2026 Restaurant Playbook: Five Data-Backed Growth Moves

3 Min Read By Jana Zschieschang

After two years defined by inflation fatigue and cautious spending, restaurant operators are entering 2026 with challenges and opportunities – consumers remain selective, but they're still dining out.

Revenue Management Solutions (RMS) Q4 2025 consumer research reveals that stability is returning. Reported visit frequency has leveled off across segments, yet 34 percent of respondents are increasing their restaurant spend (up from 22 percent last year). While 70 percent still perceive restaurant prices as high, the data reveals clear opportunities for brands willing to be precise about pricing, creative with their menus and relentless about loyalty.

Here are five trends that will separate winners from the rest, and what you need to do now.

1. The Traffic Trap: Repeated Frequency Is Your Growth Engine

Reported restaurant visits dropped in 2025, but the story isn’t uniform. Younger diners are actually increasing visits, and among those spending more at restaurants, 31 percent cite ordering more frequently as the reason—a 13-percentage-point jump from 18 percent in 2024. Translation: loyalty and habit-building aren't just nice-to-haves anymore. They're table stakes.

This dynamic underscores what RMS CEO John Oakes describes as balanced growth — where traffic and average check rise together. Higher prices can drive short-term profits, but they risk long-term growth if they turn off loyal customers.

How to prepare: Focus less on one-time traffic spikes with deep discounts and more on identifying your most profitable, high-frequency guests. Who visits twice a week instead of once? What makes them tick? Design loyalty programs, targeted offers and seamless digital ordering to move customers from one visit per week to two (or more). That incremental visit is pure profit.

2. Restaurants Have a Value Advantage (For Now)

While 70 percent of respondents perceive restaurant prices as higher than the previous month, here's the twist: 78 percent believe the same for grocery prices. Despite U.S. Bureau of Labor Statistics data showing restaurant prices rose faster than groceries in 2025 (3.7 percent vs. 2.7 percent), consumer perception lags reality—and that creates opportunity.

“Across-the-board price cuts aren’t the answer,” Oakes says. “The brands that will win in 2026 are the ones that price strategically and protect margins while clearly communicating value in ways consumers can see and feel.”

How to prepare: Focus on strategic pricing and menu engineering. Highlight bundles and quantity deals for high-frequency spenders who care about quantity and value. Lean into premium items where customers are less price sensitive.

3. Boomers Are Your Breakfast Secret Weapon

While younger generations drive traffic growth later in the day, RMS’ breakfast research reveals surprising potential: Boomers remain a reliable customer base for breakfast. They value consistency and quality over novelty—yet most operators overlook them.

RMS breakfast consumer report shows Boomers favor dine-in experiences, traditional hot plates and mid-morning visits—exactly the high-margin behaviors that fill capacity gaps and boost check averages. They're treating themselves, not rushing through a drive-thru. And they'll pay for quality without complaint.

How to prepare: Keep breakfast menus simple and profitable. Make core items easy to find, competitively priced and don’t complicate operations. And for concepts with breakfast dayparts, invest in the dine-in experience Boomers crave. This segment can provide dependable volume even as other segments fluctuate.

4. Design Digital Menus for Profit, Not Just Convenience

Delivery, takeout and mobile ordering are now habitual, particularly for Gen Z and Millennials. But as the digital mix grows, profitability depends even more on what customers see first and order most.

Don’t treat your digital menus like afterthoughts. That's leaving money on the table with every click. Visual hierarchy matters. Placement matters. And channel ownership matters even more.

How to prepare: Apply menu engineering principles to all digital touchpoints. Use strategic placement and streamlined choices to guide customers toward high-margin items. Drive traffic to your owned app with app-exclusive perks and offers, reducing dependency on third-party platforms that eat into margins. Minor optimizations — not massive redesigns — often deliver the best gains.

