MRM Research Roundup: Mid-January 2020 Edition

29 Min Read By MRM Staff

This edition of Modern Restaurant Management (MRM) magazine's Research Roundup features a gloomy start to the new year, dining trends for 2020, the importance of discounts, holiday gift card sales results, delivery frustrations, soda curiosity and a consumer culture report.

An Uncertain Start to 2020?

Restaurant year-over-year sales growth was weak during December. A shift in the Thanksgiving holiday is partly responsible for the abysmal results, reversing the positive figures recorded in November. Same-store sales growth was -2.1 percent in December, the worst result for the industry in over 2 years. This report comes from Black Box Intelligence™ (formerly TDn2K™) data based on weekly sales from over 47,000 restaurants and $75 billion in annual sales.

“As bad as the month seemed, as we said last month, the topline growth result is not telling the full story,” commented Victor Fernandez, vice president of insights and knowledge for Black Box Intelligence. “As Thanksgiving was celebrated so late in the month, it fell into December for 2019 according to the calendar we use for reporting.”

This holiday, typically associated with low restaurant sales as well as some restaurants closing that day, translated into lost sales in December of 2019 while the month did not face the same headwinds a year ago.

“Regardless of the holiday shift, December was unsurprisingly a bad month for restaurant sales,” continued Fernandez. “Yes, the first week of the month had a double-digit percentage point drop in same-store sales, but the rest of the weeks of December also reported negative sales growth. The industry has experienced a slowdown in restaurant sales throughout the year. Coupled with the fact that December of 2018 was strong in terms of same-store sales thus presenting a challenging comparison, December of 2019 was projected to be weak regardless of holiday shifts.”

Bigger Picture Still Shows Some Sales Growth for Restaurants

Same-store sales growth during Q4 shows restaurant sales decreased by -0.1 percent, which represented an improvement of 0.3 percentage points over Q3. Furthermore, calculating same-store sales growth over two years reveals a 1.4 percent growth over the fourth quarter of 2017. This was the best 2-year growth rate in all of 2019 and the fifth consecutive quarter in which the industry has been able to post positive growth under this longer-term view.

Sales growth for the entire year also achieved small positive momentum. Same-store sales growth for 2019 came in at 0.1 percent, which means the industry achieved positive growth for the last 2 consecutive years (sales growth was 0.8 percent in 2018). “From a bigger-picture perspective, what we continue to see is an industry crippled by declining traffic but continues to experience guest check growth large enough to drive some small positive sales movement. Given the traffic challenges facing the industry, stronger and sustained long-term sales growth is really not an option,” said Fernandez.

Guest Counts Continue Falling

December’s -5.7 percent same-store traffic growth reflects the negative effect of the Thanksgiving calendar shift, which worsened the latest monthly results. But the Q4 and 2019 traffic growth rates reinforce the idea that falling guest counts are, along with workforce pressures, the biggest challenges for chain restaurants today.

Same-store traffic growth was -3.4 percent during the fourth quarter. Along with Q3 of 2019, these became the only quarters with traffic growth worse than -3.0 percent since Q3 of 2017. Traffic growth for the entire year of 2019 was -3.1 percent, a drop of 1.2 percentage points compared with the growth recorded for 2018.

Family and Upscale Dining Outperformed During the Quarter

The best performing segments during Q4 (and those that achieved positive same-store sales growth) were family dining, fine dining and upscale casual. After a tough 2017, family dining has been experiencing a resurgence and had strong same-store sales growth during 2019.

On the higher end of the guest check spectrum, guests continue to respond well to fine dining brands, which has now posted 3 consecutive years of sales growth. As the rest of the industry has shifted towards increasing off-premise sales, fine dining continues to focus on delivering superior restaurant dine-in experiences for their guests. This segment is also driven by expense account users that continue to entertain their clients as a key business strategy. The attention to quality and service seems to resonate well with fine dining corporate and personal diners given the positive same-store sales growth achieved by this segment over the last 3 years.

Upscale casual also achieved positive sales growth during Q4 but experienced a small dip in sales for the entire year compared with 2018.

The Economy and Consumer Demand Expected to Continue Increasing Modestly

“The 2020 economic outlook is for more of the same,” according to Joel Naroff, president of Naroff Economic Advisors and Black Box Intelligence economist. “If you liked 2019, you will enjoy this year. If you were disappointed, then plan accordingly. While the fears of an all-out trade war seemed to have dissipated (and hopefully will not re-emerge), that does not mean the economy is likely to rebound sharply. In the U.S., consumer spending is being restrained by softening gains in wages, even as job growth remains solid and labor shortages continue to plague business. Globally, forecasts are for soft growth in China and Europe to continue.”

“There is little reason to expect a major upturn in business investment. Government spending, a prime factor in growth, may be limited by the return of trillion-dollar budget deficits. In other words, there are few factors that would constrain growth significantly or cause it to accelerate sharply. For the restaurant industry, that implies modestly rising demand this year.”

Restaurant Turnover Continues to Rise, Adding to Staffing Difficulties

Staffing difficulties continue to rise for restaurants. After a few months of flat and even improving employee retention, rolling 12-month turnover rates worsened again for both hourly employees and restaurant managers during November based on the latest Black Box Intelligence Workforce data. Turnover remains at historically high levels for the industry and is frequently cited by restaurant operators as one of their biggest obstacles for success.

Compounding the problem for restaurants is the fact that it is increasingly harder to find qualified employees to fill vacancies created by turnover. According to Black Box Intelligence’s Workforce Index, by the end of Q3, 63 percent of restaurants expressed that difficulty in recruiting hourly staff increased from the previous quarter. 58 percent of restaurant companies said recruiting difficulty increased for restaurant managers. Recruiting difficulties are even higher for limited-service brands, with a higher percentage saying they are having a harder time finding hourly employees and restaurant managers than they were three months ago.

