growth was fast casual. This segment has struggled with same-store sales and traffic for almost two years. The results since last October suggest a new strategy based on modest increases in average checks either through conservative price increases, price promotions and discounting, or perhaps both.

Fine Dining and Upscale Casual Continue to Win

The top performing industry segments and the only ones with positive sales in January were fine dining and upscale casual. These two segments have led the industry in sales growth since the beginning of last year. Consumers seem to be demonstrating a willingness to spend more on experience-based dining. Business-related dining has also been a contributing factor, especially in the case of fine dining.

Casual dining has seen a resurgence recently and was the third best-performing segment for the month. January’s results almost broke through into positive territory and the segment experienced its second-best month in the last year.

Staffing Difficulties Hurting Profitability

Optimism is hard to come by when it comes to restaurant staffing. When listing their biggest concerns for 2018, operators focus on two areas: restaurant traffic and employee staffing. They have reason to be concerned regarding the people side of the business. With the economy at full employment, turnover has reached historically high levels for both hourly and restaurant management employees.

The reason for concern is twofold: recent TDn2K research showed that during 2017, top performing restaurant brands based on same-store sales growth achieved turnover rates much lower than industry averages. The implication is that lower turnover rates are a leading indicator of superior revenues per restaurant.

On the cost end of the equation, turnover is also an enormous factor affecting profitability. According to the recent People Report™ Restaurant Recruiting and Turnover Survey, the hard costs associated with turning over one hourly, non-supervisory employee is on average about $2,000. With turnover rates well over 100 percent for most restaurant brands, the expense and disruption of business is an enormous operational cost.

Restaurant Count Decline

The U.S. restaurant count reached 647,288 in fall of 2017, a two-percent decrease in units from a year ago, based on a recent restaurant census conducted by The NPD Group, a leading global information company. The primary source of the decline in U.S. restaurant units was a three percent drop in independent units compared to a stable restaurant chain count, reports NPD’s Fall 2017 ReCount®, a census of commercial restaurant locations in the United States compiled in the spring and fall each year.

Restaurant chain counts grew to 301,183 units, a 982 unit increase, which kept the total chain count flat compared to fall 2016. The total number of independent restaurants declined to 346,105 units, a decrease of 10,952 units from last year. Quick service restaurants (QSR) declined by one percent to 353,121 units in the fall 2017 census. Fast casual chains, which are a restaurant category under QSR, increased units by four percent to a total count of 25,118. Full service restaurant units, which include casual dining, family dining, and fine dining restaurants, stood at 294,167 units in fall 2017, a two percent decline, according to NPD’s ReCount, which includes in its fall 2017 census all restaurants open as of September 30, 2017.

According to NPD’s CREST®, which daily tracks consumer use of commercial and non-commercial restaurants and foodservice outlets, total U.S. restaurant traffic ended 2017 flat and had it not been for a 1 percent increase in quick service restaurant visits, an increase primarily driven by chains, traffic would have declined.

“The U.S. restaurant count is reflective of what’s happening in the foodservice industry today overall,” said Bonnie Riggs, NPD’s restaurant industry analyst. “To expand or not to expand units is a calculated decision on the part of restaurant operators. Chains simply have more monetary resources to grow units whereas independents do not.”

Simpli.fi’s 2018 Valentine’s Day Data Analysis

Simpli.fi geo-fenced a variety of restaurants during dinner hours on Valentine’s Day and the Wednesday before Valentine’s Day (February 7) to uncover differences in foot traffic; variables included style of food, price point and chain vs non-chain (local favorites)

They wanted to find out:

- Restaurants with highest lift in foot traffic

- Differences by market

- Willingness to splurge on Valentine’s Day vs. week before

- Local business support vs. chain support

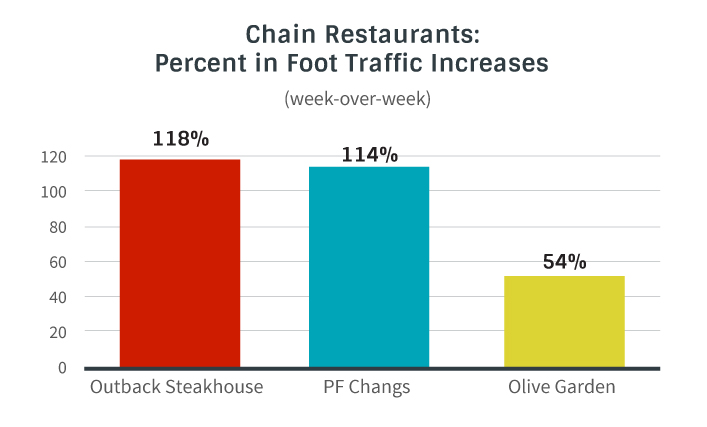

Specifically, they analyzed foot traffic data in New York, New York; Dallas and San Diego. In each of the three cities, they looked at three chain restaurants that represented a moderately priced option: Outback Steakhouse, P.F. Chang’s, and Olive Garden ($$ on Yelp)

Additionally, for all three cities, they leveraged Yelp to identify local favorites for more expensive options – restaurants that couples-in-love might splurge on for a special occasion. They geo-fenced local steakhouses, local Italian restaurants, and local Asian restaurants that represented a higher price point ($$$ on Yelp).

Here are the findings:

Valentine’s Day fell in the middle of the work week, but couples didn’t let that stop them from dining out: In every city, both chains and local spots increased foot traffic on Valentine’s Day, when compared with the previous week. Couples in love didn’t mind that the holiday was sandwiched into the middle of a work week. They went out anyway.

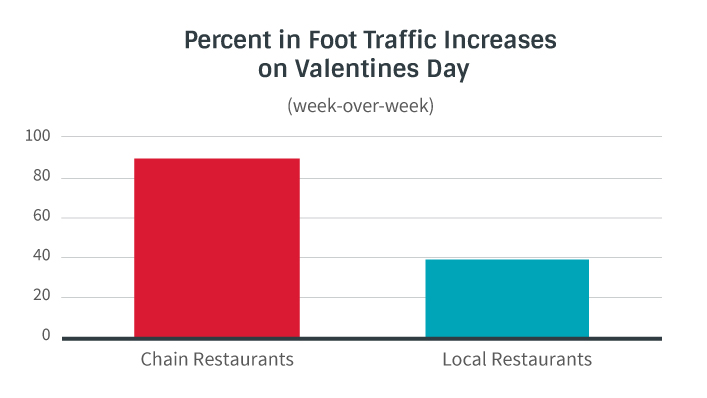

Chain restaurants reign supreme: However, chain restaurants outperformed local spots on Valentines. Said another way, moderately priced dining options had a greater increase in foot traffic on Valentine’s Day compared to more expensive options.

Chain restauants increased by an average of 89 percent, while local restaurants increased by an average of 39 percent.

The most popular chain restaurant we analyzed was Outback Steakhouse and in close second, P.F. Changs. Both saw the highest foot traffic increases week-over-week – Outback: 118 percent and P.F. Changs 114 percent. Olive Garden came in third with an average of 51 percent increase across the three markets.

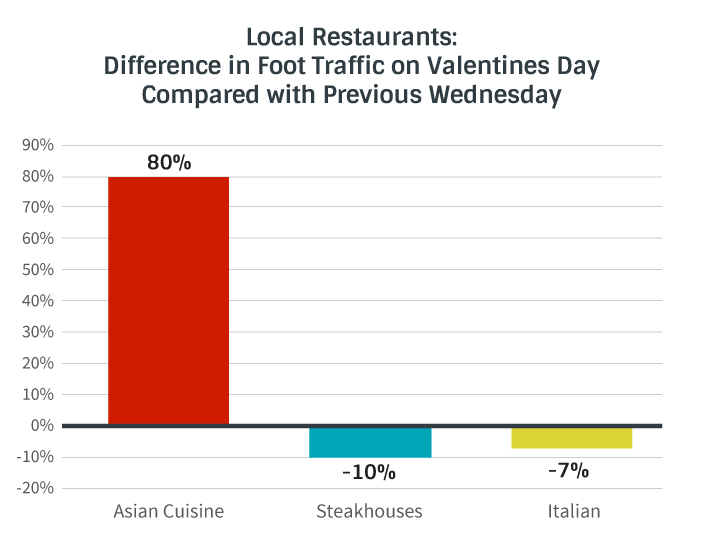

Specific to local businesses, Asian style cuisine was a favorite among all cities – seeing an increase in 80 percent average foot traffic across all three cities. San Diego couples had a taste for Asian cuisine, where local favorites saw an increase foot traffic of 78 percent.

Local steakhouses averaged a 10 percent decrease in foot traffic except for one notable exception: Pappas Steakhouse in Dallas (where dishes start at $50) experienced a 350 percent increase in foot traffic.

Local Italian restaurants averaged a seven percent decrease except for Old Trieste in San Diego which scored big with an 84 percent increase.