5. Millennials and Gen Z Fuel Growth If You Earn Their Loyalty

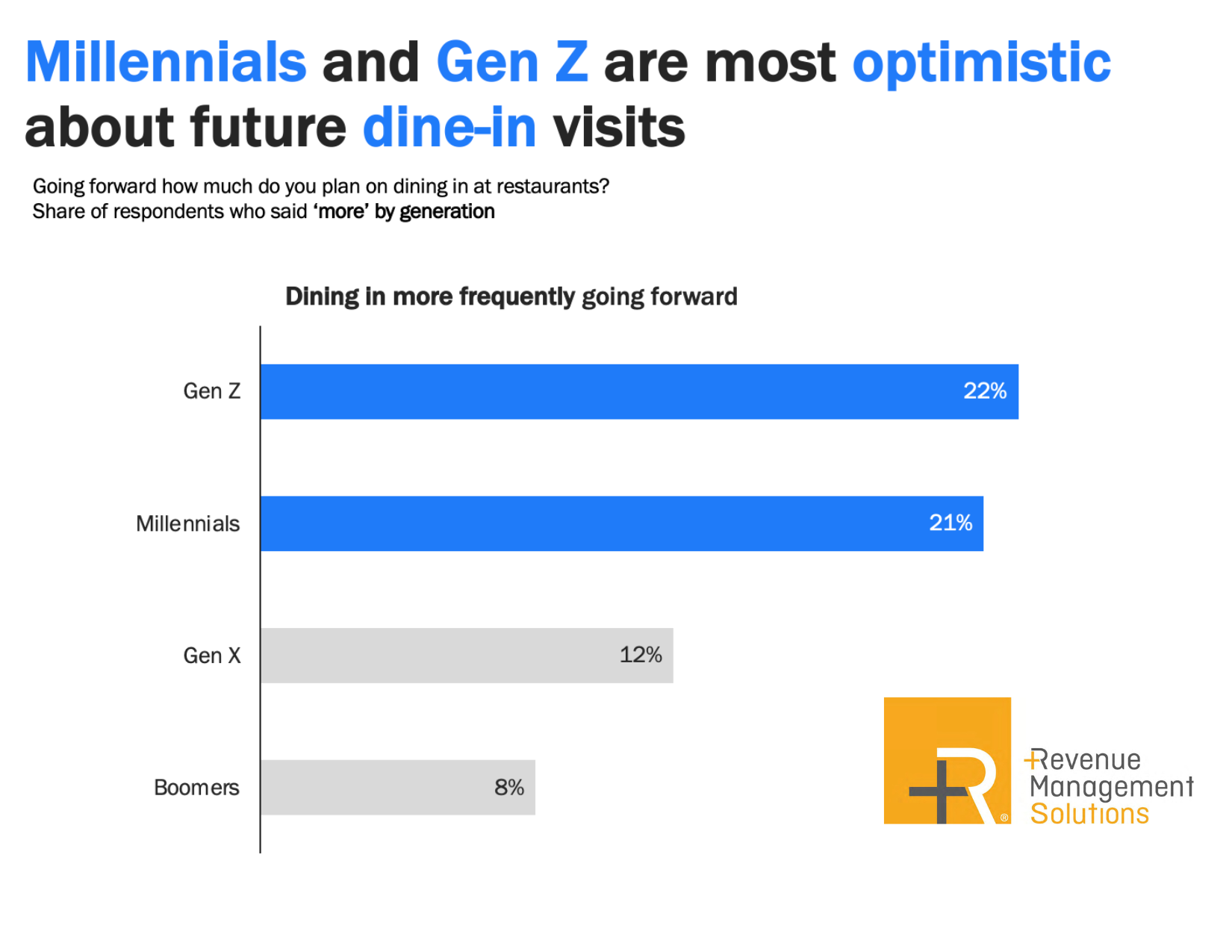

Gen Z and Millennials aren't just spending more—they're planning to visit more in 2026. Over 20 percent plan to increase dine-in frequency, compared to just eight percent of Boomers. These younger diners also dominate delivery, with 77 percent ordering weekly. They're optimistic about dining out, but they're also demanding. They expect speed, accuracy, personalization and experiences worth sharing.

How to prepare: Allocate marketing and innovation dollars accordingly. Mobile-first campaigns, digital loyalty with tiered rewards, limited-time offers and dine-in experiences should all work together to reinforce why your brand is worth returning to.

The Bottom Line: Get Precise in 2026

The data is clear. In 2026, operators need to get strategic pricing right, invest in dine-in experiences, focus on younger diners, optimize digital for profitability and build loyalty through convenience and frequency.

In short, 2026 isn’t about doing more — it’s about doing the right things better. Operators who know their customers and align pricing and menus accordingly will grow the fastest, even in a selective consumer environment.

The playbook is clear—the question is whether you'll execute it before your competition does.