As a result, the percentage of restaurant locations that is understaffed is increasing. For an industry that relies heavily on its workforce, this can only mean bad news. Especially when taking into consideration guest sentiment. Black Box Guest Intelligence sentiment data continues to show the strong relationship that exists between perceived service experience at the restaurant level and a restaurant’s sales and traffic results.

Looking Ahead

Despite declining guest counts, the industry is in a relatively stable path of flat to slightly positive same-store sales growth fueled by accelerating guest check growth. As the industry begins lapping over relatively softer sales and traffic results from the beginning of 2019, some improvements in year-over-year results are possible for these important metrics. However, declining traffic will continue to be the norm and sales growth will remain modest at best.

Two factors emerge as we start the new year that could disrupt restaurant performance. The first is the usual warning that occurs during the winter months. The weather has been a strong force in recent years, particularly in February, and is a factor that can greatly alter restaurant sales.

The other is a change in consumer sentiment based on potentially growing political instability. Election years are always tricky for restaurants, and this one is already off to a rocky start.

National Restaurant Association Survey on Top Menu Trends

Comfort food and innovation are pairing up on this year's list of what's hot in trends and creations coming to diners from restaurant kitchens. The annual What's Hot Culinary Forecast, released today by the National Restaurant Association, offers a detailed look at the topics, trends, and products–from the ordinary to the surprising–rated sizzling hot by chefs working in kitchens across the country.

Diners will see many more alternatives in restaurants this year, as owners and operators adopt eco-friendly packaging, plant-based proteins, revamped classic cocktails, specialty burger blends (mushroom-beef burgers, etc.), and unique beef and pork cuts, which all made the list of top 10 trends.

"These trends reflect Americans' desires to combine the tried and true with the new and different," said Hudson Riehle, senior vice president of research for the Association. "This mix of comfort and edginess is a microcosm of the world we live in. Consumers want something different, but want to keep what satisfies them at the same time, and more than 1 million restaurants around the country are ready to meet those wants and needs."

For the first time, the What's Hot Report also looked at off-premises trends as restaurants and third party delivery services respond to the rising consumer preference for delivery. Eco-friendly packaging was the overwhelming leader in the category, reflecting the increased importance restaurant operators are putting on sustainability practices.

Healthy is also hot this year. According to the survey, healthy bowls will sizzle on more menus, and healthy kid's meals continue to be top-of-mind for parents and chefs alike. And, while CBD-infused foods led the 2019 survey, they slipped out of the top ten this year. CBD snacks and sweets appeared in the dessert category and CBD-infused foods and beverages are in the top 5 culinary innovations.

The What's Hot survey was conducted in November-December 2019. More than 600 American Culinary Federation chefs rated 133 individual trends in 12 categories, identified in partnership with Technomic, Inc. Download the full report here.

America’s Appetite for Restaurant Deals

RetailMeNot released the 2020 Restaurant Marketing Insights guide, providing a comprehensive look at consumer behaviors when dining out and the strategies restaurant marketers can execute in the new year.

In 2019, the restaurant industry experienced a surge of consumers opting to dine out, whether that was delivery, fast food or casual dining. Busy schedules and hectic lives are often cited as reasons for increased out of home dining, but RetailMeNot research shows discounts are ensuring consumers have a taste of out-of-home meals at least once per month. For more information, click here.

According to RetailMeNot data, 86 percent of consumers eat at fast food restaurants once per month, while about two-thirds visit fast casual (67 percent) or casual (63 percent) dining establishments in that time frame. All in, eating a meal outside of the home costs an average of $281 a month for consumers.

Simultaneously, restaurateurs are using various digital strategies and adopting new meal solutions to compete for market differentiation. Still, the power of a good discount or deal continues to be the deciding factor in out-of-home dining for Americans, no matter their generation.

“Aside from a great menu, restaurants must add something extra in their marketing recipe to stand out from the crowd and appeal to consumers,” said Michelle Skupin, senior director of retail insights at RetailMeNot. “According to RetailMeNot performance data, dining deals result in higher conversion rates, lifts in guest count, and increased ticket values.”

Discounts and deals create lasting customer loyalty while giving restaurants a piece of the market share. According to 85 percent of consumers, a deal or discount influences where they choose to eat outside of their homes. It’s also enough to lure new patrons: 81 percent of diners say a deal would make them likely to switch restaurants they planned to dine at. And, of the consumers surveyed, 79 percent would at least consider revisiting a restaurant where they had had a poor experience if the restaurant offered a discount on their next meal.

Generational Divide

Websites, apps and emails all help deal-seekers find and choose their next dining destination. Digital content is specifically resonating with young diners: 74 percent of millennials and Generation Z use websites or apps to search for discounts and deals on fast food, compared to 57 percent of Gen Xers and boomers. RetailMeNot also finds similar patterns for diners looking for deals on casual and fast casual options.

RetailMeNot’s research shows content and deals from restaurants themselves are influencing diners more than digital celebrities. And it’s that way across all demographics: 67 percent of millennials and 56 percent of Gen Zers are influenced by a restaurant’s content or deals versus 49 percent and 40 percent, respectively, who are influenced by social posts from influencers.

“Consumer habits are a powerful resource for restaurants, but brands can influence a change in those behaviors if they understand not just the measurable data behind purchasing patterns, but also customers’ motivations,” said Michelle Skupin. “By having a finger on the pulse of the value-oriented consumer and as a trusted research partner, RetailMeNot aims to increase restaurateurs’ success while serving consumers high-quality offers.”

A 10-minute online survey was fielded between Tuesday, October 1, 2019, and Friday, October 4, 2019. During this time, 1,026 interviews were conducted with Americans age 18+ who have dined out within the past six months. Key groups of interest were examined in this analysis, including gender, generation and region. Additionally, restaurant spending habits were examined in an August 2019 Segmentation study conducted by Kelton Global.

Delivery Frustrations

A new study from the market research team at Zion & Zion examines the problems and frustrations that consumers experience with multi-restaurant delivery websites/apps like Grubhub and UberEATS.