City-Specific Findings

New York City

- Steakhouses stayed even in NYC

- Chains increased on average 166 percent in NY (Outback, P.F. Changs, and Olive Garden)

- For local Asian restaurants, there was a variety of foot traffic. For example, Tokyo-inspired, Zenkichi, in Brooklyn saw an increase in 226 percent foot traffic, whereas Tao in Uptown decreased 24 percent.

Dallas

- Chains in Dallas increased on average 36 percent with one P.F. Changs location in Arlington, TX (a suburb of Dallas) increasing the most, at 106 percent

- Local spots in Dallas did increase on average by 53 percent, however this was largely due to a 350 percent increase at Pappas Bro Steakhouse, which offset other local favorites like Sprezza, Uchi and Nick & Sams decreased on average, 20 percent.

San Diego

- Chains in San Diego increased 82 percent; local spots increased 36 percent.

- San Diego couples had a taste for Asian cuisine, where local favorites saw an increase foot traffic of 78 percent.

What this means for restaurants:

- Local nuances are the norm. Foot traffic behavior changes based on city, day of the week and is impacted by holidays.

- Advertisers need a digital strategy that utilizes geo-location and other targeting tactics to create dynamic audiences and optimize campaigns, messaging and creative on the local level.

Sodexo Food Trends

Rainbow bagels, unicorn food and milkshakes as big as a person’s head are so yesterday. What will be on plates over the next 12 months? As 2018 arrives, culinary leaders at Sodexo, named their food trends for the year. Kevin Cecilio, Sodexo’s senior director, culinary innovations, believes these five trends will be on the table over the next 12 months.

Sustainability

Beyond standard recycling, people will focus on reducing food waste by eating parts of foods that have previously been discarded. These include pickled watermelon rinds, beet green chimichurri and vegetable slaw using broccoli stalks.

Plant Forward Eating

Cecilio expects diners to eat more plants and grains. While dishes may have small amounts of animal proteins and dairy, the vegetables are the true star. This is different from vegetarian or vegan dishes. These meals show that vegetables are no longer just sides. Chefs are also using these ingredients in unusual ways such as matcha (made from green tea leaves) glazed doughnuts.

Fermented Foods

Fermented foods have been known for their health benefits and contain probiotics and enzymes that are important for digestion. Now they are finding their way onto the tables of foodies everywhere. Whether it’s kefir, kombucha tea, miso, sauerkraut or even pickles, fermented foods are a healthy and delicious trend that will take hold in 2018.

Non-grain Sustainable Proteins

Agriculture can take its toll on the environment so some are turning to non-grain sustainable proteins that are both good for the body and the environment. Cricket powder and algae are just two examples of this trend that could see big gains in popularity in 2018.

International Cuisine from Israel, Morocco and the Philippines

Cuisine from Israel, Morocco and the Philippines lead this year’s trends list. The food of these three countries range from the Spanish and Asian influences in Filipino cooking to the bouquet of spices that make up the flavors of Moroccan dishes to the fusion of native Israeli ingredients with the dishes brought to the country by immigrants fleeing Eastern Europe after World War II.

Mobile Tech Top Priority

Mobile technology development and integration is a top priority for restaurant franchise owners and franchisors, according to a survey conducted by TD Bank, America’s Most Convenient Bank®, at the 2017 Restaurant Finance and Development Conference in Las Vegas. In fact, more than half (59 percent) of those surveyed plan to integrate smartphone/tablet apps and/or mobile ordering, or develop a mobile app in 2018.

TD’s survey polled franchise owners and operators of quick-service and fast-casual restaurant brands. Fifty-four percent of respondents own or operate stores that are part of a major national brand, and 44 percent stated they own 25 or more restaurant locations. When asked how mobile ordering has specifically influenced their restaurants, respondents cited that it could:

- Help expand their customer base (55 percent)

- Eliminate the need to hire more staff (16 percent)

- Speed up the food preparation, cooking and delivery process (15 percent)

“In addition to the back-end benefits, mobile apps provide an opportunity for restaurants to communicate with customers in new ways by offering customized service and incentives that provide a more seamless experience and help encourage needed repeat business,” said Mark Wasilefsky, Head of Restaurant Franchise Financing Group at TD Bank. “We live in a mobile society in which consumers expect that ordering food ― like any product ― should be quick and easy. Smart franchise owners will take advantage of the latest technology to reach customers through their devices.”

Restaurants Adjust to Shifting Consumer Demographics

As the industry and customer base evolve, franchises are channeling resources into retaining existing customers while also building a new, younger fan base. Beyond mobile enhancements, survey respondents reported that their top investment areas include: adding locations (70 percent); developing social media strategies to target Generation Z, ages 0-18, (56 percent); and creating or enhancing customer loyalty programs (55 percent). Additionally, restaurant industry professionals noted that menu enhancements/changes (54 percent) and meal delivery services (47 percent) will become key business strategies.

For most franchise owners, Baby Boomers and Gen-Xers with disposable income are becoming less vital to business decisions, as Millennials (ages 20-36, also known as Generation Y) are seen as the future of the industry. Indeed, 69 percent of franchise owners believe Millennials are most responsible for fueling the innovation that affects business plans.

“Millennials make up more than one-quarter of the U.S. population, and this generation is known to seek out new experiences while expecting high-tech interactions and convenience with any purchase,” said Wasilefsky. “Restaurants that are able to cater to the preferences of Millennials will successfully capture a key customer segment and gain an edge on the competition.”

Healthcare and Immigration Reform Pose Operational Concerns

Policy changes continue to affect restaurant franchise business operations. Particularly, healthcare regulations impacted revenue and operations the most, according to 60 percent of respondents, followed by immigration reform at 18 percent. Industry-targeted policies such as menu calorie count requirements and sugar/beverage taxes, meanwhile, had less impact on the bottom line overall.

Upserve’s Pattern Trend Analysis

The beginning of the year is tough on restaurants, but there are some actions to take to help turn that around quickly. Upserve analyzed millions of daily food and beverage sales transactions for thousands of restaurants in the U.S. in 2017 and found a number of interesting patterns throughout the year that will likely repeat in 2018.

Upserve released its new Restaurant Sales and Turnover Forecast 2018 report, which provides actionable insights for Q1.

Here’s a taste of Upserve’s insights:

January Slump: It’s no surprise that New Year’s Eve is a huge event for the restaurant industry, followed by a quiet period. Just how dramatic the drop can be might startle some. Overall, food and alcohol sales at restaurants plummeted after the New Year’s Eve high, according to data pulled from thousands of restaurants across the U.S. in 2017.

Whether people have committed to a “Juiceless January” (ringing in 2018 with a full month of sobriety), or are sticking to their resolutions to eat healthier or cut their spending, overall sales decreased by as much as 38 percent, based on 2017 data.

Rebounded by Valentine’s Day: Data indicate that a rebound will likely arrive in February, specifically the Saturday after Valentine’s Day, at which time we saw a 37 percent increase in combined alcohol sales, and a nearly 40 percent growth in food sales.

Continuing through March Madness/St. Patrick’s Day: Call it the perfect storm: college basketball, St. Patrick’s Day and beer. On March 15th, beer sales hit their highest point of the year. Throughout March, restaurants saw a steady increase of nearly 4 percent in food consumption in all regions except the Northeast, where restaurant guests drank more beer, but ordered less food, through March Madness.

Turnover Trends: A relatively steady few months for staffing, the first three months of the year serve as an indicator of annual average turnover rates for restaurants. The rest of the year may see fluctuations in churn, but data show restaurateurs can plan on mapping their staffing plan based on performance during early months.

Make ‘Em Laugh

Consumers want to laugh when they see or hear an advertisement, according to a new survey from Clutch, a leading B2B research and reviews firm. Over half (53 percent) of consumers say they are most likely to remember and enjoy an advertisement if it’s funny.

Humorous advertisements offer consumers a break from everyday life.

“Humor is just something people like to feel,” said Michael Ancevic, managing partner and chief creative officer of The Fantastical, an advertising agency that represents Samuel Adams, Panera Bread, and TripAdvisor. “It’s a bit of a break from other news in the world or the seriousness of life in general.”

Humorous advertisements also tend to be among the most highly rated. All six companies that received an “A” grade for their Super Bowl advertisements in Northwestern University’s annual Kellogg School Super Bowl Advertising Review had humorous commercials: Amazon, Mountain Dew, Doritos, Avocados from Mexico, Tide, and Wendy’s.

Advertisements Need to Convey Trust and Educate Consumers

More than half (51 percent) of consumers also say they remember and enjoy an advertisement if it is from a brand they know and trust.

But an advertisement needs to deliver valuable information or consumers will lose interest. Consumers dislike advertisements that don’t educate them about the product or brand (51 percent) and/or if they could not relate to the advertisement (48 percent).

