According to a Recent Study/Survey … End-of-November 2016 Edition

16 Min Read By MRM Staff

As part of our mission to be the go-to resource for on-the-go restaurant industry professionals, Modern Restaurant Management magazine (MRM) offers highlights of recent research. This end-of-November edition features news of a downgraded forecast, Small Business Saturday success and the love of sugar.

Restaurant Struggles Expected to Continue

As consumer traffic declines, it appears that both 2016 and 2017 will not be as positive as first anticipated based on Technomic’s restaurant industry forecast released in May of this year. In particular, full service restaurant growth has been shaved by 1.4 and 0.8 points for 2016 and 2017 respectively, to where total segment nominal growth for each year is expected to be 3.5 percent. With inflation expected to be 2.7 percent in both years, real growth will only be 0.8 percent.

“Major full service chains, especially in the casual dining sector of the market, are really struggling,” states Joe Pawlak, Technomic Managing Principal. “Consumer economic uncertainty, value issues, and undifferentiated positions are putting strains on many full service chains. However, independents seem to be holding their own as consumers are gravitating to these establishments due to their unique offerings, local orientation and strong value propositions.”

In the limited service sector, Technomic’s nominal projections have been reduced to 4.5 percent and 4.9 percent for 2016 and 2017 respectively (from 5.5 percent and 5.7 percent). In particular, a slowdown in the fast casual sub-segment is driving these downgrades.

“Menu prices at some fast casual restaurants have risen to a level where the perceived value for a typical consumer has eroded,” says Technomic Principal Erik Thoresen. “Add to that the struggles of Chipotle, which represents a sizeable share of the fast casual industry, and it was evident that forecast revisions in for 2016 and 2017 were necessary.” Despite these changes, fast casual still remains among the fast growing sectors of foodservice.

America’s Favorites

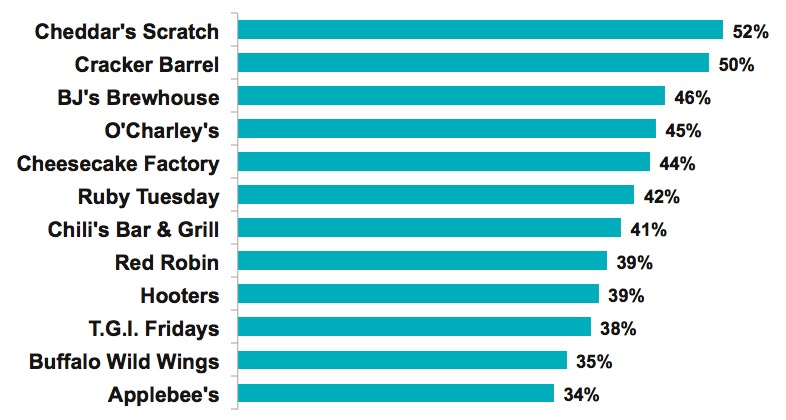

Cheddar’s Scratch Kitchen is America’s favorite general menu casual dining chain, according to a new study by Market Force Information®. More than 9,200 consumers were polled for the study, which ranks casual dining restaurant chains in seven categories: general menu, pizza, Italian, breakfast, buffet, steakhouse and seafood. This is the first time that Cheddar’s Scratch Kitchen has earned enough votes to be included in the rankings.

The nationwide study also found that in-restaurant tablet use is up, TripAdvisor is the most influential mobile app among casual dining guests, and restaurant-branded apps are suffering from an awareness problem.

Cheddar’s Scratch Kitchen Edges out Cracker Barrel

Texas-based Cheddar’s Scratch Kitchen, which has 160 locations nationwide and is known for its made-from-scratch meals, ranked first among general menu restaurants with a score of 52 percent. Cracker Barrel, which led in the previous study, ranked second with 50 percent. BJ’s Brewhouse, O’Charley’s and Cheesecake Factory rounded out the top five. Interestingly, Cheesecake Factory dropped 11 percentage points this time around.

Cheddar’s Wins on Food and Value, Hooters on Friendly Service

Why are Cheddar’s Scratch Kitchen’s guests so satisfied and loyal? Market Force asked respondents to rate the top 12 chains by various attributes and found that Cheddar’s Scratch Kitchen leads in two key areas – quality food and value – and tied for first in atmosphere and addressing allergens. O’Charley’s has the fastest service, while Cheesecake Factory stood out for its menu variety, and Ruby Tuesday for its healthy options. Hooters led in friendly service and delivering an experience, an increasingly important category in the casual dining sector.