The findings of Zion & Zion's research have implications for both restaurants and delivery apps:

- Non-millennials experience significantly more frustration (61.2 percent) with these apps than millennials (46.9 percent).

- Consumers experience problems with multi-restaurant delivery websites/apps an average of 24.4 percent of the time, including missing or incorrect food or side items, food either too cold or too warm and unacceptably late delivery.

- Of people experiencing problems, 51 percent of them say they are "very frustrated."

- Consumers will complain the most (36.9 percent) to the website/app when the food is unacceptably late. But restaurants get the blame if a main dish (50.2 percent) or side dish (50.7 percent) is missing or incorrect; and 25.4 percent of consumers will complain to the restaurant if their food is the wrong temperature.

The full research report is available here.

This Zion & Zion research study was based on a nationwide survey of 1,084 consumers. Authors of the study are Aric Zion, MS; Jennifer Spangler; and Thomas Hollmann, MBA, PhD.

Changing Consumer Habits

goPuff released first-ever Off The Shelf Report, which analyzed data from hundreds of thousands of orders over the past 12 months (November 2018 to November 2019). Due to goPuff’s direct-to-consumer relationship, the company is able to not only understand and predict order patterns, but also identify changing consumer habits, preferences and shopping behaviors as the world of e-commerce continues to evolve. Highlights of the report include: Flamin’ Hot Cheetos was the country’s favorite snack in 2019, orders for personal care items increased 24 percent during the winter months and there was a 115 percent increase in boxed and canned wine orders this year.

Changing Behaviors

Snacks

● Even as consumers eat healthier, they won’t abandon more traditional snacks: Many of goPuff’s healthier items have been trending nationwide, with increasing demand for products like Harvest Snaps Green Pea Crisps, Oatly Original Oat Milk and Good Health Veggie Stix. However, 24 percent of customers who ordered a health food item this year also had a traditional snack in their basket. This indicates that a dedicated subset of consumers is willing to shift their habits in some areas while not compromising on old favorite snacks.

Alcohol

● Wine drinkers are opening up to all packaging formats: Although bottled wine continues to make up the majority of wine orders, goPuff reported a 115 percent increase in boxed and canned wine orders in 2019. This trend towards canned and boxed wines has accelerated throughout the year, with orders for these items increasing 47 percent between July-September. These increases were largely driven by boxed wine orders, and goPuff expects continued interest in both boxed and canned wine in 2020.

● All demographics, ages 21+, are ordering alcohol online for delivery.

Wine: Women drive wine purchasing more than men, with 60 percent of goPuff wine orders coming from women over the age of 45; that said, men who are more likely to order wine exist in the 31-34 age range.

Beer: Men are more likely to purchase beer on goPuff, with 65 percent of all orders coming from men across a variety of 21+ age segments; from women, those over the age of 45 are most likely to order beer.

Hard seltzer: The biggest cohort of customers ordering hard seltzer in 2019 was men between the ages of 21-30.

Customers Want Convenience When Enjoying National Events

Customers seek added convenience during experiential events and gatherings, with goPuff orders spiking during major national events (like the Super Bowl or Game of Thrones finale). On the other hand, during family-centric holidays like Christmas Eve and Thanksgiving, customers are less likely to order convenience items for delivery, indicating they and their families are well prepared with all of the coffee, wine and essentials they need.

Looking to 2020 and the continued rise of big TV, sports and entertainment moments, goPuff anticipates customers increasingly leaning towards delivery for convenience rather than interrupting their enjoyment of these key moments.

Steadfast Behaviors

Snacks

American favorites are about flavor and experience: For the third year in a row, Flamin’ Hot Cheetos was the number one snack ordered on goPuff. However, over the past three months, demand for Gushers has skyrocketed; as a result, goPuff anticipates Gushers to overtake Flamin’ Hot Cheetos as the #1 snack in 2020.

- Snacks: Premium Saltine Crackers and Campbell's on-the-Go Chicken and Mini Round Noodles

- Drinks: Gatorade, Simply Orange Juice, Canada Dry Ginger Ale and Sprite

Most Popular Order Days by Product

Coffee

● Most popular order days: December 9 (finals week across many campuses), Memorial Day Weekend

● Least popular order days: Thanksgiving Day and Christmas Eve

Wine

● Most popular order days: New Year’s Eve and Valentine’s Day

● Least popular order days: Christmas Eve and February 4

Beer

● Most popular order days: Halloween, New Year’s Eve and Super Bowl Sunday

● Least popular order days for beer: January 2 (the day after New Year’s Day) and May 28 (the day after Memorial Day)

Regional Trends

Regional Snacking Trends

● Northeast – A Penchant for Ice Cream. Customers in the Northeast ordered more ice cream (specifically Ben & Jerry’s Milk & Cookies and Ben & Jerry’s Half Baked).

● Southeast – Salty Snacks. Customers in the Southeastern region of the U.S. showed a tendency towards saltier items. Among the top indexing items in this region were Flamin’ Hot Cheetos and Slim Jims.

● Midwest – A Love of Spice. Customers in this area ordered more Takis Fuego than any other region.

● Southwest – Our Country’s Sweet Tooth. goPuff’s Southwestern customers have the biggest sweet tooth of any region: they order more Gusher Super Sour Berry, Wonka Nerds Rope and Dr. Pepper than anyone else.

● Pacific – Our Thirstiest Region. Customers on the west coast ordered a lot of Gatorade, specifically Frost Glacier Freeze. This was also the only region to over-index on an alcohol item: White Claw spiked seltzer.

In some cities, certain products are trending:

● Boston – Hard Cider. Orders for cider in Boston increased 61 percent year over year.

● Dallas – Jerky is trending in Dallas and has had consistent, positive month-over-month growth.

● Chicago – Pizza products have been trending in Chicago for the past 6 months, when comparing pizza to other frozen foods.