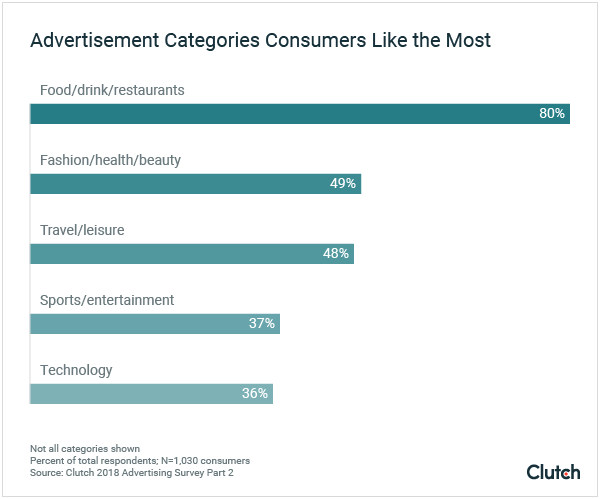

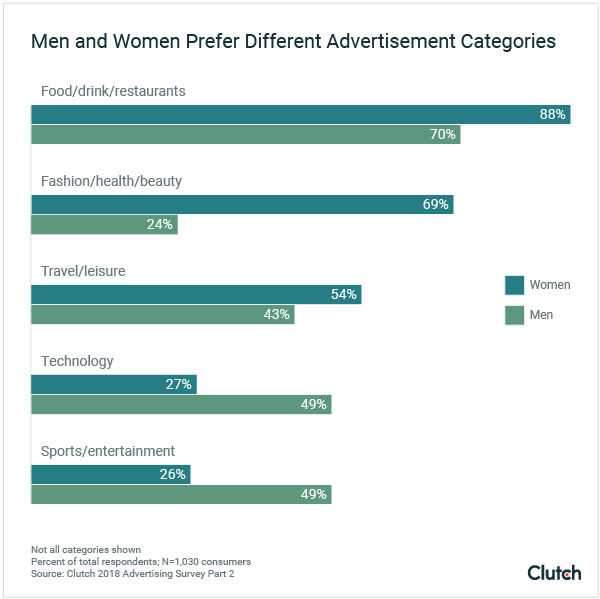

Advertisements Featuring Food & Drink Also Popular

Advertisements that feature food and drink are also popular among consumers. Eighty percent (80 percent) of survey respondents named this category in their top three.

“Everyone needs to eat, so the connection is almost a given,” said Rob Albertson, managing director of Bandwidth Marketing, an agency with clients such as Allstate, Gore-Tex, and GrubHub. “Plus, the visual aspects in a food advertisement versus almost any other medium targets your taste buds – (like) a gorgeous pizza with cheese dripping.”

When it comes to other favorite categories, there is a divide between men and women. Men prefer technology and sports advertisements (49 percent each), while women prefer fashion/beauty (69 percent) and travel/leisure advertisements (54 percent).

TV is Favored Advertising Medium

The majority of consumers (58 percent) prefer TV advertisements over any other medium. Of the nearly 25 percent who prefer online and social media advertising, 36 percent identify Facebook as the platform they prefer for social media advertisements.

Clutch’s 2018 Advertising Survey included 1,030 U.S. consumers who have seen or heard an advertisement in the past week.

Read the full report here.

Valentine’s Purchasing Habits

Global payments technology company First Data has analyzed spending data around the holiday to see what people are purchasing for their Valentines.

Luxury brands, jewelry stores and women’s ready-to-wear stores tend to be top spending destinations for Valentine’s Day, while florists made up less than 10 percent of total spend among the top “Valentines” catergories. Other findings include:

Big Ticket Items: Some Valentine’s Day favorites come with cost, with average ticket sizes for luxury brands at $711, jewelry at $378, flowers at $72, and candy at $39 on Valentine’s Day last year.

Candy and a Card: Candy and cards are a hit. Last year, the number one destination for people after they bought their Valentine candy (average ticket size $39) was to a gift shop (average ticket size of $24)

“Oops, I Forgot” Spending: The average ticket size at florists jumped from $72 on Valentine’s Day to $88 in the days after (February 15-17), perhaps as people tried to make up for missing the actual day.

The Day Affects the Dining: With Valentine’s Day falling on a Wednesday this year, upscale dining may see a drop in customers on Monday and Tuesday, while people hold off on eating out in anticipation of the holiday. In 2017, when Valentine’s Day was on a Tuesday, consumer spending hit its peak on the actual day, with a decline in spend on the Sunday and Monday ahead of it. In 2016, when Valentine’s Day fell on Sunday, there was an increase in spending for Saturday as well.

Regional Differences

West Coast Luxury: In 2017, luxury brands was the #1 category in San Francisco and Los Angeles, unseating women’s ready-to-wear which was the front runner in 2016.

Midwest Loves Flowers: Florists have been #1 in Chicago for two years in a row.

Philadelphia Heads to the Liquor Stores: Surprisingly, liquor stores came out on top in Philadelphia in both 2016 and 2017.

Chain Slowdown

The latest research from Technomic suggests a continued slowdown for the Top 500 chain restaurants, with cumulative 2017 sales growth at 3.2 percent, down from 3.8 percent in the prior year. Net unit growth also saw a decline at 1.1 percent, compared to 1.8 percent in 2016. The source of this information, Technomic’s 2018 Top 500 Chain Restaurant Advance Report, is the industry’s leading chain performance tracker, providing a one-year sales forecast by menu category, an expanded outlook and opportunities section, as well as key themes to help navigate the current industry landscape.

“Chains today are facing increasingly challenging business conditions, with most publicly held chains seeing mixed same-store sales results in 2017,” said Joe Pawlak, Technomic managing principal. “Among these challenges lie the rise of retail foodservice and other meal options. Additionally, consumers are becoming accustomed to a stronger deal environment, forcing operators to lessen their margins to stay competitive.“

Key report findings include:

- 2017 sales growth was heavily driven by limited-service chains, up by 4.1 percent

- Fast casual is once again the leading subsegment, with 8.9 percent sales growth in 2017

- Full service sales growth slowed from 1.4 percent growth in 2016 to 0.5 percent in 2017

- One of the fastest growing chains, Walk-On’s Bistreaux & Bar, is also new to the rankings

Other new entrants into the Top 500 chain rankings include Jinya Ramen Bar, bartaco and Naf Naf, who all grew their sales by over 20 percent. Out of the twenty fastest-growing chains, half of them are fast-causal concepts, proving that this subsegment is still the bright spot in the industry. Exceptional sales growth was also seen from the fine-dining subsegment which experienced a 3.8 percent increase, with growth led by Texas de Brazil Churrascaria, Ocean Prime, STK and Fogo de Chao.

Office Meal and Snack Stats

ZeroCater surveyed 100 employees and office managers to better understand the role food plays in a company’s culture and what matter’s when it comes to office meals and snacks. The following are the key findings.

Employers are using food to improve workplace culture

After a tumultuous year, employers are refocusing efforts around creating a safe and happy work environment for their teams, with a focus on shared food experiences.

- When asked how happy they were at work, 75 percent of employees said they were at an eight or higher, with 10 being the highest level of happiness. Nearly the same percentage (74 percent) of employees polled have access to free meals and snacks in the office.

- With collaboration being a key conduit of productivity, 90 percent of employers say that meals help their employees build stronger relationships with colleagues.

- Unemployment rates are at their lowest, leading to the recruitment and retention of top talent being more competitive than ever. For employers, shared meals are an integral part of the onboarding process, with 79 percent viewing meals as a way for new employees to meet their coworkers; and 67 percent say meals are a part of their retention strategy, giving employees a reason to stay at their company.

- Efficiency is key now more than ever, with 88 percent of employers saying meals save their employees time by not leaving to find lunch.

Employees see the value in access to food at work

When looking at their overall employee benefits and office perks, more than a third of employees (38 percent) rank office food as one of their top three office perks, alongside vacation time and professional development.

- Employees consider it important for their employers to provide food in the office, with 88 percent considering snacks important and 78 percent saying the same of office meals.

- Time is precious, with 70 percent of employees saying office meals save them time venturing out to find lunch.

- With finances on their mind, 76 percent of employees consider office catering to be a money-saver.

What do employees want?

For employers who are ready to take the leap with a new food program for their office, or even for those looking to reinvigorate their current office perks, the aspects of food that matter to employees might surprise you.

Employees are more health conscious than ever

- According to 65 percent of employees, having access to healthy snacks in the office is very or extremely important, with 53 percent saying office snacks help them stay healthy.

- When it comes to dietary restrictions and preferences, 55 percent of employees said it was very or extremely important to have office meals that cater to their preferences.

- 41 percent of employees want to know where the ingredients in their office meals come from.

Finances are on their minds

- 26 percent of employees say they save an average of $50 or more per week with office meals.

- 35 percent of employees say they save more than $20 per week on office snacks.

Variety and rotation matter

- The quality of the meal and variety of cuisine type are the two most important attributes of office meals for employees.