“Casual dining restaurants face fierce competition from fast casual brands. This research shows that consumers are questioning the value proposition of casual dining because they are not seeing the increase in food quality given the higher price—and a full service seems to matter less. Fast casual can be on par with food quality and offer a lower price-point,” said Cheryl Flink, Market Force’s chief strategy officer. “Still, diners are seeking an experience when they go out for a casual dining meal, so that’s an area that these chains can exploit to pull ahead of this new competition.”

Pizza Chains

In the hotly debated pizza category, Pizza Ranch took the pie with a score of 55 percent, with California Pizza Kitchen ranking second at 50 percent and Old Chicago nabbing the third-place spot with 43 percent. Others on the list included Cici’s, Round Table Pizza, Pizza Hut and Chuck E. Cheese. Pizza Ranch, which offers a buffet-style service, was top rated for its menu variety and friendly service, and ranked in the top three in most other categories. California Pizza Kitchen earned the highest marks for quality food and healthy food options. Cici’s dominated in the value category and ranked first for fast service. Chuck E. Cheese was far and away the favorite for delivering an experience, rather than just a transaction.

Italian Chains

For the third time in a row, Maggiano’s has been named America’s favorite Italian chain, earning a 61 percent score. Carrabba’s Italian Grill received a 56 percent to again land in second place, while Olive Garden ranked third and Romano’s Macaroni Grill was fourth. Maggiano’s led in most of the categories, receiving first-place scores for every category except fast service, receiving particularly strong marks for value, menu variety, experience and atmosphere, and tying for first alongside Carrabba’s for quality food and friendly service. Carrabba’s also led in fast service and healthy food options.

Breakfast Chains

Bob Evans Restaurants continue to delight diners who are looking to eat breakfast at any time of day. The Ohio-based chain once again ranked first among casual dining breakfast options, and Waffle House and Mimi’s tied for second. Village Inn ranked third, IHOP and Perkins tied for fourth and Denny’s was fifth. Bob Evans took the top spots for menu variety and healthy food options, but Mimi’s Café won when it came to high-quality food. Waffle House was lauded for having the best value and fastest service. It also tied for delivering an experience, but the experience scores in the breakfast category were overall very low and tightly clustered, with no one brand standing out.

Buffet Chains

Market Force also looked at which buffet chains are leaving guests the most satisfied, and found that Pizza Ranch is a clear leader with 55 percent. Golden Corral overtook Hometown Buffet to rank second with 40 percent, and Cici’s Pizza ranked third with 35 percent. Hometown Buffet and Old Country Buffet rounded out the top five. Pizza Ranch was found to have the best food, friendliest service and most inviting atmosphere. Golden Corral ranked No. 1 for menu variety and healthy options, and tied with Hometown Buffet for delivering an experience. Cici’s Pizza was the value leader.

Steakhouse Chains

In the battle of the beef, Texas Roadhouse was the winner for the second consecutive time. It earned 58 percent to surpass second-place Longhorn Steakhouse, which received a 59 percent. Outback Steakhouse trailed with 48 percent and was followed by Logan’s Roadhouse and Sizzler. Not surprisingly, Texas Roadhouse was the top scorer in nearly all of the categories that are most important to diners, such as quality food, value, friendly service, atmosphere, experience and variety. Sizzler was lauded for its fast service and array of healthy choices. Longhorn Steakhouse performed wall across the board, landing in the top three of every attribute studied.

Seafood Chains

Market Force received enough viable data to include a seafood category this year, after leaving it out of previous studies. Pappadeaux, which recently celebrated its 30th anniversary, led the pack with 62 percent. Bonefish Grill earned 55 percent, placing it second, while Joe’s Crab Shack was third with 49 percent, and Red Lobster was fourth with 47 percent. Pappadeaux secured the highest scores in key food and service categories, including quality food, menu variety and fast service. Joe’s Crab Shack tied with Pappadeaux for friendly service and experience, and slightly edged it out for value. Bonefish Grill had a strong showing in the food-related areas, ranking first for healthy options and second for quality food and menu variety.

