MRM Research Roundup: Halloween-2019 Edition

21 Min Read By MRM Staff

This edition of Modern Restaurant Management (MRM) magazine's Research Roundup features interesting and insightful trends from Upserve, order for pickup guest experience study results, the Fraud Aftershock Index and the importance of foot traffic.

National Menu Trends

The team at Upserve just released their latest trends report. They collected and analyzed sales data between January 2018 and July 2019 from over 10,000 restaurants nationwide, measured the sales performance of each item, and ranked each item based on its overall and trending popularity. They also analyzed how their national menu trends compared to the menus of their James Beard award-winning customers.

Some key menu trends and takeaways include:

- If you’re not including substantial and delicious vegan options, you could be missing out on a lot of business.

- Guests are getting more and more into trying unconventional seafood – the weirder, the better.

- The rise of the mocktail: how the sober-curious movement is changing cocktail menus as we know them.

- While some things never change (we all know to prepare for the end-of-summer turnover when college students return to school!) the team did find some interesting changes in staff turnover trends from last year.

- Turnover is lowest in states with higher minimum wages – don’t live in one of those states?

- The north and midwest have some of the highest rates of staff turnover.

- Front of house staff is more likely to churn –

- Everyone knows that more tables sat equals more money earned, but how do you turn tables faster without making guests feel rushed? The ideal table turn time across the country is the same: 50-60 minutes.

- Every table turn won’t be ideal, but there are ways to nudge them out sooner before the cost of camping really hits your bottom line.

- Your servers will benefit from shorter turn times as well: their tip averages level out around the same 50-60 minute mark.

Order for Pickup Stats

Rakuten Ready unveiled a benchmark study enlisting secret shoppers to evaluate the Order for Pickup customer experience and wait times at 25 top quick-service restaurant, retail and grocery brands across the U.S.

Chipotle, Panera, and Starbucks came out on top for fastest in-store pickup times overall, with retailers Best Buy and Nordstrom clocking in as best retail experiences. Among grocery experiences, H-E-B and Whole Foods made it into the top rankings.

Optimizing wait time is critical, the study found. The mobile-first customer journey also requires an innovative, convenient and seamless pickup program that stretches beyond traditional infrastructure, processes and capabilities.

The Rakuten Ready 2019 Time Study unveiled deep gaps in customer experience across categories for both in-store and curbside pickup, including orders not being ready, no dedicated pickup area, or exclusive pickup line.

"Just offering ‘Order for Pickup’ or ‘Delivery’ is not as simple as adding a feature on your website or app and marketing the service," said Jaron Waldman, Rakuten Ready Co-Founder and CEO. "It is critical that brands fully understand customer expectations so they can focus on improving the end-to-end experience – particularly that dreaded last mile, which can make or break the whole experience with your brand."

Rakuten Ready deployed secret shoppers to evaluate the state of Order for Pickup and provide insights into the best and worst practices to help brands improve their own experiences as customers gravitate to pickup to save both on time and delivery fees. The company conducted over 750 trips between July and August of 2019. Secret shoppers described their experiences including convenience of parking spots, dedicated pickup areas, readiness of the order and staff aptitude for handling orders.

The ‘NOW’ Economy

Time is paramount in the ‘Now’ economy. And while delivery is capturing all the headlines, it’s not actually delivering for consumers with late deliveries and order mistakes. This is allowing mobile order ahead for pickup to take hold with 30 percent of restaurant users and 24 percent of retail users say they have used Order for Pickup because it is actually faster than delivery.

“Smartphones and apps like Uber, DoorDash, GrubHub and Postmates have rewired customer behaviors and expectations and changed the game for retailers, quick-service restaurants and grocery,” said leading digital analyst, CX expert and author Brian Solis, who contributed to the report. “Brands must now rethink business and operational models to not only keep up with evolving customer demands but also grow new markets. Those that do win. Those that don't will lose.”

Based on Rakuten Ready order data, customers who waited less than 2 minutes were four times more likely to be repeat, loyal customers. A few brands are actually meeting and exceeding this wait time expectation for in-store pickup.

Chipotle was #1 among quick service restaurants with over 88 percent of orders ready in under 2 minutes. Other quick-service restaurants completing the majority of orders under that magic two-minute mark, including Panera and Starbucks, are succeeding for several reasons: dedicated pickup areas, exclusive mobile order pickup lines and separate prep lines for mobile orders. Although food quality sometimes suffered due to the speed at which orders were ready before the customer arrived.

At curbside, the wait goes on

Curbside pickup was a different story, with long wait times across all categories. The average wait across the retail, grocery and quick-service restaurant categories was slightly over five minutes. While the study found little variation between categories, there were clear winners and losers. The top performers – Whole Foods and Chick-Fil-A – had wait times that were far faster than those at the bottom.

For a more detailed look at benchmarks and best practices that all brands should drive toward, click here.