- When evaluating office snacks, employees ranked variety (56 percent), full shelves (47 percent) and healthy snacks (65 percent) as most important.

Restaurant and food and beverage industries find a new audience with office food programs

Achieving success in the restaurant industry is harder now than ever. Among the disruption caused by delivery and meal kits, rising operations costs, and the opening of more restaurants than ever before, restaurant owners must find additional revenue streams and actively market their restaurants — and office-meal business provides both.

- 63 percent of employees say they have visited new restaurants they discovered through their office’s meals.

- 68 percent of employees say they have purchased snacks and beverages they discovered through their office’s snack programs.

- Employees want the latest and greatest in office snacks, with 32 percent wanting the latest snack trends and 30 percent wanting to try the newest snacks on the market.

- 73 percent of companies spend $10–$15 per person, per meal. With an average company size of 248 employees, companies are spending $2,480–$3,720 per meal.

Restaurant Formats and Delivery

The opening of Nando’s’ new format ‘Nino’, a streamlined take on its core restaurant business, is the latest example of the quick-serve and delivery markets’ growing appeal for casual dining operators. These new streamlined formats can help brands capture a greater share of the growing delivery market, according to GlobalData.

While Nando’s is only just introducing its cut down format, other brands have experimented with similar forays into the quick-serve arena, many of which have failed to gain recognition and grow, due to a lack of focus. Recent examples of failed attempts include Carluccio’s, Toby Carvery Express and TGI Fast Track, which were in many ways unsuccessful at adapting their key offerings and image for the quick-serve, grab ‘n’ go crowd.

In the US, however, Buffalo Wild Wings enjoyed more success with a similar concept. Last year, the chain opened two new “B-Dubs Express” outlets. While this started with a limited, two outlet footprint, a third outlet is scheduled to open later this year in Minneapolis, and is set to benefit from a self-serve beer wall.

Louis Towell, Consumer Analyst at GlobalData, commented: “This highlights a key point of differentiation from quick serve restaurants for these cut-down casual dining operators, which routinely offer a selection of alcoholic beverages and typically focus on key millennial demographics, as highlighted by the prevalence of craft beers and ciders on their menus.”

Alongside the surge in popularity of grab ‘n’ go formats is the surge in delivery, which continues to go from strength to strength. Much like Buffalo Wild Wings’ B-Dubs Express, Nino’s streamlined menu and smaller seating area should enable the branches to better focus on consumers’ growing appetite for delivery, without the large overheads associated with larger outlets. Similarly, as these restaurants offer alcohol on their menus, they typically also offer delivery of alcohol through services such as Deliveroo, thus further broadening their appeal.

GlobalData forecasts delivery in full-service and quick-service restaurants in the UK to see growth at a Compound Annual Growth Rate (CAGR) of 3.8 percent until 2021, compared to 3.1 percent in dine-in, highlighting the improved returns achievable in delivery when compared with traditional out-of-home occasions.

Towell continues: “As a result, it is likely that brands will continue to experiment with streamlined formats, which can help them to better adapt to modern foodservice consumers’ constantly evolving needs and demands. In fact, with express varieties of Five Guys Burgers and Fries expected, as well as smaller players like Moose entering the express market, more familiar brands will try to benefit from these smaller formats in 2018.

“Any brand looking to make the move into express should consider the mistakes made by their predecessors, and ensure that their new brand is sufficiently identifiable to attract a customer base of its own.”

America’s Healthiest Eaters

New research reveals even America’s healthiest eaters cave into indulgences based on their emotional states. Forty percent of U.S. food-brand lovers who rated their daily diet as extremely healthy agreed with the statement, “When I’m feeling down, I eat something indulgent to make me feel better.” The study, conducted by full-service food branding agency, Foodmix Marketing Communications, breaks out a large group of brand lovers into smaller, differentiated and more actionable consumer segments.

The proclivity to indulge happens in spite of the healthiest eaters’ rigorous attention to how they eat in their majority lifestyles. Most (70 percent) care a lot about how their food is produced, and make sure to look for cleaner labels when food shopping (69 percent). Most (57 percent) purchase more expensive organic over non-organic food. Most (53 percent) are highly attuned to food news, and are among the first to react to food warnings and new nutritional recommendations.

As to their favorite branded food product? Yes, most of them choose a health food over comfort foods and tasty treats.

So what gives? In a food culture where most Americans are trying to eat healthier, the findings show that America’s love affair with indulgent foods has reached even the most disciplined group of eaters. It’s likely that members of this group need to give themselves “permission” to indulge, and may in fact turn indulgence food into a sort of self-care. Instead of hitting the gym after a bad day, many of these normally super-healthy eaters are hitting the refrigerator or nearest restaurant for an indulgent treat.

“For those in the food business, the takeaway is that consumers’ need to indulge has permeated the food culture, and is unlikely to diminish any time soon,” said Bill Sherman, Director of Research at Foodmix Marketing Communications. “Even organic supermarkets and health-oriented restaurants should offer some indulgent foods, perhaps in smaller portions, to capitalize on the growing indulgent factor in America’s food culture.”

The newly released study builds off 2016 market research also conducted by Foodmix Marketing Communications to learn about consumers who love food brands. The 2016 Foodmix Marketing Communications Brand Love Attributes and Usage Study uncovered the extent to which consumers love food brands, the feelings and emotions that drive brand love, and the ways in which brand love impacts consumers’ marketplace behaviors. The new study used a needs-based segmentation methodology to create six segments of brand lovers based on their unique combination of attitudes, preferences and behaviors.

“We believe that the food renaissance – in which food is becoming a central part of our culture and being used by consumers to help define themselves – is driven by consumers who are passionate about food,” said Dan O’Connell, CEO at Foodmix Marketing Communications. “For food companies, foodservice operators, and food retailers and distributors, we believe that the most desirable consumers are those most passionate about food brands. That’s because these brand lovers behave in ways that directly impact a company’s bottom line. Compared to other consumers, they are more loyal, more resistant to competitive offers and more likely to try brand extensions. They are also more willing to pay a premium and to advocate for your brand.”

Plant-Based Has to Taste Good

Whether flexitarian, vegetarian, vegan or simply eating healthy, plant-based foods are making inroads with consumers. However, new research from Mintel reveals that taste is the top reason U.S. adults who eat plant-based proteins* do so (52 percent), outranking concerns over diet** (10 percent), animal protection (11 percent), the environment (13 percent) and even health (39 percent).

While taste tops the list of reasons to eat plant-based proteins, perceived health benefits are on consumers’ minds as nearly half (46 percent) of Americans agree that plant-based proteins are better for you than animal-based options, and three quarters (76 percent) say plant-based foods are healthy. Whether a desire to avoid processed foods (39 percent), manage weight (31 percent) or promote muscle growth (16 percent), many plant-based protein consumers are motivated by maintaining or improving their health and well-being.

When it comes to making decisions in the grocery aisle, again, taste (65 percent) is the driving factor for those who eat plant-based proteins, followed by health-centric attributes. These consumers are more likely to seek plant-based protein products with no artificial ingredients (41 percent), that are high in protein (35 percent) and fiber (28 percent), and those that are non-GMO (28 percent). Non-GMO claims in particular are driving innovation in the category, as US launches of foods and beverages with plant-based proteins with a non-GMO claim grew from 3.8 percent in 2012 to 19.6 percent in 2017, according to Mintel Global New Products Database (GNPD).

“Americans are more and more avoiding food products with artificial ingredients and GMOs, and vegetarian, vegan and free-from foods have grown to be regarded as healthier options. Despite the fact that health attributes, particularly free-from, factor strongly in consumer decisions when purchasing plant-based proteins, at the end of the day, taste is the driving force behind purchase and eating decisions. While overall consumption of plant-based proteins remains low, these products benefit from a generally healthy reputation both for consumers’ diets and for the environment, and growing consumer interest in better-for-you lifestyles will continue to drive interest in the category,” said Billy Roberts, Senior Food and Drink Analyst at Mintel.

While healthy and functional attributes are of interest to consumers, with less than half (46 percent) of Americans saying they trust the functional claims made by plant-based foods, there is opportunity for brands to further communicate the benefits. In fact, seven in 10 (71 percent) Americans agree that brands should provide more information about product/ingredient origin on packaging.

“Busy consumers look for shortcuts for how to live well, and labels offer a quick and easy understanding about what a product contains and how it has been treated. In order to appeal to consumers, brands should offer a tasty product offering boasting no artificial ingredients, protein content, non-GMO, and fiber content, and be sure to highlight these features on-pack,” continued Roberts.

While plant-based proteins consumers are most likely to say they eat plant-based proteins in prepared meals (66 percent), traditionally animal-based products, such as meat (51 percent), cheese (45 percent) and milk (41 percent), are also popular plant-based options. This is especially true for consumers aged 18-34 as they are the most likely age group to eat plant-based proteins in meat (58 percent), cheese (56 percent) and milk (53 percent).