● Phoenix – Soft drinks have been trending since goPuff opened in the Phoenix market and have retained a significant share of the overall drinks category.

goPuff City Superlatives

● Cleanest cities: Bethlehem PA, Champaign-Urbana IL, and Bloomington IN ordered the most cleaning products this year.

● Saltiest cities: Kansas City KS, South Bend IN and Dallas TX ordered the most salty snacks this year.

● Sweetest cities: Albuquerque NM, Washington D.C., and Lafayette IN ordered the most sweets this year.

● Homiest cities: Champaign-Urbana IL, Syracuse NY and Washington D.C. ordered the most home products this year.

Convenient Sustainability

A convenience trends survey commissioned by leading International branding and customer experience agency I-AM has revealed that almost three-quarters of consumers (74 percent) would be happy to wait longer for goods if the delivery method was more sustainable.

The ‘HERE: NOW Exploring The Next Generation of Convenience’ survey reports that these planet-conscious consumers would approve of deliveries by bicycles or ‘green cars’, while nearly two-thirds (65 percent) would be happy for their orders to be handled by a drone or robot, rather than a person.

The survey also reveals that 92 percent would back greener delivery options – but this figure drops to just 50 percent if it meant higher costs.

Other key findings in the survey include:

Over a third of consumers (36 percent) feel that sustainable and eco-friendly options should be more convenient.

Just a third (36 percent) of consumers consider their local store an important place to meet and get to know people.

Nearly two thirds (63 percent) would be happy for their local store to be fully automated.

Nearly a third (32 percent) of consumers would like more convenience offerings in train stations.

Elsewhere the survey discloses interesting findings about the way people order and pay for goods, with more than half (56 percent) welcoming an option to order restaurant food to public parks and spaces.

A third (33 percent) state the ideal amount of time to receive a product ordered online is within 24 hours, although a third would like to receive their products in under 12 hours.

A growing interest in the ‘take now pay later’ option by text or digital tab is also evident with 63 percent favouring this method, while a huge 93 percent of consumers would like their delivery provider to offer return collections from home, and 41 percent of them would like to choose the time slot.

Meanwhile, 79 percent of consumers like new things, and are open to their new local store introducing them to new products through tastings or other trending items.

I-AM Group Partner Pete Champion said: “Convenience services need to act more like concierge services, adding exclusivity as a key differentiator. By doing this, it is the first step in creating more initiatives that can tap into and connect with local communities, creating spaces for engagement and exploration.

“Convenience should be fast and seamless, but it doesn’t always have to take place at the same time. Introduce take now pay later schemes that are either technologically-powered or built on trust, so consumers will keep coming back, building loyalty in the meantime.

“With more digitally-enabled hyper-local formats popping up, consumers want retailers to give them the convenience of not having to work out what is good and what is not. Showing consumers offerings that both tell them that an item is trendy, good in quality and curating fresh, diverse and healthy product choices allow consumers to trust and learn more.”

The survey was conducted among 2000 18 to 45-year-olds across the UK.

I-AM, headquartered in Shoreditch, London, and with overseas offices in Istanbul, Dubai and Mumbai, has a portfolio of clients in many sectors including retail, food and drink, banking, fashion, estate, telecom and tech, showrooms, education, transport and destinations.

Shortened Holidays Sales Season Takes Its Toll on Restaurant Gift Cards

Restaurants felt the impact of the shortened 2019 holiday sales season in their gift card sales, according to data from Paytronix Systems, Inc., the most advanced digital guest experience platform. The 2019 Christmas Shopping season had fewer days than 2017 or 2018, but over the long-term gift cards are still on the upswing, having experienced a significant rise during the 2018 selling season. Also, most shoppers pick up gift cards at the very last minute, so says data collected from nearly 200 brands during the time period from November 1 through December 31, 2019.

Overall, restaurants show declines in both the number of gift cards sold and in the dollar values of those cards. For the period between November 1 to December 31, 2019, Paytronix data reveals a 1.3 percent decline in cards sold, but only a .62 percent decline in dollar values sold when compare with the previous year. However, for the holiday season alone, from Black Friday to Christmas Eve, card sales were down 5.6 percent while dollar values were off by 5.8 percent.

However, while card sales are down from their 2018 peak, that year saw a 15 percent increase in card sales versus the 2017 holiday season. What’s more, 2019 sales still outpaced those in 2016, which is significant given that those two selling seasons were closer in length.

“The lesson here is that every day of the holiday season counts. Gift cards sell more during the holidays than any other time of year. In fact, you can almost see the panic in the buyers faces on the graph, which shows a last-minute spike this year that exceeds the previous three years,” said Michelle Tempesta, head of marketing for Paytronix Systems. “These cards kick off a cycle for the coming year that means great business. The majority of cards are likely to be used in the first two months of 2020, then it’s about capturing those guests and keeping them loyal.”

Other external factors can also affect gift card sales. During the first weekend of holiday sales, directly following Black Friday, a weather system that blanketed most of the country in snow and rain depressed sales on Saturday, even as Friday and Sunday showed sales increase. This resulted in a 10 percent drop in Black Friday gift card sales as compared with 2018.

This research supplements the Paytronix Annual Gift Card Sales Report: 2019, which surveyed 220 brands and found consistent 10 percent year-over-year growth in gift card sales over 2018. Paytronix offers an in-depth look into holiday gift card sales, sales by channel and service type, anticipated redemption and new insights on eGift cards. With the online ordering industry expanding, the Report also examines the impact of gift cards redeemed online.

Following trends in closed-loop restaurant gift card sales, the Paytronix holiday gift cards research includes data from gift card sales between November 1, 2019, and December 31, 2019, and includes 197 brands. The majority of the brands, 116, are full-service restaurants (FSR), 24 identify as fast casual (FC), 22 fit multiple categories, 14 are quick-service restaurants (QSR), 14 identify as fine dining and seven don’t specify a type. Regionally, the vast majority of stores, 95.32 percent, are in the United States.