Guest Threat Index

According to the 2019 Hospitality Guest Threat Index released by Morphisec, consumers are concerned about cyber-safety in the restaurant industry. The enterprise security firm surveyed 1,000 consumers, weighted for the U.S. population (18+), to examine how the increasing amount of hospitality cyberattacks and the threat of hackers targeting vulnerable Point-of-Sale (POS) systems within hotels and restaurants is impacting the mindset of consumers.

Highlights include:

- 10 percent of U.S. Consumers Over 18 (25M) self-report as being a victim of a restaurant breach.

- Almost 60 percent of consumers say restaurant POS (point-of-sale) systems are the most susceptible to cyberattacks within the hospitality industry

The fear is justified as Morphisec has found sophisticated attackers are targeting weakly defended point-of-sale systems as an entry point into the broader restaurant organization network. With many POS devices in the restaurant industry still running on Windows 7 or even Windows XP-based embedded operating systems, they are increasingly vulnerable to breaches, and cybercrime groups are taking notice.

The full report can be downloaded here.

F&B and Agribusiness

Nixon Peabody LLP’s Food, Beverage and Agribusiness group released its quarterly newsletter and industry outlook: “Food & Beverage Crystal Ball: Trends we’re following.”

Here are some highlights:

- Single-use plastics: it’s time to go. Consumer pressure is mounting to phase out single-use plastics, and replace these with more easily recyclable aluminum and glass, plant-based and compostable “hybrid” plastics, or re-use and re-fill containers. Environmental partner Alison Torbitt is keeping a pulse on how businesses should review their internal practices and consumer products to decide how they too can replace/reduce single-use plastics and make other environmentally friendly changes.

- The future of food products and packaging. Perfluoroalkyl or polyfluoroalkyl substances (PFAs) are a large family of chemicals that are oftentimes used in food packaging to provide water and grease resistance (e.g., popcorn bags, fast food containers, and pizza boxes), and have been the subject of significant regulatory action, emerging research, litigation, and public debate. Litigation associate Tracey Scarpello is keeping an eye on the recently introduced bill by U.S. Representative Debbie Dingell (D-Mich) seeking to amend the Federal Food, Drug, and Cosmetic Act (FD&C), which deems any PFA substance used in food packaging to be unsafe, and, therefore, adulterated under the FD&C Act. Additionally, at least two states (Washington and Maine) have banned the use of PFAs in certain food packaging, and California has added PFAs to its Proposition 65 list.

For the full industry outlook, click here,

Customer Experience Rankings

Food Services and Restaurants sector has been placed joint first in the UK for best customer experience alongside Hotels and Hospitality sector. The ranking is part of the ‘2019 Customer Experience Report’, an annual report from service design consultancy, Engine, which surveyed over 2,000 people across the UK and Ireland. The Food Services & Restaurant sector has consistently featured in the top three since the report was first commissioned in 2014.

When asked which brands perform best within the sector, McDonalds is in top position, followed by Nando’s in 2nd place and Wetherspoons in 3rd place. The top ten brands are:

- McDonald’s

- Nando’s

- Weatherspoon

- Pizza Hut

- Frankie & Bennies

- TGI Fridays

- Harvester

- = KFC

- = Subway

- Costa

“Interestingly the top brands all hold a strong ‘value for money’ proposition, something not always synonymous with the best customer experience” explains Joe Heapy, Engine co-founder.

“However, the top-scoring brand, McDonlad’s, has worked hard to evolve its menu, identity and service offering with new healthier options, self-serve touch-screen ordering and McDelivery in partnership with Uber Eats. They are a great example of a business that has listened to its customers and redesigned their service to meet evolving expectations and preferences.”

Heapy adds “It's also evident that new entrants into the delivery chain such as Deliveroo and Just Eat are not yet considered a valued part of the food service ecosystem as none of them featured in customer votes.”

The same report also found that the most trusted brands are those with both an online and physical high-street experience, as cited by 36 percent of respondents versus just 14 percent for online only.

“Customers have come to expect their interactions to be seamlessly joined-up across all of the touchpoints, whether in person, online, on the move or enabled by partners. With middle-market long-standers like Jamie’s Italian closing, and Carluccio’s and Pizza Express struggling, this is a sector that can’t afford to stand still” says Heapy.

“To remain relevant and feel special to consumers, brands need to reinvent themselves with stronger value propositions and memorable customer experiences.”

For further information and to download a full copy of the report, click here.

Reputation Management Revolution

Uberall, Inc. released its first “Reputation Management Revolution Report,” a global benchmark report analyzing the impact of customer reviews on brands and consumers. For the report, Uberall analyzed the Google My Business (GMB) profiles of 64,000 global (+740 reviews per location), enterprise (+10 locations) and SMB (>10 locations) business locations in four countries — US, UK, France, and Germany.