Casual Dining Frequency and New Trials

Market Force also looked how often consumers are patronizing casual dining restaurants, as well as which brands they’re trying for the first time. General menu and breakfast chains are the most frequented types of restaurants – 83 percent said they’d visited a general menu restaurant in the previous 90 days, and 54 percent had dined at a breakfast restaurant. Seafood and buffet chains had the highest number of first-time visitors among all restaurant sectors that were studied.

Tech Trends Taking Hold (and Not) in Casual Dining

Casual dining guests are more frequently using tablets in-restaurant, but do they value them? Market Force found that 37 percent had been provided with a tablet during their recent visit and, of those, 87 percent had used it. The most popular activities were paying the bill and viewing the menu, while few used them to look up nutritional information and provide feedback. However, guests failed to give tablets high ratings for improving their experience – only one-fifth said they make the experience more enjoyable, allow them to control their experience or reduce wait times.

The number of people who are downloading restaurant apps remains steady at 41 percent, and they’re mainly using them mainly to view menus, read reviews and find locations. Yelp is the most downloaded restaurant app, although TripAdvisor and Restaurant.com have gained serious momentum, with adoption rates that grew from one percent to 35 percent and 25 percent, respectively, since the previous study.

TripAdvisor is also wielding strong influence over diners’ choices. Nearly half – 48 percent – said that TripAdvisor ratings impact their restaurant choices, which is higher than Yelp’s 41 percent. Also, more indicated that they’re likely to leave a positive or negative review on TripAdvisor than they are on Yelp or other restaurant apps.

The survey was conducted online in October 2016 across the United States. The pool of 9,216 respondents represented a cross-section of the four U.S. census regions, and reflected a broad spectrum of income levels, with 53 percent reporting household incomes of more than $50,000 a year. Respondents’ ages ranged from 18 to over 65. Approximately 74 percent were female and 25 percent were male.

Small Business Saturday Success

As Small Business Saturday wrapped up its seventh year on Saturday, the outpouring of support for local businesses—including restaurants– across the country hit record highs with 72 percent of U.S. consumers aware of the day. More shoppers reported visiting local independent businesses on Small Business Saturday this year than ever before, according to results from the Small Business Saturday Consumer Insights Survey, released by the National Federation of Independent Business (NFIB) and American Express. This year, an estimated 112 million consumers reported shopping at small businesses on Small Business Saturday, marking a 13 percent increase from 2015.

Small Business Saturday saw record levels of support from communities and local organizations in 2016. More than 6,700 Neighborhood Champions from the Great Lakes to the Gulf Coast and from the Pacific Northwest to New England rallied local businesses and created events in their communities for Small Business Saturday — an increase of 63 percent over last year. Additionally, the estimated number of small business owners reached through the Neighborhood Champion program was 2.1 million.

More than 480 organizations joined the Small Business Saturday Coalition, a 13 percent increase over last year. The Coalition, a group created in 2011 to help amplify the Shop Small® message, is comprised of national, state and local associations that help coordinate activities for Small Business Saturday with consumers and small business owners.

Consumers came together to show their love for small businesses on Small Business Saturday. Among those who shopped on the day, 32 percent reported attending a community event, and 81 percent reported encouraging friends or family to shop or dine at small, independently-owned retailers and restaurants on the day as well, both on par with 2015.

Additionally, consumers and small businesses helped rally support for Small Business Saturday and their favorite small businesses on social media channels. So far this month, there were 135 million social media engagements in support of Small Business Saturday, up from 85 million in 20151.

“It’s exciting for us to see the record number of consumers who came out in support of independently-owned businesses on Small Business Saturday,” said Elizabeth Rutledge, EVP of Global Advertising and Media at American Express. “People across the country are aware of the benefits that small businesses can bring to the community, and the momentum that was started seven years ago with the first Small Business Saturday continues to build.”

At a time when an increasing number of consumers are opting to shop online—and are spreading their holiday shopping spending over a longer period of time than they did traditionally—many still prioritize visiting brick and mortar small businesses on Small Business Saturday. According to the survey, among U.S. consumers who went out and shopped in-store, total reported spending reached an estimated $15.4 billion at independent retailers and restaurants on the day, a decrease from the estimated $16.2 billion spent in 2015.