Despite this interest, it seems price may be a deterrent. Nearly two thirds (64 percent) of Americans aged 18-34 agree that plant-based foods are more expensive than others, compared to 57 percent of consumers overall. However, some brands may be worth the price as almost half (47 percent) of those aged 18-34 say brand name is important when buying plant-based foods, compared to 40 percent of consumers overall.

“Faux meat has come a long way in terms of both innovation and consumer acceptance, with meatless, ‘bleeding’ burgers and lab-grown chicken found on menus and in grocery store aisles across the country. The majority of consumers look for plant-based proteins in meat, cheese and milk, which suggests that alternative meats and dairy products will find appeal, resulting in increased consumption. Additionally, a value-oriented plant-based protein may resonate well with members of the iGeneration, Millennials and younger members of Generation X, as these consumers are more likely to say plant-based proteins are too expensive. Thus, major brands’ involvement in the category could bode well for the category as a whole,” added Roberts.

Finally, while interest in plant-based proteins is on the rise, animal-based meat is here to stay. More than two thirds (67 percent) of Americans agree that meat is essential to a balanced diet, and just over half (51 percent) believe a meal is not complete without meat.

“The opportunity for plant-based proteins appears more as a complement to animal-based proteins than as a wholesale replacement, as our research shows that many consumers are interested in plant-based proteins but still view meat as an important part of a balanced diet. The biggest challenge for the plant-based proteins category continues to be finding the right balance between flavor and health, and discovering the categories where consumers will accept the addition of plant-based varieties,” concluded Roberts.

Healthy Hand Washing

The annual Healthy Hand Washing Survey reveals that almost half of Americans say they will “definitely” or “probably” spend more money at a business that has clean, well-maintained restrooms. In addition, nearly 60 percent of Americans make a conscious decision to visit a specific business because they know it has nice restrooms.

“The inherent correlation between restroom conditions, businesses and customers extends even deeper than we realized,” says Jon Dommisse, director of strategy and corporate development for Bradley Corp. “Our survey has previously highlighted how well-maintained restrooms increase patronage; learning that people also reward these businesses with their spending power was further confirmation of how consumers respond positively to clean restrooms.”

For restaurants, the judgment surrounding the condition of restrooms is especially tough, as 82 percent think a restaurant with dirty restrooms is “extremely” or “fairly” likely to have a dirty kitchen. Further, out of all types of facilities, restaurants and health care establishments cause Americans the most concern about workers not washing their hands.

Untidy restrooms send business down the drain

The survey also shows that when businesses let restroom maintenance slip through the cracks, they are at a high risk of jeopardizing customer satisfaction and sales.

“More than half of Americans say they are unlikely to return to a business after experiencing a poorly maintained restroom,” Dommisse said. “Others will complain to management, tell a friend or leave right away without completing their business.”

That means more businesses may be on shaky ground with customers since 70 percent of Americans report having an unpleasant restroom experience – a number that has steadily increased from 59 percent over the past three years. In fact, 42 percent said they had a bad experience within just the past two months.

When asked about the biggest pain points in restrooms, an overwhelming majority identified the following circumstances as “extremely” or “very” aggravating:

- 83 percent Toilet clogged or not flushed

- 78 percent Toilet paper dispenser empty or jammed

- 74 percent Partition doors don’t latch

- 73 percent Unpleasant smells

- 72 percent Overall appearance is old, dirty or unkempt

Top restroom frustrations include having to walk across a wet floor (women in particular), reaching over someone to access soap and waiting in line for a hand dryer.

Flu-conscious Americans increase hand washing

The survey of 1,035 Americans, which was fielded January 2-5, also delved into perceptions about this year’s pervasive flu season. Almost 60 percent of Americans are “extremely” or “quite” concerned about contracting a new or particularly resilient strain of the flu. This elevated concern appears to prompt more diligent hand washing, as 65 percent of Americans say they wash their hands more frequently or more thoroughly to avoid getting germs or passing them on to others.

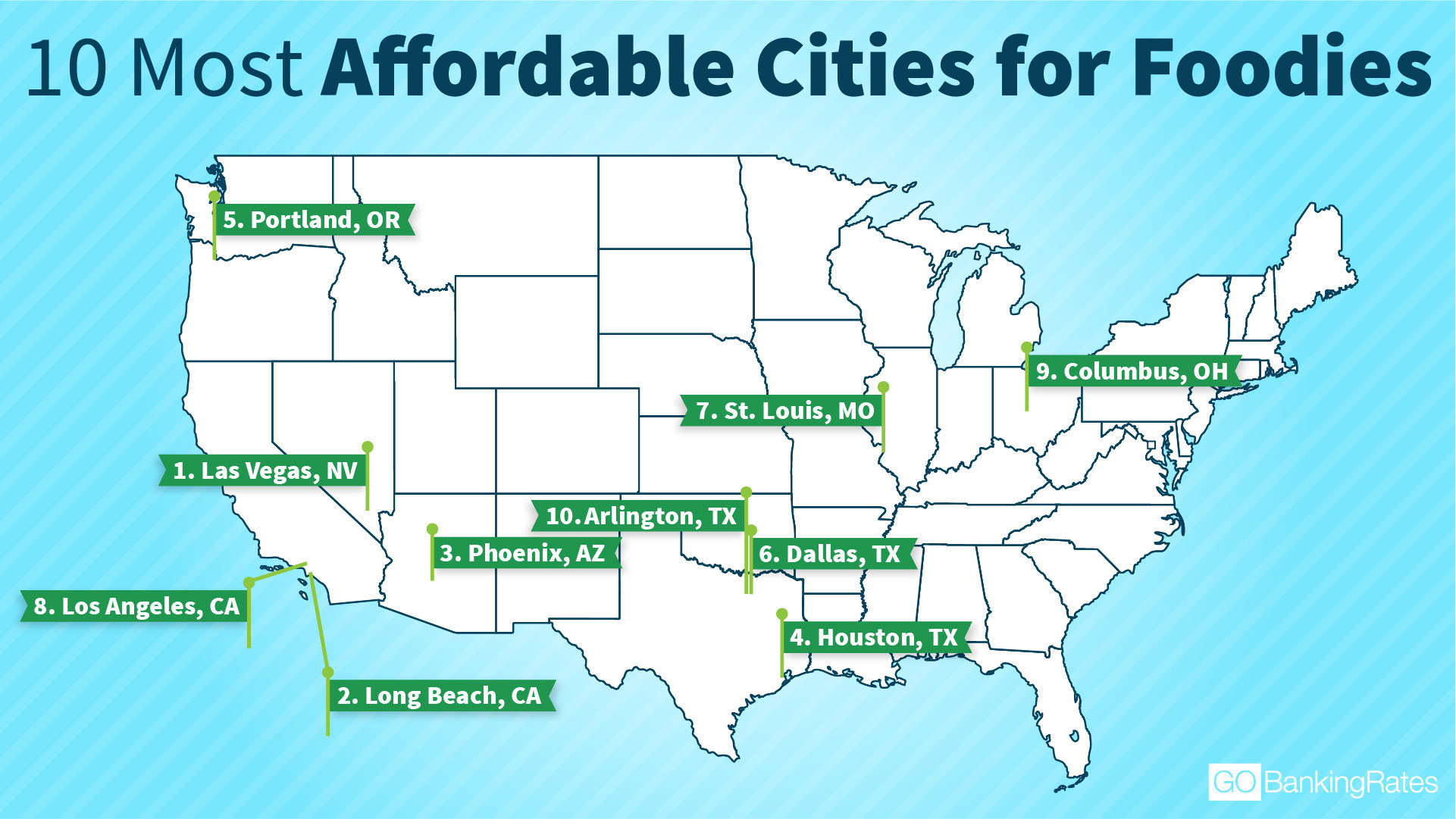

Affordable Food Options

Las Vegas and Long Beach, Calif. are the best cities to live if you are looking for affordable food options, found a new study by personal finance website GOBankingRates.

According to the study, Seattle is the worst city for foodies on a budget. The city has the fifth-highest cost of groceries in the country, and 16.45 percent of residents have low access to grocery stores. The cost of a three-course meal runs at about $65 per person.