“Near me” searches – localized mobile searches for brands and products close by – have exploded. Today, 82 percent of people have tried a “near me” search on their mobile devices. Among millennials, “near me” adoption is even greater, at 92 percent.* More than ever, as search engine and smartphone technology has advanced, consumers are prioritizing proximity and convenience.

For brick-and-mortar brands, online customer reviews are a key part of the “near me” brand experience. When conducting “near me” searches, consumers often turn to reviews and star ratings of locations across platforms like Yelp, TripAdvisor, Facebook, Instagram, Google, and more. In fact, almost half of all consumers have left such a review online,** with 95 percent influenced by reviews in their buying decisions.***

With that in mind, key findings from Uberall’s “Reputation Management Revolution Report” include:

● A Review Rating Increase of 0.1 Can Boost Conversion by up to 25 percent — Unsurprisingly, the higher the star rating of a business location, the higher the conversion rate. Conversion rate is a combination of phone calls, requests for driving directions and website clicks. However, even a marginal increase has a dramatic impact. Uberall found that a star rating increase of just 0.1 could increase the conversion rates of a business location by 25 percent

● Getting to a 3.7-Star Rating is a Key Benchmark — Locations that move from a 3.5 to a 3.7-star rating experience conversion growth of 120 percent — the highest percentage growth jump from any star rating. This means that a business location’s first priority should be to get all their locations above the 3.7-star rating threshold. Uberall also identified three specific review benchmarks businesses need to reach to achieve the best growth for their locations: 3.7 stars, 4.0 stars and 4.4 stars.

● A Review Reply Rate of 30 percent Wins More Customers — Global and enterprise business locations have the lowest review reply rate. Reply rates by business type were SMB (25 percent), enterprise (12 percent) and global brands (9 percent). However, Uberall found that a 30 percent reply rate is the benchmark for conversion growth to outstrip competitors. For example, when enterprise locations replied to at least 32 percent of reviews, they achieved 80 percent higher conversion rates than direct competitors and SMBs that replied to just 10 percent of reviews.

“A star rating increase of 0.1 can boost a listing’s conversion rate by 25 percent,” said Norman Rohr, SVP of Marketing at Uberall. “Consumers who are engaging with the brand are also extremely likely to visit a store within 24 hours, so a 25 percent rise in conversions could also mean a 25 percent increase in foot traffic every day. By focusing on review star rating and reply rate, brands can massively impact their overall conversion rates.”

Per Uberall’s analysis, when broken down by business size, SMBs are averaging higher conversion rates than the bigger brands until the 4.4-star rating mark. At that point, global and enterprise businesses start to outperform SMBs. A rating increase from 3.7 to 4.4 can increase a global brand’s conversion rate by 120 percent, while an enterprise location’s rates go up by 80 percent.

“SMBs, more so than bigger brands, rely on customer reviews to drive brand awareness and visibility,” added Rohr. “As a result of that, they are performing better than the enterprise and global brands, who typically have lower review rates and lower reply rates. To outperform both larger and smaller businesses in their area, SMBs need to be focused on replying to a large majority of reviews and keeping their rating above the third star rating benchmark of 4.4.”

For the full “Reputation Management Revolution Report,” click here.

Fraud Aftershock Index

Sift released its Fraud Aftershock Index, depicting the interconnectedness of industries as it relates to fraud, including how fraudsters move freely from one industry to another and are not limited to one type of fraud. In response to this research, Sift is unveiling new resources and technology features to allow businesses to mitigate risk and deliver positive customer experiences.

Recent data breaches have given fraudsters a wealth of data to carry out different types of fraud attacks, including posting fake content, creating fake accounts or taking over legitimate accounts. Sift’s Fraud Aftershock Index measures the impact and cadence fraudsters have when they commit multiple types of fraud or operate in more than one industry.

The two major aftershocks include:

● Fraud Type Aftershock: 45 percent of fraudsters commit more than one type of fraud

● Industry Aftershock: 86 percent of fraudsters commit fraud in more than one industry

“Today’s approaches of combating fraud are like rigid and invasive airport screenings,” said Jason Tan, CEO, Sift. “With our Digital Trust & Safety Suite, businesses can apply Dynamic Friction across multiple types of fraud to deliver a customized experience, automatically letting legitimate customers through while maximizing fraud prevention.”

Dynamic Friction is the optimal application of friction to user journeys based on behavioral and situational attributes, so protection against fraud doesn’t result in customer insult for legitimate users. In an effort to help businesses combat fraud aftershocks, Sift has made it easy to leverage Dynamic Friction with the release of Verification, a feature within the Digital Trust & Safety Suite that allows businesses to introduce multi factor authentication (MFA) at the right moment in the user journey. Verification provides online businesses the ability to apply Dynamic Friction with a single click, without requiring integration with additional tools. With Verification, trusted customers experience a painless login, while potential fraudsters are met with challenges, and businesses benefit from the alignment of risk mitigation and great customer experiences.