“Small businesses across the nation are often run by the friends, family, and neighbors that we know well, so supporting them is not only personal but critical to their success,” said NFIB CEO and President Juanita Duggan. “Partnering with American Express to promote the awareness and importance of shopping small is something we are very proud of, and look forward to continuing the success of Small Business Saturday.”

Top Chefs of the Past and the Future

The top 10 chefs of the past and next decade in the U.S. have been revealed today by Elite Traveler, the private jet lifestyle magazine, alongside food critic Andy Hayler.

Nicknamed “The Michelin Man”, Hayler has reportedly eaten at every three Michelin star restaurant in the world.

|

Most Influential Chefs of the Past Decade |

|

Thomas Keller |

|

Dan Barber |

|

Charlie Trotter |

|

Daniel Boulud |

|

Jean Georges Vongerichten |

|

Most Influential Chefs of the Next Decade |

|

Dominique Crenn |

|

Joshua Skenes |

|

Daniel Humm |

|

David Chang |

|

Grant Achatz |

Featured the list of the most influential chefs of the past decade in the US is Thomas Keller. Founder of The French Laundry and Per Se – both of which have earned three Michelin stars each.

Head chef and co-owner of Blue Hill at Stone Barns and author of The Third Plate, Dan Barber’s opinions on food and agriculture have appeared in the New York Times, amongst several other notable publications. Food critic Andy Hayler commented: “Dan Barber’s ‘farm to table approach is having a wide rippled effect on American cuisine.”

Also featured on the list of the most influential chefs of the past decade includes Charlie Trotter, who single-handedly putting Chicago on the culinary map, Daniel Boulud, owner of an entire empire of restaurants that span across the globe, and Jean Georges Vongerichten, responsible for popularizing Asian influences on traditional cooking.

On the list of influential chefs of the next decade – and the only female chef to be featured on either list – is Dominique Crenn. At her San Francisco restaurant, the menu is presented in the form of a poem, while her influence is described by Andy Hayler as “going well beyond her cooking.”

Grant Acahtz is already a world renowned chef, but Andy Hayler expects plenty more great things to come: “With his cutting edge cuisine at three-star Michelin Alinea and the regularly changing culinary themes at Next, Grant Achatz is hugely influential at the cutting edge of high end cooking.”

Other chefs set to make an impact over the next decade include Daniel Humm, chef and owner of three Michelin starred Eleven Madison Park, David Chang of Momofuku and Joshua Skenes of Saison.

Chef Success Begins at Home

Success as a master chef of haute cuisine depends less on going to culinary school than having an innovative support team along the way, according to a new study by John Ettlie, professor and Rosett Chair for Research at Rochester Institute of Technology’s Saunders College of Business.

“The extra ingredients to a chef’s success as an entrepreneur are parents and mentors,” said Ettlie. “If you don’t have innovative parents or mentors, your chances of becoming highly successful are really low.”

Ettlie’s social learning theory, “Observe, Innovate, Succeed: A Learning Perspective on Innovation and Performance of Entrepreneurial Chefs,” was published in the Journal of Business Research in partnership with Celine Abecassis-Moedas and Francesco Sguera, researchers in the Católica Lisbon School of Business and Economics, Lisbon, Portugal.

The team sampled a total of 55 restaurant chefs using two Gourmet Magazine rankings of the top 50 U.S. restaurants. They first investigated how competent role models (parents, mentors, not academics) influenced the innovation behavior of entrepreneurs in the context of haute cuisine, then evaluated how much the chefs’ innovative choices influenced the performance of the restaurants.

“We wanted to see who bubbled to the top in this highly competitive area of haute cuisine,” said Ettlie. “This is not cooking; this is creativity and craft, and food happens to be the medium. What we discovered was that it was the parents who were the primary influence on a high-end chef’s success. It all starts at home.”

Minimum Wage Ramifications

A new R Street Institute policy study—co-authored by R Street associate fellow and Marquette University economics professor Andrew Hanson and Texas Christian University economics professor Zachary Hawley—finds that a one-size-fits-all federal minimum wage increase would lead to significant job losses among the poorest workers.

