2024 Outlook: Glass Half Full?

3 Min Read By Jana Zschieschang

It’s a common assumption that past performance is the best predictor of future behavior, but the last few years have been anything but common. Quick-service restaurants (QSRs) rode the wave of unprecedented consumer behavior shifts and the successes and challenges it brought along.

So, what can the QSR industry expect in 2024? Looking back at last quarter’s performance suggests the glass is proverbially half full.

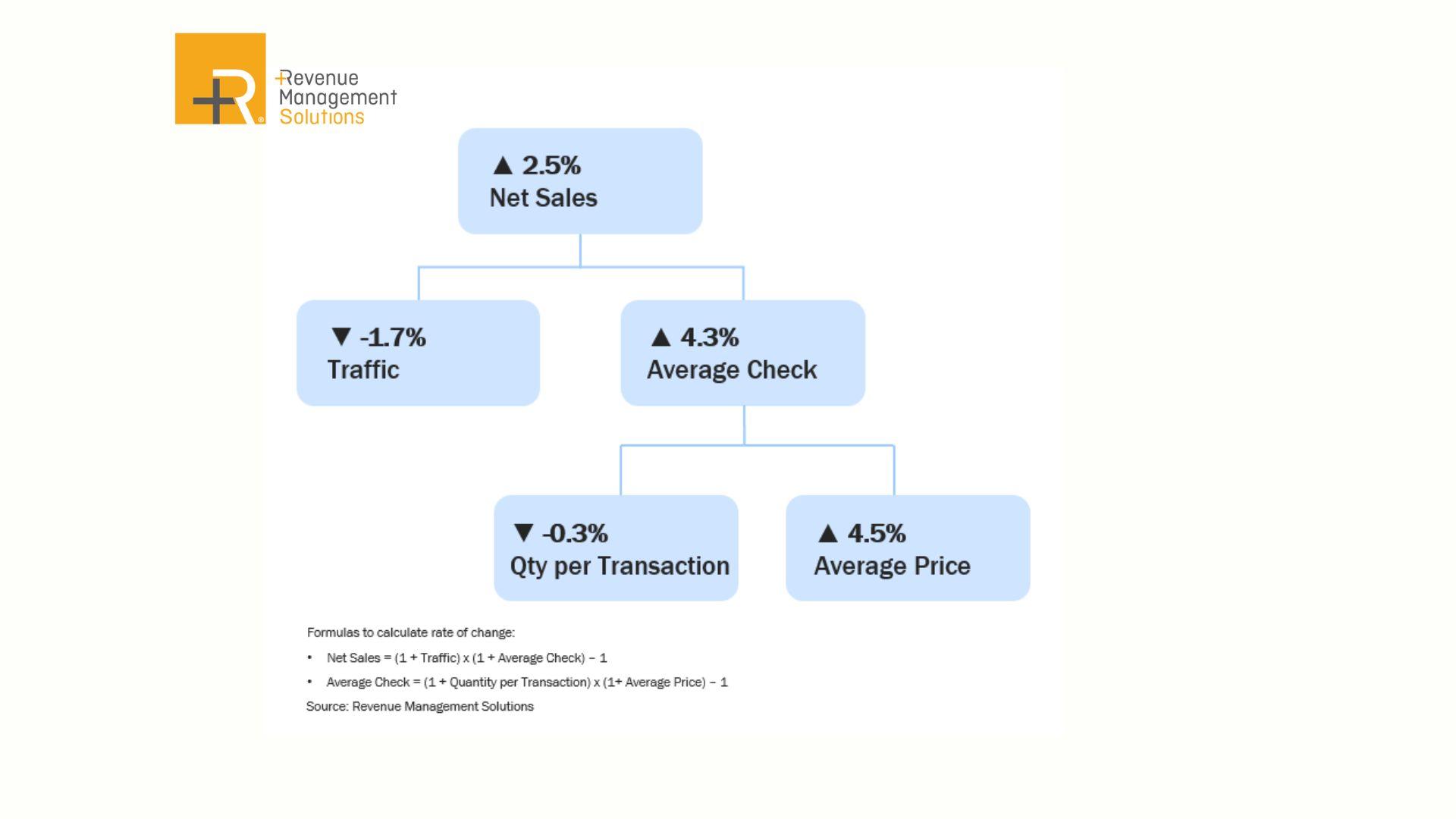

The operative word, however, may be “half.” On the positive side, Revenue Management Solution's end-of-year trends suggest performance remained stable compared to previous quarters, and sales are positive. On the negative side, traffic and quantity per transaction slid, indicating consumers are cutting back. Net sales are primarily driven by average check increases and pricing opportunities are diminishing.