For more information on why businesses should leverage Dynamic Friction, download Sift’s eBook here.

For more details on Verification, download the one pager here.

Foot Traffic Analyses

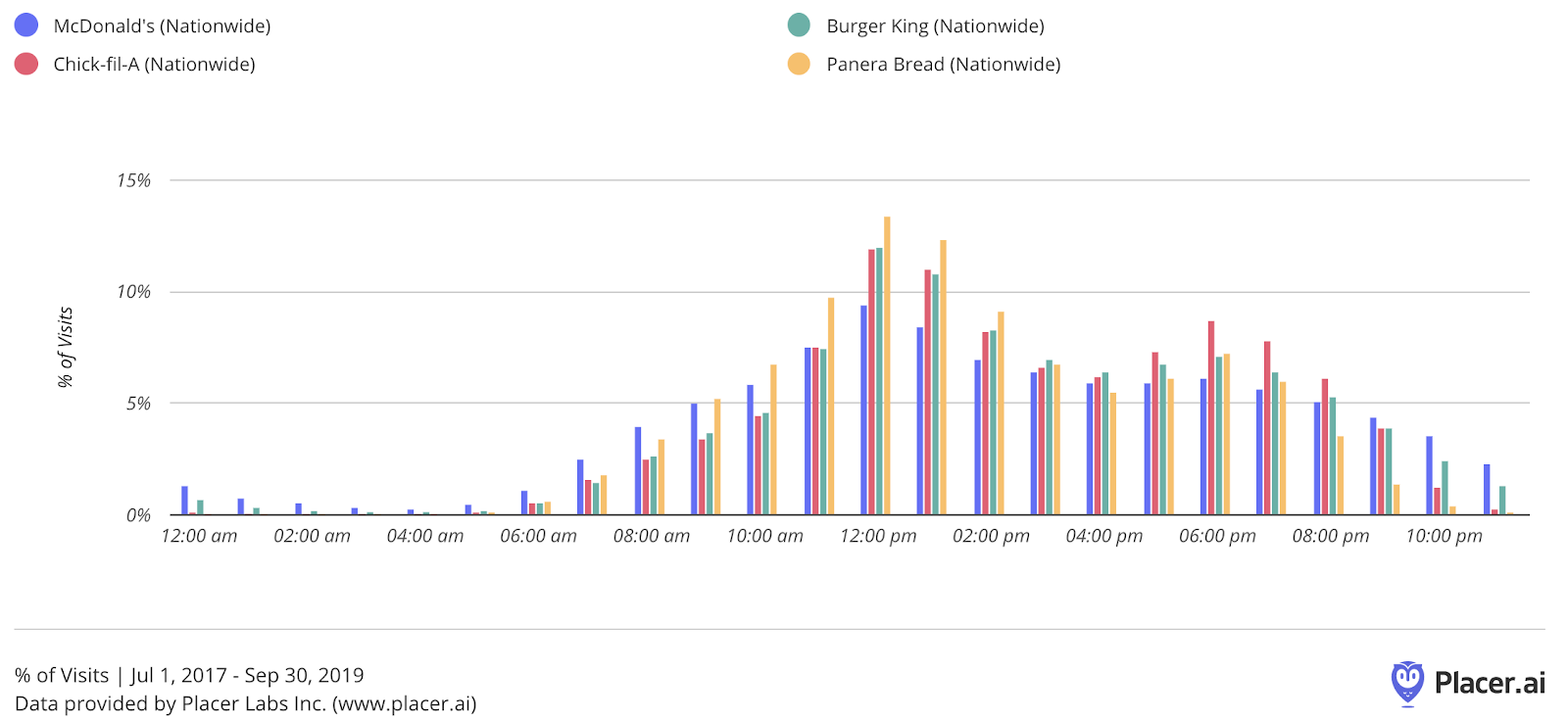

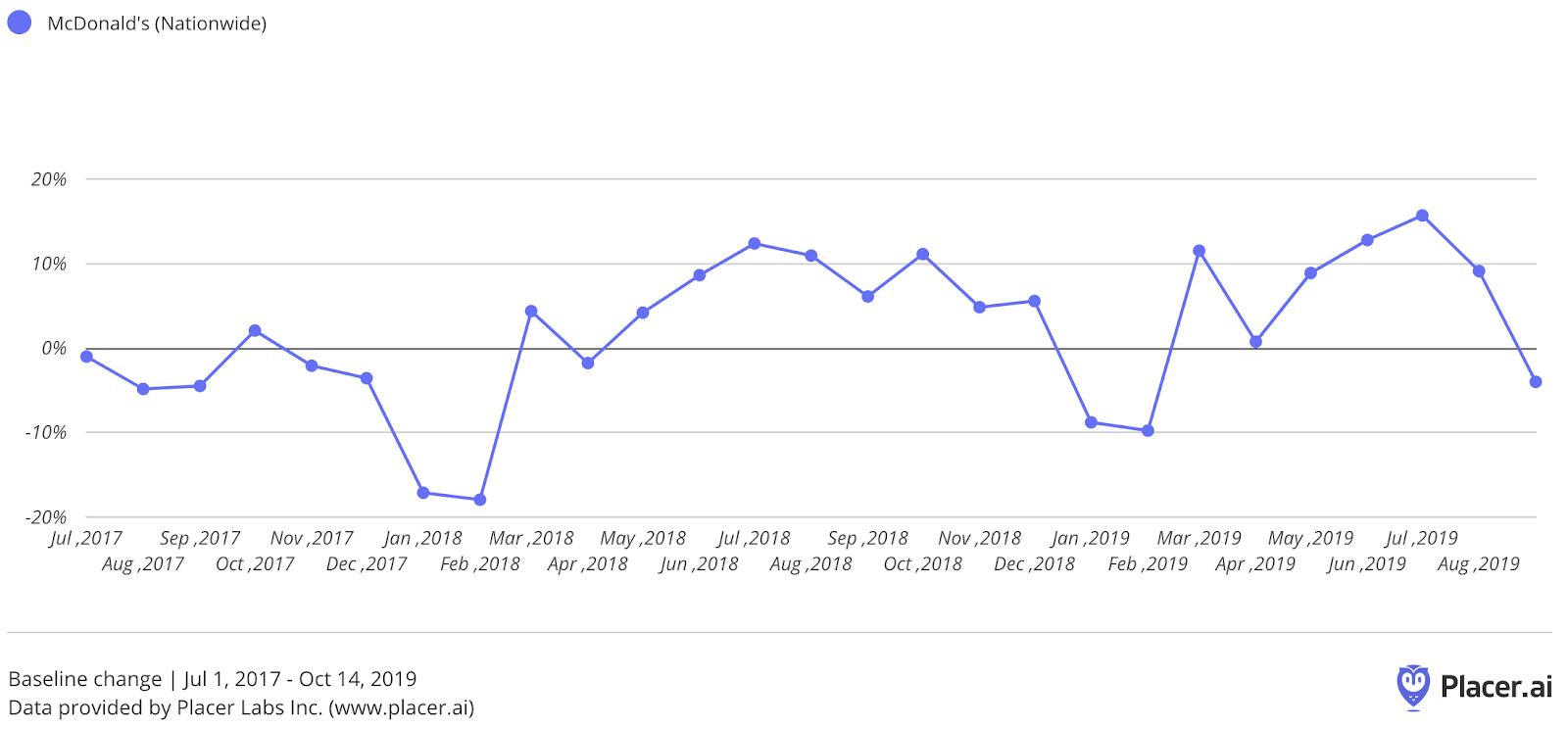

The Silicon Valley-based Placer.ai, , did a quick dive into the foot traffic data. Placer.ai’s Ethan Chernofsky (VP of Marketing) summarized the findings as follows:

- In a summer that saw the Chicken Wars drive huge value for the likes of Popeyes, KFC and others, the king of Fast Food did not fair as strong. According to their latest earnings, in-store visits were down, buttressed only by an increase in prices to provide a sales boost. But the picture surrounding McDonald’s (MCD) is slightly more complicated.

- McDonald’s visits in July were 15.7 percent above the baseline for the period from July 2017 through September 2019. This is significantly higher than the 12.4 percent mark set in July 2018 and was saw 3.0 percent more estimated visits in July Year-over-Year. Yet, August and September were both down year over year at 9.1 percent above the baseline and 4.0 percent below, compared to 10.9 percent above and 6.1 percent above in 2018.

The good news in McDonald’s case is that even the dips in 2019’s August and September are still above the same months in 2017, showing the overall growth. Yet, the downside is that a quick cure-all is going to be difficult to come by. According to a report, the company will look to breakfast to drive numbers. The problem with this strategy is that McDonald’s is already strong at breakfast, making the likelihood of a massive surge unlikely. Not only are they better in terms of morning distribution than other Fast Food leaders, but they even have similar strength to more breakfast oriented competitors like Panera.

The result is a likely need to have more minor revamps to specific menu items and to more effectively cash in on campaigns and events. For example, McDonald’s summer push on an expanded Buy One Get One free menu didn’t drive the expected impact.

In the last two years, Subway shuttered nearly 1,000 locations. One primary problem is that the push to expand too quickly led to an overabundance of stores and shrinking sales. Placer.ai, dug into the numbers to analyze the situation.