“A $15 hourly minimum wage would represent a dramatic increase in labor costs for many employers and the cost increase would be spread unevenly across industries, metropolitan areas and the wage distribution. The rise in the cost of labor under a $15 minimum wage would result in substantial job loss, with significant variation across industries and cities,” the authors write.

“The New York metro area alone would lose approximately 170,000 jobs, while Los Angeles, Chicago and Houston each would lose more than 100,000 jobs,” they add. “Nationally, 1.7 million workers in the food preparation and serving industry would lose their jobs, while more than 900,000 workers in office and administrative support occupations would lose their jobs.” Just as concerning, the study finds that the considerable job losses under a $15 minimum wage would hit the poorest workers hardest. For example, in Chicago, the poorest 10 percent of wage earners would endure 28 percent of the job losses, while in Boston, the poorest 10 percent would face 38 percent of the job losses. “The minimum wage is too blunt an instrument to be a useful policy to help improve the lives of the working poor,” the authors conclude. “Although it may help partially realize a policy goal to increase incomes for some workers, it comes with the terrible cost of job destruction for some of America’s poorest workers.”

Best Practices Hotelier-Planner Relationships

A new study shows that although the hotelier-planner relationship is most often collaborative and supportive, there are significant opportunities for improvement throughout the discovery, RFP, and execution phases of the relationship. The Incentive Research Foundation (IRF) and Prevue magazine surveyed 126 hotel sales representatives and 160 meeting and incentive travel planners in the United States about the current state of the hotelier-planner relationship, the existing obstacles to successful collaboration, and realistic ways to build better partnerships.

Among the key findings:

- The majority of both hoteliers (69 percent) and planners (54 percent-67 percent) in the study viewed their relationship with the other side as either collaborative or supportive.

- Depending on the hotel role in question (national sales, property sales, or convention services manager) only between 11 percent and 22 percent of planners viewed the relationship as one of full trust or friendship, with CSMs having the strongest relationships.

- When each group was asked to rank the top challenges they face in their interactions with the other group, the survey results illustrated that both parties come from very different perspectives.

- For both planners and hoteliers, two issues stood out as the biggest obstacles to creating exceptional programs: 1) budgets are rising slower than costs are and 2) space and date availability frequently present challenges.

The eRFP process was also a common source of frustration for both hoteliers and planners, but for reasons unique to each role.

Survey participants also shared concerns about the increasingly transactional and technological nature of the relationship, an issue that needs to be actively addressed in order to create and maintain valued partnerships on an ongoing basis.

IRF President Melissa Van Dyke said, “The hotelier-planner relationship is already highly collaborative, but advancing these relationships to ones of full trust will help increase the outcomes for the partnership and carry both parties through the multiple risk issues facing programs today.”

Juice and Smoothie Market Forecast

In recent years, the perceived high sugar content of some smoothies and juices has forced the Juice and Smoothie Bars industry to adapt its offerings to cater to consumers demanding low-sugar drinks. For this reason, cold-pressed juice, which is made by hydraulically chopping and crushing produce without using heat, thereby yielding highly nutritious juice, has risen to prominence. Industry revenue is expected to increase an annualized 2.8 percent to $2.3 billion over the five years to 2016. The industry is anticipated to grow 2.4 percent in 2016, helped by the popularity of cold-pressed juice. This research is included in IBISWorld’s Juice & Smoothie Bars in the U.S. industry report.

The industry will continue to evolve over the next five years, in line with consumer preferences. Due to increasing competition and less certainty about future consumer tastes, the industry is expected to become more nimble, with juice bars subletting space from existing retailers.

According to IBISWorld Industry Analyst Andrew Alvarez, “The cold-pressed juice craze is expected to continue for at least the short term, as consumers continue to demand menus low in sugar and high in nutrients.” The average industry profit margin is expected to expand slightly, though it will remain low due to fierce competition and rising input prices. Overall, industry revenue is projected to increase over the five years to 2021.

Consumers Demand Transparency

The new golden rule in the U.S. food industry: “An informed consumer is a satisfied consumer.” This extends not just to the information printed on labels for products such as frozen or shelf-stable foods, but also increasingly includes fresh meat and poultry sold both at retail and featured on foodservice menus, according to market research firm Packaged Facts

“Perhaps more than ever before, consumers want to know about what’s in their meat and poultry, how it was raised and where it came from. This need to know taps a breadth of concerns related to food healthfulness and sustainable practices,” said David Sprinkle, research director, Packaged Facts.