For more details on methodology and to view the full study, visit: Most and Least Affordable Cities for Foodies

Best Cities for Food Affordability

1. Las Vegas

- Average cost of groceries (monthly): $284.56

- Average cost of a meal at a cheap restaurant: $15.00

- Average cost of a three-course meal at a mid-range restaurant: $50.00

- Percent population with low access to grocery stores: 10.57 percent

2. Long Beach

- Average cost of groceries (monthly): $355.60

- Average cost of a meal at a cheap restaurant: $15.00

- Average cost of a three-course meal at a mid-range restaurant: $50.00

- Percent population with low access to grocery stores: 6.34 percent

3. Phoenix

- Average cost of groceries (monthly): $264.23

- Average cost of a meal at a cheap restaurant: $13.50

- Average cost of a three-course meal at a mid-range restaurant: $50.00

- Percent population with low access to grocery stores: 13.39 percent

Worst Cities for Food Affordability

1. Seattle

- Average cost of groceries (monthly): $393.76

- Average cost of a meal at a cheap restaurant: $15.00

- Average cost of a three-course meal at a mid-range restaurant: $65.00

- Percent population with low access to grocery stores: 16.45 percent

2. New Orleans

- Average cost of groceries (monthly): $338.69

- Average cost of a meal at a cheap restaurant: $18.00

- Average cost of a three-course meal at a mid-range restaurant: $59.00

- Percent population with low access to grocery stores: 16.8 percent

3. Minneapolis

- Average cost of groceries (monthly): $388.40

- Average cost of a meal at a cheap restaurant: $15.00

- Average cost of a three-course meal at a mid-range restaurant: $50.00

- Percent population with low access to grocery stores: 26.62 percent

Additional Insights

- Portland ranks No. 5 on the list of best cities for foodies. Although Portland’s groceries aren’t cheap (an average cost of $353.19 per month), fewer than 10 percent of residents have low access to grocery stores.

- If you are looking to dine out, Dallas offers many affordable restaurant options. The average inexpensive meal out runs only $12, and a mid-tier, three-course meal averages $50 per person.

Global Burritos Market

The “Global Burritos Market 2017-2021” report has been added to ResearchAndMarkets.com’s offering.

Global burritos market to grow at a CAGR of 5.64 percent during the period 2017-2021.

The report has been prepared based on an in-depth market analysis with inputs from industry experts. The report covers the market landscape and its growth prospects over the coming years. The report also includes a discussion of the key vendors operating in this market.

One trend in the market is extensive marketing activities and campaigns. A recent trend influencing the growth of the global burritos market is the increase in the promotional and marketing initiatives of the vendors of packaged burritos as well as burrito chains. Most consumer good marketers are now implementing social media campaigns for their product promotions or new product launches.

The popularity of Mexican food across the U.S. is increasing and the Hispanic population base is growing in the country, which create new opportunities for the global burritos market. Major restaurant chains in the U.S. such as Yum! Brands (Taco Bell), Chipotle Mexican Grill, and others, which control a significant portion of the market’s share, sell mainstream Mexican food. In addition, the increase in the number of Western and fast-food service restaurants in developing countries will also support the market’s growth during the forecast period.

Further, the report states that one challenge in the market is fluctuations in raw material prices.

Key Vendors

- Amy’s Kitchen

- Chick-fil-A

- Chipotle Mexican Grill

- Ruiz Foods

- Yum! Brands

Other Prominent Vendors

- Camino Real Kitchens

- Del Taco

- Tavistock Freebirds

- JACK IN THE BOX

- Ramona’s Food Group

Fancy Food Trends

Armed with predictions for 2018, released by the Specialty Food Association in November, the West Coast arm of the Trendspotter Panel attended the recent Winter Fancy Food Show in San Francisco. Scouring over 90,000 products, the panel assessed and noted a variety of products that either reflected the predictions, or indicated new or emerging trends.

“This is an exciting time in specialty food,” said Denise Purcell, head of content, Specialty Food Association. “We’re seeing innovation everywhere, from specific ingredients to flavor profiles. There are new spins on classics, as well as brand new categories emerging. International flavors and culture are also playing a huge role in shaping the category. This growing market is anything but boring at the moment.”

The Winter Fancy Food Show Trendspotter Panel included Polly Adema, PhD, associate professor and director of graduate Food Studies Program, University of the Pacific SF; Kara Nielsen, vice president, Trends & Marketing, CCD Innovation; Tu David Phu, chef/owner, AN – a Vietnamese Dining Experience; and Joey Wells, American Cheese Society Certified Cheese Professional and Whole Foods Market Global Senior Coordinator overseeing Specialty Cheese Product Innovation & Development.

Top Trends

1. Plant-based Foods. Plant-based foods cut across many categories and algae, which was predicted to take off in 2018, continued to appear.

- Fora Faba Butter, made with aquafaba

- K’ul Chocolate Superfood Bar, 70 percent dark chocolate, 8 grams of algae protein

- New Wave Foods, algae and plant-based shrimp

- Roland Foods Quinoa Spreads, blend of quinoa, and plant-based ingredients

- Tru Flavors Salad Dressing, a single-serve, shelf-stable, bean-based dressing

- Unisoy Vegan Jerky

- Wellnut Farms Walnut Butters, made of 100 percent walnuts

2. Functional Mushrooms. Originally on the 2018 emerging trend list, mushrooms are taking off as both a snack and a functional ingredient.

- Four Sigmatic Mushroom Elixers, powdered-drink–packets that dissolve in hot water

- Pan’s Mushroom Jerky, shiitake mushrooms with a meaty texture

- Yuguo Farms Mushroom Chips, whole, sustainably grown shiitake mushrooms

3. Alternative Sweeteners. Consumer interest in reducing refined white sugar has led to alternatives.

- Droga Chocolates Money on Honey Caramels, sweetened with True Source-verified honey

- Elements Truffles, chocolate bars that are raw, organic, dairy-free, and sweetened with honey

- Just Date Syrup, made from organic Medjool dates

- The Republic of Tea Organic Apple Cider Vinegar Sips, sweetened with monk fruit

- Salviana Raw Maguey Sap, raw prebiotic-rich syrup made from Maguey Pulquero

- Sejoyia Coco-Thins, gluten-free cookies sweetened with organic coconut sugar

- Soozy’s Muffins, Paleo certified and sweetened with organic coconut sugar

4. Deeper Middle Eastern Flavors. Prominent flavors and ingredients broadened to include Central and South Asia, and North Africa.

- Casablanca Market Moroccan Harissa, Preserved Lemons, and Purple Olives

- FoodMatch Marinated Artichokes with Harissa

- Rumi Spice Afghan Curry Braise cooking sauce, with sustainably farmed saffron from Afghanistan

- Snackgold cHarissa Gourmet Potato Crisps, partnership between Spanish gourmet potato chip makers and cHarissa spice company

Emerging Trends

5. Collagen-Infused Foods. First appearing in snack bars, it is now showing up in beverages.

- HealthVerve BBGLO Skin Rejuvenation Collagen Drink

- SkinTe sparkling tea beverage with collagen, under development by students at Oregon’sUniversity of Portland

6. Moringa. A plant native to India, it is being touted as a new superfood.

- Miracle Tea Moringa Superfood Energy Infusion Tea

- Stash Tea Organic Moringa Mint Herbal Tea

7. Black Rice. Used as an ingredient in solid and liquid form. The pigments that give the rice its color are rich in antioxidants and other health benefits.

- Suzie’s Table Black Rice Non-Dairy Beverage

- Theo’s Black Rice Quinoa Crunch Dark Chocolate Bar

8. Snack Puffs. Nut and vegetable updates to the classic cheese puffs.

- Puffworks Peanut Butter Puffs

- Suzie’s 2 Pease and a Bean, pea-protein–based puffed snack

- Vegan Rob’s Brussels Sprout Puffs, Probiotic Cauliflower Puffs, and Beet Puffs

Still Trending

9. Specialty Waters. The category is expected to grow 111.5 percent by 2021, according to Mintel category forecasting research for SFA.

- Herb & Lou’s Infused Ice Cubes, flavored water containers that consumers freeze and mix with spirits

- Kona Deep Water Purified Ocean Water from the waters of Hawaii, containing naturally occurring deep ocean electrolytes

- Water Joe Caffeinated Water, infused with 85 milligrams of caffeine, no sugar, zero calories

10. Turmeric. Native to Southeast Asia and India, it is being used as an ingredient in more categories, especially snacks.

- David Rio Turmeric Golden Latte

- Jade Spice Vegan Turmeric Salt

- Lotus Pops Roasted Lotus Seeds, in turmeric flavor

- Oskri’s 3 Egg White Protein Bar, in turmeric flavor

- Theo Chocolate Clusters, made with turmeric, hemp, chia flour and sorghum

- Theo’s Turmeric Ginger Dark Milk Chocolate Bar

- Wai Lona Turmeric Cheese Cassava Chips

- Zotter Chocolate’s Vegan White Rice & Turmeric Disc, a white chocolate treat of vegetal origin

Romantic Desires

Amora, provider of one of the highest-quality coffee, has revealed that 76 percent of respondents prefer making their coffee at home instead of purchasing on the go. The survey also shows that people enjoy their coffee nearly equally in all different flavors. 26 percent of respondents take their coffee black and strong, 24 percent of respondents take their coffee flavored, 23 percent of respondents take their coffee light and sweet and 27 percent of respondents take their coffee somewhere in the middle.

“The results showed us that most consumers prefer full-body, rich and dark roast coffee which aligns with Amora’s best sellers,” says Marina DiDomenico, co-Founder of Amora.