Foot Traffic Tells the Tale

Placer.ai, examines Tim Hortons alongside Burger King and Popeyes, Starbucks and Dunkin Donuts, and Chick-fil-A. With its leadership turnover, Placer.ai believes Tim Hortons is primed for a turnaround to its recent descent. Placer.ai examined the data and compared it to Starbucks, believing there is a unique opportunity for Tim Hortons to own the calendar better.

2019 was a difficult year for Tim Hortons with most months down year-over-year in traffic compared to 2018. From January 2017 through November 2019, Tim Hortons only saw a 14.6 percent increase while Starbucks saw visits rise 62.7 percent above the daily baseline on Black Friday.The highest daily increase Tim Hortons saw throughout the period was 48 percent.

Dunkin Donuts and Starbucks are serving similar audiences from an average household income perspective. Although Starbucks has more customers who earn over $100,000, Dunkin sees an advantage in the $75,000-$99,999 segment.

But these values change based on different locations. Placer.ai concludes Starbucks has proven especially adept at taking advantage of this fact.

Earlier this year, Chick-fil-A added Mac & Cheese to their menu and saw an uptick in traffic. Now, the brand will be running tests for new menu items in specific regions across the country.

When the last new item was released on August 13, it helped drive the second most successful week from November 2017 through November 2019, with visits 25.6 percent above the baseline.

A link to the full report can be found here.

Placer.ai, also explored Veggie Grill, Loving Hut, and Native Foods and found vegan fare might not be as meaty as once hoped: From January 1st, 2017 through November 30th, 2019, both Veggie Grill and Loving Hut had a steady decline in foot traffic. Veggie Grill’s 2019 traffic year-over-year had a noticeable decrease.

But… Native Foods saw an overall traffic increase from 2018 to 2019, although it was just under one percent. Placer.ai recommends that it is critical for brands to continue to find ways to optimize their overall footprint and marketing efforts in order to cater to this niche market. They warn that the greatest risk to vegan focused restaurants may not be their lack of popularity, but the growing inclusion of vegan-friendly options to mainstream restaurant chains. For more, click here.

2020 Consumer Culture Report

5W Public Relations released their first annual report which looks at consumer culture and the biggest influences behind today’s buying behavior. Insights will help brands tap into their customer’s wants, connect with their target audiences and create a loyal following by identifying the appropriate tools and messaging. Areas of research include impulse behavior, spending habits, purchase gratification, social media, marketing, publicity, brand activism, and more.

“As a publicist, it’s important to know what our audience wants so we can craft the appropriate messaging that will resonate and create that brand loyalty that everyone is striving for,” says 5WPR President, Dara A. Busch. “These insights allow us to better guide our clients to make smart decisions because we now have a deeper understanding of the purchasing power of each generation.”

The research shows a special focus on Millennials, who are estimated to spend 1.4 trillion in 2020. This age group emerged as the most impulsive and the most highly influenced generation, with 82 percent of Millennials purchasing an item the first time they see it if they like it enough.

When it comes to corporate image, the report dives into the pros and cons of brand activism and cause marketing, showing an overwhelming positive response to companies with a higher brand purpose. The research shows that 83 percent of Millennials find it important for the companies they buy from to align with their values.

“We’re going to see huge growth in cause marketing in 2020,” predicts 5WPR Founder and CEO, Ronn Torossian. “71 percent of Millennials will pay more for a product if they know some of the proceeds go to charity, meaning brands have the opportunity to create a positive corporate identity and increase sales if done correctly.”

On the digital side, the report looks at social media and the impact that influencers and advertising have on users. Although Facebook reigned supreme as the number one social media platform across all age groups, Instagram emerged the most effective, as 94 percent of people influenced by Instagram have clicked, shared or purchased a product seen on their feed. Interestingly enough, while social media is no doubt still driving sales, 68 percent OF MILLENNIALS (58 percent of consumers) still prefer finding new products in store to finding them online, proving that retail is far from dead.

Data from 5WPR’s Consumer Culture Report was collected from an online survey that ran from November 13 to 18, 2019 by MARU/Matchbox on behalf of 5WPR. The survey was conducted among a nationally representative sample of n=1001 american adults aged 18+.

New Era of Soda Curiosity

One in five (21 percent) U.S. consumers participated in the alcohol-free January challenge in 2019, and final numbers from 2020 are likely to be even higher. The primary beneficiary? Soft drinks.

Soda drinks were the most popular option for last year’s Dry January participants, consumed by nearly half (46 percent), followed by water (43 percent). Whether on-premise or off-premise, soft drinks are performing well—55 percent of U.S. consumers enjoy soft drinks when eating and drinking out, and U.S. retail sales are experiencing 2.9 percent growth in the past year.

This month and year-round, soft drinks will be an interesting category to watch. Soft drink brands, spirit manufacturers and retailers all have a rich opportunity to effectively and strategically engage both the regular and occasional abstainers, and the spirit-and-mixer drinkers.

Dining out is one avenue. Nielsen CGA’s 2019 Channel Strategy Report reveals that casual dining is the leading channel for soft drinks, with nearly half (48 percent) of visitors there choosing them with their food—far more than either beer (29 percent) or cocktails (13 percent).

Rising interest in social moderation and health and wellness as a year-round lifestyle provides retailers and restaurants with a huge opportunity to grow soft drinks sales. At U.S. retail, non-alcoholic beverages are worth $7 billion more than just four years ago, and $3.2 billion more in the last year alone. More than half (54 percent) of U.S. consumers surveyed by Nielsen CGA indicated that they have consciously abstained from alcohol at some point in the last 12 months.

There needs to be wider appeal to year-round soft drinkers—more adult, sophisticated choices for those people who want something premium without alcohol.