Despite being remarkably steady since the beginning of 2017, Subway has a high level of seasonality; traffic dips in the winter before rebounding in the spring. But, the data shows a bright side for 2019, which is that the summer peak was higher than normal. July and August’s traffic was 10.2 percent and 5.9 percent above the baseline for the period, beating out the 3.4 percent and 4.4 percent peaks in those same months in 2018. Placer.ai believes Subway has a strong chance to further optimize the value of each location by identifying ways to reverse their seasonal trends

But it is also clear, based on the data, that the concerns about overexpansion leading to cannibalization are very real. Placer.ai found many Subways actively compete with each other. Placer.ai concludes that the company should take a more targeted approach to expansion, which may help push the brand into new markets with maximum impact.

For the full report, click here.

Inspire Brands, the owner of the Arby’s, Buffalo Wild Wings, and Sonic restaurant chains recently added Jimmy John’s sandwich chain to its portfolio. Placer.ai, t dug into location data to see how the brand is performing and where its growth potential lies.

Some quick findings:

- Jimmy John’s shows significantly higher baseline growth than Subway compared to January 2019.

- Both Jimmy John’s and Subway see the majority of their traffic during the afternoon hours (47.7 percent of all Jimmy John’s visits occur between 12:00 pm and 3:00 pm).

- Jimmy John’s shows a weak winter season but a very strong summer performance.

- Jimmy John’s has the potential to be a great addition to QSR’s portfolio. But, the most interesting impact could be a push to help the sandwich chain expand its peak hours into the evening. Placer.ai concludes a successful expansion into dinner could offer a huge potential return.

To read the full report, click here.

The Battle for Breakfast

Many QSR and fast food chains are putting a lot of resources into their breakfast menu to keep pace with competitors. Wendy’s even announced last month their re-entrance into the ‘breakfast war.’ But, who’s actually winning the battle for morning hunger?

According to social insights firm, Fizziology, Chick-fil-A is dominating the breakfast game with 428 percent more social buzz than McDonald’s, who the data highlighted as second in breakfast-specific mentions. Chick-fil-A earned over 257k mentions because their traditional breakfast sandwich was the most frequently discussed product. Consumers also conveyed on social that the brand was “undefeated” against other fast food options that dominated breakfast-focused conversation.

Breakfast specific mentions from social users over the past six months, according to Fizziology data:

- Chick-fil-A: 257K

- McDonald's: 48.5K

- Taco Bell: 25K

- Burger King: 7K

- Subway: 6K

- Wendy’s: 6k

Wendy’s, although at the bottom of the list, only received 16 percent fewer breakfast mentions when compared to Burger King, despite Burger King serving breakfast since 1978 and Wendy’s announcing their new breakfast menu last month.

Going All in on Digital

Uber, Amazon, Airbnb, DoorDash and other apps have created a consumer with little patience and expectations higher than ever. If something doesn’t work how we want, we abandon it within seconds. Now, fast-food giants such as McDonald’s have changed their business model to adapt to the hyper-digital consumer.

The restaurant industry is uniquely primed to use digital experiences to its advantage. Imagine having a customized menu tailored to your food preferences or allergies – similar to how Amazon curates recommended products and Netflix suggests new shows to watch.

According to new data by AppDynamics, consumers embrace this shift and are ready to back companies with the same mindset:

- Over the next three years, 85 percent of consumers expect to select brands on the variety of digital services (web, mobile, connected device, etc) they provide

- 54 percent of consumers now place a higher value on their digital interactions with brands than their physical interactions

- 50 percent would be willing to pay more for an organization’s product or service if its digital services were better than a competitor

Cooking at Home, Sustainability and Wellness on Menu for 2020

More home cooking, less food waste, flavors from East Africa and the end of cauliflower’s moment in the spotlight are some of the predictions for 2020 that emerged at the fifth annual The Next Big Bite trends event presented by Les Dames d’Escoffier New York (LDNY).

Panelists included Justin Chapple, culinary director at large at Food & Wine, Jake Cohen, editorial and test kitchen director of feedfeed, Gaby Dalkin, creator of the website What’s Gaby Cooking, Cassy Joy Garcia, a nutrition consultant and creator of the influential Fed + Fit blog and podcast, Vallery Lomas, a lawyer turned baking blogger and winner of ABC’s season three of The Great American Baking Show and Megan Scott, a member of the team behind the new edition of the Joy of Cooking.

Sarah Carey, editorial director, food and entertaining, for Martha Stewart Living served as moderator. The keynote was delivered by Deb Perelman, a self-taught home cook and creator of the super popular cooking blog Smitten Kitchen. Jessica B. Harris, noted culinary historian and orator, presented the closing keynote.

Perelman said her vision for 2020 isn’t driven by the next big thing. Instead, like many cooks juggling work and family, she’s “just looking for my new favorite thing to cook. And hopefully in time for dinner.”