Key Findings:

- Nearly half of respondents claim they consume coffee every morning and can’t start their day without it.

- Most consumers prefer full-bodies, rich, dark roast coffee amongst any other flavor.

- Consumers claim that both the coffee brand name and convenience are equally important aspects to them.

- 76 percent of respondents confirm they prefer making their coffee at home instead of purchasing it on the go.

- Only 24 percent of respondents prefer to purchase coffee on the go.

Valentine’s Day is a time when consumers are more indulgent with their coffee consumption, with nearly half of consumers unable to start their day without it. Amora believes the key to gifting coffee on Valentine’s Day is giving a premium flavor that enlivens the consumer with each sip day after day.

“The results we received from our first Valentine’s Day survey didn’t come as much of a surprise,” says co-Founder of Amora, Marina DiDomenico. “According to the survey data, consumers consider taste to be the #1 most important aspect of coffee compared to price, brand and convenience. This data point in particular further proves Amora’s business model which guarantees fresh, premium grade coffee delivered directly to customers’ homes each month, eliminating their curiosity into how old the beans are or how long they’ve been sitting on shelves.”

The survey was completed by more than 200 women and men nationwide between the ages of 18-60.

State of the Wine Industry

Silicon Valley Bank (SVB) released its “State of the Wine Industry 2018” report today. The 17th annual report assesses current conditions in the wine industry and provides a unique forecast based on economic and behavioral trends.

Highlights and predictions from the 2018 report show that industry sales growth is ebbing as younger consumers and retiring baby boomers impact buying behaviors and preferences, which will have implications for wineries and their direct-to-consumer marketing efforts:

- Consumers continue to leave lower-price segments in favor of better-quality offerings, but total sales growth is leveling off.

- For the industry as whole, sales will rise by 2 to 4 percent, while volumes will increase up to one percent.

- Overall pricing will remain flat with price increases difficult to pass through to consumers.

- The premium wine segment – which we define as above $10 per bottle – will grow in the range of four to eight percent, down from the estimate of 10 to 14 percent in 2017.

- Overall supply is balanced, with chardonnay demonstrating particularly strong demand. Cabernet is balanced with flat to downward pressure at the high end of the market.

- Increasing imports will continue in the lower premium price points.

- Acquisitions will cool somewhat from the torrid pace of the past three years. We still will see foreign purchases of US wineries and significant transactions for vineyard properties.

- North Coast grape prices, which have seen rapid growth in the past five years, should slow their growth rate.

“2018 will be a good year for the wine industry, and while there will still be sales growth, the rate of growth is slowing,” said Rob McMillan, founder of Silicon Valley Bank’s Wine Division and author of the report. “The successful wineries 10 years from now will be those that adapt to a different consumer with different values – a customer who uses the internet in new and interactive ways, is frugal and has less discretionary income than their generational predecessors.”

Additional findings and forecasts for 2018:

- Millennials are migrating away from red blends and introductory wines and are starting to have a positive impact on other lower-priced still wine categories, both domestic and foreign.

- While boomers are still the leading consumers of fine wine, they are consuming less as they age, are changing their spending patterns in dollars spent and are moving away from the high price points as they adjust to living on a fixed income.

Read the full report here.

IRF Trends Study

The Incentive Research Foundation released its signature study, The IRF 2018 Trends Study. The study highlights ten key trends that will affect organizations, their products and services, and the workforce in 2018. From market optimism to concerns about risk and safety, the study identifies key areas of change and their implications for workforce engagement, incentive travel and recognition.

“The IRF 2018 Trends Study clearly demonstrates that professionals in the non-cash rewards industry continue to experience a tremendous amount of change,” said IRF President Melissa Van Dyke. “From culture shifts to technological advances to regulatory pressure, the IRF is tracking some essential shifts in the industry and discussing how to anticipate and respond to these trends.”

The Top Ten Trends for Incentive Travel, Reward and Recognition Programs in 2018 are:

1. Building a Brand-Asset Culture Becomes a Business Imperative

With over 80 percent of businesses’ value in their intangibles, the IRF expects non-cash awards to grow as the focus on brand, culture, and innovation becomes even more critical to business success.

2. Market Optimism Leads to Budget Growth

The incentive travel industry’s net optimism score for the economy is up almost 20 points from 2017, and average annual per-person spend of $3,915 reflects a 4 percent increase.

3. Regulatory Pressure Drives Changes

Over 70 percent of respondents to the IRF’s Regulations Study said they had made changes to their programs’ design, communications, rewards, and/or reporting in response to regulations.

4. Cost and Time Tensions Continue

Although incentive travel budgets were up again in 2017, 60 percent of respondents said costs are rising faster than budgets.

5. Increased Focus on Managing Risk and Ensuring Safety

From PCI compliance to concerns over the EU’s GDPR (General Data Protection Regulation), ensuring program participant data is secure and appropriately used is a central concern for all types of non-cash award programs.

6. Expanding Capability with Increasingly Predicative and Intelligent Technology

Predictive analytics, artificial intelligence, and augmented reality capabilities will be a fundamental requirement for the effective incentive, rewards, and events business partner.

7. Wellness Hits a Tipping Point: Expectations for Comfort & Healthy Options

The largest number of net increases (38 percent) reported by IRF trend respondents was the inclusion of wellness/well-being components, focused on fitness, food, and comfort, in their programs.

8. Unique Destinations Gaining Popularity

Planners are interested in new and different sub-destinations. Whereas Rome may have been the primary consideration in the past, Puglia, Italy is becoming an attractive option.

9. Merchandise Awards Move Toward the Meaningful

There is a strong desire in 2018 not for more choice, but for more meaning. Impactful products may have local sourcing or organic roots and be easily personalized and customizable.

10. Gift Cards Gain Momentum

Mid-size firms on average spend almost half a million dollars annually on gift cards across all programs, while the largest firms each spend over $1 million annually.

The IRF 2018 Trends Study was supported by IRF Research Advocacy Partner Prevue Magazine.

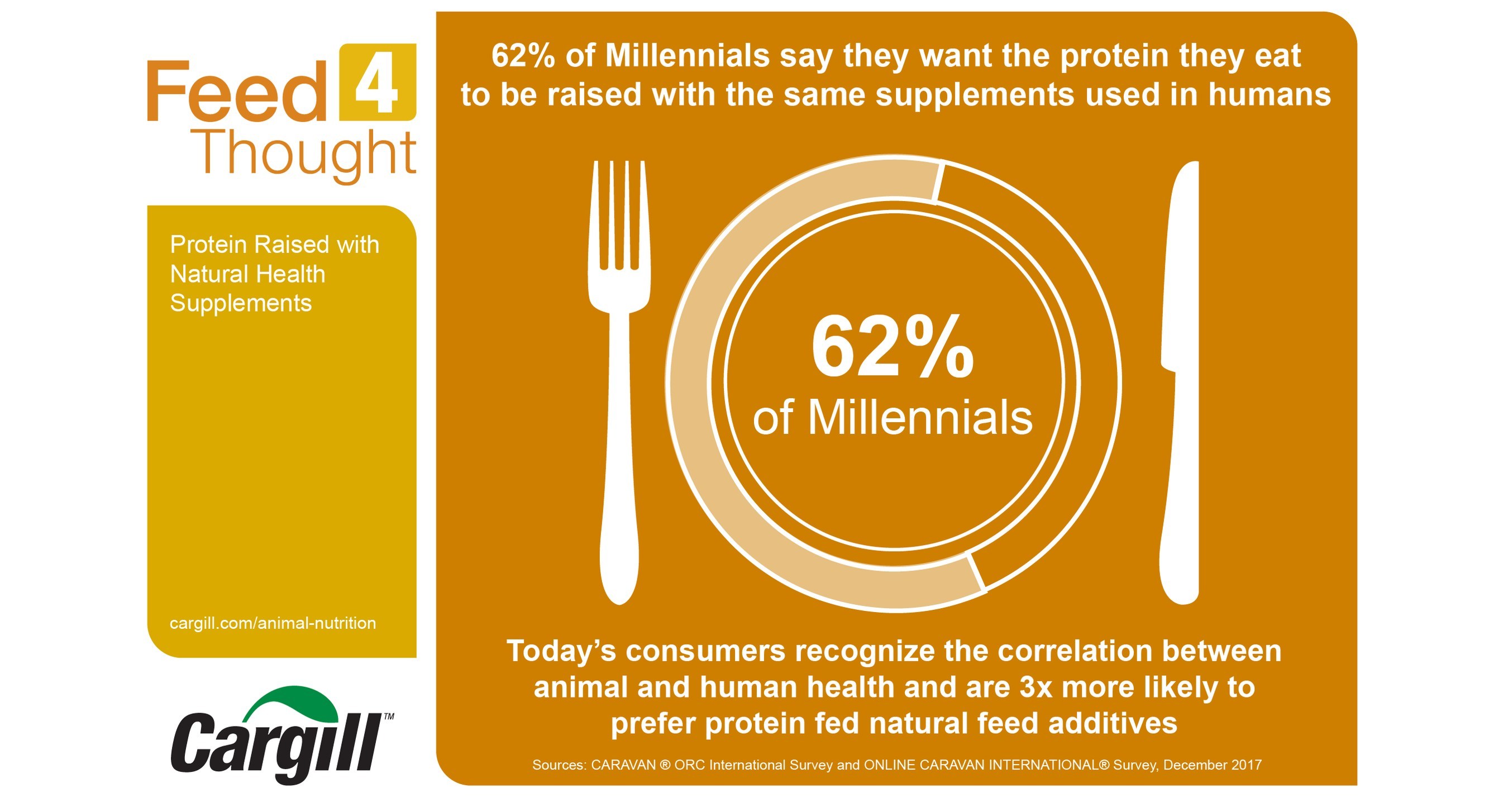

Cargill’s Feed4Thought

Millennials, ever interested in where and how their food is produced, want their protein to be raised with the same natural health supplements they would use themselves—and they are driving this trend among the general U.S. consumer base.