It’s not just the abstainers who are driving soft drinks forward. While 21 percent of consumers participated in the last Dry January, 79 percent did not—and January is just one month in the year. Spirits are driving the beverage alcohol industry forward more than beer or wine, with 5.7 percent growth at U.S. retail in the last year. Spirits are also the biggest category in several key channels in the on-premise space.

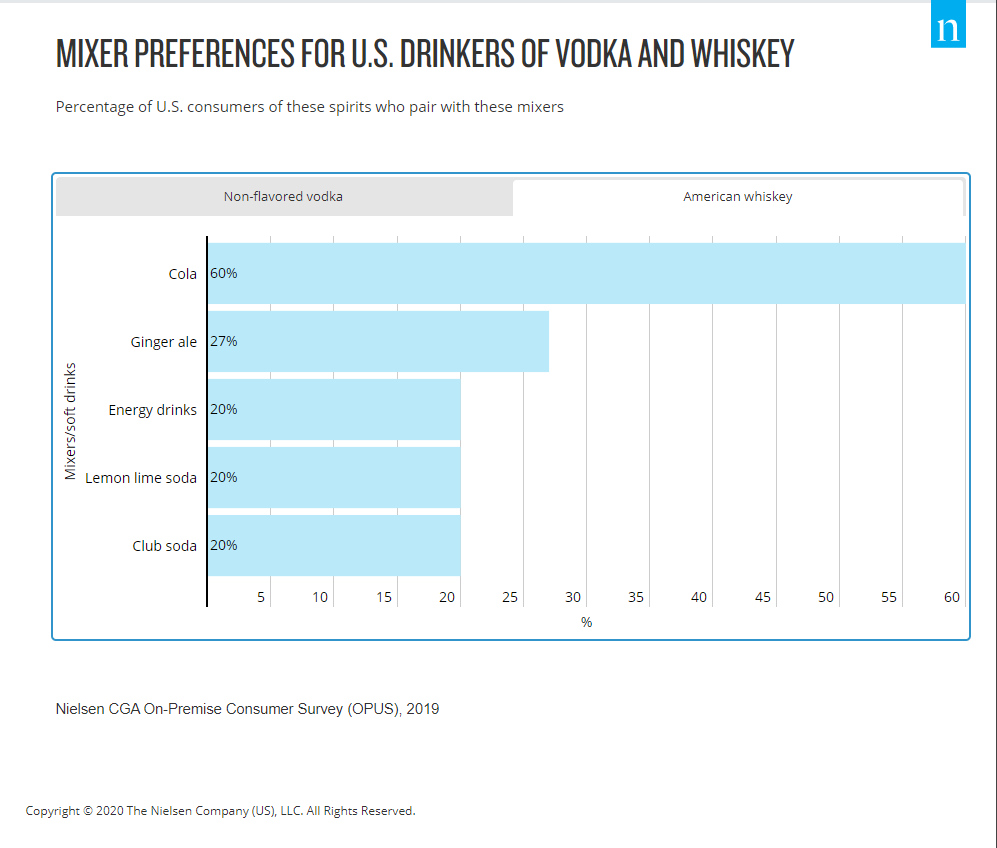

Different spirits demand different mixers, and soft drinks need to mirror the premiumization occurring within spirits. Spirit drinkers are willing to explore mixer variations depending on the spirit on offer, ranging from soda to fruit juice.

In the U.S. on-premise, vodka and whiskey are the biggest revenue drivers for spirits, as 20 percent of survey consumers drink vodka and 17 percent drink whiskey. Club soda and cola are among the favorites for mixer pairings.

Some of these are performing well at retail—cola sales are up 2.2 percent, club soda sales are up 7.1 percent—but opportunity remains for beverages like orange juice (down 6.3 percent) and cranberry juice (down 5.8 percent). Regardless of the base liquor, consumers have very specific flavor preferences. Berry (54 percent) and fruity/sweet (50 percent) top consumer flavor preferences for the cocktails they drink. And at retail, assorted flavor soft drinks have an impressive 18.9 percent sales growth rate—followed by an increased affinity for ginger (ginger beer is up 7.7 percent, and ginger ale is up 5.9 percent).

The soft drinks opportunity is there: weekly U.S. retail sales for the week ending January 19, 2019 were up 5.7 percent in dollar sales year-over-year, and 52-week sales as of November 2019 are up 2.9 percent. The onus is on U.S. retailers, suppliers and manufacturers to maximize a sizable revenue opportunity, both this month and throughout the year.

Coffee Before Donuts

There are 18,010 donut shops in the U.S. and although “donuts” get top billing in this quick service restaurant (QSR) category, consumers visit them more for the coffee than the donuts, reports The NPD Group. There were 2.1B servings of coffee ordered at QSR donut restaurants versus 805M servings of donuts in the year ending October 2019, reports NPD’s ongoing foodservice market research.

Some may think that donut and coffee go together like burger and fries but only 15 percent of QSR Donut purchases include a donut and coffee combo, according to NPD’s receipt harvesting service, Checkout. For those who visit donut shops, 68 percent of their purchases include coffee and only 30 percent include a donut. Those coffee buyers tend to be aficionados of specialty coffee, like lattes and frozen coffee, versus regular coffee. Servings of specialty coffee ordered at donut shops are up 14 percent while regular coffee servings are down by 4 percent.

Whether it’s for the coffee or the donuts, there were 3.2B visits made to QSR donut outlets in the year ending October 2019, up 2 percent compared to same period year ago. The 2 percent visit gains to donut shops compares to a 1 percent traffic increase for the total QSR restaurant segment and no increase for total restaurant industry traffic.

“We are a nation of coffee drinkers and while we like our donuts too, we tend to be fueled by coffee and drink more of it,” says David Portalatin, NPD food industry advisor and author of Eating Patterns in America. “The takeaway for donut shops? If you serve good tasting coffee with your good tasting donuts, consumers will visit.”