Nevertheless, Perelman predicts shifts in dining habits. People will cook and entertain more at home amid economic and political uncertainty, and will be more adept at preparing meals thanks to the wealth of information available. “They’ll be cooking as a break from the news,” she said.

Against a backdrop of changing tastes and concerns about wellness and the environment, panelists agreed that interest in cooking—and cookbooks–will remain strong. “More and more folks want to learn,” said Chapple, who noted that many people buying his own cookbooks are doing so for kids.

Garcia, who has built a strong online following across various platforms, said cookbooks give her audience something tangible. “That is a really important touchpoint for people when we are so digital,” she said.

Panelists shared trends they wish would disappear: baby vegetables, diet and nutrition fads such at keto and paleo, associating cocktails with health benefits, and charcoal in food such as the baguettes Lomas found on a recent trip to Paris. Perelman noted her Smitten Kitchen audience is losing interest in cauliflower versions of items such as rice, pizza and gnocchi and other trendy items including pumpkin spice, avocado toast, aquafaba, truffle oil, pink salt, instapots, meal kits and more.

Panelists said food trends to look for include sustainable seafood, vegan alternatives for recipe ingredients and more interest in spice and acid.

Harris, who gave her keynote address via video, predicts we’ll be seeing more “new foods from unknown and untapped, or unheralded cultures.” Examples include fonio, a gluten-free grain from Senegal likened to a cross between quinoa and couscous, ahi peppers from Peru, and new rice varieties and greens. She also expects to see more foods from Eastern Africa, including Kenya, and Caribbean food “going beyond jerk, rice and peas” such as callaloo and a “deep, richly seasoned” pepperpot stew

“Food is culture. What’s on our plate often reflects who we are. In the upcoming year we will be serving it up and savoring it thoroughly. We will need that comfort because we have got a lot going on,” Harris said.

The Next Big Bite was sponsored by Kerrygold, Wolf Gourmet, Melitta, Hestan Culinary, Niman Ranch, Abigail Kirsch, Catskill Provisions, Ramona, Kris Wine, La Caravelle Champagne, Los Dos, New Belgium and Liberty Coca-Cola.

Growing Demand for Vegan Pasta

The vegan pasta market is on a pace to grow ~9 percent annually through 2029, propelled in bulk by the global rise in vegan and plant-based eating with astounding stats. Affluent millennial in particular has been the central driver of the worldwide shift away from consuming animal-based products – giving a boost to the demand for vegan pasta in the fast growing global F&B industry. These insights are based on a report on Vegan Pasta Market by Future Market Insights.

In 2019, worldwide sales of vegan pasta, contributed by both conventional and organic variants, are estimated to reach a value of ~US$ 136 Mn. Demand for conventional vegan pasta continues to ride on wider availability, and its relatively low cost has made it the product of choice among consumers.

Key Takeaways from the Vegan Pasta Market Study

- The steady demand for conventional vegan pasta is likely to suffer with upsurge in the popularity of organic food products.

- Organic vegan pasta will fare much better in line with increased emphasis on good health and growing incidences of food adulteration.

- Wheat has long remained the preferred source or primary ingredient for traditional pasta, and continues to capture substantial share in the new vegan pasta space.

- Certain limitations or adverse effects of wheat including gluten intolerance are likely to compelled manufacturers to explore other sources to offer gluten-free options.

- Study reports that demand for legumes and fava beans as a source of vegan pasta will increase with striking CAGR of ~12 percent and ~14 percent respectively through 2029.

- As compared to developing regions, the sales of vegan pasta are envisaged to be higher in the countries of North America and Europe.

“As the growth of vegan culture and vegetarianism is expected to be quite strong going forward, vegan pasta will go mainstream with manufacturers centering on extended portfolio and branding their products with nutritional and environmental benefits,” says the report analyst.

Product Innovation Focused on Healthier and Sustainable Diets

The vegan pasta market is still at its infancy, with plenty of room for improvement. A variety of vegan pasta is likely to hit the shelves in the near future, as manufacturer prioritize ‘organic’ and ‘gluten-free’ aspects to ensure higher product quality and nutritional benefits.

Traditional pasta companies as well as many startups are set to capitalize on the steadily expanding market.

Barilla stays ahead in the game with the launch of one-ingredient legume pasta, made with just chickpeas and red lentils, in September 2018.

Veganism as a concept is practically unknown in remote areas and certain cities in developing countries, signifying a relatively low growth prospects of vegan pasta market in regions such as South Asia and Middle East & Africa. The scenario may change in the next ten years on the account of macro factors including internet penetration, which has been fueling the unification of media and food culture.

Shopper Recall

Leveraging behavioral data in conjunction with attitudinal insights may help researchers close the recall gap, based on a new study released today by consumer insights platform DISQO. The report assesses the variation between what consumers recall shopping for online versus their actual behaviors, which is known as the consumer recall gap.