Cargill’s latest Feed4Thought survey, which polled more than 1,000 people in the U.S. in Dec. 2017, found 62 percent of millennials want the protein they eat to be raised with the same health supplements used in humans, such as probiotics, plant extracts and essential oils. Consumers in general report they are three times more likely to prefer protein that were fed those natural feed additives to improve the animal’s digestive health and overall well-being.

“We’ve seen a rise in the popularity of digestive health supplements for humans, which is echoed in the demand for protein raised with natural supplements,” said Chuck Warta, president of Cargill Premix and Nutrition. “People want natural, wholesome and sustainable ingredients. In turn, they are increasingly seeking out protein options in line with their values and personal natural health routines.”

Additional results from the Feed4Thought survey include:

- Probiotics were the most well-recognized natural supplement for animals (43 percent).

- Almost three-quarters (72 percent) of respondents were aware of the availability of natural health products to feed animals.

- More than 80 percent of respondents reported adjusting or supplementing their diet to achieve better gut health.

Investing in Natural Feed Additives

Other consumer research confirms this trend, which is driven by rapidly increasing demand for quality animal products. A recent MarketsandMarket™ study projects the total probiotics animal feed market will reach about $5.07 billion by 2022, growing at a rate of nearly eight percent per year. Meanwhile, a senior industry analyst from Nutrition Business Journal, said global supplement sales for humans will also grow steadily through 2020.

“It’s important for the animal agriculture community to remain in touch with food trends so that we can continue to provide the choices consumers demand,” said Hannah Thompson-Weeman, vice president of communications at the Animal Agriculture Alliance. “Just as human health supplement offerings expand and improve, so do the options to raise animals with natural supplements. Consumers can now find the meat, milk and eggs raised with the same natural health supplements they personally use.”

Pizza Preferences

Cumberland Farms announced the results of a survey around consumers’ preferences and popular debates when it comes to pizza. The results tackled the ongoing pineapple conversation, showing that 65 percent of respondents are in favor of the warm fruit on their pizza. The survey also asked participants how they feel about pizza in the morning, and while you may think that most would prefer eggs, a whopping 85 percent of respondents said they indulge in cold leftovers for breakfast. Cumberland Farms’ pizza debates survey revealed the following:

- Most respondents are traditionalists when it comes to how they eat their pizza, with 78 percent saying they eat their slice from end to crust.

- When it comes to dipping pizza in ranch dressing, the jury is still out. While 47 percent of respondents think it’s delicious, 52 percent think it takes away from the taste of the pizza.

- 92 percent of respondents believe pizza should forever be a finger food, and that it should be eaten with your hands rather than with a fork and a knife.

- When it comes to the debate surrounding cooked pineapple on pizza, the results are in! A whopping 65 percent of respondents love their pie topped with the warm fruit, and 33 percent of them deem Hawaiian as their favorite type of pizza.

- Eggs for breakfast? Try cold pizza, instead. 85 percent of respondents love reaching for leftover slices versus toast in the morning.

- If you’re going to order pizza, 71 percent believe you should go big or go home and order it by the box versus by the slice. Leftovers, anyone?

Most Romantic Cities

OpenTable revealed its 2018 rankings of the 25 Most Romantic Cities in America.

While diners across the nation are looking for that special meal on Valentine’s Day, certain cities prove that they are a step above in providing dining experiences that exude romance from the moment you step inside the restaurant. To identify the ranking of cities where romantic dining is inherently part of the culture, the OpenTable Most Romantic Cities Index was calculated using three variables: the percentage of restaurants rated “romantic” according to OpenTable diner reviews; the percentage of tables seated for two; and the percentage of people who dined out for Valentine’s Day in 2017.

“From cozy seaside settings such as Carmel to hip urban locales like Brooklyn, this year’s standout cities and their dining scenes are attracting diners and inspiring romance,” said Caroline Potter, Chief Dining Officer for OpenTable. “These breakout romantic dining destinations are staking their claims as hot spots for couples who celebrate their relationship with enchanting restaurant experiences on Valentine’s Day — and every day.”.

25 Most Romantic Cities in America for 2018

- Biloxi, Mississippi

- Birmingham, Alabama

- Virginia Beach, Virginia

- Oklahoma City, Oklahoma

- Tulsa, Oklahoma

- Baton Rouge, Louisiana

- Providence, Rhode Island

- Reno, Nevada

- Carmel, California

- Memphis, Tennessee

- Savannah, Georgia

- Milwaukee, Wisconsin

- Louisville, Kentucky

- San Antonio, Texas

- St. Louis, Missouri

- Omaha, Nebraska

- Santa Barbara, California

- Salt Lake City, Utah

- Austin, Texas

- Fort Worth, Texas

- Detroit, Michigan

- Charleston, South Carolina

- Brooklyn, New York

- Buffalo, New York

- Raleigh, North Carolina

Food Retail Trends

Today’s food retail trends will shape the industry for years to come, and retailers know it. In the brand new report U.S. Food Market Outlook 2018, market research firm Packaged Facts examines and forecasts how current trends across 14 food retail categories will influence growth through 2022.

Here are five of the most intriguing trends and opportunities identified in U.S. Food Market Outlook 2018:

- Cereal reimagined: Marketers will continue to make their existing big cereal brands as healthy as possible, although many new products will still be focused on indulgence and decadence. Next generation innovation will focus on expanding use of cereal in new ways, and experimenting with ingredients and processes to enhance nutrition. Don’t be surprised to see marketers creatively repositioning cereal into other products and meals beyond breakfast.

- Emphasis on chocolate as “food” not “candy”: Can chocolate build a reputation as a healthy snack choice rather than merely as a satisfying indulgence for America’s sweet tooth? Marketers are betting on it. Says David Sprinkle, research director for Packaged Facts, “Chocolate companies are increasingly jumping on the better-for-you snacking trend, which leverages frequency of snacking by Americans with a balanced approach to nutrition that explores realistic options rather than a more dogmatic philosophy that forbids snacks or sweets altogether.” The key will be creating healthier, more nutritious chocolate “foods” that don’t sacrifice the all important taste component.

- Ecommerce market for meal and snack bars deepens: Although online sales for meal and snack bars are relatively small, they are expected to increase with the advent of online grocery shopping, which allows consumers to receive bars and other foods without having to browse store shelves. The convenience of online grocery shopping is especially appealing to Millennials and families with small children, as they often have busy schedules and do not have time to plan and shop for groceries.

- The continued evolution of cheese: America’s love affair with cheese is both deepening and evolving. Consumers increasingly want healthier, better-for-you cheese that isn’t only low in fat or sodium, but is fresh, organic and made from healthier milk. Today’s busy consumers also demand convenience and manufacturers continue to offer products and packaging that are easy to use and store, and are portable. Cheese manufacturers are capitalizing on the snacking and on-the-go eating trends with a slew of new products in special cuts, sizes and packs. Packaged Facts forecasts innovation will continue to maximize the experience of eating cheese with unique takes on flavor and indulgence, craftsmanship and authenticity, and health and nutrition.

- Bread baked for digestive health: With the increased focus on their potential, probiotics have become one of the biggest trends today in the food and beverage industry. Nonetheless, the food industry itself hasn’t figured out how best to market probiotic food and beverages, beyond yogurt and similar traditional sources. But that is changing, at least in the bread industry. For instance, Orlando Baking’s True Grains was one of the first lines of probiotics breads in North America. The Cleveland-based company partnered with the Cleveland Clinic in association with the clinic’s Go! Well for Healthy Eating initiative to develop the products. True Grains Seed’licious bread is made with probiotic cultures to promote digestive health, and features flax seed, sunflower seeds, chia seeds, and millet for a good source of Omega 3. Packaged Facts expects to see an expansion of probiotic breads in the coming years.