Gen Z Shopping Habits

As the oldest members of Generation Z move into the workforce, a recent study by First Insight, Inc., found that they are making more shopping decisions based on sustainable retail practices than even Millennials and Generation X. Further, the study found that Baby Boomers are far less concerned with sustainability when it comes to the items they buy, even less so than their predecessors, the Silent Generation.

According to The State of Consumer Spending: Gen Z Shoppers Demand Sustainable Retail, 62 percent of Generation Z survey participants prefer to buy from sustainable brands, on par with Millennials, while 54 percent of Generation X and 44 percent of the Silent Generation said the same. However, only 39 percent of Baby Boomers agreed, pointing to a vast divide between Baby Boomers and younger generations.

Generation Z is also the most willing to pay more for sustainable products (73 percent) compared to Millennials (68 percent), Generation X (55 percent) and Baby Boomers (42 percent). Half of the Silent Generation expressed this sentiment. The majority of Generation Z (54 percent) are willing to spend an incremental 10 percent or more on sustainable products, versus 50 percent of Millennials, 34 percent of Generation X, 23 percent of Baby Boomers and 36 percent of the Silent Generation.

Of note, the majority of respondents across generations expect retailers and brands to become more sustainable, according to 73 percent of Generation Z, 78 percent of Millennials, 84 percent of Generation X, 73 percent of Baby Boomers and 68 percent of the Silent Generation.

“While Baby Boomers seem to be the holdouts when it comes to expecting more sustainable practices within retail overall, the research shows that with every generation, sustainability is becoming further embedded in purchase decisions,” said Greg Petro, CEO of First Insight. “It’s incredibly important that retailers and brands continue to follow the voices of their customers. With Generation Z on track to becoming the largest generation of consumers this year, retailers and brands must start supercharging sustainability practices now if they are to keep pace with expectations around sustainability for these next-generation consumers, whether it is through consignment, upcycling, or even gifting around major holidays.”

The results were announced today during NRF 2020 in New York. Download the report to see all the key findings from the study here.

Other significant findings of the survey include:

Recommerce Growing in Popularity as Majority of Every Generation Shops Secondary Market: Recommerce is gaining traction across every generation with Generation Z (59 percent), Generation X (63 percent), Millennials (64 percent) and the Silent Generation (62 percent) and even Baby Boomers (52 percent) say they shop the secondary markets. When considering sustainable models:

Majority of Younger Generations are Buying Upcycled Products: The majority of younger generations including Generation Z (59 percent) and Millennials (57 percent) would purchase upcycled products made of discarded objects or materials to create a product of higher quality or perceived value than the original, whereas fewer Generation X (47 percent) and Baby Boomers (38 percent) said the same. Interestingly, the Silent Generation was more inclined to buy upcycled products than Baby Boomers, with 52 percent saying they would buy upcycled products.

Resale/Consignment Models More Popular with Generation X, Millennials and Generation Z. The RealReal, ThredUp, Poshmark, and Tradesy were reported as the second-most popular recommerce models with Generation Z (46 percent), Millennial (48 percent), and Generation X (46 percent) reporting they use these services. Baby Boomers (39 percent) and the Silent Generation (22 percent) are using them less, but still more than other recommerce models.

Clothing Swaps and Peer-to-Peer Marketplaces Least Popular Model: While moderately popular with Millennials (24 percent) and Generation Z (29 percent), clothing swaps are not as widely adopted as other recommerce models, with less than 20 percent of Gen X, Baby Boomer and the Silent Generation respondents reporting using them. Peer-to-peer marketplaces like Storr and rentals are least popular overall, with less than 10 percent of respondents reporting using them.

All Generations Rank Quality Over Environmental Concerns on Reasons They Shop Sustainable Brands

When asked why respondents shop sustainable brands, quality ranked higher than environmental concerns across every generation. Seventy-eight percent of Generation Z, 85 percent of Millennials, 81 percent of Generation X, 83 percent of Baby Boomers and 70 percent of the Silent Generation ranked quality as important. While both factors were rated as important, environmental concerns ranked lower, with only 70 percent of Generation Z, 71 percent of Millennials, 70 percent of Generation X, 72 percent of Baby Boomers and 66 percent of the Silent Generation respondents ranking it as important.

Giving and Receiving of Sustainable Gifts Ranks Most Important for Generation Z

The vast majority of Generation Z believe both giving and receiving sustainable gifts to be somewhat or very important (64 percent and 65 percent respectively), with the majority of Millennials (62 percent and 55 percent) feeling the same. By comparison, older generations, including Generation X (51 percent and 46 percent), Baby Boomers (40 percent and 36 percent) and the Silent Generation (44 percent for both giving and receiving) reported fewer than half of respondents feeling the same way.

Of note, Generation Z is the most likely to return/exchange a gift that was not sustainable (56 percent) versus Millennials (44), Generation X (30), and Baby Boomers (19). Thirty-four percent of the Silent Generation respondents reported the same.

Online Provides Opportunity for Alcohol Retailers

A new report released today by Rabobank, a leading global food and agribusiness bank, estimates that alcohol brands and retailers miss out on billions in online sales opportunities annually, even as alcohol ecommerce sales in the U.S. reached $2.6 billion in 2019.

“If they only look at current sales, industry executives will severely underestimate the value of their ecommerce opportunity,” said Bourcard Nesin, a beverage analyst at Rabobank and author of the “2020 Alcohol Ecommerce Playbook” report. “There is no doubt consumers will move their beverage spending online. The question is whether beverage companies and retailers have the vision to invest proactively in their ecommerce capabilities.”

In the report, Nesin argued that industry leaders must consider the value of missed sales opportunities, the future importance of online shopping for younger generations entering their prime spending years and how online experiences influence consumer behavior in-store.

The report categorizes alcohol ecommerce into four channels, each with distinct challenges and opportunities: online grocery, alcohol marketplaces, direct-to-consumer (DtC) wine online, and online liquor stores.

Online Grocery: Includes supermarkets and other general food and beverage retailers that offer online alcohol sales. Sales reached $295 million, growing 115 percent year-over-year (YOY) in 2019.