Participants were members of the DISQO Audience who had opted in to behavioral tracking, which measured their digital shopping activities in comparison to their individual responses to survey questions. The study assessed whether individual responses matched corresponding behaviors.

The study found that while consumers are able to recall general behaviors with relative accuracy, their recollection of specific shopping activities faltered.

Respondents overestimated online shopping for electronics up to 26 percent

Respondents overestimated online shopping for personal care items up to 35 percent

The divergence between what consumers report and their actual behavior is not a new concern. However, it is rarely measured. As a result of DISQO’s study, the importance of leveraging multiple market research methodologies, particularly to better understand what people say and do, has been quantified.

“We are always investigating and advancing the pursuit of data quality and accuracy. Incorporating behavioral signals into our market research is an important step toward that goal, and must be deployed to get an accurate view of consumer activity,” said Carl Van Ostrand, VP of Consumer Insights at DISQO. “While surveys are crucial in understanding audience sentiment, reliance on recollection alone provides only a partial picture. By unifying attitudinal and behavioral data, marketers and researchers can attain a higher level of clarity and understanding.”

Understanding online behavior has been a priority for e-commerce sites for years, and now even traditional brick-and-mortar retailers are starting to take notice of the need to better understand the digital path to purchase. For instance, the online grocery shopping industry is expected to soon reach $100 billion a year domestically (Source: FMI and Nielsen 2018), and major grocers are starting to take notice.

Yelp Economic Average

Yelp Inc. released third quarter data for the Yelp Economic Average (YEA), a benchmark of local economic strength in the U.S. The report finds slow national growth, up by only .07 percent in the third quarter, as several of California’s local economies continued long-term declines, led by San Jose and San Francisco.

YEA is calculated from the fourth quarter of 2016, nationally and for 50 metros, reflecting data from millions of local businesses and tens of millions of users on Yelp’s platform. The report measures local economic strength through business survival and consumer interest. For every quarterly release since the introduction of YEA earlier this year, its change from the prior quarter has matched the change in GDP growth. According to researchers, Yelp provides a timely and accurate measure of a huge swath of the economy that is often missed by many major indicators.

“As China trade tensions, Fed deliberations, and impeachment inquiry talk trickles down to Main Street, the Yelp Economic Average has barely budged,” said Carl Bialik, Yelp’s data science editor. “At the same time, California’s biggest local economies are continuing to struggle. Construction limits and increasing rent are pushing consumers and workers farther from businesses, contributing to continued quarterly declines in some of the state’s biggest metro areas, with retail and restaurants taking the biggest hits.”

California’s Local Economy Declines

While reports show that California’s position in the national and global economies is strong, the state has seen the biggest decline in local economic activity among the 50 major U.S. metros YEA tracks. San Francisco, San Jose and San Diego all rank in the bottom five metros, while Los Angeles is in the bottom ten and Sacramento places below average. Limits to development around California have driven up housing costs, which has restricted the supply of workers, raised labor costs, and limited consumption, according to the McKinsey Global Institute.

California’s shopping businesses have been hardest hit, ranking at the bottom in each of the five California metros, with stores selling shoes, cellphones, and women’s clothing falling the sharpest. Restaurants, food, and nightlife categories are also struggling in all five California cities. The declines range from 2.6 percent in San Diego to 9.3 percent in San Jose, with an above-average fall of 6 percent in San Francisco. As rents in San Jose and San Francisco have surged, retail and restaurants have felt the impact.

San Francisco and San Jose have particularly struggled with construction limits and rents, and they’ve consistently ranked as the bottom two metros in the economic average in each of the last three quarters. The other California metros had been doing better at times but dipped in performance heading into this quarter.

New Fast Growing Cities Emerge

Buffalo (NY) and Pittsburgh (PA) join Milwaukee (WI), Honolulu (HI), and Portland (ME) in the top five boomtowns this quarter, knocking out Louisville (KY) and Memphis (TN) from last quarter. Home services businesses have been among the strongest in all five of the top metros. Local factors also propelled these boomtowns to their success, including food trucks in Milwaukee, life coaches in Buffalo, junk removal in Honolulu, juice bars in Portland, and software developers in Pittsburgh.

Shopping and Lower-Priced Restaurants Gain Ground

While still below its level three years ago, retail gained ground for a second straight quarter. Stores selling items that shoppers might want to check out in person were among the gainers: sporting goods, appliances, hardware stores, antiques, furniture stores, and art galleries. Department stores and women’s clothing also advanced. Cellphones and computers, which previously lost business to online retail, made a bit of a comeback this quarter.

Lower-priced and stay-at-home options were among the strongest in the restaurants, food, and nightlife categories, while several types of upscale restaurants declined, indicating a shift toward value and eating in. The strongest types of food and drink businesses in the third quarter included chicken wings, pizza, and sandwiches; and grocery stores, delis, and stores selling beer, wine and spirits.