For many consumers, choosing a meat and poultry dish revolves around keeping it real: they seek all-natural choices that reflect their desire to keep human intervention they perceive as negative out of the process. Packaged Facts’ survey data reveals that more than 6 in 10 restaurant meat and poultry eaters say that “all natural” is important to them when selecting meat/poultry dishes at a restaurant.

Animal welfare and sustainability also play a role in their decision, as does how the animal is fed—grass or vegetarian, for example. In this respect, consumers are likely weighing the effect of feeding choice on the quality, taste and healthfulness of the dish.

And local is more important than ever. The percentage of consumers who make an extra effort to buy local should crack 50 percent within the next couple of years, in the face of widening concerns about where food comes from.

But in the era of global supply chains, local is also relative: the United States serves as its consumers’ backyard. Everything from trout to berries to steaks now comes from the far corners of the world to the local supermarket or restaurant, which can bring a litany of questions and concerns to U.S. consumers lips—and helps explain why meat and poultry from America’s own backyard wins hands down.

Sugary Concerns

Healthline.com, conducted research among over 3,000 Americans on their knowledge of sugar and how it affects the body to gauge their relationship about their own sugar consumption and the effects it has on them. The Healthline Sugar Survey finds that while Americans are aware of the negative effects of sugar, they aren’t doing much about it because they don’t actually know how.

Two out of three survey respondents said that sugar was their main concern (over fat and carbs) and admit they need to reduce their sugar intake. Many told us they feel guilty about eating sugar but their answers show that they don’t fully understand how much sugar is contained in their foods, nor do they fully comprehend the role of sugar in physical addiction.

The survey reveals surprising data and sobering insights: few have succeeded in achieving a healthy relationship with sugar; most of us seek to eat less sugar but fail. The majority of those surveyed admit to eating too much sugar yet three out of four do not know the recommended amount of added sugar to take in on a daily basis. Two out of three guess wrong on sugar contents of popular foods and 70 percent don’t know how many grams are in a teaspoon of sugar nor the calorie equivalent.

While only one in 10 reported successfully breaking up with sugar, the majority of us feel guilty, misinformed and confused about our relationship with sugar. Healthline’s conclusion: it’s time to shed greater light on sugar: where we are in our relationship cycle; what science has told us and how to do something about it.

The Healthline survey did reveal a high percentage of people seek foods labeled as having little or no sugar. More than half, 56 percent, said while shopping, they prioritized the label designating “no sugar added” and 32 percent looked for “sugar free” foods. Only 10 percent said they don’t look at food labels, but for those who do, over 1 in 3 (38 percent) don’t trust food labels.

By July 26, 2018 the Nutrition Facts label for packaged foods are required to change including listing “total sugar” and “added sugars.”1 Americans are in for quite a surprise as to the actual amount of total and added sugar packaged food items really contain as today significant amounts of added sugar are hidden in the ingredients listing and not the Nutrition Facts. There are over 60 different names for sugar — most unrecognizable to the average consumer.

Additionally, there seems to be a misunderstanding when it comes to foods that contain a high amount of sugar that aren’t perceived to be as sugar-laden as categories that overtly contain sugar as a central ingredient, such as cake, ice cream, and sweetened cereal. For example, when respondents were asked to select the food item with the most sugar in pairings, they incorrectly assumed common baked goods and dessert contained more sugar than a yogurt with fruit or an energy bar.

Adding complexity is also the fact that the vast majority (76 percent) were not aware of the American Heart Association’s daily recommendation for added sugar intake —Men (36 grams/9 teaspoons/150 calories) and Women (24 grams/6 teaspoons/100 calories).2 The amount of sugar that is considered “too much” has not been engrained into the minds of most consumers as it has for other nutrition facts such as total calories, carbs, and fat.

“We lead with empathy first and foremost,” said Tracy Stickler, Editor in Chief. “Whether it’s being more conscious about the added sugars in our diets, reducing our daily intake or breaking an addiction, we need help. With all the recent press about the politics of added sugar in our foods and who is to blame for the whitewashing of sugar, we decided the time was now to take the issues from the lobbying table to the dinner table along with trusted advice from experts and real life success stories.”