Alcohol Marketplaces: Platforms for brands to sell their alcohol online (i.e. Drizly or Minibar). Sales reached $265 million, growing 60 percent YOY.

DtC Wine Online: Includes wine sales processed through a winery website and shipped directly to consumer without involvement of a distributor. Sales reached $950 million, increasing by at least 9 percent last year.

Online Liquor Stores: Pure play liquor retailers with ecommerce capabilities. It is the most mature channel, with sales reaching $1.1 billion annually.

Supermarkets are currently the largest channel for alcohol sales. But with more than 10 percent of all grocery expected to move online over the next four years, grocers without an alcohol ecommerce strategy will miss out on $3.7 billion in alcohol sales by 2023.

According to the report, alcohol is the fastest growing category in grocery, but its share of online sales is nearly 90 percent lower than its share of in-store sales. Increased alcohol sales can be a boost for major grocery store chains that are under pressure to grow their online grocery sales overall.

To maximize sales opportunities, companies should ensure the online buying process is a seamless experience for consumers. The report explains that many ecommerce teams lack the resources to provide sufficient content and adequate product information for the many websites and sales platforms online.

“Consumers are rapidly moving their food and beverage spending online, creating new shopping habits and brand relationships in the digital world,” Nesin said. “If the alcohol industry does not act quickly, their brands will be left out of this important relationship-building process. Ecommerce, rather than a source for growth, could then become a wedge separating alcohol brands from their consumers.”

For more information and access to the report, click here.

Mezcal Sales to See Strong Growth through 2027

The global mezcal market is projected for an impressive CAGR of over 13 percent during 2019 – 2027, as the drink is gaining stupendous popularity as a perfect alcoholic drink for human consumption. Global mezcal sales are set to create a multi-billion-dollar market in the near future.

Though in their nascent stage, craft spirits have become a mainstay for mezcal sales, following the expansion of craft breweries and distilleries, particularly in the developed regions. Mezcal manufacturers are already responding to the rising interest of consumers in new brands with interesting innovations in terms of products types, flavors, and concentrates.

Key Takeaways – Mezcal Market Research

- Mezcal Joven and Mezcal Reposado remain sought-after. However, Mezcal Anejo will exhibit a higher CAGR through 2027.

- Sales of mezcal are projected to be higher in the Middle East & Africa and Asia Pacific.

- The beverage sector offers lucrative growth opportunities to mezcal manufacturers. They are likely to assist bigger sectors of industry and develop more innovative beverage products to attract the younger population.

- Among various distributional channels, modern trade is expected to show the fastest growth by the end of 2027.

- Sales of mix tequila concentrates will be higher throughout forecast period.

The global mezcal market is expected to get more attractive over the forecast period. The rise and spread of cocktail culture in developed as well as developing regions is underpinning a major shift in consumers’ preferences for alcoholic drinks. Mezcal is being increasingly preferred over tequila and other popular alcoholic beverages, driven by its growing availability in various flavors.

Market to Gain Boost, with Increasing Number of Mezcal Producers

While nearly 90 percent of mezcal is prepared in a Mexican city – Oaxaca, currently, there are strong possibilities of several other mezcal brewing areas emerging in the near future. A sizeable number of other Mexican cities as well as other countries have expressively increased their international visibility in terms of high mezcal production capacity. Durango, a state in northern Mexico stands the second leading producer of mezcal. This state recently introduced its own new brands in the mezcal market of the U.S.

Competitive Landscape Analysis

The mezcal market is highly fragmented due to the presence of a large number of players around the world. These key players are focusing on the acquisition of smaller players, especially to control the luxury spirits segment and to expand their product offerings. Some of the prominent market players covered in this FMI study include Bacardi Limited., Familia Camarena Tequila, Craft Distiller, Destileria Tlacolula, Diageo Plc., Don Julio, S.A.de., EI Silencio Holdings INC, Fidencio Mezcal, Ilegal Mezcal, Sombra Mezcal, William Grant & Sons Ltd, Sauza Tequila Import Company, Rey Campero., and Brown-Forman Corporation (Grupo Industrial Herradura, S.A. de C.V.

These insights are based on a report on Mezcal Market by Future Market Insights.

Shoppers Want Self Checkout

While nearly two-thirds of consumers frequently use self-checkout machines at the grocery store, nearly 75 percent stated difficulty in entering goods and frequent overrides were their biggest concerns with the technology. And 90 percent of consumers desire self-checkout machines that can automatically identify items. The survey conducted over SurveyMonkey and sponsored by Shekel Brainweigh Ltd. , takes consumers’ pulse on checkout, vending machines, convenience and autonomous store technologies. Nearly 80 percent of survey respondents were between the ages of 18-60 years old and 62 percent were female.

Key findings of the survey include:

Self-Checkout

Nearly 80 percent of consumers needed assistance at least once during their self-checkout experience, and almost 30 percent of consumers using self-checkout were pulled aside by store personnel to check their purchases.

Nearly 60 percent were more likely to use self-checkout if technology improvements (system simplification, automated entries and more accuracy) were deployed.

Nearly 90 percent of respondents visit convenience stores at least once a week for grocery items

Nearly 25 percent said the fastest possible checkout would also significantly improve their experience.

Autonomous Micro Market

Less than 15 percent of survey respondents have visited a fully autonomous micro market; but those that have visited a micro market cited convenience, speed, selection variety and pricing as the main benefits of these locations.

Vending

Nearly 50 percent would purchase healthy food items from a vending machine if readily available.

Nearly 50 percent of consumers cited lack of selection and fresh products in today’s vending machines as frustrations.

Yoram Ben Porat, CEO of Shekel Brainweigh said, “The results of our Consumer survey are coherent to the market trends as we know for some time, and well represent the major desires of consumers for improvement of their unattended shopping: better and faster shopping experience, availability of stores and variety of products.”