QSRs Stay Strong

A ray of hope shines from the findings of RMS’ year-end look at evolving consumer behavior. When asked if they had ordered more or less from full-service, fast-casual and QSRs in the past month, respondents were primarily bearish, except when it came to QSRs. Twenty-six percent of the 800 respondents said they ordered more from a QSR in the last month, with 25 percent ordering less. While not overly optimistic, QSR significantly outperformed the other categories. Nearly 50 percent of survey respondents reported they spent less time dining out at fast casual, full service and breakfast spots.

With little margin for taking price, brands will need to adopt a broad perspective, focusing on creative traffic-driving strategies, and get down into the specifics by analyzing local competitor and consumer data.

As consumers continued to watch spending during the holiday-laden end of the year, QSRs remained a budget-friendly way for guests to enjoy dining out without overspending.

When and How Are Consumers Dining?

Daypart spending implies that guests seek convenience during the dinner hour – it was the best-performing daypart for QSRs, up +0.6 percent. Perhaps due to changing behavior or cost cutting, lunch and breakfast traffic are both down -3.3 percent YOY.

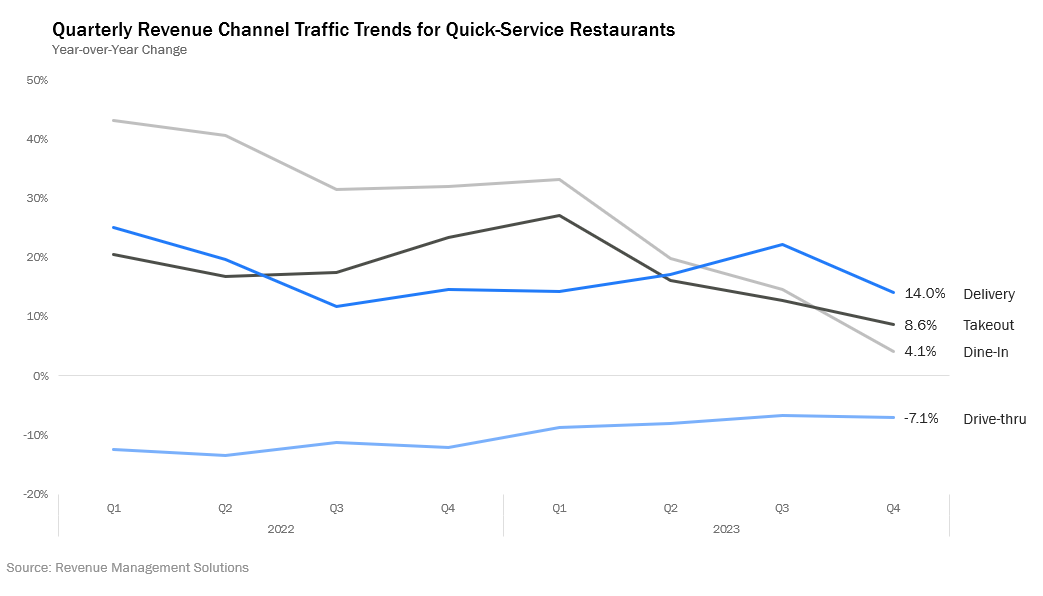

And consumers remain omnivorous in how they dine. Takeout and dine-in usage jumped in Q4 and delivery traffic increased +14.0 YOY. Our survey supports the data: Half of respondents report ordering delivery at least once a week. Drive-thru remains down -7.1 percent YOY but has steadily increased since Q4 2022. (Fig. 2)

However, one element signifies a cloud on the horizon. Inflation slowed to 3.4 percent in December 2023 vs. 6.5 percent in December 2022 and the steep rate of average price increases by QSRs has slowed to just +4.5 percent in Q4 2023. Yet, two years of steady inflation has left consumers with a heavy load. More than one-third of our survey respondents stated that they are spending less on restaurants by ordering less frequently (48 percent), ordering less expensive items (46 percent) and, as we saw with QSR frequency, choosing less costly restaurants (46 percent).

Mind the (Food) Gap

RMS Vice President Richard Delvallée anticipates that the widening price gap between Food Away From Home (FAFH) and Food at Home (FAH) could put further pressure on already negative traffic numbers.

In addition, Delvallée points out that if a brand’s pricing significantly exceeds the FAFH index, it further negatively impacts customer traffic.

With little margin for taking price, brands will need to adopt a broad perspective, focusing on creative traffic-driving strategies, and get down into the specifics by analyzing local competitor and consumer data.

RMS believes that with a continued focus on the value equation and pricing strategies that balance staying competitive with maintaining customer footfall, the opportunity to gain market share still exists – even as the industry and consumers navigate the challenges posed by inflation.